DPC Gotham Grows Up 1913

Of course I’ve been following oil prices too, on top of all the other topics. The economics of oil has become amusing, in that it raises a lot of questions. First of all, obviously, why are prices falling as much as they are? In the financial world, people are prone to thinking that the price of everything moves up or down due to what goes on in the markets. That traders decide what shines and what doesn’t, be it stocks, bonds or commodities. Me, I haven’t thought that for a long time.

If central banks, the Fed first and foremost, buy bonds and stocks in order to manipulate their prices, and they ‘set’ interest rates as well, I just don’t see any reason to presume they would leave gold and silver and oil alone. That still leaves plenty of questions though. Apparently, someone up there wants low oil prices the same way they want low interest rates. But why, and why now?

The Saudis first announced they would cut production, but recently they’ve said they’d cut prices instead. Saudis also reported a budget deficit a few weeks ago (imagine that, they spend more than they earn!). And it wouldn’t be the first time the US and Saudi Arabia have struck a deal on oil production numbers and prices with political goals in mind.

Stemming the flow of income for IS would seem to be an option. But they sell their oil at a huge discount (50-70%?!) to world prices already, so they wouldn’t be hit terribly hard. On a side note, going after the middle men who buy and sell IS oil would be much more effective than the more or less random bombing we see today. We might want to wonder why this doesn’t happen a lot more, and a lot more out in the open. The CIA doesn’t make enough from the poppy trade yet?

Hurting Russia might be a valid reason. No doubt, lots of pretend smart folks in Washington have come up with the notion. Only, is it really all that smart? Far as I can see, if you want to lower prices to a level where Moscow starts to hurt, you laos risk making large swaths of the domestic US shale industry unprofitable. And that industry is already bleeding – borrowed to boot – money left right and center.

Moreover, the pressure to lift the ban on US exports keeps growing. Exports into a world market that operates on price levels potential US exporters can hardly make a living with. Sure, the conventional producers feel crowded out by shale, but how can that be a reason to start selling at a – potential – loss elsewhere?

Talking about conventional producers, aka Big Oil, they’ve already been hit by plummeting stock values. Based to a large extent on dwindling reserves. And huge capital investments in ever riskier, more expensive and in essence simply highly questionable projects.

Which they engage in anyway because it’s all they have left. Against which backdrop, I’ll repeat myself here, shale enthusiasts should ask themselves why Big Oil has sold off, or simply closed down, so many shale plays recently. Another repeat: shale is a money play, not an energy one. There’s simply not nearly enough there there.

But let’s get back to the drop in oil prices, and the reason why. Not that it’s disconnected from shale, not at all, but there are other forces at work as well. Let’s run through a bunch of quotes from a Telegraph piece today, to see how the main press views the situation:

World On The Brink Of Oil War As OPEC Bickers Over Price

A sudden slump in the price of crude has exposed deep divisions within the Organisation of Petroleum Exporting Countries (Opec) ahead of its final scheduled meeting of the year next month to decide on how much oil to pump. Some members, led by Iran, have called for immediate action to stem the drop in oil prices [..] Brent has tumbled 20% in the last three months after touching $115 per barrel in June. [..] Shale oil [..] can cost up to $80 per barrel to produce [..] However, at current price levels many of these new so called “tight oil” wells are approaching the point when they will soon become unprofitable.

In a declining global economy, and like it or not, that’s what we’re in, organizations such as OPEC, but also the EU, cannot but break apart. There is not enough reason to stick together, and there are lots of reasons not to. I wrote eons ago that down the line, the only thing to do for many OPEC members would be to produce and sell all they can. And even then.

The Export Land Model developed by Jeffrey Brown, old friend from our Oil Drum days, and Sam Foucher, former co-Montrealer, states that oil producing nations will – tend to – require an ever larger portion of their production for domestic use. Their populations grow very fast, and so does the lifestyle of all these extra people. There’s a reason Saudi Arabia reported that deficit.

Besides, every nation in this shrinking global economy will have trouble to make ends meet. That goes for OPEC members even more than for others, because oil is often the only profitable industry they have. The only possible option is cats in a sack: compete till death. And I’m sorry for using that metaphor, some of my best friends are cats. This will happen in the EU too down the line: from cooperation to competition, driven by sheer necessity and desperation.

By the way, the article says “Shale oil [..] can cost up to $80 per barrel to produce”, but I have zero doubt that the vast majority of shale oil costs far more per barrel. Just depends what you include in your accounting. So the next line, … at current price levels many of these new so called “tight oil” wells are approaching the point when they will soon become unprofitable, is I think complete bogus. There’s no way they’re not already bleeding money faster than the greater fish in the casino.

