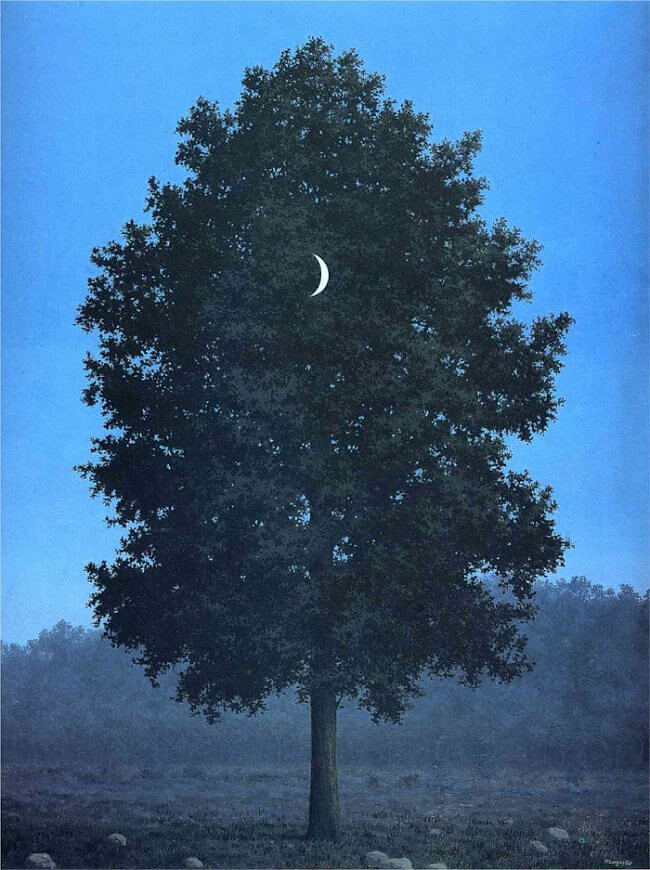

René Magritte Sixteenth of September 1956

Kherson Refugees Reject Western Media Claims of Russia “Kidnapping” Them

Tucker TikTok

Just the name—the RESTRICT Act—ought to tell you what it’s about.

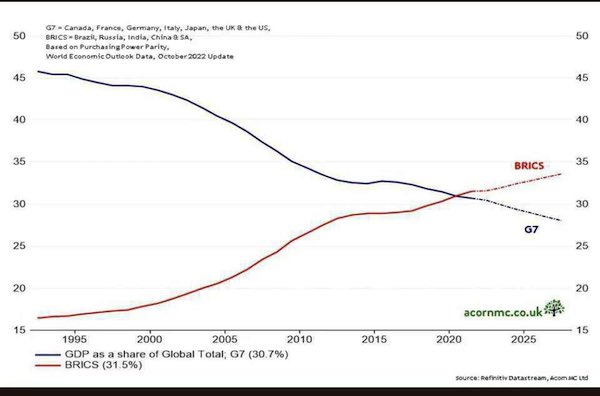

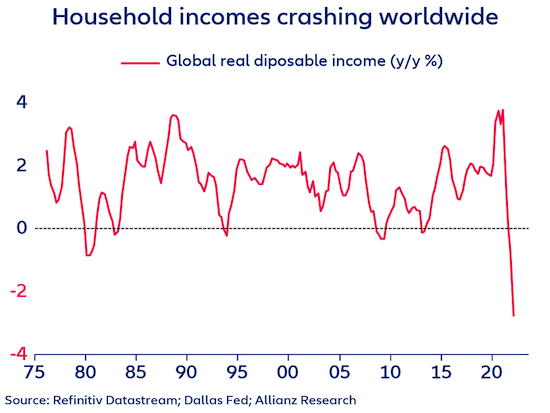

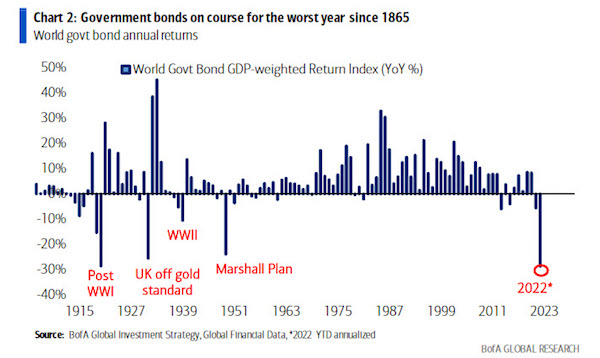

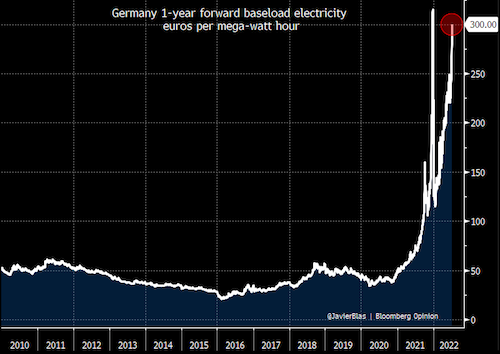

The more things deteriorate in the West, the more the leadership class feels it is losing control — so the more they will try to repress the people.

And it will get a lot worse.pic.twitter.com/jTgWSIiKI5

— Gonzalo Lira (@GonzaloLira1968) March 28, 2023

Todd

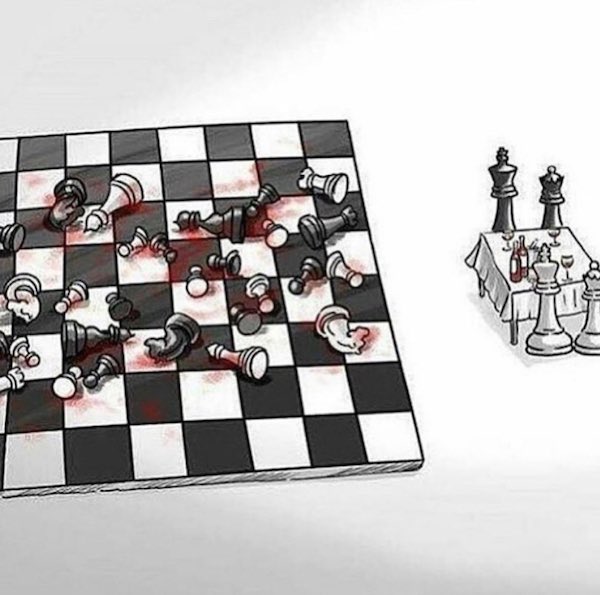

The U.S. conspiracy against Russia was crushed.

