Harris&Ewing Oil for salads 1918

Abenomics and BOJ stimulus are dismal failures. So what to do? Moar of the same of course. How much longer can Abe remain in power?

• Japan Deflation Intensifies (R.)

Japanese manufacturers’ confidence was subdued in June and service-sector sentiment deteriorated from three months ago on weak consumption, a central bank survey showed, in discouraging signs for a fragile economy grappling with a strong yen and slack overseas demand. The results of the survey could have been much worse had it captured the gloom from Britain’s vote last week to leave the EU, which spread turmoil in financial markets and put pressure on the Bank of Japan to expand its stimulus later this month. Separate data on Friday showed household spending fell for the third straight month in May and core consumer prices suffered their biggest annual drop since 2013, keeping policymakers under pressure to do more to spur growth.

“Worsening sentiment for non-manufacturers represents weak demand. This gives the government an incentive to increase stimulus spending,” said Daiju Aoki at UBS Securities. “If the government announces the size of stimulus spending shortly after the upper house election next week, the BOJ could ease policy at the end of the month,” he said. The BOJ’s closely-watched quarterly tankan survey showed the headline index for big manufacturers’ sentiment stood at plus 6, unchanged from three months ago and better than a median market forecast of plus 4. Big non-manufacturers’ sentiment index worsened to plus 19 from plus 22, the survey showed, as retailers felt the pain from weak domestic consumption and a slowdown in spending among overseas tourists.

“The yen strengthened about 8% against the dollar in June.”

• Japan’s Prices Keep Falling in Challenge to Abe, Kuroda (BBG)

With a little more than a week until Japan goes to the polls for an upper-house election, a batch of economic data released Friday underscores the challenge Prime Minister Shinzo Abe faces in convincing voters that his policies are working. Consumer prices excluding fresh food fell for a third straight month and household spending declined, undermining efforts to revitalize the world’s third-largest economy. While corporate confidence and unemployment were unchanged, there is still little pressure for higher wages. Friday’s data followed reports earlier this week showing that industrial production fell more than economists had forecast and retail sales were flat in May, adding to concern that Japan’s recovery may be faltering after the economy returned to growth in the first quarter.

The U.K.’s vote to leave the European Union has strengthened the yen and roiled financial markets, increasing risks to corporate earnings for Japanese companies. The data will put more pressure on Bank of Japan Governor Haruhiko Kuroda to expand monetary stimulus at the policy meeting later this month, especially with the stronger yen and the central bank far from its 2% inflation target. “Given concerns over the effects of the Brexit vote and the strengthening yen, there is a high chance that the BOJ will ease further at its July meeting,” said Hiroaki Muto at Tokai Tokyo Research Center. “If the BOJ doesn’t move this time, there’s a possibility that the yen will strengthen further.” The Topix index dropped about 9% in June, plunging on June 24 with the Brexit vote, the most since the aftermath of the 2011 earthquake. The yen strengthened about 8% against the dollar in June.

Chinese deflation.

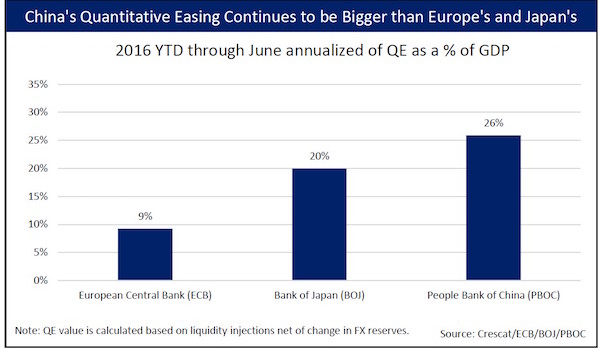

• China QE Dwarfs Japan and EU (VW)

