DPC Broadway from Chambers Street, NYC 1910

Adding more debt! Brilliant!

• Dash For Debt Ahead Of US Rate Rise (FT)

A spate of jumbo corporate debt offerings has lifted US issuance to a record high as companies seek to lock in financing to fund multibillion-dollar acquisitions before the Federal Reserve lifts rates for the first time since the financial crisis. US multinationals have raised more than $132bn in so-called jumbo-deals debt offerings above $10bn in size in 2015, more than a fourfold increase from a year earlier as companies including Microsoft, Hewlett-Packard Enterprise and UnitedHealth take advantage of low interest rates, according to data from Dealogic. The offerings have buoyed overall corporate debt deal values in the US to a record of $815bn, with more than a month and a half to go before year end. The figure surpasses the previous high set in 2014 of $746bn.

There has been strong investor appetite for the debt offerings, which have been used to fund acquisitions, buy back stock and pay for dividends, leading bond funds to balloon in size. “It’s two years of incredible issuance flows”, says Mitch Reznick at Hermes Investment Management. “It’s driven by a desire to get financing done ahead of lift-off and a lot of this is going into M&A … The issuance just continues and continues.” After a slow summer, with companies braced for a rise in interest rates that never came as they struggled with the global oil price rout, issuance has picked up. Close to $30bn of debt has been raised in each of the past two weeks. It has been a particularly big year for highly rated debt, with issuance at a record $633bn. The $182bn worth of junk bond sales trail the 2012 peak of $246bn.

David Walker seems to have been silent for a while. But he’s back.

• Ex-GAO Head David Walker: US Debt Is Three Times More Than You Think (Hill)

The former U.S. comptroller general says the real U.S. debt is closer to about $65 trillion than the oft-cited figure of $18 trillion. Dave Walker, who headed the Government Accountability Office (GAO) under Presidents Bill Clinton and George W. Bush, said when you add up all of the nation’s unfunded liabilities, the national debt is more than three times the number generally advertised. “If you end up adding to that $18.5 trillion the unfunded civilian and military pensions and retiree healthcare, the additional underfunding for Social Security, the additional underfunding for Medicare, various commitments and contingencies that the federal government has, the real number is about $65 trillion rather than $18 trillion, and it’s growing automatically absent reforms,” Walker told New York’s AM-970 in an interview airing Sunday.

The former comptroller general, who is in charge of ensuring federal spending is fiscally responsible, said a burgeoning national debt hampers the ability of government to carry out both domestic and foreign policy initiatives.“If you don’t keep your economy strong, and that means to be able to generate more jobs and opportunities, you’re not going to be strong internationally with regard to foreign policy, you’re not going to be able to invest what you need to invest in national defense and homeland security, and ultimately you’re not going to be able to provide the kind of social safety net that we need in this country,” he said.

He said Americans have “lost touch with reality” when it comes to spending. Walker called for Democrats and Republicans to put aside partisan politics to come together to fix the problem. “You can be a Democrat, you can be a Republican, you can be unaffiliated, you can be whatever you want, but your duty of loyalty needs to be to country rather than to party, and we need to solve some of the large, known, and growing problems that we have,” he said.

Other than for gamblers, The Fed’s made itself irrelevant for quite a while now.

• Fed Proves Irrelevant in $2.6 Trillion Slice of Debt Market (Bloomberg)

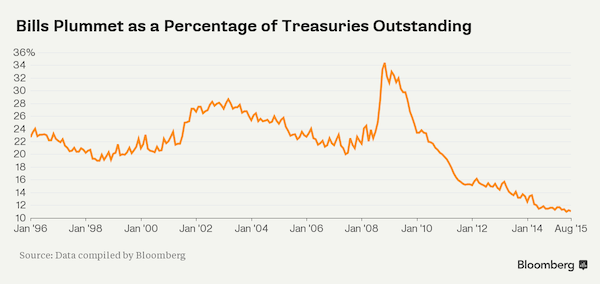

The blowout U.S. jobs report for October means the Federal Reserve may be weeks away from raising interest rates. For U.S. savers earning next to nothing on $2.6 trillion of money-market mutual funds, the move will barely register. The reason is that there’s an unprecedented shortfall in the safest assets, especially Treasury bills – a mainstay of money funds and traditionally the government obligations that are most sensitive to changes in Fed policy. The shortage means some key money-fund rates will probably remain near historic lows even if the central bank increases its benchmark from near zero next month. The phenomenon is a consequence of regulators’ efforts to curb risk after the financial crisis.