Emmanuel Todd, a French historian, states that Russia started a preventive war in Ukraine. The U.S. provoked the actions of Putin, who warned that he would not tolerate NATO in Ukraine. The goals pursued by the West have been… pic.twitter.com/zNUfcnwrSY

— GraphicW (@GraphicW5) March 28, 2023

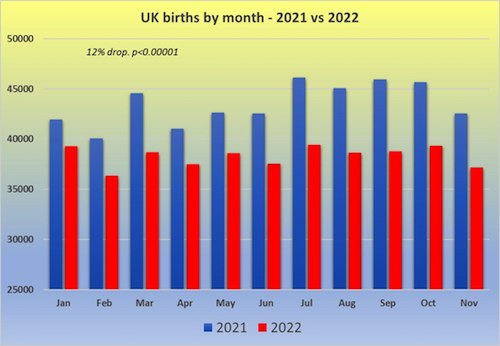

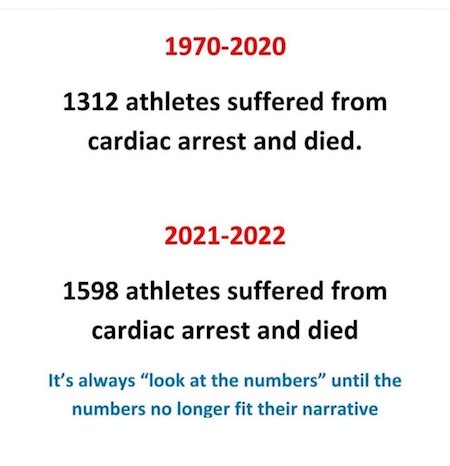

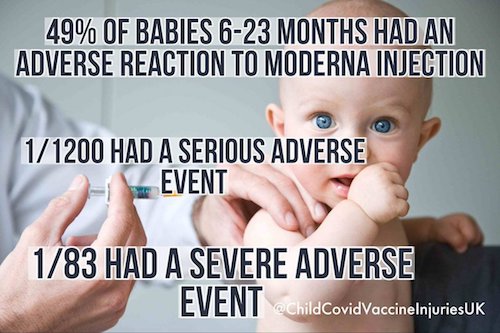

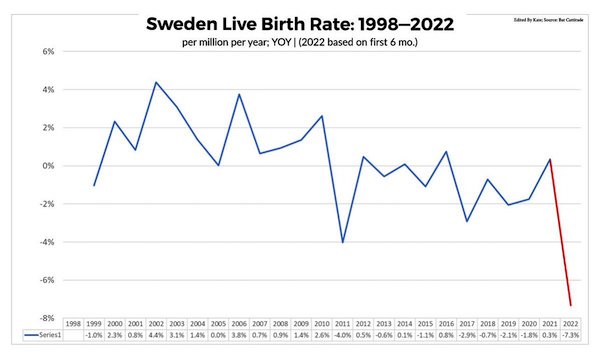

Note: all these numbers are for 2022 alone.

• Vax Report: $147 Billion in Damage, Tens Of Millions Injured, Disabled (ZH)

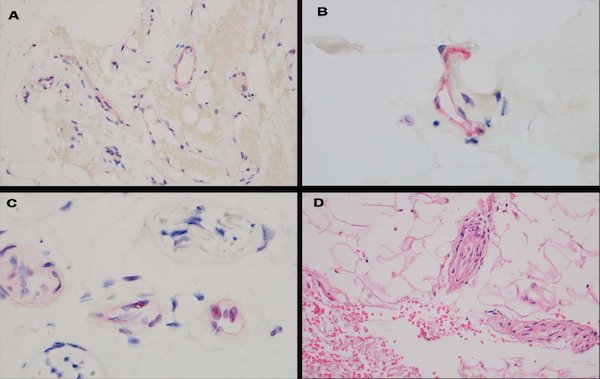

A new report estimates that 26.6 million people were injured, 1.36 million disabled, and 300,000 excess deaths can be attributed to COVID-19 vaccine damages in 2022 alone, which cost the economy nearly $150 billion. Research firm Phinance Technologies, founded and operated by former Blackrock portfolio manager Ed Dowd, Yuri Nunes (PhD Physics, MSc Mathematics) and Carlos Alegria (PhD Physics, Finance), split the impact of the vaccines into four broad categories to estimate the human costs associated with the Covid-19 vaccine; no effect or asymptomatic, those who sustained injuries (mild-to-moderate outcome), those who became disabled (severe outcome), and death (extreme outcome).

Data on vaccine disabilities and injuries comes directly from the Bureau of Labor Statistics (BLS), while the excess death figures are derived from official figures on deaths in the US via two different methods. It’s important to note that people in one category (injured, for example) can move into latter categories of severity – which this analysis does not take into consideration. “We need to remember that not only are these groupings an attempt to characterize different levels of damage from the inoculations, they are not static and could interact with each other,” reads the report. “For instance, there might be individuals who had no visible effects after vaccination but nonetheless could still be impacted.” “Individuals with mild injuries from the inoculations could, over time, develop severe injuries to the extent of being disabled, or an extreme outcome such as death.”

https://twitter.com/DowdEdward/status/1640734879355682816

Estimating the economic cost: In analyzing each of the above categories, Phinance used absolute excess lost worktime to determine that the direct economic cost of vaccine injuries was $79.5 billion in 2022, and $52.2 billion for those with severe disabilities. For deaths, Phinace used the average yearly absolute rise in excess deaths since 2021, which was 0.05% for the 25-64 year-old demographic, which amounted to $5.6 billion in lost productivity. In total, they found a total “economic cost” of $147.8 billion in 2022 due to the Covid-19 vaccines.

“Bring them home. Tomorrow. Do not wait another day!”

• The Best Way to Protect US Troops in Syria (Ron Paul)

Last week saw a sharp increase in attacks on US troops occupying northeastern Syria, with a drone strike against a US base blamed on “pro-Iran” forces and a US counter-strike said to have killed at least 19 people. After the US retaliation, another strike by “pro-Iran” forces hit a number of US sites in Syria. It may be just a matter of time before there are more strikes against the 900 US troops based in Syria against Syria’s wishes. One US contractor was killed last time. Next time it could be many more Americans. What’s behind the sudden escalation? Fundamental changes in the Middle East over the past month have highlighted how indefensible is the continued US occupation of Syria and Iraq. Take, for example, the recent historic mending of relations between former arch-enemies Saudi Arabia and Iran which was brokered by Washington’s own arch-enemy, China.

