Thomas Eakins Walt Whitman 1891

“The Bank for International Settlements estimates that 60pc of the world economy is locked into the US currency system, and that debts denominated in dollars outside US jurisdiction have ballooned to $9.8 trillion.”

• Fed Risks Repeating Lehman Blunder As US Recession Storm Gathers (AEP)

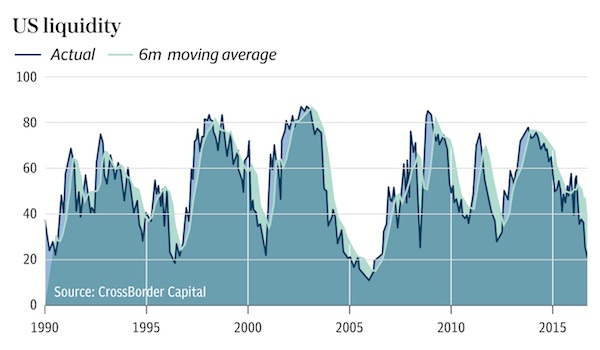

The risk of a US recession next year is rising fast. The Federal Reserve has no margin for error. Liquidity is suddenly drying up. Early warning indicators from US ‘flow of funds’ data point to an incipent squeeze, the long-feared capitulation after five successive quarters of declining corporate profits. Yet the Fed is methodically draining money through ‘reverse repos’ regardless. It has set the course for a rise in interest rates in December and seems to be on automatic pilot. “We are seeing a serious deterioration on a monthly basis,” said Michael Howell from CrossBorder Capital, specialists in global liquidity. The signals lead the economic cycle by six to nine months. “We think the US is heading for recession by the Spring of 2017. It is absolutely bonkers for the Fed to even think about raising rates right now,” he said.

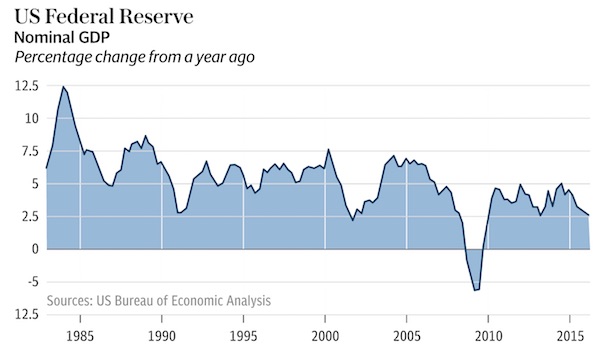

The growth rate of nominal GDP – a pure measure of the economy – has been in an unbroken fall since the start of the year, falling from 4.2pc to 2.5pc. It is close to stall speed, flirting with levels that have invariably led to recessions in the post-War era. “It is a little scary. When nominal GDP slows like that, you can be sure that financial stress will follow. Monetary policy is too tight and the slightest shock will tip the US into recession,” said Lars Christensen, from Markets and Money Advisory. If allowed to happen, it will be a deeply frightening experience, rocking the global system to its foundations. The Bank for International Settlements estimates that 60pc of the world economy is locked into the US currency system, and that debts denominated in dollars outside US jurisdiction have ballooned to $9.8 trillion.

The world has never before been so leveraged to dollar borrowing costs. BIS data show that debt ratios in both rich countries and emerging markets are roughly 35 percentage points of GDP higher than they were at the onset of the Lehman crisis. This time China cannot come to the rescue. Beijing has already pushed credit beyond safe limits to almost $30 trillion. Fitch Ratings suspects that bad loans in the Chinese banking system are ten times the official claim. The current arguments over Brexit would seem irrelevant in such circumstances, both because the City would be drawn into the flames and because the eurozone would face its own a shattering ordeal. Even a hint of coming trauma would detonate a crisis in Italy.

[..] The velocity of M1 money in the US has continued to slow, hitting a 40-year low of 5.75 over the summer, and markets are only just awakening to the unsettling thought that China’s latest boomlet has already topped out. Beijing is having to hit the brakes again. Crossborder said new rules for money market funds that came into force this month have complicated the picture, causing the stock of US commercial paper to shrivel by $200bn. Yet there are ways to filter out some of these effects. The plain fact is that 3-month lending rates in the off-shore ‘eurodollar’ markets in London have tripled since July to 0.93pc, sharply tightening conditions for global finance. Investors may have been too complacent in discounting these gyrations as part of a regulatory hiccup when something more sinister is emerging.

