Emil Nolde Half Moon Over The Sea 1945

Watch the female cadet

Another angle of Joe Biden’s fall on stage today. Watch the reactions. pic.twitter.com/74ChFqPafI

— The Post Millennial (@TPostMillennial) June 1, 2023

Putin rule the world

Putin’s response to WSJ’s Ann Simmons when asked if he wants to rule the world. pic.twitter.com/efXqGxvCDA

— Putin Direct (@PutinDirect) May 31, 2023

Trump Hannity

https://twitter.com/i/status/1664470133748776963

BRICS vs G7

BRICS vs G7… pic.twitter.com/BlQtxdbsxd

— Mats Nilsson (@mazzenilsson) June 1, 2023

What’s the use of proposing things you know will not happen?

• Ukraine Calls for Massive Demilitarized Zone Inside of Russia (LI)

As a condition for ending the war, an aide to President Volodymyr Zelensky has demanded Russia remove its military forces along its border with Ukraine. Kiev hopes the area within Moscow’s borders will be manned by international forces. Presidential adviser Mykhailo Podolyak called for a 100-120 kilometer demilitarized zone within Russia. “It will be necessary to introduce a demilitarization zone of 100-120 km on the territory of Belgorod, Bryansk, Kursk, and Rostov republics. Probably with a mandatory international control contingent at the first stage,” he tweeted on Monday. Kiev is seeking to take control over Moscow’s nuclear and missile programs as well.

“Reduction of offensive weapons (missiles with extended range). International conference to organize control over the nuclear arsenal of the [Russian Federation],” Podolyak said in a separate tweet. Podolyak has made other demands of Moscow on the social network during recent days. On Saturday, he stated that the war can only end when the Russian government of Vladimir Putin was removed from power. The adviser added that “there is nothing to talk about with” the current administration in the Kremlin and Putin should be extradited for war crimes. While Kiev makes one-sided proposals for ending the conflict, the Ukrainian army is struggling to regain any of the territory controlled by Moscow.

Russian forces control about 20% of Ukraine, recently capturing Bakhmut after a months-long battle. The Kremlin says it has annexed about five Ukrainian oblasts and it will not return those to Kiev’s control. It seems unlikely Kiev will be able to force Moscow to make concessions demanded by Podolyak. However, the conditions laid out by Zelensky’s adviser could hinder international efforts aimed at ending the war in Ukraine. Brazil’s President Luiz Inácio Lula da Silva was attempting to build momentum towards a deal, but that was scuttled when Zelensky skipped a meeting with the Brazilian leader. Additionally, a coalition of African nations and China are attempting to work towards a negotiated settlement in the war.

No.

• Zelensky Demands NATO and EU Membership For Kiev (RT)

Ukrainian President Vladimir Zelensky insisted on Thursday that his country needed to be admitted to both the EU and NATO this year, or the West would be failing not just Ukraine, but Moldova, Georgia, Belarus and others. “Russia is afraid of NATO,” Zelensky argued at the summit of the European Political Community, which is being held at Castle Mimi in Bulboaca, Moldova. Moscow, he claimed, “tries to swallow only those who are outside the common security space,” or leave behind “frozen conflicts” like Transnistria. Every European country that borders Russia “should be a full member of the EU and NATO,” Zelensky said. “There are only two alternatives to this: either an open war, or a creeping Russian occupation.”

Admitting Ukraine would send a sign to Moldova, Georgia, and Belarus, he claimed, but “if even Ukrainians, who are proving our commitment to freedom and the values of a united Europe with blood, have not yet heard a clear positive answer about joining the EU and NATO, the hopes of the others are becoming completely illusive.” Both NATO and the EU have long-standing policies of not admitting new members if they are currently engaged in conflicts or have unresolved territorial disputes. Though both blocs have made multiple exceptions for Ukraine since last year, the Germans at least appeared unwilling to cross that line.

“There are clear criteria for membership. You can’t have border conflicts for instance,” Chancellor Olaf Scholz said on Thursday. His foreign minister, Annalena Baerbock – herself an outspoken advocate of Kiev – also argued it was “clear that we cannot talk about new membership in the middle of a war.” On Wednesday, the Financial Times reported that Zelensky had threatened to skip the NATO summit in Lithuania in July unless the bloc gave Kiev the security guarantees he demanded. Russia considers NATO’s eastward expansion to be a threat to its national security, and has cited Ukraine’s aspirations to join the US-led bloc as one of the reasons for the current conflict. The bloc has provided Ukraine with over $100 billion in military aid over the past year, while insisting both that Russia “must lose” and that they are not directly involved.

