Wassily Kandinsky Moscow II 1916

“Under the Target2 system, which is the way eurozone central banks keep account of liabilities to each other, Italy already owes £442bn.”

• Italy: No Easy Fixes For The European Central Bank (G.)

The last eurozone crisis was solved – or deferred – when the president of the European Central Bank, Mario Draghi, declared in July 2012 that the institution was ready to do “whatever it takes” to save the euro. Bond markets calmed down, weak banks got access to funding again and an economic recovery of sorts materialised. In terms of central bank rescue acts, it was a textbook operation. Unfortunately, there are no easy ECB fixes for the new Italian crisis. The ECB’s first problem is its own powers. Even if it were minded to try to reverse the dramatic sell-off in Italian bonds, the rules say it is only supposed to respond to emergency calls from countries that have agreed to budget conditions.

With new elections now likely in Italy in the autumn, it’s hard to see how a deal could be done. Even if a technical fudge could be found, the second problem is that the eurozone’s big powers might prefer the ECB to do nothing. Günther Oettinger, the EU’s budget commissioner, seems to believe a bout of market turmoil “might become a signal to [Italian] voters after all to not vote for populists on the right and left”. In practice, the experience might provoke a bigger vote for anti-euro parties, but the strategy seems set.

The third problem for the ECB will come if capital drains from Italian banks. In that case the ECB could in theory claim a clear need to intervene to prevent damage to eurozone banks outside Italy. But, again, there could be pressure to stay on the sidelines. Under the Target2 system, which is the way eurozone central banks keep account of liabilities to each other, Italy already owes £442bn. Any ECB-backed support for its banks would see that figure rise further, provoking fears over repayment. Note that Target2 imbalances are already a hot topic in Germany, where the Bundesbank is the single biggest creditor.

I’m sure it has the will. Draghi’s Plunge Protection Team is working hard today, euro’s up 0.5%. The problem is that everyone knows whatever the ECB does is only a temp stopgap.

• Investors Ask If ECB Has Will And Means To Save Euro From Italian Turmoil (R.)

Investors are again speculating what the ECB could do to solve the problem of a surge in Italy’s debt yields that is causing stress for Italian banks and reviving questions about a euro break up. The stakes will be huge if a repeat election in the euro zone’s third-largest economy become a de facto referendum on Italy’s membership of the euro and its role in the European Union. Italy’s economy is at least 10 times bigger than that of Greece, which needed 250 billion euros ($289 billion) of euro zone and IMF money to bail it out. If Italy needed a similar level of support, the numbers involved would be eyewatering.

Total IMF firepower would only add up to around 500 billion euros and even with the 400 billion euros that the European Stability Mechanism could conceivably get together, it still wouldn’t completely cover Italy. Perhaps it’s no wonder then that Italy’s bond markets saw their worst sell-off in 26 years on Tuesday and investors are starting to look inquisitively at the ECB. “If this continues for another couple of sessions, I think you will have to see some official (European) response,” said Saxo Bank’s head of foreign exchange strategy John Hardy. “It becomes a ‘whatever it takes’ kind of moment,” he added, recalling the promise made in 2012 by ECB President Mario Draghi to keep the euro intact.

Inflexibility killed the cat.

• Blanchard: Europe Should Be OK – But ‘I’m Very Worried About Italy’ (CNBC)

Political chaos in the euro zone’s third-biggest economy won’t be going away anytime soon, according to IMF former chief economist Olivier Blanchard, who on Tuesday issued an ominous assessment of the country. Panic roiled markets Tuesday as a political fight in Italy prompted one of its worst market sell-offs in years. Underlying investor fear was the prospect of Italy leaving the euro and others following suit, which Blanchard, now an economics professor at the Massachusetts Institute of Technology, described as more of a psychological fear than a realistic threat.

The potential concern, rather, involves Italy’s creditors, who would have to “move carefully,” the economist told CNBC’s Joumanna Bercetche in Paris. The rest of Europe may avoid a domino effect, but Italy looks to remain mired in a quagmire. “I suspect in this case the EU will do whatever is needed to prevent contagion, so I’m not terribly worried about contagion,” Blanchard said. “I’m very worried about Italy. Not worried about the rest of Europe. It will be tough, but the rest of Europe, the rest of (the) euro will be OK.” [..] “The writing was on the wall,” Blanchard said. “When you have capital mobility, and you give signals that you might not stay in the euro … then you expect investors to move, and I think that’s what we are seeing.”

