Wyland Stanley “J.A. Herzog Pontiac, 17th & Valencia Sts., San Francisco.” 1936

As I said on election day in America is The Poisoned Chalice.

• Trump’s Unhappy Fate: A Financial Crisis Far Worse Than The Last (Rickards)

As earthquake doesn’t care if you’re progressive or populist. It destroys your house all the same. Likewise a financial crisis is indifferent to a politician’s policy mix. Systemic crises proceed according to their own dynamic based on the array of agents in a system, and systemic scale. The tempo of recent crises in 1994, 1998, and 2008 says a crisis is likely soon. A new global financial panic will be one legacy of the Trump administration. It won’t be Trump’s fault, merely his misfortune. The equilibrium and value-at-risk models used by banks will not foresee the new panic. Those models are junk science relying as they do on notions of efficient markets, normally distributed risk, continuous liquidity, and a future that resembles the past. None of those hypotheses match reality.

Advances in behavioural psychology have demolished the idea of efficient markets. Data shows the degree distribution of risk is a power curve not a normal bell curve. Liquidity evaporates when most needed. Prices gap down; they do not move continuously. Each of the 1994, 1998, and 2008 crises was worse than the one before, and required more drastic intervention. The future does not resemble the past; it keeps getting worse. The standard models are in ruins. Recent model improvements that take into account so-called tail risk still fail to come to grips with systemic scale. The most catastrophic event possible in a complex system is an exponential function of scale. In plain language, if you double system size, you do not double risk; you increase it by a factor of five or more.

Since 2008, the largest banks in the world are larger in terms of gross assets, share of total deposits, and notional value of derivatives. Everything that was too-big-to-fail in 2008 is bigger and exponentially more dangerous today. The living wills and resolution authority of Dodd-Frank are entrances to gated communities. They seem imposing, but are a façade. They will do nothing to stop an angry mob. Increases in regulatory capital will not suffice. When a leveraged financial institution faces a liquidity panic, no amount of capital is enough. As boxing legend Mike Tyson mused, no plan survives the first punch in the face.

[..] What snowflake could precipitate the next financial panic? Deutsche Bank is an obvious candidate. Less obvious is a failure to deliver physical gold by a London bullion bank. That would expose the hyper-leveraged “paper gold” market for what it is. A natural disaster on the scale of Fukushima would do as well. Looming over these catalysts is a global dollar shortage, which has been limned by economists Claudio Borio and Hyun Song Shin at the Bank for International Settlements. The strong dollar could precipitate a wave of defaults on $9 trillion of dollar-denominated emerging markets corporate debt. Those defaults would make the 1994 Tequila Crisis look tame.

The 2008 crisis was truncated with tens of trillions of dollars of currency swaps, money printing, and rate cuts coordinated by central banks around the world. The next crisis will be beyond the scope of central banks to contain because they have failed to normalise either interest rates or their balance sheets since 2008. Central banks will be unable to pull another rabbit out of the hat; they are out of rabbits.

Trump vs special interests. Why jump to conclusions?

• Trump’s Appointments (Paul Craig Roberts)

We do not know what the appointments mean except, as Trump discovered once he confronted the task of forming a government, that there is no one but insiders to appoint. For the most part that is correct. Outsiders are a poor match for insiders who tend to eat them alive. Ronald Reagan’s California crew were a poor match for George H.W. Bush’s insiders. The Reagan part of the government had a hell of a time delivering results that Reagan wanted. Another limit on a president’s ability to form a government is Senate confirmation of presidential appointees. Whereas Congress is in Republican hands, Congress remains in the hands of special interests who will protect their agendas from hostile potential appointees. Therefore, although Trump does not face partisan opposition from Congress, he faces the power of special interests that fund congressional political campaigns.

