Dora Maar Model in swimsuit 1936

Putin Oliver Stone

https://twitter.com/i/status/1634559549095944192

Noem CBDC

https://twitter.com/i/status/1634369634672443392

Ritter

Lock ‘em up

This is so good….. I could play it over and over and over.

— Juanita Broaddrick (@atensnut) February 11, 2023

Trump Jan 6 peace

The video that nobody got to see because Twitter took it down 5 minutes after it launched on J Six. pic.twitter.com/dxpX7noOYd

— JMAN (@ProducerJMAN) April 23, 2022

Inauguration

A video I've never seen. "Biden's " Innaguration day

RETWEET pic.twitter.com/UEHEuGz3Ud— frank baeman (@DonBauman61) March 8, 2023

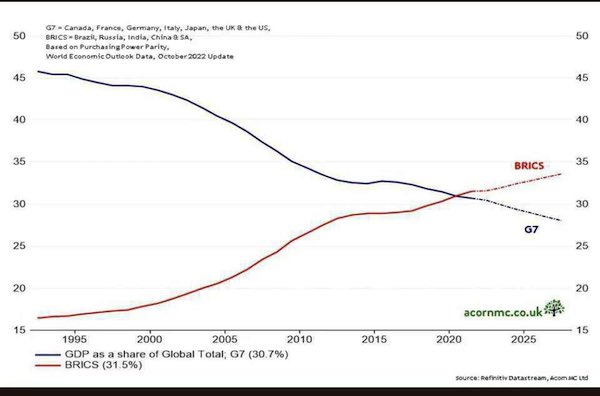

Pepe Escobar: “So the Exceptionalist Realm spent TRILLIONS OF DOLLARS in wars across West Asia. With one single Sun Tzu move – Iran meets Saudi – China laid it all to waste. This humiliation is Afghanistan multiplied by trillions.”

• Seismic Iran-Saudi Rapprochement Isolates US (Lauria)

Ever since the 1979 Islamic Revolution that overthrew the U.S.-allied Shah of Iran, the rivalry between the two major Middle East powers — Iran and Saudi Arabia — has been at the heart of every conflict across the region. The announcement on Friday that Iran and Saudi Arabia have normalized relations could have a seismic effect on all these conflicts and leave the U.S. on outside looking in. In Lebanon, Iranian-backed Hezbollah and Saudi-backed parties might begin to resolve their differences, a unity that would worry Israel and lessen U.S. influence in the country. In Syria, Hezbollah and Iranian militias have been battling Saudi-backed jihadists for more than a decade. The Syrian war could now come to an end. In Yemen, U.S.-backed Saudis have been fighting the Houthi, who have been driven into a closer alliance with Iran. Obstacles to a peace deal have now been removed.

In Iraq, reconciliation between Sunni and Shia could make the U.S. presence and influence irrelevant and unwelcomed by all sides. In Bahrain, Iranian-backed Shi’ites in conflict with the Saudi-aligned monarchy could sideline the presence of the U.S. Fifth Fleet in a region on the mend. And in Saudi Arabia itself, the state’s tensions with Shi’tes in the eastern oil regions should lessen. The historic rapprochement and resumption of formal diplomatic ties between Saudi Arabia and Iran could transform the Middle East. And the United States doesn’t like it one bit. The U.S. has depended on the Saudi-Iranian divide to pursue its interests in the region. After this development, the U.S. and Israeli front against Iran should lose their chief Arab ally, Saudi Arabia. The Saudis are now in a position to defy U.S. economic sanctions on Iran — a nightmare for Washington.

An end to the Yemen war, which the Biden administration has been making feeble noises about, would mean having to accept Iranian influence on the Arabian peninsula. An end to the war in Syria would be the death knell for the American regime change project in that country. It will put U.S. occupying forces in the east of Syria in an uncomfortable position. And it could spell the end of covert support for some of the most vile jihadists in the region, which depended on Saudi backing. Worst of all for the United States, China has stepped in to be the statesman the U.S. refused to be to resolve differences that have ripped the Middle East apart. That has to produce sleepless nights inside the Beltway. If anything proves China is committed to stability in the world and the U.S. to instability, it is this deal.

The entire country runs on western NGOs. Detailed report.