Markets were already nervous about M5S and Lega’s economic plans for Italy. Though the parties did not in fact pledge to leave the euro, they signaled a disregard for the EU’s fiscal rules, such as those limiting states’ deficit levels. [..] Asked if there may be positives to the standoff in the form of EU concessions for Italy in order to prevent a pull-out, Blanchard responded, “No. I am not optimistic.” Unsurprisingly, he described himself as very bearish on the country. The best-case scenario, the economist said, would be for the winners of the next elections to provide a program that satisfies the voter base — victory is predicted for the populist parties again — but remains fiscally responsible.

Wolf Richter is dead on: “..Italian bonds – no matter what maturity – should never ever have traded with a negative yield..”

• NIRP’s Revenge: Italian Bonds Plunge, Worst Day in Decades (WS)

On Tuesday, Italian bonds had their worst day in Eurozone existence, even worse than any day during the worst periods of the 2011 debt crisis. And this comes after they’d already gotten crushed on Monday, and after they’d gotten crushed last week. And this happened even as the ECB is carrying on its QE program, including the purchase of Italian government bonds; and even as it pursues its negative-interest-rate policy (NIRP). As bond prices plunge, yields spike by definition, and the spike in the two-year yield was spectacular, going from 0.3% on Monday morning to 2.73% on Tuesday end of day:

But note that until May 26, the two-year yield was still negative as part of the ECB’s interest rate repression. On that fateful day, the two-year yield finally crossed the red line into positive territory. To this day, it remains inexplicable why the ECB decided that Italian yields with maturities of two years or less should be negative – that investors, or rather pension beneficiaries, etc., who own these misbegotten bonds, would need to pay the Italian government, one of the most indebted in the world, for the privilege of lending it money. But that scheme came totally unhinged just now. The 10-year Italian government bond yield preformed a similar if not quite as spectacular a feat. Over Monday and Tuesday, it went from 2.37% to 3.18%:

But here’s the thing: Italian bonds – no matter what maturity – should never ever have traded with a negative yield. Their yields should always have been higher than US yields, given that the Italian government is in even worse financial shape than the US government. Italy’s debt-to-GDP ratio is 131%, and more importantly, it doesn’t even control its own currency and cannot on its own slough off a debt crisis by converting it into a classic currency crisis, which is how Argentina is dealing with its government spending. The central bank of Argentina recently jacked up its 30-day policy rate to 40% to keep the peso from collapsing further. That’s the neighborhood where Italy would be if it had its own currency. But the ECB’s QE shenanigans and NIRP drove even Italian yields below zero, and so now here is NIRP’s revenge.

Oettinger takes the prize for the biggest fool so far.

• Italy Could Be The Next Greece – Only Much Worse (CNBC)

Nearly a decade after a protracted Greek debt crisis spooked global markets, a fresh round of political turmoil in Italy has revived fears about the fate of the European financial system and its common currency. This time, the numbers are a lot bigger. “Italy’s economy is 10 times larger than that of Greece, whose debt crisis shook the euro area’s foundations,” wrote Desmond Lachman, a resident fellow at the American Enterprise Institute, in a recent blog post. “The single currency is unlikely to survive in its present form if Italy were forced to exit that monetary arrangement.”

Italy’s economy has been struggling since the Great Recession years with a debt load that rivals the heavy Greek borrowing that forced massive cuts in public services there and drove Greece into a deep recession. That Italian debt crisis has become central to the ongoing political instability, as multiple governments have failed to resolve it. [..] Even if the populist parties stop short of a clear call for exiting the euro, their strength has widened the political gap with EU officials in Brussels. In an echo of the Greek debt crisis, the latest turmoil has reopened a political rift between Germany and the “peripheral” economies of Greece, Italy and Spain. That political divide will further complicate ongoing efforts to resolve Italy’s crushing debt burden.

On Tuesday, EU officials promised to respect Italian voters’ right to choose their own government, after Germany’s European commissioner said Italians should not vote for the populists. “My worry, my expectation, is that the coming weeks will show that the markets, government bonds, Italy’s economy, could be so badly hit that these could send a signal to voters not to elect populists from the left or right,” Guenther Oettinger, a German commissioner who oversees the EU budget committee, said in a German television interview.

“..a relationship that was neither voluntary nor equal – the very opposite of the credo on which the EU was based.”

