Paul Klee In angel’s care (In Engelshut) 1931

“If all these peoples’ ideas were not relevant, or popular, they would not need to be banned.”

It’s World Press Freedom Day today. Painfully ironic. We can’t let Facebook police our world. Or, rather, be police, judge and henchman all in one. We need laws for this and we need to apply them.

I don’t do Facebook anymore since they froze our account, what is it, 3 years ago?! I see Paul Joseph Watson every now and then on Twitter and though I don’t see myself becoming his best friend, he is an intelligent and articulate guy who has never violated Facebook’s regulations. Other than he has a link to Alex Jones. It’s easy to say Good Riddance, but you are next.

• Day of the Long Knives (Kassam)

Alex Jones, Paul Joseph Watson, Laura Loomer and Milo Yiannopoulos have been unpersonned by the digital tech giant Facebook and its subsidiary Instagram. They’re coming for you, next. Or more likely, for us. Human Events stands shoulder-to-shoulder with those being routinely targeted by the would-be ‘Masters of the Universe’, no matter if we agree with them or not. Also banned was Louis Farrakhan, the anti-Semitic leader of the repugnant Nation of Islam group. But Farrakhan, like the others, should not have his fate decided by some little nerd in Silicon Valley who has decided his or her feelings are hurt. His fate should be decided in the court of public opinion, with sunlight acting as the greatest disinfectant.

Unfortunately, recent precedent has informed Big Tech that its methods to some extent work. The removal of people like Laura Loomer, Milo, and Tommy Robinson has directly impacted their livelihoods, their work, and their fundamental freedoms. And while Farrakhan is far from someone we would be seen dead around, it is only intellectually consistent if the rules apply both ways. For the psychopaths of Silicon Valley however, intellectual considerations come a distinct last to power, profit, and pandering. The likelihood is Farrakhan’s inclusion on the list is simply a sop to make the decision seem less of a one way street. If I were him, I’d be especially pissed off at being the fall guy in this regard.

But Jones, Loomer, Milo, and Watson have a claim to massive anger too, given they are being lumped in with a man who has said “white people deserve to die”, and who has said to Jewish people, “…don’t you forget, when it’s God who puts you in the ovens, it’s forever!” Tommy now struggles to gain traction – albeit with a smile on his face – and a plan to drive a bus around the country with a big screen on it, to highlight the censorship he faces. Milo – and he will probably hate me for saying this – faces total financial ruin. Alex Jones has had a massive business ripped out from under him. And Laura Loomer has been relegated to staging protests on the front lawns of those who needlessly aggress her.

If they can make a buck from it, they certainly will.

• Is The Media Driving America Insane? (LN)

Now that more of us are consuming news media more often than ever, a higher number of Americans are being fed a steady mental diet of outrage, fear, and hostility wrapped in clickbait headlines designed to make us even more contemptuous of those whose political beliefs clash with our own. Many media outlets have transformed emotionally charged, but ultimately irrelevant, stories into their bread and butter, manipulating their audiences into giving them their precious clicks in exchange for a dose of anger and panic. Otherwise unimportant stories are catapulted into the mainstream simply because the press knows Americans will tune in and boost their ratings.

The Covington kids fiasco is a prime example. What should have been a local matter was morphed into an issue of national importance by a left-wing media apparatus that wanted to further their “MAGA Hat-wearing white people are the spawn of Satan” narrative. In the end, what is accomplished? For the press, it is higher ratings and more clicks. But for the American public, it is a heightened sense of fear, hatred, and stress – a toxic brew rending the social fabric. It is no wonder that many are predicting another civil war. It would be easy to dismiss such claims as pure alarmism, but given how the Fourth Estate wields their influence, this reality is not hard to imagine. Is it possible to reverse course? Sure, but it won’t be easy. The media is in this game for two reasons: To earn a profit, and to achieve their political objectives. They have no incentive to inform rather than persuade. If the trend persists, things are sure to get uglier before they get better.

Such a piece coming from the Guardian is pretty priceless. Even if it makes some valid points, it’s publications like that which seek to alter reality. Don’t report the news, but manufacture it.

• How The News Took Over Reality (G.)