• Georgia Has A Huge Western-Funded NGO Sector (Trenin)

Tbilisi’s main street, Rustaveli Avenue, was blocked for several days, this week, As thousands of people chanted anti-government slogans in front of the parliament building and sang the Georgian national anthem. Even more protesters gathered at the square in the evenings. By nightfall, the enraged crowd was throwing firecrackers, stones, and Molotov cocktails at the police, attempting to take down an iron fence and storm the parliament. The police used water cannons to promptly put out the fires and showered the crowds with water, at the same time spraying tear gas to disperse those present. What led to this violent confrontation is perhaps difficult to understand from the perspective of a Western reader. It wasn’t a “civil society” uprising in the sense you might find, for example, in a country like France.

Instead, it was organized by people whose livelihoods were threatened by the proposed legislation. In a poor country like Georgia, foreign-funded roles pay multiple times better than local gigs. By taking on the NGO industry, the government went up against a powerful, and relatively well-heeled lobby. The protests were initially triggered by a bill ‘On the Transparency of Foreign Influence’, which was adopted by the Georgian parliament on its first reading. On Tuesday, 76 deputies voted in favor of adopting the bill and 13 deputies opposed it. During the discussion stage, MPs from opposition parties said they would not allow the so-called “Russian law” to be considered in parliament. This resulted in a fight between opponents and supporters of the legislation.

[..] The strong reaction to the initiative does not seem surprising considering how many foreign NGOs are active in Georgia. In a review of the Georgian civil sector published in 2020, the Asian Development Bank indicated that there is no special legislation on non-profit or non-governmental organizations in the country, although they are listed in the general register of companies, which as of the beginning of 2019 consisted of 12,800 organizations. At the same time, the vast majority of such organizations rely on foreign funding, according to the Georgian national statistics service Sakstat. As of spring 2022, there were 7,972 companies with foreign founders operating in the country. With a total population of 3.7 million, there are around 460 people per foreign NPO in Georgia. For comparison, as of November 2022, there were over 500 active “foreign agents” registered in the US, under FARA.

Moscovia = Muscovy

• Kiev Considers Renaming Russia (RT)

Ukrainian President Vladimir Zelensky has instructed his government to consider renaming Russia as ‘Moscovia’, an unofficial designation used centuries ago. The move comes after a petition insisted that by using the word ‘Russia’, Ukraine is endorsing a “dangerous claim” that its neighbor is a direct descendant of Kievan Rus. In a statement on Friday, Zelensky said he had turned to Ukrainian Prime Minister Denis Shmigal with a request that the petition, which had gathered the necessary 25,000 votes to be considered, be “comprehensively processed.” The issue “needs to be carefully worked out both in terms of the historical and cultural context, and from the perspective of possible international legal consequences,” with scientific institutions taking part in the process, the Ukrainian president added.

Commenting on the move, Russian Foreign Ministry spokeswoman Maria Zakharova stated that it was “further evidence of an attempt to create an ‘anti-Russia’ out of Ukraine.” The name ‘Moscovia’ dates back to the Grand Duchy of Moscow, one of principalities of Kievan Rus in the late Middle Ages. The modern Russian state formed around this center of power while retaining historic and cultural roots stemming from Rus. The author of the petition, which was submitted in late November 2022, claimed that the name ‘Russia’ “gave grounds for further encroachment” on the history of Kievan Rus as foreigners often confuse the words ‘Russia’ and ‘Rus’. Many Ukrainian nationalists reject the notion that the two have some kind of historical link, arguing that only Ukraine can be viewed as the true heir of Kievan Rus.

The petition also demands that the word ‘Russian’ be replaced with ‘Moscovian’ and that the Russian Federation be renamed as ‘the Moscovian Federation’. In recent years, Ukrainian authorities have embarked on a renaming spree, targeting thousands of place names they deemed to be linked to Russia or the Soviet Union. The campaign intensified after Moscow launched its military operation against the neighboring country in February 2022. In October last year, Kiev officials renamed a street which had honored Soviet Marshal Rodion Malinovsky, who played a prominent role in liberating Ukraine from Nazi occupation. The name of the street now celebrates the “heroes” of the Azov Battalion, which is notorious for its support of neo-Nazi ideology.

