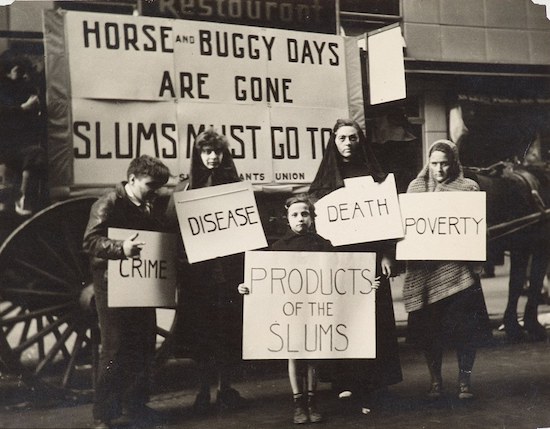

Joe Schwartz/Jewish Museum May Day Parade, New York City 1936

Neither candidate in the US presidential election has had many specifics to offer on their economic ideas and projected policies, and that may be a smart move for both. If only because none of the two has indicated any real understanding of what awaits America as per November 9. And I don’t mean where the stock markets will be tomorrow morning, or the price of gold, though short term volatility is obviously certain.

The November 7 rally on Wall Street made plenty clear where everyone’s bets are placed -on Hillary-, so much so that there’s not much of a rally left if she wins. A Trump win could well see some panic, downward pressure for the dollar and stocks, upward pressure for gold, but there’s no telling how long that would last.

It’s the medium to long term future that’s far more interesting. Because who wins makes no difference for the reality of the US economy. It’s been abysmal for years, and there are no plans available for turning that around. Government debt – across the board- and budget deficits don’t help, but they’re not the biggest deal; the US controls its own currency.

It’s private debt, consumer debt, that will offer the winner his or her poisoned chalice. With 94 million Americans not counted as part of the workforce, and untold million others in jobs that pay hardly or no living wage, with so many millions of jobs that no longer pay sufficient or even any benefits, consumer spending has nowhere to go but down.

In an economy where that spending is good for 70% of GDP -perhaps a bit less by now, a bad enough sign-, taking spending power away from people is deadly. The only way people have been able to either keep up appearances or even just make ends meet is going into debt.

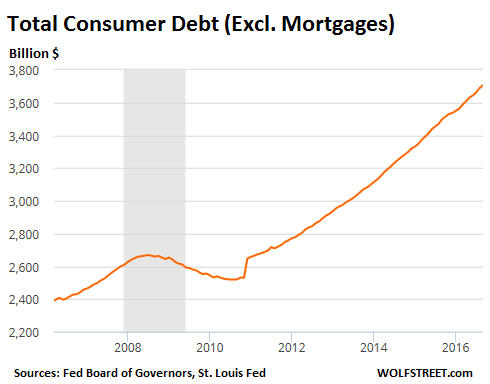

This graph from Wolf Richter shouldn’t really need any explanation, but people have been so numbed by endless repetitions of sunny skewed data that it does. Sure, mortgage debt no longer looks as bad, thanks to foreclosures, jingle mail etc. So Wolf depicts debt without mortgages.

In just 9 years, from let’s say Bear Stearns to roughly this summer, consumer debt in America has gone up more than 50% ex-mortgages. And it’s not as if it was low in 2007, quite the contrary. The graph shows us what the American economy has survived on. It’s as plain vanilla as that. It’s the only graph you need, all the rest is just decoration. And it’s every inch as scary as it looks.

There was a time when America worked for its money, for its homes, for its cars, its healthcare, for the education of its children. There was a time when America produced and sold enough to be able to afford all that. Those days are long gone. Today, the prospect is one of borrowing more money to be able to pay back what you borrowed yesterday.

If and when interest rates start to rise, either in and of themselves or because the Fed has an epiphany, all that debt will get much harder, and much more expensive, to repay. Increasingly, Americans will unceremoniously and rapidly start to fall off the back end of the truck, and one by one lower consumer spending even more.

There’s nothing a new president can do about this. There is a slight difference, granted, in that Hillary largely thinks she can let things continue as they have -but look at that graph, they cannot continue!-, while Donald Trump wants to tear up international trade deals and bring back jobs to America.

Trump’s idea look a tad wiser, but so much manufacturing infrastructure has been obliterated that there’s no telling how fast it can be rebuilt. It’ll take years, for sure. Moreover, America cannot produce most items as cheap as many other countries can, so already squeezed consumers will get squeezed even more.

It’ll have to be back all the way to Henry Ford, paying people more so they can afford what they produce. But, again, look at that graph. If Americans didn’t have that debt burden, and again that’s ex-mortgages, the ‘Ford model’ might have been more feasible. It is not now.

Either of the candidates would have had to base their campaigns on a story of ‘we need to take a few steps back in order to do better later’, and that’s still a politically deadly message in today’s realm of eternal growth, fictional as it may be. People will vote for the better promise, not for the more realistic one. After all, how can they tell? It’s not as if the media will enlighten them.

There’s only one set of possible circumstances under which people will even just accept the ‘few steps back’ idea, and that’s wartime. Which is exactly what Hillary seems to be going for, judging from her neverending anti-Russia, anti-Putin and anti-Assad ‘utterances’ that look very hard to step back from. Maybe she understands America’s economic predicament better than I think?!

I like Wikipedia’s definition of a Pyrrhic victory, couldn’t hardly have put it better myself: “A Pyrrhic victory is a victory that inflicts such a devastating toll on the victor that it is tantamount to defeat. Someone who wins a Pyrrhic victory has been victorious in some way. However, the heavy toll negates any sense of achievement or profit.”

That sounds about right. I just have the idea that Hillary would enjoy it a bit more, and more blindly, than the Donald would. But it wouldn’t make much difference regardless. Obama’s had the luck that he’s been able to hide the economic downfall on his watch behind a $10+ trillion increase in the Fed balance sheet and a multiple trillion, 50% increase in household debt.

The next president won’t have any such gift thrown into their laps. The new president will have to empty the poisoned chalice.

Imagine being -almost- 70 years old, well-off, and still wanting that job. What’s that make a body? In urgent need of a lifetime of therapy? Mariana Trench-deep unhappy?

And on top of that both candidates already know close to half the country hates their guts to begin with.

Remember, not even Socrates could beat the poisoned chalice.