Unknown Butler’s dredge-boat, sunk by Confederate shell, James River, VA 1864

Where would they be without a stock market bubble, and without ZIRP?

• SocGen: Corporate America Is Nearing A ‘Toxic’ Debt Crisis (BI)

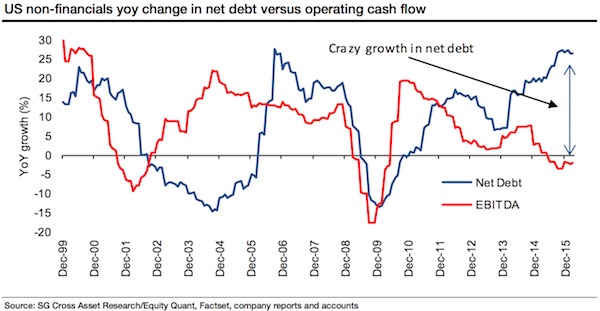

US companies have a looming problem of their own making, and it may soon come back to crush them. According to Andrew Lapthorne, head of quantitative analysis at Societe Generale, the amount of debt that businesses have accumulated over the last five to six years has put them on the verge of a serious crisis. Lapthorne wrote in a note to clients on Tuesday: “This level of borrowing in some sectors of the economy is now booming (with the risk of spinning out of control) to such an extent that we think that the build-up of debt on US non-financial corporate balance sheets represents one of the largest mispriced risks in terms of future market stability, downside risk and future economic growth.”

Lapthorne’s argument is essentially that US corporations have decided to borrow money in order to fuel growth larger than that warranted by economic demand. But now with the assets backing this debt starting to decline in value, the wheels are going to fall off. Lapthorne believes there has been one cause of this behavior: central banks. “Aggressive monetary policy in the form of QE and zero or negative interest rates is all about encouraging (forcing?) borrowers to take on more and more debt in an attempt to boost economic activity, effectively mortgaging future growth to compensate for the lack of demand today,” he wrote. From the supply end, making financing debt easier through low interest rates and quantitative easing “encouraged” corporations to take on the debt loads.

On the demand end, investors loved the higher-yielding corporate debt, since US Treasury yields remained so low. Put it together and you have a central-bank-fueled bubble, which Lapthorne called “toxic.” And so with little economic growth to speak of or invest in, corporations have funneled this debt-financed money into share buybacks and mergers in order to improve profitability and the illusion of growth. In fact, Lapthorne said, companies are spending 35% more than their incoming cash flows, higher than previous peaks in 1998 and 2008. The upside is that as stock prices have risen, companies have been able to pay back debt either through raising new debt or still-growing profits. But now with profits on the decline and shakier asset markets, the danger is coming to a head.

So no matter how you look at it, argued Lapthorne, companies have mountains of debt. And as profits and eventually stock prices start to get squeezed from all-time highs, the ability of companies to pay back their debt will get worse.

Something tells me the real number is much higher.

• US Corporations Have $1.4 Trillion Hidden In Tax Havens: Oxfam (G.)

US corporate giants such as Apple, Walmart and General Electric have stashed $1.4tn (£980bn) in tax havens, despite receiving trillions of dollars in taxpayer support, according to a report by anti-poverty charity Oxfam. The sum, larger than the economic output of Russia, South Korea and Spain, is held in an “opaque and secretive network” of 1,608 subsidiaries based offshore, said Oxfam. The charity’s analysis of the financial affairs of the 50 biggest US corporations comes amid intense scrutiny of tax havens following the leak of the Panama Papers. And the charity said its report, entitled Broken at the Top was a further illustration of “massive systematic abuse” of the global tax system. Technology giant Apple, the world’s second biggest company, topped Oxfam’s league table, with some $181bn held offshore in three subsidiaries.

Boston-based conglomerate General Electric, which Oxfam said has received $28bn in taxpayer backing, was second with $119bn stored in 118 tax haven subsidiaries. Computing firm Microsoft was third with $108bn, in a top 10 that also included pharmaceuticals giant Pfizer, Google’s parent company Alphabet and Exxon Mobil, the largest oil company not owned by an oil-producing state. Oxfam contrasted the $1.4tn held offshore with the $1tn paid in tax by the top 50 US firms between 2008 and 2014. It pointed out that the companies had also enjoyed a combined $11.2tn in federal loans, bailouts and loan guarantees during the same period. Overall, the use of tax havens allowed the US firms to reduce their effective tax rate on $4tn of profits from the US headline rate of 35% to an average of 26.5% between 2008 and 2014.