Zel talk

HOW did #Zelensky got to be elected? Even ppl in the east of #Ukraine voted for him. Because he promised peace and negotiations with #Russia

Once elected he rapidly made a turn to 180. Was he threatened to make this change? Or lied to begin with? pic.twitter.com/OPcq9dN5xr— Arthur Morgan (@ArthurM40330824) March 12, 2023

“Schweinisch Bandera-Reich”

• Medvedev Suggests New Name For Ukraine (RT)

Former Russian President Dmitry Medvedev has proposed renaming Ukraine in honor of notorious Nazi collaborator Stepan Bandera. His suggestion came after Ukrainian President Vladimir Zelensky told his government to consider a proposal to change Russia’s name. On Friday, Zelensky instructed authorities to “thoroughly study” the proposal to officially rename Russia to ‘Moscovia.’ He was reacting to an online petition, which argued that the name ‘Russia’ provided grounds for “further encroachment” on the history of Kievan Rus, a medieval state from which both Russia and Ukraine trace their origin. Many Ukrainian nationalists claim that their homeland is the only true heir of Rus.

The name ‘Moscovia’ dates to the Grand Duchy of Moscow and was historically used by some authors to describe the Russian state. On Saturday, Medvedev, who served as Russian president between 2008 and 2012, and currently serves as deputy chairman of the Security Council, fired back in a post on his Telegram channel. “Our response?… Only the Schweinisch Bandera-Reich,” he wrote. The word “schweinisch” means “piggish” in German. Medvedev was apparently referencing the idolization by some Ukrainian politicians of Stepan Bandera, a World War II-era leader of the Organization of Ukrainian Nationalists (OUN). Bandera collaborated with Adolf Hitler’s government during the early stages of the Nazi invasion of the Soviet Union.

He was later arrested and imprisoned by the Germans over disagreements about the future of Ukraine. After the war, Bandera fled to West Germany, where in 1959 he was assassinated by a KGB agent. The Ukrainian Insurgent Army – the OUN’s military wing founded in 1943 – positioned itself as a guerilla force fighting both Soviet and German troops. Its agents committed multiple atrocities against Polish, Jewish and Russian civilians. Bandera and his followers are honored as heroes in modern Ukraine, with streets and buildings named after them. Nationalists hold annual torchlit processions on Bandera’s birthday in Kiev and other cities.

Zero grip on reality.

• Russia Should Lose, But Not ‘Too Badly’ – US Congressman (RT)

The US doesn’t “actually want Russia to lose too badly” in Ukraine, Democratic Congressman Seth Moulton claimed in an interview on Friday. While some Washington lawmakers have gone as far as to call for regime change in Moscow, the Kremlin has repeatedly stated that it will succeed in achieving all the goals of its military operation. “I don’t know if it’s good for the stability of the world if the Russian regime collapses,” Moulton told Luke Coffey of the Hudson Institute, a think tank funded by several NATO governments and US arms manufacturers. Citing the risk of nuclear proliferation that would come with the collapse of Russia, Moulton said that the “abject defeat of the Russians and the whole regime collapse is probably not what we actually want.”

“We absolutely want Ukraine to win, we want Russia to lose, but we don’t actually want Russia to lose too badly,” he continued. Moulton sits on the House Armed Services Committee, and voted with the rest of his party to authorize a $40 billion military and economic aid package to Ukraine last year. He told Coffey that this aid should continue, and that the Biden administration should provide Kiev with more tanks and artillery ammunition in order to mount a counteroffensive against Russian forces this year. Lawmakers in both parties have suggested more extreme measures, however, with Republican Senator Lindsey Graham calling last year for the assassination of Russian President Vladimir Putin, and a bipartisan group urging President Joe Biden last month to supply Ukraine with US-made fighter jets – a move that former Russian President Dmitry Medvedev described as a “red line” that would place the US at “war against Russia.”

In Ukraine, President Vladimir Zelensky has repeatedly stated that he intends to retake four formerly Ukrainian provinces that voted to join Russia last year, as well as Crimea, which held a similar referendum in 2014. Not only would such a move be “met with inevitable retaliation using weapons of any kind,” in Medvedev’s words, it would also be impossible at present, with Ukrainian forces mired in battle in the Donbass city of Artyomovsk, called Bakhmut in Ukraine. The Kremlin has stated on multiple occasions that its special military operation in Ukraine will continue until its goals are achieved. These goals, as set out by Putin last year, are the demilitarization of Ukraine, the “denazification” of its leadership, its establishment as a neutral country, and the defense of the Russian-speaking population of the Donetsk and Lugansk regions.

They’ve gone overboard recently.