Money-market industry rules set to take effect in October 2016 may lead investors and fund companies to shift as much as $650 billion into short-maturity government obligations, according to JPMorgan Chase. Meanwhile, the amount of bills as a share of government debt is the lowest since at least 1996, at about 10%, and the Treasury is just beginning to ramp up issuance of the securities after slashing it amid the debt-ceiling impasse. “The demand for high-quality short-term government debt securities is insatiable and there is just not enough supply,” said Jerome Schneider at PIMCO. “Even given the increased bill sales coming as the debt-limit issue has passed, it won’t keep up with rising demand from regulatory forces. This will keep rates low.”

While the U.S. government stands to benefit as the imbalance holds down borrowing costs, it’s proving the bane of savers. Average yields for the biggest money-market funds, which buy a sizable chunk of the $1.3 trillion Treasury bills market, haven’t topped 0.1% since 2010, according to Crane Data. In 2007, they were above 5% before the Fed started slashing rates to support the economy. With returns this low, investors have less incentive to sock away cash. The Standard & Poor’s 500 index has earned 3.8% this year, including dividends.

Debt that gets sold for pennies on the dollar from one collector to the next. American disgrace.

• Zombie Debt Is Menacing America And Mine Even Has A Name: Kathryn (Guardian)

Her name is Kathryn. Every few weeks, I’ll answer the phone, and someone will want to talk to her. In fact, whoever is on the other end of the line will insist on talking to her. They assume that I am her, even when I inform her that I’m not and that I don’t know who she is. They threaten that if I don’t bring her to the phone, I’ll face “consequences”. Sometimes I’ll get two phone calls a day, every day of the week. These debt collectors want Kathryn to repay some student loans, and every time her file is sold to a new agency, my phone number is transferred along with it – and I have to begin convincing a new bunch of folks that this isn’t the way to find her. Halloween may be over, but the world of zombie debt is a year-round horror show.

Aggressive collectors buy credit card accounts from original lenders like Chase or Bank of America that have been written off as in default and impossible to collect on. Having paid only pennies for every dollar owed to acquire these accounts, the new collectors have a big financial incentive to collect the maximum they can – it’s not about recouping money but about seeing how much they can make. Getting someone to agree to pay $1 for every $10 of debt owed could mean a 100% return. Small wonder that a number of players in this space resort to abusive practices, and the Federal Trade Commission (FTC) announced last week a new nationwide initiative involving not only 47 attorneys general and many state regulatory agencies but also numerous local bodies and even a Canadian provincial regulator.

Operation Collection Protection will try to halt the industry’s worst practices – and it’s needed, says Edith Ramirez, chairwoman of the FTC. “We receive more complaints about this industry than any other,” she told a press conference last Thursday, noting that debt collectors make a billion contacts a year with consumers. “The majority [of those] are legal. Many are not.” With consumer debt climbing steadily, the problem is more likely to grow than to diminish. In 2010, Americans had total consumer debt of nearly $2.5tn, Ramirez said. Today, excluding mortgage debt, that figure is closer to $3.34tn (with mortgages added to the mix, it would be more than $11tn), and the average household has a credit card balance that stands at $7,281. When you consider the fact that many Americans don’t have credit cards or don’t carry balances, that average balance is actually much higher.

True, new rules mean that it’s harder for banks and credit card purveyors to get students to load up on debt, over and above their student loans. And more households are being more disciplined in how they use their credit cards, paying off their balance in full. But there also are some troubling signs, including the Federal Reserve’s survey results showing that of those Americans who carried a balance from one month to the next, more than half made only the minimum payment on their accounts. It’s those folks who are most at risk of ending up fielding calls from debt collectors down the road.