“At the same time, it is clear that we cannot talk about new membership in the middle of a war..”

• Germany Tells Zelensky NATO Can’t Consider Ukrainian Membership Now (RT)

Ukraine cannot join NATO while it remains locked in a conflict with Russia, German Foreign Minister Annalena Baerbock has said. Last month, German Chancellor Olaf Scholz also expressed skepticism about Kiev’s admission into the US-led military bloc. Speaking ahead of a meeting of NATO foreign ministers in Norwegian capital Oslo on Thursday, Baerbock claimed that the bloc’s doors remain open for potential new members. This applies to Sweden in particular, but also to Ukraine, she said. “At the same time, it is clear that we cannot talk about new membership in the middle of a war,” Baerbock stressed regarding Ukraine’s aspirations.

German Chancellor Scholz said last month that Kiev’s potential NATO membership “doesn’t stand on the agenda anytime soon.” He cited a “whole range of requirements belonging to NATO’s criteria that Ukraine can’t fulfill at present.” The chancellor argued that the bloc should for the time being focus on helping Ukraine to “defend its land” against Russian forces. While some NATO members such as Poland and the Baltic states have long advocated a fast track for Ukraine’s accession, others, including the US and Germany, are reluctant to commit to such a scenario, the Financial Times reported in April.

Citing anonymous sources, the FT claimed on Wednesday that Ukrainian President Vladimir Zelensky had “made clear to NATO leaders that he will not attend the Vilnius summit [in July] without concrete security guarantees and a road map for accession.” Kiev formally applied to join the US-led bloc in September 2022, arguing that the collective defense it provides to members would ensure Ukraine’s security against Russia. Moscow, in turn, considers NATO’s eastward expansion to be a threat to its national security, and has cited Ukraine’s aspirations to join the bloc as one of the reasons for the current conflict.

The ultimate li(n)e: we protect you.

• Zelensky Warns Doubts On Ukraine NATO Membership Endanger Europe (Az.)

Ukraine’s President Volodymyr Zelenskyy warned European leaders that any doubts they show before admitting Kyiv into the Nato alliance will embolden Russia to attack more countries, Report informs, citing foreign media. “We must remember that every doubt we show here in Europe is a trench that Russia will definitely try to occupy,” he told a European summit in Moldova. Ukraine is a candidate to join both Nato and the European Union, and Moldova the EU, but some European capitals are wary of setting a formal timeline for membership as Russia’s invasion continues.

But, addressing four dozen European leaders from inside and outside the union and the alliance, the Ukrainian leader warned that delaying a decision would undermine the West’s strength. He complained that if Ukraine and Moldova have no clear path to joining the groupings, vulnerable pro-Western political forces in Belarus and Georgia will be at risk. “Whether these doubts are about vital security steps or doubts about our unity, maybe about our ability to meet the challenges of our time, every doubt brings more insecurity,” he said.

But why? Does Rutte think Ukraine can win? Hard to imagine. Does he know Ukrainians will get killed? Of course he does.

• Netherlands Looks To Buy Dozens More Tanks For Ukraine (RT)

Dutch officials are reportedly making plans to buy dozens more Leopard 1 tanks, as well as Patriot missiles, to help boost Ukraine’s firepower in its ongoing conflict with Russia. The Netherlands’ Cabinet aims to purchase Leopards from Swiss state-owned manufacturer Ruag, Dutch online media outlet NL Times reported on Thursday, citing people familiar with the plans. The deal will require approval from Switzerland’s government, which has tried to maintain neutrality amid the Russia-Ukraine conflict. Amsterdam joined with Germany and Denmark in February to buy at least 100 Leopard 1A5 battle tanks for Ukraine from German manufacturers. Swiss newspaper Targes-Anzeiger reported that the Netherlands seeks to buy 96 Leopard 1s, an older version of the tank, from Ruag. At the same time, the Netherlands is looking to provide more Patriot missiles or parts to operate them to help boost Ukraine’s air defenses, the NL Times said.

