Jack Delano Lower Manhattan 1941

The indignation over Trump’s comments on Saudi Arabia is shifting into overdrive. Perhaps that’s needed to expose the hypocrisy inherent in them. It’s not Trump, it’s America that has condoned torture and murder by the House of Saud for decades. That started actively assisting the Saudi’s in Yemen under Obama. Trump refuses to be set up by the media and Democrats as the fall guy for $150 oil prices. He’s thinking: let Congress do it, now that it’s blue. If that’s immoral, he’s not alone.

• Senate Calls On Trump For Saudi Answers (BBC)

US President Donald Trump has been asked to ascertain whether Saudi Crown Prince Mohammed bin Salman played a role in the murder of Jamal Khashoggi. Republican and Democratic leaders of the US Senate Foreign Relations Committee on Tuesday sent a letter demanding a second investigation. Mr Trump earlier defended US ties with Saudi Arabia despite international condemnation over the incident. Khashoggi was killed on 2 October inside the Saudi consulate in Istanbul. In a statement on Tuesday, Mr Trump acknowledged that the crown prince “could very well” have known about Khashoggi’s brutal murder, adding: “Maybe he did and maybe he didn’t!”

He later stated that the CIA had not made a “100%” determination on the killing. Following the president’s comments, Republican Senator Bob Corker and Democrat Bob Menendez issued a statement on behalf of the Senate Foreign Relations Committee. In it they called on Mr Trump to focus a second investigation specifically on the crown prince so as to “determine whether a foreign person is responsible for an extrajudicial killing, torture or other gross violation” of human rights. The request, issued under the Global Magnitsky Human Rights Accountability Act, requires a response within 120 days.

OK, CNN, do your job.

• Saudi Arabia Tortured Female Right-to-Drive Activists – Amnesty (AP)

Several activists imprisoned in Saudi Arabia since May, including women who campaigned for the right to drive, have been beaten and tortured during interrogation, Amnesty International has said. Saudi Arabia has detained at least 10 women and seven men on vague national security allegations related to their human rights work, the organisation said on Tuesday. Those detained include Loujain al-Hathloul, Eman al-Nafjan and Aziza al-Yousef, who had campaigned for the right to drive before the decades-long ban was lifted in June. Amnesty said that according to three testimonies it obtained, some of the activists were repeatedly given electric shocks and flogged, leaving some unable to walk or stand properly. In one instance, an activist was hung from the ceiling.

Another testimony said one of the detained women was subjected to sexual harassment by interrogators wearing face masks. The kingdom is at the centre of an international firestorm after the killing of Saudi journalist Jamal Khashoggi, who had written critically about Crown Prince Mohammed bin Salman’s crackdown on dissent, including the arrests of the women activists. Khashoggi was killed and then dismembered by Saudi agents in the kingdom’s consulate in Istanbul on 2 October. Lynn Maalouf, Amnesty’s Middle East research director, said: “Only a few weeks after the ruthless killing of Jamal Khashoggi, these shocking reports of torture, sexual harassment and other forms of ill-treatment, if verified, expose further outrageous human rights violations by the Saudi authorities.”

What a waste of resources.

• Trump Submits Answers To Robert Mueller Questions In Russia Probe (Ind.)

Donald Trump has submitted written answers to questions from Special Counsel Robert Mueller as part of the probe into Russian meddling in the 2016 election and possible collusion with the Trump campaign. “We answered every question they asked that was legitimately pre-election and focused on Russia,” Trump lawyer Rudy Giuliani said in an interview. “Nothing post-election. And we’ve told them we’re not going to do that.” Mr Giuliani said Trump did not plan to answer any questions from Mr Mueller on whether he tried to obstruct the investigation once he won office, such as by firing former FBI Director James Comey last year. “It is time to bring this inquiry to a conclusion,” the lawyer said in an earlier statement on the probe, which Mr Trump has repeatedly called a “witch hunt.”

Mr Trump signed the submission on Tuesday before he left Washington to spend the Thanksgiving holiday in Florida, a person familiar with the matter said. Mr Mueller was tasked to probe “any matters that arose or may arise directly from the investigation” into possible collusion between Mr Trump’s campaign and Russia during the 2016 election. [..] Mr Giuliani said in his statement the president had provided “unprecedented cooperation” with the probe over the past year and a half, noting that more than 30 White House-related witnesses had been questioned and 1.4 million pages of material turned over before Mr Trump responded to the pre-election questions in writing. He added that “much of what has been asked raised serious constitutional issues and was beyond the scope of a legitimate inquiry.”

