Fred Stein Times Square at Night 1947

“I think Secretary of Defense [General] James Mattis gave the president a list of options, this being the smallest…”

• Eyewitness Says Syrian Military Anticipated US Raid (ABC)

Syrian military officials appeared to anticipate Thursday’s night raid on Syria’s Shayrat airbase, evacuating personnel and moving equipment ahead of the strike, according to an eyewitness to the strike. Dozens of Tomahawk missiles struck the airbase near Homs damaging runways, towers and traffic control buildings, a local resident and human rights activist living near the airbase told ABC News via an interpreter. U.S. officals believe the plane that dropped chemical weapons on civilians in Idlib Province on Tuesday, which according to the Syrian Observatory for Human Rights killed 86 people, took off from the Shayrat airbase. The attack lasted approximately 35 minutes and its impact was felt across the city, shaking houses and sending those inside them fleeing from their windows. Both of the airport’s major runways were struck by missiles, and some of its 40 fortified bunkers were also damaged.

Local residents say the Russian military had used the airbase in early 2016 but have since withdrawn their officers, so the base is now mainly operated by Syrian and Iranian military officers. There is also a hotel near the airport where Iranian officers have been staying, though it was not clear whether it was damaged. The eyewitness believes human casualties, at least within the civilian population, were minimal, as there was no traffic heading toward the local hospital. [..] Former National Security Adviser and ABC News contributor Richard Clarke said this attack, one of the quickest displays of force by a new president in recent history, is largely “symbolic.”

Following a 2013 chemical weapons attack that killed more than 1400 people outside of Damascus which a U.S. government intelligence assessment concluded likely used a nerve agent, the Obama administration threatened retaliation but ultimately called off planned airstrikes after Assad agreed to turn over the majority of his chemical weapons arsenal to an international watchdog group. Trump has attempted to blame Obama’s “weakness” for the worsening violence in Syria. “This attack on one air base seems more symbolic,” Clarke said. “I think Secretary of Defense [General] James Mattis gave the president a list of options, this being the smallest. It was a targeted attack not designed to overwhelm the Syrian military … I think the president was trying to differentiate himself from his predecessor.”

“Tesla has never made money and never will make money. Next to Amazon, it’s the biggest Ponzi scheme in U.S. history.”

• The Biggest Stock Bubble In US History (IRD)

Please note, many will argue that the p/e ratio on the S&P 500 was higher in 1999 than it is now. However, there’s two problems with the comparison. First, when there is no “e,” price does not matter. Many of the tech stocks in the SPX in 1999 did not have any earnings and never had a chance to produce earnings because many of them went out of business. However – and I’ve been saying this for quite some time and I’m finally seeing a few others make the same assertion – if you adjust the current earnings of the companies in SPX using the GAAP accounting standards in force in 1999, the current earnings in aggregate would likely be cut at least in half. And thus, the current p/e ratio expressed in 1999 earnings terms likely would be at least as high as the p/e ratio in 1999, if not higher. (Changes to GAAP have made it easier for companies to create non-cash earnings, reclassify and capitalize expenses, stretch out depreciation and pension funding costs, etc).

We talk about the tech bubble that fomented in the late 1990’s that resulted in an 85% (roughly) decline on the NASDAQ. Currently the five highest valued stocks by market cap are tech stocks: AAPL, GOOG, MSFT, AMZN and FB. Combined, these five stocks make-up nearly 10% of the total value of the entire stock market. Money from the public poured into ETFs at record pace in February. The majority of it into S&P 500 ETFs which then have to put that money proportionately by market value into each of the S&P 500 stocks. Thus when cash pours into SPX funds like this, a large rise in the the top five stocks by market cap listed above becomes a self-fulfilling prophecy. The price rise in these stocks has nothing remotely to do with fundamentals. Take Microsoft, for example (MSFT). Last Friday the pom-poms were waving on Fox Business because MSFT hit an all-time high.

This is in spite of the fact that MSFT’s revenues dropped 8.8% from 2015 to 2016 and its gross margin plunged 13.2%. So much for fundamentals. In addition to the onslaught of retail cash moving blindly into stocks, margin debt on the NYSE hit an all-time high in February. Both the cash flow and margin debt statistics are flashing a big red warning signal, as this only occurs when the public becomes blind to risk and and bet that stocks can only go up. As I’ve said before, this is by far the most dangerous stock market in my professional lifetime (32 years, not including my high years spent reading my father’s Wall Street Journal everyday and playing penny stocks).