In recent years, there has been enormous concern about the time we spend on our web-connected devices and what that might be doing to our brains. But a related psychological shift has gone largely unremarked: the way that, for a certain segment of the population, the news has come to fill up more and more time – and, more subtly, to occupy centre stage in our subjective sense of reality, so that the world of national politics and international crises can feel more important, even more truly real, than the concrete immediacy of our families, neighbourhoods and workplaces. It’s not simply that we spend too many hours glued to screens. It’s that for some of us, at least, they have altered our way of being in the world such that the news is no longer one aspect of the backdrop to our lives, but the main drama. The way that journalists and television producers have always experienced the news is now the way millions of others experience it, too.

From a British or American standpoint, the overwhelmingly dominant features of this changed mental landscape are Brexit and the presidency of Donald Trump. But the sheer outrageousness of them both risks blinding us to how strange and recent a phenomenon it is for the news – any news – to assume such a central position in people’s daily lives. In a now familiar refrain, the New York Times columnist Nicholas Kristof bemoans his social circle’s “addiction to Trump” – “at cocktail parties, on cable television, at the dinner table, at the water cooler, all we talk about these days is Trump.” But Trump’s eclipse of all other news is not the only precondition for this addiction. The other is the eclipse of the rest of life by the dramas of the news.

Excellent point. But there’s more: how does Assange’s freedom relate to that of the people who got banned from Facebook yesterday? Most of us will initially react to that question with something about what and who we like, but that’s not good enough.

• Assange or Khashoggi: Whither Journalistic Standards? (Aziz)

Did international media and free press advocates who once celebrated Assange, utilized his revelations and heaped awards on Wikileaks, collectively agreed to abandon their erstwhile hero? And why the turnaround? (It’s not easy to explain although one observer suggests former associates actually conspired to depose him.) Increased silence from within Assange’s refuge presaged his recent ‘capture’. Then, when he suddenly appeared, subdued by dozens of guards, how shamelessly international media rushed to cheer his arrest. They seemed to delight in highlighting scant, salacious details of his condition at the time of his arrest. Reprehensible. Dismaying. Will those gloating journalists care what his captors do to Assange in detention?

This for the man whose political analyses and Wikileaks revelations had been daily headlines not long ago. This for a journalist and publisher who introduced a profound strategy to expose a government’s sinister diplomatic schemes, excesses and crimes documented by their own internal reports. This for an organization gathering evidence of government wrongdoing at a critical time, starting in 2006 when U.S. wars in Iraq and Afghanistan were being reevaluated by a sobering public. Rumors of military crimes, cover-ups, torture, black-site prisons, etc. had gradually, although belatedly, gained credibility and, following the Abu Graib Prison revelations, Wikileaks provided irrefutable evidence of how U.S.A. and its allies conducted their wars.

From the WSJ Editorial Board yesterday: “Mr. Barr has since released the full Mueller report with minor redactions, as he promised, and with the “context” intact. Keep in mind Mr. Barr was under no legal obligation to release anything at all. Mr. Mueller reports only to Mr. Barr, not to the country or Congress.

Mr. Barr has also made nearly all of the redactions in the report available to senior Members of Congress to inspect at Justice. Yet as of this writing, only three Members have bothered—Senate Judiciary Chairman Lindsey Graham, Senate Majority Leader Mitch McConnell and ranking House Republican on Judiciary Doug Collins. Not one Democrat howling about Mr. Barr’s lack of transparency has examined the outrages they claim are hidden.”

Doug Collins’ tirade is a good listen. No need to agree with him.

• Democrats Rage At Empty Chair As Barr Misses Mueller Hearing (ZH)

Refusing to allow the fact that AG Barr chose not to attend today’s Mueller Report hearing, angry Democrats took full advantage of the photo-op to conjure images of a terrified attorney general cowering from the truth and protecting a clearly guilty-of-something president. Despite Barr’s decision last night not to attend, because he objected to Democratic demands that their staff counsel be able to question him, Democrats went forward with the theater of the hearing anyway, setting up an empty chair for the absent attorney general. As The Hill reports, Rep. Steve Cohen (D-Tenn.) brought a bucket of Kentucky Fried Chicken to the morning event, and accused Barr of being a coward after it ended. House Judiciary Chairman Jerrold Nadler (D-N.Y.) tore into Barr, accusing him of failing to check President Trump’s “worst instincts” and misrepresenting Mueller’s findings.