The NATO member previously gave Kiev two Patriot launchers and a number of missiles. “We are looking very closely at what we can still do,” Dutch Prime Minister Mark Rutte said on Thursday after arriving in Moldova for a summit of European leaders. However, he added that given the Netherlands’ own security needs, “you can’t deliver everything you’ve got.” He called for more countries to join the coalition of nations supplying Patriot missiles to Ukraine. German lawmakers last week approved the purchase of 18 Leopard 2A8 tanks and 12 Panzerhaubitze 2000 howitzers to replace weapons stockpiles that were sent to Kiev. The deal reportedly includes an option to buy 105 additional Leopards. Berlin’s latest aid package for Ukraine includes 30 Leopard 1 tanks. Ukraine has repeatedly said that the supply of foreign heavy weapons is crucial for the success of its planned counteroffensive. Moscow, meanwhile, has warned that the Western-delivered tanks and other systems would be treated as legitimate targets on the battlefield.

Wow. Talk about propaganda.

• The Guardian View On Vladimir Putin’s War: Terror Without Purpose (G.)

Vladimir Putin has never been honest with the Russian people about the war in Ukraine. He lied about the scale of the invasion and the reasons for it. The deception is sustained with propaganda and repression. Outlawing the truth has kept the reality of war mostly out of sight, which is a condition of public acquiescence. That doesn’t mean that millions would rise up against their government if confronted with the true horror of what is being done to Ukraine in their name. The bellicose cult is well embedded in Russian society. But it is easier to support a war that unfolds on television than one that can be heard flying overhead, which is why drone strikes against targets in Moscow this week have rattled the Kremlin. Ukraine denies involvement in the attack, as it does automatically when military operations cross Russia’s borders, in deference to Kyiv’s western allies who are made uncomfortable by such bold incursions.

There were also reports on Wednesday of a fire at an oil refinery in the southern Russian Krasnodar region, started by a drone. The raid on Moscow caused little damage but plenty of alarm, which is the point. Getting the war within visible range of ordinary Russians is embarrassing for Mr Putin. It undermines his aura of control. It is harder to pretend things didn’t happen when people can see them from their windows. Most analysts interpret these attacks as part of a disorientation strategy, forcing the Kremlin to divert resources and attention away from the frontline in advance of a Ukrainian counteroffensive to recapture occupied territory. The same applies to the murkier business of raids across the Ukrainian border into Russia’s Belgorod region, carried out by far-right, anti-Putin Russian militias.

The fog of war is dense, with Ukrainian strategists cultivating uncertainty to unsettle Russian defences and Russian lines of command, tangled amid factional bickering in Moscow and between rival commanders on the ground. That makes it all the more important to keep a focus on core facts and moral imperatives: Ukraine is the victim of an unprovoked invasion by forces whose primary tactic is terrorising the civilian population into submission by means of indiscriminate murder and destruction. This campaign of atrocity has not succeeded, because Ukrainians have shown heroic fortitude and ingenuity on an epic scale. Also, they have been armed for that endeavour by western governments, which had to balance fear of escalation with a realistic appraisal of the character of Mr Putin’s regime, and the threat he posed to European peace if unchecked.

Russia did not start its territorial aggression against Ukraine in 2022, but eight years earlier, in Crimea. Mr Putin did not stop there because Russia wanted to have complete dominance over the domestic and foreign policy orientation of the government in Kyiv. He gambled that the west would look away again. Thankfully, the Russian president was mistaken. He thought then that Russia’s appetite for carnage, even from a losing position, would outlast western solidarity with Ukraine. That too turns out to be a miscalculation, so far. Without a follow-up strategy, Mr Putin’s war is sustained by his monstrous pride, readiness to sacrifice conscript soldiers for no measurable purpose and a political apparatus that allows him to cover up his failures. Those conditions make Russia’s position look solid. But they could turn out to be brittle, as long as Ukraine’s allies stand firm.

“The Russian economy currently retains its rank as the 11th in the world, based upon standard gross domestic product (GDP) comparisons. However, when one converts Russia’s $1.78 trillion GDP using the “basket of goods” formulation of purchasing power parity (PPP) (i.e., what similar goods cost in the United States versus Russia), Russia’s actual economic strength converts to $4.80 trillion, making it the world’s sixth largest economy, surpassing all but China, the US, India, Japan, and Germany.”

• Sanctions Against Russia Failed. I Saw It Firsthand (Scott Ritter)

I just returned from a month-long visit to Russia, during which time I had the opportunity to see a dozen different cities covering nearly the entire expanse of the Russian Federation. Prior to my departure, I was filling up the tank of my car, when I noticed a sticker on the gas pump. The sticker portrayed a smiling Joe Biden, the President of the United States, gesturing to his right. Underneath the image were printed the words, “I did this!” [..] In January and February 2023, Russia spent 2 trillion rubles ($26 billion) on defense, a 282% jump on the same period a year ago. Far from being unable to replenish its military strength and sustain the conflict in Ukraine, Russia is far outpacing NATO in terms of rushing military material to the frontlines by 4 to 1 in terms of tanks and armored fighting vehicles and 5 to 1 in artillery ammunition.