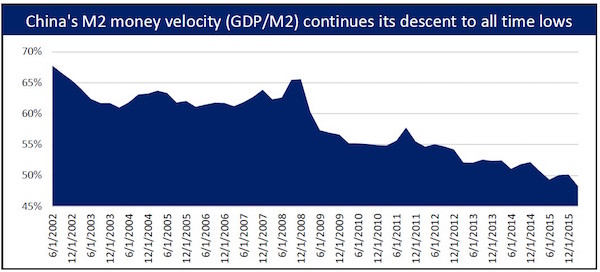

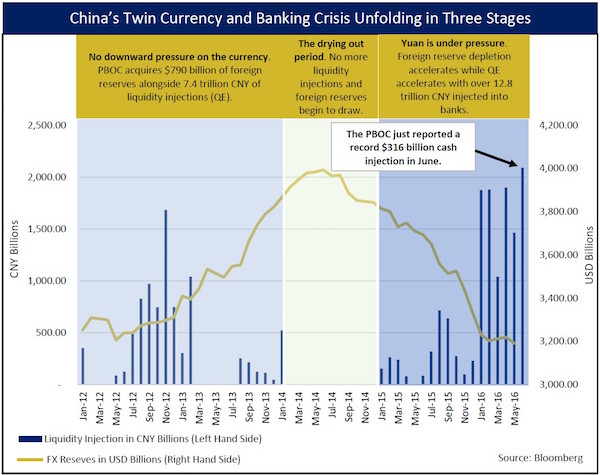

In July of 2014, we wrote about the huge imbalance with respect to China’s M2 money supply and nominal GDP relative to the US. At the time, China’s M2 money supply was 71% higher than the US but its economy was 56% smaller, which we said was an indication of the overvaluation of the Chinese currency. Since that time, the yuan has fallen by only 6.8% relative to the dollar. We haven’t seen anything yet. Today, the circumstances have significantly worsened. Money supply has continued to grow faster than GDP. With over $30 trillion of assets in its banking system and an underappreciated non-performing loan problem, we are convinced that China is headed for a twin banking and currency crisis. Money velocity has reached historically low levels which reflects China’s extreme credit imbalance and its crimping impact on its ability to generate future real GDP growth.

Just as worrying as the immense amount of credit built up, China has been reporting major downward revisions in its balance of payments (BoP) accounts. For more than a decade, China had been reporting an impossible twin surplus in its BoP accounts. When we wrote about this issue in 2014, we emphasized the likelihood of massive illicit capital outflows that not been accounted for. At that time, according to the State Administration of Foreign Exchange of China (SAFE), China had accumulated a BoP imbalance that was close to $9.4 trillion surplus since 2000 which we believed represented capital outflows that should have been recorded in the capital account.

The same accumulated BoP number today, revised by SAFE several times since, is now a deficit of about $2.8 trillion. Essentially, with its revisions, the SAFE has acknowledged even more capital outflows over the last 16 years than we had initially identified. On the capital account side, there was a downward revision of $10.1 trillion – from a $4.2 trillion surplus to a $5.9 trillion deficit. On the current account side, the revisions show that Chinese exports have not been as strong as initially reported over the last decade and a half. China’s current account surplus has been reduced by $2.1 trillion– going from $5.1 trillion to $2.9 trillion over the last 16 years. What we initially considered to be a $9.4 trillion imbalance has been more than proven by a $12.2 trillion revision.

Cryptic fun.

• China To ‘Tolerate’ Weaker Yuan (R.)

China’s central bank would tolerate a fall in the yuan to as low as 6.8 per dollar in 2016 to support the economy, which would mean the currency matching last year’s record decline of 4.5%, policy sources said. The yuan is already trading at its lowest level in more than five years, so the central bank would ensure any decline is gradual for fear of triggering capital outflows and criticism from trading partners such as the United States, said government economists and advisers involved in regular policy discussions. Presumptive U.S. Republican Presidential nominee Donald Trump already has China in his sights, saying on Wednesday he would label China a currency manipulator if elected in November.

The economists and advisers are not directly briefed on policy by the People’s Bank of China (PBOC), but they have regular meetings and interactions with central bank officials and they provide policy recommendations. They said the central bank would tolerate a further weakening of the yuan this year to between 6.7-6.8 per dollar. “The central bank is willing to see yuan depreciation, as long as depreciation expectations are under control,” said a government economist, who requested anonymity due to the sensitivity of the matter. “The Brexit vote was a big shock. The market volatility may last for some time.”

Good read.