Perhaps the loudest bell ringing and signaling a top is the market’s valuation of Tesla. On Monday the market cap of Tesla ($49 billion) surpassed Ford’s market cap ($45 billion) despite the fact that Tesla delivered 79 thousand cars in 2016 while Ford delivered 2.6 million. “Electric Jeff” (as a good friend of mine calls Elon Musk, in reference to Jeff Bezos) was on Twitter Monday taunting short sellers. At best his behavior can be called “gauche.” Musk, similar to Bezos, is a masterful stock operator. Jordan Belfort (the “Wolf of Wall Street”) was a small-time dime store thief compared to Musk and Bezos. Tesla has never made money and never will make money. Next to Amazon, it’s the biggest Ponzi scheme in U.S. history. Without the massive tax credits given to the first 200,000 buyers of Tesla vehicles, the Company would likely be out of business by now.

And to think even without demographics pensions look screwed too, just from financial engineering and insane debt levels.

• The Unavoidable Pension Crisis (Roberts)

There is a really big crisis coming. Think about it this way. After 8 years and a 230% stock market advance the pension funds of Dallas, Chicago, and Houston are in severe trouble. But it isn’t just these municipalities that are in trouble, but also most of the public and private pensions that still operate in the country today. Currently, many pension funds, like the one in Houston, are scrambling to slightly lower return rates, issue debt, raise taxes or increase contribution limits to fill some of the gaping holes of underfunded liabilities in their plans. The hope is such measures combined with an ongoing bull market, and increased participant contributions, will heal the plans in the future. This is not likely to be the case. This problem is not something born of the last “financial crisis,” but rather the culmination of 20-plus years of financial mismanagement.

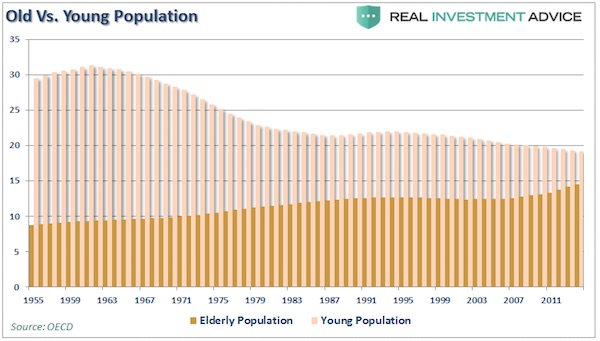

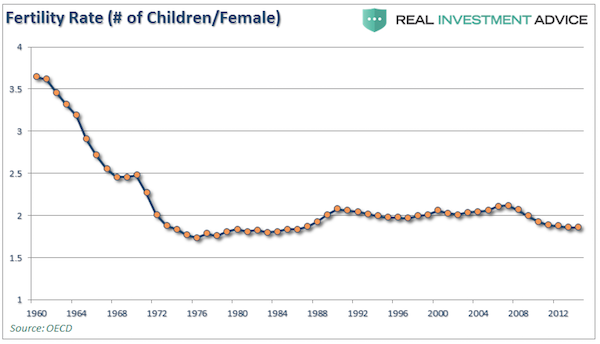

An April 2016 Moody’s analysis pegged the total 75-year unfunded liability for all state and local pension plans at $3.5 trillion. That’s the amount not covered by current fund assets, future expected contributions, and investment returns at assumed rates ranging from 3.7% to 4.1%. Another calculation from the American Enterprise Institute comes up with $5.2 trillion, presuming that long-term bond yields average 2.6%. With employee contribution requirements extremely low, averaging about 15% of payroll, the need to stretch for higher rates of return have put pensions in a precarious position and increases the underfunded status of pensions. With pension funds already wrestling with largely underfunded liabilities, the shifting demographics are further complicating funding problems.