“He has failed the men and women of the Department by placing the needs of the President over the fair administration of justice,” Nadler said. “He has even failed to show up today.” Republicans did not take it lying down with Rep. Matt Gaetz (R-Fla.) noted vociferously that “Judiciary Democrats say AG Barr is “terrified.” Yesterday he testified for over five hours in an open hearing. Today, they cut off my microphone.” And, Rep. Doug Collins (R-Ga.) accused Nadler of staging a “circus political stunt” and said the Democratic chairman wanted the hearing to look like an impeachment hearing. “That is the reason. The reason Bill Barr is not here today is because the Democrats decided they didn’t want him here today. That’s the reason he’s not here,” Collins said. “Not hearing from him is a travesty to this committee today.”

Over the 206-year history of this committee, staff have never questioned witnesses in an oversight hearing. Never. Not once. So, to say Chairman Nadler’s demands are unprecedented would be an understatement. pic.twitter.com/CCWKGr3QOM

— House Judiciary GOP (@JudiciaryGOP) May 2, 2019

Excellent read. Mueller wanted to make Trump’s firing of Comey to be obstruction. But that would have taken some hoops to jump through.

• How President Trump’s Legal Team Outfoxed Mueller (Chamberlain)

When the Mueller Report was released on April 18th, most commentators focused on the “explosive” factual allegations. But other than the shocking revelation that the President once used an expletive in private, very few of those facts were novel; most were leaked long ago. At the end of Volume II of the Mueller Report, however, there were 20 pages of genuinely new material. There, the former FBI director turned Special Counsel Robert Mueller defended his “Application of Obstruction-Of-Justice Statutes To The President.” These overlooked 20 pages were dedicated to defending Mueller’s interpretation of a single subsection of a single obstruction-of-justice statute: 18 U.S.C. § 1512(c)(2).

That’s quite strange, but you know what’s stranger still? In June 2018, Bill Barr, then in private practice at Kirkland & Ellis, wrote a detailed legal memorandum to Deputy Attorney General Rod Rosenstein. This memo came to light in December, when Barr was nominated for Attorney General. The subject was Mueller’s interpretation of the aforementioned 18 U.S.C. § 1512(c)(2). [..] Reading Barr’s June 2018 memo alongside the last twenty pages of the Mueller Report is a curious experience. Together, they read like dueling legal briefs on the meaning of 18 U.S.C. § 1512(c)(2); the type of material one would expect to see from adversarial appellate litigators.

So-why did Robert Mueller dedicate 20 pages of his report to a seemingly obscure question of statutory interpretation? Why did Bill Barr write a detailed legal memorandum to Rod Rosenstein about that very same statute? And how, exactly, did Bill Barr know that that § 1512(c)(2) was central to Mueller’s obstruction theory – in June 2018, when he was still in private practice at Kirkland? [..] why, exactly, was the interpretation of 18 U.S.C. § 1512(c)(2) so contested? Let’s start by looking the statute, excerpted here: (c) Whoever corruptly— (1) alters, destroys, mutilates, or conceals a record, document, or other object, or attempts to do so, with the intent to impair the object’s integrity or availability for use in an official proceeding; or (2) otherwise obstructs, influences or impedes any official proceeding, or attempts to do so [is guilty of the crime of obstruction].

Why was this so important to Mueller? Because most of the obstruction statutes couldn’t possibly apply to President Trump’s behavior, as they require that a defendant obstruct a “pending proceeding” before an agency or tribunal. It is settled law that an FBI investigation does not constitute such a proceeding. But § 1512(c) applies to acts of obstruction done with the intent of impairing evidence for a future, potential proceeding. That made it potentially usable against the President.

Ukraine is central. Even without Biden.

• Ukrainian Embassy Confirms DNC Contractor Solicited Trump Dirt In 2016 (Hill)

The boomerang from the Democratic Party’s failed attempt to connect Donald Trump to Russia’s 2016 election meddling is picking up speed, and its flight path crosses right through Moscow’s pesky neighbor, Ukraine. That is where there is growing evidence a foreign power was asked, and in some cases tried, to help Hillary Clinton. In its most detailed account yet, Ukraine’s embassy in Washington says a Democratic National Committee insider during the 2016 election solicited dirt on Donald Trump’s campaign chairman and even tried to enlist the country’s president to help.

