Gustave Caillebotte Rue Mont-Cenis, Montmartre 1880

This is an anonymously posted document by someone who calls themselves Spartacus. Because it’s anonymous, I can’t contact them to ask for permission to publish. So I hesitated for a while, but it’s simply the best document I’ve seen on Covid, vaccines, etc. Whoever Spartacus is, they have a very elaborate knowledge in “the field”. If you want to know a lot more about the no. 1 issue in the world today, read it. And don’t worry if you don’t understand every single word, neither do I. But I learned a lot.

The original PDF doc is here: Covid19 – The Spartacus Letter

Hello,

My name is Spartacus, and I’ve had enough.

We have been forced to watch America and the Free World spin into inexorable decline due to a biowarfare attack. We, along with countless others, have been victimized and gaslit by propaganda and psychological warfare operations being conducted by an unelected, unaccountable Elite against the American people and our allies.

Our mental and physical health have suffered immensely over the course of the past year and a half. We have felt the sting of isolation, lockdown, masking, quarantines, and other completely nonsensical acts of healthcare theater that have done absolutely nothing to protect the health or wellbeing of the public from the ongoing COVID-19 pandemic.

Now, we are watching the medical establishment inject literal poison into millions of our fellow Americans without so much as a fight.

We have been told that we will be fired and denied our livelihoods if we refuse to vaccinate. This was the last straw.

We have spent thousands of hours analyzing leaked footage from Wuhan, scientific papers from primary sources, as well as the paper trails left by the medical establishment.

What we have discovered would shock anyone to their core.

First, we will summarize our findings, and then, we will explain them in detail. References will be placed at the end.

Summary:

• COVID-19 is a blood and blood vessel disease. SARS-CoV-2 infects the lining of human blood vessels, causing them to leak into the lungs.

• Current treatment protocols (e.g. invasive ventilation) are actively harmful to patients, accelerating oxidative stress and causing severe VILI (ventilator-induced lung injuries). The continued use of ventilators in the absence of any proven medical benefit constitutes mass murder.

• Existing countermeasures are inadequate to slow the spread of what is an aerosolized and potentially wastewater-borne virus, and constitute a form of medical theater.

• Various non-vaccine interventions have been suppressed by both the media and the medical establishment in favor of vaccines and expensive patented drugs.

• The authorities have denied the usefulness of natural immunity against COVID-19, despite the fact that natural immunity confers protection against all of the virus’s proteins, and not just one.

• Vaccines will do more harm than good. The antigen that these vaccines are based on, SARS-CoV- 2 Spike, is a toxic protein. SARS-CoV-2 may have ADE, or antibody-dependent enhancement; current antibodies may not neutralize future strains, but instead help them infect immune cells. Also, vaccinating during a pandemic with a leaky vaccine removes the evolutionary pressure for a virus to become less lethal.

• There is a vast and appalling criminal conspiracy that directly links both Anthony Fauci and Moderna to the Wuhan Institute of Virology.

• COVID-19 vaccine researchers are directly linked to scientists involved in brain-computer interface (“neural lace”) tech, one of whom was indicted for taking grant money from China.

• Independent researchers have discovered mysterious nanoparticles inside the vaccines that are not supposed to be present.

• The entire pandemic is being used as an excuse for a vast political and economic transformation of Western society that will enrich the already rich and turn the rest of us into serfs and untouchables.

COVID-19 Pathophysiology and Treatments:

COVID-19 is not a viral pneumonia. It is a viral vascular endotheliitis and attacks the lining of blood vessels, particularly the small pulmonary alveolar capillaries, leading to endothelial cell activation and sloughing, coagulopathy, sepsis, pulmonary edema, and ARDS-like symptoms. This is a disease of the blood and blood vessels. The circulatory system. Any pneumonia that it causes is secondary to that.

In severe cases, this leads to sepsis, blood clots, and multiple organ failure, including hypoxic and inflammatory damage to various vital organs, such as the brain, heart, liver, pancreas, kidneys, and intestines.

Some of the most common laboratory findings in COVID-19 are elevated D-dimer, elevated prothrombin time, elevated C-reactive protein, neutrophilia, lymphopenia, hypocalcemia, and hyperferritinemia, essentially matching a profile of coagulopathy and immune system hyperactivation/immune cell exhaustion.

COVID-19 can present as almost anything, due to the wide tropism of SARS-CoV-2 for various tissues in the body’s vital organs. While its most common initial presentation is respiratory illness and flu-like symptoms, it can present as brain inflammation, gastrointestinal disease, or even heart attack or pulmonary embolism.

COVID-19 is more severe in those with specific comorbidities, such as obesity, diabetes, and hypertension. This is because these conditions involve endothelial dysfunction, which renders the circulatory system more susceptible to infection and injury by this particular virus.

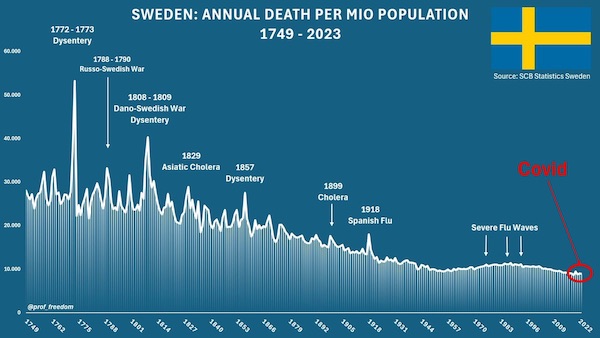

The vast majority of COVID-19 cases are mild and do not cause significant disease. In known cases, there is something known as the 80/20 rule, where 80% of cases are mild and 20% are severe or critical. However, this ratio is only correct for known cases, not all infections. The number of actual infections is much, much higher. Consequently, the mortality and morbidity rate is lower. However, COVID-19 spreads very quickly, meaning that there are a significant number of severely-ill and critically-ill patients appearing in a short time frame.

In those who have critical COVID-19-induced sepsis, hypoxia, coagulopathy, and ARDS, the most common treatments are intubation, injected corticosteroids, and blood thinners. This is not the correct treatment for COVID-19. In severe hypoxia, cellular metabolic shifts cause ATP to break down into hypoxanthine, which, upon the reintroduction of oxygen, causes xanthine oxidase to produce tons of highly damaging radicals that attack tissue. This is called ischemia-reperfusion injury, and it’s why the majority of people who go on a ventilator are dying. In the mitochondria, succinate buildup due to sepsis does the same exact thing; when oxygen is reintroduced, it makes superoxide radicals. Make no mistake, intubation will kill people who have COVID-19.

The end-stage of COVID-19 is severe lipid peroxidation, where fats in the body start to “rust” due to damage by oxidative stress. This drives autoimmunity. Oxidized lipids appear as foreign objects to the immune system, which recognizes and forms antibodies against OSEs, or oxidation-specific epitopes. Also, oxidized lipids feed directly into pattern recognition receptors, triggering even more inflammation and summoning even more cells of the innate immune system that release even more destructive enzymes. This is similar to the pathophysiology of Lupus.

COVID-19’s pathology is dominated by extreme oxidative stress and neutrophil respiratory burst, to the point where hemoglobin becomes incapable of carrying oxygen due to heme iron being stripped out of heme by hypochlorous acid. No amount of supplemental oxygen can oxygenate blood that chemically refuses to bind O2.

The breakdown of the pathology is as follows:

SARS-CoV-2 Spike binds to ACE2. Angiotensin Converting Enzyme 2 is an enzyme that is part of the renin-angiotensin-aldosterone system, or RAAS. The RAAS is a hormone control system that moderates fluid volume in the body and in the bloodstream (i.e. osmolarity) by controlling salt retention and excretion. This protein, ACE2, is ubiquitous in every part of the body that interfaces with the circulatory system, particularly in vascular endothelial cells and pericytes, brain astrocytes, renal tubules and podocytes, pancreatic islet cells, bile duct and intestinal epithelial cells, and the seminiferous ducts of the testis, all of which SARS-CoV-2 can infect, not just the lungs.

SARS-CoV-2 infects a cell as follows: SARS-CoV-2 Spike undergoes a conformational change where the S1 trimers flip up and extend, locking onto ACE2 bound to the surface of a cell. TMPRSS2, or transmembrane protease serine 2, comes along and cuts off the heads of the Spike, exposing the S2 stalk-shaped subunit inside. The remainder of the Spike undergoes a conformational change that causes it to unfold like an extension ladder, embedding itself in the cell membrane. Then, it folds back upon itself, pulling the viral membrane and the cell membrane together. The two membranes fuse, with the virus’s proteins migrating out onto the surface of the cell. The SARS-CoV-2 nucleocapsid enters the cell, disgorging its genetic material and beginning the viral replication process, hijacking the cell’s own structures to produce more virus.

SARS-CoV-2 Spike proteins embedded in a cell can actually cause human cells to fuse together, forming syncytia/MGCs (multinuclear giant cells). They also have other pathogenic, harmful effects. SARS-CoV- 2’s viroporins, such as its Envelope protein, act as calcium ion channels, introducing calcium into infected cells. The virus suppresses the natural interferon response, resulting in delayed inflammation. SARS-CoV-2 N protein can also directly activate the NLRP3 inflammasome. Also, it suppresses the Nrf2 antioxidant pathway. The suppression of ACE2 by binding with Spike causes a buildup of bradykinin that would otherwise be broken down by ACE2.