[..] With Trump under heavy attack prior to his inauguration, he cannot afford drawn out confirmation fights and defeats. Does Trump’s choice of Steve Mnuchin as Treasury Secretary mean that Goldman Sachs will again be in charge of US economic policy? Possibly, but we do not know. We will have to wait and see. Mnuchin left Goldman Sachs 14 years ago. He has been making movies in Hollywood and started his own investment firm. Many people have worked for Goldman Sachs and the New York Banks who have become devastating critics of the banks. Read Nomi Prins’ books and visit Pam Martens website, Wall Street on Parade. My sometimes coauthor Dave Kranzler is a former Wall Streeter. Commentators are jumping to conclusions based on appointees past associations. Mnuchin was an early Trump supporter and chairman of Trump’s finance campaign.

He has Wall Street and investment experience. He should be an easy confirmation. For a president-elect under attack this is important. Will Mnuchin suppport Trump’s goal of bringing middle class jobs back to America? Is Trump himself sincere? We do not know. What we do know is that Trump attacked the fake “free trade” agreements that have stripped America of middle class jobs just as did Pat Buchanan and Ross Perot. We know that the Clintons made their fortune as agents of the 1%, the only ones who have profited from the offshoring of American jobs. Trump’s fortune is not based on jobs offshoring. Not every billionaire is an oligarch. Trump’s relation to the financial sector is one as a debtor. No doubt Trump and the banks have had unsatisfactory relationships. And Trump says he is a person who enjoys revenge.

Not the Jill Stein petition. More the Soros one.

• Petition To Reverse US Election Result Becomes Most Popular In History (Ind.)

A petition asking for the result of the US election to be reversed is now the most popular in the history of Change.org. The signatories – who total 4.6 million people – call on the Electoral College to stop Donald Trump from being President, which is a theoretically possible but never-before-attempted way of altering the result of the US election. Hillary Clinton won millions more votes than Donald Trump, but Mr Trump became President-elect because of the voting system. The petition is titled “Make Hillary Clinton President” and argues that because Ms Clinton won the popular vote she should be made President. It also argues that the President-elect is “unfit to serve”. With 4.6 million signatures, the petition has over two million more votes than the second largest campaign on the website. That was a campaign asking for the Yulin Dog Meat Festival to be shut down, which was begun three years ago.

The petition against Mr Trump was begun just after the election on 10 November. It was started by social worker Daniel Brezenoff. Signatures to the petition are based on the idea that it is still possible for the result of the election to be reversed. The Electoral College system requires that representatives of each state cast ballots to decide who will actually become the new President – those members of the college are supposed to vote for whoever won their state, but could theoretically change their mind. “On December 19, the Electors of the Electoral College will cast their ballots,” the petition writes. “If they all vote the way their states voted, Donald Trump will win. However, in 14 of the states in Trump’s column, they can vote for Hillary Clinton without any legal penalty if they choose.”

Since the petition has started, some legal proceedings have been launched to test the legal penalty in those other states. There has never really been any need to enforce them, since faithless electors make up only a tiny number of people, but activists are looking to encourage more people not to vote this year. The petition itself argues that the Electoral College should change its mind because of the results of the popular vote. “Hillary won the popular vote,” the description reads. “The only reason Trump “won” is because of the Electoral College.

But wait, there’s more…

• Jill Stein Supporters Drop Pennsylvania Recount Suit (WSJ)

Supporters of Green Party presidential candidate Jill Stein on Saturday withdrew a last-ditch lawsuit in Pennsylvania state court aimed at forcing a statewide ballot recount, another major setback in the effort to verify the votes in three states that provided President-elect Donald Trump his margin of victory. Ms. Stein’s campaign announced in a statement Saturday that the Pennsylvania lawsuit had been dropped after the court demanded that a $1 million bond be posted by the 100 Pennsylvania residents who brought the suit, which was backed by the campaign. Recounts will still proceed in a handful of Pennsylvania precincts, but it is far from the statewide recount that Ms. Stein initially was hoping for.

She is also pushing recounts in Wisconsin and Michigan after a prominent computer scientist laid out a case that the election results may have been hacked. Legal challenges have also been filed in state and federal court to halt those recount efforts as well. The decision also dashes the aspirations of some Democrats, who had hoped that enough irregularities or missing votes would be found across all three states to overturn the election results that saw Mr. Trump, the Republican candidate, prevail over Democrat Hillary Clinton. Mrs. Clinton would need to declared the winner in all three states to reverse the election results.