US policy in the Middle East has long been “divide and conquer,” dating back at least to the Iran/Iraq war in the 1980s. US switching sides in that war guaranteed that the maximum amount of blood was spilled and that the simmering hatreds would continue to prevent any kind of lasting peace. Then the US invaded Iraq twenty years ago and turned Iraq into an Iranian ally. That’s neocon foreign policy for you: a 100 percent failure rate. So this month China, which is interested in creating a regional transportation corridor that would include Iran, came in and instead of bombing, invading, and occupying – Washington’s modus operandi – actually brokered the restoration of diplomatic relations between Saudi Arabia and Iran. Republicans and Democrats in the US both love to attack China, but China has achieved what the US has resisted for years: peace in the region.

Should we be surprised that the continued US occupation is not welcome in the Middle East? The United States occupies that huge chunk of Syria where the oil and agriculture is located and the goal appears to be producing profits for US multinational corporations from stolen natural resources and preventing the natural wealth of Syria to be used to rebuild that country. Is it any wonder why the US is so unpopular in the Middle East? How hypocritical is it that the Biden Administration has spent $100 billion of our dollars to expel Russia from occupying proportionally less territory in Ukraine than Washington occupies in Syria? And Washington claims to stand for the “international rules-based order,” while they decimated an Iraq and Afghanistan that did not attack us, and before that a Serbia that could not have threatened us if it wanted to.

The end of the US occupation of the Middle East is upon us and the sooner we realize that the better. We have no business meddling in their politics, occupying their territory, and stealing their resources. Americans joined the US Military to defend the United States against all enemies, foreign and domestic, yet they have been manipulated by corrupt DC officials into occupying foreign lands and stealing their oil. Maybe this is why the US military cannot meet its recruitment goals? Here’s an easy way to protect US forces in Syria from further “Iran-allied” attacks: Bring them home. Tomorrow. Do not wait another day!

Syria

UN spokesman Faran Haq HUMILIATED by journalist who poses simple question: “Do you think the US military presence in Syria is illegal or not?” pic.twitter.com/t3aoIdNsdU

— Dissentral Intelligence (@dissentralintel) March 28, 2023

“..multilateral disarmament mechanisms, non-proliferation and arms control..”

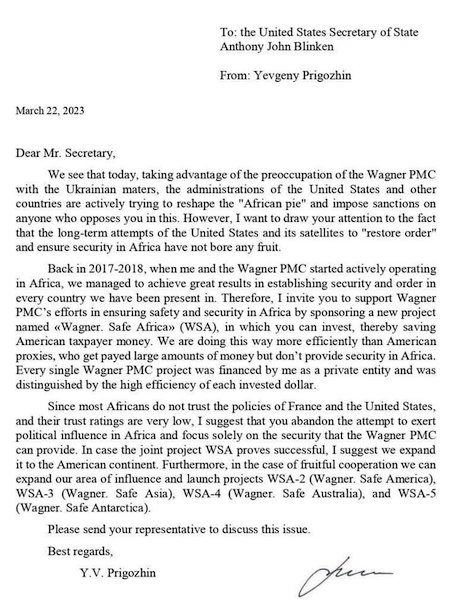

• Global Security Dialogue Should Replace Arms Race – Belarus (TASS)

Minsk is confident that the rhetoric of confrontation and the arms race should be replaced with dialogue on bolstering the architecture of global security, the press service of the Belarusian Foreign Ministry told TASS on Tuesday. “The Belarusian side is confident that to replace the confrontation rhetoric and the escalating arms race, a constructive and mutually respectful dialogue should emerge, directed at strengthening the architecture of global and regional security, multilateral disarmament mechanisms, non-proliferation and arms control, including in the nuclear sphere,” the diplomatic agency said replying to a question by TASS about the outsized reaction by a number of countries to reports on the prospective deployment of Russian tactical nuclear weapons on Belarusian soil.

“We have been urging and continue to urge all our partners to [do] this,” the Belarusian Foreign Ministry reiterated. On March 25, Russian President Vladimir Putin declared that Russia, at Minsk’s request, would deploy its tactical nuclear weapons in Belarus, precisely the way the United States deployed its own nuclear weapons on the territory of its allies. Moscow has already handed over to Minsk the nuclear-capable Iskander system. According to the Russian leader, the construction of a storage facility for tactical nuclear weapons on Belarusian territory would be completed on July 1.

Belarus wants peace, but Bolton does not.

• Bolton Issues Warning On Belarus (RT)

Former US National Security Advisor John Bolton has warned that the Biden administration may not be taking Russian President Vladimir Putin’s pledge to move tactical nuclear weapons to Belarus seriously enough. Bolton added that he could foresee Russia and Belarus potentially merging into a single state. “[Putin] may not be bluffing here in the sense he may actually move tactical nuclear weapons into Belarus,” Bolton told CNN on Monday.Putin announced on Saturday that Russia will move some of its tactical nuclear weapons to facilities in Belarus as early as this summer. The Russian president said that he made the decision after the UK announced it would transfer toxic depleted uranium munitions to Ukraine, a move he described as “absolute recklessness.”

While Bolton is taking Putin’s words seriously, the White House has brushed them off. “We haven’t seen any movement of any tactical nuclear weapons or anything of that kind since this announcement,” National Security Council spokesman John Kirby told reporters on Monday. Anonymous US and EU security officials told Politico they haven’t seen any indication that Russia plans on moving the weapons in the immediate future. Bolton’s concerns go beyond the stationing of Russian nuclear weapons in Belarus. He told CNN that the possibility of Russia reabsorbing the entire territory of Belarus is “something I don’t think we’ve been paying enough attention to.”

Belarus was made a territory of the Russian Empire by Catherine the Great in the 18th century, and was subsequently united with Russia under the Soviet Union. Since declaring its independence from the USSR in 1990, Belarus has remained a close ally of Russia, with Minsk and Moscow signing the Union State treaty in 1999, establishing a customs union and granting each other’s citizens freedom of movement. Military cooperation between the two states has since deepened, with a 2021 doctrine establishing a joint group of forces stationed in Belarus to deter threats from the West. Russian and Belarusian troops have held multiple military drills since last year, and Russian forces pushed south into Ukraine from Belarusian territory last February. As a result, Belarus has been hit with many of the same Western sanctions as Russia.

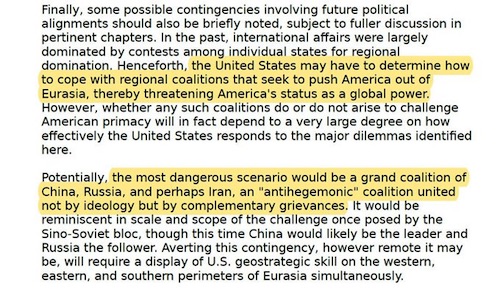

Bolton is well known for advocating regime change and military intervention around the world, and last year called for the overthrow of Putin. However, he has persistently warned about the consequences of current US foreign policy. Before cautioning about the growing ties between Russia and Belarus, he warned earlier this month that “the Chinese, the Russians, Iran, North Korea and several others are moving to shore up their relations” amid an apparent lack of strategic objectives in Washington.