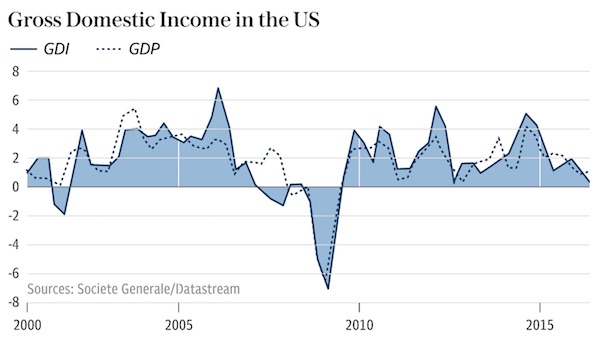

[..] Albert Edwards from Societe Generale says gross domestic income (GDI) was the most accurate gauge of the economy as the pre-Lehman crisis unfolded, and this measure has been flat for the last two quarters.”The pronounced weakness of GDI relative to GDP might be an ominous omen, for it may well be indicating that a US recession is already underway – just as it was in 2007,” he said.

A central bank that tells politicians what legislation it desires can never again claim independence anymore.

• ECB Urges EU To Curb Virtual Money On Fear Of Losing Control (R.)

The European Central Bank wants EU lawmakers to tighten proposed new rules on digital currencies such as bitcoin, fearing they might one day weaken its own control over money supply in the euro zone. The European Commission’s draft rules, aimed at fighting terrorism, require currency exchange platforms to increase checks on the identities of people exchanging virtual currencies for real ones and report suspicious transactions. In a legal opinion published on Tuesday, the ECB said EU institutions should not promote the use of digital currencies and should make clear they lack the legal status of currency or money.

“The reliance of economic actors on virtual currency units, if substantially increased in the future, could in principle affect the central banks’ control over the supply of money … although under current practice this risk is limited,” the ECB said in the opinion for the European Parliament and Council. “Thus (EU legislative bodies) should not seek in this particular context to promote a wider use of virtual currencies.” The ECB argues the Commission’s proposal does not go far enough as it does not cover the use of virtual money to buy goods and services. “Such transactions would not be covered by any of the control measures provided for in the proposal and could provide a means of financing illegal activities.”

Dissaving.

• Saudi Arabia’s Bond: a Defining Trade for 2016 (WSJ)

Want a single instrument that wraps together nearly every big political, financial and economic theme in today’s world? Saudi Arabia’s mammoth $17.5 billion bond issue, marking its debut in international markets, is it. The size of the deal is impressive but actually the least important thing about it. Big bond deals tend to build a momentum of their own. But it does speak to the search for yield. The $6.5 billion 30-year portion of Saudi Arabia’s bond is set to pay 2.1 percentage points more in yield than a comparable U.S. Treasury, or around 4.6%. That is a sizeable pickup in a world where developed-market bond yields are on the floor or in negative territory. That Saudi Arabia is doing the deal at all is a more telling factor: The oil bounty that has propelled the economy has run dry.

The 18-month-long rout in oil prices that started in 2014 sent the country hurtling from a budget surplus to a deficit in 2015 of 15.9% of GDP that is set to narrow only to 13% in 2016, according to the IMFd. In 2013, government debt stood at just 2.2% of GDP, according to Moody’s. By 2017, it is forecast to be 22.9%. The level isn’t a source of concern, but the swift change shows the country’s stark reversal of fortunes. In the near term, buyers of the bonds are betting largely on oil. Swings in the price are likely to have a direct impact on the perception of Saudi Arabia as a credit. The recovery in oil prices, which stand close to their high of the year, has eased concerns about financial stability and helps explain some of the enthusiasm for the deal. But further ahead, this is a bet on the ability and willingness of the country to transform itself while maintaining social and political stability.