Not exactly news, is it? Of course there will be an investigation of Hillary, Comey and a whole circus around them. It would be a serious perverson of justice if there isn’t.

• Trump Wanted To Order Justice Dept To Prosecute Clinton, Comey – NYT (R.)

U.S. President Donald Trump wanted to order the Justice Department to prosecute two political foes, his one-time presidential opponent Hillary Clinton and former FBI director James Comey, in the spring, but his White House counsel rebuffed him, the New York Times reported on Tuesday. Don McGahn, the White House counsel at the time, wrote a memo to the president outlining consequences for Trump if he did order these prosecutions. The outcomes ranged from the traditionally independent Justice Department refusing to comply, to congressional probes and voter outcry, the Times reported.

The New York Times also reported Trump’s lawyers privately asked the Justice Department to investigate Comey for mishandling sensitive government information and his role investigating Clinton’s use of a private email account and server, but law enforcement officials declined. It was not clear if Trump read the memo or pursued the prosecutions further, the New York Times said. It was also not clear what specific charges Trump wanted the Justice Department to pursue against Comey and Clinton, the Times reported. Trump has publicly railed against Clinton’s private email use during her tenure as U.S. Secretary of State, as well as her role in the Obama administration’s decision to allow a Russian company to buy a uranium mining firm.

Time to start writing about finance again?!

• Dow Plunges More Than 500 Points, Erases Gain For 2018 (CNBC)

The Dow Jones Industrial Average and S&P 500 fell sharply on Tuesday and turned negative for the year as a decline in Target shares pressured retailers, while some of the most popular tech shares dropped again. The 30-stock Dow dropped 551.80 points to 24,465.64 and the S&P 500 plunged 1.8 percent to close at 2,641.89. The Dow and S&P 500 were up 1.2 percent and 0.6 percent, respectively, for 2018 entering Tuesday. Meanwhile, the Nasdaq Composite also dropped 1.7 percent to 6,908.82 but managed to hang on to a slight gain for 2018. Tuesday’s declines come after the Dow dropped 395 points on Monday.

Stocks hit their lows of the day after Doubleline Capital founder Jeffrey Gundlach said stocks are still too expensive, adding there has not been a “panic low” yet. The Dow was down nearly 650 points at its session low, while the S&P 500 and Nasdaq had both dropped more than 2 percent. Target fell 10.5 percent after reporting weaker-than-expected earnings for the previous quarter. The company also posted lighter-than-forecast same-store sales, which is a key metric for retailers.

Nah, they’re not investors.

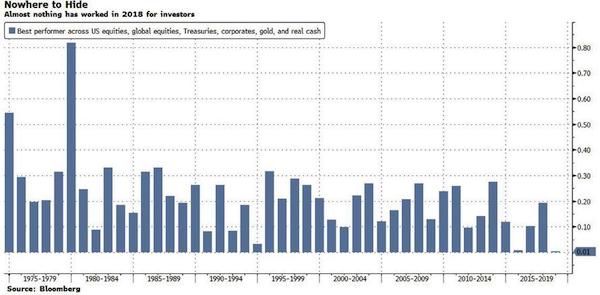

• Stunned Investors Observe The Market Carnage In Shock (ZH)

After another abysmal day, in which every single sector in the market closed in the red as stocks tumbled 2%, capping a dreadful two-month stretch since the S&P hit its all time highs exactly two months ago, which has seen both the S&P and the Dow turn red for the year with the Nasdaq just barely holding onto green, while oil crashed 6% slumping to a one year low, junk bonds matched a record streak of losses, the overall market just suffered one of its worst sessions in the past three years. But what is most remarkable is the following chart from Bloomberg which shows the year-to-date return of the best performing asset between US and global equities, corporate bonds, Treasuries, gold and real cash, and according to which 2018 is shaping up as what may be the worst year on record for cross-asset investors. Indeed, nothing at all has worked this year!

The inability of any single asset class to escape the dismal black hole supergravity of devastating losses in a brutal post-BTFD catharsis that has mutated into an equal-opportunity rout, crushing returns across all assets, has left investors reeling, shellshocked and paralyzed, and dreading what may come tomorrow let alone next year when both the US economy and corporate earnings are expected to see their supercharged recent growth rates come crashing back down to earth. “While there’s still no ‘panic in the streets,’ most traders are unconvinced that the selling will slow down anytime soon,” said Instinent’s head of trading Larry Weiss. “The flight to quality is now a flight to cash. It’s tough to convince anyone that now is the time to put money to work.”