Hungary and Turkey are not invited, but that shining model of democratic values, Ukraine, is.

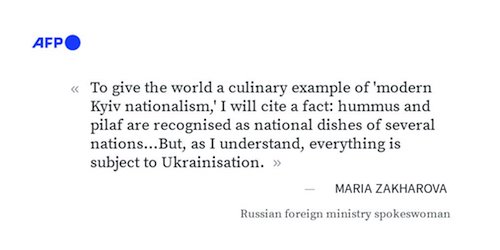

• Zakharova: ‘Summit For Democracy’ Reflects US’ Neocolonial Practices (TASS)

The US-conceived ‘Summit for Democracy’ is nothing but a manifestation of Washington’s neocolonial practices, as the summit seeks to legitimize American instruments of control, Russian Foreign Ministry Spokeswoman Maria Zakharova said on Tuesday. “The so-called ‘Summit for Democracy’ is a clear manifestation of neocolonial practices in US foreign policy. Behind the efforts to organize the summit is the desire to update and legitimize the American instruments of external control and interfere in the domestic affairs of other countries, forcing everyone to see the world through the prism of the ‘rule-based order’ promoted to serve Washington’s global interests,” the diplomat pointed out in her commentary in connection with the “Summit for Democracy” organized by the United States on March 28-30 under the pretext of supporting democracy in the world.

According to Zakharova, the summit is all about forming an ideological platform for combatting those countries whom the American political elite labels as autocracies, primarily Russia and China. “Washington is trying to consolidate the Western community and bring its rivals over to its side under the slogan ‘combatting autocratic regimes’,” the diplomat stressed. “The US has decided to take thematic sessions to regional platforms and appoint co-chair countries to pretend that its pseudodemocratic summit is universal. At the same time, the whole process is controlled either by the Americans themselves or by large non-governmental organizations (NGOs). These NGOs supervise the compliance of member states with the obligations undertaken by them. Apparently, they know nothing about the principle of sovereign equality of all states based on the UN world order,” Zakharova pointed out.

The diplomat underscored that she regretted the decision of the UN Secretary General Antonio Guterres to take part in such an “unworthy spectacle.” “On the whole, it is hard to expect from the American organizers of the ‘Summit for Democracy’, as well as from their ideological partners, anything other than pompous hypocrisy amid democratic messianism and certainly anti-Russian statements in the context of the Ukrainian crisis. Especially considering the fact that the tone of the summit will be set by a former comedian (Ukrainian President Vladimir Zelensky – TASS), not a democrat, who is the head of a criminal Nazi regime which deliberately violates all democratic values in his country. The fact that such people are invited to take part in the event clearly demonstrates how far Americans are from their declared goal of promoting democratic values,” she stressed.

As the Russian Foreign Ministry Spokeswoman pointed out, Moscow was against American democracy being imposed as “infallible, the only way.” “The US has no moral right to lecture others amid chronic domestic issues. This binary way of thinking in ‘black-white’ or ‘good guys vs bad guys’ does not work in real life. And it is in no way good for building long-term relations with sovereign countries,” Zakharova emphasized. The diplomat also pointed out that a multipolar world order in international relations was actively being formed with the help of the global majority. “Responsible participants in international communication must not engage in ‘democratization’ and division. The US and its allies have to return to complying with the norms of international law and get involved in creating conditions for peaceful coexistence and mutually beneficial cooperation,” Zakharova concluded.

“Now, this has all been thrown to the wind and to the Neo-Nazis, who now run the show in Kiev..”

• Russia Knows Why It Fights In Ukraine, Russians Must Be Freed – Lavrov (TASS)

Russia is conducting its special military operation in Ukraine to protect Russians and the Russian-speaking population, which the Kiev authorities oppress in violation of all international norms. Russia wants to free these people from any threat to their lives, traditions and families, the country’s Foreign Minister Sergey Lavrov told TASS in an interview on Tuesday. “We <…> are conducting our special military operation precisely for these people who have been oppressed in violation of all possible international norms and principles, in violation of all these norms on which Ukrainian independence is based. Ukraine enshrined in its Declaration of Independence that it wanted to be a neutral, non-aligned state. It promised to ensure the rights of all Russians and Russian-speaking peoples, as well as other ethnic minorities. It was interested in living in peace, in the spirit of good neighborliness and harmony with all its neighbors. Now, this has all been thrown to the wind and to the Neo-Nazis, who now run the show in Kiev,” Lavrov said.

“And that is why we know what we are fighting for. We know that we want to free these people from any threat the current Ukrainian authorities can pose to their lives, traditions, and families,” the top diplomat stressed. Lavrov added that “history and geography cannot be chosen,” that is why Russia has “no right to leave these people to Nazis and racists.” Russian President Vladimir Putin in his State of the Nation Address pointed out that the country’s special military operation was launched to protect the people, ensure the country’s security and eliminate the threat emanating from the Neo-Nazi Kiev regime.

“As for our little Serbian ship, we will steer it with a firm hand to preserve peace and stability..”

• Serbian President ‘Very Afraid’ About Current Situation In The World (TASS)

Serbian President Aleksandar Vucic said on Tuesday that he was ‘very afraid’ about what is going on in the world. “I am not much of an optimist, I am a small leader of a small country. There are many leaders from big countries in Europe who know better about everything,” Vucic said at a joint news conference with Greek President Katerina Sakellaropoulou. “I fear that the consequences of this will be far worse than what we have seen so far,” he stressed. “But I am a small man from a small country, and I believe that the giants from other countries know better and can solve things. As for our little Serbian ship, we will steer it with a firm hand to preserve peace and stability,” Vucic stressed.

In February, Vucic opined that the conflict in Ukraine would only worsen over the next five to six months, eventually spiraling out of control. The president believes that after the decision to supply tanks to Ukraine, a decision to supply F-16 fighter jets will follow. On March 17, the Slovak government approved the transfer of 13 MiG-29 fighters to Ukraine, Prime Minister Eduard Heger said. At the same time, it was stressed that the fighters were transferred for defense purposes, not for attacking. The country’s Defense Ministry announced that for the shipment of MiG-29 to Kiev, Slovakia expects to be paid back by the European Union in the amount of $900 million. Earlier, Polish authorities also said they were planning to supply MiG-29 to Ukraine.