In written answers to questions, Ambassador Valeriy Chaly’s office says DNC contractor Alexandra Chalupa sought information from the Ukrainian government on Paul Manafort’s dealings inside the country, in hopes of forcing the issue before Congress. Chalupa later tried to arrange for Ukrainian President Petro Poroshenko to comment on Manafort’s Russian ties on a U.S. visit during the 2016 campaign, the ambassador said. Chaly says that, at the time of the contacts in 2016, the embassy knew Chalupa primarily as a Ukrainian-American activist, and learned only later of her ties to the DNC. He says the embassy considered her requests an inappropriate solicitation of interference in the U.S. election.

Am I still the only one who thinks this is good news?

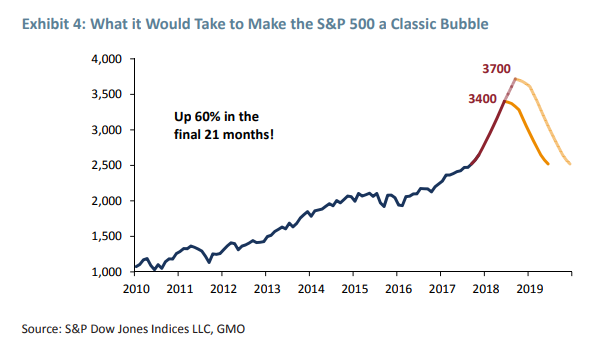

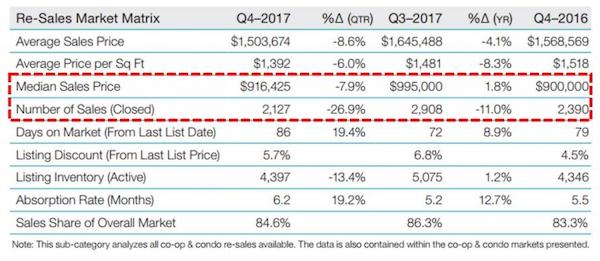

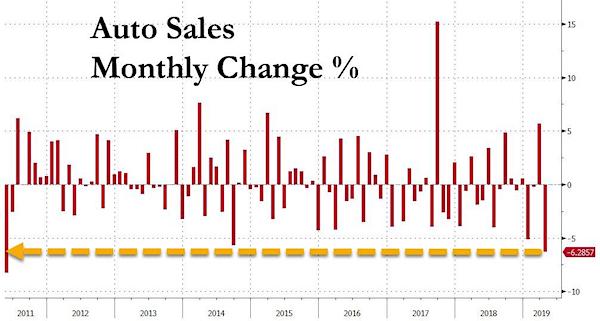

• April US Auto Sales Crash 6.1%, Worst Slide In 8 Years (ZH)

It was yet another dismal month for US auto sales in April, continuing a recessionary trend that has been in place not only in the US, but globally, for the better part of the last 12 months and certainly since the beginning of 2019. The nonsense-excuse-du jour for this month’s disappointing numbers is being placed on the weather on seasonality on rising car prices, which easily pushed away an overextended, broke and debt-laden U.S. consumer. In a nutshell, US auto sales in April tumbled by 6.1% – the biggest monthly drop since May 2011 – to just 16.4 million units, the lowest since October 2014.

Aside for an incentive-boost driven rebound in March, every month of 2019 has seen a decline in the number of annualized auto sales. Furthermore, as David Rosenberg notes, the -4.3% Y/Y trend is the weakest it has been for the past 8 years. Adding “fuel to the fire”, the average price of a new car in April came in at $36,720, the highest ASP so far this year, according to The Detroit News. It comes at a time where interest rates remain above 6% on average, further pressuring sales.