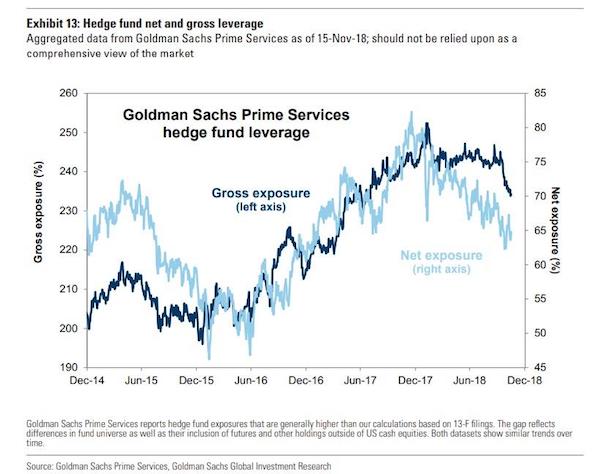

[..] Hedge funds, who hoped that “buy the dip” would work one last time and who rushed into the traditional “safety” of tech stocks at the end of October, were whipsawed, and turned net sellers this month, with the group accounting for the most selling among major industries according to Goldman Sachs. Meanwhile, as if sensing the coming storm, Goldman writes that hedge fund net exposures steadily declined throughout 2018, including during 2Q and 3Q while the broad equity market rallied, leaving most investors in the cold. Net long exposure calculated based on 13-F filings and publicly-available short interest data registered 49% at the start of 4Q, a decline from 56% at the start of 2018, and one of the lowest in years.

Potential volatility in oil is huge. Any little shrapnel of news, Saudi, Iran, Russia, shale, can force prices up 50%.

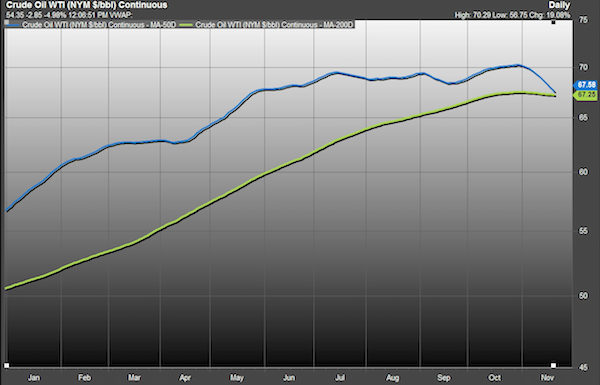

• A Death Cross Is Forming In US Oil (MW)

Oil is already in a bear market, but now a fresh, negative pattern is crystallizing in the commodity that has absolutely bludgeoned bulls over the past two months. January West Texas Intermediate crude on its first full session as the front-month contract, was down a whopping 7.5%, to $52.91 a barrel on the New York Mercantile Exchange and that downtrend has propelled the U.S. benchmark to the brink of forming a death cross—a chart formation in an asset that many market technicians believe marks the point that a short-term decline morphs into a longer-term downtrend (see chart below).

Based on the continuous chart for the most-active oil contract, the 50-day moving average at $67.58 a barrel is less than 0.5% shy of falling beneath the long-term 200-day moving average at $67.25, according to FactSet data. At the current rate of decline, a death cross could occur within a week or two. Both the U.S. contract and the global benchmark Brent oil are in bear market, usually characterized as a decline of at least 20% from a recent peak. In fact, U.S. oil is down 31% from its Oct. 3 peak at $76.41 a barrel.

Miners are ditching their equipment.

• Bitcoin Plunges As Much As 16% To Below $4,100, A New Low For The Year (CNBC)

Bitcoin is still struggling to find a bottom this week. The digital currency dropped as much as 16 percent on Tuesday to its lowest level since Sept. 30, 2017, according to data from CoinMarketCap.com. Bitcoin fell as low as $4,076.59, bringing its total losses in seven days to roughly 30 percent. The cryptocurrency briefly pared those losses and was down about 7 percent in afternoon trading. As U.S. stock markets closed though, bitcoin was still down 12 percent over 24 hours, trading near $4,299, according to data from CoinDesk.