Meanwhile back in the casino…

• Dollar Bulls are Vulnerable as Currency’s Strength May Cap Rates (Bloomberg)

Dollar bulls have reason to be wary of the currency’s Friday rally on stronger-than-forecast U.S. labor data. The jobs report bolstered the case for a December interest-rate increase by the Federal Reserve and propelled a broad gauge of the greenback past this year’s previous high. Yet the last time the dollar was this strong, the central bank flagged it as a burden on exporters and a damper of inflation, driving the currency down by the most since 2009. The March experience is raising red flags for investors and strategists. A surging dollar may lead Fed officials to warn that currency moves will limit rate increases in 2016, even if they boost their benchmark next month from near zero, where it’s been since 2008.

“It’s going to be really hard for them to hike rates aggressively,” said Brendan Murphy, a senior portfolio manager at Standish Mellon. Once the Fed lifts rates, “you may be nearing the end of this broader move we’ve seen in the dollar.” Murphy says he’s betting on the greenback versus the euro and currencies from commodity exporting nations, but he’s trimmed positions since the start of the year. The dollar appreciated to its strongest level since April versus the euro and its highest in more than two months versus the yen after a Labor Department report showed U.S. employers added 271,000 workers in October, the most this year.

And then still poo-poohs the downfall. Talk your book.

• Global GDP Worse Than Official Forecasts Show, Maersk CEO Says (Bloomberg)

The world’s economy is growing at a slower pace than the IMF and other large forecasters are predicting. That’s according to Nils Smedegaard Andersen, CEO at A.P. Moeller-Maersk. His company, owner of the world’s biggest shipping line, is a bellwether for global trade, handling about 15% of all consumer goods transported by sea. “We believe that global growth is slowing down,” he said in a phone interview. “Trade is currently significantly weaker than it normally would be under the growth forecasts we see.” The IMF on Oct. 6 lowered its 2015 global gross domestic product forecast to 3.1% from 3.3% previously, citing a slowdown in emerging markets driven by weak commodity prices. It also cut its 2016 forecast to 3.6% from 3.8%.

But even the revised forecasts may be too optimistic, according to Andersen. “We conduct a string of our own macro-economic forecasts and we see less growth – particularly in developing nations, but perhaps also in Europe – than other people expect in 2015,” Andersen said. Also for 2016, “we’re a little bit more pessimistic than most forecasters.” Maersk’s container line on Friday reported a 61% slump in third-quarter profit as demand for ships to transport goods across the world hardly grew from a year earlier. The low growth rates are proving particularly painful for an industry that’s already struggling with excess capacity.

Trade from Asia to Europe has so far suffered most as a weaker euro makes it tougher for exporters like China to stay competitive, Andersen said. Still, there are no signs yet that the global economy is heading for a slump similar to one that followed the financial crisis of 2008, he said. “We’re seeing some distortions amid this redistribution that’s taking place between commodity exporting countries and commodity importing countries,” he said. “But this shouldn’t lead to an outright crisis. At this point in time, there are no grounds for seeing that happening.”

And everywhere else. The entire global economy was propped up by China’s Ponzi for years. No more.

• China Slowdown Hits Earnings in Japan (WSJ)

Profits at major Japanese companies are on track to fall for the first time in more than a year during the third quarter, partly the result of a slowdown in China’s economy. Earnings fell a combined 3.2% from a year earlier, according to data compiled by SMBC Nikko Securities that covered 70% of companies listed on the first section of the Tokyo Stock Exchange with a financial year ending March 31. All had released quarterly earnings as of Friday. If that result holds after all companies have reported, it would be the first decline since earnings fell 7% in the second quarter of 2014, after a sales-tax increase hit Japanese consumers and set off a recession. Now external factors are playing a bigger role, analysts say. As China’s economy has cooled further, for example, its steel makers unloaded supply on the international market, driving prices lower and hurting their Japanese competitors.

Kobe Steel Ltd. saw its profit fall by more than half during the fiscal first half and cut its projection for full-year earnings by another 20%, after lowering it by half in September. Nippon Steel & Sumitomo, meanwhile, saw its shares tumble last week after it lowered its full-year net profit forecast by 31%. JFE Holdings Inc. downgraded its full-year ordinary profit outlook by 50%. “The China-related sectors performed poorly, especially Japan’s top three steel makers, who were hit hard by an oversupply of Chinese steel,” said Atsushi Watanabe at Mitsubishi UFJ Morgan Stanley. Komatsu, which makes heavy machinery, said its sales to China fell by half during the first half of the fiscal year, and reported a 16.5% drop in net profit. Demand in China showed no signs of improving in the most recent quarter after worsening in the previous quarter, said Yasuhiro Inagaki, the company’s senior executive officer and general manager for business coordination.