• “Everything Has Gone Wrong”: Soros Warns “Major” Financial Crisis Is Coming (ZH)

Until recently, it could have been argued that austerity is working: the European economy is slowly improving, and Europe must simply persevere. But, looking ahead, Europe now faces the collapse of the Iran nuclear deal and the destruction of the transatlantic alliance, which is bound to have a negative effect on its economy and cause other dislocations. The strength of the dollar is already precipitating a flight from emerging-market currencies. We may be heading for another major financial crisis. The economic stimulus of a Marshall Plan for Africa and other parts of the developing world should kick in just at the right time. That is what has led me to put forward an out-of-the-box proposal for financing it.

“The EU is in an existential crisis. Everything that could go wrong has gone wrong,” he said. To escape the crisis, “it needs to reinvent itself.” “The United States, for its part, has exacerbated the EU’s problems. By unilaterally withdrawing from the 2015 Iran nuclear deal, President Donald Trump has effectively destroyed the transatlantic alliance. This has put additional pressure on an already beleaguered Europe. It is no longer a figure of speech to say that Europe is in existential danger; it is the harsh reality.” “We may be heading for another major financial crisis,” Soros said explicitly.

“I personally regarded the EU as the embodiment of the idea of the open society. It was a voluntary association of equal states that banded together and sacrificed part of their sovereignty for the common good. The idea of Europe as an open society continues to inspire me. But since the financial crisis of 2008, the EU seems to have lost its way. It adopted a program of fiscal retrenchment, which led to the euro crisis and transformed the eurozone into a relationship between creditors and debtors. The creditors set the conditions that the debtors had to meet, yet could not meet. This created a relationship that was neither voluntary nor equal – the very opposite of the credo on which the EU was based.”

Interference in a country’s politics. Hmm.

• Soros-Backed Campaign To Push For New Brexit Vote Within A Year (G.)

A campaign to secure a second Brexit referendum within a year and save the UK from “immense damage” is to be launched in days, the philanthropist and financier George Soros has announced. The billionaire founder of the Open Society Foundation said the prospect of the UK’s prolonged divorce from Brussels could help persuade the British public by a “convincing margin” that EU membership was in their interests. In a speech on Tuesday ahead of the launch of the Best for Britain campaign – said to have already attracted millions of pounds in donations – Soros suggested to an audience in Paris that changing the minds of Britons would be in keeping with “revolutionary times”.

Best for Britain had already helped to convince parliamentarians to extract from Theresa May a meaningful vote on the final withdrawal deal, he said, and it was time to engage with voters, and Brussels, to pave the way for the UK to stay in the bloc. It is expected to publish its campaign manifesto on 8 June. Soros, 87, said: “Brexit is an immensely damaging process, harmful to both sides … Divorce will be a long process, probably taking more than five years. Five years is an eternity in politics, especially in revolutionary times like the present. “Ultimately, it’s up to the British people to decide what they want to do. It would be better however if they came to a decision sooner rather than later. That’s the goal of an initiative called the Best for Britain, which I support.

“Best for Britain fought for, and helped to win, a meaningful parliamentary vote which includes the option of not leaving at all. This would be good for Britain but would also render Europe a great service by rescinding Brexit and not creating a hard-to-fill hole in the European budget. “But the British public must express its support by a convincing margin in order to be taken seriously by Europe. That’s what Best for Britain is aiming for by engaging the electorate. It will publish its manifesto in the next few days.”

Recovery.

• Pace Of Greek Credit Contraction Increases In April (K.)

The funding deficit is growing in the Greek economy, as there was a sharper credit contraction in April, data from the Bank of Greece showed on Tuesday. The pace of financing Greek households and enterprises stood at -1.9% last month, from -1% in March and -0.9% in February. The flow of credit turned negative by 1.2 billion euros in April from the positive amount of 217 million euros in March. The negative flow means that loans repaid outweighed those issued, after factoring in loan write-offs and sales of nonperforming loans by banks.

In practice the fresh credit issued is offset by the burden of the increased write-offs and payments mostly by enterprises. Data analysis showed that the funding flow to the economy’s basic domains last month was negative by 2.4% for industry and by 1.7% for construction. At the same time the financing rate for tourism was marginally positive at 1%, while in commerce the rate was zero, against a positive 1% in March. The sector with the lowest funding rate in comparison with last year was electricity and water, which declined 12.6%.