When calculated with kill ratios that are overwhelmingly in favor of Russia, the fact is that Russia is sapping the strength of NATO and its Ukrainian proxy, while expanding its own. In addition to nearly tripling the size of its special military operation contingent, Russia is simultaneously building up the forces necessary to meet the expansion of its army from its pre-conflict size of 1 million, to a force of more than 1.5 million. Moreover, Russia’s increase in military production has not only softened the economic impact of the US-sponsored sanctions, but also helped reverse their impact across Russia’s industrial base. Everything I saw while touring Russia underscored the incontrovertible fact that, because of Western sanctions, the Russian economy has been compelled to undertake changes which have not only made it more resilient, but also more productive and efficient.

Foreign investments are surging in, proving that there is a world that exists beyond that controlled by the American economic hegemon. Moreover, because sanctions have curtailed the previous practice of Russian business tycoons sending their wealth abroad, there is a huge amount of domestic economic capital available for reinvestment into the Russian economy. This truth was evident in every city I visited, where there were unprecedented levels of infrastructure improvements and new construction taking place.

“..almost half the grain that made its way to the EU ended up as fodder for pigs raised by Spanish ham producers.”

• Black Sea Grain Deal Hits Obstacle – UN (RT)

Russia has notified the Joint Coordination Center in Istanbul it will restrict the passage of grain ships to the port of Yuzhny until Ukraine reopens the Togliatti-Odessa ammonia pipeline, UN spokesman Stephane Dujarric told reporters on Thursday. Dujarric said that Director General Rebecca Greenspan of the UN Conference on Trade and Development (UNCTAD) is working to resolve the pipeline issue, but there was no progress to report yet, according to the TASS news agency. The UN also expressed concern that the implementation of the deal has slowed down, with only 33 ships leaving Ukrainian ports in May, “two times less than in April.” Meanwhile, the number of inspection teams has been reduced from three to two.

Yuzhny is one of the three ports covered by the July 2022 Black Sea Initiative, the others being Chernomorsk and Odessa. The agreement mediated by the UN and Türkiye provided for the shipments of Ukrainian grain by sea, as well as the unblocking of Russian agricultural exports – but only the first part has been implemented. On May 17, Moscow agreed to extend the deal for another 60 days. Turkish President Recep Tayyip Erdogan announced the decision on the eve of the presidential election, which he went on to win in the runoff. In a Facebook post on Thursday, Ukraine’s ministry of renovation and infrastructure accused Russia of “another unjustified refusal … to register the incoming fleet.”

A senior official in Kiev told Reuters, on condition of anonymity, that Ukraine would consider reopening the Togliatti-Odessa pipeline if the Black Sea deal was expanded to include more ports and more commodities. Speaking to reporters earlier in the day, Russian Deputy Foreign Minister Sergey Vershinin said that none of the five issues Moscow had identified with the deal – of which the Togliatti-Odessa pipeline was but one – have been addressed by the UN, “Our position remains unchanged – the export of ammonia is part of the existing agreements and was supposed to start simultaneously with the transportation of Ukrainian grain,” Vershinin said, adding that without addressing the five issues, there is no point in discussing the extension of the grain deal beyond July 17.

The deal was originally trumpeted in Ukraine and the West as a breakthrough in addressing food shortages in Africa and parts of Asia. According to data revealed by the Turkish Ministry of Commerce last week, however, 47% of the Ukrainian exports went to EU countries, and only 27% reached places like Egypt, Kenya, and Sudan. More than 30 million tons of grain have been transported by 953 ships since August 2022, with corn making up 50% of the cargo and wheat another 27%. Much of the grain was not for human consumption, but marked as animal feed. According to the research one Austrian outlet published in February, almost half the grain that made its way to the EU ended up as fodder for pigs raised by Spanish ham producers.

Google translation.