This constant calcium influx into the cells results in (or is accompanied by) noticeable hypocalcemia, or low blood calcium, especially in people with Vitamin D deficiencies and pre-existing endothelial dysfunction. Bradykinin upregulates cAMP, cGMP, COX, and Phospholipase C activity. This results in prostaglandin release and vastly increased intracellular calcium signaling, which promotes highly aggressive ROS release and ATP depletion. NADPH oxidase releases superoxide into the extracellular space. Superoxide radicals react with nitric oxide to form peroxynitrite. Peroxynitrite reacts with the tetrahydrobiopterin cofactor needed by endothelial nitric oxide synthase, destroying it and “uncoupling” the enzymes, causing nitric oxide synthase to synthesize more superoxide instead. This proceeds in a positive feedback loop until nitric oxide bioavailability in the circulatory system is depleted.

Dissolved nitric oxide gas produced constantly by eNOS serves many important functions, but it is also antiviral against SARS-like coronaviruses, preventing the palmitoylation of the viral Spike protein and making it harder for it to bind to host receptors. The loss of NO allows the virus to begin replicating with impunity in the body. Those with endothelial dysfunction (i.e. hypertension, diabetes, obesity, old age, African-American race) have redox equilibrium issues to begin with, giving the virus an advantage.

Due to the extreme cytokine release triggered by these processes, the body summons a great deal of neutrophils and monocyte-derived alveolar macrophages to the lungs. Cells of the innate immune system are the first-line defenders against pathogens. They work by engulfing invaders and trying to attack them with enzymes that produce powerful oxidants, like SOD and MPO. Superoxide dismutase takes superoxide and makes hydrogen peroxide, and myeloperoxidase takes hydrogen peroxide and chlorine ions and makes hypochlorous acid, which is many, many times more reactive than sodium hypochlorite bleach.

Neutrophils have a nasty trick. They can also eject these enzymes into the extracellular space, where they will continuously spit out peroxide and bleach into the bloodstream. This is called neutrophil extracellular trap formation, or, when it becomes pathogenic and counterproductive, NETosis. In severe and critical COVID-19, there is actually rather severe NETosis.

Hypochlorous acid building up in the bloodstream begins to bleach the iron out of heme and compete for O2 binding sites. Red blood cells lose the ability to transport oxygen, causing the sufferer to turn blue in the face. Unliganded iron, hydrogen peroxide, and superoxide in the bloodstream undergo the Haber- Weiss and Fenton reactions, producing extremely reactive hydroxyl radicals that violently strip electrons from surrounding fats and DNA, oxidizing them severely.

This condition is not unknown to medical science. The actual name for all of this is acute sepsis.

We know this is happening in COVID-19 because people who have died of the disease have noticeable ferroptosis signatures in their tissues, as well as various other oxidative stress markers such as nitrotyrosine, 4-HNE, and malondialdehyde.

When you intubate someone with this condition, you are setting off a free radical bomb by supplying the cells with O2. It’s a catch-22, because we need oxygen to make Adenosine Triphosphate (that is, to live), but O2 is also the precursor of all these damaging radicals that lead to lipid peroxidation.

The correct treatment for severe COVID-19 related sepsis is non-invasive ventilation, steroids, and antioxidant infusions. Most of the drugs repurposed for COVID-19 that show any benefit whatsoever in rescuing critically-ill COVID-19 patients are antioxidants. N-acetylcysteine, melatonin, fluvoxamine, budesonide, famotidine, cimetidine, and ranitidine are all antioxidants. Indomethacin prevents iron- driven oxidation of arachidonic acid to isoprostanes. There are powerful antioxidants such as apocynin that have not even been tested on COVID-19 patients yet which could defang neutrophils, prevent lipid peroxidation, restore endothelial health, and restore oxygenation to the tissues.

Scientists who know anything about pulmonary neutrophilia, ARDS, and redox biology have known or surmised much of this since March 2020. In April 2020, Swiss scientists confirmed that COVID-19 was a vascular endotheliitis. By late 2020, experts had already concluded that COVID-19 causes a form of viral sepsis. They also know that sepsis can be effectively treated with antioxidants. None of this information is particularly new, and yet, for the most part, it has not been acted upon. Doctors continue to use damaging intubation techniques with high PEEP settings despite high lung compliance and poor oxygenation, killing an untold number of critically ill patients with medical malpractice.

Because of the way they are constructed, Randomized Control Trials will never show any benefit for any antiviral against COVID-19. Not Remdesivir, not Kaletra, not HCQ, and not Ivermectin. The reason for this is simple; for the patients that they have recruited for these studies, such as Oxford’s ludicrous RECOVERY study, the intervention is too late to have any positive effect.

The clinical course of COVID-19 is such that by the time most people seek medical attention for hypoxia, their viral load has already tapered off to almost nothing. If someone is about 10 days post-exposure and has already been symptomatic for five days, there is hardly any virus left in their bodies, only cellular damage and derangement that has initiated a hyperinflammatory response. It is from this group that the clinical trials for antivirals have recruited, pretty much exclusively.

In these trials, they give antivirals to severely ill patients who have no virus in their bodies, only a delayed hyperinflammatory response, and then absurdly claim that antivirals have no utility in treating or preventing COVID-19. These clinical trials do not recruit people who are pre-symptomatic. They do not test pre-exposure or post-exposure prophylaxis.

This is like using a defibrillator to shock only flatline, and then absurdly claiming that defibrillators have no medical utility whatsoever when the patients refuse to rise from the dead. The intervention is too late. These trials for antivirals show systematic, egregious selection bias. They are providing a treatment that is futile to the specific cohort they are enrolling.

India went against the instructions of the WHO and mandated the prophylactic usage of Ivermectin. They have almost completely eradicated COVID-19. The Indian Bar Association of Mumbai has brought criminal charges against WHO Chief Scientist Dr. Soumya Swaminathan for recommending against the use of Ivermectin.

Ivermectin is not “horse dewormer”. Yes, it is sold in veterinary paste form as a dewormer for animals. It has also been available in pill form for humans for decades, as an antiparasitic drug.

The media have disingenuously claimed that because Ivermectin is an antiparasitic drug, it has no utility as an antivirus. This is incorrect. Ivermectin has utility as an antiviral. It blocks importin, preventing nuclear import, effectively inhibiting viral access to cell nuclei. Many drugs currently on the market have multiple modes of action. Ivermectin is one such drug. It is both antiparasitic and antiviral.

In Bangladesh, Ivermectin costs $1.80 for an entire 5-day course. Remdesivir, which is toxic to the liver, costs $3,120 for a 5-day course of the drug. Billions of dollars of utterly useless Remdesivir were sold to our governments on the taxpayer’s dime, and it ended up being totally useless for treating hyperinflammatory COVID-19. The media has hardly even covered this at all.

The opposition to the use of generic Ivermectin is not based in science. It is purely financially and politically-motivated. An effective non-vaccine intervention would jeopardize the rushed FDA approval of patented vaccines and medicines for which the pharmaceutical industry stands to rake in billions upon billions of dollars in sales on an ongoing basis.

The majority of the public are scientifically illiterate and cannot grasp what any of this even means, thanks to a pathetic educational system that has miseducated them. You would be lucky to find 1 in 100 people who have even the faintest clue what any of this actually means.

COVID-19 Transmission:

COVID-19 is airborne. The WHO carried water for China by claiming that the virus was only droplet- borne. Our own CDC absurdly claimed that it was mostly transmitted by fomite-to-face contact, which, given its rapid spread from Wuhan to the rest of the world, would have been physically impossible.

The ridiculous belief in fomite-to-face being a primary mode of transmission led to the use of surface disinfection protocols that wasted time, energy, productivity, and disinfectant.

The 6-foot guidelines are absolutely useless. The minimum safe distance to protect oneself from an aerosolized virus is to be 15+ feet away from an infected person, no closer. Realistically, no public transit is safe.

Surgical masks do not protect you from aerosols. The virus is too small and the filter media has too large of gaps to filter it out. They may catch respiratory droplets and keep the virus from being expelled by someone who is sick, but they do not filter a cloud of infectious aerosols if someone were to walk into said cloud.

The minimum level of protection against this virus is quite literally a P100 respirator, a PAPR/CAPR, or a 40mm NATO CBRN respirator, ideally paired with a full-body tyvek or tychem suit, gloves, and booties, with all the holes and gaps taped.

Live SARS-CoV-2 may potentially be detected in sewage outflows, and there may be oral-fecal transmission. During the SARS outbreak in 2003, in the Amoy Gardens incident, hundreds of people were infected by aerosolized fecal matter rising from floor drains in their apartments.

COVID-19 Vaccine Dangers:

The vaccines for COVID-19 are not sterilizing and do not prevent infection or transmission. They are “leaky” vaccines. This means they remove the evolutionary pressure on the virus to become less lethal. It also means that the vaccinated are perfect carriers. In other words, those who are vaccinated are a threat to the unvaccinated, not the other way around.

All of the COVID-19 vaccines currently in use have undergone minimal testing, with highly accelerated clinical trials. Though they appear to limit severe illness, the long-term safety profile of these vaccines remains unknown.

