Mathew Brady Abe Lincoln 1864

It’s showdowns all the way down. It would be good if they can do this one with a bit more smart. But they’re losing everything so far, so no high hopes. Of course it’s beyond gross to be chanting “send her home” at a rally. But he’s winning it all and they are not. The Democrats need a plan, they need brains, they need to organize.

• Showdown With Trump Looms As House Votes To Block Arms Sale To Saudi Arabia (AP)

Congress is heading for a showdown with President Donald Trump after the House voted to block his administration from selling weapons and aircraft maintenance support to Saudi Arabia. The Democratic-led House on Wednesday passed the first of three resolutions of disapproval, 238-190, with votes on the others to immediately follow. Trump has actively courted an alliance with Riyadh and has pledged to veto the resolutions. The Senate cleared the measures last month, although by margins well short of making them veto proof. Overturning a president’s veto requires a two-thirds majority. The arms package is worth an estimated $8.1 billion and includes precision guided munitions, other bombs, ammunition, and aircraft maintenance support.

Very predictable and therefore very stupid. It’s no time to start fights you can’t possibly win.

• House Votes Down Democrat’s Bid To Impeach Trump Over Recent Tweets (AP)

The House easily killed a maverick Democrat’s effort Wednesday to impeach President Donald Trump for his recent racial insults against lawmakers of color, in a vote that provided an early snapshot of just how divided Democrats are over trying to oust him in the shadow of the 2020 elections. Democrats leaned against the resolution by Texas Rep. Al Green by about a 3-2 margin as the chamber killed the measure 332-95. The vote showed that so far, House Speaker Nancy Pelosi has been successful in her effort to prevent a Democratic stampede toward impeachment before additional evidence is developed that could win over a public that has so far been skeptical about ousting Trump.

Even so, the numbers also showed that the number of Democrats open to impeachment remains substantial. About two dozen more conversions would split the party’s caucus in half over an issue that could potentially dominate next year’s presidential and congressional campaigns. “There’s a lot of grief, from a lot of different quarters,” Green, speaking to reporters after the vote, said of the reaction he’s received from colleagues. “But sometimes you just have to take a stand.” Every voting Republican favored derailing Green’s measure.

Pelosi and other party leaders considered his resolution a premature exercise that needlessly forced vulnerable swing-district lawmakers to cast a perilous and divisive vote. It also risked deepening Democrats’ already raw rift over impeachment, dozens of the party’s most liberal lawmakers itching to oust Trump. Recent polling has shown solid majorities oppose impeachment. Even if the Democratic-run House would vote to impeach Trump, the equivalent of filing formal charges, a trial by the Republican-led Senate would all but certainly acquit him, keeping him in office.

And here’s another loss. It doesn’t stop.

• Feds End Investigation Into Trump Org And Hush Money Payments (CNN)

Federal prosecutors in New York have ended their investigation into the Trump Organization’s role in hush money payments made to women who alleged affairs with President Donald Trump and have been ordered by a judge to release additional information connected to their related probe of former Trump lawyer Michael Cohen, according to court documents filed Wednesday. CNN reported Friday that the Manhattan US Attorney’s office had approached the end of its investigation of the Trump Organization and wasn’t poised to charge any executives involved in the company’s effort to reimburse Cohen for money he paid to silence one of the women. That payment constituted an illegal campaign contribution, according to prosecutors. Trump has denied the affair allegations.

“The campaign finance violations discussed in the Materials are a matter of national importance,” US District Court Judge William Pauley wrote in his decision. “Now that the Government’s investigation into those violations has concluded, it is time that every American has an opportunity to scrutinize the Materials.” Pauley ordered a copy of the government’s July status report and copies of search warrant materials from the Cohen case to be filed publicly with very limited redactions by Thursday at 11 a.m. ET. The conclusion of federal prosecutors’ investigation of the Trump company’s role in the Cohen matter marks a significant victory for the President’s family business, although it likely doesn’t come as a complete surprise.

There had been no contact between the Manhattan US Attorney’s office and officials at the Trump Organization in more than five months, CNN reported Friday. A lawyer for Trump, Jay Sekulow, said: “We are pleased that the investigation surrounding these ridiculous campaign finance allegations is now closed. We have maintained from the outset that the President never engaged in any campaign finance violation.”

I see many Chinese tourists here in Athens. And often think Beijing can’t let that trend continue, because these people can’t pay for their trips in yuan. But yes, it’s easier to start with halting the outflow of larger amounts.