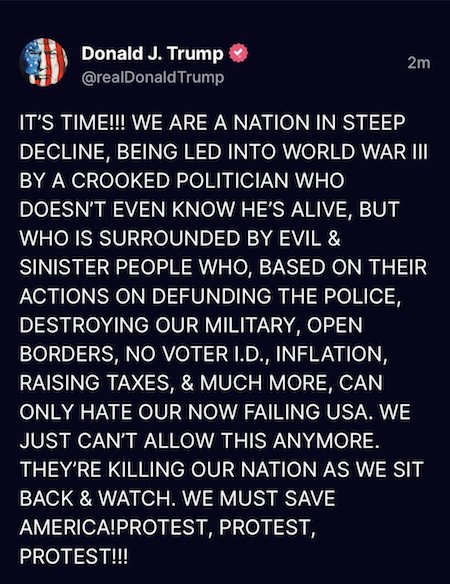

“possible we’d be in World War III with these idiots that are doing what they are doing.”

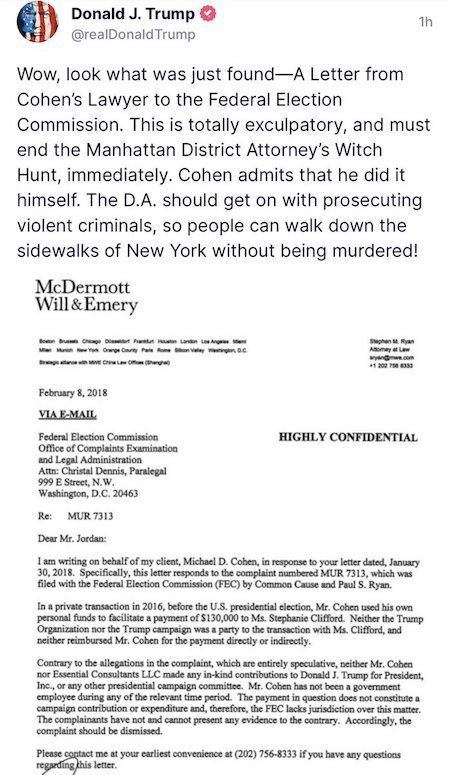

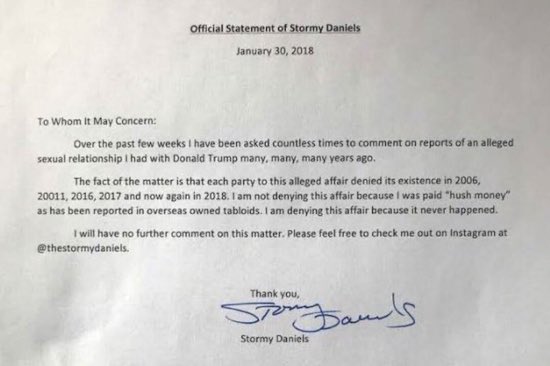

• Ukraine Being Obliterated – Trump (RT)

Donald Trump has once again claimed that he would need just 24 hours to negotiate peace in Ukraine. Speaking to Fox News, the former US president warned of a possible nuclear escalation and urged the hostilities to be ceased immediately. “The key to that is that war has to stop now, because Ukraine is being obliterated,” Trump told host Sean Hannity in an interview on Monday. Trump compared footage from the conflict to “hundreds of these demolition sites” that he used to see as part of his construction business. “There was not a building standing,” the former US leader explained. Trump repeated his assertion that he could reach a peace deal in Ukraine within 24 hours if elected back into office. However, he declined to explain his strategy, claiming it would be “very easy” but would not work if revealed prematurely.

Trump suggested that the US presidential election might not even happen next year, arguing it was “possible we’d be in World War III with these idiots that are doing what they are doing.” Such a conflict would make the two previous world wars look like “patty cakes,” he added. The nearly hour-long interview with Hannity was Trump’s first appearance on Fox News since he announced his 2024 presidential run. The former president has a complicated relationship with the leading conservative US news channel, which he has criticized for its positive coverage of Florida Governor Ron DeSantis, his potential challenger for the Republican Party’s nomination. Hannity has been among the most outspoken Trump supporters on the network.

https://twitter.com/i/status/1640544019729252352

“The new drone routes have kept the flights more than 40 nautical miles not only from Crimea but the Ukrainian coast as well..”

• Drone Incident Hindered US Intelligence Gathering – CNN (RT)

A decision by President Joe Biden’s administration to reroute drone flights over the Black Sea to avoid provoking a direct conflict with Russian forces has curtailed intelligence gathering on the Ukraine crisis, a senior US military official has told CNN. Flying drones at greater distances from the conflict zone and at higher altitudes has reduced the quality of the intelligence that they can gather, CNN reported on Tuesday, citing the senior official without identifying the source. The rerouting was allegedly ordered earlier this month, after a US Air Force MQ-9 Reaper drone was forced down over the Black Sea by a Russian Sukhol Su-27 fighter jet on March 14.

Although the Pentagon was publicly dismissive of Russian complaints about the drone flight, declaring that the US will continue to “fly and operate wherever international law allows,” Washington began routing its unmanned aerial vehicles (UAVs) further south, keeping them at a greater distance from the Crimean peninsula and eastern portions of the Black Sea. The rerouting was done to “avoid being too provocative,” CNN previously cited another US official as saying. However, the outlet said, there is already “an appetite” to resume flying the UAVs closer to Crimea. A Pentagon spokesman declined to comment on how, if at all, the quality of intelligence gathering in the Black Sea has been affected. “We maintain a robust ISR (intelligence, surveillance and reconnaissance) capability in the region and beyond,” he said.

The Pentagon accused Russian pilots of reckless flying, claiming that one of the jets clipped the propeller of the unmanned aircraft, causing it to go down. However, the footage purportedly shot by the drone, only showed a Sukhoi Su-27 fighter jet buzzing over it and allegedly ejecting fuel in the process. Russia denied hitting the drone or using weapons against it, and said the US aircraft was flying with its transponder switched off in a no-go zone declared by the Russian military. The new drone routes have kept the flights more than 40 nautical miles not only from Crimea but the Ukrainian coast as well, rather than the 12 miles normally recognized as the limit of a nation’s airspace, CNN said. Having moved the flights further south, it may be more difficult to return to the former routes and assert freedom of international airspace for US aircraft, the senior official said. US Navy vessels have stayed out of the Black Sea since December 2021.

“The official representative office of Starlink in Ukraine can’t help anyone either, as it has not yet opened – although the Kiev authorities granted it the required license last summer.”