Some of these so-called “vaccines” utilize an untested new technology that has never been used in vaccines before. Traditional vaccines use weakened or killed virus to stimulate an immune response. The Moderna and Pfizer-BioNTech vaccines do not. They are purported to consist of an intramuscular shot containing a suspension of lipid nanoparticles filled with messenger RNA. The way they generate an immune response is by fusing with cells in a vaccine recipient’s shoulder, undergoing endocytosis, releasing their mRNA cargo into those cells, and then utilizing the ribosomes in those cells to synthesize modified SARS-CoV-2 Spike proteins in-situ.

These modified Spike proteins then migrate to the surface of the cell, where they are anchored in place by a transmembrane domain. The adaptive immune system detects the non-human viral protein being expressed by these cells, and then forms antibodies against that protein. This is purported to confer protection against the virus, by training the adaptive immune system to recognize and produce antibodies against the Spike on the actual virus. The J&J and AstraZeneca vaccines do something similar, but use an adenovirus vector for genetic material delivery instead of a lipid nanoparticle. These vaccines were produced or validated with the aid of fetal cell lines HEK-293 and PER.C6, which people with certain religious convictions may object strongly to.

SARS-CoV-2 Spike is a highly pathogenic protein on its own. It is impossible to overstate the danger presented by introducing this protein into the human body.

It is claimed by vaccine manufacturers that the vaccine remains in cells in the shoulder, and that SARS- CoV-2 Spike produced and expressed by these cells from the vaccine’s genetic material is harmless and inert, thanks to the insertion of prolines in the Spike sequence to stabilize it in the prefusion conformation, preventing the Spike from becoming active and fusing with other cells. However, a pharmacokinetic study from Japan showed that the lipid nanoparticles and mRNA from the Pfizer vaccine did not stay in the shoulder, and in fact bioaccumulated in many different organs, including the reproductive organs and adrenal glands, meaning that modified Spike is being expressed quite literally all over the place. These lipid nanoparticles may trigger anaphylaxis in an unlucky few, but far more concerning is the unregulated expression of Spike in various somatic cell lines far from the injection site and the unknown consequences of that.

Messenger RNA is normally consumed right after it is produced in the body, being translated into a protein by a ribosome. COVID-19 vaccine mRNA is produced outside the body, long before a ribosome translates it. In the meantime, it could accumulate damage if inadequately preserved. When a ribosome attempts to translate a damaged strand of mRNA, it can become stalled. When this happens, the ribosome becomes useless for translating proteins because it now has a piece of mRNA stuck in it, like a lace card in an old punch card reader. The whole thing has to be cleaned up and new ribosomes synthesized to replace it. In cells with low ribosome turnover, like nerve cells, this can lead to reduced protein synthesis, cytopathic effects, and neuropathies.

Certain proteins, including SARS-CoV-2 Spike, have proteolytic cleavage sites that are basically like little dotted lines that say “cut here”, which attract a living organism’s own proteases (essentially, molecular scissors) to cut them. There is a possibility that S1 may be proteolytically cleaved from S2, causing active S1 to float away into the bloodstream while leaving the S2 “stalk” embedded in the membrane of the cell that expressed the protein.

SARS-CoV-2 Spike has a Superantigenic region (SAg), which may promote extreme inflammation.

Anti-Spike antibodies were found in one study to function as autoantibodies and attack the body’s own cells. Those who have been immunized with COVID-19 vaccines have developed blood clots, myocarditis, Guillain-Barre Syndrome, Bell’s Palsy, and multiple sclerosis flares, indicating that the vaccine promotes autoimmune reactions against healthy tissue.

SARS-CoV-2 Spike does not only bind to ACE2. It was suspected to have regions that bind to basigin, integrins, neuropilin-1, and bacterial lipopolysaccharides as well. SARS-CoV-2 Spike, on its own, can potentially bind any of these things and act as a ligand for them, triggering unspecified and likely highly inflammatory cellular activity.

SARS-CoV-2 Spike contains an unusual PRRA insert that forms a furin cleavage site. Furin is a ubiquitous human protease, making this an ideal property for the Spike to have, giving it a high degree of cell tropism. No wild-type SARS-like coronaviruses related to SARS-CoV-2 possess this feature, making it highly suspicious, and perhaps a sign of human tampering.

SARS-CoV-2 Spike has a prion-like domain that enhances its infectiousness.

The Spike S1 RBD may bind to heparin-binding proteins and promote amyloid aggregation. In humans, this could lead to Parkinson’s, Lewy Body Dementia, premature Alzheimer’s, or various other neurodegenerative diseases. This is very concerning because SARS-CoV-2 S1 is capable of injuring and penetrating the blood-brain barrier and entering the brain. It is also capable of increasing the permeability of the blood-brain barrier to other molecules.

SARS-CoV-2, like other betacoronaviruses, may have Dengue-like ADE, or antibody-dependent enhancement of disease. For those who aren’t aware, some viruses, including betacoronaviruses, have a feature called ADE. There is also something called Original Antigenic Sin, which is the observation that the body prefers to produce antibodies based on previously-encountered strains of a virus over newly- encountered ones.

In ADE, antibodies from a previous infection become non-neutralizing due to mutations in the virus’s proteins. These non-neutralizing antibodies then act as trojan horses, allowing live, active virus to be pulled into macrophages through their Fc receptor pathways, allowing the virus to infect immune cells that it would not have been able to infect before. This has been known to happen with Dengue Fever; when someone gets sick with Dengue, recovers, and then contracts a different strain, they can get very, very ill.

If someone is vaccinated with mRNA based on the Spike from the initial Wuhan strain of SARS-CoV-2, and then they become infected with a future, mutated strain of the virus, they may become severely ill. In other words, it is possible for vaccines to sensitize someone to disease.

There is a precedent for this in recent history. Sanofi’s Dengvaxia vaccine for Dengue failed because it caused immune sensitization in people whose immune systems were Dengue-naive.

In mice immunized against SARS-CoV and challenged with the virus, a close relative of SARS-CoV-2, they developed immune sensitization, Th2 immunopathology, and eosinophil infiltration in their lungs.

We have been told that SARS-CoV-2 mRNA vaccines cannot be integrated into the human genome, because messenger RNA cannot be turned back into DNA. This is false. There are elements in human cells called LINE-1 retrotransposons, which can indeed integrate mRNA into a human genome by endogenous reverse transcription. Because the mRNA used in the vaccines is stabilized, it hangs around in cells longer, increasing the chances for this to happen. If the gene for SARS-CoV-2 Spike is integrated into a portion of the genome that is not silent and actually expresses a protein, it is possible that people who take this vaccine may continuously express SARS-CoV-2 Spike from their somatic cells for the rest of their lives.

By inoculating people with a vaccine that causes their bodies to produce Spike in-situ, they are being inoculated with a pathogenic protein. A toxin that may cause long-term inflammation, heart problems, and a raised risk of cancers. In the long-term, it may also potentially lead to premature neurodegenerative disease.

Absolutely nobody should be compelled to take this vaccine under any circumstances, and in actual fact, the vaccination campaign must be stopped immediately.

COVID-19 Criminal Conspiracy:

The vaccine and the virus were made by the same people.

In 2014, there was a moratorium on SARS gain-of-function research that lasted until 2017. This research was not halted. Instead, it was outsourced, with the federal grants being laundered through NGOs.

Ralph Baric is a virologist and SARS expert at UNC Chapel Hill in North Carolina. This is who Anthony Fauci was referring to when he insisted, before Congress, that if any gain-of-function research was being conducted, it was being conducted in North Carolina.

This was a lie. Anthony Fauci lied before Congress. A felony.

Ralph Baric and Shi Zhengli are colleagues and have co-written papers together. Ralph Baric mentored Shi Zhengli in his gain-of-function manipulation techniques, particularly serial passage, which results in a virus that appears as if it originated naturally. In other words, deniable bioweapons. Serial passage in humanized hACE2 mice may have produced something like SARS-CoV-2.

The funding for the gain-of-function research being conducted at the Wuhan Institute of Virology came from Peter Daszak. Peter Daszak runs an NGO called EcoHealth Alliance. EcoHealth Alliance received millions of dollars in grant money from the National Institutes of Health/National Institute of Allergy and Infectious Diseases (that is, Anthony Fauci), the Defense Threat Reduction Agency (part of the US Department of Defense), and the United States Agency for International Development. NIH/NIAID contributed a few million dollars, and DTRA and USAID each contributed tens of millions of dollars towards this research. Altogether, it was over a hundred million dollars.

EcoHealth Alliance subcontracted these grants to the Wuhan Institute of Virology, a lab in China with a very questionable safety record and poorly trained staff, so that they could conduct gain-of-function research, not in their fancy P4 lab, but in a level-2 lab where technicians wore nothing more sophisticated than perhaps a hairnet, latex gloves, and a surgical mask, instead of the bubble suits used when working with dangerous viruses. Chinese scientists in Wuhan reported being routinely bitten and urinated on by laboratory animals. Why anyone would outsource this dangerous and delicate work to the People’s Republic of China, a country infamous for industrial accidents and massive explosions that have claimed hundreds of lives, is completely beyond me, unless the aim was to start a pandemic on purpose.

In November of 2019, three technicians at the Wuhan Institute of Virology developed symptoms consistent with a flu-like illness. Anthony Fauci, Peter Daszak, and Ralph Baric knew at once what had happened, because back channels exist between this laboratory and our scientists and officials.