But stimulus doesn’t make people spend.

• China’s Trade Drop Means More Stimulus Measures Coming (Bloomberg)

China’s exports fell for a fourth straight month and imports matched a record stretch of declines, signaling that the mounting drag from slower global growth will push policy makers toward expanding stimulus. Overseas shipments dropped 6.9% in October in dollar terms, the customs administration said Sunday, a bigger decline than estimated by all 31 economists in a Bloomberg survey. Weaker demand for coal, iron and other commodities for China’s declining heavy industries helped drag imports down 18.8% in dollar terms, leaving a record trade surplus of $61.6 billion.

The report signals that policy makers may need to unleash more fiscal stimulus to support growth even after the People’s Bank of China cut the main interest rate six times in the last year to a record low and devalued the currency. The government has already relaxed borrowing rules for local authorities, and the top economic planning body has stepped up project approvals. “The October trade data keep pressure on for more domestic easing,” said Louis Kuijs, head of Asia economics at Oxford Economics in Hong Kong. “Measures are likely to continue to focused on shoring up domestic demand rather than weakening the currency. And over time the role of fiscal policy expansion should rise.”

At least we’re all falling together.

• China Exports Slump as Global Demand Shrinks (WSJ)

China’s exports fell in October for the fourth consecutive month, as a once-powerful engine of the country’s growth continued to sputter in the face of weak global demand. The world’s appetite for goods from China—the world’s second-largest economy accounts for nearly one-fifth of global factory exports—has been lower than expected this year. Meanwhile, weak domestic demand continues to reduce imports. Both are contributing to China’s growth slowdown. “The mix of the data is again not encouraging,” said Commerzbank economist Zhou Hou. “Trade momentum is unlikely to turn around in the near term.” Sunday’s results suggest the export scene is worsening. China’s General Administration of Customs said October exports fell 6.9% year-over-year in dollar terms, after a drop of 3.7% in September.

Imports in October fell by a sharper-than-expected 18.8% from a year earlier, after a 20.4% fall in September. China’s trade surplus widened in October to $61.64 billion from $60.3 billion in September. China’s Commerce Ministry said Thursday in a report that exports are likely to see little increase in 2015, while imports will likely report a “relatively big” decline as falling commodity prices continue to weigh on trade flows. China’s rising labor and land costs in recent years have weakened the competitiveness of the nation’s exporters, the Commerce Ministry said. The average wage for workers in coastal provinces, including the manufacture hub of Guangdong province, has reached $600 a month, twice the level of Southeast Asian countries.

Yay! Protectionism! Let’s sign us another free trade deal, shall we?!

• Steel Exports From Top Producer China Drop as Trade Friction Rises (Bloomberg)

The flood of steel that mills in China are pushing onto global markets eased from a record in October amid rising trade frictions and weak overseas demand, signaling that what’s been a safety valve for the world’s top producer may now be starting to close. Outbound cargoes shrank 20% to 9.02 million metric tons last month from September, according to customs data released on Sunday. That was the lowest figure since June, and below the monthly average so far this year of 9.21 million tons. “The slump in steel exports last month compared with September reflects rising trade frictions for Chinese products,” Helen Lau at Argonaut Securities said by e-mail on Sunday.

China’s mills, which account for half of global production, have exported unprecedented volumes of steel this year to try to counter contracting demand in Asia’s top economy. The surge has undermined prices and increased competition from India to Europe and the U.S., spurring complaints that the trade is unfair. While down on-month, China has still shipped 25% more steel this year than in the same period of 2014. The global steel market is being overwhelmed with metal coming from China’s state owned and state-supported producers, a collection of industry groups including the American Iron and Steel Institute said on Thursday. The next day, ArcelorMittal cut its full-year profit target, citing exceptionally low Chinese export prices.

Evidence of cases against Chinese steel imports is surfacing worldwide. Last week, the U.S. Department of Commerce said it planned duties of 236% on imports of corrosion-resistant steel from five Chinese companies. More than 20 cases have been lodged against China’s cargoes, with about seven from Southeast Asia. “Lower steel exports reflect waning demand from overseas trading partners,” Xu Huimin at Huatai Great Wall Futures said before the data. Financial markets and many businesses in China were closed Oct. 1-7, which may have also contributed to the drop in exports, Xu said.