• Foreign Purchases Of US Homes Plunge 36%, Chinese Flee The Market (CNBC)

Challenging conditions in the U.S. housing market, along with tighter currency controls by the Chinese government, caused a stunning drop in foreign demand for American homes. The dollar volume of homes purchased by foreign buyers from April 2018 through March 2019 dropped 36% from the previous year, according to the National Association of Realtors. The decline was due to a drop in the number and average price of purchases. Foreigners bought 183,100 properties with a total value of about $77.9 billion, down from 266,800 valued at $121 billion in the previous period. They paid a median price of $280,600, which is higher than the median for all existing homebuyers ($259,600), but it was down from $290,400 the previous year.

“A confluence of many factors — slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale — contributed to the pullback of foreign buyers,” said Lawrence Yun, NAR’s chief economist. “However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.” The Chinese were the leading buyers for the seventh consecutive year, purchasing an estimated $13.4 billion worth of residential property. Yet that was a 56% decline from the previous 12 months and comparatively the biggest percentage drop of all foreign buyers. Chinese economic growth slowed to 6.3% in 2019 compared with 6.9% in 2017, when the previous buyer survey began. The Chinese government also tightened its grip on the outflow of cash to purchase foreign property.

New Zealand housing, like Australia and Vancouver, depends on the Chinese too.

• New Zealand’s Armour-Plated Housing Bubble (Hickey)

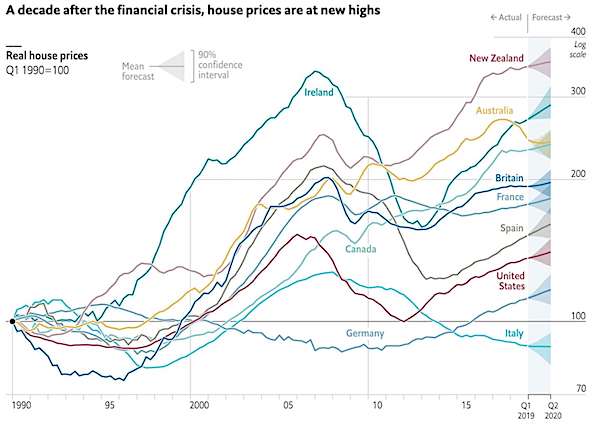

New Zealanders usually welcome the praise when overseas authorities describe us as the best in the world. This time, not so much. In the past fortnight, global economic news authorities The Economist and Bloomberg Economics have both declared New Zealand houses to be vastly over-valued relative to both rents and incomes. They describe New Zealand as in bubble territory similar to those seen in other countries before the Global Financial Crisis and vulnerable to the sort of 30-40 percent price crash seen in the likes of Ireland and parts of the US through 2007 to 2010. The Economist’s long-running Global House Price Index was refreshed on June 27 with March quarter data for most countries and showed New Zealand top of the pops when it came to over-valuation relative to incomes and second most over-valued relative to rents behind Canada.

It found New Zealand prices in the December quarter of 2018 to be 57 percent over-valued relative to rents, just above Australia’s 42 percent overvalued in the March quarter. New Zealand was 113 percent over-valued relative to rents, just behind Canada’s 120 percent, The Economist found. New Zealand prices have more than trebled since 1990, while British and American prices are still less than double what they were 30 years ago. “On this basis, house prices appear to be on an unsustainable path in Australia, Canada and New Zealand,” The Economist wrote. “Ten years ago they reached similarly dizzying heights against rents and incomes in Spain, Ireland and some American cities, only to endure a brutal collapse,” it concluded.

[..] New Zealand’s housing market is now worth NZ$1.13 trillion, which is up by more than $1 trillion from NZ$123 billion in 1990. The increase is more than triple because there are more houses with more extras (decks/garages/rooms) added on. That’s $1 trillion in untaxed capital gains, which at the top marginal rate would have generated extra tax revenues of $330 billion, or enough to build nearly 700,000 new state houses or fund the next 14 years of New Zealand Superannuation payments. Our housing market is worth 3.9 times our GDP and more than 7.2 times the value of our stock market. For comparison sake, Australia’s housing market is worth A$6.6 trillion or 3.5 times Australia’s GDP and 3.3 times the value of its stock market. America’s housing market is worth US$33.3 trillion or 1.6 times US GDP and 1.5 times the value of the US stock market.

Governments like bubbles.

