Russell Lee Agricultural day laborer family near Spiro, Sequoyah County, Oklahoma June 1939

Every people has the right to self-determination, but only if it pleases a bunch of self-elected overlords and if it serves their purpose. How else can we interpret the fact that the Donetsk self-organized referendum was rejected by the West and even labeled criminal by the Kiev government that in turn is labeled criminal in Donetsk, all of whom say the May 25 across-Ukraine election is the real and legal thing, as the Donetsk region has already vowed to boycott that election? You can have a referendum to separate yourself from Ukraine, but only under Ukraine law. That is, the law of a government that has threatened to ban your language from being used where you live and that has been put in place, and maintained there, by armed groups that are shooting at you, must decide your right to self-determination.

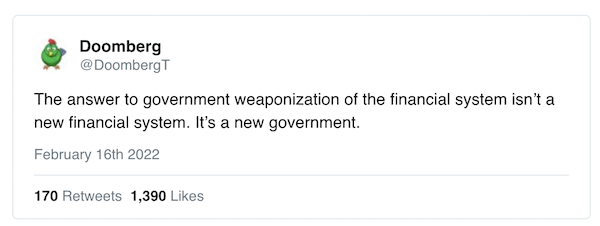

The biggest irony in my view came from a Bloomberg article this weekend, which said:

EU leaders say the [situation] may be spiraling out of Putin’s control. “Armed thugs with modern weapons are stirring old tensions and stoking new hatreds,” U.K. Foreign Secretary William Hague said [..] Putin “seems to have unleashed forces that he cannot control.”

Which made me think: if according to you he’s not in control, how can you threaten him with more sanctions? How does that work? Do you mean to say you want him to seize control, as in send in his army? I think maybe you it’s you guys who have lost control, and you think that’s somehow working in your favor. So you let it go.

I have no – reason to – doubt that Hague’s MI5 and MI6 have elbowed their asses into Kiev too, but it’s the American involvement that so far stands out. A recount: It seems like ages ago that we heard of the active roles played by Assistant Secretary of State Victoria Nuland and US ambassador to Ukraine Geoffrey Pyatt, who hand-picked Yatsenyuk for the PM role after their hand-picked overthrow of the elected Yakunovich government. And who, when the protests by grandmothers in Maidan square didn’t move fast enough, or would perhaps even have threatened to fail – without much, if any, violence on the part of the government, lest we forget – started supporting the Right Sector and Svoboda party, which had not only the gun power needed to finish what the grandmothers could not, but also links to, and insignia of, a past that no well thinking modern American should want anything to do with.

But Nuland, along with the people she shares her ideas with stateside, has never been a thinking modern American. Still, that’s just one aberration. What followed were visits to Kiev by Senator McCain handing out sweets to those grandmothers who could have been his daughters while the insignia guys moved in on the elected government’s quarters with the ever heavier artillery McCain himself may well have had a hand in delivering. By now were definitely in a place America should never have wanted to be in. And it was all just getting started. And $5 billion had already been spent on NGO infiltration measures, that they wanted to get a return on.

Yanukovich didn’t flee because either the grandmothers, or the right wing militia, or even the US and EU, didn’t want him. He left because Putin didn’t want him. Or at least not enough to risk a fight for him. Something that may well have been missed by everyone who’s not a chess player. Putin knew, every step of the way, what the western involvement was. Not just the overt war-mongering Nuland and McCain brought to the table, but the whole scala. Putin’s only mistake may have been that he didn’t think the US would be stupid enough to do what they did end up doing; a serious enough mistake in itself.

After the Yats coup, which the west still claims was somehow legal, unlike the Crimea and Donetsk referendums, CIA chief John Brennan visited Kiev. What happened after that is that since Ukrainian soldiers have been very reluctant to fire on their own people, and there was a plan in place to attack the ethnic Russian eastern part of Ukraine, which holds the industrial base, the attacks in the east are now executed by Special Forces, in which the not exactly sparkly clean Right Sector plays a major role, as does Blackwater, which has 400 operatives on the ground, according to German media. The Right Sector and Blackwater get help from dozens of CIA and FBI agents also on the scene.

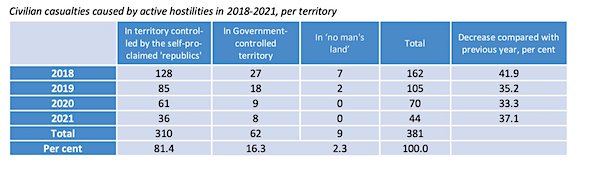

By now you’re talking serious US presence. And then you get the Odessa “incident” 10 days ago. In which an occupied building was set on fire, many people were burnt alive, and those who tried to escape the flames were shot or even clubbed to death by the crowd that surrounded the burning edifice. Today’s count: 42 dead, 60 hospitalized of which 26 are in grave condition, 48 missing. A scene reminiscent of a 70 year-old past in that part of the world that everybody claims they never wanted to see again, but that never would have happened had not the US and EU supported the perpetrators. The burning building tactic, apparently, was repeated a few days ago in the eastern coastal city of Mariupol.

If you live in the US or the EU, you must realize these things are executed in your name, and if you don’t protest them, you have no “Ich hab es nicht gewusst” excuse if and when the people come calling who were the victims or have family and friends who were. The “official” Ukraine elections take place less than 2 weeks from today, and they are guaranteed to take place among an avalanche of mayhem, violence and deaths. For which Putin will be handed all the blame and then some by the western governments and media, but which will carry a heavy handed signature from the people who represent you and me. You can sit in an office tower in Manhattan or London or Paris, or a retail store in Boise, Idaho, or Berlin or Madrid, but that doesn’t mean you can wash your hands of the bloodshed and look the other way. What is being committed in your name is what we call crimes against humanity. And it’s going to get worse. And this is just Ukraine.

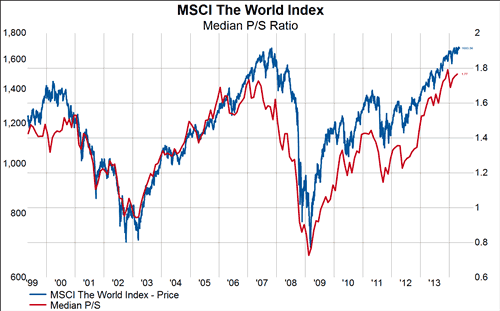

Great graphs.

• Are Stocks Cheap? (Zero Hedge)

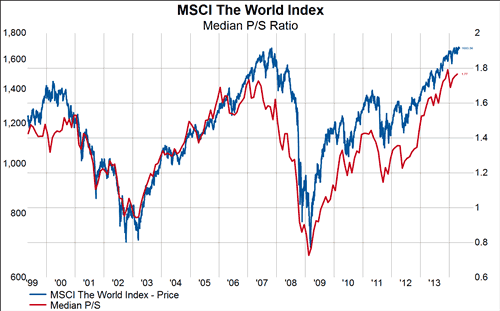

As if the question actually needs to be asked, we thought the following 3 charts would provide at least some defense against the constant barrage of “healthy rotation” bullshit currently being used to maintain assets-under-management as professionals unwind their levered longs into a newly-willing retail public. As Gavekal notes, the following charts show that the median stock is trading at valuation levels only seen at the previous stock market highs of 2007 and 2000. Measuring the valuation level of the median stock in an index can help mitigate the market-cap-weighted bias associated with many index level valuation statistics. This is important because index level valuations that are heavily influenced by a handful of large companies can give a misleading representation of prevailing valuations for most stocks. In the below charts we show the median valuation for stocks in the MSCI World Index (red line, right axis) and compare it to the Index price (blue line, left axis).