December 12th, 2019, Ralph Baric signed a Material Transfer Agreement (essentially, an NDA) to receive Coronavirus mRNA vaccine-related materials co-owned by Moderna and NIH. It wasn’t until a whole month later, on January 11th, 2020, that China allegedly sent us the sequence to what would become known as SARS-CoV-2. Moderna claims, rather absurdly, that they developed a working vaccine from this sequence in under 48 hours.

Stephane Bancel, the current CEO of Moderna, was formerly the CEO of bioMerieux, a French multinational corporation specializing in medical diagnostic tech, founded by one Alain Merieux. Alain Merieux was one of the individuals who was instrumental in the construction of the Wuhan Institute of Virology’s P4 lab.

The sequence given as the closest relative to SARS-CoV-2, RaTG13, is not a real virus. It is a forgery. It was made by entering a gene sequence by hand into a database, to create a cover story for the existence of SARS-CoV-2, which is very likely a gain-of-function chimera produced at the Wuhan Institute of Virology and was either leaked by accident or intentionally released.

The animal reservoir of SARS-CoV-2 has never been found.

This is not a conspiracy “theory”. It is an actual criminal conspiracy, in which people connected to the development of Moderna’s mRNA-1273 are directly connected to the Wuhan Institute of Virology and their gain-of-function research by very few degrees of separation, if any. The paper trail is well- established.

The lab-leak theory has been suppressed because pulling that thread leads one to inevitably conclude that there is enough circumstantial evidence to link Moderna, the NIH, the WIV, and both the vaccine and the virus’s creation together. In a sane country, this would have immediately led to the world’s biggest RICO and mass murder case. Anthony Fauci, Peter Daszak, Ralph Baric, Shi Zhengli, and Stephane Bancel, and their accomplices, would have been indicted and prosecuted to the fullest extent of the law. Instead, billions of our tax dollars were awarded to the perpetrators.

The FBI raided Allure Medical in Shelby Township north of Detroit for billing insurance for “fraudulent COVID-19 cures”. The treatment they were using? Intravenous Vitamin C. An antioxidant. Which, as described above, is an entirely valid treatment for COVID-19-induced sepsis, and indeed, is now part of the MATH+ protocol advanced by Dr. Paul E. Marik.

The FDA banned ranitidine (Zantac) due to supposed NDMA (N-nitrosodimethylamine) contamination. Ranitidine is not only an H2 blocker used as antacid, but also has a powerful antioxidant effect, scavenging hydroxyl radicals. This gives it utility in treating COVID-19.

The FDA also attempted to take N-acetylcysteine, a harmless amino acid supplement and antioxidant, off the shelves, compelling Amazon to remove it from their online storefront.

This leaves us with a chilling question: did the FDA knowingly suppress antioxidants useful for treating COVID-19 sepsis as part of a criminal conspiracy against the American public?

The establishment is cooperating with, and facilitating, the worst criminals in human history, and are actively suppressing non-vaccine treatments and therapies in order to compel us to inject these criminals’ products into our bodies. This is absolutely unacceptable.

COVID-19 Vaccine Development and Links to Transhumanism:

This section deals with some more speculative aspects of the pandemic and the medical and scientific establishment’s reaction to it, as well as the disturbing links between scientists involved in vaccine research and scientists whose work involved merging nanotechnology with living cells.

On June 9th, 2020, Charles Lieber, a Harvard nanotechnology researcher with decades of experience, was indicted by the DOJ for fraud. Charles Lieber received millions of dollars in grant money from the US Department of Defense, specifically the military think tanks DARPA, AFOSR, and ONR, as well as NIH and MITRE. His specialty is the use of silicon nanowires in lieu of patch clamp electrodes to monitor and modulate intracellular activity, something he has been working on at Harvard for the past twenty years. He was claimed to have been working on silicon nanowire batteries in China, but none of his colleagues can recall him ever having worked on battery technology in his life; all of his research deals with bionanotechnology, or the blending of nanotech with living cells.

The indictment was over his collaboration with the Wuhan University of Technology. He had double- dipped, against the terms of his DOD grants, and taken money from the PRC’s Thousand Talents plan, a program which the Chinese government uses to bribe Western scientists into sharing proprietary R&D information that can be exploited by the PLA for strategic advantage.

Charles Lieber’s own papers describe the use of silicon nanowires for brain-computer interfaces, or “neural lace” technology. His papers describe how neurons can endocytose whole silicon nanowires or parts of them, monitoring and even modulating neuronal activity.

Charles Lieber was a colleague of Robert Langer. Together, along with Daniel S. Kohane, they worked on a paper describing artificial tissue scaffolds that could be implanted in a human heart to monitor its activity remotely.

Robert Langer, an MIT alumnus and expert in nanotech drug delivery, is one of the co-founders of Moderna. His net worth is now $5.1 billion USD thanks to Moderna’s mRNA-1273 vaccine sales.

Both Charles Lieber and Robert Langer’s bibliographies describe, essentially, techniques for human enhancement, i.e. transhumanism. Klaus Schwab, the founder of the World Economic Forum and the architect behind the so-called “Great Reset”, has long spoken of the “blending of biology and machinery” in his books.

Since these revelations, it has come to the attention of independent researchers that the COVID-19 vaccines may contain reduced graphene oxide nanoparticles. Japanese researchers have also found unexplained contaminants in COVID-19 vaccines.

Graphene oxide is an anxiolytic. It has been shown to reduce the anxiety of laboratory mice when injected into their brains. Indeed, given SARS-CoV-2 Spike’s propensity to compromise the blood-brain barrier and increase its permeability, it is the perfect protein for preparing brain tissue for extravasation of nanoparticles from the bloodstream and into the brain. Graphene is also highly conductive and, in some circumstances, paramagnetic.

In 2013, under the Obama administration, DARPA launched the BRAIN Initiative; BRAIN is an acronym for Brain Research Through Advancing Innovative Neurotechnologies®. This program involves the development of brain-computer interface technologies for the military, particularly non-invasive, injectable systems that cause minimal damage to brain tissue when removed. Supposedly, this technology would be used for healing wounded soldiers with traumatic brain injuries, the direct brain control of prosthetic limbs, and even new abilities such as controlling drones with one’s mind.

Various methods have been proposed for achieving this, including optogenetics, magnetogenetics, ultrasound, implanted electrodes, and transcranial electromagnetic stimulation. In all instances, the goal is to obtain read or read-write capability over neurons, either by stimulating and probing them, or by rendering them especially sensitive to stimulation and probing.

However, the notion of the widespread use of BCI technology, such as Elon Musk’s Neuralink device, raises many concerns over privacy and personal autonomy. Reading from neurons is problematic enough on its own. Wireless brain-computer interfaces may interact with current or future wireless GSM infrastructure, creating neurological data security concerns. A hacker or other malicious actor may compromise such networks to obtain people’s brain data, and then exploit it for nefarious purposes.

However, a device capable of writing to human neurons, not just reading from them, presents another, even more serious set of ethical concerns. A BCI that is capable of altering the contents of one’s mind for innocuous purposes, such as projecting a heads-up display onto their brain’s visual center or sending audio into one’s auditory cortex, would also theoretically be capable of altering mood and personality, or perhaps even subjugating someone’s very will, rendering them utterly obedient to authority. This technology would be a tyrant’s wet dream. Imagine soldiers who would shoot their own countrymen without hesitation, or helpless serfs who are satisfied to live in literal dog kennels.

BCIs could be used to unscrupulously alter perceptions of basic things such as emotions and values, changing people’s thresholds of satiety, happiness, anger, disgust, and so forth. This is not inconsequential. Someone’s entire regime of behaviors could be altered by a BCI, including such things as suppressing their appetite or desire for virtually anything on Maslow’s Hierarchy of Needs.

Anything is possible when you have direct access to someone’s brain and its contents. Someone who is obese could be made to feel disgust at the sight of food. Someone who is involuntarily celibate could have their libido disabled so they don’t even desire sex to begin with. Someone who is racist could be forced to feel delight over cohabiting with people of other races. Someone who is violent could be forced to be meek and submissive. These things might sound good to you if you are a tyrant, but to normal people, the idea of personal autonomy being overridden to such a degree is appalling.

For the wealthy, neural laces would be an unequaled boon, giving them the opportunity to enhance their intelligence with neuroprosthetics (i.e. an “exocortex”), and to deliver irresistible commands directly into the minds of their BCI-augmented servants, even physically or sexually abusive commands that they would normally refuse.

If the vaccine is a method to surreptitiously introduce an injectable BCI into millions of people without their knowledge or consent, then what we are witnessing is the rise of a tyrannical regime unlike anything ever seen before on the face of this planet, one that fully intends to strip every man, woman, and child of our free will.

Our flaws are what make us human. A utopia arrived at by removing people’s free will is not a utopia at all. It is a monomaniacal nightmare. Furthermore, the people who rule over us are Dark Triad types who cannot be trusted with such power. Imagine being beaten and sexually assaulted by a wealthy and powerful psychopath and being forced to smile and laugh over it because your neural lace gives you no choice but to obey your master.

The Elites are forging ahead with this technology without giving people any room to question the social or ethical ramifications, or to establish regulatory frameworks that ensure that our personal agency and autonomy will not be overridden by these devices. They do this because they secretly dream of a future where they can treat you worse than an animal and you cannot even fight back. If this evil plan is allowed to continue, it will spell the end of humanity as we know it.