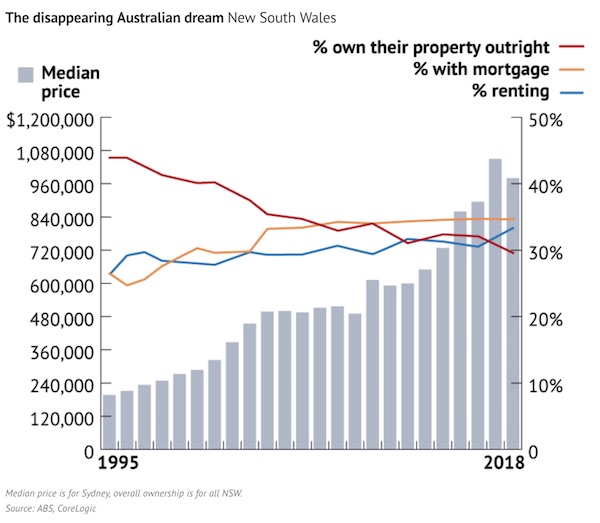

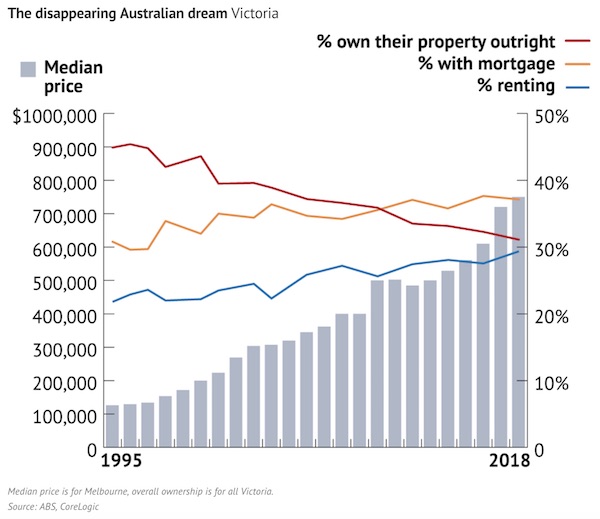

• Extraordinary Collapse In Home Ownership In Sydney And Melbourne (SMH)

The number of people owning their home outright has collapsed by a third as house prices have soared four-fold over the past two decades, leaving a growing number of older Australians shackled to mortgages as they head into retirement. In the mid-1990s, almost 44 per cent of people in NSW owned their home outright, but according to the Australian Bureau of Statistics this has now fallen to just 29.7 per cent. At the same time, the proportion of people in NSW with a mortgage has jumped by more than 30 per cent, with many of those heading towards their retirement years. The swing from ownership to mortgage has occurred over the past 20 years as the median house price in Sydney lifted by 460 per cent, even taking into account the recent market softening.

It’s a similar story in Victoria, where in the mid-1990s more than 45 per cent of people were mortgage-free, but now that figure has fallen to just 31 per cent. Victorians are among the most exposed to changing interest rates, with more than 37 per cent of people holding a mortgage. Two decades ago less than 30 per cent held a housing debt with their bank. Over the same period, the median house price in Melbourne has soared from $126,131 to $806,000. The Northern Territory has the smallest proportion of people who own their home outright, at just 17 per cent. Among the states, just 27 per cent of residents in Queensland and Western Australia enjoy life without a mortgage or rental payments.

Dalio channels Minsky: stability leads to instability. He must be aware of that.

There are always big unsustainable forces that drive the paradigm. They go on long enough for people to believe that they will never end even though they obviously must end. A classic one of those is an unsustainable rate of debt growth that supports the buying of investment assets; it drives asset prices up, which leads people to believe that borrowing and buying those investment assets is a good thing to do. But it can’t go on forever because the entities borrowing and buying those assets will run out of borrowing capacity while the debt service costs rise relative to their incomes by amounts that squeeze their cash flows. When these things happen, there is a paradigm shift.

Debtors get squeezed and credit problems emerge, so there is a retrenchment of lending and spending on goods, services, and investment assets so they go down in a self-reinforcing dynamic that looks more opposite than similar to the prior paradigm. This continues until it’s also overdone, which reverses in a certain way that I won’t digress into but is explained in my book Principles for Navigating Big Debt Crises [..] Another classic example that comes to mind is that extended periods of low volatility tend to lead to high volatility because people adapt to that low volatility, which leads them to do things (like borrow more money than they would borrow if volatility was greater) that expose them to more volatility, which prompts a self-reinforcing pickup in volatility.

There are many classic examples like this that repeat over time that I won’t get into now. Still, I want to emphasize that understanding which types of paradigms exist and how they might shift is required to consistently invest well. That is because any single approach to investing—e.g., investing in any asset class, investing via any investment style (such as value, growth, distressed), investing in anything—will experience a time when it performs so terribly that it can ruin you.