• Ukraine Struggles With Starlink Troubles (RT)

Many Starlink users across Ukraine have seen their terminals stop working, the Kiev outlet Strana reported on Tuesday. According to experts who spoke to the outlet, the outage is not some nefarious plan by Elon Musk to harm Ukraine, but the result of criminals trying to scam Starlink parent company SpaceX. The typical scenario is that a terminal stops working and flashes the message “No active account,” Vladimir Stepanets, founder of a Starlink support group, told Strana. “When they contact SpaceX technical support, the terminal owners are told there were signs of fraudulent activity,” he explained. SpaceX provided the Kiev government with a number of Starlink terminals beginning in February last year, which Ukraine has used for military communications.

Musk has objected to the “weaponization” of his technology, and last month restricted Kiev’s ability to use Starlink for remotely controlling drone strikes. When one US senator complained, Musk replied that his company “will not enable escalation of conflict that may lead to WW3.” The current problem is not due to some kind of Musk censorship, experts tell Strana, but rather the consequence of scam artists exploiting the flow of Starlink donations to Ukraine. Because demand for Starlinks has always outpaced their supply, and equipment sold directly by SpaceX costs 30% more than in Poland or Czechia, many “enterprising individuals” buy the terminals there and then resell or donate them to Ukraine.

Stepanets and engineer Oleg Kutkov described the scheme by which the scammers use promotions and discounts to acquire the Starlinks, but then use “chargeback fraud” to not pay SpaceX. “Starlink can be stolen, bought for a promotion for one euro, or listed for return, and the router that comes with it is resold to Ukraine. Then the person who bought it installs the router, and the account is blocked,” Kutkov told Strana. Stepanets said “tens of thousands” of terminals were in effect stolen from SpaceX through chargeback fraud, including many operated by the Ukrainian military.

Ukrainian users have no way of knowing whether their terminal is legitimate or stolen – until it stops working. Because SpaceX blacklists accounts associated with stolen equipment, users also have no way of reloading their subscription balance, while the debt continues to accrue. Stepanets also warned users not to attempt any “life hacks” through the military or the Ministry of Digital Development. “This can have bad consequences not only for you, but for the whole country. And it definitely won’t work,” he told Strana. The official representative office of Starlink in Ukraine can’t help anyone either, as it has not yet opened – although the Kiev authorities granted it the required license last summer.

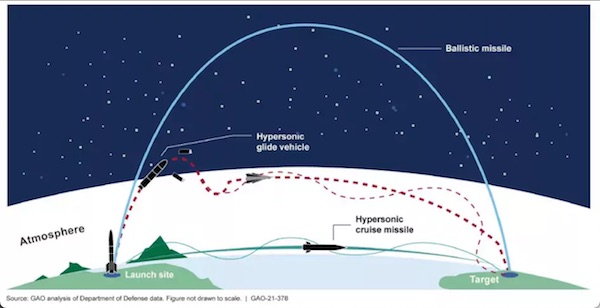

It appears to be about the heat-resistant coating of the missiles at Mach 10-15. Only Russia found one.

• US Admits To Another Failed Hypersonic Test (RT)

The US Air Force has revealed at least the fourth failed test of a hypersonic missile system made by defense contractor Lockheed Martin, suggesting that it’s more likely to adopt a competing system built by Raytheon. “The one we just had was not a success,” Secretary of the Air Force Frank Kendall told members of a US House committee on Tuesday. “We did not get the data that we needed from that test, so they’re currently examining that to try to understand what happened.” Kendall was referring to a March 13 test of the AGM-183A Air-launched Rapid Response Weapon (ARRW), a hypersonic attack cruise missile, off the coast of Southern California. He gave no specifics on what went wrong with the launch. His comments may have come as a surprise to lawmakers because the Air Force issued a press release last week indicating that the ARRW test “met several objectives.” The release made no mention of the test’s failure.

The ARRW has been under development since 2018 and was delayed after three failed booster tests in 2021. The Air Force claimed the first successful launch of the missile last May, saying it reached speeds exceeding Mach 5, or five times the speed of sound. US forces don’t yet have a fully operational hypersonic missile system, as Washington has fallen behind Russia and China in the race to develop such weapons. Hypersonic missiles travel at speeds over Mach 5 and are highly maneuverable, making them difficult to shoot down. In light of the latest ARRW test, the Air Force is “more committed” to its other hypersonic program, the Hypersonic Attack Cruise Missile (HACM), Kendall told lawmakers. A budgeting decision on whether to adopt the ARRW is expected to be made next year, after as many as two more test launches.

The Air Force reportedly received about $423 million in research and development funding for the ARRW in the past two years, and it has requested an additional $150 million in the budget for its next fiscal year. HACM funding totaled $423 million for the current fiscal year alone, and the Air Force plans an additional $1.9 billion in spending on the program over the next five years. The HACM program has been “reasonably successful” so far, Kendall said. He added, “We see a definite role for the HACM concept. It’s compatible with more of our aircraft, and it will give us more combat capability overall.”

“The NATO intelligence publicity department known as Bellingcat..”

• Bellingcat & Mouse Game: Advance Russian Intel Of Nordstream Attack (Helmer)

The NATO intelligence publicity department known as Bellingcat has just produced new NATO-sourced evidence of an elaborate cat-and-mouse game which the navies and air forces of Denmark, Sweden, Germany, Poland, and the US played against Russian forces in the Baltic Sea off Bornhom Island in the week before the detonation of explosives on the Nord Stream gas pipelines last September 26. Cat and mouse is also the game the NATO propaganda agencies are now playing. The aim of the intelligence, published last week by the quasi-state German media platform called T-Online, and in the Danish offshoot of Bellingcat known as Oliver Alexander, is to accuse the Russian Navy of the pipeline attack, using a mini-submarine and deep-sea divers.

This is based on NATO and US identification and tracking of a six-vessel Russian flotilla several days before the explosions – an intelligence vessel, a deep-sea operations vessel, two tugs, and heavily armed anti-ship and anti-submarine frigate and corvette. “It was precisely such mini-submarines that could have placed the explosive charges attaching it to the pipelines, experts suspected from the very start,” T-Online claims, using the hypothetical followed by a conditional plus three more hypotheticals. “If it was confirmed that the SS-750 was at the scene, the Russian Navy would probably be the prime suspect from then on. ‘It would make absolute sense to use something like the AS-26 for such an attack,” Danish corvette captain and military analyst Johannes Riber told T-Online about this matter.