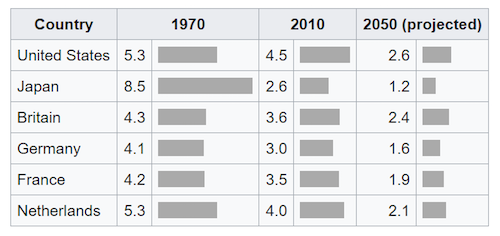

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.) However, this “support ratio” is not only declining in the U.S. but also in much of the developed world. This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate. In 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. By 1980, the support ratio dropped to 5.1 and by 2010 it was 4.1. It is projected to reach just 2.1 by 2050. The table below shows support ratios for selected countries in 1970, 2010, and projected for 2050:

Happy days!

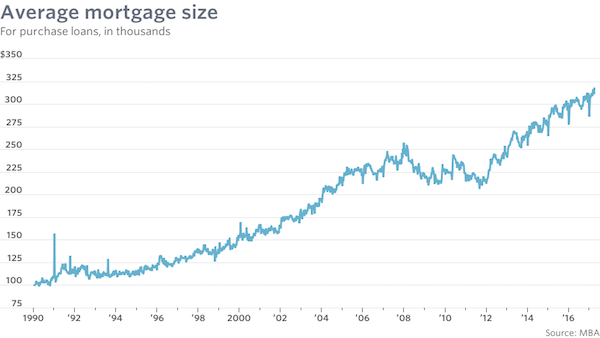

• Americans Are Taking Out The Largest Mortgages On Record (MW)

For the past few years, the housing market has been unbalanced. Strong demand and lean supply keep pushing prices higher and higher. On Wednesday, a fresh piece of data confirmed that trend. The Mortgage Bankers Association’s weekly purchase loan data showed that the average size of a home loan was the largest in the history of its survey, which goes back to 1990. Higher prices have a few different effects on the market. Buyers have to make tradeoffs on the kinds of homes they can afford, or may be shut out of ownership altogether. They may also adjust their borrowing. Larger mortgage sizes may reflect not just more expensive properties, but also more leveraged ones.

The 20% down payment is a relic: the median down payment in 2016 was 10%. For first-time buyers, it was 6%. First-timers and other buyers of less-expensive homes are more leveraged now than they were at the height of the housing bubble a decade ago. Home loan sizes aren’t the only things that have changed in the years since MBA started its survey. Back at the start of the survey, the median mortgage size was only about 3.3 times the median annual income. It’s now over five times as big – though buyers get bigger homes and lower interest rates.

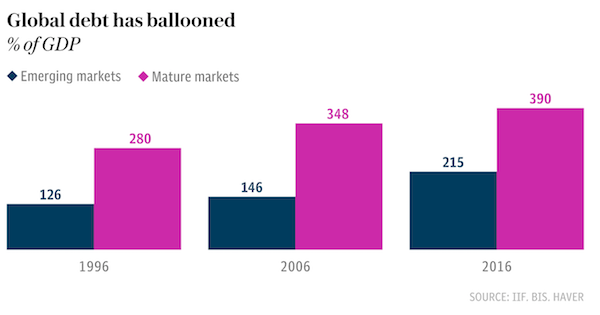

Over $70 trillion since 2008.

• Global Debt Explodes At ‘Eye-Watering’ Pace To Hit £170 Trillion (Tel.)

Global debt has climbed at an “eye-watering” pace over the past decade, soaring to a fresh high of £170 trillion last year, according to the Institute of International Finance (IIF). The IIF said total debt levels, including household, government and corporate debt, climbed by more than $70 trillion over the last 10 years to a record high of $215 trillion (£173 trillion) in 2016 – or the equivalent of 325pc of GDP. It said emerging markets posed “a growing source of concern” to financial stability and the global economy as debt burdens in these countries climb at a rapid pace. The IIF data showed the increase was partly driven by a “spectacular rise” in emerging markets, where total debt stood at $55 trillion at the end of 2016, or 215pc of total emerging market GDP.

Debt has risen from $16 trillion in 2006 and $7.4 trillion in 1996. The body, which represents the world’s top financial institutions, said a wave of maturing debt this year presented a “growing refinancing risk”. It estimates that more than $1.1 trillion of emerging market bonds and loans will mature this year, with dollar-denominated debt accounting for a fifth of all redemptions. It said China faced around $40bn of dollar-denominated redemptions this year, while Russia faced redemptions of $20bn. International bodies including the IMF and OECD have warned that rising interest rates in the US could bring an end to an emerging market corporate debt binge as companies in these countries see their debt servicing costs rise in local currency terms. “While risks associated with currency mismatches may not be as acute as during past emerging market debt crises, the overall emerging market debt burden – particularly as global interest rates head higher – is a growing source of concern,” the IIF said in a note.