[..] falling oil prices are also a double-edged sword for Britain’s economy and investors [..] prices are approaching the point when many of the developments planned offshore west of Shetland by international oil companies could be placed on ice. A sharp drop-off in domestic oil production and associated tax receipts from the North Sea would give Mr Osborne an unwelcome hole to fill in the government’s public finances [..] However, falling oil prices will help to keep inflation low.

This is pure fun: every economy in the world is trying, in vain, to boost inflation, but Britain wants it lowered. It does touch on a major point, though: all the investments and projects, whether new or existing, that will be cancelled due to lower prices. AN industry that defeats itself, you got to love it.

All eyes are now firmly focused on the next move by Opec, which controls 60% of the world’s oil reserves and about a third of daily physical supply. [..] Opec states have largely managed to maintain cohesion over the last decade as prices over $100 per barrel have enriched their economies and encouraged adherence to quotas. This consensus is now starting to break down [..]

There is no cohesion when everybody does the cats in a sack thing. Not in OPEC, not in the EU, not in any of these organizations founded in times of plenty. You name them: World Bank, IMF, UN, they’ll all start breaking down. Which in most cases is not a bad thing. They all acquire power they should never have been allowed to. Question of democracy.

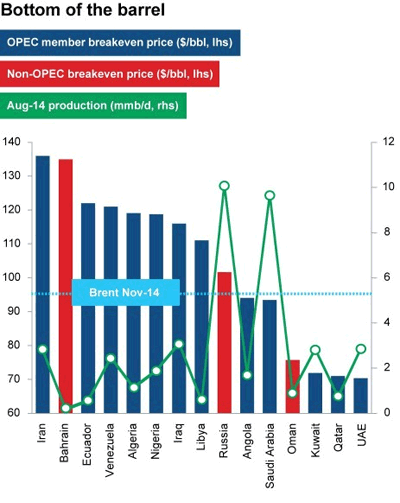

Then, using data from Reuters, IEA, Deutsche and Bloomberg, the Telegraph produces this graph, which is very interesting even if it leaves a few questions. Like: how reliable are the data, especially knowing some are from the IEA? And: what does the Nov 14 in the middle of the graph stand for? Contracts for future delivery? We’ll have to assume so. Let’s just say it’s about the trends, more than the precise numbers. For comparison, Brent is at $92.31 right now, having lost another 1.19% on Friday. The American WTI standard is at $89.74, a loss of 1.4%.

Would you look at that: Iran and Bahrain need $135 per barrel, Ecuador, Venezuela, Algeria, Nigeria, Iraq, Libya need between $110 and $120 and Russia needs $100. Angola and Saudi Arabia are just about – but only just – scraping by, and only Oman, Kuwait, Qatar and UAE are sitting pretty.

And the Saudis volunteer to lower prices rather than cut production? Politics. Just imagine the amount of money Iran is losing at these levels. I’m less sure about Russia, given that these are western made data, but Putin’s not in a comfy spot, certainly not as the biggest producer of them all. Again, I can’t verify the numbers, I treat them merely as trends, but that should be enough to provide an idea of what is happening in oil.

Yes, there is less demand, China has been overstating its numbers for a long time now, and it’s not buying what those false numbers would seem to imply. But what’s more important, I think, is the amounts of money borrowed to produce, and keep producing, based on the overly positive numbers from not just China, but also Europe, Japan and the US. Everything’s been built on lofty growth ‘expectations’, and there is no growth.

Iran has the highest fiscal break-even price for its budget at over $130 per barrel of Brent, compared with the UAE at around $70 per barrel and Saudi Arabia at about $90. However, the Gulf’s Arab states are all sitting on huge cash piles that are held overseas through sovereign wealth funds and foreign currency assets that can be drawn upon to help them weather any short-term drop in oil export revenues.

But are we talking short-term drops? Ironically, the current prices (and remember, oil was at $40 in 2008) are set to cause such mayhem in production and investment that prices must go up again no matter what the economy does.

Iran, possibly supported by Iraq, will push hard for a change in Opec’s production targets at the meeting and a cut to its overall output by 500,000 barrels per day (bpd) from the 30m bpd limit that it currently sets for members. [..] Saudi Arabia’s influential oil minister, Ali Naimi, who has so far dismissed calls for an emergency meeting to be held ahead of November. Nevertheless, the kingdom has taken the precaution of trimming its own output and reducing the price of crude it offers to customers in Asia in an apparent move to defend its market share.