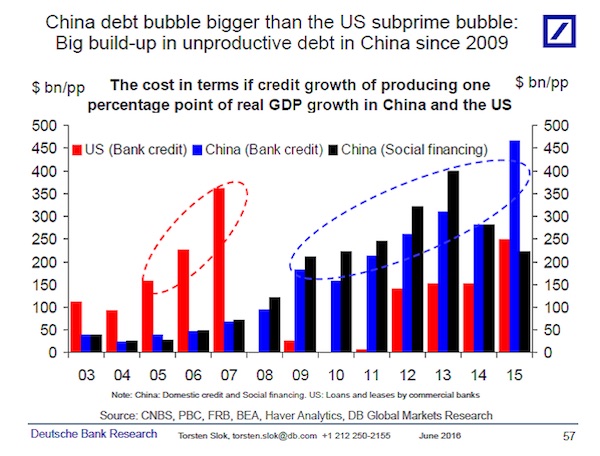

• China Is Headed For A 1929-Style Depression: Andy Xie (MW)

Andy Xie isn’t known for tepid opinions. The provocative Xie, who was a top economist at the World Bank and Morgan Stanley, found notoriety a decade ago when he left the Wall Street bank after a controversial internal report went public. Today, he is among the loudest voices warning of an inevitable implosion in China, the world’s second-largest economy. Xie, now working independently and based in Shanghai, says the coming collapse won’t be like the Asian currency crisis of 1997 or the U.S. financial meltdown of 2008. In a recent interview with MarketWatch, Xie said China’s trajectory instead resembles the one that led to the Great Depression, when the expansion of credit, loose monetary policy and a widespread belief that asset prices would never fall contributed to rampant speculation that ended with a crippling market crash.

China in 2016 looks much the same, according to Xie, with half of the country’s debt propping up real-estate prices and heavy leverage in the stock market — indicating that conditions are ripe for a correction. “The government is allowing speculation by providing cheap financing,” Xie told MarketWatch. China “is riding a tiger and is terrified of a crash. So it keeps pumping cash into the economy. It is difficult to see how China can avoid a crisis.” Xie’s viewpoints have at times attracted unwelcome attention. In 2006, when he was a star Asia economist at Morgan Stanley a leaked email to colleagues in which he said money laundering was bolstering growth in Singapore led to his abrupt departure from the bank. In early 2007, he termed China’s surging markets a “bubble” that could lead to a banking crisis,” and in 2009 he likened them to a “Ponzi scheme.”

“Most of the responses from manufacturers also preceded the Brexit vote, suggesting July could be even tougher.”

• Asian Factories Struggle, Brexit Throws Up New Threats (R.)

China’s vast factory sector flatlined in June as exports shrank and jobs were cut, a worrying trend evident across Asia that argues for yet more policy stimulus as doubts gather over the potency of measures taken so far. The hard times signaled by a range of surveys was not what the world needed a week after Britain’s vote to leave the European Union condemned that bloc to months, if not years, of political and economic instability. Most of the responses from manufacturers also preceded the Brexit vote, suggesting July could be even tougher. “The unimaginable has happened and the UK vote will cast a long shadow over the UK, Europe and global markets for some time to come,” warned Westpac head currency strategist Robert Rennie.

“A structurally weaker pound, a softer euro and weaker global growth beckons.” Among the many surveys out on Friday, China’s official Purchasing Managers’ Index (PMI) slipped a tick to 50 in June, dead on the level that is supposed to separate growth from contraction. One saving grace was the services sector measure, which nudged up to 53.7 in a positive sign for consumer activity. More worrying was the Caixin version of the PMI, which covers a greater share of smaller firms, where the index fell to a four-month trough of 48.6 in June, from 49.2 in May.

“..the euro area’s aggregate fiscal impulse will be negative in 2017—exactly the opposite of what it should be when a surplus region is faced with a shock to external demand..”

• Europe Post-Brexit (Brad Setser)

A few thoughts, focusing on narrow issues of macroeconomic management rather than the bigger political issues. The U.K. has been running a sizeable current account deficit for some time now, thanks to an unusually low national savings rate. That means, on net, it has been supplying the rest of Europe with demand—something other European countries need. This isn’t likely to provide Britain the negotiating leverage the Brexiters claimed (the other European countries fear the precedent more than the loss of demand) but it will shape the economic fallout. The fall in the pound is a necessary part of the U.K.’s adjustment. It will spread the pain from a downturn in British demand to the rest of the euro area.