A bit moot as long as they’re TBTF?!

• US Banks Not Prepared For Another Financial Crisis (G.)

Some of the US’s biggest banks still lack a proper plan for bankruptcy, in the event of another major financial crisis, US regulators said on Wednesday. In the wake of the great recession banks were required to come up with “living wills” to prove they had a credible plan for bankruptcy that would not require another bailout from the taxpayers. But after reviewing the plans of five institutions – JP Morgan Chase, Wells Fargo, Bank of America, Bank of New York Mellon and State Street Corp – the Federal Reserve and the Federal Deposit Insurance Corp (FDIC) have determined that the banks have yet to meet that requirement. “The goal to end too big to fail and protect the American taxpayers by ending bailouts remains just that: only a goal,” said Thomas Hoenig, FDIC vice-chairman. The banks are to submit revised proposals by 1 October.

According to feedback from the regulators, one of the main concerns with JP Morgan’s proposal was the bank’s liquidity in a time of need. Regulators were concerned the bank would not be able to shift money around to fund some of its operation during a time of stress or bankruptcy. “Obviously we were disappointed,” said Marianne Lake, JP Morgan’s chief financial officer. “The most important thing is that we work with our regulators to understand their feedback in more detail.” Bank of America also needs better processes for estimating its liquidity needs, the regulators said. And while Wells Fargo was deemed to have “firm-wide, high-quality liquid assets”, regulators raised concerns over “quality control, senior management oversight, and recovery and resolutions planning staffing”. In its statement, Wells Fargo said it was disappointed its plan was “determined to have deficiencies” but the feedback was “constructive and valuable to our resolution planning process”.

As confidence recedes…

• The Beginning of the End of Central Bank Easing (BBG)

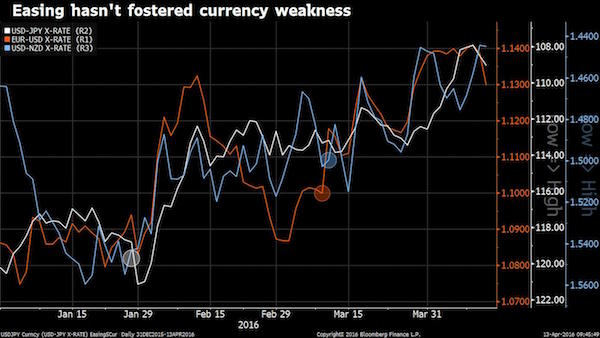

Traders are now taking the long view on central bank easing, shifting focus to which monetary policymakers will be the first to change course and withdraw stimulus, according to Bank of America Merrill Lynch FX Strategist Athanasios Vamvakidis. The euro-area, Japan, Norway, New Zealand, and Sweden are the five major developed economies in which central banks have eased policy this year—and by some financial metrics, they don’t have much to show for it. In all of these instances, currencies have strengthened relative to the U.S. dollar in the wake of more accommodative monetary policy (denoted by a circle on the chart below.)

A possible counterpoint: it’s not necessarily that fighting central banks has worked, but that the Federal Reserve’s dovish surprise in March has meant more to these currency pairs than outright easing. That argument might not fully pass the smell test, however, as most of these domestic stocks markets have also declined since monetary policy became more accommodative. So with currencies getting stronger and equities falling (with the exception of New Zealand), Vamvakidis argues “that positioning for a scenario in which some central banks give up easing is worth the cost.” His observations support the notion that the marginal efficacy of stimulus is waning—or as this worry is more commonly expressed, that central banks are running out of ammunition.

He adds, “It is unlikely, in our view, that the next big FX trade will be from a central bank that surprises markets by easing policies more, which was the case in recent years.” A soft global economic backdrop prompted the Federal Reserve to telegraph a slower path for higher interest rates in March. As such, this shift to a focus on exit strategies might seem premature or optimistic, but the opposite may also be true. For instance, in the case of Japan, there are technical limits to the amount of sovereign bonds that can be bought, a dynamic which might force the central bank to begin dialing down this part of its asset-purchasing program. “Markets have already started testing central banks and have been reacting counterintuitively to policy easing,” concludes Vamvakidis. “Central banks can fight back, as the Fed has successfully done recently, but we do not believe that this is sustainable as long as the global recovery continues.”

Boomerang.

