Albert Gleizes The football players 1912-13

As I said on March 15: “If I were New Zealand’s government, and Australia’s, I’d say this is not the time for the countries’ white populations to speak. Let the Maori do the talking instead. It’s their land.”

Incredibly emotional display of the famous #NewZealand Haka performed to honor the victims of the #NewZealandMosqueAttack pic.twitter.com/v66ACLq7Fx

— Safwan Choudhry (@SafwanChoudhry) March 17, 2019

Maybe not the kind of thing we should want to be swept under the carpet. But don’t underestimate Boeing’s political power. A series of tweets from a pilot and software engineer sheds a lot of light on what happened with the 737-MAX: one corner cut led automatically to the next one being cut. Until there were no more corners left. Dominoes. Zero Hedge has that series here.

Mike -Mish- Shedlock adds this: “If the above analysis by Trevor Sumner is correct, the planes were too complicated to fly because Boeing cut corners to save money, then did not even have the decency to deliver them with needed warning lights and operation instructions. There may be grounds for a criminal investigation here, not just civil. Regardless, Boeing’s decision to appeal to Trump to not ground the planes is morally reprehensible at best. Trump made the right call on this one, grounding the planes, albeit under international pressure. [..] By the way, if the timelines presented are correct, the FAA got in bed with Boeing, under Obama.”

• How Boeing, FAA Certified The Suspect 737 MAX Flight Control System (ST)

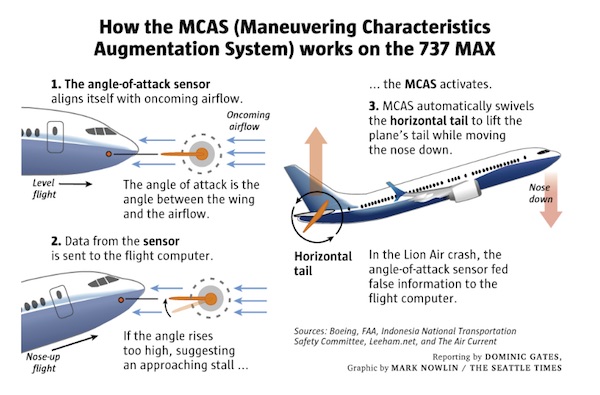

As Boeing hustled in 2015 to catch up to Airbus and certify its new 737 MAX, Federal Aviation Administration (FAA) managers pushed the agency’s safety engineers to delegate safety assessments to Boeing itself, and to speedily approve the resulting analysis. But the original safety analysis that Boeing delivered to the FAA for a new flight control system on the MAX — a report used to certify the plane as safe to fly — had several crucial flaws. That flight control system, called MCAS (Maneuvering Characteristics Augmentation System), is now under scrutiny after two crashes of the jet in less than five months resulted in Wednesday’s FAA order to ground the plane.

Current and former engineers directly involved with the evaluations or familiar with the document shared details of Boeing’s “System Safety Analysis” of MCAS, which The Seattle Times confirmed. The safety analysis: • Understated the power of the new flight control system, which was designed to swivel the horizontal tail to push the nose of the plane down to avert a stall. When the planes later entered service, MCAS was capable of moving the tail more than four times farther than was stated in the initial safety analysis document. • Failed to account for how the system could reset itself each time a pilot responded, thereby missing the potential impact of the system repeatedly pushing the airplane’s nose downward. •Assessed a failure of the system as one level below “catastrophic.” But even that “hazardous” danger level should have precluded activation of the system based on input from a single sensor — and yet that’s how it was designed.

The people who spoke to The Seattle Times and shared details of the safety analysis all spoke on condition of anonymity to protect their jobs at the FAA and other aviation organizations. Both Boeing and the FAA were informed of the specifics of this story and were asked for responses 11 days ago, before the second crash of a 737 MAX last Sunday. Late Friday, the FAA said it followed its standard certification process on the MAX. Citing a busy week, a spokesman said the agency was “unable to delve into any detailed inquiries.” Boeing responded Saturday with a statement that “the FAA considered the final configuration and operating parameters of MCAS during MAX certification, and concluded that it met all certification and regulatory requirements.”