It’s easy to see, from the graph, why Iran would be up in arms – so to speak, for now -. Why the Saudis cut their prices is less obvious. Trying to finish off a handful fellow OPEC members who are already drowning? Aiding Washington vs Moscow? Revenge on North Dakota?

According to Opec figures, Saudi Arabia cut its output over the summer by more than 400,000 bpd to 9.6m bpd.

How reliable are OPEC numbers? Are those just the ones members themselves report? Saudi Arabia has a deficit, AND they cut prices, AND they cut production? I can’t say I’ve figured out either the real actions, or the reasons behind them, but that doesn’t make any sense as a stand-alone set of facts. So why do they do it, if they do, if these things are accurate? We’ve yet to find out.

Saudi enjoys some of the lowest production costs, excluding capital expenditure on new projects, in the region of $2 per barrel, giving it a large margin to soak up a sudden drop-off in price. This compares with estimated production costs in the North Sea which are in the region of $50 per barrel, according to Oil & Gas UK figures.

The graph puts Saudi production costs at $90 per barrel, and the Telegraph, which published the graph, puts it at $2? Please explain, guys. Is that $88 per barrel in “capital expenditure on new projects”?

An end to Tehran’s economic isolation could trigger the opening up of its oil industry to foreign investment, a move that would bring more crude onto an already flooded market. Iran is currently producing around 3m bpd of crude but it is thought with access to Western technology this figure could be easily doubled.

Wouldn’t that be lovely in the current market? Might as well shut down shale altogether?!

Combined with Iraq, which aims to eventually increase production capacity to as much as 9m bpd by the end of the decade, both countries could challenge the current dominant position of Saudi Arabia and the Arab Gulf states within Opec. The looming issue of global over-capacity has been further complicated by the sudden return to the market of light, sweet Libyan crude.

Yay, more added goodies.

Fracking has helped the US achieve its highest oil production levels since 1986 over the last two months at a rate of 8.5m bpd. The threat of a full lifting of the ban on exports has also helped the US to drive down the price and potentially cripple the Russian economy. Moscow is largely dependent on crude sales for foreign currency earnings and oil trading at around $80 per barrel for a period of months could bring the country to its knees.

Something tells me that Putin is far more aware of the reality of the shale industry than Americans are. Which is that shale oil has a present, but no future.

[..] if Opec fails to cut production in response to the current trend in falling oil prices then around 9% of US “tight oil” output would be immediately rendered uneconomic at a level of $90 per barrel. This figure would rise to 39% should prices slump as low as $80 per barrel.

Again, I don’t belive this for a second. It may be true is you exclude capital costs, but what if you include them, as in normal accounting, and what happens when interest rates rise, in an industry that’s borrowed itself up to its infinity and beyond?

Cute article, nice try, but in the end it leaves far too many questions.

Speaking of which, where do Shell and Exxon stand in all this? What are their breakeven prices across the board? Exxon and Rosneft announced a first Arctic well this week, but at what price can it produce? Does Big Oil have a future? Does OPEC have one? In both cases, I’m in the not-at-all-sure camp. Or maybe there’s no such camp, but then I hereby started it.

Saw a piece of news flash by today about a Dutch report that states their planned offshore wind parks would cost Holland billions of additional dollars every year, not save them. That’s a lot of extra costs for a small economy that’s already broke (they don’t now that yet, but they will, just like all the rest).

So what is the future of oil? There are too many questions out there to answer that question, but what seems clear is that this future, no matter what it will be, is going to be nothing like what we were told it would be.

The same goes for the future of energy in general, and the way our societies utilize it, given that large scale wind power cannot deliver on its promises, in economies which themselves can’t deliver on their promises either.

Number 1: our economic situation is much worse than we care to admit, edged on by politicians and media. Number 2: there isn’t nearly as much oil and gas as we are led to believe. Number 3: wind and solar are things our – soon to be – impoverished economies won’t be able to afford.

That is to say: not on a centralized scale. In smaller units, we may be able to make things happen. It’s a bit of a guess, but given that big, centralized and globalized units are hitting a brick wall all over, it may well be all we have left. That or the deluge.

The oil industry runs on the same fumes as the housing industry: credit. Saudi Arabia has a deficit, and US shale adds a fortune in debt every day as it plays the pig and lipstick. Who needs profits when you can borrow all you need?