Goldman is not a consumer bank. They might actually profit from this.

• Wall Street Doubts Trump Wants to Split Up Biggest US Banks (BBG)

President Donald Trump and his advisers have vowed to bring back a Depression-era law that would cleave the biggest U.S. lenders in half by separating commercial and investment banking operations. Wall Street doesn’t expect that to happen. After chief economic adviser Gary Cohn reiterated the administration’s stance toward the Glass-Steagall Act in a private meeting with lawmakers on Wednesday, analysts said they viewed any radical regulatory changes as unlikely. Shares of Bank of America and JPMorgan Chase, which would be most affected by the rule, rose Thursday after Bloomberg first reported on Cohn’s comments. Reinstating Glass-Steagall, which was created after the banking crises of the 1930s and repealed in 1999, would require a rewriting of U.S. banking rules. The Dodd-Frank Act took more than a year of work by Congress.

The Trump administration hasn’t put forward a detailed plan and the revisions proposed by House Republicans don’t involve the return of Glass-Steagall. “Anything resembling Glass-Steagall is so far from happening that it’s hard to envision,” said Ian Katz, an analyst at Capital Alpha. “It simply isn’t a priority issue in Congress.” The Republicans who control the House and the Senate want to loosen banking regulations, not make them stricter, Katz wrote. The Republican Party made restoring Glass-Steagall part of its platform, and Trump sometimes criticized the big banks during the campaign, saying “I’m not going to let Wall Street get away with murder.” Since taking office, he’s appointed Cohn and several other former Goldman Sachs bankers to top posts, and said that he’ll look to JPMorgan CEO Jamie Dimon for advice about regulatory reform.

Treasury Secretary Steven Mnuchin said during his confirmation hearing that he opposes the old Glass-Steagall, but supports a “21st Century” version. He didn’t elaborate on what he meant. “If you’ve listened to all the rhetoric on regulation, we’ve no real guidance on where we are going,” said Christopher Wheeler, an Atlantic Equities analyst in London. “The uncertainty is immense and what you have to believe is that things will continue as they are.” The regulation might not mean that commercial and investment banks have to be separated, Cowen Group analyst Jaret Seiberg wrote in a report. Instead, the government could require that broker-dealers be subsidiaries of holding companies, rather than banks, he said. That would mean that the brokerage arm would have to be separately funded. “Cohn was the most likely obstacle within the Trump White House,” Seiberg wrote. “With him supporting Glass-Steagall’s restoration, there is no one in the inner circle left to fight it.”

More uncharted territory. We tend to forget, but for 10 years now they’re grasping in the dark. They have no idea what they do, all they have to go on are outdated textbooks that were flawed to begin with. Time to audit the Fed and then close it.

• Fed’s Asset Shift To Pose New Test Of Economy’s Recovery, Resilience (R.)

The Federal Reserve’s coming decision to reduce its massive asset holdings will set off a complex dance with global investors and the U.S. Treasury as it tries to put a final end to policies used to fight the 2007 financial crisis without upending the economy along the way. It is a feat with no clear precedent, according to analysts and officials involved in the process: a central bank trying to squeeze trillions of dollars out of markets it has supported for a decade, and in the process likely pushing up the cost of home buying, corporate finance and an array of other activities. Though final decisions have not been made, the Fed may shift policy as soon as the end of this year, and over 2018 begin pulling anywhere from $20 billion to $60 billion a month out of bond markets, according to a review of current Fed asset holdings.

For several years during the crisis, the Fed added to its holdings of U.S. Treasury bonds and securities backed by home mortgages to the tune of $85 billion a month before the program was slowed. The purchases were an emergency measure made necessary because the Fed’s short-term interest rate – its primary tool to encourage people and businesses to spend and invest – had already been cut to zero. With the economy still in freefall, the asset purchases added to demand for financial securities, and are thought to have held down long-term interest rates in general, a boost to the home-building and other industries in particular. The central bank is already raising its short-term interest rate and has managed a series of increases without slowing the economy. When it starts to scale back the size of its $4.5 trillion stockpile of Treasury bonds and mortgage-backed securities – essentially reversing the purchases it made during the crisis – it will pose a stiff new test of the economy’s resilience.