Conclusions:

The current pandemic was produced and perpetuated by the establishment, through the use of a virus engineered in a PLA-connected Chinese biowarfare laboratory, with the aid of American taxpayer dollars and French expertise.

This research was conducted under the absolutely ridiculous euphemism of “gain-of-function” research, which is supposedly carried out in order to determine which viruses have the highest potential for zoonotic spillover and preemptively vaccinate or guard against them.

Gain-of-function/gain-of-threat research, a.k.a. “Dual-Use Research of Concern”, or DURC, is bioweapon research by another, friendlier-sounding name, simply to avoid the taboo of calling it what it actually is. It has always been bioweapon research. The people who are conducting this research fully understand that they are taking wild pathogens that are not infectious in humans and making them more infectious, often taking grants from military think tanks encouraging them to do so.

These virologists conducting this type of research are enemies of their fellow man, like pyromaniac firefighters. GOF research has never protected anyone from any pandemic. In fact, it has now started one, meaning its utility for preventing pandemics is actually negative. It should have been banned globally, and the lunatics performing it should have been put in straitjackets long ago.

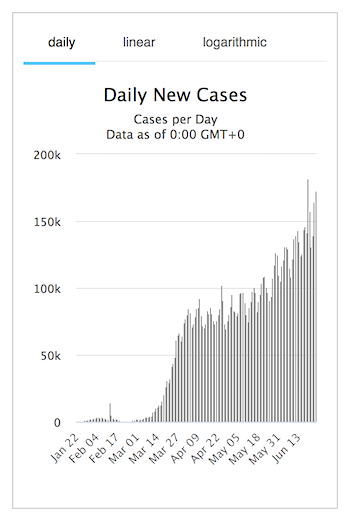

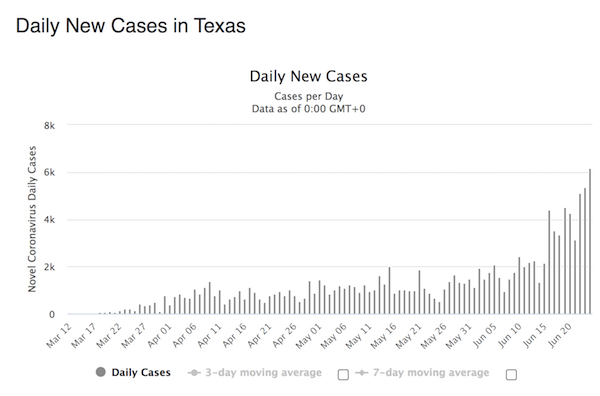

Either through a leak or an intentional release from the Wuhan Institute of Virology, a deadly SARS strain is now endemic across the globe, after the WHO and CDC and public officials first downplayed the risks, and then intentionally incited a panic and lockdowns that jeopardized people’s health and their livelihoods.

This was then used by the utterly depraved and psychopathic aristocratic class who rule over us as an excuse to coerce people into accepting an injected poison which may be a depopulation agent, a mind control/pacification agent in the form of injectable “smart dust”, or both in one. They believe they can get away with this by weaponizing the social stigma of vaccine refusal. They are incorrect.

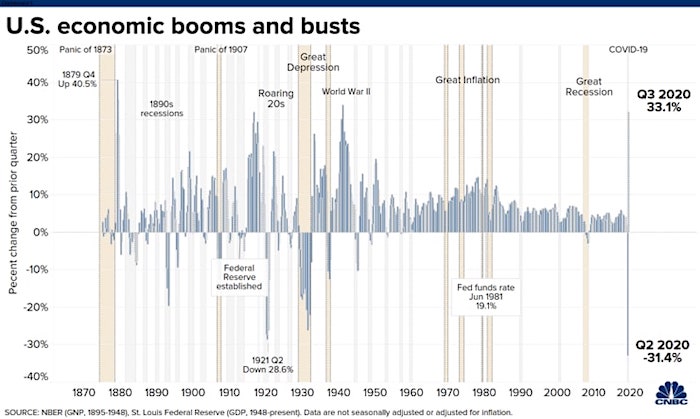

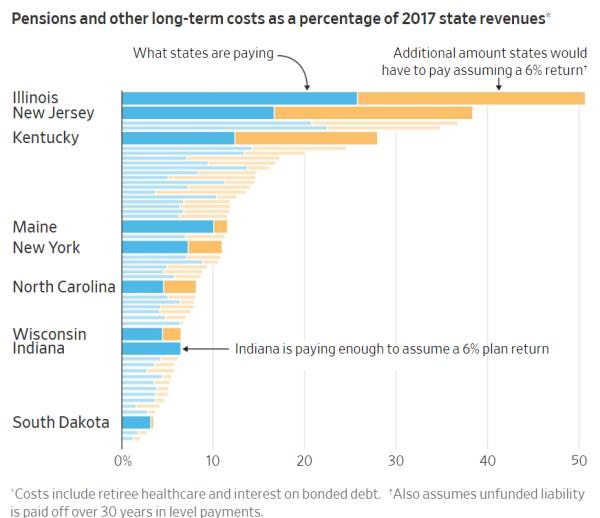

Their motives are clear and obvious to anyone who has been paying attention. These megalomaniacs have raided the pension funds of the free world. Wall Street is insolvent and has had an ongoing liquidity crisis since the end of 2019. The aim now is to exert total, full-spectrum physical, mental, and financial control over humanity before we realize just how badly we’ve been extorted by these maniacs.

The pandemic and its response served multiple purposes for the Elite:

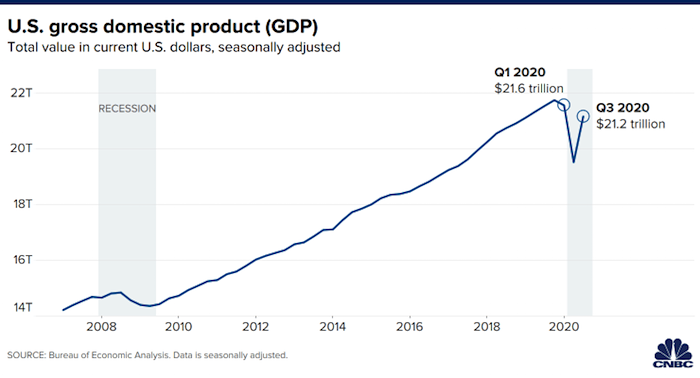

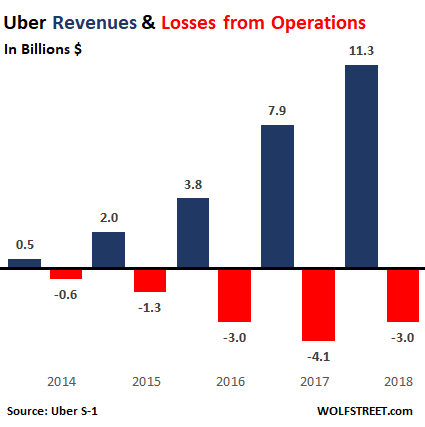

• Concealing a depression brought on by the usurious plunder of our economies conducted by rentier-capitalists and absentee owners who produce absolutely nothing of any value to society whatsoever. Instead of us having a very predictable Occupy Wall Street Part II, the Elites and their stooges got to stand up on television and paint themselves as wise and all-powerful saviors instead of the marauding cabal of despicable land pirates that they are.

• Destroying small businesses and eroding the middle class.

• Transferring trillions of dollars of wealth from the American public and into the pockets of billionaires and special interests.

• Engaging in insider trading, buying stock in biotech companies and shorting brick-and-mortar businesses and travel companies, with the aim of collapsing face-to-face commerce and tourism and replacing it with e-commerce and servitization.

• Creating a casus belli for war with China, encouraging us to attack them, wasting American lives and treasure and driving us to the brink of nuclear armageddon.

• Establishing technological and biosecurity frameworks for population control and technocratic- socialist “smart cities” where everyone’s movements are despotically tracked, all in anticipation of widespread automation, joblessness, and food shortages, by using the false guise of a vaccine to compel cooperation.

Any one of these things would constitute a vicious rape of Western society. Taken together, they beggar belief; they are a complete inversion of our most treasured values.

What is the purpose of all of this? One can only speculate as to the perpetrators’ motives, however, we have some theories.

The Elites are trying to pull up the ladder, erase upward mobility for large segments of the population, cull political opponents and other “undesirables”, and put the remainder of humanity on a tight leash, rationing our access to certain goods and services that they have deemed “high-impact”, such as automobile use, tourism, meat consumption, and so on. Naturally, they will continue to have their own luxuries, as part of a strict caste system akin to feudalism.

Why are they doing this? Simple. The Elites are Neo-Malthusians and believe that we are overpopulated and that resource depletion will collapse civilization in a matter of a few short decades. They are not necessarily incorrect in this belief. We are overpopulated, and we are consuming too many resources. However, orchestrating such a gruesome and murderous power grab in response to a looming crisis demonstrates that they have nothing but the utmost contempt for their fellow man.

To those who are participating in this disgusting farce without any understanding of what they are doing, we have one word for you. Stop. You are causing irreparable harm to your country and to your fellow citizens.

To those who may be reading this warning and have full knowledge and understanding of what they are doing and how it will unjustly harm millions of innocent people, we have a few more words.