Are Stocks Cheap? Price-to-Sales – Nope!

Read more …

The system rots not at the surface, but from within.

• As Smart Money “Harvests” Gains, Small Caps And Greater Fools Get Killed (TPit)

Leon Black, epitome of the smart money and CEO of private equity giant Apollo Global Management, explained the phenomenon this way during Thursday’s earnings call:

At a conference in the spring of last year, I was somewhat infamously quoted as saying that we were selling everything that was not nailed down. Here, at Apollo, since then, it’s no secret we’ve been very active in monetizing the existing investments of the funds we manage, but even I didn’t foresee the remarkable pace of the activity to come…. For now, in terms of harvesting, we intend to remain active in capitalizing on market conditions as appropriate.

This “harvesting” takes place when the smart money sells its investments at peak valuations and at the peak of the market to the dumb money, often mutual funds that get stuffed into the retirement nest eggs of the unwitting. So this had to happen. With stock markets soaring for five years straight, with home prices jumping in the double digits two years in a row, and with other assets defying gravity each in its own manner, regular folks started doing the math and extending straight lines from these data points decades into the future, and they discovered that they’ll be able to retire once again comfortably. Or more precisely, 50% of them made that discovery, according to Gallup. The highest percentage since 2007, just before all heck broke lose.

This optimism of regular folks is required for the smart money to be able to “harvest” its gains. The mainstream media has been playing along by breathlessly covering the Dow, which set another all-time high on Friday, and the S&P 500 which is just a smidgen off its all-time high. But beneath the surface, stock after stock has been getting slaughtered. It just doesn’t show up in these two indices. The stocks of the largest corporations have been doing pretty well. Due to their enormous market capitalization, they dominate mathematically the capitalization-weighted indices. And in that capacity, they paper over the systematic, wholesale destruction of smaller stocks, and particularly of the darlings of the last few years. Some of this destruction has gnawed through the layers of large-cap stocks in other indices: the NASDAQ is down 6.9% from its 52-week high in March; the small-cap Russell 2000 is down 8.8%; the IBB Biotech Index 17.8%; the FDN Internet Index 18.9%; the SOCL social media index 27.0%…. It’s brutal out there.

Read more …

Democracy needs a redefinition.

• Hedge Fund Titans Are Testing The Quality Of US Democracy (FT)

John Paulson made his fortune by taking a massive short position against the US housing bubble. Today the hedge fund billionaire is betting that the US political system will fail. This time he has company. Other billionaires have launched a lawsuit to force the US Treasury to pay shareholders vast sums from the government-sponsored housing enterprises that it bailed out in 2008. Betting on Washington’s largesse has become a routine investment strategy. Whether this one works, aspiring billionaires should take note: if you want to strike it lucky, try shorting American democracy. The risk is small and the rewards are spectacular.

In 2008, the US government did “whatever it takes” to save the world economy from a rerun of the 1930s. Bailing out the people who had caused the crisis was an ugly spectacle that helped embitter politics in the US and elsewhere. But it was a necessary evil. The alternative was too dire to contemplate. As it usually does, the US system got its act together in an emergency. The real problem is how it functions in normal times. Two of the largest beneficiaries of Washington’s firefighting were Fannie Mae and Freddie Mac, the mortgage underwriters, which took $187.5bn in taxpayers’ money to keep them alive. Without that infusion, the entire US housing finance system would have seized up – and with it the global economy. And Fannie and Freddie would have ceased to exist.

Six years later, some of the richest people on the planet are petitioning the courts to reward Fannie and Freddie’s shareholders for having been rescued by the US taxpayer. Last week, the two enterprises, which are in government “conservatorship” – a step short of nationalisation – said they would bring their total dividend payments to the US Treasury to $213bn since 2009, which is above the original bailout. Although both enterprises were delisted, investors bought their common and preferred shares on the grey market and now want their speculation redeemed. The US Treasury rightly argues that the dividends do not qualify as a repayment of the bailout. Moreover, it is the government that will pick up the bill if the housing market goes into reverse. The losses will continue to be socialised even if the gains are temporarily flowing to the taxpayer.

Bill Ackman, the activist investor, last week predicted that the case would go all the way to the US Supreme Court. Given its recent record, that should be little comfort to American taxpayers. But the hedge funds’ real game is to stop Congress from passing legislation that would wind down the two behemoths and share part of their vast mortgage risk with the private market. As long as Fannie and Freddie stay alive, there is hope for the speculators.

Read more …

The fall of capitalism was predicted a long time ago.

• This 1 Quote And Who Said It Prove Capitalism Is Dying (Paul B. Farrell)

Quiz. One question. Your answer will tell who you are, deep within, your moral conscience. And why America has lost its moral compass, but doesn’t know it’s lost, nor why. And that’s an economy killer. Yes, just one answer tells all. Ask yourself, who said: “The disposition to admire, and almost to worship, the rich and the powerful, and to despise, or, at least, to neglect persons of poor and mean condition is the great and most universal cause of the corruption of our morals.” No, it’s not who you think. But your answer will reveal why America lost its moral compass. And why capitalism is dying. Was it some extreme leftist? Karl Marx? Pope Francis? Obama? Maybe a hard-right conservative criticizing progressives: Ayn Rand? Paul Ryan? Billionaire Koch Bros.? An academic: Thomas Piketty, Jared Diamond. Economist Joseph Stiglitz? Nouriel Roubini? Maybe an entertainer: Bono, Springsteen, Jay-Z? [..]

Another possible guess: Thomas Piketty? Does the answer come from his new book, “Capital in the Twentieth-First Century?” [..] … here’s everything you need to know about Piketty’s attack on capitalism and its inherent tendency to widen the world’s inequality gap: “When the rate of return on capital exceeds the rate of growth of output and income, as it did in the nineteenth century and seems quite likely to do again in the twenty-first,” said Piketty, “capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.”

So go back to the quiz question: If neither Piketty nor Pope Francis, nor someone on the extreme left or hard-right said it … then who said: “The disposition to admire, and almost to worship, the rich and the powerful, and to despise, or, at least, to neglect persons of poor and mean condition is the great and most universal cause of the corruption of our moral sentiments.” Answer: Adam Smith, the father, creator, patron saint of American capitalism. Yes, Adam Smith, in his “Treatise on Moral Sentiments.”