• Ukraine Is Lying About Casualty Ratios To Justify Holding Of Bakhmut (MoA)

The linked Financial Times piece, reprinted in the Irish Times, actually quotes the Ukrainian national security chief Oleksiy Danilov as saying that the kill ratio was one to seven in Ukraine’s favor. The whole passage is nuts: “US and European officials estimate 200,000 Russian troops have been killed or seriously injured since February last year, and Ukraine about half that. One western official said Russia had suffered “between 20,000 and 30,000 casualties over the past six months”, adding that most of them were mercenaries fighting for the Wagner private military company. Wagner’s operations have been largely focused on Bakhmut. Nato officials estimate one Ukrainian had been killed or injured for every five Russians. Ukrainian national security chief Oleksiy Danilov last week estimated the ratio was “one to seven in our favour”.

This makes no sense. Had 200,000 Russian’s be killed or seriously wounded in the war while 20,000 to 30,000 of those were killed or wounded in the past six month then the first six month of the war would have cost the Russian side 175,000 losses. That’s more than the total numbers that were, until the recent mobilization, involved in the whole campaign. Those numbers must have been pulled from hot air. Danilov casualty ratio is likewise obvious nonsense. The Medical Department of the U.S. Army has a book about CAUSATIVE AGENTS OF BATTLE CASUALTIES IN WORLD WAR II. It is quoted here: “A report on the causative agents of battle casualties in World War II showed the comparative incidence of casualties from different types of weapons for several theaters. Compilers of the report believed that, while the more detailed subdivisions within their three major classes were open to question, their findings on the percent of total casualties due to small arms, artillery and mortars, and “miscellaneous” were reasonably accurate.

From these they drew the following conclusions: 1. Small arms fire accounted for between 14 and 31 percent of the total casualties, depending upon the theater of action: The Mediterranean theater, 14.0 percent; the European theater, 23.4 percent; and the Pacific theaters, 30.7 percent. 2. Artillery and mortar fire together accounted for 65 percent of the total casualties in the European and Mediterranean theaters, 64.0 and 69.1, respectively. In the Pacific, they accounted for 47.0 percent. The Encyclopedia Britannica likewise notes for World War I: “The greatest number of casualties and wounds were inflicted by artillery, followed by small arms, and then by poison gas.” When I was in officer school the number estimated for a big war in Europe was 75% of casualties due to artillery and aerial bombing.

Data from the European Commission, quoted by El Pais, says that Russia has a 10:1 advantage in artillery: According to data from the European Commission to which EL PAÍS has had access, Russia fires between 40,000 and 50,000 artillery shells per day, compared to 5,000-6,000 Ukrainian forces expend. The Estonian government, which has been one of largest contributors to Kyiv’s war effort, puts the average use of artillery at between 20,000 and 60,000 Russian shells per day, and 2,000 to 7,000 Ukrainian rounds, according to a document sent to EU Member States by Tallinn, to which this newspaper has had access The Russian forces fire ten times the number of shells the Ukrainians can fire. In a modern war artillery fire causes 65+% of all casualties. It is thus impossible that Ukraine is losing less soldiers than the Russians. The total ratio may well be 7 to 1 but it will certainly be to the advantage of the Russian forces side.

“..unlimited profits” by conducting “directed evolution” research on the Covid-19 virus, in order to “proactively develop new vaccines..”

• Russia Issues Latest Report On US-Funded Biolabs In Ukraine (RT)

US-funded biological research laboratories are continuing to operate in Ukraine in spite of official statements indicating that they had been “deactivated,” the Russian Defense Ministry said in a Friday report on Washington’s international pathogen research programs. According to the commander of Russia’s Nuclear, Biological and Chemical Defense Forces, Lieutenant General Igor Kirillov, Moscow has obtained documents that suggest Kiev has continued to coordinate with the Pentagon in the military biological field, including the transfer of pathogenic biomaterials. Kirillov pointed to an official appeal from ‘ch2m-hill’ – a key Pentagon contractor – to Ukrainian companies participating in a “program to counter particularly dangerous pathogens in Ukraine.”