• Negative Swap Rates Impede Kuroda’s Push To Boost Japan Lending (BBG)

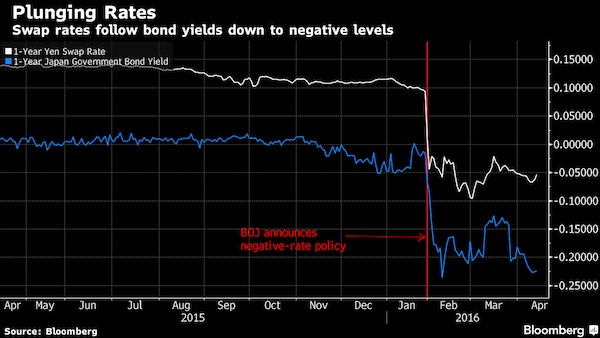

Negative rates for swapping interest payments are hindering the ability of corporate borrowers to hedge their liabilities – another way in which the Bank of Japan’s unorthodox attempt to revive lending could backfire. The fixed rate paid in exchange for floating-rate payments for a year in Japan’s interest rate swap market fell below zero after the BOJ started charging banks for reserves in February, and was at minus 0.049% on Thursday. Floating-rate loans in Japan aren’t allowed to have repayment rates below zero, causing a disconnect with traditional hedging methods. “Interest-rate swaps aren’t functioning properly” as hedging tools, said Satoshi Oda at Credit Agricole in Tokyo. “Without swaps, banks will have trouble making floating-rate loans and will need to extend fixed-rate loans, but most banks don’t like lending at fixed rates, so they’re becoming hesitant about making new loans.”

Lending growth in Japan excluding trusts slowed to 2% in March from a year earlier, the weakest pace in three years, according to BOJ data released Tuesday. Sumitomo Mitsui Trust Bank sees a drop in swap-market activity as companies avoid using the contracts amid uncertainty about whether regulators will allow floating-rate repayments below zero. When companies take out such loans, they often enter into a derivative deal to hedge, agreeing to pay the fixed swap rate in return for a floating-rate payment that protects them if borrowing costs rise. However, while loan deals stipulate that repayment rates won’t be negative, depriving companies of that benefit, swap transactions do allow for negative payments, meaning the hedger could wind up exposed to risks in both the swap and loan market.

Can’t keep the greenback down forever. It’s too costly.

• Currencies Across Asia Fall Sharply Against US Dollar (WSJ)

Currencies across Asia including the Chinese yuan dropped sharply against the U.S. dollar Thursday, with markets caught off-guard as the Singapore central bank restrained the appreciation of its currency to stoke growth. The yuan saw its biggest one-day depreciation since January, and the Singapore dollar fell by the most within a day this year. Meanwhile, the South Korean won weakened after the ruling party lost its parliamentary majority. Asian currencies had firmed up against the greenback in recent weeks, partly thanks to the Federal Reserve having signaled it would raise interest rates at a slower rate this year than previously expected. Economic policy makers from the Group of 20 nations had pledged at a meeting in February to avoid sparking a currency war through competitive devaluation.

A weakening of the yuan against the U.S. dollar in its daily fix weighed on currencies across the region, after a 0.46% depreciation—the biggest since January. The region’s currency markets had started the day on the back foot as traders assessed first the impact of South Korea’s elections, followed by a surprise easing of monetary policy by Singapore’s central bank. Movements of the yuan fix, which determines the levels at which the currency can trade inside mainland China, have recently been more determined by market forces. Today’s depreciation reflects strength in the U.S. dollar on Wednesday. Thursday’s yuan depreciation was the biggest since Jan. 7, when markets had speculated that moves to weaken the yuan could trigger a global currency war. Competitive currency devaluation hasn’t materialized among major economies since then, but other central banks in smaller countries in Asia are loosening policy in the meantime.

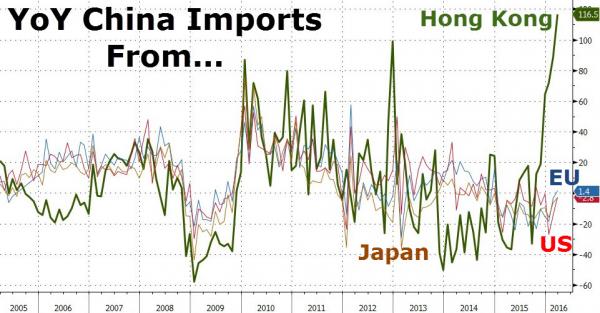

“China’s March imports from Hong Kong soared an implausible 116% YoY!”