Nice story, but he seeks to blame Trump instead of the FAA, and that doesn’t go anywhere.

• Boeing’s Doomed 737 Max’s (Margolis)

I don’t like flying. I consider it unnatural, unhealthy and fraught with peril. But I do it all the time. For me, it’s either fly or take an ox cart. In fact, I’ve been flying since I was six years old – from New York to Paris on a lumbering Boeing Stratocruiser, a converted, double-decker WWII B-29 heavy bomber. I even had a sleeping berth. So much for progress. Lots can go wrong in the air. Modern aircraft have thousands of obscure parts. If any one of them malfunctions, the aircraft can be crippled or crash. Add pilot error, dangerous weather, air traffic control mistakes, mountains where they are not supposed to be, air to air collisions, sabotage and hijacking.

I vividly recall flying over the snow-capped Alps in the late 1940’s aboard an old Italian three-motor airliner with its port engine burning, and the Italian crew panicking and crossing themselves. Some years ago, I was on my way to Egypt when we were hijacked by a demented Ethiopian. A three day ordeal ensued that included a return flight to New York City from Germany, with the gunman threatening to crash the A-310 jumbo jet into Wall Street – a grim precursor of 9/11. My father, Henry Margolis, got off a British Comet airliner just before it blew up due to faulty windows.

Which brings me to the current Boeing crisis. After a brand new Boeing 737 Max crashed in Indonesia it seemed highly likely that there was a major problem in its new, invisible autopilot system, known as MCAS. All 737 Max’s flying around the world should have been grounded as a precaution. But America’s aviation authority, the Federal Aviation Administration (FAA), allowed the Max to keep flying. The FAA is half regulator and half aviation business promoter, a clear conflict of interest. The crash of a new Ethiopian 737 Max outside Addis Ababa under very similar circumstances to the Lion Air accident set off alarm bells around the globe.

Scores of airlines rightly grounded their new Max’s. But the US and Canada did not. The FAA continued to insist the aircraft was sound. The problem, it was hinted between the lines, was incompetent third world pilots. It now appears that America’s would-be emperor, Pilot-in–Chief Donald Trump, may have pressed the FAA to keep the 737 Max’s in the air. Canada, always shy when it comes to disagreeing with Washington, kept the 737 Max’s flying until there was a lot of evidence linking the Indonesia and Ethiopian crashes. Trump finally ordered the suspect aircraft grounded. But doing so was not his business. That’s the job of the FAA. But Trump, as usual, wanted to hog the limelight. By now, the 737 Max ban is just about universal.

Mess. 11 days left.

• The EU Has Never Had More Power Over Britain (G.)

It is easy to assign all the blame to Mrs May, the control freak who lost control. The charge list against her is certainly a lengthy one. She triggered article 50 before her government had an agreed strategy for withdrawal and her senior team then wasted months squabbling with itself rather than advancing the negotiations with the EU. Ignoring advice to the contrary and without advance discussion with her cabinet, she made a prison for herself by laying down red lines that made the negotiations more difficult and set her up for a string of ignominious subsequent reversals. When she threw away her majority at an election she didn’t have to call, she carried on as if nothing had changed rather than trying to reach out to other parties to forge a broad consensus about a way forward.

That made her the hostage of the Democratic Unionist party and the Brexit ultras on the right of her party. Mrs May has one quality that is of value in a political crisis. She has resilience. She lacks all the other ones, such as imagination, advocacy and agility. True, all true, and yet not the whole truth. Any account of this nightmare that holds Mrs May solely culpable is not a complete explanation for how we got here. In a dark corner of what remains of its political brain, the Tory party knows that it is collectively guilty of driving the country it professes to love into this shaming mess. With a few prescient exceptions, the Conservatives all backed David Cameron when he promised a referendum on the cynical basis that he might not have to deliver it and with the arrogant assumption that, if he did have to, he would easily win it.

“She reminds me occasionally of that character from Monty Python where all the arms and legs are cut off but he then tells the opponent: ‘Let’s call it a draw.’