The document reports on the continuation of the Defense Threat Reduction Agency’s (DTRA) biological program in Ukraine and outlines future tasks, such as consolidating collections of dangerous pathogens and deploying systems for managing bio risks and monitoring the epidemiological situation. Kirillov also stated that, in January 2023, the government of Ukraine published a new set of requirements for the “accounting, storage, transportation and destruction” of various pathogens, which included instructions for the international transportation by air of substances with the highest hazard class. He noted that the transport document templates provided in the guidelines only featured examples of US labs as recipients or senders of the hazardous biomaterials.

The lieutenant general warned that Kiev and Washington could potentially use their research to carry out “provocations with dangerous pathogens,” which they would later blame on Russia. In his report, Kirillov reiterated Russia’s concerns with the potential risks associated with the “dual-use” programs that the US implements on its own territory and abroad. He pointed out that the work of US biolabs on dangerous pathogens “seems to be the height of recklessness” against the backdrop of viral outbreaks such as anthrax and cholera in various parts of the world and the rise in animal diseases such as African swine fever, avian influenza, and foot and mouth disease.

The commander also drew attention to the US pharmaceutical industry’s attempts to secure “unlimited profits” by conducting “directed evolution” research on the Covid-19 virus, in order to “proactively develop new vaccines,” which Pfizer R&D director Jordan Walker admitted to in a Project Veritas expose. Kirillov also reiterated Russia’s position that the main goal of US bio programs across the world was to “establish global biological control” by degrading the national health systems of other countries and subverting the provisions of the Biological and Toxin Weapons Convention (BTWC) with its own rules, which were developed to serve the interests of Washington and its allies.

I’m sure it’s all defensive.

• Poland Builds Europe’s Largest Land Force (Az.)

Warsaw is embarking on its biggest re-armament drive in 50 years in response to the growing threat posed by Russia, Report informs via The Telegraph. But in mid-December, Poland’s 11th Artillery Regiment received 24 South-Korean made K9 self-propelled howitzers that can hit targets up to 34 miles away, bringing new and deadly capabilities to the regiment. Stationed not far from the Russian border, Captain Marek Adamiak unit has long grappled with outdated kit. “As an artillery officer I’m excited by the new equipment,” Captain Adamiak told The Telegraph. “We can manoeuvre better, we can shoot from anywhere. There is no place we can’t shoot from. We had a lot of old artillery but now we have very new weapons.”

The war happening in neighboring Ukraine has given the Poles the confidence that if the conflict came to their doorstep, they would now have the weapons to fight back. The 24 guns are just the tip of a massive defence spending programme by Poland. Spurred on by war next door and the growing fear that Poland could one day be in the sights of the Kremlin looking to return to the days when the Russian empire once stretched to River Vistula, the Polish government is determined to arm up – and fast. This year it will spend 4 percent of its GDP on defence, an amount double the Nato requirement, and one that will make Poland the biggest, per-capita, spender on defence in the alliance.

Some of the deals for new equipment pre-date the Ukraine war when Poland, already conscious of the Russian threat, had started to revamp armed forces still burdened with a lot of Soviet-era equipment. “The criminal assault carried out by the Russian Federation, targeting Ukraine, and the unpredictable nature of Putin means that we need to accelerate the equipment modernisation even further,” Mariusz Blaszczak, the Polish defence minister, told the Defence24 portal. “It is of key importance to increase the levels of security as fast as possible for Poland. We can do this only by creating a strong military. Strong enough to deter any potential aggressor from deciding to attack.”

Poland has placed orders for 1,000 K2 main battle tanks from South Korea, and 250 brand new M1A2 SEPv3 Abram tanks from the US. This will turn Poland into the owner of Europe’s biggest tank force, dwarfing the UK’s fleet of 227. Its artillery will be bolstered by the arrival of 600 K9s, 18 HIMARS launchers with 9,000 rockets, and 288 K239 Chunmoo MRL systems from South Korea. Over 1,000 Polish-made Borsuk infantry fighting vehicles will carry Polish troops into battle, while air cover will come from 96 AH-64E Apache helicopters bought from the US, and 48 FA-50 combat aircraft now on order from South Korea. All of this will be underscored by plans to double the size of the Polish Army to 300,000, which would turn Poland into Europe’s biggest military power, in terms of manpower, west of Ukraine.

Orban

NATO country leader Orban believes that the West is very close to seriously proposing sending NATO troops into Ukraine. pic.twitter.com/aho3EuVuLS

— Mats Nilsson (@mazzenilsson) March 11, 2023

If the bombs are, then so are the soldiers.