• China’s Trade Data Has Never Been This Fake (ZH)

The narrative is set – today’s rally is predicated on “strong” Chinese trade data. So what happens when one chart explodes that narrative as totally fallacious for three simple reasons… First, the data is clearly cooked… As Bloomberg’s Tom Orlik notes, China’s March imports from Hong Kong soared an implausible 116% YoY! As it is clearly disguising capital flows… “Trade mis-invoicing as a way to hide capital flows remains a factor. In the past, over-invoicing for exports was used as a way to hide capital inflows. The latest data show the reverse phenomenon, with over-invoicing of imports as a way of hiding capital outflows.” Does this look “real”?

Second, there is the base effect which EVEN CHINA warned would be a factor: “But beware two factors; the government itself has warned that the base line from March 2015 is low. A reminder that observers shouldn’t get complacent about the downward pressures still threatening China’s economy”. And then finally, there’s the figures themselves, can they be trusted? But did anyone really need an excuse to buy the record highs in stocks, or send Trannie sup 3% on the day? Of course not!

Ambrose loses faith.

• China’s Leaders Are Blowing Their Last Chance To Avert An Economic Crisis (AEP)

China panic has abated. The Shanghai Composite index is back above 3,000. The much-feared devaluation never happened. The yuan has strengthened against the dollar this year, to the consternation of Western macro-tourists. Outflows of money have slowed as dollar debt is paid off and Chinese investors wind down ‘carry trade’ positions. The central bank (PBOC) is no longer depleting the country’s $3.2 trillion foreign reserves to defend the exchange rate, and thereby tightening monetary policy as a nasty side-effect. China has the apparatus of an authoritarian state to curb capital flight, and is not shy about using it. The IMF has just raised its forecast for Chinese growth this year to 6.5pc, insisting that it is still far too early to talk about a hard-landing. Yet that is where the good news ends, for there is a poisonous sting in the tail.

Maurice Obstfeld, the IMF’s chief economist, said the trade-off for this year’s growth spurt is even more trouble down the road. “While we have upgraded near-term projections, we have downgraded the farther out projections,” he said. “Our concern is some of the stimulus is likely to take the form of higher credit growth, more support for sectors that are in a secular sense declining and not that productive. We worry about the quality of growth more than the quantity of growth,” he said. There you have the nub of the matter. Stripped of IMF circumlocutions, he is telling us that the Communist Party has once again let rip with debt-driven stimulus for the housing market and rust-bowl industries already chocking with overcapacity, stoking yet another mini-cycle to put off the day of reckoning.

The likelihood that China will fail to grasp the nettle of reform in time to avert a structural crisis is rising from probable to almost certain. As the well-meaning premier Li Keqiang keeps warning his colleagues in the Standing Committee, the current course leads straight into the middle income trap. We can put away those charts projecting China’s ‘sorpasso’, the moment when the country overtakes the US to become the world’s biggest economy. It is not going to happen in 2020, and will look even less likely in 2030, when China’s demographic dividend turns to deficit and the workforce goes into precipitous decline. “Implementation of a more ambitious and comprehensive policy agenda is urgently needed to stay ahead of rising financial sector vulnerabilities,” said the IMF today in its Global Financial Stability Report.

The section on China reads like a horror story. The “credit overhang” has exploded to 25pc of GDP, perpetuating a vicious circle of falling factory gate prices and plunging profits. While the IMF does not use the term, China is basically in a ‘debt-deflation’ trap. Earnings have been dropping more quickly than nominal interest rates, automatically tightening the noose. “The ability of many Chinese listed firms to service their debt obligations is eroding,” it said. The ratio of gross debt to earnings (EBITDA) has doubled to four since 2010. Debt at risk – where earnings do not cover interest payments – has risen from 4pc to 14pc in five years. It has reached 39pc for steel, 35pc for mining and retail, and 18pc for manufacturing and transport.

And thereby China’s.

• Panama Papers Reveal Hong Kong’s Murky Financial Underbelly (AFP)

Jasmine Li was still a student when she opened her first offshore bank account through Mossack Fonseca Hong Kong, but the shady world she entered that day had been part of the city’s underbelly for decades. The granddaughter of China’s then fourth-ranked politician was among dozens named in a vast cache of documents leaked from the Panama law firm that have given a glimpse into how the rich and powerful hide their money. But the so-called Panama Papers, released by the International Consortium of Investigative Journalists this month, have also exposed the key role played by Hong Kong and Singapore in funnelling that wealth into tax havens.