Inbound cargoes of iron ore shrank 12% to 75.52 million tons last month from September, according to the customs figures. Purchases totaled 774.5 million tons in the first 10 months, little changed compared with the same period a year earlier, the data showed. China is the world’s largest buyer. Iron ore stockpiled at Chinese ports rose 1.5% to 86 million tons in the week to Nov. 6, according to Shanghai Steelhome Information. Ore with 62% content delivered to Qingdao was at $48.21 a dry ton on Friday, 32% lower this year, according to Metal Bulletin Ltd.

No kidding: “President Xi Jinping was already unhappy he was taking the blame for the economic gloom that had settled over China..”

• China Delays Economic Liberalization (WSJ)

The closed-door meeting of some of China’s most powerful economic mandarins this fall was getting tense. Their boss, President Xi Jinping, was already unhappy he was taking the blame for the economic gloom that had settled over China this summer, and it was their job to come up with ways to fix it. Officials from the state planning commission at the Sept. 22 meeting in a conference room at the agency’s headquarters called for the kind of big spending on airports, roads and other government projects that Beijing had relied on to rev up the economy in recent years, according to internal minutes of the meeting. Finance-ministry officials disagreed, favoring a plan to encourage Chinese consumers to buy more electronics, cars, clothes and other goods China churns out.

But most in the room agreed on one thing: It would be hard to proceed with plans to liberalize the tightly controlled economy and still hope to meet Mr. Xi’s 7% GDP-growth target for 2015. Such plans, laid out in better times, weren’t likely to deliver the shot of growth China’s economy needed. “Reform itself faces huge problems,” said an attendee at the Sept. 22 meeting, which gathered officials of the National Development and Reform Commission—the planning agency—and the finance ministry, according to the minutes, reviewed by The Wall Street Journal. “It’s doubtful that any reform dividends can be translated into economic growth in the foreseeable future.” In the weeks following, China has taken new steps to slow plans that had been meant to loosen control over the financial system, adding to similar delaying moves since summer.

Some steps have the effect of keeping industries on life support. On Oct. 23, the central bank scrapped its cap on deposit rates. But it backed away from freeing interest rates from its control, as it was previously expected to do, saying it feared that might raise funding costs for businesses and consumers. Other steps seek to hold money in the domestic economy rather than letting it flow abroad. On Oct. 30, the central bank and other agencies dialed back on plans for Shanghai’s free-trade zone, a testing ground for financial overhauls, that would have let residents more easily buy foreign assets.Many measures China’s leaders have delayed since summer are ones that economists and some Chinese leaders have long said are needed to put the world’s second-largest economy on a sustainable growth path in coming years.

Foreclosures. Throwing people out into the streets. Make them slaves.

• Greece Told To Break Bailout Deadlock By Wednesday (Kath.)

A Euro Working Group held via teleconference on Sunday failed to result in an agreement between Greece and its lenders ahead of Monday’s Eurogroup. A high-ranking European official told Kathimerini’s Brussels correspondent Eleni Varvitsiotis said it was agreed that the two sides would try to settle the outstanding issues by Wednesday so that another Euro Working Group, possibly with officials meeting in person, could be held on Friday. During Sunday’s teleconference it was made clear to the Greek participants that Athens is already three weeks behind schedule, Kathimerini understands. The key stumbling block is primary residence foreclosures. Greece has put forward stricter criteria that protects 60% of homeowners, while suggesting that this is then gradually reduced over the next years. Greek officials will continue deliberating with their eurozone colleagues over the next hours in a bid to ensure that Monday’s Eurogroup does not end in a negative manner.

“..driven by China’s battle against pollution, economic reforms and its efforts to promote renewable energy..” No, driven by deflation. By China’s economic slump.