• Ursula von der Leyen’s Name Embroiled In Scandal In Bulgaria (LePoint)

One more scandal in Bulgaria? Ursula von der Leyen could have done without it. Her name appears in a sound recording secretly made during a meeting of the Let’s continue the change party (PP, according to the Bulgarian initials) which was to validate the government agreement reached with the rival party, the Gerb, of Boïko Borissov . This four and a half hour recording had the effect of a bomb! Its broadcast was programmed to derail the negotiations between the PP and the Gerb. We hear, in fact, the former Prime Minister Kiril Petkov. Not knowing that he was being tapped, he recklessly reveals the content of a telephone conversation with the President of the European Commission. There was, indeed, on May 21, a telephone contact between Petkov and von der Leyen about the possible accession of Bulgaria to the euro zone and the Schengen area. The Commission supports Bulgaria in these two undertakings. That’s not the problem.

“I asked her what our chances of being accepted are,” Petkov said. She answered me: “For Schengen, you have a great chance. For the euro zone, you have to find a way around the rules, that is to say ‘fit into the framework’. I answered her: “Can we -we have inflation minus the Ukraine effect .” And she was like, ‘Don’t quote me, we’ll try to help you.’ » On the side of the Commission, we naturally deny the content of the remarks. “There is a structured process for joining the euro zone, which applies to all countries, says the European executive. The Commission provides its support to fulfill the conditions. Of course, the rules must be followed. » We will never know what terms are really used by each other, but this recording is a furious reminder of Greece ‘s contentious entry conditions into the euro zone.

Athens, with the help of Goldman Sachs, had provided false data to circumvent the criteria for joining the euro zone. The pot of roses was revealed during the Eurozone crisis, when the real statistics were restored by Andreas Georgiou . A sinister episode that left its mark on German public opinion, which was very upbeat at the time. Bulgaria, already very fragile, should not repeat the same subterfuge.

Reads like a full time job.

• Breadcrumbs From A Buried FBI Source May Lead To A Bigger Biden Scandal (Fed.)

After a confidential human source claimed then-Vice President Joe Biden agreed to accept money from a foreign national to affect policy decisions, FBI agents used what’s called an FD-1023 form to record the allegation. Now FBI Director Christopher Wray is defying a May 3 congressional subpoena to provide this form. On Tuesday, in response to Wray’s refusal to hand over the documents, Oversight and Accountability Committee Chair James Comer announced the House will move to hold the FBI director in contempt of Congress. It isn’t that announcement — or even the other explosive ones released over the past year by Comer’s Senate colleague, Chuck Grassley — that prove the most telling, however. Rather, it is the combination of all the details, big and small, that suggests the scandal set to unfold over the coming weeks will be bigger than anyone imagined.

Take recent big news from whistleblower disclosures revealing that the Justice Department and the FBI have the unclassified FD-1023 form spelling out Biden’s alleged criminal behavior. Then combine that with other known information to discover the bigger picture. For instance, in response to Wray’s failure to comply with the subpoena, Grassley, who had previously noted the FD-1023 form was five or six pages long, indicated that the confidential human source (CHS) was “an apparent trusted FBI source.” This is huge because Grassley wouldn’t make that claim unless the whistleblower had. That means the source is not some random guy walking in off the street, but rather an existing “trusted” CHS, which is why the FBI used the FD-1023 form. In response to Wray’s stonewalling, Comer likewise revealed some significant details, clarifying late last week that the CHS reporting document was dated June 30, 2020, and referenced “the amount of money the foreign national allegedly paid to receive the desired policy outcome” as “five million.”

These details could only have come from a whistleblower with deep knowledge of the investigation, meaning the whistleblower’s characterization of the CHS as “trusted” carries more weight. Likewise, the whistleblower’s claim that the FD-1023 “includes a precise description of how the alleged criminal scheme was employed as well as its purpose,” is more credible given the whistleblower’s knowledge of other details. Comer’s reference to “five million” is also intriguing. In a letter to Wray, Attorney General Merrick Garland, and Delaware U.S. Attorney David Weiss, Grassley had previously revealed a promise by a Chinese communist government-connected enterprise to funnel $5 million to “Hunter and James Biden to compensate them for work done while Joe Biden was vice president.” Records released by Grassley and Sen. Ron Johnson, R-Wis., also confirmed a $5 million payment to James and Hunter Biden from another Chinese-connected business.