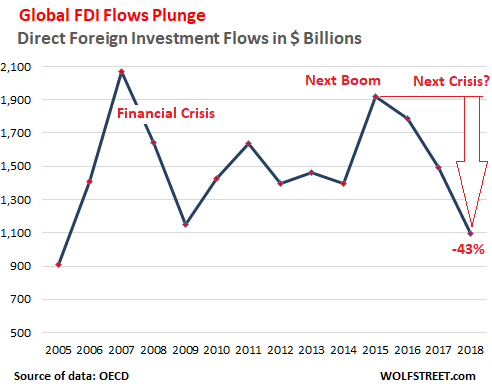

Mostly US funds flowing back home.

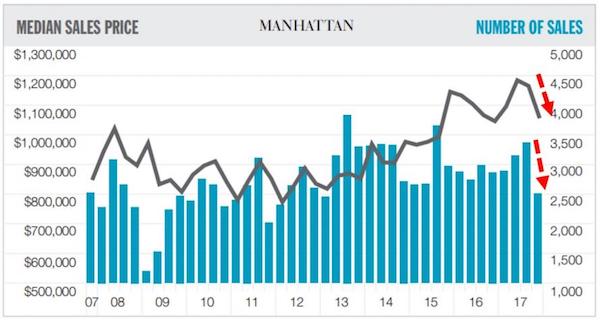

• Global Foreign Direct Investment Flows Collapse (DQ)

Global foreign direct investment flows plunged by another 27% in 2018 — after having already plunged 16% in 2017 — to just $1.1 trillion, the equivalent of 1.3% of global GDP, the lowest ratio since 1999, according to new data released by the OECD. It was the third consecutive annual plunge in global FDI flows, as more and more companies either choose not to invest in businesses or assets in other countries or are prevented from doing so. At the peak in 2015, before the trade wars began, before the Brexit vote happened, and before China began cracking down on the capital outflows that had fueled big-ticket purchases of strategic companies across the globe as well as surging asset prices in multiple jurisdictions, global FDI flows totaled $1.92 trillion and represented around 2.5% of global GDP. FDI has since collapsed by 43%.

The OECD apportions much of the blame for the latest fall in FDI flows on the US tax reform in 2017, which prompted many US companies to repatriate large amounts of earnings held with foreign affiliates in countries such as Ireland and Switzerland, which both suffered a massive reduction in inward foreign investment last year. The U.S. is traditionally the world’s biggest source of FDI, but last year it recorded negative outflows for the first time since 2005, as the movement of funds from U.S. investors into global businesses and assets reversed and flowed back toward the U.S., at least on paper. The total sum of outflows last year was -$48 billion, compared to $316 billion in 2017.

Time to reserve some space for MMT. Harrison has some valid views.

• Hippie-Punching MMT (Edward Harrison)

A lot of people like to argue that the central bank and the central government are independent and autonomous powers. And the argument goes that because of this autonomy, central governments like the US aren’t really all-powerful because the central bank can simply refuse to create more IOUs. I think this is a ridiculous argument, though. The central bank is the central government’s agent. And it exists only as a vehicle for executing banking and monetary policies in the government’s interest. The independence it enjoys is entirely at the central government’s discretion – mostly to create the appearance of non-politically motivated policy which would create inflation and debase the currency. If push came to shove, the central government would do whatever it took to issue IOUs to promise to pay the bearer of its money the required sum of fiat currency.

Notice, though, that Euro Zone governments don’t have the same power because they cannot create euros. Sure, they can enforce tax in euros with the coercive power of the penalty of prison as an incentive. But, when their euro taxes fall short, they can’t create euros to make up the shortfall. The euro is not their IOU. They are just like any other debtor in the eurozone. And the MMT crowd were onto this right from the start. In fact, one of the MMT forefathers, Wynne Godley, predicted the European Sovereign Debt Crisis when the euro was first conceived in 1992. On the other hand, most mainstream economists were caught flat-footed by the crisis. They were operating under the assumption that the bond vigilantes had the same power over all debtors including sovereigns.

They said the bond vigilantes just gave sovereigns more leeway. And that’s still their position today despite all evidence to the contrary. How do you trade that? For me, I trade that by saying Germany is the de facto ‘sovereign’ in the euro zone because of its size and fiscal rectitude. The euro would have to cease to exist before German sovereign debt came under attack from bond vigilantes. Now, if Deutsche Bank went bankrupt and Germany bailed it out at great cost and went on a deficit binge to boot and government debt to GDP ended up ballooning to 120% of GDP, things would be different.