Who blinked first?

• EU Plans To Boost Spending In South, Cut Funds For Eastern Europe (RT)

The European Commission proposed on Tuesday increased spending of EU money on Italy and other southern member states hit by the economic and migrant crises, while reducing funds for regions in the former communist eastern countries, Reuters reports. The proposal on the 2021-2027 budget comes as Italy is facing the prospect of snap elections after the summer. The commission proposed a new methodology to distribute funds that takes into account unemployment levels and the reception of migrants, and not just economic output as previously done. This will result in a reduction of regional funds for eastern countries because they have grown faster in recent years. The budget would increase to €1.1 trillion ($1.2 trillion) from €1 trillion in the current seven-year period. A third of spending would be allocated to help reduce the gap between rich and poor regions of the bloc.

Jim on Memorial Day.

• It’s Hard To Be An Empire (Jim Kunstler)

I suppose that military prowess is all we’ve got left in the national pride bag in these times of foundering empire. Few are fooled these days by the “land of opportunity” trope when so many young people are lucky to get a part-time gig on the WalMart loading dock along with three nights a week of slinging Seaside Shrimp Trios for the local Red Lobster. Of course, there are a few choice perches in venture capital out in Silicon Valley, or concocting collateralized loan obligations in the aeries of Wall Street — but nobody is playing Aaron Copeland’s Fanfare for the Common Man to celebrate these endeavors.

There’s a macabre equivalency between our various overseas war operations and the school shootings that are now a routine feature of American daily life. The purposes are equally obscure and the damage is just as impressive — many lives ruined for no good reason. But consider more lives are lost every year in highway crashes than in the Mexican War of the 1840s and more Americans are dying each year lately of opioid overdoses than the entire death toll of the Vietnam War. America’s soul is at war with its vaunted way-of-life.

It’s hard to be an empire, for sure, but it’s even harder, apparently, to be a truly virtuous society. First, I suppose, you have to be not insane. It’s hard to think of one facet of American life that’s not insane now. Our politics are insane. Our ideologies are insane. The universities are insane. Medicine is insane. Show biz is insane. Sexual relations are insane. The arts are insane. The news media is utterly insane. And what passes for business enterprise in the USA these days is something beyond insane, like unto the swarms of serpents and bats issuing from some mouth of hell in the medieval triptychs. How do you memorialize all that?

“..the trade renege could leave Washington dancing with itself..”

• China Slams Surprise US Trade Announcement, Says Ready To Fight (R.)

China on Wednesday lashed out at Washington’s unexpected statement that it will press ahead with tariffs and restrictions on investments by Chinese companies, saying Beijing was ready to fight back if Washington was looking to ignite a trade war. The United States said on Tuesday that it still held the threat of imposing tariffs on $50 billion of imports from China and would use it unless Beijing addressed the issue of theft of American intellectual property. The declaration came after the two sides had agreed earlier this month to look at steps to narrow China’s $375 billion trade surplus with America, and days ahead of a visit to Beijing by U.S. Commerce Secretary Wilbur Ross for further negotiations.

William Zarit, chairman of the American Chamber of Commerce in China, said Washington’s threat of tariffs appeared to have been “somewhat effective” thus far. “I don’t think it is only a tactic, personally,” he told reporters on Wednesday, adding that the group does not view tariffs as the best way to address the trade frictions. “The thinking became that if the U.S. doesn’t have any leverage and there is no pressure on our Chinese friends, then we will not have serious negotiations.” [..] The Global Times said the United States was suffering from a “delusion” and warned that the “trade renege could leave Washington dancing with itself”.

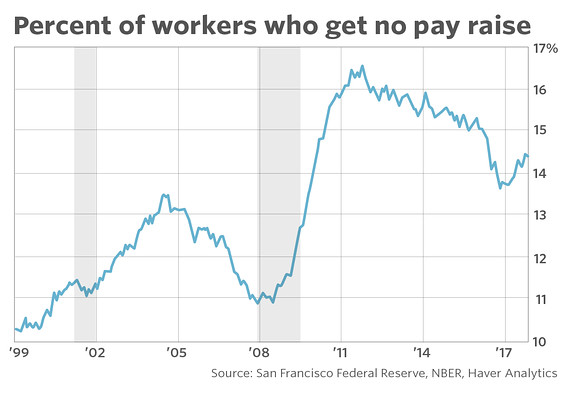

What you get with bogus claims of full employment.