The price plunge came after weeks of rare stability for the world’s largest and best-known cryptocurrency. While global markets churned in October, bitcoin traded comfortably in the $6,400 range — a break from volatility earlier this year. Its total losses this year are now more than 65 percent. ts epic rise last year started right after Thanksgiving as it began to gain status as a household name. Since then, the cryptocurrency has fallen more than 40 percent. Bitcoin first topped $10,000 at the end of November and made it to nearly $20,000 a week before Christmas as retail investors poured in and two regulated exchanges prepared to launch futures markets.

“With share repurchases in these companies being almost three times their actual investment, one must wonder how much actual U.S. economic growth they are expecting.”

• Misguided Share Buybacks Are Hollowing Out Companies’ Balance Sheets (MW)

GE was one of Wall Street’s major share buyback operators between 2015 and 2017; it repurchased $40 billion of shares at prices between $20 and $32. The share price is now $8.60, so the company has liquidated between $23 billion and $29 billion of its shareholders’ money on this utterly futile activity alone. Since the highest net income recorded by the company during those years was $8.8 billion in 2016, with 2015 and 2017 recording a loss, it has managed to lose more on its share repurchases during those three years than it made in operations, by a substantial margin. Even more important, GE has now left itself with minus $48 billion in tangible net worth at Sept. 30, with actual genuine tangible debt of close to $100 billion.

As the new CEO Larry Culp told CNBC last Monday: “We have no higher priority right now than bringing those leverage levels down.” The following day, GE announced the sale of 15% of its oil services arm Baker Hughes, for a round $4 billion. Of course, since that sale values Baker Hughes at $26 billion, and GE paid $32 billion for 62% of Baker Hughes as recently as last year, which looks to me like a valuation for the whole company of $52 billion, GE shareholders appears to have lost half the value of their investment in Baker Hughes in about 18 months. [..] A recent Financial Times article outlined how the five tech companies with the most cash (Apple, Alphabet, Cisco, Microsoft and Oracle) have repurchased an astounding $115 billion of stock in the first three quarters of 2018.

By contrast, the total capital spending of the five companies was only $42.6 billion during the same period. The story then congratulated investors for having done so well out of President Trump’s tax reform, which lowered the corporate tax rate, thus encouraging investment in the United States. With share repurchases in these companies being almost three times their actual investment, one must wonder how much actual U.S. economic growth they are expecting. [..] These share repurchases are misguided in so many ways. First, Apple, Alphabet and Microsoft are valued by the stock market at close to $1 trillion, levels no company has ever reached before. If you ignore the current stock price, a company repurchasing its shares is simply giving away its cash and reducing its share count; it creates no value.

Dangerously close to a political statement.

• Bank of England Backs Theresa May’s Brexit Deal, Warns Of No-Deal Dangers (G.)

Mark Carney has thrown his weight behind Theresa May’s Brexit deal, warning that a no-deal scenario would damage the economy, trigger job losses, lead to lower pay for workers and cause inflation to rise. The governor of the Bank of England said May’s draft EU withdrawal agreement would “support economic outcomes” that would be positive for the British economy, primarily because it would give Britain more time to prepare for whatever final Brexit deal is agreed between Westminster and Brussels. “We welcome the transition arrangements in the withdrawal agreement. It’s at the heart [of the deal],” he told MPs on the Treasury select committee, a week after the prime minister agreed the terms of the deal with the EU.

“[The deal] improves our ability to discharge our function relative to having no deal,” he added. The timing of the governor’s comments could help to support May as she faces tough opposition from across the political divide, following cabinet resignations and Labour’s promise to vote it down in parliament. Carney warned that failure to agree a Brexit deal with Brussels before the March 2019 deadline would deliver a “large negative shock” to the UK economy that would have a persistent effect, lowering growth and causing job losses. He said such an outcome would deliver an “unprecedented supply shock” to the UK economy with few historical or international comparisons. “It wouldn’t be a happy situation to be in,” he said.

These talks should have started two years ago. And even then.

• May’s Brussels Trip Only Start Of ‘Endless’ EU Trade Talks (G.)

When Theresa May goes to Brussels for tea with Jean Claude Juncker on Wednesday afternoon, the two leaders will have in front of them a metaphorical Christmas tree of a political declaration. “And every member state has put a bauble on it”, an EU diplomat said. A seven-page document published last week, offering some heads of terms on the future relationship, is set to more than double to some 20 pages. Calls for more ambitious language around the trade elements have been made. Demands for a Spanish veto over any deal covering Gibraltar have been tabled. And an array of asks on so called “level playing field” commitments in any future trade deal are in the mix.