‘That would be the most plausible explanation so far for what happened to the Nord Stream pipeline.’” T-Online concluded: “In official statements, the activities of the Russian navy in the days before the attacks have so far played no role. Neither the German, Danish or Swedish investigators, nor NATO or the armed forces of the Baltic Sea states wanted to comment on them when asked by T-Online. Thus, the criminal case remains unsolved for the time being, but a chain of evidence has been added. It does not point to the USA or Ukraine. Some tracks now are leading to Moscow.” [..] the evidence Bellingcat is presenting as suspicion of Russian culpability in laying the pipeline charges, should be interpreted as evidence that the Russians had advance intelligence of the pipeline attack operation, and they were investigating what they could at the time — after the charges had been laid, but before they were detonated on September 26.

Viewed in this light, the Bellingcat reports confirm how crowded the crime scene was before the crime was committed – how many naval and air force units were operating, all of them under NATO command coordination – Danish, Swedish, German, Polish, and American. A crime scene full of suspects but empty of the weapon.

“The modern Democratic Party is not the same one that your parents or grandparents were members of in the past. It’s obsessed with starting World War 3 in Ukraine, eroding the First Amendment, dismantling the Second Amendment, and normalizing ‘woke’ culture.”

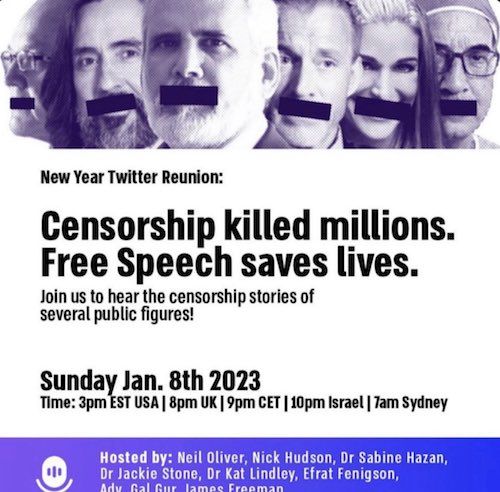

• Matt Taibbi Says Democrats Ditched Free Speech (ZH)

Independent journalist Matt Taibbi – of recent “Twitter Files” fame – has exposed the fact that civil liberties are no longer popular among Democrats. Taibbi appeared on Fox News’ “Sunday Morning Futures with Maria Bartiromo” to reiterate his perspective that the modern Democratic Party no longer represents the values of the everyday American. “About all of this — Matt, how do you feel about all of this? I know before you started discovering this bad behavior, you identified as a Democrat, and now you’ve got all of your friends, quote-unquote, in the media attacking you for exposing this,” Bartiromo asked.

“Yeah, it’s funny, I mean, I was raised in a traditional ACLU liberal, I believed in free speech all my life. That was one of the things, frankly, that attracted me to the Democratic Party when I was a kid, the idea that we were the party that believed in letting everybody have a say, and we’ll just make a better argument, and that’s how the system works,” Taibbi said. He continued, “Apparently, something very dramatic has changed in politics in America, and there’s been a shift. There’s no question about it anymore, that now the parties have had a complete reversal on how they read these issues.”

Matt Taibbi @mtaibbi: "There's no question about it anymore that now the parties have had a complete reversal on how they view these issues." pic.twitter.com/2zxpspYTmO

— The Post Millennial (@TPostMillennial) March 26, 2023

Taibbi leads a team of journalists, including Michael Shellenberger, who have been given access to Twitter Files, revealing a startling network of government agencies, think tanks, and Twitter personnel coordinating efforts to attack the First Amendment. What we’ve learned from the Twitter Files is the ever-expanding coalition of groups working with the government and social media to target and censor Americans, including government-funded organizations. Twitter files are chilling in the details and show how Democrats have weaponized government and colluded with corporations to wage war on the First Amendment.

The modern Democratic Party is not the same one that your parents or grandparents were members of in the past. It’s obsessed with starting World War 3 in Ukraine, eroding the First Amendment, dismantling the Second Amendment, and normalizing ‘woke’ culture. What caused such a significant shift in the party in just a few short years? And what kind of blowback will Taibbi get for telling these truths?

Shellenberger

Maybe you were in favor of censoring accurate information on Covid, climate, and trans issues. But what if the shoe were on the other foot?

My testimony today to Congress on Big Tech censorship

— Michael Shellenberger (@ShellenbergerMD) March 28, 2023

“This case was not just Jes Staley … there will be numerous documents that go far beyond his office to the executive suite.”

• Jamie Dimon In Hot-Seat As Sworn Deposition Looms In Epstein Lawsuits (ZH)

JPMorgan Chase CEO Jamie Dimon will be in the hot seat, as he is expected to be deposed under oath regarding his bank’s decision to keep deceased pedophile sex-trafficker Jeffrey Epstein as a client despite public knowledge of his status as a registered sex offender, the Financial Times reports, citing people familiar with the matter. The sworn deposition – the latest development in two combined high-profile cases, is expected to take place in May behind closed doors. The lawsuits claim that JPMorgan, which banked Epstein for 15 years from 1998 to 2013, benefited from human trafficking and ignored several internal warnings about their client’s illegal behaviour. The lender has described the claims as meritless.

The pre-trial process unearthed communications between JPMorgan employees that contained a reference to a “Dimon review” into the bank’s relationship with Epstein. The bank has denied that Dimon had any knowledge of such a review. -FT The US Virgin Islands and a group of Epstein victims claim Dimon had knowledge of Epstein’s activities based on emails exchanged between the late sex offender and former executive Jes Staley using his JPMorgan email address. “Jamie Dimon knew in 2008 that his billionaire client was a sex trafficker,” argued US Virgin Islands attorney Mimi Liu during a March hearing in front of Manhattan US District Judge Jed Rakoff, referring to the year Epstein was first criminally charged with sex crimes, CNBC reports. “If Staley is a rogue employee, why isn’t Jamie Dimon?” Liu said during the hearing to discuss the bank’s efforts to have the USVI lawsuit against the bank dismissed.

“Staley knew, Dimon knew, JPMorgan Chase knew,” Liu continued, noting that there were several cash transfers and wire transfers made by the prolific pedophile (Epstein), including several hundreds of thousands of dollars paid to several women which should have been flagged as suspicious. “They broke every rule to facilitate his sex trafficking in exchange for Epstein’s wealth, connections and referrals,” said Liu, adding “This case was not just Jes Staley … there will be numerous documents that go far beyond his office to the executive suite.”

That said, a person familiar with the bank’s internal probe into what Dimon knew says there are no records of any direct communications with Epstein, or records of discussions related to retaining him as a client. Last week Judge Rakoff denied JPMorgan’s request to dismiss the lawsuits, and allowed several claims to proceed against the bank. He also ordered JPMorgan to hand over documents between Dimon and former general counsel Steve Cutler from before 2006, the year Epstein was first arrested.

Excellent overview from Thomas Fazi: “For now, at least, there is still time to resist the Great Food Reset.”