This was always the plan. Use technology to strengthen democracy.

• M5S Plans To ‘Revolutionize Democracy’ With Online Voting, E-petitions (LI)

Italy’s anti-establishment Five Star Movement party plans to introduce online voting and public referendums to increase “democracy and transparency” in the country’s capital. Five Star councillors presented the draft resolution at Rome’s city hall on Monday, where it will be debated. They claimed the proposed ideas would take the city “from Mafia Capitale [the ongoing corruption scandal which has seen dozens of Rome politicians and businessmen put on trial] to direct democracy and transparency in five years”. The ideas suggested included online consultations and participatory budgeting. The latter process would give citizens more say in how Rome money is spent, and has already been introduced by Five Star-led local authorities in some areas, including Mira and Ragusa.

In a blog post, leader Beppe Grillo said that within a year, a Five Star government would introduce public petitions which can be created online and sent directly to the Italian parliament for discussion – a system which already exists in the UK, for example. “It should be the citizens and the local community who govern cities through the Internet, using collective intelligence,” said Grillo. “The web is revolutionizing the relationship between citizens and institutions making direct democracy feasible, as applied in ancient Greece.” Angelo Sturni, one of the councillors behind the proposal, said: “We also want to experiment with electronic voting in referendums, using the American model.” Discontent over widespread corruption in Rome, as revealed in the Mafia Capitale trial, was one of the main factors in Five Star candidate Virginia Raggi’s victory in mayoral elections last June.

UK, France, Germany, Holland, Belgium: merchants of death. Government sponsored murder.

• Arms Sales Becoming France’s New El Dorado, But At What Cost? (F24)

When Qatar agreed to buy 24 French Rafale fighter jets in a €6.3 billion contract at the end of April, it represented yet another major success for France’s arms industry, coming hot on the heels of further multi-billion euro sales of Rafales to Egypt and India. The deals have been hailed by Hollande and his government. According to France’s Minister of Defence Jean-Yves Le Drian, in comments made to the Journal du Dimanche newspaper Sunday, the Qatar contract brought the value of the country’s arms exports to more than €15 billion this year so far. That sum is already more than the €8.06 billion for the whole of 2014, which itself was the highest level seen since 2009 – suggesting a continued upward trajectory for the French arms trade and one that is providing a much-needed salve to the country’s economic woes.

But some of these deals have raised more than a few eyebrows, with anti-arms trade campaigners critical of France’s willingness to sell weapons to countries with less than stellar human rights records. These concerns are only set to rise when Hollande heads first to Doha on Monday and then Saudi Arabia’s capital of Riyadh the day after, where furthering the recent success of the French arms industry is likely to be one of his top priorities. Saudi Arabia has already proved a lucrative trading partner for French arms manufacturers, most recently in a deal signed in November that saw the kingdom buy $3 billion-worth (€2.7 billion) of French weapons and military equipment to supply the Lebanese army. The oil-rich country is currently on something of an arms spending spree. Last year, the Saudis surpassed India to become the world’s biggest arms importer, upping its spending by 54% to €5.8 billion, according to a report by industry analyst IHS.

France, thanks to some adept diplomatic manoeuvering in recent years, is well placed to take advantage of the Saudi cash cow. Paris has been an increasingly close ally of Riyadh ever since it was among the most vocal in backing military intervention against Syria’s President Bashar al-Assad, a key ally of Shiite Iran – one of Sunni Saudi Arabia’s main regional rivals. “You’re seeing political fractures across the region, and at the same time you’ve got oil, which allows countries to arm themselves, protect themselves and impose their will as to how they think the region should develop,” Ben Moores, author of the IHS report, told AP in March. France, of course, is not alone in striking lucrative arms deals in the region. The US remains the biggest arms exporter to the Middle East, with $8.4 billion (€7.5 billion) worth of weapon sales in 2014, while the UK and Germany are also major players.