Read more …

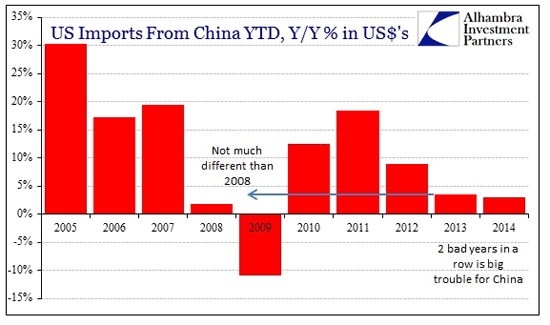

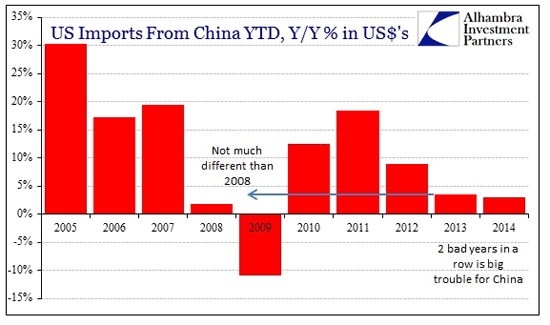

• Q1 Imports Below 2012 – No Keynesian Escape Velocity Here (Alhambra)

April trade data for Chinese exports purportedly show a rebound forming, though its size and even legitimacy is still much in doubt. The fake Hong Kong invoice scandal of last year is making comparisons to this year difficult, but that doesn’t and won’t quell the extrapolations.

The export data are “somewhat inconsistent with the weakness seen in new export orders” in purchasing managers’ indexes from the government and HSBC Holdings Plc, said Barclays Plc analysts led by Chang Jian, chief China economist in Hong Kong.

This disparity doesn’t exclude the possibility of a rebound, only that any conclusions may need corroborative evidence to be consistent.

Exports fell 6.6% in March from a year earlier and plunged 18.1% in February, the biggest drop since the global financial crisis, based on previously released data.

According to the Chinese figures, then, exports were still down in March after an atrocious February. That should be matched at the other end of the trade link in the destination countries. The problem, particularly for US trade with China, is that the Census Bureau estimated that imports from China rebounded in March rather than fell further as the Chinese claim. [..] To clear up some of this mess, we can look at the figures YTD. What that shows is that the March rebound was only enough to partially offset serious weakness in earlier months.

That’s trouble for China because last year was just as feeble. Their entire growth and credit orientation is predicated on swift growth in end markets. Slow growth (or none) instead ends up feeding back as brewing credit issues from companies that were expecting robust growth projections to actually come to fruition in order to maintain the credit flow. After two years of this, accumulating defaults may just be inevitable.

Read more …

• Doug Kass: 7 Important Bubbles In Our Current Market (Benzinga)

Aptly-named financial bubbles can disappear just as quickly as they form. Seabreeze Partners Management Inc. President Doug Kass was a special guest on Benzinga’s #PreMarket Prep, and he talked about where he thinks the biggest bubbles are right now. Depending on your point of view, Kass said, there’s about eight or nine. Here are the seven he outlined for us:

IPOs Kass called the IPO market the most obvious bubble, because more than 75% of the IPOs brought to market haven’t been profitable.

Social Media Social media stocks are being valued on the notion of addressable markets. Kass said this is similar to 1999, when Internet stocks were priced “relative to eyeballs.”

Debt “There’s obviously a bubble in the amount of debt as a percentage of global GDP that is held by the major central banks,” Kass said.

Quantitative Easing Another bubble is the belief that the Federal quantitative easing policy is sufficient, by itself, to generate a self-sustaining recovery in the domestic economy.

Credit There’s a strange situation when Spanish and Italian yields converge with U.S. ones, Kass said, and there’s a problem when Greece is able to sell bonds at the rate they recently did about three weeks ago.

Chinese and Shadow Banking “There’s certainly excesses of bubbles in the Chinese banking and shadow banking industries, as well as how many hundreds of trillions of dollars of derivatives notional outstanding exist,” he said.

Buybacks The last bubble that Kass mentioned was buybacks. Goldman Sachs reported that this past March was its busiest on record with nearly $75 billion in buyback authorizations. The first quarter saw almost 300 authorizations that totaled nearly $200 billion, which sets a pace for over $700 billion in authorizations for this year. “That’s the second most ever behind 2007, which was the market top. And we all know that corporations typically buy high and sell low,” Kass said. “The last time we saw this rush to buy was 2007 – the year the market peaked.”

Kass believes the bubbles already have begun to pop. What he calls the “high-beta earthquake” began in the first week of March, when the league-leading biotech stocks began to break down. Then it continued in the following weeks, as [tech] companies all got “schmeissed” in the market, Kass said. “I think this is the first shot across the bow,” he said. Although share prices are benefiting from a combination of massive liquidity and zero interest rate policy, Kass thinks investors are increasingly realizing that each progressive quantitative easing is having a more measured impact on domestic growth. “We have rates at zero. They have been for some time. QE has obviously become a blunt tool,” he said. “Think about it. We’ve had it easy for five years, and we have 0.1% real GDP in the first quarter announced yesterday.” Even though a Fed run by ‘Helicopter’ Ben (Bernanke) and, who I call ‘Whirlybird’ Janet Yellen can change how things look, they can’t change how things are,” he said.

Read more …

Tick, tick, tock ….

• Xi Says China Must Adapt to ‘New Normal’ of Slower Growth (Bloomberg)

Chinese President Xi Jinping said the nation needs to adapt to a “new normal” in the pace of economic growth and remain “cool-minded” amid a slowdown that analysts forecast will lead to the weakest expansion since 1990. China’s growth fundamentals haven’t changed and the country is still in a “significant period of strategic opportunity,” Xi said, according to a Xinhua News Agency report on the central government website on May 10. At the same time, the government must prevent risks and take “timely countermeasures to reduce potential negative effects,” he said. Policy makers are trying to keep economic expansion from slipping below Premier Li Keqiang’s 2014 target of about 7.5% while reining in a credit boom that a central bank official said threatens to undermine the financial system.

The government has so far limited its support to tax breaks, and speeding up infrastructure and social housing investment, with Li saying last week the focus remains on the quality of growth and on changing the structure of the economy. “Xi’s comment showed that the Chinese government is reluctant to roll out large stimulus now,” said Xu Gao, chief economist with Everbright Securities Co. in Beijing, who previously worked for the World Bank. “At the same time, economic weakness remains and pressure from the property market is rising. The government has to gradually step up policy easing, especially on the monetary policy side.”

Read more …

Yes, it is.

• Chinese Housing Apocalypse On The Way? (MarketWatch)

The possibility of a collapse in China’s bubbly housing market has long been a threat hanging over the nation’s markets and economy. But exactly what would happen if the bubble bursts in a messy way? Barclays sent a note out Friday looking at a trio of scenarios: a base case in which housing prices continue their slow-but-steady path lower, a “downside risk” case in which prices drop by 10% or so, and a “hard landing” situation in which a housing crash tanks the economy. “Is China’s property bubble at the bursting point? Our answer is not yet. Our base case remains for a gradual deflating of the bubble over 2014-15,” writes Barclays economist Jian Chang.