• Global Coal Consumption Heads for Biggest Decline in History (Bloomberg)

Coal consumption is poised for its biggest decline in history, driven by China’s battle against pollution, economic reforms and its efforts to promote renewable energy. Global use of the most polluting fuel fell 2.3% to 4.6% in the first nine months of 2015 from the same period last year, according to a report released Monday by the environmental group Greenpeace. That’s a decline of as much as 180 million tons of standard coal, 40 million tons more than Japan used in the same period. The report confirms that worldwide efforts to fight global warming are having a significant impact on the coal industry, the biggest source of carbon emissions. It comes a day before the International Energy Agency is scheduled to release its annual forecast detailing the ways the planet generates and uses electricity.

“These trends show that the so-called global coal boom in the first decade of the 21st century was a mirage,” said Lauri Myllyvirta, Greenpeace’s coal and energy campaigner. The decline in coal use will help reduce greenhouse-gas emissions that are blamed for heating up the planet. To limit the rise in global temperatures to 2 degrees Celsius (3.6 degrees Fahrenheit) – the level scientists say cannot be exceeded if the world is to avoid catastrophic climate change – emissions from coal must fall 4% annually through 2040, Greenpeace said.

In China, responsible for about half of global coal demand, use in the power sector fell more than 4% in the first three quarters and imports declined 31%, according to the report. Since the end of 2013, the country’s electricity consumption growth has largely been covered by new renewable energy plants. “The coal industry likes to point to China adding a new coal-fired power plant every week as evidence that coal demand will pick up in the future, but the reality on the ground is rather different,” according to the report. “Capacity utilization of the plants has been plummeting. China is now adding one idle coal-fired power plant per week.”

They can’t. Nobody can. Get that through to your skulls. It’s a demand issue. Deflation.

• Saudi Arabia Will Not Stop Pumping To Boost Oil Prices (FT)

Saudi Arabia is determined to stick to its policy of pumping enough oil to protect its global market share, despite the financial pain inflicted on the kingdom’s economy. Officials have told the Financial Times that the world’s largest exporter will produce enough oil to meet customer demand, indicating that the kingdom is in no mood to change tack ahead of the December 4 meeting in Vienna of the producers’ cartel Opec. “The only thing to do now is to let the market do its job,” said Khalid al-Falih, chairman of the state-owned Saudi Arabian Oil Company (Saudi Aramco). “There have been no conversations here that say we should cut production now that we’ve seen the pain.”

Saudi Arabia rocked oil markets last November when Opec decided against production cuts, making clear that the kingdom was abandoning its policy of reducing supplies to stabilize the price. Since then, the oil price has collapsed from a high of $115 a barrel last year to $50 a barrel. Global oil companies, which have put hundreds of billions of dollars of investment on hold as a result of low prices, will be disappointed by the Kingdom’s stance. The effect on business sentiment has sparked domestic criticism of the market share policy engineered by Ali al-Naimi, the oil minister, and agreed by both the late King Abdullah and the current King Salman, who was crown prince last year and ascended the throne in January.

Officials in Riyadh say their policy will be vindicated in one to two years when revived demand swallows the global oil glut and prices begin to recover. They argue that in the past, Opec output cuts raised prices to levels where more expensive production, such as shale and deep-sea oil, could flourish. Moving ahead, Opec – led by Saudi Arabia – plans to pump as much as it can towards meeting global oil demand, leaving higher-cost producers to make up the remainder. For higher-cost producers, “$100 oil was perceived as a guarantee of no risk for investment”, said Mr Falih. “Now, the insurance policy that’s been provided free of charge by Saudi Arabia does not exist any more.”

Yeah, they can really see 5 years ahead over there. It’s something in the air.

• Kuwait Sees Oil Glut of Up to Five Years (Bloomberg)

Oil markets will continue to be oversupplied for as long as five years as producers in the Middle East ramp up output, according to Mohammed Al-Shatti, Kuwait’s representative to OPEC. Iraq pumped a record 4.4 million barrels a day in June, according to data compiled by Bloomberg. Libyan output, which has declined by more than half due to conflict, can return “at any moment,” Al-Shatti said in an interview Saturday in Doha. Iran has the capacity to boost exports by 500,000 barrels a day within one week of sanctions being lifted and by 1 million a day within six months, Roknoddin Javadi, managing director of state-run National Iranian Oil Co., said last month.