• Dutch PM Compares Theresa May To Monty Python Limbless Knight (G.)

Theresa May is like the knight in Monty Python and the Holy Grail who loses his arms and legs in a duel and calls it a draw, the Dutch prime minister has said. Mark Rutte, who appeared visibly irritated last week at the failure of MPs to pass the Brexit deal, admitted feeling “angry” at the impasse in Westminster. He said his frustration was focused on the posturing of those seeking to make party political points during a major national crisis but praised May’s “incredible” resilience in the face of repeated knock-backs in the House of Commons. “Look, I have every respect for Theresa May,” Rutte said in an interview with the Dutch broadcaster WNL on Sunday.

“She reminds me occasionally of that character from Monty Python where all the arms and legs are cut off but he then tells the opponent: ‘Let’s call it a draw.’ She’s incredible. She goes on and on. At the same time, I do not blame her, but British politics.” The black knight sketch in the 1975 Monty Python film had John Cleese playing the role of the deluded swordsman who could not admit defeat, even as Graham Chapman’s King Arthur cut off all his limbs. Rutte said of the prime minister’s predicament: “You can see what happens when a country puts everything on the roulette wheel and takes a risk, and the whole thing collapses. That is what is happening. Economic, financial, politically, England is in a very bad position right now.”

After 40 years of EU membership, the UK stands to plunge into chaos when 1000s of laws and regulations evaporate. Very predictable, but mostly ignored.

• 100,000 Children in UK ‘Could Become Undocumented’ Overnight After Brexit (G.)

Thousands of children of EU nationals risk becoming a new “Windrush generation”, a children’s legal charity has said. They are concerned that vulnerable children could become undocumented in the same way as the Caribbean children who came to the UK decades ago only to suffer at the hands of the Home Office’s hostile environment decades later. An estimated 900,000 EU national children are in the UK with about 285,000 born in the country. Coram Children’s Legal Centre fears that children in foster care, in care homes, and others from vulnerable families could slip through the net of the new Home Office registration scheme for EU nationals after Brexit.

The Home Office estimates that between 10% and 20% of all applicants will be vulnerable, unable to provide documentary evidence of their time in the UK. “If just 15% of the current population of EU national children fail to ‘regularise’ their status before the cut-off point, 100,000 children would be added to the UK’s undocumented child population overnight, nearly doubling it [the numbers of existing undocumented children],” said Kamena Dorling, group head of policy and public affairs at Coram. About 5,000 children of EU nationals are separated from their parents and are in care and Coram is calling on the government to force local authorities to identify them now in order to get their settled status before the cut-off point in 2020 or 2021.

Dumb headline from BBC for a very real issue: schools care for poor pupils, and then see their funding cut.

• ‘Pupil Poverty’ Pressure On School Cash (BBC)

Schools in England are having to “pick up the pieces” for families in poverty, including giving food and clothes to children, head teachers warn. But, they say, that is unsustainable when schools are facing “funding cuts”. Heads will raise their concerns at the Association of School and College Leaders’ (ASCL) annual conference. Education Secretary Damian Hinds will tell the conference he is setting up an expert advisory group to help teachers with “the pressures of the job”. The advisory group, including the mental health charity Mind and teachers’ representatives, will look at ways to improve wellbeing among teachers and to tackle stress. [..]

Edward Conway, head of St Michael’s Catholic High School in Watford, says: “Pupil poverty has increased significantly over the past eight years, with us providing food, clothing, equipment and securing funds from charitable organisations to provide essential items such as beds and fridges.” The head teachers’ union has canvassed the views of school leaders, whose comments include: “When schools have to buy shoes for children to wear to school on a regular basis, we must have a problem.” Another head said: “In 24 years of education, I have not seen the extent of poverty like this. “Children are coming to school hungry, dirty and without the basics to set them up for life. “The gap between those that have and those that do not is rising and is stark.”

Where Britain is: “sitting in the EU departure lounge.”

• With Brexit Approaching UK’s Voice In Brussels Grows Quiet (G.)