Think he means that for pension funds as well?

• Ray Dalio Says Gold Top Investment During Upcoming ‘Paradigm Shift’ (CNBC)

Hedge fund kingpin Ray Dalio is seeing a case for gold as central banks get more aggressive with policies that devalue currencies and are about to cause a “paradigm shift” in investing. Dalio, founder of the world’s largest hedge fund, wrote in a LinkedIn post that investors have been pushed into stocks and other assets that have equity-like returns. As a result, too many people are holding these types of securities and likely to face diminishing returns. “I think these are unlikely to be good real returning investments and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold,” the Bridgewater Associates leader said.

“Additionally, for reasons I will explain in the near future, most investors are underweighted in such assets, meaning that if they just wanted to have a better balanced portfolio to reduce risk, they would have more of this sort of asset. For this reason, I believe that it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio. I will soon send out an explanation of why I believe that gold is an effective portfolio diversifier.” [..] Dalio’s call comes two weeks before the Federal Reserve is expected to cut its benchmark interest rate by at least a quarter point. That move comes after a three-year cycle of raising rates from the historically accommodative near-zero levels implemented during the financial crisis.

The fresh trends are part of what he labeled a new “paradigm shift” that comes after the last one during the crisis. Investors, Dalio said, are going to need to change their mindset about what will work after the longest bull market run in Wall Street history. “In paradigm shifts, most people get caught overextended doing something overly popular and get really hurt,” he wrote. “On the other hand, if you’re astute enough to understand these shifts, you can navigate them well or at least protect yourself against them.”

“Turkey makes more than 900 parts of the F-35..”

• US Removes Turkey From F-35 Program After S-400 Purchase From Russia (R.)

The United States said on Wednesday that it was removing Turkey from the F-35 fighter jet program, a move long threatened and expected after Ankara began accepting delivery of an advanced Russian missile defense system last week. The first parts of the S-400 air defense system were flown to the Murted military air base northwest of Ankara on Friday, sealing NATO ally Turkey’s deal with Russia, which Washington had struggled for months to prevent. “The U.S. and other F-35 partners are aligned in this decision to suspend Turkey from the program and initiate the process to formally remove Turkey from the program,” Ellen Lord, the undersecretary of defense for acquisition and sustainment, told a briefing.

Turkey’s foreign ministry said the move was unfair and could affect relations between the two countries. Lord said moving the supply chain for the advanced fighter jet would cost the United States between $500 million and $600 million in non-recurring engineering costs. Turkey makes more than 900 parts of the F-35, she said, adding the supply chain would transition from Turkish to mainly U.S. factories as Turkish suppliers are removed. “Turkey will certainly and regrettably lose jobs and future economic opportunities from this decision,” Lord said. “It will no longer receive more than $9 billion in projected work share related to the F-35 over the life of the program.”

The F-35 stealth fighter jet, the most advanced aircraft in the U.S. arsenal, is used by NATO and other U.S. allies. Washington is concerned that deploying the S-400 with the F-35 would allow Russia to gain too much inside information about the aircraft’s stealth system. “The F-35 cannot coexist with a Russian intelligence collection platform that will be used to learn about its advanced capabilities,” the White House said in a statement earlier on Wednesday.

One of my greatest heroes. She does what Muhammad Ali did.

• Chelsea Manning’s Daily Fines for Grand Jury Resistance Increase to $1000 (SP)

Daily fines against Chelsea Manning for resisting a grand jury investigating WikiLeaks increased to $1000 on July 16. On May 16, Judge Anthony Trenga held Manning in civil contempt and ordered her to be sent back to the William G. Truesdale Adult Detention Center in Alexandria. The court also imposed a fine of $500 per day after 30 days, and then a fine of $1000 per day after 60 days. From June 16 to July 15, the court fined her $500/day. Those fines total $15,000. If Manning “persists in her refusal” for the next 15 months or until the grand jury’s term ends, her legal team says she will face a total amount of fines that is over $440,000. This excessive amount may violate her Eighth Amendment rights under the Constitution.

In May, Manning’s attorneys filed a motion challenging the harshness of the fines. The federal court has yet to rule on the motion or hold a hearing. The motion asserted there is no “appropriate coercive sanction” because Manning will never testify. She should be released from jail and relieved of all fines. “Ms. Manning has publicly articulated the moral basis for her refusal to comply with the grand jury subpoena, in statements to the press, in open court, and most recently, in a letter addressed to this court,” her attorneys stated. “She is suffering physically and psychologically, and is at the time of this writing in the process of losing her home as a result of her present confinement.”