“But self-fulfilling expectations of falling house prices, financial difficulties among developers on the back of a highly leveraged economy with huge local-government debt, and a fragile financial system with a large shadow-banking sector, suggest the risks of a disorderly adjustment are real and rising,” she writes. In the base case, a gradual drop in prices and slower property sales would “weigh on overall investment and limit 2014 GDP growth to around 7.2%,” which is also the bank’s current forecast for China’s gross domestic product expansion. In the “downside risk” scenario, which Jian Chang assigns a 25% probability, “consumption growth would slow by more than in our baseline scenario but remain resilient, given the mild price correction,” while GDP growth would slow to between 6% and 6.5% this year and next.

As for the worst case, housing prices would tumble by more 30% nationwide, leading to “widespread defaults, insolvencies and bankruptcies,” as well as a liquidity crisis and GDP growth falling below 5% “for a couple of quarters.” While Barclays doesn’t assign a numerical probability for this last scenario, it offers some “factors” to watch out for. Possible precursors for such a collapse include “a sharp shift in financial-market risk attitude,” “failure of a major developer or a sizable financial institution,” and “policy mistakes as the government pushes reforms.”

Read more …

A 90.9% drop …

• Japan Current Account Surplus Shrinks Amid Weak Exports (Reuters)

Japan posted a much lower-than-expected current account surplus in March on weak demand for exports and rising imports, reinforcing recent signs that the recovery in the world’s third-biggest economy is being hampered by slow shipments. The surplus stood at 116.4 billion yen (676 million pounds), much less than the median forecast for a 305.0 billion yen surplus, finance ministry data showed. That was also well below a 612.7 billion yen surplus in February. Imports jumped in March partly due to increased demand before a sales tax increase at the start of April.

Excluding this one-off factor, economists say the data shows that a steady shift of manufacturing capacity overseas means Japan can no longer export its way to growth, and that it needs to boost its services sector to rebalance its economy. “The current account surplus could stabilise in the second quarter,” said Hiroaki Muto, senior economist at Sumitomo Mitsui Asset Management Co. “But structural changes mean exports are likely to remain weak. We need to respond to this change by increasing productivity in the services sector to meet domestic demand.” Imports jumped an annual 23.2% in March, the data showed. On the other hand, exports rose only 6.2% from the previous year.

Read more …

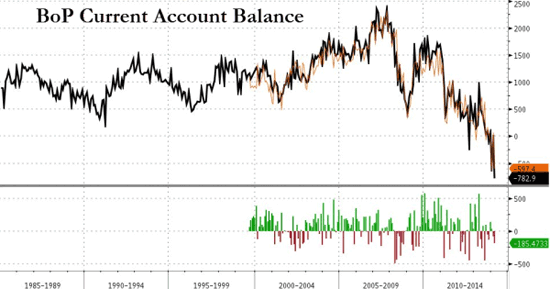

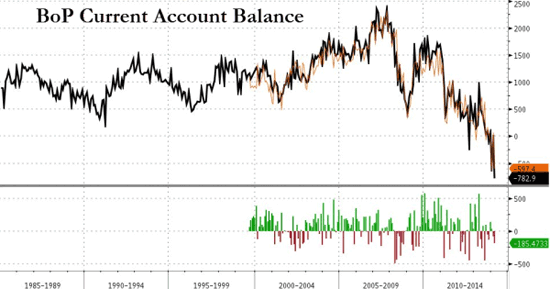

• Japan Balance Of Payments Current Account Collapses To Record Deficit (ZH)

Any day, week, month, quarter, year now… that J-Curve ‘recovery’ will come bounding over the horizon and save the Japanese economy from its inevitable death spiral… for now, presented with little comment aside for historical confirmation (as even Goldman Sachs has now given up on hope of a bounce), Japan’s largest (seasonally-adjusted) Balance of Payment Trade Deficit ever…

Must be the weather… As Bloomberg notes, this seems related to the tax hike…

Consumers splurged on items such as refrigerators and computers in March before the 3 percentage point tax rise, boosting imports already climbing due to a weaker yen and nuclear plant closures pushing up energy costs. A slide into a sustained deficit could make Japan more reliant on overseas funding to service the world’s biggest debt burden.

But… don’t worry…

“It’d be a problem if the government fails to demonstrate a clear path for budget consolidation should Japan fall into a structural current account deficit,” Tsutomu Saito, an economist at Daiwa Institute of Research in Tokyo

Oh yeah – they have a plan.

Goldman provides a little more color (and it’s just as uninspiring)…

For FY2013 as a whole, the current account recorded a surplus of +¥789.9bn but was far lower than the +¥4.2tn in FY2012 and the lowest since comparable records became available in FY1985.

The breakdown of the March balance of payments (non-adjusted) shows the trade deficit widening to -¥1.13tn (February: -¥533.4bn), as export growth slowed to +6.2% yoy (February: +15.7%) and import growth accelerated +23.2% (February: +14.1%). The services deficit narrowed to -¥58.4bn (February: -¥193.4bn).

Read more …

Hey, Martin …

• What is Yours Ain’t Yours: Cameron, Confiscation (Armstrong)

David Cameron has come out and argued that taxes will rise unless he can raid bank accounts in the UK. Cameron argues he will “have to put up taxes” unless tax officials are given draconian powers to raid people’s bank accounts if they think they even owe money. Trust me – all politicians share ideas. Obama is already conniving a way to do the same thing – you can bet on that. There is no elite private conspiracy of some dominating group. That implies some comprehension of what is even possible. I have sat in the room with such people and these conspiracy stories give these people way too much credit for being intelligent. Nobody smart enough to handle the job ever seeks such positions. Governments are run by lawyer-politicians who think they need only decree some law that solves the problem. They understand nothing. Why should people keep money in a bank in the UK after Cameron makes such a statement? He is way too stupid to realize people act in anticipation.

If I said I was going to punch you in the face, would you stand there or act in anticipation like move or fight back? Politicians cannot get this through their head that the economy functions always in anticipation of future events. They are just crazy – although not out of their mind entirely just yet. They can read a script, but they are incapable of understanding the people or math. These people are simply beyond control. All they can see is the immediate issue to survive day-by-day. They have absolutely zero comprehension of what they are doing and even less understanding of what happens when there is no more money they can raid. Those at the helm of the world need no elite-conspiracy. They are too stupid to have long-term plans beyond 30 days. This is how Empires Collapse – they are following the precise step-by-step guide for total chaos.

Read more …

No kidding.

• ‘We have not dealt with European bank crisis’ (Telegraph)

Europe’s banks need a fundamental restructuring to sort out the mess from the 2008 financial crisis and enable them to fund the growth that the eurozone and British economies so desperately need, a former senior aide to European Commission president José Manuel Barroso has claimed. Philippe Legrain, who in February ended a three-year stint as Mr Barroso’s independent economic adviser, believes that a banking shake-up is essential as the first part of a three-pronged strategy to get Europe back on track. “Europe needs to restructure its banking system,” he said in an interview with The Telegraph. “The Americans have been much more vigorous in that than we have.”