“Lower prices will continue until the glut in the market ends,” Al-Shatti said. “Many countries are expected to increase production. Iranian crude is expected to return and that means an increase in production.” Demand isn’t expected to absorb the extra capacity and it will take shifts in supply to affect prices, he said. Al-Shatti said geopolitical disruptions or reduced future output because of the 30% fall in capital expenditure by oil companies could cause an increase.

And these are just guesses.

• Airpocalypse Now: China Pollution Reaching Record Levels (Guardian)

Residents of north-eastern China donned gas masks and locked themselves indoors on Sunday after their homes were enveloped by some of the worst levels of smog on record. Levels of PM2.5, a tiny airborne particulate linked to cancer and heart disease, soared in Liaoning province as northern China began burning coal to heat homes at the start of the winter. In Shenyang, Liaoning’s capital, visibility levels plummeted to as little as 100 metres, the state broadcaster CCTV said. China’s official news agency, Xinhua, published an apocalyptic gallery of images showing the country’s latest smog crisis alongside the headline: “Fairyland or doomsday?” In some areas of Shenyang, PM2.5 readings reportedly surpassed 1,400 micrograms per cubic metre, which is about 56 times the levels considered safe by the World Health Organisation.

“The air stings and makes my eyes and throat feel sore when I’m outdoors,” one woman, who had ventured out to buy a face mask, was quoted as saying. “As for what exactly we should do, I don’t know,” she added. By Monday afternoon there had been a slight improvement, although air quality remained at “hazardous” levels in Shenyang, an industrial city of about 8 million inhabitants. The Associated Press said Sunday’s smog represented one of the worst episodes of air pollution recorded in China since authorities began releasing air quality data in 2013. There was indignation on social media as China confronted its latest “airpocalypse”. “The government knows how severe the smog problem is, so why haven’t they tackled it?” one critic wrote on Weibo, China’s Twitter.

“What’s the point of having an environmental protection department? The precondition for developing the economy is not damaging the environment. Our leaders are all well educated. Can’t they understand this simple truth?” Others reacted with resignation. “Other than reporting it, what can the government do?” Shenyang, a major industrial centre since the days of Mao Zedong, has been attempting to clean up its act in recent years by relocating factories and starting to use natural gas instead of coal to heat homes. But on Monday doctors in Shenyang were dealing with the consequences of the latest bout of toxic pollution to hit their city. Yang Shenjia, who works at the Liaoning Jinqiu Hospital, said there had been a sudden influx of patients suffering from breathing complaints over the past two days. “The respiratory department’s inpatient wards are full,” the doctor told Xinhua.

Because nobody really keeps track.

• The Unbearable Lightness Of Chinese Emissions Data (Reuters)

Precise data collection is a tricky business everywhere, as the Volkswagen scandal over discrepancies between the German auto company’s emissions claims and the real world performance of its engines has shown. But getting accurate emissions data is crucial for governments seeking a global climate accord in Paris this December. Negotiators say that, to succeed, any agreement must be built upon “measurable, reportable and verifiable” statistics in order to assess whether countries are on track to meet their emissions targets. And getting a better grasp of the right numbers is particularly crucial in the case of China, which is widely assumed to be the world’s largest carbon emitter. China’s energy use is so great that even minute errors in data can translate into a difference of millions of tonnes of emissions.

No one currently knows how many tonnes of carbon China emits each year. Its emissions are estimates based on how much raw energy is consumed, and calculations are derived from proxy data consisting mostly of energy consumption as well as industry, agriculture, land use changes and waste. Many outside observers view the accuracy of those figures with skepticism. “China’s contribution (to the global climate plan in Paris) is based on CO2 emissions but China doesn’t publish CO2 emissions,” said Glen Peters, senior researcher at the Center for International Climate and Environmental Research in Oslo. “You’re left in the wilderness, really.”

Demands for better data played a major role in the failure of the 2009 Copenhagen conference, when China and several developing nations balked at providing the rest of the world with detailed data, claiming it would be an intrusion on their sovereignty. The last time Beijing produced an official figure was in 2005, when it said its emissions stood at “approximately” 7.47 billion tonnes. And while it has promised that emissions will peak by 2030 at the latest, experts say the statistical uncertainty is so great that forecasts on what that peak means can vary from 11 to 20 billion tonnes a year. That margin is greater than the entire annual carbon footprint of Europe.

