Dorothea Lange Migratory agricultural worker family fixing tire along California highway US 99 1937

The IMF’s Independent Evaluation Office (IEO) issued a report a few days ago entitled ‘The IMF and the Crises in Greece, Ireland, and Portugal’. It is so damning for managing director Christine Lagarde and her closest associates, that it’s hard to see, certainly at first blush, how they could all keep their jobs. But don’t be surprised if that is exactly what will happen.

Because organizations like the IMF don’t care much, if at all, about accountability. Their leaders think they are close to untouchable, at least as long as they have the ‘blessing’ of those whose interests they serve. Which in case of the IMF means the world’s major banks and the governments of the richest nations (who also serve the same banks’ interests). And if these don’t like the course set out, a scandal with a chambermaid is easily staged.

But the IEO doesn’t answer to Lagarde, it answers to the IMF’s board of executive directors. Still, despite multiple reports over the past few years out of the ‘inner layers’ of the Fund that were critical of, and showed far more comprehension of events than, Lagarde et al, the board never criticizes the former France finance minister in public. And maybe that should change; if the IMF is to hold on to the last shreds of its credibility, that is. But that brings us back to “Organizations like the IMF don’t care much, if at all, about accountability.”

What the IEO report makes very clear is that the IMF should never have agreed, as part of the Troika, to assist the EU in forcing austerity upon Greece without insisting on significant debt relief, in the shape of a haircut, or (a) debt writedown(s). The IMF’s long established policy is that both MUST happen together. But its Troika companion, the EU, is bound by the Lisbon Treaty, which stipulates: “The Union shall not be liable for or assume the commitments of central governments”. Also, the ECB can not “finance member states”.

If Lagarde and her minions had stayed true to their own ‘principles’, they should have refused to impose austerity on Greece if and when the EU refused debt relief (note: this has been playing out since at least 2010). They did not, however.

The IMF caved in (how willingly is hard to gauge), and the entire Troika agreed to waterboard Greece. The official excuse for bending the IMF’s own rules was the risk of ‘contagion’. But in a surefire sign that Lagarde et al were not acting with, let’s say, a “clear conscience”, they hid this decision from their own executive board.

Moreover, the IEO now says it was unable to obtain key records or assess the activities of secretive “ad-hoc task forces”. “Many documents were prepared outside the regular established channels; written documentation on some sensitive matters could not be located; [the IEO] has not been able to determine who made certain decisions or what information was available, nor has it been able to assess the relative roles of management and staff..”

One must wonder why the IMF has an executive board at all. Is it only to provide a facade of credibility and international coherence? When it becomes so clear, and -no less- through a report issued by one of its own offices, that its ‘boots on the ground’ care neither for its established policies nor for its board, isn’t it time for the board to interfere lest the Fund loses even more credibility?

The IMF’s main problem, which many insiders may ironically see as its main asset, is the lack of transparency, combined with the overwhelming power exerted by the US and Europe. And Europe’s grip on the IMF is exactly what the report is about, in that it accuses Lagarde et al of bowing to EU pressure, to the extent that it abandons its own guiding ‘laws’. It acted like it was the European Monetary Fund, not the international one.

So there’s no transparency, no accountability, and in the end that will lead to no credibility and no relevance. Well, that’s exactly how the EU lost Britain. And that shows where accountability and credibility are important even for non-democratic supra-national institutions, something these institutions are prone to neglect.

No, there will not be a vote put to the people, no referendum on the IMF. Though that would sure be interesting. What can happen, though, is that countries, even large ones like China and Russia, threaten to leave, perhaps start their own alternative fund. These things have already been widely discussed.

What is sure is that the US/Europe-centered character of the Fund will have to change. If Washington and Brussels try to appoint another European as managing director (an unwritten law thus far) they will face a rebellion.

That next appointment may come sooner than we think. Because Christine Lagarde is in trouble. It’s even a bit strange, and that’s putting it gently, that she’s still in her job. What’s hanging over her head is a 2008 case, in which she approved a payment of €403 million to businessman Bernard Tapie, for ‘losses’ he was to have suffered in 1993 when French bank Crédit Lyonnais supposedly undervalued his stake in Adidas.

Lagarde is accused of negligence in the case, in particular because she ignored advice from her own ministry (yeah, that does smack like the IMF thing) and let the Tapie case go to a special arbitration committee instead of the courts. That Tapie was a supporter of the Sarkozy government Lagarde served as finance minister at the time makes it juicier.

So does this: In 1993 Crédit Lyonnais was a private bank. But in 2008, it had been wound up and was run by a state-operated consortium. Therefore, the €403 million ‘awarded’ to Tapie out-of-court was all taxpayers money. Even juicier: in December 2015, a French appeal court overruled the compensation and ordered Tapie to repay the money, with interest.