“There has been a belief that it’s best to try to preserve existing banks and exercise regulatory forbearance rather than force them to face up to their losses, sorting viable banks from unviable ones, recapitalising viable ones and closing down the unviable – the usual standard policy for dealing with a banking crisis. “The rule book has been broken here in Europe and the result is that we have a zombie banking system that keeps alive zombie companies that should go bust, while failing to extend credit to promising new companies that could deliver future growth. “That’s one of the big reasons why productivity in Britain has been so poor. The justification has been to stabilise the system but you end up freezing the economy. “You might say that this is all old hat and that the UK is growing again but that growth is coming almost entirely from increased consumption, with real wages that are still falling and from a housing bubble that returns to the old model of boom and bust.”

Read more …

Nice history.

• ‘It Was The Point Where The Eurozone Could Have Exploded’ (FT)

When the history of the eurozone crisis is written, the period from late 2011 through 2012 will be remembered as the months that forever changed the European project. Strict budget rules were made inviolable; banking oversight was stripped from national authorities; and the printing presses of the European Central Bank would become the lender of last resort for failing eurozone sovereigns.

Next week, European voters will go to the polls to render a verdict on what EU leaders created over those 12 months. If opinion polling is any indication, their judgment will be harsh: anti-EU parties are poised for unprecedented gains from France to Finland, Athens to Amsterdam. Over the course of the past six months, the Financial Times has interviewed dozens of participants in those decisions to tell the full story of how this new eurozone was created. From mid-level bureaucrats to prime ministers, they tell an unsettling tale of accidents, near misses and seemingly foolhardy brinkmanship. But in the end, these same leaders appear to have prevailed. The euro has been saved. The Europe they have created, for good or for ill, will be their legacy. [..]

To the astonishment of almost everyone in the room, Angela Merkel began to cry. “Das ist nicht fair.” That is not fair, the German chancellor said angrily, tears welling in her eyes. “Ich bringe mich nicht selbst um.” I am not going to commit suicide. For those who witnessed the breakdown in a small conference room in the French seaside resort of Cannes, it was shocking enough to watch Europe’s most powerful and emotionally controlled leader brought to tears. But the scene was even more remarkable, those present said, for the two objects of her ire: the man sitting next to her, French President Nicolas Sarkozy, and the other across the table, US President Barack Obama.

It would be the low point in a brutal, recrimination-filled night, one many participants would recall as the nadir of the three-year eurozone crisis. Mr Sarkozy had hoped his leadership of the Group of 20 summit would cement his standing on the global stage en route to re-election. Instead, everything was falling apart. Greece was imploding politically; Italy, a country too big to bail out, appeared just days away from being cut off from global financial markets; and Ms Merkel, try as Mr Sarkozy and Mr Obama might, could not be convinced to increase German contributions to the eurozone’s “firewall” – the “big bazooka” or “wall of money” they believed had to grow dramatically to fend off attacks by panicking bond traders.

Instead, a cornered Ms Merkel threw the French and American criticism back in their faces. If Mr Sarkozy or Mr Obama did not like the way her government ran, they had only themselves to blame. After all, it was their allied militaries that had “imposed” the German constitution on a defeated wartime foe six decades earlier. “It was the point where clearly the eurozone as we know it could have exploded,” said a member of the French delegation at Cannes. “It was the feeling [that with] the contagion, at this point, you were on the brink of explosion.

Read more …

And Durden’s great comment on it:

• US-Funded Global Bailout Prevented Collapse Of The Eurozone (Zero Hedge)

Goldman’s recent ascendent to the head of the ECB, Mario Draghi, sent Italian bond yields soaring in the process forcing Berlusconi to quit, Greece’s G-Pap also quit after his failed referendum gambit, and the one thing that prevented the all out collapse of the Eurozone, was the (latest) US-Funded global bailout of November 30, 2011. And ever since then it has been one lie after another, starting with Draghi’s “Whatever it takes” bluff to prevent the collapse the Euro, knowing full well the ECB is unable to monetize bonds at will like the US Fed (in his own words), and which has since transformed to a “whatever it takes” to push the Euro lower (confirming that the Eurozone is only viable in a EURUSD 1.20-1.40 corridor, and proceeding with the OMT “program” which still doesn’t actually exist, nearly two years after its introduction.

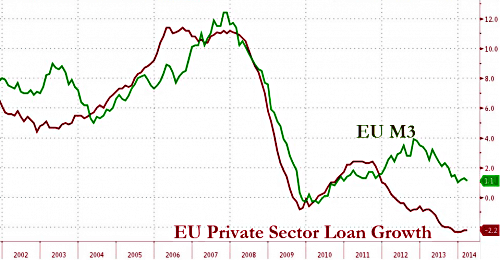

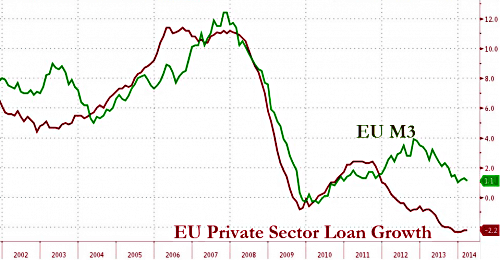

So what has happened in Europe since the fateful Cannes G-20 summit in 2011 which made Merkel cry? Why nothing. Absolutely nothing has changed, that infamous austerity which everyone hates never actually happened (those confused about this are urged to look at all time record high (and rising fast) debt numbers across the Eurozone periphery), and worst of all, that most important Keynesian variable – private sector loan growth – never picked up. As the chart below shows, Eurozone lending to private business remains at a record low, and very deflationary, -2.2%.

The reason: since European government merely kicked the can courtesy of yet another global central bank “put” exercise, all the politicians were spared the dread of actually implementing painful reforms. So what did Europe do? It changed the definition of GDP sufficiently to make Spain and Italy appear as if the two fulcrum nations are growing, and also suckered US hedge funds and private equity firms to chase after European non-performing loans and bad debt, now that the scramble for distressed real estate is finally over as US housing has finished its fourth dead cat bounce.

But at least Merkel did not have to cry any more, as the return of the Deutsche Mark was delayed by a few more years, at the expense of all those peripheral workers (the lucky ones who did not lose their job of course) who devoid of the capacity for an external, FX, rebalancing have seen their wages crater for years, just so Germany can keep its export machine humming courtesy of a cheaper currency. We wonder if once the effect of the liquidity tsunami fades alongside the Fed taper (especially since the ECB’s bluff of full, Fed-style QE will remain nothing more than just that, a bluff), and European bonds are finally reacquainted with selling, in turn sending the continent in yet another recession because, we will repeat again, nothing in Europe has been fixed, whether European stubbornness wins out again, and the member nations would opt out for disintegration of the most artificial union in history, or whether Angela Merkel will cry one final time?

Read more …

A small world.

• 2 Banking Giants Implore US Authorities to Go Easy (NY Times)

Two of the world’s biggest banks, facing the threat of criminal charges, are mounting final bids for leniency. To avoid the fallout from pleading guilty — no giant bank has done so in more than two decades — BNP Paribas and Credit Suisse made last-ditch appeals to prosecutors and regulators in recent weeks, according to people briefed on the talks. The private meetings came after prosecutors sought guilty pleas from the parent companies of both banks: BNP of France over doing business with countries like Sudan that the United States has blacklisted, and Credit Suisse for offering tax shelters to wealthy Americans.