And this is what the merchants of death leave behind.

• Guns Are The True Cause Of Hunger And Famine (G.)

Last year, the World Bank revised its position on conflict – upgrading it from being one of many drivers of suffering and poverty, to being the main driver. In Somalia, despite some political progress the conflict has put more than half the population in need of assistance, with 363,000 children suffering acute malnutrition. In north-east Nigeria, conflict with Boko Haram has left 1.8m people still displaced, farmers unable to grow crops, and 4.8 million people need food. In Yemen, an escalation in conflict since 2015 has worsened a situation already made dire by weak rule of law and governance. Now more than 14 million people need food aid. Only if we understand conflict can we understand hunger. South Sudan is another example. I worked there for two years following the signing of the comprehensive peace agreement in 2005.

Right now a place called Koch, where Mercy Corps works, is in what the famine early warning systems network calls a “level 4 emergency phase”. This means that people will start to die of hunger in a matter of months if they don’t receive enough aid. Until recent years, Koch was a thriving community with fertile land. It has been destroyed in armed clashes since conflict broke out in South Sudan in December 2013. Families have had to move time and time again and disease is rampant due to the lack of clean water. As one father of five told our team in Koch: “My house was burnt, everything was looted and I do not know how to rebuild my life.” Across the places where we work and where people are facing starvation, the pattern is the similar.

Hunger is not some freak environmental event; it is human-made, the result of a deadly mix of conflict, marginalisation and weak governance. Yet watching some of the news and the crisis appeals, one could be forgiven for thinking that what we need is another Live Aid song and airdrops of food. Red Nose Day has been criticised for portraying Africa as a place where “nothing ever grows”. A recent social media campaign to send a plane filled with food to Somalia gathered support: a noble gesture, but not a long-term solution. Mercy Corps’ own emergency response is not the long-term answer either.

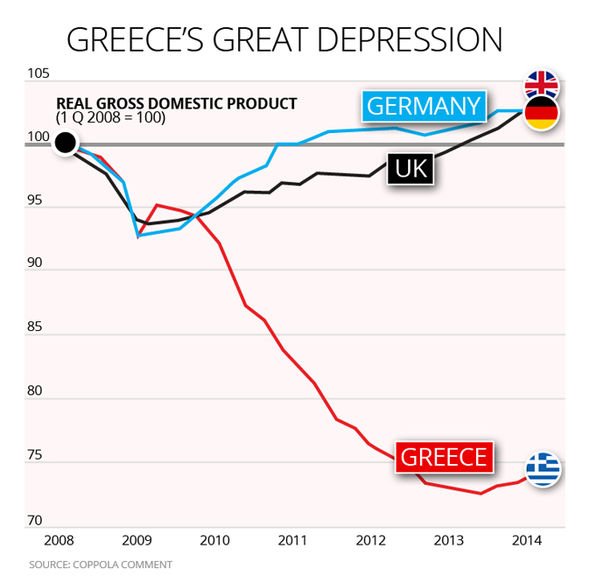

It’s easy to label something ‘theft’, but for Greeks it’s either go illegal or sit in the dark, freeze etc. Still can’t believe this is the European Union.

• Greece’s Dark Age: How Austerity Turned Off The Lights (R.)

Kostas Argyros’s unpaid electricity bills are piling up, among a mountain of debt owed to Greece’s biggest power utility. His family owe €850 to the Public Power Corporation (PPC), a tiny fraction of the state-controlled firm’s 2.6 billion euros ($2.8 billion) in unpaid bills. Argyros picks up only occasional work as an odd-job man. “When you only work once a week, what will you pay first?” said the 35-year-old, who lives in a tiny apartment in an Athens suburb with his unemployed wife and four small children. The Argyros family are emblematic of deepening poverty in Greece following seven years of austerity demanded by the country’s international creditors. They burn wood to heat their home in winter, food is cooked on a small gas stove, and hot water is scarce.