What’s peculiar about Lagarde staying on at the IMF is that she is not merely under investigation or even ‘only’ accused of committing a crime. Instead, she has been ordered to stand trial, something she’s spent 8 years trying to avoid. Still, apparently nobody sees any problem in her continuing to act as Managing Director of the IMF.

That is quite something. And it directly affects the Fund’s credibility. If a president or prime minister of a country, any country, had been ordered to stand trial, the likely procedure would be to temporarily stand down and let someone else take care of government business pending the trial.

As it stands, however, Lagarde is allowed to sit pretty. And then? Borrowing from the Guardian: “A charge of negligence in the use of public money carries a one-year jail sentence and a €15,000 fine. The CJR is made up of six members of the French Assemblée Nationale, six members of the upper house, the Senate and three magistrates. No date has been set for the hearing.”

Ironically, negligence turns out to be a very light charge. Someone in Lagarde’s position could have given away or squandered trillions of euros and then be fined €15,000. But then, class justice is alive and well in France. What are the odds that she will be convicted? She’d have to be found with a chambermaid in Manhattan for that to happen…

That’s perhaps what the IMF board are thinking too. Whether that’s wise remains to be seen. Hubris rules all these institutions, sheltered as they are from the real world. But the real world is changing.

Ironically, many people think these changes will reinforce the IMF. Since the Fund can issue a sort of ‘super money’ in the shape/guise of Special Drawing Rights (SDRs), and especially China would seem to like SDRs becoming the world’s reserve currency instead of the US dollar, the IMF in some people’s eyes holds a trump card.

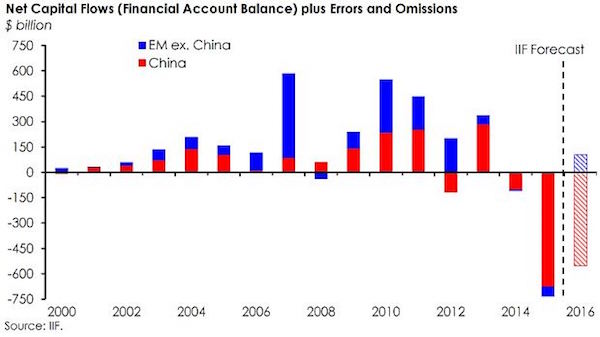

There may well be an effort to hide private and public debt throughout the planet even more than it is hidden now, through SDRs. We’ll likely see governments and perhaps large corporations issue bonds denominated in SDRs. China seems to think that this could potentially halt much of its capital flight.

My trouble with this is that it’s either too unclear or too clear who would profit most from such schemes. Even if the next managing director of the IMF is not European, but Asian or African, the puppet masters of the Fund will still be the same western financial ‘cabal’. And I don’t see China or Russia signing up to that kind of control, and willingly expand it by making SDRs far more important.

Then again, there’s a sh*tload of debt that needs to be hidden, and the whole world is running out of carpet to sweep it under. Then again, Russia is not that indebted. It’ll be hard to get a consensus.

But all that won’t help Greece. Let’s get back to that. We left off where Lagarde conspired with the EU, under the guise of preventing contagion, to abandon the IMF’s own rules in order to waterboard the country. Of course, we know, though nobody writing on the IEO report mentions it, that the contagion they were trying to prevent was not so much between nations but between banks.

The bailout-related policies and actions that Lagarde hid from her own board (!) were designed to make French and German banks ‘whole’ at the cost of the Greek people. It became austerity, so severe as to make no sense whatsoever -certainly inside an alleged ‘Union’-, even if the IMF -not the world most charitable institution- has always banned this without being accompanied by strong debt relief.

Schäuble and Dijsselbloem saved Germany and Holland at the expense of Greece. This will end up being the undoing of the EU, even if nobody’s willing to acknowledge it despite the glaring evidence of the Brexit.

It will probably be the undoing of the IMF as well. And there I get back to what I’ve said 1000 times: centralization can only work in times of growth. There is no conceivable reason, other than dictatorship, why people would want to be part of a centralizing movement unless they get richer from it.

In today’s shrinking global economy, we have passed a point of no return in this regard. Everyone will want out of these institutions, and get back to making their own decisions about their own lives, instead of having these decisions being taken by some far away board with no accountability.

Let’s end with a few quotes about the IEO report. Ambrose Evans-Pritchard was in fine form:

IMF Admits Disastrous Love Affair With The Euro and Apologises For The Immolation Of Greece

The International Monetary Fund’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory.