Explanations at the link. h/t Mish

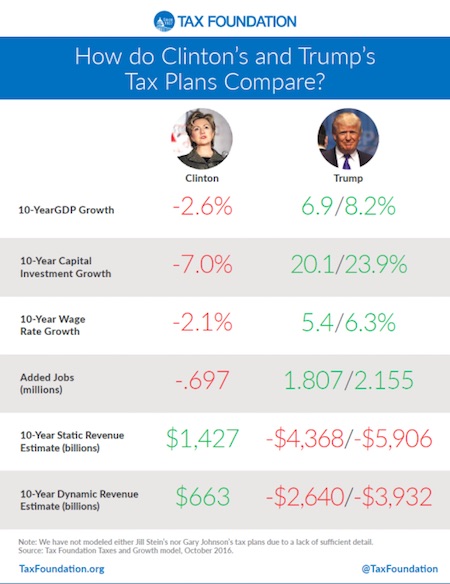

• How do Clinton and Trump’s Tax Plans Compare? (TF)

Both Hillary Clinton and Donald Trump have released tax plans during the campaign. The Tax Foundation has analyzed both the plans using our Taxes and Growth (TAG) model to estimate how their plans would impact taxpayers, federal revenues, and economic growth. Below, is a chart that contains all you need to know about the candidates’ plans.

“..if you are afraid that Donald Trump is a racist/sexist clown with a dangerous temperament, you have been brainwashed by the best group of brainwashers in the business right now..”

• Trump is a Pink Elephant (Scott Adams)

Here’s a little thought experiment for you: If a friend said he could see a pink elephant in the room, standing right in front of you, but you don’t see it, which one of you is hallucinating? Answer: The one who sees the pink elephant is hallucinating. Let’s try another one. If a friend tells you that you were both abducted by aliens last night but for some reason only he remembers it, which one of you hallucinated? Answer: The one who saw the aliens is hallucinating. Now let’s add some participants and try another one. If a crowd of people are pointing to a stain on the wall, and telling you it is talking to them, with a message from God, and you don’t see anything but a stain, who is hallucinating? Is it the majority who see the stain talking or the one person who does not? Answer: The people who see the stain talking are experiencing a group hallucination, which is more common than you think.

In nearly every scenario you can imagine, the person experiencing an unlikely addition to their reality is the one hallucinating. If all observers see the same addition to their reality, it might be real. But if even one participant can’t see the phenomenon – no matter how many can – it is almost certainly not real. Here I pause to remind new readers of this blog that I’m a trained hypnotist and a student of persuasion in all its forms. I’ve spent a lifetime trying to learn the tricks for discerning illusion from reality. And I’m here to tell you that if you are afraid that Donald Trump is a racist/sexist clown with a dangerous temperament, you have been brainwashed by the best group of brainwashers in the business right now: Team Clinton. They have cognitive psychologists such as Godzilla advising them. Allegedly.

I remind you that intelligence is not a defense against persuasion. No matter how smart you are, good persuaders can still make you see a pink elephant in a room where there is none (figuratively speaking). And Clinton’s team of persuaders has caused half of the country to see Trump as a racist/sexist Hitler with a dangerous temperament. That’s a pink elephant. As a public service (and I mean that literally) I have been trying to unhypnotize the country on this matter for the past year. I don’t do this because I prefer Trump’s policies or because I know who would do the best job as president. I do it because our system doesn’t work if you think there is a pink elephant in the room and there is not. That isn’t real choice. That is an illusion of choice.

Trump represents what is likely to be a once-in-a-lifetime opportunity to bring real change to a government that is bloated and self-serving. Reasonable people can disagree on policies and priorities. But Trump is the bigger agent for change, if that’s what you think the country needs. I want voters to see that choice for what it is. And it isn’t a pink elephant. If you are wondering why a socially liberal and well-educated cartoonist such as myself is not afraid of Trump, it’s because I don’t see the pink elephant. To me, all anti-Trumpers are experiencing a shared illusion.

If you don’t even jail people for this kind of stuff, your justice system is fast eroding.

• California Launches Criminal Probe Into Wells Fargo Account Scandal (R.)

The California Attorney General’s Office has launched a criminal investigation into Wells Fargo over allegations it opened millions of unauthorized customer accounts and credit cards, according to a seizure warrant seen by Reuters. Attorney General Kamala Harris authorized a seizure warrant against the bank that seeks customer records and other documents, saying there is probable cause to believe the bank committed felonies. The probe marks the latest setback for the bank in a growing scandal that led to the abrupt retirement of its chief executive officer, monetary penalties, compensation clawbacks, lost business and damage to its reputation.

[..] This is at least the second criminal probe to be opened into Wells Fargo since last month. In September a source told Reuters that federal prosecutors are also looking into the matter. An affidavit filed by Special Agent Supervisor James Hirt with the California Department of Justice reveals that interviews with possible victims of the fraud have already started. One victim, identified only as “Ms. B,” told the investigator that she had declined a request by a Wells Fargo teller in late 2011 or 2012 to open new accounts. But sometime in late 2013 or early 2014, she started to receive notices that she and her husband “allegedly owned on three life insurance policies held by the bank,” the affidavit says.