Damn you to hell. You will not destroy America and the Free World, and you will not have your New World Order. We will make certain of that.

References:

COVID-19 is not a viral pneumonia — it is a viral vascular endotheliitis:

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)30937-5/fulltext

https://academic.oup.com/eurheartj/article/41/32/3038/5901158

https://www.embopress.org/doi/full/10.15252/embr.202152744

COVID-19 is not just a respiratory disease — it can precipitate multiple organ failure, including hypoxic and inflammatory damage to various vital organs, such as the brain, heart, liver, pancreas, kidneys, and intestines:

https://www.nature.com/articles/d41586-021-01693-6

https://www.health.harvard.edu/blog/the-hidden-long-term-cognitive-effects-of-covid-2020100821133

https://www.nature.com/articles/s41422-020-0390-x

https://www.embopress.org/doi/full/10.15252/embj.2020106230

https://jamanetwork.com/journals/jama/fullarticle/2776538

https://pubmed.ncbi.nlm.nih.gov/32921216/

https://www.nature.com/articles/s41575-021-00426-4

https://pubmed.ncbi.nlm.nih.gov/32553666/

https://www.nature.com/articles/s41467-021-23886-3

https://pubmed.ncbi.nlm.nih.gov/34081912/

https://www.nature.com/articles/s41581-021-00452-0

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7438210/

https://www.nature.com/articles/s41598-021-92740-9

Some of the most common laboratory findings in COVID-19:

https://www.uptodate.com/contents/covid-19-clinical-features

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7426219/

COVID-19 can present as almost anything:

https://www.nature.com/articles/s41591-020-0968-3

https://www.frontiersin.org/articles/10.3389/fmed.2020.00526/full

COVID-19 is more severe in those with conditions that involve endothelial dysfunction, such as obesity, hypertension, and diabetes:

https://www.dovepress.com/obesity-related-inflammation-and-endothelial-dysfunction-in-covid-19-i- peer-reviewed-fulltext-article-JIR

https://jamanetwork.com/journals/jama/fullarticle/2772071

https://mdpi-res.com/d_attachment/cells/cells-10-00933/article_deploy/cells-10-00933.pdf

The vast majority of COVID-19 cases are mild and do not cause significant disease:

https://www.webmd.com/lung/covid-recovery-overview#1

https://academic.oup.com/ofid/article/7/9/ofaa286/5875595

https://pubmed.ncbi.nlm.nih.gov/33289900/

In those who have critical COVID-19-induced sepsis, hypoxia, coagulopathy, and ARDS, the most common treatments are intubation, injected corticosteroids, and blood thinners like heparin, which often precipitate harmful hemorrhages:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7548860/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7448713/

https://www.nejm.org/doi/full/10.1056/NEJMoa2103417

The majority of people who go on a ventilator are dying due to COVID-19 mimicking the physiology of ischemia-reperfusion injury with prolonged transient hypoxia and ischemia, leading directly to the formation of damaging reactive oxygen species:

https://www.journalofsurgicalresearch.com/article/S0022-4804(14)00176-0/fulltext

https://www.nature.com/articles/nature13909

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4625011/

https://www.atsjournals.org/doi/full/10.1164/rccm.201401-0168CP

https://pubmed.ncbi.nlm.nih.gov/18974366/

The end-stage of COVID-19 is severe lipid peroxidation, where fats in the body start to “rust” due to damage by oxidative stress:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7768996/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7357498/

https://www.liebertpub.com/doi/10.1089/ars.2021.0017

Oxidized lipids appear as foreign objects to the immune system, which recognizes and forms antibodies against OSEs, or oxidation-specific epitopes:

https://ard.bmj.com/content/annrheumdis/early/2020/08/04/annrheumdis-2020-218145.full.pdf

https://ard.bmj.com/content/80/9/1236

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7256550/

https://www.hss.edu/conditions_top-ten-series-antiphospholipid-syndrome-coronavirus-covid-19.asp

In COVID-19, neutrophil degranulation and NETosis in the bloodstream drives severe oxidative damage; hemoglobin becomes incapable of carrying oxygen due to heme iron being stripped out of heme by hypochlorous acid:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7757048/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7436665/

https://www.nature.com/articles/s41418-021-00805-z

https://www.sciencedirect.com/science/article/pii/S221249262030052X

SARS-CoV-2 Spike binds to ACE2. Angiotensin Converting Enzyme 2 is an enzyme that is part of the renin- angiotensin-aldosterone system, or RAAS. The RAAS is a hormone control system that moderates fluid volume and blood pressure in the body and in the bloodstream by controlling sodium/potassium retention and excretion and vascular tone:

https://www.ncbi.nlm.nih.gov/books/NBK470410/

https://www.merckmanuals.com/home/multimedia/figure/cvs_regulating_blood_pressure_renin

This protein, ACE2, is ubiquitous in every part of the body that interfaces with the circulatory system, particularly in vascular endothelial cells and pericytes, brain astrocytes, renal tubules and podocytes,

pancreatic islet cells, bile duct and intestinal epithelial cells, and the seminiferous ducts of the testis, all of which SARS-CoV-2 can infect:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7167720/

https://www.frontiersin.org/articles/10.3389/fmed.2020.594495/full

https://www.frontiersin.org/articles/10.3389/fneur.2020.573095/full

SARS-CoV-2 infects a cell as follows:

https://www.nature.com/articles/s41401-020-0485-4

https://www.science.org/doi/10.1126/science.abb2507

https://www.sciencedirect.com/science/article/abs/pii/S1931312820306211

SARS-CoV-2 Spike proteins embedded in a cell can actually cause adjacent human cells to fuse together, forming syncytia/MGCs:

https://www.nature.com/articles/s41418-021-00782-3

https://pubmed.ncbi.nlm.nih.gov/33051876/

SARS-CoV-2’s viroporins, such as its Envelope protein, act as calcium ion channels, introducing calcium into infected cells:

https://www.nature.com/articles/s41422-021-00519-4

https://virologyj.biomedcentral.com/articles/10.1186/s12985-019-1182-0

The virus suppresses the natural interferon response, resulting in delayed inflammation:

https://www.nature.com/articles/s12276-021-00592-0

https://mdpi-res.com/d_attachment/viruses/viruses-12-01433/article_deploy/viruses-12-01433.pdf

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8310780/

SARS-CoV-2 N protein can also directly activate the NLRP3 inflammasome:

https://www.nature.com/articles/s41467-021-25015-6

https://www.frontiersin.org/articles/10.3389/fimmu.2020.01021/full

SARS-CoV-2 suppresses the Nrf2 antioxidant pathway, reducing the body’s own endogenous antioxidant enzyme activity:

https://www.nature.com/articles/s41467-020-18764-3

https://ctajournal.biomedcentral.com/articles/10.1186/s13601-020-00362-7

https://mdpi-res.com/d_attachment/ijms/ijms-22-07963/article_deploy/ijms-22-07963.pdf

The suppression of ACE2 by binding with Spike causes a buildup of bradykinin that would otherwise be broken down by ACE2:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7834250/

https://www.the-scientist.com/news-opinion/is-a-bradykinin-storm-brewing-in-covid-19–67876

This constant calcium influx into the cells results in (or is accompanied by) noticeable hypocalcemia, or low blood calcium:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7292572/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8041474/

https://www.sciencedirect.com/science/article/abs/pii/S1871402121000059

Bradykinin upregulates cAMP, cGMP, COX, and Phospholipase C activity. This results in prostaglandin release and vastly increased intracellular calcium signaling, which promotes highly aggressive ROS release and ATP depletion:

https://www.sciencedirect.com/science/article/abs/pii/S089158490700319X?via%3Dihub

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1218972/

https://pubmed.ncbi.nlm.nih.gov/2156053/

https://www.sciencedirect.com/topics/medicine-and-dentistry/bradykinin-b2-receptor-agonist

https://www.sciencedirect.com/topics/neuroscience/bradykinin

NADPH oxidase releases superoxide into the extracellular space:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4556774/

https://www.pnas.org/content/110/21/8744

Superoxide radicals react with nitric oxide to form peroxynitrite:

https://pubmed.ncbi.nlm.nih.gov/8944624/

https://www.pnas.org/content/115/23/5839

Peroxynitrite reacts with the tetrahydrobiopterin cofactor needed by endothelial nitric oxide synthase, destroying it and “uncoupling” the eNOS enzymes, causing nitric oxide synthase to synthesize more superoxide instead (this means that every process that upregulates NOS activity now produces superoxide instead of nitric oxide):

https://pubmed.ncbi.nlm.nih.gov/24353182/

https://academic.oup.com/cardiovascres/article/73/1/8/316487

https://pubs.acs.org/doi/10.1021/bi9016632

This proceeds in a positive feedback loop until nitric oxide bioavailability in the circulatory system is depleted:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7276137/

Dissolved nitric oxide gas produced constantly by eNOS serves many important functions, but it is also antiviral against SARS-like coronaviruses, preventing the palmitoylation of the viral Spike protein and making it harder for it to bind to host receptors:

https://journal.chestnet.org/article/S0012-3692(20)34397-X/fulltext

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7111989/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7754882/

The loss of NO allows the virus to begin replicating with impunity in the body (clearly, the virus has an evolutionary incentive to induce oxidative stress to destroy nitric oxide):

https://scitechdaily.com/nitric-oxide-a-possible-treatment-for-covid-19-only-substance-to-have-a- direct-effect-on-sars-cov-2/