Brexit uncertainty is thus a sizable negative shock to growth in Britian’s euro area trading partners not just to Britain itself: relative to the pre-Brexit referendum baseline, I would guess that Brexit uncertainty will knock a cumulative half a%age point off euro area growth over the next two years.* Of course, the euro area, which runs a significant current account surplus and can borrow at low nominal rates, has fiscal capacity to counteract this shock. Germany is being paid to borrow for ten years, and the average ten year rate for the euro area as a whole is around 1%. The euro area could provide a fiscal offset, whether jointly, through new euro area investment funds or simply through a shift in say German policy on public investment and other adjustments to national policy.

I say this knowing full-well the political constraints to fiscal action. The Germans do not want to run a deficit. The Dutch are committed to bringing an already low deficit down further. France, Italy and especially Spain face pressure from the Commission to tighten policy. The Juncker plan never really created the capacity for shared funding of investment. The euro area’s aggregate fiscal stance is, more or less, the sum of national fiscal policies of the biggest euro area economies. If I had to bet, I would bet that the euro area’s aggregate fiscal impulse will be negative in 2017—exactly the opposite of what it should be when a surplus region is faced with a shock to external demand. A lot depends on the fiscal path Spain negotiates once it forms a new government, given that is running the largest fiscal deficit of the euro area’s big five economies.

€150 billion. Chump change. Wait, there was a eurozone debt crisis in 2011?

Italy’s banks can now issue bonds with the same guarantee sovereign bonds have. But only the solvent ones, as in: those who don’t need it.

This is worse than a band-aid. Just wait till the vultures wake up.

• EU Approves Italian Contingency Plan To Guarantee Bank Liquidity (R.)

The European Commission has authorized an Italian government plan to guarantee liquidity for banks in the event of a financial crisis in the euro zone’s third-largest economy, an EU executive spokeswoman said on Thursday. The Commission approved the scheme last Sunday, another EU official said, days after Britain voted to leave the EU, triggering a sell-off in European bank stocks, especially in Italy, home to roughly a third of the euro zone’s bad debts. The scheme, worth up to €150 billion according to some media reports, would only be triggered in circumstances similar to the euro zone debt crisis of 2011, when some banks in the currency bloc needed to be bailed out and the interbank market had ceased to function. “Given the financial markets turmoil of recent days, the government saw it fit to prepare for all scenarios, even the most improbable, to be ready to step in to protect savers,” the Italian Treasury said in a statement.

Italian officials stressed they did not expect Italy to suffer a 2011-style meltdown in confidence but said it was prudent to plan for a worst-case scenario. Italian bank shares ended up 2% on Thursday after news of the scheme. Under the scheme, a bank can ask the government to guarantee its bond issues, ensuring that it can raise money even in troubled markets, but it only applies until the end of this year and only to banks with solvent balance sheets. “In this way, they can issue bonds that, with the assistance of the public guarantee, are similar to an Italian government bond,” said one source familiar with the scheme. [..] Rome has said it is concerned that Italian banks, which hold €360 billion of bad loans, risk attack by hedge funds betting that market turmoil, increased by last week’s Brexit vote, could tip them into a full-blown crisis.

How Germany is blowing up the very EU that is making it rich.

More than any of its peers, the Italian economy has suffered since joining the euro in 1999. Since 2007, its economy has contracted by 10% and suffered not one, not two, but three recessions. Competitive export-led growth has been deeply impaired by virtue of Italy’s being effectively yoked to the massive German economy. Despite the rise of China, Germany has been able to maintain its top three ranking among world exporters. The secret weapon? That would be the euro. In 1998, the year before Germany switched to the euro, the country exported $540 billion. By 2015, that figure had swelled to $1.3 trillion. Italy’s exports have also grown, but not nearly as robustly, coming in last year at $459 billion compared to $242 billion the year before it joined the euro.

Just as it once was the case with China, Germany benefits from its relatively weak currency. If Germany was not tethered to its weaker-economy neighbors and was still on the Deutsche Mark, it would have a significantly stronger currency and substantially lower exports due to the price of its exports being much more expensive for world markets. Back in 2011, UBS put pencil to paper and figured that losing the common currency would trigger an immediate effective tax increase for the average German citizen of about €7,000 and between €3,500 to €4,000 every single year going forward. By contrast, swallowing half the debt of Greece, Ireland and Portugal at that time would have generated a little over €1,000 tab per citizen.