Everyone with power is.

• Who’s Powering the War on Cash? (DQ)

[..] cash’s days are numbered, as technological advances and changes in generational priorities dampen its allure. The world is brimming with individuals and institutions determined to put it out of its misery. Top of the list are the world’s central banks, which have the perfect motive for whacking cash: i.e. to make negative interest rates an eternal — or at least, more enduring — reality. And the only way to do that is to stop depositors from cashing out, as the Bank of England chief economist Andrew Hadlaine all but admitted in 2014. Japan and Europe are already deep into negative territory, and Fed Chair Janet Yellen has already said that the U.S. should be prepared for the same outcome. But as long as cash exists, there’s no way of preventing depositors from doing the logical thing – i.e. taking their money out of the bank and parking it where the erosive effects of NIRP can’t reach it.

Central banks are not the only ones who dream of a cash-free world. For credit card companies, cash is the ultimate rival. As such, it’s no surprise that the likes of Visa and MasterCard are among those pushing the hardest for a cashless economy. For banks, the benefits are no less obvious, including cost cuts, greater control over the flow of customer funds, and larger fees. As for politicians, Eurocrats and global plutocrats, including the senior servants of the IMF, World Bank and United Nations, they will enjoy even greater access to and dominion over the people’s funds. What better way of controlling the people than by controlling their access to the money they need to survive? It would amount to what Martin Armstrong calls “totalitarian control over the economy.”

These powerful agents have already created a perfect platform for achieving their dream: The Better Than Cash Alliance (BTCA), a UN-hosted partnership of governments, companies and international organizations. Its purpose, in its own words, is “to accelerate the transition from cash to digital payments globally through excellence in advocacy, knowledge and services to members.” The Better Than Cash Alliance’s membership list reads like a who’s who of some of the world’s most influential corporations and institutions. They include Coca Coca, Visa and Mastercard. Apple is, for now, conspicuously absent from the list, but in its place representing the tech industry is the Bill and Melinda Gates Foundation.

Also on the list are the Citi Foundation, the US Agency for International Development (USAID), and the World Saving Banks Institute, which represents 7,000 retail and savings banks worldwide. Member institutions range from powerful private foundations — including the Ford Foundation and the Clinton Development Initiative — to a bewildering alphabet soup of UN organizations, including WFP (the World Food Programme), UNFPA (the UN Population Fund), UNPD (the UN Development Program), IFAD (the International Fund for Agricultural Development) and UNCDF (the UN Capital Development Fund).

Interesting theme, but in an article of this length, confining your self to central bankers only seems a shame.

• The Cult Of The Expert – And How It Collapsed (G.)

When the history is written of the revolt against experts, September 2008 will be seen as a milestone. The $85bn rescue of the American International Group (AIG) dramatised the power of monetary gurus in all its anti-democratic majesty. The president and Congress could decide to borrow money, or raise it from taxpayers; the Fed could simply create it. And once the AIG rescue had legitimised the broadest possible use of this privilege, the Fed exploited it unflinchingly. Over the course of 2009, it injected a trillion dollars into the economy – a sum equivalent to nearly 30% of the federal budget – via its newly improvised policy of “quantitative easing”. Time magazine anointed Bernanke its person of the year. “The decisions he has made, and those he has yet to make, will shape the path of our prosperity, the direction of our politics and our relationship to the world,” the magazine declared admiringly.

The Fed’s swashbuckling example galvanized central bankers in all the big economies. Soon Europe saw the rise of its own path-shaping monetary chieftain, when Mario Draghi, president of the European Central Bank, defused panic in the eurozone in July 2012 with two magical sentences. “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro,” he vowed, adding, with a twist of Clint Eastwood menace, “And believe me, it will be enough.” For months, Europe’s elected leaders had waffled ineffectually, inviting hedge-fund speculators to test the cohesion of the eurozone. But now Draghi was announcing that he was badder than the baddest hedge-fund goon. Whatever it takes. Believe me.