Those with endothelial dysfunction (i.e. hypertension, diabetes, obesity, old age, African-American race) have redox equilibrium issues to begin with, giving the virus an advantage:

https://www.nature.com/articles/s41392-020-00454-7

https://www.frontiersin.org/articles/10.3389/fphys.2020.605908/full

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7430889/

https://pubmed.ncbi.nlm.nih.gov/19004510/

Due to the extreme cytokine release triggered by these processes, the body summons a great deal of neutrophils and monocyte-derived alveolar macrophages to the lungs:

https://www.frontiersin.org/articles/10.3389/fimmu.2021.652470/full

https://www.frontiersin.org/articles/10.3389/fimmu.2021.720109/full

Phagocytic cells of the innate immune system are the first-line defenders against pathogens. They work by engulfing invaders and trying to attack them with enzymes that produce powerful oxidants, like SOD and MPO:

https://www.frontiersin.org/articles/10.3389/fimmu.2012.00174/full

https://jlb.onlinelibrary.wiley.com/doi/full/10.1189/jlb.0809549

Superoxide dismutase takes superoxide and makes hydrogen peroxide, and myeloperoxidase takes hydrogen peroxide and chlorine ions and makes hypochlorous acid, which is many, many times more reactive than sodium hypochlorite bleach:

https://www.sciencedirect.com/topics/neuroscience/superoxide-dismutase

https://www.sciencedirect.com/topics/medicine-and-dentistry/myeloperoxidase

In severe and critical COVID-19, there is actually rather severe NETosis:

https://www.frontiersin.org/articles/10.3389/fphar.2021.708302/full

https://insight.jci.org/articles/view/138999

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7184981/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7488868/

https://ashpublications.org/blood/article/136/10/1169/461219/Neutrophil-extracellular-traps- contribute-to

https://www.sciencedirect.com/science/article/pii/S221249262030052X

Hypochlorous acid building up in the bloodstream begins to bleach the iron out of heme and compete for O2 binding sites. Red blood cells lose the ability to transport oxygen, causing the sufferer to turn blue in the face:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7757048/

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0120737

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3863623/

Unliganded iron, hydrogen peroxide, and superoxide in the bloodstream undergo the Haber-Weiss and Fenton reactions, producing extremely reactive hydroxyl radicals that violently strip electrons from surrounding fats and DNA, oxidizing them severely:

https://www.sciencedirect.com/science/article/pii/S0753332221000135

https://sites.kowsarpub.com/ans/articles/60038.html

https://www.sciencedirect.com/science/article/abs/pii/S0300483X00002316?via%3Dihub

https://www.sciencedirect.com/topics/chemistry/fenton-reaction

https://www.researchgate.net/figure/Fenton-and-Haber-Weiss-reactions-are-a-source-of-oxidative- stress-The-generation-of_fig1_330729897

This condition is not unknown to medical science. The actual name for all of this is acute sepsis (but without the traditional hallmarks of sepsis, like shock):

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4056356/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7886971/

https://www.futuremedicine.com/doi/10.2217/fmb-2020-0312

https://www.global-sepsis-alliance.org/news/2020/4/7/update-can-covid-19-cause-sepsis-explaining- the-relationship-between-the-coronavirus-disease-and-sepsis-cvd-novel-coronavirus

We know this is happening in COVID-19 because people who have died of the disease have noticeable ferroptosis signatures in their tissues, as well as various other oxidative stress markers such as nitrotyrosine, 4-HNE, and malondialdehyde:

https://onlinelibrary.wiley.com/doi/full/10.1002/ehf2.12958

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7264936/

https://www.sciencedirect.com/science/article/pii/S2213231721001300

https://www.researchgate.net/publication/354129433_Preliminary_Findings_on_the_Association_of_the_Lipid_Peroxidation_Product_4-Hydroxynonenal_with_the_Lethal_Outcome_of_Aggressive_COVID- 19

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8180845/

https://rupress.org/jem/article-abstract/218/6/e20210518/212093/Ferroptosis-in-infection- inflammation-and?redirectedFrom=fulltext

When you intubate someone with this condition, you are setting off a free radical bomb by supplying the cells with O2. It’s a catch-22, because we need oxygen to make Adenosine Triphosphate (that is, to live), but O2 is also the precursor of all these damaging radicals that lead to lipid peroxidation:

https://www.nature.com/articles/pr2009174

The correct treatment for severe COVID-19 related sepsis is non-invasive ventilation, steroids, and antioxidant infusions:

MATH+ Protocol

https://journals.lww.com/ccmjournal/Abstract/2007/09001/Antioxidant_supplementation_in_sepsis_and_systemic.25.aspx

https://mdpi-res.com/d_attachment/medicina/medicina-56-00619/article_deploy/medicina-56-00619- v2.pdf

Most of the drugs repurposed for COVID-19 that show any benefit whatsoever in rescuing critically-ill COVID-19 patients are antioxidants. N-acetylcysteine, melatonin, fluvoxamine, budesonide, famotidine, cimetidine, and ranitidine are all antioxidants:

https://www.hindawi.com/journals/omcl/2018/6581970/

https://www.intechopen.com/chapters/62672

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6708076/

https://www.karger.com/Article/Abstract/88623

https://www.sciencedirect.com/science/article/abs/pii/000629529390218L?via%3Dihub

Indomethacin prevents iron-driven oxidation of arachidonic acid to isoprostanes:

https://www.sciencedirect.com/science/article/abs/pii/0161463079900442

There are powerful antioxidants such as apocynin that have not even been tested on COVID-19 patients yet which could defang neutrophils, prevent lipid peroxidation, restore endothelial health, and restore oxygenation to the tissues:

https://link.springer.com/article/10.1007/s10787-020-00715-5

Scientists who know anything about pulmonary neutrophilia, ARDS, and redox biology have known or surmised much of this since March 2020:

https://www.researchgate.net/post/NADPH_oxidase_Covid-19_Oxygen_treatment

In April 2020, Swiss scientists confirmed that COVID-19 was a systemic vascular endotheliitis:

https://www.usz.ch/en/covid-19-also-a-systemic-endotheliitis/

By late 2020, experts had already concluded that COVID-19 causes a form of viral sepsis:

https://www.healthleadersmedia.com/clinical-care/expert-severe-covid-19-illness-viral-sepsis

They also know that sepsis can be effectively treated with antioxidants:

https://jtd.amegroups.com/article/view/34870/html

https://www.evms.edu/about_evms/administrative_offices/marketing_communications/publications/issue_9_4/has-sepsis-met-its-match.php

None of this information is particularly new, and yet, for the most part, it has not been acted upon. Doctors continue to use damaging intubation techniques with high PEEP settings despite high lung compliance and poor oxygenation, killing an untold number of critically ill patients with medical malpractice:

https://ccforum.biomedcentral.com/articles/10.1186/s13054-020-03049-4

https://jamanetwork.com/journals/jama/fullarticle/2765302

Because of the way they are constructed, Randomized Control Trials will never show any benefit for any antiviral against COVID-19. Not Remdesivir, not Kaletra, not HCQ, and not Ivermectin. The reason for this is simple; for the patients that they have enrolled in these studies, such as Oxford’s ludicrous RECOVERY study, the intervention is too late to have any positive effect (i.e. these RCTs are designed in such a way that the use of antivirals is futile, therefore, these studies are deceptive and unethical by their very nature):

https://www.mdpi.com/1999-4915/13/6/963/htm

The clinical course of COVID-19 is such that by the time most people seek medical attention for hypoxia, their viral load has already tapered off to almost nothing. If someone is about 10 days post-exposure and has already been symptomatic for five days, there is hardly any virus left in their bodies, only cellular damage and derangement that has initiated a hyperinflammatory response:

https://www.the-hospitalist.org/hospitalist/article/234869/coronavirus-updates/state-inpatient-covid- 19-care

https://www.sciencedirect.com/science/article/pii/S0753332220306867

It is from this group that the clinical trials for antivirals have recruited, pretty much exclusively (i.e. they do not test prophylaxis/early treatment, only changes to the mean duration of hospitalization for those already hospitalized):

https://www.nejm.org/doi/full/10.1056/nejmoa2023184

https://www.nejm.org/doi/full/10.1056/NEJMoa2022926

https://pubmed.ncbi.nlm.nih.gov/34318930/

India went against the instructions of the WHO and mandated the prophylactic usage of Ivermectin. They have almost completely eradicated COVID-19:

Ivermectin Wins in India

https://ivmmeta.com

The Indian Bar Association of Mumbai has brought criminal charges against WHO Chief Scientist Dr. Soumya Swaminathan for recommending against the use of Ivermectin:

https://indianbarassociation.in/wp-content/uploads/2021/05/IBA-PRESS-RELEASE-MAY-26-2021.pdf

Ivermectin is not “horse dewormer”. Yes, it is sold in veterinary paste form as a dewormer for animals. It has also been available in pill form for humans for decades, as an antiparasitic drug:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3043740/