“The judge’s outrageous demand that voters pay such an exorbitant figure is a shameful, unacceptable barrier to democratic participation,” said Ms. Stein in the statement. “This is yet another sign that Pennsylvania’s antiquated election law is stacked against voters. By demanding a $1 million bond from voters yesterday, the court made clear it has no interest in giving a fair hearing to these voters’ legitimate concerns over the accuracy, security and fairness of an election tainted by suspicion.”

…. straight to federal court.

• Jill Stein To Pursue Pennsylvania Recount Petition In Federal Court (R.)

Green Party candidate Jill Stein late Saturday vowed to bring her fight for a recount of votes cast in Pennsylvania in the U.S. presidential election to federal court, after a state judge ordered her campaign to post a $1 million bond. “The Stein campaign will continue to fight for a statewide recount in Pennsylvania,” Jonathan Abady, lead counsel to Stein’s recount efforts, said in a statement. Saying it has become clear that “the state court system is so ill-equipped to address this problem,” the statement said “we must seek federal court intervention.” The Stein campaign said it will file for emergency relief in the Pennsylvania effort in federal court on Monday, “demanding a statewide recount on constitutional grounds.”

The bond was set by the Commonwealth Court of Pennsylvania a day after representatives of President-elect Donald Trump requested a $10 million bond, according to court papers. The court gave the petitioners until 5 p.m. local time on Monday to post the bond, but said it could modify the amount if shown good cause. Instead, Stein’s campaign withdrew. “Petitioners are regular citizens of ordinary means. They cannot afford to post the $1,000,000 bond required by the court,” wrote attorney Lawrence Otter, informing the court of the decision to withdraw.

“The last time OPEC set a quota, members exceeded it for 20 of the 24 months before the cap was scrapped..”

• Brent Caps Biggest Weekly Advance Since 2009 on OPEC Agreement (BBG)

Brent oil capped its biggest weekly gain since 2009 after OPEC approved its first supply cut in eight years, with attention now shifting to compliance with the deal and how other producers will react to a price rally. Futures closed at the highest in more than a year in London and New York. OPEC’s three largest producers – Saudi Arabia, Iraq and Iran – overcame discord to reach Wednesday’s pact to reduce the group’s output by 1.2 million barrels a day, while Russia pledged a cut of as much as 300,000. The accord ended the group’s pump-at-will policy started in 2014 aimed at protecting market share and driving out high-cost competitors such as shale. “Everyone wins, but U.S. shale producers are the big winners from the OPEC deal,” Francisco Blanch at Bank of America said.

“The agreement made sense purely on economic logic. OPEC wanted to end the price war.” OPEC set a collective output target at the lower end of the range outlined two months ago in Algiers, boosting prices and prompting predictions of a possible advance to $60 a barrel from Goldman Sachs and Morgan Stanley. Some analysts warned that the rally may encourage higher output from producers outside the group, including in the U.S. The last time OPEC set a quota, members exceeded it for 20 of the 24 months before the cap was scrapped at the end of 2015.

Two of the finest in a long conversation. Here’s a tiny snippet of Hudson talking.

• Steve Keen, Michael Hudson Unpick Historical Path to Global Recovery (MH)

Killing the Host will be published in German at the end of the month of November, and, basically, it’s a more popular version of The Bubble and Beyond. And it shows that when the financial sector takes over, it’s very much like a parasite in nature. And people think of parasites simply as taking the life blood of the host and draining the energy. But in order to do that, the parasite has to have an enzyme to take over the host’s brain. And the key thing in nature is they take over the brain, and they convince the host that the free luncher is actually part of the host’s own body, and even its baby to be protected. And that’s what the financial sector has done.