Dotcom should sue to bankrupt the entire nation.

• New Zealand To Reform Intelligence After Illegal Spying On Kim Dotcom (NZH)

John Key has opened up the spy agencies to public scrutiny in a way which we have never seen in New Zealand. We know more now about what they do and even how they do it. We know how the two agencies are managed, in that the GCSB and NZSIS both have top-flight lawyers in charge. There will always be those who say we don’t know enough. For those people, we now have improved oversight of the agencies. This also happened under the Prime Minister’s watch as minister in charge of the agencies. The new Inspector General of Intelligence and Security Cheryl Gwyn – another superb lawyer – has been a breath of the freshest air. Mr Key has since stepped away from directly overseeing the agencies, which is a further liberation. It seems right that the most powerful weapons of state should sit with someone whose role is to objectively challenge his Cabinet colleagues.

Now, even at a ministerial level, the SIS and GCSB answer to a lawyer, this time Attorney General Chris Finlayson. In terms of oversight and public disclosure, we are heading into an era unparalleled in our history. Citizens now have more ability to see and have explained the tasks done in their name. Again, it might not be enough but it is considerably more than we have had before. That’s where we have come to, three years after Mr Key had to admit Kim Dotcom and one of his co-accused had been illegally spied on by the GCSB. He also had to apologise – a concession which must have been galling. That single event appears to be the point at which the Prime Minister stopped taking at face value the assurances given by the intelligence agencies, and began a programme for reformation which is huge in its scale and largely behind closed doors.

For all the comparative openness, it is unlikely the public will ever know the truth about how far adrift our intelligence agencies wandered. As a broad indication, consider the fact that respected senior lawyers with strong state experience now sit at all significant levels of the intelligence community. When you’re unsure about the law, you need lawyers. But there have also been reports which paint a picture of the state of New Zealand’s intelligence services, past and present. None are individually explicit in their descriptions of how bad it was but the collective run of reports gives an impression of the intelligence community as an isolated part of government, lost to the public they were serving, changing purpose and shape under a cloak of secrecy.

Ha ha! There’s Herr Schäuble again. Been a while. Always good for laugh. At the expense of others.

• German Disagreement Over Tighter Asylum Rules (Bloomberg)

German Finance Minister Wolfgang Schaeuble and Vice Chancellor Sigmar Gabriel were at odds over stricter asylum rules for some applicants from Syria, just days after Chancellor Angela Merkel defused a rebellion in her ruling coalition against her open-door refugee policy. Speaking on German ARD public television on Sunday, Schaeuble and Gabriel disagreed over a proposal by Interior Minister Thomas de Maiziere to grant refugees from Syria who aren’t individually persecuted a limited asylum status that restricts family reunions in Germany. “Family reunions can and must be restricted for people who are granted subsidiary protection, and that’s the large majority,” Schaeuble said. “This is a necessary decision and I’m very much in favor that we find agreement on this in the coalition quickly.”

De Maiziere cast doubt on a lasting compromise in the coalition over the weekend, telling N-TV television that the government should consider granting some Syrians only temporary asylum and limiting family reunions. Merkel earlier extracted a compromise from her coalition partners to set up migrant processing centers in Germany, in which the Social Democratic Party, led by Gabriel, prevailed. “Every time we reach an agreement, shortly thereafter there’s a new proposal that wasn’t on the table before,” Gabriel said on ARD, adding his party can’t agree to a proposal that wasn’t previously discussed in the coalition. “That leads to a situation in which Germans get the impression that the left hand doesn’t know what the right hand is doing in the government.”

As many as 1 million people are expected to seek shelter in Germany from war and poverty in their homelands. Merkel, while having pledged to do everything to stem the flow, has ruled out closing borders or placing upper limits on the numbers who qualify for asylum. A European Union report last week said the influx could boost Germany’s economy by 0.1 percentage point this year and 0.4 point in 2016. Schaeuble and Gabriel agreed the EU needs to regain control over its borders and set quotas for refugees who would then be distributed among the bloc’s members. “We are close to the limit of our capabilities,” Schaeuble said. As long as there’s no coordinated distribution within Europe, “we must send the message to the countries where the refugees are coming from that they shouldn’t be misled, that not everyone can come.”

Home › Forums › Debt Rattle November 9 2015