The date of the FD-1023 form, June 30, 2020, also proves significant when read in conjunction with Grassley’s letter to Wray in July 2022. In that letter, Grassley said the whistleblower had claimed that “the FBI developed information in 2020 about Hunter Biden’s criminal financial and related activity,” but “that in August 2020, FBI Supervisory Intelligence Analyst Brian Auten opened an assessment which was used by a FBI Headquarters (‘FBI HQ’) team to improperly discredit negative Hunter Biden information as disinformation and caused investigative activity to cease.” The whistleblower further alleged that in September 2020, the FBI HQ team that handled the Auten assessment, after concluding the reporting was disinformation, placed the information in a restricted access sub-file that only the particular agents who uncovered the CHS’s information could access.

David Stockman was Reagan’s budget director. Hard to claim he doesn’t know what he’s talking about.

“Speaker Kevin McCarthy has straw for brains and a Twizzlers stick for a backbone..”

• Speaker McCarthy’s Rotten Deal (David Stockman)

If there was ever any doubt, now we know: Speaker Kevin McCarthy has straw for brains and a Twizzlers stick for a backbone. He was within perhaps five days of breaking the iron grip of America’s fiscal doomsday machine, yet inexplicably he turned tail and threw in the towel for a mess of fiscal pottage. We are referring, of course, to the impending moment when the US Treasury would have been forced to forgo scheduled vendor or beneficiary distributions in order to preserve incoming cash for interest payments and other priorities. That act of spending deferrals and prioritization would have obliterated the debt “default” canard once and for all, paving the way for a nascent fiscal opposition to regain control of the nation’s wretched public finances. And there should be no doubt that we were damn close to that crystalizing moment. After all, Grandma Yellen herself forewarned just last week on Meet The Press that absent a debt ceiling increase, the Treasury Department would have to prioritize payments and leave some bills unpaid:

“And my assumption is that if the debt ceiling isn’t raised, there will be hard choices to make about what bills go unpaid,” Yellen said on NBC’s “Meet the Press…….“We have to pay interest and principle on outstanding debt. We also have obligations to seniors who count on Social Security, our military that expects pay, contractors who’ve provided services to the federal government, and some bills have to go unpaid….” And, of course, that prioritization and deferral could have been easily done. Federal receipts are now running about $450 billion per month, meaning that after paying $61 billion of interest, $128 billion for Social Security, $26 billion for Veterans and $47 billion for military pay and O&M there would still be $188 billion left to cover at least 50% of everything else. That is to say, no sweat with respect to servicing the public debt, and a lot of sweat among the constituencies that would have had payments delayed or reduced.

So, yes, the GOP has truly earned the Stupid Party sobriquet. No ifs, ands or buts about it. Instead of spending days negotiating over the minutia of budgetary scams, tricks and slights-of-hand, which is the entirety of the McCarthy deal, they should have been demanding from the Treasury a detailed list of scheduled payments by day for the first few weeks in June. And then, in return for continued negotiations on meaningful spending cuts and reforms, demanded assurance from the White House that enough of these due bills would be temporarily stuck in the drawer (deferred), if necessary, to ensure payment of scheduled interest, Social Security, military pay and Veterans pensions. That is to say, McCarthy had Sleepy Joe over the proverbial barrel. But instead of applying the wood to his political backside good and hard, the Speaker chose to hold Biden’s coat and help him get back up, praising the latter’s supercilious retainers as he did so.

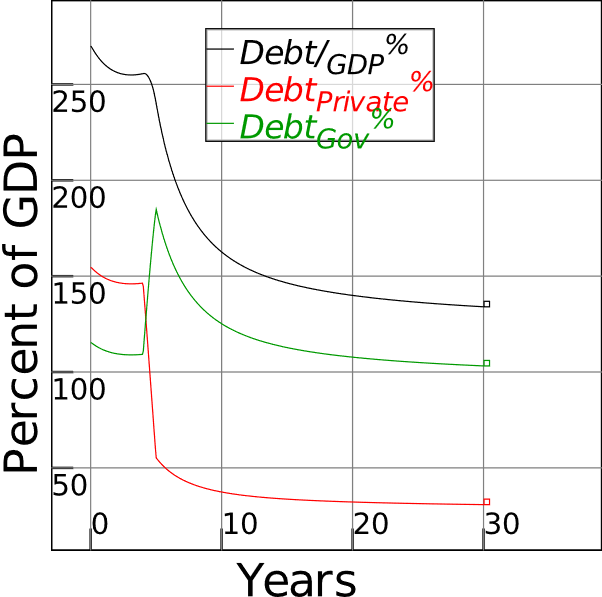

A jubilee through inflation?