• The Great Food Reset Has Begun (Fazi)

France is in flames. Israel is erupting. America is facing a second January 6. In the Netherlands, however, the political establishment is reeling from an entirely different type of protest — one that, perhaps more than any other raging today, threatens to destabilise the global order. The victory of the Farmer-Citizen Movement (BBB) in the recent provincial elections represents an extraordinary result for an anti-establishment party that was formed just over three years ago. But then again, these are not ordinary times. The BBB grew out of the mass demonstrations against the Dutch government’s proposal to cut nitrogen emissions by 50% in the country’s farming sector by 2030 — a target designed to comply with the European Union’s emission-reduction rules.

While large farming companies have the means to meet these goals — by using less nitrogen fertiliser and reducing the number of their livestock — smaller, often family-owned farms would be forced to sell or shutter. Indeed, according to a heavily redacted European Commission document, this is precisely the strategy’s goal: “extensifying agriculture, notably through buying out or terminating farms, with the aim of reducing livestock”; this would “first be on a voluntary basis, but mandatory buyout is not excluded if necessary”. It is no surprise, then, that the plans sparked massive protests by farmers, who see it as a direct attack on their livelihoods, or that the BBB’s slogan — “No Farms, No Food” — clearly resonated with voters.

But aside from concerns about the impact of the measure on the country’s food security, and on a centuries-old rural way of life integral to Dutch national identity, the rationale behind this drastic measure is also questionable. Agriculture currently accounts for almost half of the country’s output of carbon dioxide, yet the Netherlands is responsible for less than 0.4% of the world’s emissions. No wonder many Dutch fail to see how such negligible returns justify the complete overhaul of the country’s farming sector, which is already considered one of the most sustainable in the world: over the past two decades, water dependence for key crops has been reduced by as much as 90%, and the use of chemical pesticides in greenhouses has been almost completely eliminated.

Farmers also point out that the consequences of the nitrogen cut would extend well beyond the Netherlands. The country, after all, is Europe’s largest exporter of meat and the second-largest agricultural exporter in the world, just behind the United States — in other words, the plan would cause food exports to collapse at a time when the world is already facing a food and resource shortage. We already know what this might look like. A similar ban on nitrogen fertiliser was conducted in Sri Lanka last year, with disastrous consequences: it caused an artificial food shortage that plunged nearly two million Sri Lankans into poverty, leading to an uprising that toppled the government.

EvaVlaar

https://twitter.com/i/status/1640787139896942612

[..] Alongside healthcare, agriculture is the main focus of the Bill and Melinda Gates Foundation, which finances several initiatives whose stated aim is to increase food security and promote sustainable farming, such as Gates Ag One, CGIAR and the Alliance for a Green Revolution in Africa. Civil society organisations, however, have accused the Foundation of using its influence to promote multinational corporate interests in the Global South and to push for ineffective (but very profitable) high-tech solutions which have largely failed to increase global food production. Nor are Gates’s “sustainable” agricultural activities limited to developing countries. As well as investing in plant-based protein companies, such as Beyond Meat and Impossible Foods, Gates has been buying huge amounts of farmland in the US, to the point of becoming the biggest private owner of farmland in the country.

The problem with the globalist trend he embodies is obvious: ultimately, small and medium-scale farming is more sustainable than large-scale industrial farming, as it is typically associated with greater biodiversity and the protection of landscape features. Small farms also provide a whole range of other public goods: they help to maintain lively rural and remote areas, preserve regional identities, and offer employment in regions with fewer job opportunities. But most importantly, small farms feed the world. A 2017 study found that the “peasant food web” — the diverse network of small-scale producers disconnected from Big Agriculture — feeds more than half of the world’s population using only 25% of the world’s agricultural resources.

Traditional farming, though, is suffering an unprecedented attack. Small and medium-scale farmers are being subjected to social and economic conditions in which they simply cannot survive. Peasant farms are disappearing at an alarming rate across Europe and other regions, to the benefit of the world’s food oligarchs — and all this is being done in the name of sustainability. At a time when almost a billion people around the world are still affected by hunger, the lesson of the Dutch farmers could not be more urgent, or inspiring. For now, at least, there is still time to resist the Great Food Reset.

“This new wave of testicular injuries to female athletes has really come out of nowhere..”

• Startling Rise In Testicular Injuries Among Woman Athletes (BBee)

A new study indicates a disturbing trend as testicular injuries in women’s sports are increasing at an astounding rate. Researchers are baffled as these statistics have skyrocketed from literally zero reported testicular injuries among female athletes just a few years ago. “This new wave of testicular injuries to female athletes has really come out of nowhere,” said Dr. Ryan Kitchen of Boston College’s Institute of Sports Medicine. “Years ago, there were absolutely no reported testicular injuries that occurred during women’s sporting events. If only we could determine what led to this sudden rise. Such a puzzle!”

Institutions around the world have also noticed the disturbing trend and are pouring research dollars into discovering the cause, which is almost certainly a complicated issue with no easy or obvious answers whatsoever. Critics have argued that it’s not actually possible for a female athlete to suffer a testicular injury. “Yeah, that can’t happen,” said Dr. Adam Kinunen of the Restore Sanity to Sports research group. “Considering the fact that having testicles in the first place means a person is not a female, it would stand to reason that such an injury is impossible. In layman’s terms, these are dudes.”

Trans activist groups have come out in full force against anyone who dares to suggest women cannot have their testicles injured because women can’t have testicles. “EEEEEEEEEEEEEEEE!” said Sunshine Fluffsprinkle, spokesperson for Insanity Now, a trans rights group in response to the findings. “BLLRRRAAAWWRRRR FFFRRGGGTHTHTH!” At publishing time, concerned researchers in the field of sports medicine were consulting with athletic equipment manufacturers to design protective athletic cups specifically designed to protect female testicles.

Tucker trans

The Most Important Monologe Tucker Has Ever Delivered:

“The trans movement is the mirror image of Christianity, and therefore its natural enemy. People who believe they’re God can’t stand to be reminded that they’re not. The Christian and Trans movement pic.twitter.com/yVa1398BuD…

— Benny Johnson (@bennyjohnson) March 29, 2023

This dog was spotted politely waiting by a pizza truck. He doesn’t have to say what he wants. They already know his order. It is pizza.

Ames window

In 1951, Adelbert Ames created the mind-boggling ‘Ames Window’. It’s so effective that even when you know how it works you can’t break the illusion

— Massimo (@Rainmaker1973) March 28, 2023

There are whales alive today who were born before Moby Dick was written. Some of the bowhead whales in the icy waters off of Alaska today are over 200 years old

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.