While BNP and Credit Suisse proposed more modest guilty pleas from their subsidiaries rather than parent companies, the people briefed on the talks said, prosecutors appeared to balk at those overtures, challenging broader public concerns that banks have grown so important to the economy that they are effectively “too big to jail.” In the case of Credit Suisse, which recently created a subsidiary to house the “U.S. offshore business,” prosecutors have privately indicated that they are unwilling to charge the newly formed unit. The bank is now expected to strike a deal with prosecutors as soon as this week, the people briefed on the talks said. BNP made its own appeals. Underscoring the gravity of a guilty plea for the bank, BNP’s chief executive and two of his top lieutenants traveled to Washington and New York to make their case last week, the people said.

They reserved last Thursday for meeting BNP’s regulators in Manhattan — the Federal Reserve Bank of New York and Benjamin M. Lawsky, New York State’s top financial regulator. At a morning meeting in Mr. Lawsky’s conference room overlooking the Statue of Liberty, according to two of the people briefed on the talks, the regulator explained his plans to penalize at least a dozen BNP employees for their role in processing transactions for Sudan and Iran. But the crucial meeting occurred two days earlier in Washington, the people said, on Tuesday afternoon at the Justice Department’s headquarters. It was there that the executives outlined concerns about a guilty plea to the three prosecutors leading the case [..] The pitch was simple. The executives and lawyers warned that a guilty plea could wreak havoc on BNP and the broader economy well beyond France’s borders.

The argument — playing on the fear that criminal charges could prompt regulators to revoke a bank’s license to operate, the corporate equivalent of the death penalty — helped the British bank HSBC escape criminal charges in 2012. It also stoked a public outcry that Wall Street giants have grown so large and important that they cannot be charged. But the prosecutors appeared to brush off the concerns, according to the people briefed on the talks, having heard similar appeals in cases involving softer penalties like so-called deferred prosecution agreements. Mr. O’Neil and Mr. Bharara, in questioning the bank’s lawyers and executives, indicated they had doubts that a guilty plea would imperil the bank or the economy.

Read more …

• Credit Suisse Chief Urged To Quit As US Tax Spat Nears End (FT)

A senior Swiss politician has called for Credit Suisse’s chief executive and chairman to step down, as political pressure mounts on the bank ahead of an expected settlement to its long-running tax spat with the US. Since forcing UBS, Credit Suisse’s domestic rival, to pay a $780m fine in 2009 for helping US citizens evade taxes, the Department of Justice has been pursuing other Swiss banks that it believes committed similar offences. It is considering criminal charges against Credit Suisse, and a settlement in which Credit Suisse’s parent or subsidiary pleads guilty could be announced within weeks, people familiar with the matter have said.

Against this backdrop, Christian Levrat, head of the Swiss Social Democrats, said that Urs Rohner and Brady Dougan, Credit Suisse’s chairman and chief executive, as well as general counsel, Romeo Cerutti, should all resign. “They are a liability for the bank,” he said in an interview with the NZZ am Sonntag newspaper. “I was surprised that they didn’t offer to step down at the bank’s annual general meeting on Friday. That would have been responsible and in the interest of the bank and Switzerland.”

Credit Suisse has been attempting to resolve the US dispute for three years, and Mr Rohner stressed at the AGM that the bank was “doing everything” it could to bring matters to a close. However, he gave no details of how a final resolution might be constituted, and rejected a call from one shareholder that Mr Dougan resign. Mr Levrat criticised Credit Suisse for saying in 2009 that it was unaffected by the US’s allegations, and also criticised Mr Dougan for saying in a senate hearing earlier this year that wrongdoing at Credit Suisse had been restricted to a small group of employees. “A few months after Mr Dougan said under oath that there had been no systematic wrongdoing by the bank, Credit Suisse is probably going to have to make a guilty plea on behalf of the whole bank. The credibility of Credit Suisse’s management is dead,” he said.

Read more …

Tick tock …

• Europe’s Companies Write Off $500 Billion In Late Paid And Unpaid Debt (FT)

The debt written off by Europe’s companies due to late payment or non-payment of bills has swelled to €360bn despite the pick-up in economic activity in the region. The late payment consequences for businesses pose a real threat to Europe s competitiveness and social wellbeing, said Lars Wollung, president of Intrum Justitia, a credit management group. Hardest hit by the problem . . . are small and medium enterprises. Justitia surveyed more than 10,000 business managers in 33 European countries, including Russia, for the annual European Payment Index.

Bad debts – bills or invoices which companies have written off due to late or non-payment – grew from 3% of annual revenues in 2013, or €350bn, to 3.1% this year, or €360bn. Nearly three-quarters of the companies taking part in the research said that there had been no improvement in the late payments problem in the past three months despite the economic pick-up, and 46% believed late and non-payment risks were actually increasing. Graeme Fisher, head of policy at the UK s Federation of Small Businesses, said that, although the public sector had upped the speed with which it paid suppliers, there was still a serious problem in the private sector.

Even when the public sector pays promptly, the money doesn t sloosh down the system promptly because of the culture of late payment, he said. 40% of the companies which took part in the EPI research said the severity of late payment problems was preventing them from hiring staff. Unemployment in the eurozone was nearly 12% of the labour force in March according to Eurostat. Suppliers are often unwilling to go public about late payment problems for fear of jeopardising relationships with their most important customers. Late payments can be a massive problem, mainly for cash flow reasons, said one small business owner, based in Gloucester, England, who spoke to the FT on condition of anonymity.

Read more …

Darn!

• Japanese Dump Most Euro Bonds on Record (Bloomberg)

Japanese investors sold a record amount of euro-denominated long and medium-term bonds in March, Ministry of Finance data showed today. Money managers in Japan made net sales of 1.96 trillion yen ($19.2 billion), capping four months of reductions, the Tokyo-based Ministry of Finance said today. That’s the longest stretch of sales since the 10 months ended December 2011, during the euro region’s sovereign-debt crisis. Last year, Japanese investors bought a net 5.39 trillion yen of such bonds. “The situation in Ukraine may have played a part,” Ayako Sera, a Tokyo-based market strategist at Sumitomo Mitsui Trust Bank Ltd., said in reference to euro debt selling.

“It’s possible Japanese money will be forced to go back into some of the higher yielding countries in the region going forward. The global hunt for yield is likely to continue for some time.” Japanese investors sold 1.79 trillion yen of long-term German bunds in March, also the highest reported in data going back to 2005, the MOF report showed. They bought a net 536.3 billion yen of long-term U.S. Treasuries, the most since November, and snapped up 68.7 billion yen of Australian sovereign debt, adding to purchases in January and February. Investors also sold 481.1 billion yen of Dutch sovereign bonds and 71.6 billion yen of Italian debt.