For years a British foreign minister has shuttled once a month to Brussels or Luxembourg to meet their European counterparts. The crises of the world have crowded the agenda: from the Arab spring to the annexation of Crimea, coups, stolen elections and intractable wars. Monday, in theory, could be the last time the United Kingdom name plate is on the table. While a Brexit extension is a near-certainty, the official departure date is still 29 March. Uncertainty over exit day requires careful diplomacy. On Monday the British minister will have the chance to weigh in on the EU’s China strategy, ahead of a summit with Beijing on 9 April.

While British officials remain involved in discussions, the UK will hang back on strategic questions about how the EU should approach China. Nobody wants to be seen as lecturing European allies, while sitting in the EU departure lounge. A government spokesperson said: “The UK will continue to take a full part in discussions at the [Foreign Affairs Council], focusing on those issues that matter most to the UK and EU.” Other day-to-day EU business provides a jarring contrast with the government’s Brexit strategy: one of Theresa May’s last acts as an EU leader will be to sign a routine communique on strengthening the single market – the one she insists Britain must leave.

Meanwhile, the UK’s 73 MEPs do not know if they will be out of a job in a fortnight, or in three months. “It is really unsettling, but we are the least people to worry about,” said the Liberal Democrat MEP Catherine Bearder, speaking just outside the chamber in Strasbourg under the strident ring of a voting bell. The uncertainty facing MEPs is nothing, she adds, compared with the unknowns confronting business. “A politician’s life is always uncertain, you never know if you are going to come back for the next mandate.”

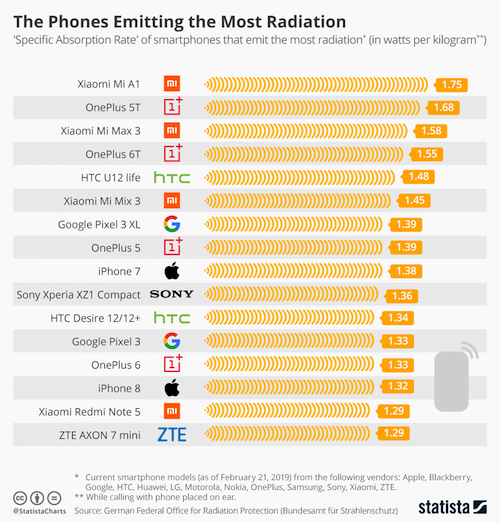

Radiation.

• Smartphone Shipments In China Collapse To Six Year Low (ZH)

Months after Apple stunned the market by announcing it would no longer be reporting quarterly iPhone unit sales, we have some insight as to the reason. February saw smartphone shipments in China collapse to their lowest levels in six years, indicating that the super-saturated industry has failed to turn around amidst a global economy that is grinding slower. Shipments to China came in at 14.5 million units for February, down 19.9% from last year, according to Reuters, who cited the China Academy of Information and Communications Technology. It’s the lowest total since February 2013.

February is traditionally a tough month for Chinese consumer purchases, as the Chinese spend a majority of the month celebrating the new year. However, this year’s drop was more concentrated than past years, as a result of both a slowing economy and the ongoing U.S./China trade war. When Apple recently cut sales forecasts this year, it blamed China for weighing on its results. To try and stimulate demand, the company paired with China-based Ant Financial to offer interest-free iPhone financing. Other retailers in China have tried similar promos to try and spur demand. This has some manufacturers, like Huawei, looking to corner the higher margin end of the market instead. Huawei saw its market share of China’s $500 to $800 device segment rise to 26.6% from 8.8% in 2018, according to data from Counterpoint Research. Apple, on the other hand, saw its share fall to 54.6% from 81.2%.

As an added bonus, we recently reported on Chinese smartphones also emitting the most radiation of any smartphones worldwide. The current smartphone creating the highest level of radiation is the Mi A1 from Chinese vendor Xiaomi. Another Chinese phone is in second place – the OnePlus 5T. In fact, the two companies are represented heavily in a list of “Phones Emitting the Most Radiation” that was recently released by Statista. 8 of the top 16 handsets being made by one of these two companies. Premium Apple phones, such as the iPhone 7 and the iPhone 8 are also here to be seen, as are the latest Pixel handsets from Google.