Classical economics was all about separating the rent-extracting sectors – landlords, monopolies, and finance – from the rest of the economy. And that was unearned income. It wasn’t necessary. And the whole idea of classical economics from Quesnay’s Tableau Economique to all the way through Adam Smith and John Stuart Mill was to look at the finance sector and the landlord sector and monopolies as unnecessary. You’re going to get rid of them. You’re going to tax away all the land’s rent or else nationalize the land. And you are going to have public enterprises as basic infrastructure so that they couldn’t be monopolized. Well, you had a revolution against classical economics in the 1890s and 1900s, and the national income now – accounts make it appear as if the financial sector and the real estate sector and the monopolies – oil and gas – are all contributing to GDP.

So a few months ago, you had the head of Goldman Sachs – Lloyd Blankfein – say, the Goldman Sachs managers are the most productive workers in the United States, because we make $22 million a year in salary, and we get bonuses. And that’s all considered as contributing to GDP. That’s the financial services that we’re providing $22 million per manager of financial services. Now what they don’t realize is that this $22 million per manager in that Goldman Sachs extracts money from the rest of the economy. It’s a zero-sum game. And instead of adding to the GDP, you should have – A subtraction. Yes, you should have – all of this is overhead – unnecessary. And since 2008, the 99% of the population in America, and I think in most of Europe, too, have seen their incomes go down. But the 1% have had their financial and real estate incomes go up so much more that there is an illusion of growth. And what’s been growing is the tumor, not the actual economic body.

Italian debt is a threat to the entire eurozone, not just Greece.

• The Italian Trouble for Greek Debt (BBG)

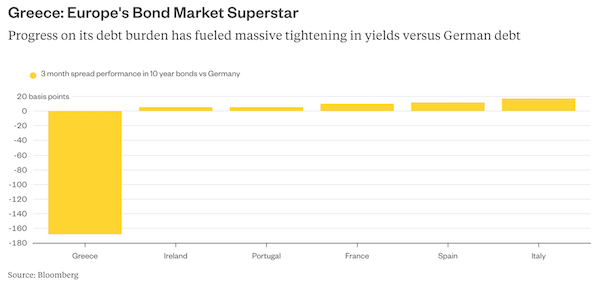

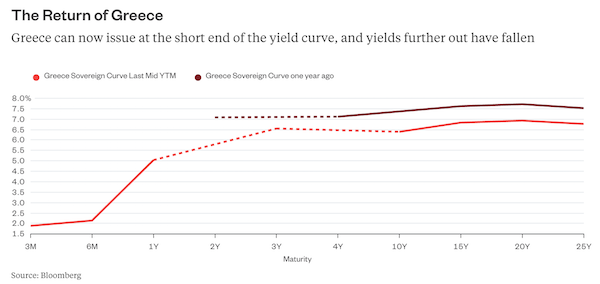

If the fallout for Sunday’s Italian referendum is bad for Italian bonds, it could well be worse for one of Europe’s star performers this year: Greece.Greek debt has tightened massively to German bonds in the past three months, while all other main European government securities have been widening. Growing confidence in Greek Prime Minister Alexis Tsipras’s willingness to conform to the Troika requirements on the latest bailout package, is behind this.

The pot of gold at the end of the rainbow would be inclusion into the ECB’s bond purchase program – Greece has long been excluded since it’s not rated investment grade. A shift in the rules would be a reward for budget discipline.This has looked until recently like a long shot, but a tectonic shift in attitude is underway. A recent piece of evidence for this is a remark from ECB policy maker Benoit Couere on Tuesday. He said that Greece can maintain a 3.5% primary budget surplus to GDP for years after the current bailout ends in 2018 – that is a major vote of confidence. Such recent Greek outperformance could easily unwind on a “no” vote on Italian constitutional reform. As Gadfly has argued, that could create serious problems not just for Italy, the world’s third-largest debtor, but also for other borrowers in the region.

It’s all the US have done for decades.

• Will 2017 See End Of US Neocons’ Promotion Of Chaos Theory? (RT)

Trump will hopefully be an assertive defender of US interests rather than an assertive meddler, says Oxford Crisis Research Institute Director Mark Almond.