Now you see why bailing out is so easy to do, though the Germans do put on a great show of irritation at having to foot such bills. But let’s be honest. Consider the alternative. Reverse that effect and, with all else being equal, you begin to appreciate why Italy’s exports have become relatively more expensive, burdened as they are with a more expensive currency than they would have had. Consider that globalization had already done a number on the country’s once magnificent industrial base when Italy opted into the euro and left the lire behind. Since then, the country’s industrial capacity has been further decimated, shrinking by 15%. To take but one example, in 2007, Italy manufactured 24 million appliances; by 2012 it had declined to 13 million.

S&P doesn’t mind doing useless things.

• Standard & Poor’s Cuts EU Credit Rating (G.)

The European Union has suffered a downgrade of its long-term credit rating following the UK’s Brexit vote last week. In a move that will increase the borrowing costs for the 28-member bloc, the credit ratings agency S&P said the EU should see its status as a safe haven for investors reduced to AA from AA+. The agency said: “After the decision by the UK electorate to leave the EU … we have reassessed our opinion of cohesion within the EU, which we now consider to be a neutral rather than positive rating factor.” International investors use credit agency reports to gauge the safety of their funds and the likelihood that their investments will become insolvent. Pension funds and other investors typically move their money to safe havens in times of uncertainty.

But concerns that the ripple effects of the Brexit vote will hit the profits of corporations in Europe, the US and Japan and hurt government finances have grown in recent days. Earlier this week S&P became the last of the three major ratings agencies to strip the UK of its last AAA rating as it warned that the economic, fiscal and constitutional risks the country faced had increased following the EU referendum result. The UK was placed on negative watch, which puts the government on notice of possible further downgrades, after S&P described the result of the vote as “a seminal event” that would “lead to a less predictable, stable and effective policy framework in the UK”. The agency added that the vote to remain in Scotland and Northern Ireland “creates wider constitutional issues for the country as a whole”.

“..the ECB apparently determined it will not go broke in subzero land even if it is driving insurance companies, pension funds, banks and plain old savers in exactly that direction.”

• Price Discovery, RIP (David Stockman)

That was quick. With nearly 85% of the Brexit loss recovered in three days and the market now up for the quarter and the year, what’s not to like? After all, the central banks are purportedly at the ready, and, in the case of the ECB and BOE, are already swinging into action according to their shills in the MSM. MarketWatch thus noted,

Markets were boosted by reports indicating the ECB is weighing changes to its bond-buying program, while “the Bank of England also said they are all in,” said Joe Saluzzi at Themis Trading. The ECB is considering changing the rules regarding the types of bonds it can buy as part of its stimulus package to amid concerns it could run out of securities to buy under current stipulations, according to Bloomberg News. The report followed comments from BOE Gov. Mark Carney, who indicated the central bank is poised to further ease monetary policy to combat.

Well now, by the sound of it you would think that the madman Draghi is fixing to uncork the mother of all QEs if there is a danger that the ECB will “run out of securities to buy”. Who would have thought that the debt engorged governments of the eurozone couldn’t manufacture enough IOUs to satisfy Mario’s “buy” button? In fact, with public debt at 91% of GDP you would think that the $12.5 trillion outstanding would be enough to go around. It turns out, however, that the operative phrase is “under current stipulations”. In a fit of apparent prudence, the ECB determined that in buying $90 billion of government bonds and other securities per month, it would only purchase securities with a yield higher than its negative 0.4% deposit rate.

That’s right. Stumbling around in their monetary puzzle palace, the geniuses at the ECB determined that subzero rates are just fine with one condition. Namely, so long as they don’t have to pay more to own German bonds, for example, than German banks are paying to deposit excess funds at the ECB. Stated differently, the ECB apparently determined it will not go broke in subzero land even if it is driving insurance companies, pension funds, banks and plain old savers in exactly that direction. But then comes the catch-22. The more bonds Draghi promises to buy, the more the casino front-runners scarf-up those same bonds on 95% repo leverage – knowing that Mario will gift them with a big fat gain on their tiny sliver of capital at risk.

“The behaviour of the jet stream suggests massive hits to the [global] food supply and the potential for massive geopolitical unrest. There’s very strange things going on on planet Earth right now.”