But there’s no bubble.

• Apartment Values Tipped To Plunge As Much As 50% In Some Sydney Areas (DM)

Apartment values in Australia’s big cities are set to plunge, with prices in one suburb to plummet as much as 50 per cent according to one industry observer, as Chinese buyers abandon off-the-plan residential tower projects. Ryde, in Sydney’s north, is Australia’s second-worst performing property market with dwelling values diving by 14.8 per cent during the past year, CoreLogic data showed. Digital Finance Analytics founder Martin North, an economist, feared apartment values there could be sliced in half during the next three years before stagnating for a decade. ‘We’ve got massive oversupply in those areas but you’ve just got no demand,’ he told Daily Mail Australia on Friday.

‘Some of the central high-rise apartments in the inner urban areas, like Ryde, 40 per cent now is certainly feasible. ‘In the worst case, you could see unit prices nearly halve.’ Starr Partners chief executive Doug Driscoll, who specialises in the Sydney real estate market, said Mr North’s forecasts were far fetched. He did, however, blame councils for approving too many developments. ‘We had an influx of foreign investment. We had an environment of record low interest rates, money was easily available – these things don’t last forever,’ he told Daily Mail Australia. ‘In some suburbs, in some pockets, we have seen an oversupply.’

From Australia, but applicable worldwide.

• Ultra Low Wage Growth The Intended Outcome Of Government Policies (Quiggin)

The long debate over the causes of wage stagnation took an unexpected turn last week, when Finance Minister Matthias Cormann described (downward) flexibility in the rate of wage growth as “a deliberate design feature of our economic architecture”. It was a position that was endorsed in a flurry of confusion 16 seconds after it had been rejected by Defence Industry Minister Linda Reynolds. Cormann had said policies aimed at pushing wages up could cause “massive spikes in unemployment”. The ease with which Reynolds was trapped into at first rejecting and then accepting what her ministerial colleague had said flowed from the fact that Cormann had broken one of the standing conventions of politics in Australia, and for that matter, the English-speaking world.

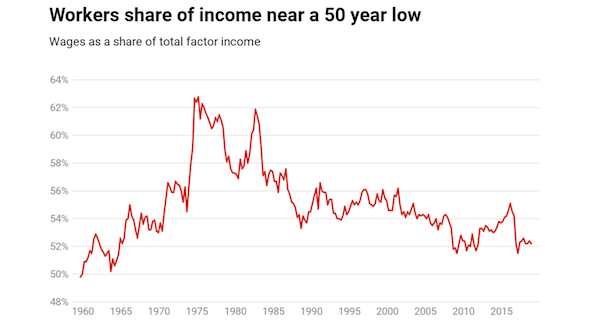

For more than forty years, both the architecture of labour market regulation and the discretionary choices of governments have been designed with the precise objective of holding wages down. These policies have been quite successful, as can be seen from the graph. However, at least until recently, there has been bipartisan agreement on at least one aspect of them – that no one should mention their role in holding back wages. Instead, the decline in the wage share of national income has been variously blamed on • technology • immigration • imports from China and, more recently, • the end of the mining boom. None of these explanations stand up to scrutiny.

The lame and the blind. Reports should look at the size of Deutsche relative to the German economy, and the nerves that touches in Berlin.

• Deutsche Bank And Commerzbank Go Public On Merger Talks (R.)

Deutsche Bank and Commerzbank confirmed on Sunday they were in talks about a merger, prompting labor union concerns about possible job losses and questions from analysts about the merits of a combination. Germany’s two largest banks issued short statements following separate meetings of their management boards, a person with knowledge of the matter said, indicating a quickening of pace in the merger process, although both also warned that a deal was far from certain. “In light of arising opportunities, the management board of Deutsche Bank has decided to review strategic options,” Deutsche said in its statement.