Read more …

• Finnish Finance Minister Ousted as Party Head Over Austerity

Finnish Finance Minister Jutta Urpilainen was ousted as Social Democratic leader yesterday as her party turned to a trade union leader advocating more stimulus to promote growth in the northernmost euro member. Antti Rinne, head of the trade union Pro, won the backing of 257 party members against Urpilainen’s 243 at a congress yesterday in Seinaejoki, northwest of Helsinki. Urpilainen said she will step down as finance minister and leave the government. “Social democrats in Finland and in Europe must again target full employment,” Rinne, 51, said in a speech today. “Economic policies must target strengthening nascent growth and creating confidence in the future. The key are investments that create the foundations for rapid growth in the future.”

Voters have grown dissatisfied with austerity policies that have collided with a broader decline in Finnish business, as Nokia shrinks and the paper industry struggles. Finland’s economy has contracted in three of the past five years, pushing unemployment to 9.5% in March. Industrial production shrank for the 17th consecutive month in March.

Read more …

• Chrysler’s Phony Recovery (David Stockman)

One theme of the false recovery narrative peddled by the Wall Street/Washington axis is that the leading symbols of the 2008 crisis—-the big banks, AIG, housing, the auto industry—-are all fixed owing to Washington’s drastic and massive interventions at the time and since then. But the truth is just the opposite: Nothing has been fixed because all cans have been floated down the road by the Fed’s deluge of money printing. What has happened is that credit market debt outstanding—public and private— has soared from $52 trillion on the eve of the crisis to $59 trillion today, thereby putting a floor under the economy temporarily, but one which will become a huge burden down the road to households, business and governments alike as interest rates eventually normalize.

Likewise, the liquidity driven stock market is up by nearly 200%. This is temporarily providing a “wealth effects” boost to the discretionary spending habits of the top 10-20% of households, but one which will quickly reverse when today’s giant stock and “risk asset” bubble finally bursts. And sectors such as autos which were hit by a sharp one-time inventory liquidation in the winter-spring of 2008-2009 have had a modest rebound to more normal levels of production and inventory. But this doesn’t represent investment and productivity based organic growth – just a natural, short-term rebound from crisis conditions. The truth is that the auto bailouts did not save or create a single new auto job. [..]

The illusion of recovery stems from violent inventory fluctuations that were triggered by the Fed’s bubble finance. Chrysler’s sales and production numbers can be made to look impressive on a three-to-four year basis because the 2009 low-point of US sales at 10.5 million units was an artifact of the crisis and the current run-rate in the 15-16 million unit range is a unsustainable peak fueled by a renewed explosion of sub-prime auto lending. In truth, the trend rate of US new car sales never really dropped below 12-13 million. And it will probably fallback to the 13-14 million unit level—once the Fed’s latest financial bubble collapses and sub-prime loans dry-up and go into a new cycle of defaults. In that context, the idea that Chrysler’s North American sales will grow by nearly 50% of the next five years, as Marchionne proclaimed at Chrysler’s recent analyst day, is a laughable delusion.

Read more …

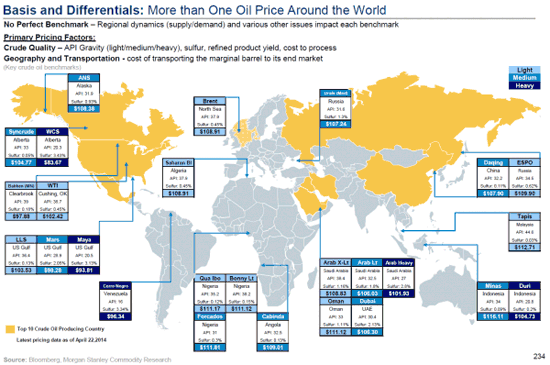

More great graphs.

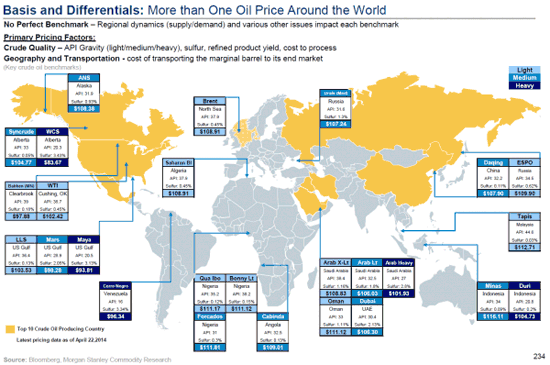

• Everything You Wanted To Know About Global Oil Fundamentals (Zero Hedge)

There’s more than one oil price around the world and as the following comprehensive (but brief) overview from Morgan Stanley’s Global Energy Teach In shows, crude oil pricing across the world is dynamic and multi-factorial – from fundamental factors (such as simple supply and demand and seasonality) to macro factors (such as USD strength, macro sentiment, and “burden”) and risk premia (e.g. geopolitics), the following provides everything you wanted to know about global crude oil fundamentals, but were afraid to ask…

Read more …

“About 90,000 “mass incidents” – a euphemism for protests – occur each year in China, triggered by corruption, pollution, illegal land grabs and other grievances.”

• Chinese Police Hunt For Protesters After Waste Plant Clash (Reuters)

Protesters in eastern China clashed with police at a rally against plans to build a huge waste incinerator that residents fear will be harmful to their health and add to pollution. Choking smog blankets many Chinese cities and the environmental degradation resulting from the country’s breakneck economic growth is angering its increasingly well-educated and affluent population. The demonstrations, which have run for more than two weeks, turned violent on Saturday, with hundreds of police descending on to the streets of Yuhang, close to the tourist city of Hangzhou. At least 10 protesters and 29 policemen were injured, more than 30 cars were overturned, two police cars set on fire and four more smashed up, according to state media.

The government says it will shelve plans to build the plant if it does not have popular support. Two suspects involved in the violence had already turned themselves in, the official China Daily said, adding that police were urging others to surrender. Nobody died in the protests, the Yuhang government said on its website. Similar protests have also succeeded in getting projects shut down elsewhere in China. The eastern city of Ningbo suspended a petrochemical project after days of demonstrations in November 2012, and protests forced the suspension of a paraxylene plant in the northeastern city of Dalian the year before.

Hangzhou, capital of prosperous Zhejiang province and best known in China as the site of a famous lake, has seen its lustre dimmed in recent years by a recurrent smog problem. Pictures on China’s Twitter-like Weibo site showed police fighting with protesters and at least two protesters with blood streaming down their faces. Another picture showed several hundred people surrounding a large group of police. “We don’t want our children and grandchildren to get cancer. Give us back our beautiful home,” read one letter of protest carried on Weibo. About 90,000 “mass incidents” – a euphemism for protests – occur each year in China, triggered by corruption, pollution, illegal land grabs and other grievances.

Read more …

• The EU’s Approach To Ukraine Has Been Catastrophic (Telegraph)

Arguing that the EU blundered badly in Ukraine doesn’t mean you support Putin. That really shouldn’t need saying. Let me get the Godwin’s Law reference out of the way right at the beginning: most historians believe that Neville Chamberlain could have played his hand better in 1938, but this doesn’t make them Nazis. The West in general, and the EU in particular, chose to intervene directly in domestic Ukrainian politics, backing opponents of the thuggish but none the less freely-elected President Yanukovych. It doesn’t seem to have occurred to them that they were thereby inviting others to intervene.