• Scientists Warn Of ‘Global Climate Emergency’ Over Jet Stream Shift (Ind.)

Environmental scientists have declared a “global climate emergency” after the Northern hemisphere jet stream was found to have crossed the equator, bringing “unprecedented” changes to the world’s weather patterns. Robert Scribbler and University of Ottawa researcher Paul Beckwith warned of the “weather-destabilising and extreme weather-generating” consequences of the jet stream shift. The scientists said the anomalies were most likely precipitated by man-made climate change, which caused the jet stream to slow down and create larger waves. Scribbler wrote in a post on his environmental blog on Tuesday: “It’s the very picture of weather-weirding due to climate change. Something that would absolutely not happen in a normal world.

Something, that if it continues, basically threatens seasonal integrity. The blogger explained the barrier between the two jet streams generates the strong divide between summer and winter, and the “death of winter” could commence if it is eroded as warm weather leaks into the “winter zone” of the year. He continued: “As the poles have warmed due to human-forced climate change, the Hemispherical Jet Streams have moved out of the Middle Latitudes more and more. You get this weather-destabilising and extreme weather generating mixing of seasons.” Meanwhile, Mr Beckwith confirmed the changes would usher in a sustained period of “climate system mayhem” which could prove difficult to resolve.

He said: “Our climate system behaviour continues to behave in new and scary ways that we have never anticipated, or seen before. “Welcome to climate chaos. We must declare a global climate emergency. “The behaviour of the jet stream suggests massive hits to the [global] food supply and the potential for massive geopolitical unrest. There’s very strange things going on on planet Earth right now.”

Absolute must read. How is it possible that my adopted home away from home gets it so right, yet no-one else tries to learn from it?

• Refugees Encounter a Foreign Word: Welcome (NY Times)

Much of the world is reacting to the refugee crisis – 21 million displaced from their countries, nearly five million of them Syrian — with hesitation or hostility. Greece shipped desperate migrants back to Turkey; Denmark confiscated their valuables; and even Germany, which has accepted more than half a million refugees, is struggling with growing resistance to them. Broader anxiety about immigration and borders helped motivate Britons to take the extraordinary step last week of voting to leave the EU. In the United States, even before the Orlando massacre spawned new dread about “lone wolf” terrorism, a majority of American governors said they wanted to block Syrian refugees because some could be dangerous.

Donald J. Trump, the presumptive Republican presidential nominee, has called for temporary bans on all Muslims from entering the country and recently warned that Syrian refugees would cause “big problems in the future.” The Obama administration promised to take in 10,000 Syrians by Sept. 30 but has so far admitted about half that many. Just across the border, however, the Canadian government can barely keep up with the demand to welcome them. Many volunteers felt called to action by the photograph of Alan Kurdi, the Syrian toddler whose body washed up last fall on a Turkish beach. He had only a slight connection to Canada – his aunt lived near Vancouver – but his death caused recrimination so strong it helped elect an idealistic, refugee-friendly prime minister, Justin Trudeau.

The Toronto Star greeted the first planeload by splashing “Welcome to Canada” in English and Arabic across its front page. Eager sponsors toured local Middle Eastern supermarkets to learn what to buy and cook and used a toll-free hotline for instant Arabic translation. Impatient would-be sponsors — “an angry mob of do-gooders,” The Star called them — have been seeking more families. The new government committed to taking in 25,000 Syrian refugees and then raised the total by tens of thousands. In the ideal version of private sponsorship, the groups become concierges and surrogate family members who help integrate the outsiders, called “New Canadians.” The hope is that the Syrians will form bonds with those unlike them, from openly gay sponsors to business owners who will help them find jobs to lifelong residents who will take them skating and canoeing.

Ms. McLorg’s group of neighbors and friends includes doctors, economists, a lawyer, an artist, teachers and a bookkeeper. Advocates for sponsorship believe that private citizens can achieve more than the government alone, raising the number of refugees admitted, guiding newcomers more effectively and potentially helping solve the puzzle of how best to resettle Muslims in Western countries. Some advocates even talk about extending the Canadian system across the globe. (Slightly fewer than half of the Syrian refugees who recently arrived in Canada have private sponsors, including some deemed particularly vulnerable who get additional public funds. The rest are resettled by the government.)