• American Guided Bombs Are ‘Operational’ in Ukraine (LI)

The Department of Defense confirmed that advanced bombs are operational in Ukraine. The Joint Direct Attack Munition-Extended Range (JDAM-ER) can hit targets 50 miles away. The Pentagon’s confirmation comes after President Joe Biden ordered the Pentagon to transfer “precision aerial munitions” to Kiev in December. On Monday, U.S. Air Force Gen. James Hecker, head of US Air Forces in Europe, told reporters that the JDAM-ER was operational in Ukraine. “Recently, we’ve just gotten some precision munitions [to Ukraine] that had some extended range and go a little bit further than the gravity drop bomb and has precision [guidance],” Hecker said. “That’s a recent capability that we were able to give them probably in the last three weeks.” JDAMs are primarily used to increase the accuracy of bombs.

The official did not specify how many or what variation of JDAMs would be sent. The JDAM-ER can be equipped onto 2,000 or 500 pound bombs and will deliver the munition up to 45 miles. JDAMs are compatible with some Western-made fighter jets and drones. Officially, Kiev does not possess any aircraft that can drop precision munitions. Biden said he has “for now” ruled out sending American-made aircraft. However, the UK is training Ukrainian pilots on Western-made fighter jets. Ukrainian pilots are in the US this week to determine how much training the airmen will need to become proficient on American planes. Additionally, JDAMs have been tested on Quickstrike underwater mines. The Quickstrike bombs are dropped by aircraft in shallow waters and can sit on the seabed for some time before being activated. If Ukraine is utilizing JDAMs on Quickstike mines, it’s still unclear what aircraft Kiev is using in the operations.

Set them all free, except for those few caught on tape destroying property and/or attacking people.

• Elon Musk Demands Release Of ‘QAnon Shaman’ (RT)

SpaceX and Twitter CEO Elon Musk has called for the release of Jacob Chansley, the war-painted Trump supporter jailed for his role in the January 6, 2021, riot on Capitol Hill. Recently released video footage shows Chansley, nicknamed the ‘QAnon Shaman’ by the media, peacefully walking through the Capitol with a police escort. Musk tweeted a video on Friday showing Chansley encouraging his fellow protesters to “go home,” telling them that Donald Trump had asked them to leave the area. “Free Jacob Chansley,” he captioned the video. “Chansley was falsely portrayed in the media as a violent criminal who tried to overthrow the state and who urged others to commit violence. But here he is urging people to be peaceful and go home,” Musk wrote in a follow-up tweet. “I’m not part of MAGA,” he added, referring to Trump’s ‘Make America Great Again’ movement, “but I do believe in fairness of justice.”

Chansley pleaded guilty in 2021 to one count of obstructing an official proceeding, and was sentenced to 41 months in prison. One of the first protesters to enter the Capitol on the day of the riot, Chansley was photographed inside the Senate chamber wearing a horned fur helmet with his face painted in the colors of the American flag.The federal judge who sentenced Chansley described his actions as “horrific” and “terrifying.” However, video footage aired by Fox News host Tucker Carlson on Monday showed Chansley walking around the interior of the Capitol alongside two police officers, before dedicating a prayer to the officers. The Democrat-led January 6 Committee – formed to investigate Trump’s culpability in the riot – kept this footage under wraps. It was provided to Carlson by House Speaker Kevin McCarthy, after the GOP retook control of the House of Representatives in January.

Quiz

BREAKING : Previously Unseen January 6th Footage pic.twitter.com/0jxqANbNVn

— @stevenvoiceover (@stevenvoiceover) March 7, 2023

“Chansley got 4 years in prison for a non-violent, police-escorted tour?” Musk wrote in another tweet on Friday. That tweet was “fact checked” when shared on Instagram, with the platform linking to media reports claiming that police repeatedly asked Chansley to leave the building, and therefore did not “help” him around the Capitol. “The Capitol Police literally opened the Senate chamber door for him on camera!” Musk exclaimed. “But who are you going to believe, Instagram ‘fact-checkers’ or your own lying eyes!?” Chansley is one of nearly 1,000 protesters arrested in connection with the riot, 306 of whom were charged with obstructing an official proceeding, according to Justice Department figures. The vast majority – 919 – of defendants were charged with entering a restricted federal building, while 326 were charged with assaulting or disobeying a police officer. Of those detained, 518 have pleaded guilty, most of them to misdemeanor offenses.