• A Debt Jubilee of Biblical Proportions Is Coming Soon (IM)

The US federal government has the biggest debt in the history of the world. And it’s continuing to grow at a rapid, unstoppable pace. In short, the US government is fast approaching the financial endgame. Here’s why… Today, the US federal debt has gone parabolic and is scores of trillions. To put it in perspective, if you earned $1 a second 24/7/365—about $31 million per year—it would take you over 1,008,378 YEARS to pay off the US federal debt. And that’s with the unrealistic assumption that it would stop growing.

The truth is, the debt will keep piling up unless Congress makes some politically impossible decisions to cut spending. But don’t count on that happening. In fact, they’re racing in the opposite direction now that they’ve normalized multitrillion-dollar deficits. The amount of debt is so extreme that even a return of interest rates to their historical average would mean paying the interest expense on the debt would consume more than half of current tax revenues. Interest expense would eclipse Social Security and defense spending and become the largest item in the federal budget. Second, a return to the historical average interest rate will not be enough to reign in inflation—not even close. A drastic rise in interest rates is needed. If that happened, it could mean that the US government is paying more for the interest expense than it takes in from taxes.

In short, the Federal Reserve is trapped. Raising interest rates high enough to dent inflation would bankrupt the US government. In other words, it’s game over. They have no choice but to “reset” the system—that’s what governments do when they are trapped. How are they going to reset the system? Nobody knows for sure. But I’d bet a debt jubilee of biblical proportions will be a big part of it. So then, how will the US government repudiate its impossible federal debt burden? My guess is that they won’t be explicit. That would look too much like a default. It would destroy the role of the US as the center of the world’s financial system. Given a choice, I don’t think the US government would choose immediate self-destruction. Since power does not relinquish itself voluntarily, we should presume they’ll decide to stealthily implement their federal debt jubilee through inflation.

Should be a lot simpler.

• Twitter Head Of Trust & Safety Gone After “Mistake” Banning Documentary (ZH)

As Matt Taibbi detailed earlier via Racket News, at roughly 8:30 a.m. ET this morning, Jeremy Boreing, co-founder and co-CEO of the Daily Wire, posted a lengthy thread on Twitter outlining what appeared to be a major reversal on speech issues on the Elon Musk-owned platform. “Twitter canceled a deal with @realdailywire to premiere What is a Woman? for free on the platform because of two instances of ‘misgendering,’” Boreing wrote, adding, “I’m not kidding.” Noting the film would be labeled “hateful conduct,” the thread detailed a months-longer roller-coaster dispute between the producers of What is a Woman?, a controversial documentary by Matt Walsh released a year ago today, and the current incarnation of the bird site.

In celebration of the release anniversary Walsh, Boreing, and the Daily Wire began making plans to partner with Twitter for a 24-hour livestream today, June 1, 2023. Twitter at first responded with enthusiasm, offering the chance to buy “a package to host the movie on a dedicated event page” and “a chance for us to promote the event to every Twitter user over the first 10 hours.” The initial exchange came roughly a month ago, and the Wire team planned a significant ad buy and other promotions.

Weeks later, Twitter ominously asked the Daily Wire for a review copy of Walsh’s movie. Boreing said the firm then found out Twitter would not only “no longer provide us with support,” but bluntly told them they would “limit the reach” of the film if the Daily Wire went ahead with the event on its own. In one of many odd twists to this story, the problem involved two alleged instances of “misgendering,” a category of offense Twitter controversially removed from hate speech guidelines in April. “They gave us the opportunity to edit the film to comply. We declined,” wrote Boreing. Boreing’s tweet-storm today provoked a quick backlash on the platform, with personalities like Tim Pool promising to terminate his “enterprise Blue subscription” if the decision wasn’t reversed. As if by magic, Musk at 1:33 p.m. tweeted that it was a “mistake by many people at Twitter”:

[..] Update (2000ET): Following Elon Musk’s comments earlier that the cancellation of a deal to show Daily Wire’s ‘What Is A Woman?’ documentary “was a mistake by many people at Twitter,” Fortune reports that Twitter’s head of trust and safety is no longer in Twitter’s internal slack, citing an unidentified person and a screenshot of her deactivated account. Reuters later reported that Ella Irwin told them that she has resigned from the social media company. As The Wall Street Journal reports, Irwin’s departure is the second time someone in that role has left since Elon Musk bought the company in October. Yoel Roth, who had previously served as Twitter’s head of trust and safety, left the company in November, and Irwin subsequently took the top job overseeing user content and safety policies.