[..] In Greece, the IMF violated its own cardinal rule by signing off on a bailout in 2010 even though it could offer no assurance that the package would bring the country’s debts under control or clear the way for recovery, and many suspected from the start that it was doomed. The organisation got around this by slipping through a radical change in IMF rescue policy, allowing an exemption (since abolished) if there was a risk of systemic contagion. “The board was not consulted or informed,” it said. The directors discovered the bombshell “tucked into the text” of the Greek package, but by then it was a fait accompli.

[..] The injustice is that the cost of the bailouts was switched to ordinary Greek citizens – the least able to support the burden – and it was never acknowledged that the true motive of EU-IMF Troika policy was to protect monetary union. Indeed, the Greeks were repeatedly blamed for failures that stemmed from the policy itself. This unfairness – the root of so much bitterness in Greece – is finally recognised in the report. “If preventing international contagion was an essential concern, the cost of its prevention should have been borne – at least in part – by the international community as the prime beneficiary,” it said.

That would seem to leave the IMF just one option: to apologize profoundly to Greece, to demand from the EU that all unjust measures be reversed and annulled, and to set up a very large fund (how about €1 trillion) specifically to support the Greek people, including retribution of lost funds, repair of the health care system, reinstatement of a pension system that can actually keep people alive and so on and so forth.

And to top it off of course: debt writedowns as far as the eye can see. You f**k up, you pay the price. This makes me think of a remark by Angela Merkel a few weeks ago, she said ‘we have found the right mix when it comes to Greece’. Well, Angela, that is so completely bonkers it’s insulting, and the IMF’s own evaluation office says so.

I like this one from Bill Black as well:

It was only after forcing the Greek people into a pointless purgatory of a decade of disaster that the troika would consider providing debt relief…The only ‘debt relief’ they offer to discuss is a ‘long rescheduling of debt payments at low interest rates.’ This, under their own dogmas, will lock Greece into a long-term debt trap that will materially lower Greece’s growth rate for decades and leave it constantly vulnerable to recurrent financial crises. That is a recipe for disaster for Greece, Italy, and Spain (collectively, 100 million citizens) and for the EU. It is financial madness – and that ignores the political instability it will cause to force an EU member nation to twist slowly in the wind for 50 years.”

Got that one off of Yanis Varoufakis’ site, and he must be feeling very vindicated, even if not nearly enough people express it, by the IMF report. Because he’s said all along what they themselves are now admitting. But it ain’t much good if nothing changes, is it? Or, as Varoufakis put it:

[..] to complete this week’s drubbing of the troika, the report by the IMF’s Independent Evaluation Office (IEO) saw the light of day. It is a brutal assessment, leaving no room for doubt about the vulgar economics and the gunboat diplomacy employed by the troika. It puts the IMF, the ECB and the Commission in a tight spot: Either restore a modicum of legitimacy by owning up and firing the officials most responsible or do nothing, thus turbocharging the discontent that European citizens feel toward the EU, accelerating the EU’s deconstruction.

[..] The question now is: What next? What good is it to receive a mea culpa if the policies imposed on the Greek government are the same ones that the mea culpa was issued for? What good is it to have a mea culpa if those officials who imposed such disastrous, inhuman policies remain on board and are, in fact, promoted for their gross incompetence?

In sum, an urgent apology is due to the Greek people, not just by the IMF but also by the ECB and the Commission whose officials were egging the IMF on with the fiscal waterboarding of Greece. But an apology and a collective mea culpa from the troika is woefully inadequate. It needs to be followed up by the immediate dismissal of at least three functionaries.

First on the list is Mr Poul Thomsen – the original IMF Greek Mission Chief whose great failure (according to the IMF’s own reports never before had a mission chief presided over a greater macroeconomic disaster) led to his promotion to the IMF’s European Chief status. A close second spot in this list is Mr Thomas Wieser, the chair of the EuroWorkingGroup who has been part of every policy and every coup that resulted in Greece’s immolation and Europe’s ignominy, hopefully to be joined into retirement by Mr Declan Costello, whose fingerprints are all over the instruments of fiscal waterboarding. And, lastly, a gentleman that my Irish friends know only too well, Mr Klaus Masuch of the ECB.

You probably guessed by now that I would certainly and urgently add Christine Lagarde to that list of people to be fired. And not appoint another French citizen as managing director. Too risky. They do crazy things. The IMF must be reorganized, and thoroughly, or it no longer has a ‘raison d’être’.

I see no reason to doubt that those who call the shots are too blinded by hubris to execute such measures, so I’ll list these things one more time: transparency, accountability, credibility and if you don’t have those you will lose your relevance.

But it’s probably a bad idea to begin with to let an economy, if not a world, in decline, be governed by the same people who owe their positions to its rise. It would seem to take another kind of mindframe.