“However, an international meeting on this topic is possible, a meeting of delegates from the whole world..”

• Trip To Moscow Not Impossible, Pope Francis Says (TASS)

A trip to Moscow is not impossible, Pope Francis said in an interview with the Argentina’s La Nacion news outlet. “This is not impossible. We hope we will be able to do that. I would like to bring to the attention that there are no promises. I have not closed this door,” the Pontiff said in the interview. At the same time, the head of the Roman Catholic Church expressed doubt regarding the possibility of a bilateral meeting between Russian President Vladimir Putin and his Ukrainian counterpart Vladimir Zelensky under auspices of the Vatican.

“However, an international meeting on this topic is possible, a meeting of delegates from the whole world,” he said. The Vatican is working in this direction, the Pontiff noted. [The Vatican has] no peace formula, the peace service is in place,” Pope Francis added. Pope Francis repeatedly said earlier that his trip to Kiev is possible only on condition of visiting Moscow. The Pontiff said that he is open for a meeting with both presidents, of Russia and Ukraine, on the way from the apostolic trip to Africa in early February.

What a surprise.

• Over $250 Billion Swindled From US Pandemic Fund (RT)

More than $250 billion in Covid-19 relief funds were lost to “fraud” and “waste,”the directors of three US government agencies testified before the House Oversight and Accountability subcommittee on Thursday. Compounding what Deputy Inspector General Sheldon Shoemaker of the Small Business Administration (SBA) called “the biggest fraud in a generation,” the officials stressed that the figures they gave represented an extremely conservative estimate of the total amount lost as they did not include the amount defrauded from the Pandemic Unemployment Assistance program. According to a statement submitted by Shoemaker ahead of the hearing, the SBA has already uncovered $190.7 billion in potential fraud across relief programs under its jurisdiction. Specifically, it expects to find upwards of $100 billion within the scandal-plagued Paycheck Protection Program.

Acting Treasury Inspector General Richard Delmar admitted to just $2.6 billion in dubious charges confirmed at his agency, pleading that ongoing audits precluded making an estimate of the full cost. Larry Turner, inspector general of the Department of Labor, blamed the massive losses on a lack of preparation, insufficient oversight, and even the government’s generosity, making a “highly conservative” estimate of $76 billion in fraudulent spending. With no functioning system in place to verify applicants’ qualifying details in a reasonable time frame, the “unprecedented infusion of federal funds” into the program made it irresistible to fraudsters, he told the subcommittee.

Rep. Keith Mfume (D-Maryland) expressed shock that no one had predicted that requiring only “self-certification” to access such a prodigious cash hoard would lead to “a lot of hanky-panky,” while Rep. Byron Donalds (R-Florida) pointed out that the agencies did not even use existing checks and balances to vet applicants, and Rep. Maxwell Frost (D-Florida) highlighted that state unemployment systems were hopelessly outdated even before the pandemic placed them under unprecedented stress. Of $45.6 billion in potential fraud lent out in association with one Labor Department program, Turner acknowledged upon questioning that $267 million had gone to dead people.

Asked about the possibility of recovering the money, Turner said that hunting down the perpetrators was financially unrewarding, as “once money goes out the door, it is hard to get it back.” Even in cases where the government has been able to track down Covid-19 benefit fraudsters and claw back some of the funds, the inspectors general were unable to tell subcommittee members what had become of some of the money. More than $5 trillion in pandemic relief funds have been distributed since 2020. By some estimates, as much as $400 billion was stolen from the unemployment relief program alone.

Bankman Fried all over again.

• Silicon Valley Bank Employees Made Large Donations to Biden, Dems (GP)

As The Gateway Pundit reported on Friday, Silicon Valley Bank was closed by the FDIC due to the bank losing over 60% of its value after the company disclosed major losses from security sales. Many political pundits and investors have called for lawmakers to bailout out the failed bank. Those advocating for bailouts have shied away from telling the public that SVB employees and affiliates voted in the leaders responsible for the current economic crisis. Open Secret’s data reveals in the 2020 election cycle Silicon Valley Bank employees and affiliates donated over $188,000 dollars to political candidates. Over 90% of the donations which amounted to $173,434 went to Democratic candidates whereas 7.2% or $13,763 went towards Republican candidates.