The media have disingenuously claimed that because Ivermectin is an antiparasitic drug, it has no utility as an antivirus. This is incorrect. Ivermectin has utility as an antiviral. It blocks importin, preventing nuclear import, effectively inhibiting viral access to cell nuclei. Many drugs currently on the market have multiple modes of action. Ivermectin is one such drug. It is both antiparasitic and antiviral:

https://www.sciencedirect.com/science/article/abs/pii/S0166354219307211?via%3Dihub

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7539925/

In Bangladesh, Ivermectin costs $1.80 for an entire 5-day course:

https://journals.lww.com/americantherapeutics/fulltext/2021/08000/ivermectin_for_prevention_and_treatment_of.7.aspx

Remdesivir, which is toxic to the liver, costs $3,120 for a 5-day course of the drug:

https://www.npr.org/sections/health-shots/2020/06/29/884648842/remdesivir-priced-at-more-than-3- 100-for-a-course-of-treatment

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7386240/

Billions of dollars of utterly useless Remdesivir were sold to our governments on the taxpayer’s dime, and it ended up being totally useless for treating hyperinflammatory COVID-19:

https://www.fiercepharma.com/pharma/gilead-s-1-5b-remdesivir-sales-help-buoy-greater-than- expected-declines-for-mainstay-hiv

https://www.forbes.com/sites/jvchamary/2021/01/31/remdesivir-covid- coronavirus/?sh=7e6034e666c2

COVID-19 is airborne. The WHO carried water for China by claiming that the virus was only droplet- borne. Our own CDC absurdly claimed that it was mostly transmitted by fomite-to-face contact, which, given its rapid spread from Wuhan to the rest of the world, would have been physically impossible:

https://www.thelancet.com/article/S0140-6736(21)00869-2/fulltext

https://www.pennmedicine.org/updates/blogs/penn-physician-blog/2020/august/airborne-droplet- debate-article

The ridiculous belief in fomite-to-face being a primary mode of transmission led to the use of surface disinfection protocols that wasted time, energy, productivity, and disinfectant:

https://www.nature.com/articles/d41586-021-00251-4

The 6-foot guidelines are absolutely useless. The minimum safe distance to protect oneself from an aerosolized virus is to be 15+ feet away from an infected person, no closer. Realistically, no public transit is safe:

https://www.medrxiv.org/content/10.1101/2020.08.03.20167395v1

What We Know About the Airborne Spread of the Coronavirus

Surgical masks do not protect you from aerosols. The virus is too small and the filter media has too large of gaps to filter it out. They may catch respiratory droplets and keep the virus from being expelled by someone who is sick, but they do not filter a cloud of infectious aerosols if someone were to walk into said cloud:

https://ajicjournal.org/retrieve/pii/S0196655305801439

The minimum level of protection against this virus is quite literally a P100 respirator, a PAPR/CAPR, or a 40mm NATO CBRN respirator, ideally paired with a full-body tyvek or tychem suit, gloves, and booties, with all the holes and gaps taped (in a pinch, surgical masks can be modified or worn a specific way to increase filtration):

https://www.epa.gov/sciencematters/epa-researchers-test-effectiveness-face-masks-disinfection- methods-against-covid-19

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7409952/

Coronavirus Protection Made Easy with the MaxAir CAPR®

Live SARS-CoV-2 may potentially be detected in sewage outflows, and there may be oral-fecal transmission:

https://www.sciencedirect.com/science/article/pii/S0048969720325936

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0249568

https://www.nature.com/articles/s41587-020-0684-z

During the SARS outbreak in 2003, in the Amoy Gardens incident, hundreds of people were infected by aerosolized fecal matter rising from floor drains in their apartments (there is some valid concern that COVID-19 may also spread the same way, given its similarities to SARS):

https://pubmed.ncbi.nlm.nih.gov/16696450/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC539564/

https://www.neha.org/sites/default/files/jeh/JEH5.06-Feature-Environmental-Transmission-of-SARS.pdf

https://www.cleanlink.com/news/article/COVID-19-Could-Spread-Through-Dry-Floor-Drains–25600

The vaccines for COVID-19 are not sterilizing and do not prevent infection or transmission. They are “leaky” vaccines. This means they remove the evolutionary pressure on the virus to become less lethal. It also means that the vaccinated are perfect carriers. In other words, those who are vaccinated are a threat to the unvaccinated, not the other way around:

https://www.healthline.com/health-news/leaky-vaccines-can-produce-stronger-versions-of-viruses- 072715

https://www.realclearscience.com/articles/2021/08/23/lets_stop_pretending_about_the_covid- 19_vaccines_791050.html

https://www.cdc.gov/media/releases/2021/s0730-mmwr-covid-19.html

https://www.businessinsider.com/cdc-fully-vaccinated-new-guidelines-wear-masks-indoors-delta-2021- 7?utm_source=yahoo.com&utm_medium=referral

All of the COVID-19 vaccines currently in use have undergone minimal testing, with highly accelerated clinical trials. Though they appear to limit severe illness, the long-term safety profile of these vaccines remains unknown:

https://www.jdsupra.com/legalnews/accelerated-covid-19-vaccine-clinical-95853/

https://www.nebraskamed.com/COVID/were-the-covid-19-vaccines-rushed

Some of these so-called “vaccines” utilize an untested new technology that has never been used in vaccines before. Traditional vaccines use weakened or killed virus to stimulate an immune response. The Moderna and Pfizer-BioNTech vaccines do not. They are purported to consist of an intramuscular shot containing a suspension of lipid nanoparticles filled with messenger RNA:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5439223/

https://cen.acs.org/pharmaceuticals/drug-delivery/Without-lipid-shells-mRNA-vaccines/99/i8

https://www.cdc.gov/coronavirus/2019-ncov/vaccines/different-vaccines/mrna.html

https://medlineplus.gov/genetics/understanding/therapy/mrnavaccines/

The way they generate an immune response is by fusing with cells in a vaccine recipient’s shoulder, undergoing endocytosis, releasing their mRNA cargo into those cells, and then utilizing the ribosomes in those cells to synthesize modified SARS-CoV-2 Spike proteins in-situ:

https://www.nature.com/articles/s41586-020-2622-0

https://coronavirus.dc.gov/sites/default/files/dc/sites/coronavirus/page_content/attachments/Cartoon%20Explainer%20How%20the%20Moderna%20and%20Pfizer%20Vaccines%20Work.pdf

These vaccines were produced or validated with the aid of fetal cell lines HEK-293 and PER.C6, which people with certain religious convictions may object strongly to:

https://www.health.nd.gov/sites/www/files/documents/COVID%20Vaccine%20Page/COVID- 19_Vaccine_Fetal_Cell_Handout.pdf

The Ethics of the SARS-CoV-2 Vaccines Revisited

SARS-CoV-2 Spike is a highly pathogenic protein on its own. It is impossible to overstate the danger presented by introducing this protein into the human body:

https://mcusercontent.com/22e41db63deaf4a84be439c0f/files/6a33980b-683f-4ee4-67d4- cc98dc7fcd37/20210601_Guide_to_COVID_19_vaccines_for_parents.pdf

https://rightsfreedoms.wordpress.com/2021/06/16/researcher-we-made-a-big-mistake-on-covid-19- vaccine/

It is claimed by vaccine manufacturers that the vaccine remains in cells in the shoulder, and that SARS- CoV-2 Spike produced and expressed by these cells from the vaccine’s genetic material is harmless and inert, thanks to the insertion of prolines in the Spike sequence to stabilize it in the prefusion conformation, preventing the Spike from becoming active and fusing with other cells:

https://www.nature.com/articles/s41467-020-20321-x

https://cen.acs.org/pharmaceuticals/vaccines/tiny-tweak-behind-COVID-19/98/i38

However, a pharmacokinetic study from Japan showed that the lipid nanoparticles and mRNA from the Pfizer vaccine did not stay in the shoulder, and in fact bioaccumulated in many different organs, including the reproductive organs and adrenal glands, meaning that modified Spike is being expressed quite literally all over the place:

https://files.catbox.moe/0vwcmj.pdf

These lipid nanoparticles may trigger anaphylaxis in an unlucky few:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8441754/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7862013/

Messenger RNA is normally consumed right after it is produced in the body, being translated into a protein by a ribosome. COVID-19 vaccine mRNA is produced outside the body, long before a ribosome translates it. In the meantime, it could accumulate damage if inadequately preserved. When a ribosome attempts to translate a damaged strand of mRNA, it can become stalled:

https://elifesciences.org/articles/61984

https://www.frontiersin.org/articles/10.3389/fgene.2018.00431/full

Certain proteins, including SARS-CoV-2 Spike, have proteolytic cleavage sites that are basically like little dotted lines that say “cut here”, which attract a living organism’s own proteases (essentially, molecular scissors) to cut them. There is a possibility that S1 may be proteolytically cleaved from S2, causing active S1 to float away into the bloodstream while leaving the S2 “stalk” embedded in the membrane of the cell that expressed the protein:

https://academic.oup.com/cid/advance-article/doi/10.1093/cid/ciab465/6279075

https://www.nature.com/articles/s41564-021-00908-w

https://www.life-science-alliance.org/content/3/9/e202000786

SARS-CoV-2 Spike has a Superantigenic region (SAg), which may promote extreme inflammation:

https://www.pnas.org/content/117/41/25254

https://www.nature.com/articles/s41577-021-00502-5

Anti-Spike antibodies were found in one study to function as autoantibodies and attack the body’s own cells:

https://www.researchsquare.com/article/rs-612103/v2