Mossack Fonseca’s Hong Kong offices were their busiest in the world, the ICIJ analysis showed, setting up thousands of shell companies including some linked to China’s top political brass, the city’s richest man, Li Ka-shing, and movie star Jackie Chan. Experts say the Asian financial hubs have already channelled billions into tax havens, and the Boston Consulting Group predicts they will be the world’s fastest-growing offshore centres over the next five years. “Hong Kong is set up to make it easy for people to do business, and it is very easy to do business here,” said Douglas Clark, a barrister with one of Hong Kong’s largest chambers.

“But when it’s easy to do business then it’s easy to do any type of business, legal or illegal.” Offshore companies are not necessarily illegal, but they operate on the fringes of what is allowed and their opaque structures make it easy to conceal ill-gotten or politically inconvenient wealth. They have proved a boon for Hong Kong and Singapore, which are known not only for their financial expertise but also light-touch regulation, discretion and non-cooperation with foreign tax authorities. Both are already on regulators’ radars – the EU briefly added Hong Kong to its tax blacklist last year – but experts say they are unlikely to do anything to jeopardise the lucrative offshore business.

For what it’s worth (It’s IMF, after all): “These loans could translate into potential bank losses of approximately 7% of GDP..”

• IMF: $1.3 Trillion In Corporate Bank Loans At Risk Of Default In China (Sky)

The IMF has warned that $1.3tn (£913bn) in corporate bank loans are at risk of default in China. The fund’s latest Global Financial Stability Report said the figure was recognised by the authorities in Beijing and was “manageable” given the country’s rate of economic growth – currently running just below 7%. But the world’s lender of last resort said the situation underlined the concerns of financial markets over the sustainability of China’s economic model, given the volatility witnessed last summer and in January when stock values plunged. It said: “The magnitude of these vulnerabilities calls for an ambitious policy agenda”.

The IMF said the issue of corporate debt could not be ignored and it called for a further strengthening of China’s financial institutions, suggesting that another global stock market rout could knock world GDP growth by as much as 4%. Investor confidence has been damaged by a slowdown in the world economy – blamed on the deterioration in Chinese growth as it moves to rebalance its economy from a heavy infrastructure and industrial powerhouse towards a more services-based model. The IMF said falling profitability in China, linked to lower GDP growth, was behind its concern for borrowings at risk of default. There was clear evidence, it said, that a growing number of companies were not earning enough to cover interest payments. “These loans could translate into potential bank losses of approximately 7% of GDP,” it added.

All these parties chiming in on Brexit will achieve the opposite of what they want.

• Is The IMF ‘Consistently Wrong’? (CNBC)

Supporters of a British exit from the European Union were left enraged this week after a new report by the IMF led to calls of inaccuracy and political bias. The Washington D.C.-based organization said the U.K. referendum on its membership of the EU had already created uncertainty for investors and said a so-called “Brexit” could do “severe regional and global damage by disrupting established trading relationships.” U.K. Prime Minister Cameron and Finance Minister George Osborne both used their Twitter accounts Tuesday to promote the IMF’s latest assessment with the latter calling it “one of most important interventions yet in EU debate.” Bookmaker Ladbrokes is currently predicting there’s a 33% chance that Britons will vote to leave the European bloc in an upcoming referendum on June 23.

The fierce debate has strained relationships and seen major political heavyweights put forward opposing views. The warning – just weeks before the June 23 vote – was heavily criticized by John Longworth, a former director-general of the British Chambers of Commerce, who resigned from his role in March after being drawn into the political row. The British government is officially campaigning to stay within a renegotiated EU and Longworth claimed that it had “friends in high places” with this latest backing by the IMF. The IMF did not respond immediately when asked by CNBC about claims of bias and inaccuracy. “I’m fully expecting a whole series of international organizations to make comments saying we ought to stay in the EU running up to the 23rd of June, no doubt orchestrated by the U.K. government,” Longworth told CNBC Wednesday.

Real demand cuts will be much deeper than OPEC lets on.