The only evening light is the blue glare of a TV screen, for fear of racking up more debt. Five-watt lightbulbs provide a dim glow and Argyros worries about the effect on their eyesight. More than 40% of Greeks are behind on their utility bills, higher than anywhere else in Europe. People in poor neighborhoods are also increasingly turning to energy fraud, meaning that the problem for PPC is much higher than the mountain of unpaid bills suggests. Power theft is costing PPC around €500-600 million a year in lost income, an industry official said, requesting anonymity because he was not authorized to divulge the numbers. Public disclosures by the Hellenic Electricity Distribution Network Operator HEDNO, which checks meters, show that verified cases of theft climbed to 10,600 last year, up from 8,880 in 2013 and 4,470 in 2012.

Authorities believe theft is far higher than the cases verified by HEDNO, another official said, declining to be named. Households in the country are equipped with analog meters, which are easy to hack. One of the most common tricks is using magnets, which slow down the rotating coils to show less consumption than the real amount, a HEDNO official said. Some websites even offer consumers tips and tricks on power fraud. For households who have had their electricity cut off, a group of activists calling themselves the “I Won’t Pay” movement have taken it upon themselves to reconnect the supply. The group says it has done hundreds this year. PPC, which has a 90% share of the retail market and 60% of the wholesale market, is supposed to reduce this dominance to less than 50% by 2020 under Greece’s third, 86 billion euro bailout deal.

It’s time to make this personal. Against Schäuble and Dijsselbloem, Merkel and Rutte and Hollande. They are killing people. There’s nothing innocent about that. Making it personal is the only thing that’ll work. Bring it to their doorstep. Literally to their doorstep.

• On Dimitris Christoulas: ‘He Is A Part Of History Now’ (AlJ)

On the morning of April 4, 2012, a gunshot sounded amid the city’s hustle and bustle. As passers-by rushed to work through Syntagma Square in central Athens, Dimitris Christoulas had taken his life with a shotgun a few metres from the Greek parliament. The 77-year-old pensioner, a former pharmacist, had left a note in his pocket. “The occupation government literally annihilated my ability to survive,” he wrote. “I depended on my decent pension, which I alone and without the support of the state, paid for 35 years.” His only daughter, Emmy Christoula, had known nothing about his plans. But, speaking as the fifth anniversary of his death approached, she confidently described her father’s public suicide as a political act. Her father woke up in the morning, got dressed, and wrote two identical notes – putting one in his pocket and leaving the other on his kitchen table for his daughter to read.

He took the subway to the square, site of the country’s most important protests for more than a century. When Dimitris arrived at Syntagma, he texted his daughter – “It’s the end, Emmy,” he wrote – and switched off his phone. Greek morning television talk shows broke the news of Christoulas’s suicide a few minutes after it happened. Hundreds soon gathered to pay their respects. Flowers, letters and notes of resistance were left by the tree where he chose to take his life. Spaniards wrote songs of his resistance. Irish poets wrote odes to him. His funeral turned into a rally against the austerity measures imposed on Greece, when the country’s debt payments became too onerous to pay amid the worldwide recession. The country’s creditors called for harsh spending cuts and steep tax increases so that Athens could make the payments. Protests and riots became a staple of life in Athens in the years that followed.

Five years on from Christoulas’ suicide, the crisis has only grown deeper. Greece’s debt is 175% of its GDP. Greek officials have cut retirees’ pensions 17 times to around half of their value before the recession, according to the Greek Association of Pensioners. Budget cuts have also been implemented in education, health, and welfare services. Lenders must improve most government decisions. Unemployment stands at more than 23%. A fourth bailout agreement is expected soon. According to the Greek Statistical Service, suicides have increased by 68% since 2008, the first year Greek economic growth stagnated. “I’m of a certain age and don’t have the power of dynamically reacting,” wrote Christoulas in his suicide note. “I can’t find another solution to a dignified end, as soon I’d have to start scavenging through the garbage to find my own food.”

Christoulas’ suicide became a symbol of the devastating effects of austerity on the Greek people. Until then, the majority of the stories published in the international media on the issue were about lazy Greeks who deserved their comeuppance for living off debt for so many years. “[My father] taught me that you shouldn’t just follow history, you should write it,” said Emmy, adding that she has accepted her father’s decision but still aches from his absence. Emmy describes her father as a wiry and lean man who had long participated in public life. Her first childhood memories include sitting on his shoulders at pro-democracy rallies against Greece’s military government in the 1970s. The police brutality didn’t deter father and daughter from participating.