Christian Sewing, Deutsche Bank’s chief executive, told employees that Deutsche still aimed “to remain a global bank with a strong capital markets business… with a global network.”A merged bank would likely be the third largest in Europe after HSBC and BNP Paribas, with roughly 1.8 trillion euros ($2.04 trillion) in assets, such as loans and investments, and a market value of about 25 billion euros. [..] However, skeptics questioned the wisdom of a merger. “We do not see a national champion here, but a shaky zombie bank that could lead to another billion-euro grave for the German state. Why should we take this risk?” said Gerhard Schick, finance activist and ex-member of the German parliament.

While the banks had not publicly commented on merger talks until Sunday, Finance Minister Olaf Scholz last Monday confirmed that there were negotiations. On Sunday, the ministry acknowledged the announcement and said it remained in regular contact with all parties. However, there were signs of political opposition. Hans Michelbach, a lawmaker from the Christian Social Union (CSU), the Bavarian sister party of Chancellor Angela Merkel’s Christian Democratic Union (CDU), urged the government to sell its 15 percent stake in Commerzbank before a deal. “There may not be an ownership by the federal government in a merged big bank indirectly through an old stake. We do not need a German State Bank AG,” he told Reuters.

Hearsay report.

• Saudi Crown Prince Allegedly Stripped Of Some Authority (G.)

The heir to the Saudi throne has not attended a series of high-profile ministerial and diplomatic meetings in Saudi Arabia over the last fortnight and is alleged to have been stripped of some of his financial and economic authority, the Guardian has been told. The move to restrict, if only temporarily, the responsibilities of Crown Prince Mohammed bin Salman is understood to have been revealed to a group of senior ministers earlier last week by his father, King Salman. The king is said to have asked Bin Salman to be at this cabinet meeting, but he failed to attend.

While the move has not been declared publicly, the Guardian has been told that one of the king’s trusted advisers, Musaed al-Aiban, who was educated at Harvard and recently named as national security adviser, will informally oversee investment decisions on the king’s behalf. The Saudi embassy in Washington has declined multiple requests for comment since the Guardian approached it on Tuesday. The relationship between the king and his son has been under scrutiny since the murder of Saudi journalist Jamal Khashoggi, which was alleged to have been ordered by Prince Mohammed and provoked international condemnation of the crown prince. This has been denied by the Saudi government.

Experts on the Middle East are divided over whether the murder, and concern over the kingdom’s role in the conflict in Yemen, have led to tension at the heart of the notoriously secretive royal court. But while most observers expect Prince Mohammed to accede to the thrown, there are some signs that the king is seeking to rein in his controversial son at a time when Saudi Arabia is under the spotlight. The Guardian has been told Prince Mohammed did not attend two of the most recent weekly meetings of cabinet ministers, which are headed by the king. The crown prince has also not attended other high-profile talks with visiting dignitaries, including one last week with the Russian foreign minister, Sergey Lavrov.

And this is just what we see, what washes up on beaches. “16 rice sacks. 4 banana plantation style bags and multiple shopping bags” in the whale’s stomach..”

• Dead Whale Washed Up In Philippines Had 40kg Of Plastic Bags In Stomach (G.)

A young whale that washed up in the Philippines died from “gastric shock” after ingesting 40kg of plastic bags. Marine biologists and volunteers from the D’Bone Collector Museum in Davao City, in the Philippine island of Mindanao, were shocked to discover the brutal cause of death for the young curvier beaked whale, which washed ashore on Saturday. In a damning statement on their Facebook page, the museum said they uncovered “40 kilos of plastic bags, including 16 rice sacks. 4 banana plantation style bags and multiple shopping bags” in the whale’s stomach after conducting an autopsy. Images from the autopsy showed endless piles of rubbish being extracted from the inside of the animal, which was said to have died from “gastric shock” after ingesting all the plastic.

[..] The use of single-use plastic is rampant in south-east Asia. A 2017 report by Ocean Conservancy stated that China, Indonesia, the Philippines, Thailand, and Vietnam have been dumping more plastic into the ocean than the rest of the world combined. Marine biologist Darrell Blatchley, who also owns the D’Bone Collector Museum, said that in the 10 years they have examined dead whales and dolphins, 57 of them were found to have died due to accumulated rubbish and plastic in their stomachs.