• OPEC Warns of Deeper Cuts to Oil Demand (BBG)

OPEC said it may deepen cuts to its forecast for global oil demand growth due to slowing economic expansion in emerging markets, warmer weather and the removal of fuel subsidies. OPEC trimmed estimates for demand growth in 2016 by 50,000 barrels a day because of a slowdown in Latin America, projecting worldwide growth of 1.2 million barrels a day. Weakness in Brazil’s economy, the removal of fuel subsidies in the Middle East and milder winter temperatures in the northern hemisphere could prompt further cutbacks, the group said. “Current negative factors seem to outweigh positive ones and possibly imply downward revisions in oil demand growth, should existing signs persist going forward,” the organization’s Vienna-based secretariat said in its monthly market report.

“Economic developments in Latin America and China are of concern.” Oil climbed to a four-month high in London on Tuesday as OPEC nations prepare to meet with Russia and other non-members in Doha this weekend to complete an accord on freezing oil production, an effort to tame the global crude surplus. OPEC’s report said that “positive market sentiments continue to arise” from the freeze plan. The group’s data shows that the 11 OPEC members who are confirmed to attend the Doha talks are pumping 487,000 barrels a day below January levels, the benchmark proposed for the freeze deal.

Libya has said it won’t attend the meeting, and Iran has yet to decide. Saudi Arabia’s output has remained stable since January, the report showed. All 13 members pumped 32.25 million barrels a day in March, up 14,900 a day from February, according to external estimates compiled by OPEC. Global oil demand will average 94.18 million barrels a day in 2016, according to the report. This year’s growth rate of 1.2 million barrels a day is down from 1.54 million a day in 2015 amid a slowdown in consumption of industrial fuels and middle distillates in China and Latin America.

The era of plastic is in fact simply the era of oil.

• Seen From The Future, Ours Is The Era Of Plastic (BBG)

Historians may soon be looking back at the 20th and early 21st centuries as the time of computers and the Internet, bold ventures into space and the splitting of the atom. But what will scholars in the distant future find worthy of note? If there’s anyone around with a penchant for paleontology hundreds of thousands of years from now, a surprise awaits in the stratigraphic layers containing the remains of our time. Anyone digging into the earth would find a sudden, explosive increase in a new kind of material – plastic. Once underground, plastic will fossilize well, leaving a distinct signature. And there’s plenty of it. Until the 20th century, plastic was virtually nonexistent. Since then, humans have created 5 billion tons. The paleontologist Jan Zalasiewicz has calculated that if it were all converted into cling wrap, there would be enough to wrap the globe.

Until about 20 years ago, Zalasiewicz said, the idea that people could permanently change the planet was considered nonsense. Human beings were too puny and the planet too vast. “The scale of geological processes such as mountain building and volcanic eruptions have been held to be much greater than anything humans can rustle up,” he said. But over the last several decades, he added, it’s become clear that human-generated effects “can be big on a geological scale and can be more or less permanent.” Geologic maps of the future might refer to our time as the Slobocene era, or the Trashiferous period. Or maybe the name scientists recently coined – Anthropocene – will stick. It refers to the time when humankind started to make an indelible mark. Changes that characterize the Anthropocene include the widespread production of aluminum and concrete as well as plastics, and distinct changes in the chemistry of the atmosphere and oceans.

Plastics have been important for distributing clean food and water, for medical devices, surgical gloves and affordable clothing. They’ve played a big role in health and sanitation. The fact that they don’t dissolve or decay is a plus for most of their intended uses. But there are unintended consequences. Some plastics are recycled, but most go into landfills or become litter. Recently, scientists have come to realize that much of the plastic in the environment is in the form of invisible particles. Some of these come from the breakdown of bags and other floating trash in the oceans, some from toothpaste and cosmetics, and much of it from clothes, which are mostly made from synthetic materials and give off plastic fibers every time they go through a wash. These “microplastics” can be measured in sand from beaches around the world, and in the guts of many fish.

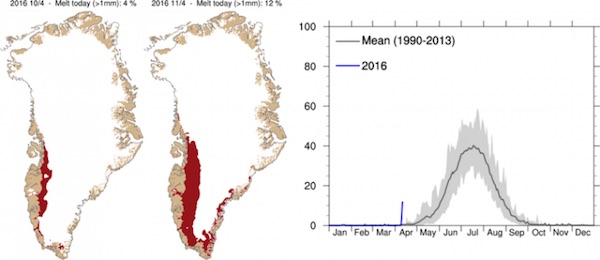

Scary graph of the day.