Joe Biden received the most donations with $66,748, followed by the DNC Service Corps and Pete Buttigieg. Other notable names and organizations that benefitted from Silicon Valley Bank employees in the 2020 election cycle were the Lincoln Project, Bernie Sanders Kamala Harris, and Raphael WarnockRepublicans did see some donations from Silicon Valley Bank affiliates but they weren’t as lucrative. The Republican Nationals Committee received the most notable donation which amounted to $5,271. The Silicon Valley Bank PAC in 2020 was a bit more balanced when it came to donations between Republicans and Democrats.Republican Rep. Patrick McHenry of North Carolina and Democratic Rep. Maxine Waters both received $2,500. Former Representative Anthony Gonzalez of Ohio who previously voted to impeach Trump received $1,000.

A cheap banking licence?! But first, the bailouts. There’s talk of the FDIC paying everyone 50%.

• Musk Lets In Possibility Of Buying Bankrupt Silicon Valley Bank (TASS)

US businessman and billionaire Elon Musk has posted a tweet assuming the possibility of buying the bankrupt Silicon Valley Bank (SVB). “I think Twitter should buy SVB and become a digital bank,” one of the users tweeted. “I’m open to the idea,” Musk replied in a comment. On Friday, the California Department of Financial Protection announced the bankruptcy of SVB, one of the largest banks in the United States. This became the largest bankruptcy of a US bank since times of the 2008 financial crisis, CNN TV Channel said earlier. The Federal Deposit Insurance Corporation was appointed as the receiver for Silicon Valley Bank.

“I do think Dr. Fauci and the CDC changed the definition of gain-of-function research, so that Fauci has, like, this wiggle room, but they were juicing up this virus..”

• House GOP ‘Building the Case’ to Issue Criminal Referrals Against Fauci (BN)

House Republicans are “building the case” to issue criminal referrals against Dr. Anthony Fauci for lying to Congress, according to news reported on “The Benny Show” with journalist Benny Johnson. “So, specifically before your committee, and also before Rand Paul over in the Senate, Dr. Fauci has, of course, absolved himself of all funding of gain-of-function,” Johnson said. “He said he doesn’t know anything about it. It is verifiable and demonstrable that he lied. Now, there are codes in Congress. I have a code right here, 18 U.S. Code 1001.” “1001,” Jordan said. “Statements — false statements to Congress,” Johnson said. “Says you can be imprisoned, says you can be imprisoned for eight years if you lie to Congress. It seems like there has never been a more clear-cut case of some individual lying to Congress.”

“Yeah, we can do — there could be a referral, but you would refer to the Biden Justice Department,” Jordan remarked. “I don’t know that — they’re going to pursue that, but you can definitely do that. You could, have to have one of the committees, the Senate Judiciary Committee could do a referral. I doubt they will with the Democrats in charge.” “We could do a referral potentially,” he continued. “I would, frankly, prefer just to have Dr. Fauci come back in and take another round of questions here, but we’re building the case. You know, like, we had Dr. Redfield testify last week, Chairman Wenstrup did. I thought he was — I thought he was great. As were the other witnesses that were brought in.”

“So, again, laying that foundation,” he continued. “I do think Dr. Fauci and the CDC changed the definition of gain-of-function research, so that Fauci has, like, this wiggle room, but they were juicing up this virus, no doubt about it, juicing up this virus, making it more — I don’t know the technical, but making it juiced up and more deadly, I guess, maybe the correct word.” “Yes,” Johnson remarked. “So, they were doing that in this lab and I think that’s clear,” Jordan said. “So, we’ll just have to see as we move through this investigation.”

Macgregor

Col. DOUGLAS MACGREGOR: "I think we'll do what we did after Vietnam… We killed 2 million Vietnamese. We lost 58,000 dead. The Ukrainians have already lost much more in the last year than we ever lost in Vietnam. But what happened to the 2 million Vietnamese dead? We didn't… pic.twitter.com/9QQmJWvYfw

— COMBATE |🇵🇷 (@upholdreality) March 11, 2023

Former US Army Colonel Douglas MacGregor says the US is using NATO to forcibly transform other countries in its image and subjugate them to its financial system. pic.twitter.com/u9pPY523E5

— Hassan Mafi (@thatdayin1992) March 11, 2023

Bob Newhart at 93

Walnut World

https://twitter.com/i/status/1634593087937822720

Hello!

https://twitter.com/i/status/1634339185804079104

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.