There is even talk of side-declarations to the political declaration emerging at the special Brexit summit next Sunday to allow member states to feel that they have drawn a line in the sand about the real trade talks to come. “It’s all getting very confusing,” admitted a second EU diplomat. Not to Sir Andrew Cahn, the former chief executive of the government’s UK Trade & Investment (UKTI) department, who was also an aide to Neil Kinnock when vice president of the European commission in the late 1990s. This is, he said, likely to be a mere amuse-bouche to the “continuous endless” talks that will open on the UK’s trading relationship with Brussels after 29 March 2019 as the UK finds its way around the EU’s orbit.

“It is a classic EU negotiation and the member states are performing their normal way,” Cahn said. “The French always come in late to toughen their negotiating position towards the end, and that’s when they can get some additional things. “The Spanish are copying with Gibraltar – although that is partly a function of domestic Spanish politics with Pedro Sánchez [the Spanish prime minister] being vulnerable at home.”

What, she didn’t tell you?

• UK To Be ‘Frozen Out’ Of 182 EU Decisions During Brexit Transition (Ind.)

The UK will be “frozen out” of EU decisions on no fewer than 182 new rules in the months after Brexit, a new analysis says, including over budget spending, road signs and drinking water. The full scale of fresh regulations in the pipeline – during Theresa May’s planned 21-month transition period – exposes the blunder of making Britain “a rule-taker, not a rule-maker”, it warns. During that transition, the UK will be bound by Brussels’ decisions but without any ministers in the EU council, or MEPs in the European parliament, to influence them. Now the campaign for a People’s Vote on the Brexit outcome has examined the decisions expected before 2020, which also include alcohol-taxing and rules for UK investment funds.

“This analysis sets out for the first time the full scale of the UK’s capitulation under this so-called deal,” said Chris Bryant, a Labour supporter of People’s Vote. “The prime minister’s deal would weaken our ability to have a say in over 180 crucial decisions that are going to be made in Europe while the UK is in transition – meaning we have to abide by their rulings but have no say and no ability to protect Britain’s interests. “This dodgy deal will leave Britain frozen out of decision making and forced to pay billions of Euros for the privilege.” The argument goes to the heart of criticism – by both pro and anti-Brexit MPs – that the UK will be a “vassal state” during the transition phase.

Russophobia continues unabated.

• Interpol Elects South Korean As Its President In Blow To Russia (G.)

South Korea’s Kim Jong-yang has been elected as Interpol’s next president, edging out a longtime veteran of Russia’s security services who was strongly opposed by the US, Britain and other European nations. The White House and its European partners had lobbied against Alexander Prokopchuk’s attempts to be named the next president of the international police body, saying his election would lead to further Russian abuses of Interpol’s “red notice” system to go after political opponents. Prokopchuk is a general in the Russian interior ministry and serves as an Interpol vice-president. Kim was chosen by Interpol’s 94-member states at a meeting of its annual congress in Dubai.

He will serve until 2020, completing the four-year mandate of his predecessor, Meng Hongwei, who went missing in his native China in September. Beijing later said Meng resigned after being charged with accepting bribes. Critics say that Prokopchuk oversaw a policy of systematically targeting critics and dissidents during his time in charge of the Russian office of Interpol. On Tuesday, the US secretary of state, Mike Pompeo, threw his weight behind Kim, who is the acting president of the global police body. “We encourage all nations and organisations that are part of Interpol and that respect the rule of law to choose a leader with integrity. We believe Mr Kim will be just that,” Pompeo told reporters.

If only we move to recycled plastic! Geez, Louise, how about no plastic at all? You can cut at least 50% without changing anything much at all. More recycling is a fake message.

• Tax ‘Virgin Packaging’ To Tackle Plastics Crisis – Report (G.)

The government should introduce a new tax on virgin packaging to revolutionise the recycling system in the UK and tackle the plastics crisis, according to a new report. The study, presented to MPs and industry figures at Westminster on Tuesday evening, calls on ministers to impose a fee on packaging materials and offer a rebate for those products that use more recycled material. The WWF and the Resource Association, which commissioned environment consultancy Eunomia to produce the report, said the proposals would transform the UK’s broken recycling system – and drastically reduce the demand for raw materials, including fossil fuels. Dr Lyndsey Dodd, head of marine policy at WWF UK, said: “Our oceans are choking on plastic, 90% of the world’s sea birds have fragments of plastic in their stomach.