RT: What obstacles remain preventing the UN from sending aid to Aleppo? Mark Almond: Obviously, there is still an area controlled by the rebels where there is fighting, and the rebels have not always been terribly concerned about discriminating between their enemies and aid workers. But it is quite bizarre that now, as you actually have people, tens of thousands of people, who are finally accessible, that the UN agencies are not actually rushing to help. Because, after all, these are people who are in need, and the weather is very bad in addition to all the suffering caused by the violence.

But I think we have to, I’m afraid, accept the fact that the UN is not composed of people from outside the normal world of politics – after all, the head of its aid agency is a former British conservative MP, [UN Special Envoy for Syria’s Senior Adviser] Jan Egeland is a Norwegian political activist who has been for a long time very critical of Russia. So, we are talking of people who do have a political past, even if they are now presented as being somehow the representatives of global charity or global concern. But I am afraid they are politicians.

RT: Do you think the standoff in Aleppo will continue for much longer? Despite major gains by the Syrian Army, the rebels are reportedly refusing to surrender. Mark Almond: I think the remaining rebel forces are in a very difficult position, so unless something changes through some external intervention which would widen the wall and would be a very dangerous development. And I don’t see the US, either doing it itself or, for that matter, encouraging any of its friends to do it, like Turkey or Saudi Arabia, neither of which, I think, really has the stomach for such a fight. So, the likelihood is that the horrible conflict in Aleppo itself is grinding towards a conclusion. And that may also mean that in 2017 we can look towards trying to repair the international situation around Syria.

The new president of the US has said that he is much more prepared to offer realpolitik rather than an ideologically driven agenda to produce regime change [that], if necessary, [says]… “if we can’t have regime change, at least we can have chaos and, perhaps, out of that chaos, something good will come.” I think we’ve seen, really, over the last 25 years, from the chaos we helped produce in Afghanistan through to Syria today, that the chaos theory that the neocons in Washington have promoted has actually bitten back. We’ve seen terrorist attacks in Western Europe, we’ve seen [them] in the US. I think Trump recognizes that even though he is going to be a very assertive defender of American interests, he is not going to be an assertive meddler. And that does offer some hope.

Friedman’s easy fodder.

• Late Is Enough: On Thomas Friedman’s New Book (Matt Taibbi)

“The folksiness will irk some critics … But criticizing Friedman for humanizing and boiling down big topics is like complaining that Mick Jagger used sex to sell songs: It is what he does well.” –John Micklethwait, review of Thank You for Being Late, in The New York Times With apologies to Mr. Micklethwait, the hands that typed these lines implying Thomas Friedman is a Mick Jagger of letters should be chopped off and mailed to the singer’s doorstep in penance. Mick Jagger could excite the world in one note, while Thomas Friedman needs 461 pages to say, “Shit happens.” Joan of Arc and Charles Manson had more in common. Thomas Friedman was once a man of great influence. His columns were must-reads for every senator and congressperson.

He helped spread the globalization gospel and push us into war in Iraq. But he’s destined now to be more famous as a literary figure. No modern writer has been lampooned more. Hundreds if not thousands of man-hours have been spent teaching robots to produce automated Friedman-prose, in what collectively is a half-vicious, half-loving tribute to a man who raised bad writing to the level of an art form. We will remember Friedman for interviewing 76% of the world’s taxi drivers, for predicting “the next six months will be critical” on 14 occasions over two and a half years (birthing the neologism, “the Friedman unit”), and for his unmatched, God-given ability to write nonsensical metaphors, like his classic “rule of holes”: “When you’re in one, stop digging. When you’re in three, bring a lot of shovels.”

Friedman’s great anti-gift is his ability to use many words when only a few are necessary. He became famous as a newspaper columnist for taking simple one-sentence observations like, “Wow, everyone has a cell phone these days,” and blowing them out into furious 850-word trash-fires of mismatched imagery and circular argument. The double-axel version of this feat was to then rewrite that same column over and over again, in the same newspaper, only piling on more incongruous imagery and skewing rhetoric to further stoke that one thought into an even higher and angrier fire.