• Greenland’s Melt Season Started Nearly Two Months Early (CC)

To say the 2016 Greenland melt season is off to the races is an understatement. Warm, wet conditions rapidly kicked off the melt season this weekend, more than a month-and-a-half ahead of schedule. It has easily set a record for earliest melt season onset, and marks the first time it’s begun in April. Little to no melt through winter is the norm as sub-zero temperatures keep Greenland’s massive ice sheet, well, on ice. Warm weather usually kicks off the melt season in late May or early June, but this year is a bit different. Record warm temperatures coupled with heavy rain mostly sparked 12% of the ice sheet to go into meltdown mode. Almost all the melt is currently centered around southwest Greenland.

According to Polar Portal, which monitors all things ice-related in the Arctic, melt season kicks off when 10% of the ice sheet experiences surface melt. The previous record for earliest start was May 5, 2010. This April kickoff is so bizarrely early, scientists who study the ice sheet checked their analysis to make sure something wasn’t amiss before making the announcement. “We had to check that our models were still working properly” Peter Langen, a climate scientist at the Denmark Meteorological Institute (DMI), told the Polar Portal. But alas, the models are definitely working and weather data and stories coming out of West Greenland have borne that out. According to DMI, temperatures at Kangerlussuaq, a small village in southwest Greenland, set an April record for that location when they reached 64.4°F (17.8°C) on Monday. That’s just a scant .4°F (.2°C) off the all-time Greenland high for April. Heavy rain have also inundated local communities.

As long as their own people don’t pay a penny….

• EU Nations Use Foreign Aid Budgets To Pay For Refugee Costs (G.)

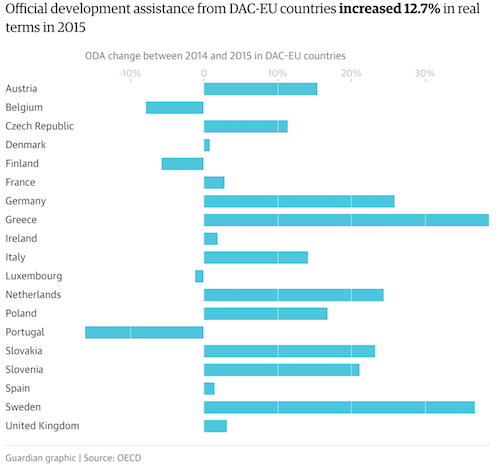

The amount of foreign aid money rich nations spend on dealing with the impact of the refugee crisis at home has almost doubled over the past year and now accounts for 9% of all development expenditure, according to the latest official figures. The preliminary statistics, from the OECD, show that wealthy donor countries spent a net total of $131.6bn (£92.5bn) on aid in 2015, compared with $135.2bn the previous year. Of that, $12bn went on domestic spending – or “in-donor refugee costs”, up from $6.6bn in 2014. Many of the European countries most affected by the mass migration of people recorded surges in their official development assistance (ODA) in 2015: Greece’s aid spending rose by 38.7%; Sweden’s by 36.8%; Germany’s by 25.9%; the Netherlands’ by 24.4%, and Austria’s by 15.4%. The OECD says that all these rises, to greater or lesser extents, were caused by growing in-donor refugee costs.

According to the organisation, members of its development assistance committee (DAC) spent 6.9% more in real terms in 2015 than they did the previous year, making it “the highest level ever achieved for net ODA”. It said ODA as a share of gross national income was 0.3%, putting it on a par with 2013, when aid reached a record, real terms high of $135.1bn. However, the European Network on Debt and Development (Eurodad) said many EU countries are now the biggest recipients of their own aid, adding that the latest figures had been “dramatically inflated” by the diversion of aid to cover the domestic costs of the refugee crisis. “While it is very important that we care for refugees arriving on our shores, our own costs should not be classed as international development aid, and money to cover this must come from other sources,” said Jeroen Kwakkenbos, Eurodad’s policy and advocacy manager.

“We must stop raiding aid budgets to solve our own problems at the expense of the poorest people who desperately need more and better aid. The figures presented today show clear issues with the reporting rules as the largest increases were for domestic budget gaps related to the refugee crisis.” Amy Dodd, of the Concord AidWatch initiative, said: “Unfortunately, official figures today confirm that despite some positive exceptions, the EU once again missed its overall aid target in 2015. “The figures are a real blow to the credibility of the EU and its member states at precisely the moment they should be demonstrating their commitment to implementing the promises they made to provide sufficient, high quality sustainable development financing for [the sustainable development goals].”