In the summer of 2013, when Hollywood rolled out its latest Superman film, cartoonists quickly seized upon a gag that would soon become obvious. Caricatures depicted central-bank chieftains decked out in Superman outfits. One showed Bernanke ripping off his banker’s shirt and tie, exposing that thrilling S emblazoned on his vest. Another showed the bearded hero hurtling through space, red cape fluttering, right arm stretched forward, a powerful fist punching at the void in front of him. “Superman and Federal Reserve chairman Ben Bernanke are both mild-mannered,” a financial columnist deadpanned. “They are both calm, even in the face of global disasters. They are both sometimes said to be from other planets.”

They’re going to roast her today, and not in a funny way.

• Theresa May To Tell EU Leaders ‘There Will Be No Second Referendum'(G.)

Theresa May is to warn her 27 fellow European Union leaders over a working dinner in Brussels that Britain’s decision to leave is irreversible and there can be no second referendum. Thursday’s meeting of the European council will be the prime minister’s first opportunity to address the leaders of all the other member states since the UK voted to leave the European Union in June. Donald Tusk, the European council president, has insisted Britain’s future relationship with the EU will not be on the formal agenda for the two-day meeting, but he will give May the opportunity to set out the “current state of affairs in the country” over coffee at the end of the meal.

A No 10 source said she would tell her fellow EU leaders: “The British people have made a decision and it’s right and proper that that decision is honoured. There will be no second referendum. The priority now has got to be looking to the future, and the relationship between the UK, once we leave”. The source added that the prime minister would also seek to reassure the other member states, amid growing fears that Brexit could unleash political and economic instability in Britain and the rest of Europe. “She wants the outcome at the end of this process to be a strong UK, as a partner of a strong EU,” the source said. “She doesn’t want the process of the UK leaving to be damaging for the rest of the EU. She wants it to be a smooth, constructive, orderly process.”

Painful times ahead.

• Australia Housing Boom Peak Has Passed – Morgan Stanley (BBG)

Australia’s housing boom has passed its peak, with a looming apartment glut set to lead to a sharp slowdown in future developments, according to Morgan Stanley. The slowdown in construction will hurt economic growth, put 200,000 jobs at risk and prompt the central bank to resume cutting interest rates next year, Morgan Stanley analysts led by Daniel Blake said in a note dated Oct. 19. “We believe the growth contribution from the housing boom has already peaked and look for a plateau over 2017 and decline through 2018,” the analysts said. The housing industry is also facing a “more imminent credit crunch” for purchases and developments, they said. “The greatest vulnerability is settlement risk on the 160,000 apartments we forecast being completed through the end of 2017,” they said in the report.

“Listed developers report low failure rates currently, but also confirm credit availability has tightened, especially for foreign investors. Non-bank credit is moving to plug the gap at higher interest rates, but we expect some projects will land with the receiver.” Shares of developer Lendlease Group slumped as much as 5.5% in Sydney trading Thursday after the company flagged a slowdown in building activity, saying Sydney apartment activity is peaking and the Melbourne apartment sector is facing a high level of supply. In May, all 391 apartments offered by Lendlease at a project in Sydney were snapped up in just four hours. A national housing oversupply of about 100,000 dwellings will develop by 2018, Morgan Stanley said, as a glut of apartment projects are completed, particularly in Sydney and Melbourne.

Cohen is the no. 1 American expert on Russia. Audio file at the link.

• Did the White House Declare War on Russia? (Stephen F. Cohen)

Nation Contributing Editor Stephen F. Cohen and John Batchelor continue their weekly discussions of the new US-Russian Cold War. Cohen reports that a statement by Vice President Joe Biden on NBC’s Meet the Press on October 16, released on October 14, stunned Moscow (though it was scarcely noted in the American media). In response to a question about alleged Russian hacking of Democratic Party offices, in order to disrupt the presidential election and even throw it to Donald Trump, Biden said the Obama administration was preparing to send Putin a “message,” presumably in the form of some kind of cyber-attack.

The Kremlin spokesman and several leading Russian commentators characterized Biden’s announcement as a virtual “American declaration of war on Russia” and as the first ever in history. Cohen observed that at this fraught stage in the new US-Russian Cold War, Biden’s statement, which clearly had been planned by the White House, could scarcely have been more dangerous or reckless—especially considering that there is no actual evidence or logic for the two allegations against Russia that seem to have prompted it. Biden was reacting to official US charges of Kremlin hacking for political purposes. Cohen points out that in fact no actual evidence for this allegation has been produced, only suppositions or, as Glenn Greenwald has argued, “unproven assertions.”