Irwin, who joined Twitter about a year ago, declined to comment Thursday on the reasons for her decision to leave Twitter. She said in an interview she felt she had always been honest in her work. Presumably by her definition of “honest”. Musk noted briefly in a response to questions about the ban/throttling of the documentary: “being fixed.” The Twitter CEO added in a thread with the creator of the documentary that “It will be advertising-restricted, as advertisers have the right to decide what content their ads appear with, which will impact reach to some degree.” It appears there are still plenty of anti-free-speech workers at Twitter…

Excuse to keep him locked up: pending investigation.

• FBI Reopens Case Around Julian Assange (IC)

The FBI has reopened an investigation into Australian journalist Julian Assange, according to front-page reporting from the Sydney Morning Herald. The news that the FBI is taking fresh investigative steps came as a surprise to Assange’s legal team, given that the U.S. filed charges against the WikiLeaks founder more than three years ago and is involved in an ongoing extradition process from a maximum security prison in the United Kingdom so that he can stand trial in the United States. Assange is charged under the Espionage Act with obtaining, possessing, and publishing classified information that exposed U.S. war crimes in Iraq and Afghanistan, crimes that themselves have gone unpunished. The Morning Herald reporting also comes amid heightened hopes in Australia that a resolution to the case, which has raised serious press freedom issues in the U.S. and abroad, was near at hand.

The country’s ruling party has spoken in defense of Assange, as has the nation’s opposition party leader. In early May, a cross-party delegation of influential Australian lawmakers met with the U.S. Ambassador Caroline Kennedy, urging that a deal be struck to return Assange to Australia before U.S.-Australian relations were harmed further by the prosecution. The U.S. has otherwise complicated its relationship with Australia in recent weeks even as it seeks closer ties in order to compete with China in the region. Australia spent weeks preparing for Joe Biden to make a major visit to the nation in May, only to see him cancel the trip at the last minute to fly back from Japan to continue with debt ceiling negotiations. And this week, the U.S. also warned Australia that some of its military units may be ineligible to cooperate with U.S. forces due to their own alleged war crimes in Australia.

It is not lost on the Australian public that Assange is being prosecuted for uncovering and publishing evidence of U.S. war crimes. In May, the Morning Herald reported, the FBI requested an interview with Andrew O’Hagan, who was brought on more than 10 years ago to work as a ghostwriter on Assange’s autobiography. The FBI may have thought he would be cooperative because O’Hagan’s relationship with Assange soured; O’Hagan publicly criticized Assange as narcissistic and difficult to work with and published an unauthorized version in the London Review of Books instead. But O’Hagan told the Morning Herald he was not willing to participate in his prosecution. “I might have differences with Julian, but I utterly oppose all efforts to silence him,” he said.

“..members of the Chicago “Outfit” had successfully packed up and were on their way out of town before being mugged on their way to the airport.”

• Due To High Crime, Mafia Closes Its Chicago Office (BBee)

Today marked the end of an era, as the Mafia announced it was officially closing its Chicago branch due to the rising wave of violent crime in the city. “We just can’t operate under these conditions,” said street boss Albert “Albie the Falcon” Vena, speaking on behalf of Salvatore “Solly D” DeLaurentis, who has run the Chicago organization since 2021. “How are we supposed to conduct respectable business — loan sharking, bribery, racketeering, illegal gambling — with so much crime going on? It’s insane!” The Windy City has long been known for its organized crime operations, dating back even before the days of Al “Scarface” Capone in the 1920s Prohibition Era. Today’s mobsters now lament the difficulty they face in doing horrible things behind the scenes in the city while so many even more horrible things are being done in broad daylight.

“One of our best leg-breakers got his legs broken by a gang of 40 high schoolers last week,” said organization member Frank “Toots” Caruso. “They recorded it and put it on TikTok. We just don’t feel safe around here. I’m afraid to just walk down the street!” Rising crime rates in Chicago have become a staple under Democrat leaders, resulting in skyrocketing numbers of violent crimes and shooting deaths, despite the city having some of the strictest gun laws in the nation. “You think we’re gonna be out there working?” asked Nicholas “Jumbo” Guzzino. “Are you kidding me? I don’t wanna get shot!” At publishing time, members of the Chicago “Outfit” had successfully packed up and were on their way out of town before being mugged on their way to the airport.

Oscar

https://twitter.com/i/status/1664223997137940481

One

https://twitter.com/i/status/1664325552545624064

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.