Despite the public outcry, more products are being made with virgin, or new, plastic than with recycled plastic.” Last year the Guardian revealed that plastic production is set to increase by 40% over the next 10 years as fossil fuel companies look to use raw materials produced by fracking in the US. The new report follows an announcement in October that the government is launching a consultation on the introduction of a tax on all plastic packaging with a recycled content of less than 30%. [..] Earlier this year the Guardian reported the plastics recycling industry was under investigation for suspected widespread abuse and fraud within the export system. Since China banned the import of plastic waste, the UK has been chasing other markets in Malaysia, Vietnam and Thailand, but these countries are also imposing restrictions due to the stockpiling of waste.

“..115 plastic cups, four plastic bottles, 25 plastic bags, two flip-flops, a nylon sack and more than 1,000 other assorted pieces of plastic..”

• Dead Whale Washes Ashore In Indonesia With 6 Kilos Of Plastic In Stomach (AP)

A dead whale that washed ashore in eastern Indonesia had a large lump of plastic waste in its stomach, including drinking cups and flip-flops – causing concern among environmentalists and government officials in one of the world’s largest plastic polluting countries. Rescuers from Wakatobi National Park found the 9.5-metre sperm whale late on Monday in waters near Kapota Island, southeast of Sulawesi, after receiving a report from environmentalists that villagers had surrounded the dead creature and were beginning to butcher its rotting carcass, park chief Heri Santoso said. Researchers from wildlife conservation group WWF and the park’s conservation academy found about 5.9 kilograms of plastic waste in the animal’s stomach – including 115 plastic cups, four plastic bottles, 25 plastic bags, two flip-flops, a nylon sack and more than 1,000 other assorted pieces of plastic.

“Although we have not been able to deduce the cause of death, the facts that we see are truly awful,” said Dwi Suprapti, a marine species conservation coordinator at WWF Indonesia. She said it was not possible to determine if the plastic had caused the whale’s death because of the animal’s advanced state of decay. Indonesia, an archipelago of 260 million people, is the world’s second-largest plastic polluter after China, according to a study published in the journal Science in January. It produces 3.2 million tonnes of mismanaged plastic waste a year, of which 1.29 million tonnes ends up in the ocean, the study said.

Can we say the MSM wakes up with this USA Today piece?

• Julian Assange Deserves A Medal of Freedom, Not A Secret Indictment (USA Today)

On the same day the Assange indictment scored headlines, Trump awarded seven Presidential Medals of Freedom. No controversy greeted posthumous awards to Babe Ruth and Elvis Presley — unlike the ruckus regarding Miriam Adelson, wife of Republican super-donor Sheldon Adelson. Public Citizen, a liberal nonprofit, howled that the Adelson award “is just the latest sign of [Trump’s] ability to corrupt and corrode all aspects of the government.” New York Times columnist Paul Krugman caterwauled that it was “ludicrous” and “and an insult to people who received the medal for genuine service.” In reality, Presidential Medals of Freedom have routinely been exploited to buttress the political establishment, with bevies of awards for political operators, members of Congress, and pliable foreign leaders.

President Lyndon Johnson distributed a bushel of Medals of Freedom to his Vietnam War architects and enablers, perhaps as consolation prizes for losing the war. (The medal awarded to Defense Secretary Robert McNamara, whose lies about the war making progress cost thousands of Americans and Vietnamese their lives, fetched $40,625 at an auction a few years ago.) President George W. Bush conferred Medals of Freedom on his Iraq war team, including CIA chief George “Slam Dunk” Tenet, Iraq viceroy Paul Bremer, and ambassador Ryan Crocker, whom Bush called “America’s Lawrence of Arabia.”

Some of the biggest fabulists of the modern era — including Henry Kissinger and Dick Cheney — also pocketed the award.The controversies over Assange and Adelson provide a serendipitous opportunity to update the freedom awards. Because few things are more perilous to democracy than permitting politicians to coverup crimes, there should be a new Medal of Freedom category commending individuals who have done the most to expose official lies. This particular award could be differentiated by including a little steam whistle atop the medal — vivifying how leaks can prevent a political system from overheating or exploding.

Assange would deserve such a medal — as would Thomas Drake and Edward Snowden (who revealed NSA’s abuses), John Kiriakou (who revealed CIA torture), and Daniel Ellsberg (who leaked the Pentagon Papers). Admittedly, there may be no way to stop presidents from giving steam whistle freedom awards to political donors’ wives. Organizations like Wikileaks are among the best hopes for rescuing democracy from Leviathan. Unless we presume politicians have a divine right to deceive the governed, America should honor individuals who expose federal crimes.