While the US political-media establishment has uncritically stated the allegation as fact, a MIT expert, professor Theodore Postol, has written that there is “no technical way that the US intelligence community could know who did the hacking if it was done by sophisticated nation-state actors.” Instead, Cohen suggests, the charges, leveled daily by the Clinton campaign as part of its McCarthyite Kremlin-baiting of Donald Trump, are mostly political, and he laments the way US intelligence officials have permitted themselves to be used for this unprofessional purpose. Moreover, it is far from clear that the Kremlin actually favors Trump, despite Clinton’s campaign claims.

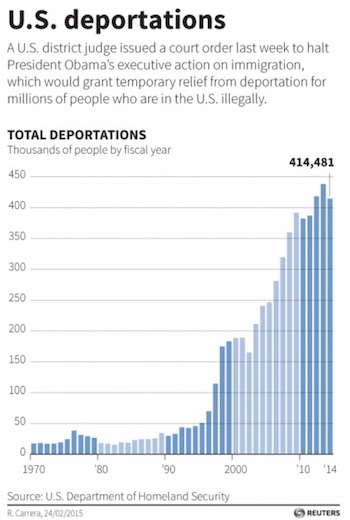

“Obama is now on pace to deport more people than the sum of all 19 presidents who governed the United States from 1892-2000..”

• What Obama’s Record Deportations Look Like (I’Cept)

Donald Trump noted during the third presidential debate that the Democratic president, Barack Obama has deported millions of people. Indeed, Obama has deported more people than any modern president. From January, at Fusion.net: “Donald Trump’s bilious blather about immigrants reminds us—more often than most people need reminding—that words matter. But the Obama administration’s recent wave of police-state raids on Central American women and children, whose only crime is poverty and a lack of proper paperwork, reminds us that actions matter too. When it comes to getting tough on immigration, Republican candidates talk the talk, but Obama walks the walk. Obama has deported more people than any U.S. president before him, and almost more than every other president combined from the 20th century.

“Immigration-flow numbers are staggering in both directions. In 2014, it’s estimated that more than 200,000 Central Americans tried to emigrate to the United States without documentation. But the Obama government has been deporting them as fast as it can. Since coming to office in 2009, Obama’s government has deported more than 2.5 million people—up 23% from the George W. Bush years. More shockingly, Obama is now on pace to deport more people than the sum of all 19 presidents who governed the United States from 1892-2000, according to government data.

“And he’s not done yet. With the clock ticking down his final months in office, Obama appears to be running up the score in an effort to protect his title as deporter-in-chief from future presidents. To pad the numbers, Homeland Security is now going after the lowest-hanging fruit: women and children who are seeking asylum from violence in Central America. “This is the only time I remember enforcement raids on families of women and children who are fleeing some of the most violent places on the planet,” says Royce Bernstein Murray, director of policy for the National Immigrant Justice Center.

Intelligent species.

• Use Of Strongest Antibiotics Rises To Record Levels On European Farms (G.)

Use of some of the strongest antibiotics available to treat life-threatening infections has risen to record levels on European farms, new data shows. The report reinforces concerns about the overuse of antibiotics on farms, following revelations from the Guardian of the presence of the superbug MRSA in UK-produced meat, in imported meat for sale in UK supermarkets, and on British farms. According to the data from the European Medicines Agency, medicines classified as “critically important in human medicine” by the World Health Organisation appear to be in frequent use on farm animals across the major countries of the EU, including the UK.

This comes in spite of WHO advice that, because of their importance, these drugs should be used only in the most extreme cases, if at all, in treating animals. The latest report from the EMA collates data from member states on the sales of antibiotics for veterinary purposes in 2014, and shows that antibiotic use on farms fell by about 2% on the previous year overall, and by as much as 12% in many countries. But this disguises the rise in the use of the strongest medicines, such as colistin, which is a last resort for life-threatening human illness. The percentage of antibiotics sales made up by the most potent antibiotics remained steady or in some cases increased slightly, indicating an increase in the amount of so-called critically important antibiotics used.

For instance, sales of fluoroquinolones – the newest versions of which are used to treat life-threatening illnesses including pneumonia and Legionnaire’s disease – stood at 141 tonnes across the countries surveyed in 2013, and rose to 172 tonnes in 2014. Sales of macrolides, also classed as critically important to human health, rose from 59 to 67 tonnes in the same period. This shows that efforts to prevent the drugs most crucial for human health from being used in farming are failing.

Home › Forums › Debt Rattle October 20 2016