• High Number Of Workers With No Pay Raise Says Inflation Worries Overblown (MW)

An unusually high percentage of American workers still aren’t getting pay raises nine years after the end of the Great Recession — and that suggests the threat of inflation is still quite low. Some senior Federal Reserve officials, including Kansas City Fed President Esther George, want to raise U.S. interest rates more rapidly to head off the potential for higher wages to stoke inflation. The specter of higher rates has pushed up interest rates and acted as a drag on stocks. Yet a new report by researchers at the regional central bank George leads to suggest there’s little cause for alarm.

The Kansas City Fed researchers found that an abnormally high share of employees still in the same jobs haven’t received a pay raise in the last 12 months despite a 3.9% unemployment rate that is the lowest in almost two decades. Economists refer to the phenomenon as “wage rigidity.” [..] The rate of future wage growth in the U.S. also tends to rise more slowly than usual when a high number of people aren’t getting any raises at all, the research suggests. In the most recent 12-month period ended in April, hourly U.S. wages increased at a 2.6% rate. Normally when the unemployment rate is as low as it is now, wages tend to rise 3.5% to 4.5% year.

What they claimed would never happen.

• industrial-Scale Beef Farming Comes To The UK (G.)

Thousands of British cattle reared for supermarket beef are being fattened in industrial-scale units where livestock have little or no access to pasture. Research by the Guardian and the Bureau of Investigative Journalism has established that the UK is now home to a number of industrial-scale fattening units with herds of up to 3,000 cattle at a time being held in grassless pens for extended periods rather than being grazed or barn-reared. Intensive beef farms, known as Concentrated Animal Feeding Operations (CAFOs) are commonplace in the US. But the practice of intensive beef farming in the UK has not previously been widely acknowledged – and the findings have sparked the latest clash over the future of British farming.

The beef industry says that the scale of operations involved enables farmers to rear cattle efficiently and profitably, and ensure high welfare standards. But critics say there are welfare and environmental concerns around this style of farming, and believe that the farms are evidence of a wider intensification of the UK’s livestock sector which is not being sufficiently debated, and which may have an impact on small farmers. In contrast to large intensive pig and poultry farms, industrial beef units do not require a government permit, and there are no official records held by DEFRA on how many intensive beef units are in operation. But the Guardian and the Bureau has identified nearly a dozen operating across England. [..] The largest farms fatten up to 6,000 cattle a year.

Stop the madness!

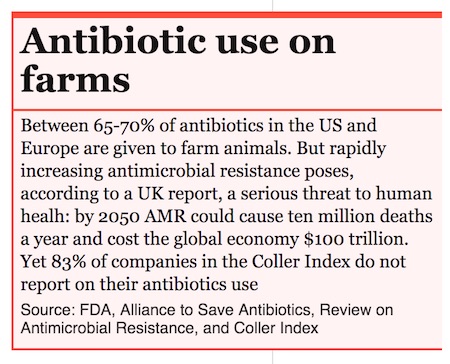

• Meat And Fish Multinationals ‘Jeopardising Paris Climate Goals’ (G.)

Meat and fish companies may be “putting the implementation of the Paris agreement in jeopardy” by failing to properly report their climate emissions, according to a groundbreaking index launched today. Three out of four (72%) of the world’s biggest meat and fish companies provided little or no evidence to show that they were measuring or reporting their emissions, despite the fact that, as the report points out, livestock production represents 14.5% of all greenhouse gas emissions. “It is clear that the meat and dairy industries have remained out of public scrutiny in terms of their significant climate impact.

For this to change, these companies must be held accountable for the emissions and they must have credible, independently verifiable emissions reductions strategy,” said Shefali Sharma, director of the Institute for Agriculture and Trade Policy European office. The new Coller FAIRR Protein Producers Index has examined the environmental and social commitments of 60 of the world’s largest meat and fish producers and found that more than half are failing to properly document their impact, despite their central role in our lives and societies.

Many of the names in the index will be unfamiliar, but their consolidated revenues of $300bn cover around one-fifth of the global livestock and aquaculture market – roughly one in every five burgers, steaks or fish. The companies looked at by the index include giants like the Australian Agricultural Company, which has the biggest cattle herd in the world; the Chinese WH Group, the largest global pork company; or the US’s Sandersons, which processes more than 10 million chickens a week.

Home › Forums › Debt Rattle May 30 2018