Ukraine was always going to matter more to Moscow than to Brussels, yet EU diplomats seemed genuinely nonplussed when, after they had sponsored undemocratic regime change in Kiev, Putin did the same in Crimea. To repeat, none of this is to exculpate the Russian leader. He runs a paranoid and autocratic regime, in which opponents are imprisoned, critics harassed, journalists murdered. Annexing Crimea was not simply a violation of the law of nations; it was an explicit betrayal of Russia’s solemn promises to respect its neighbour’s territorial integrity. Ukraine is not the first country to have felt the weight of Putin’s revanchism; which makes the EU’s decision to goad him from a position of weakness even more bewildering.

European and other Western diplomats might reasonably have pursued one of two strategies vis-à-vis Russia. They could have decided to overlook Putin’s authoritarianism and treat him, albeit guardedly, as a partner. They could have taken the view that, in the long term, the main strategic threats to the West were likely to come from further afield than Russia, and drawn Moscow into an entente cordiale. This would have meant accepting Putin’s offer of a Lisbon-to-Vladivostok free trade zone, and so sparing Ukraine from having to choose between the EU and Putin’s customs union.

Alternatively, Washington and Brussels might have taken the view that the Kremlin’s values were incompatible with theirs, that Russia’s readiness to resort to force put it beyond the comity of nations, and that the freedom of action of former Soviet states was too high a price to pay for Moscow’s goodwill. It could have encouraged these republics to join the West, and guaranteed their sovereignty by placing Nato bases on their eastern or northern marches. Both these approaches would have had their drawbacks; but the milk-and-water diplomacy pursued instead has been nothing short of calamitous.

When Viktor Yanukovych rejected economic ties with Brussels, the EU backed his overthrow and signed the accord with the interim regime that had toppled him. All the assurances that European politicians had given about fresh elections, respect for the Russian language and so on were forgotten. The uneasy balance that had existed between (to borrow nineteenth-century Russian terminology ) Slavophiles and Westernisers, was upset, and many Eastern Ukrainians openly renounced their allegiance to Kiev, giving Putin the opening he needed. It’s easy to criticise with hindsight, you might say. But the Russian intervention was, I’m afraid, wholly predictable. It’s the ineptness on our side is so shocking.

Read more …

• Odessa 10 Days On: 42 Dead, 60 Hospitalized, 48 Missing (RT)

Residents of Odessa, Ukraine have gathered for a memorial service to commemorate the victims of the May 2 bloodshed who died in a fire in the city’s House of Trade Unions which was set ablaze by pro-Kiev radicals. Several hundred people turned up Saturday on Kulikovo Pole Square in central Odessa – the site of the tragedy that shocked the entire international community. The participants of the memorial service brought flowers, candles and lit icon-lamps. The square used to house anti-Maidan encampment where protesters were collecting signatures in support of a referendum on the federalization of Ukraine and granting Russian status of a second official language.

On May 2, violent clashes erupted between rallies of anti-government protesters and that of radicals supporting the Maidan-imposed authorities in Kiev. The confrontation lead to the tragedy that left 46 people dead and over 200 injured as nationalists burnt the protesters camp and then set on fire the Trade Unions House with opposition activists trapped inside. According to a witness of the massacre, many of those who managed to escape the flames were then strangled or finished with bats by radicals.

Forty two of those killed in the massacre have been identified by local and social media. Odessa news portal dumskaya.net published an unofficial list of the victims and the reasons of death: for a majority of victims it allegedly was “gas poisoning”. However, several victims reportedly died of gunshots, while others burnt alive or crashed on the ground after jumping out of windows trying to escape the deadly flames. Their ages vary from about 20 to 70. Up to 48 people according to various sources are still considered missing. Over 60 remain in hospitals, including 26 in a grave condition.

Read more …

• US Involvement In Ukraine: Sickening Hypocrisy (Ron Paul Institute)

As most in the former USSR celebrated the 69th Victory Day over Nazi Germany today, the US-backed government in Kiev (which took power after the February coup) decided to launch one of its bloodiest military operations thus far, this time against the anti-coup protesters Mariupol, eastern Ukraine. As much of the Ukrainian military has proven unreliable to the post-coup regime in Kiev, the new interim authorities have assembled their own “national guard” and other militias from the extreme nationalists who were behind the violence in Kiev just two months ago. The result is an extremely aggressive “shock troop” force that seems to shoot first when faced with protesters.

The US government has repeatedly claimed that protesters in eastern Ukraine who reject the legitimacy of the post-coup government in Kiev are in fact Russian agents. With an intelligence budget of nearly $100 billion, however, US authorities have only been able to put forth debunked claim after debunked claim. First it was satellite imagery proving Russian troops massing on the border. Debunked. Then it was the blatant “anti-Semitic” forgery which Kerry insisted he was certain had been issued by the anti-Kiev authorities in the east. Debunked. Then it was photos hustled by the State Department said to show Russian special forces active in Ukraine. Debunked. And so on.

It seems that to the US government, facts simply do not matter. In pre-February 22 Kiev, the legitimate government was warned against using any force to put down an armed revolt. That rebellion, now in power, is actually encouraged by the US to use military force against civilians in eastern Ukraine. And force it uses. Here, protesters armed only with folding chairs found themselves under live fire from Kiev forces. Warning: two unarmed protesters are shot in the video, which is extremely graphic. One of them is shot in the head, to the horror of the crowd all around him. Here is another angle.

Here, Kiev forces open fire on a police station in Mariupol that announced it would no longer take orders from Kiev. You can see one of the troops — in a civilian neighborhood — fire a rocket-propelled grenade directly into the police headquarters. The police building was demolished with an unknown number of dead.

Still, protesters continue to resist the rule of Kiev. Today, as the pro-Kiev governor of Kerson oblast spoke fondly of Hitler’s forces trying to “liberate” Ukraine from communist rule, one brave mother could take it no longer. She marched right up to the podium (starting at 1:40) with her baby in arms, told the politician off, grabbed his microphone, and threw it to the ground. That’s non-violent resistance at its best.

Things weren’t much better for coup-installed president Turchynov and prime minister Yatsenyuk. In Kiev, capitol of the revolution, they were heckled by the crowd at the Victory Day gathering, who drowned them out chanting “Hitler Kaputt! Bandera Kaputt!”

Nevertheless, they retain support from the force that still matters: the US government and its NATO war machine, which seems totally uninterested in military violence against civilians. In fact, the US administration has called these military operations against unarmed civilians “proportionate and reasonable.” US Ambassador to the United Nations Samantha Power, who had just two months ago cheered on armed protesters seeking to overthrow the elected government in Kiev and warned that government against any response to the violent protests, was singing a different tune now that the US-backed insurgents have attained power. As Ukrainian military forces launched a bloody operation last week in the eastern city of Slavyansk, she told her UN counterparts that the Kiev “response is reasonable, it is proportional, and frankly it is what any one of our countries would have done in the face of this threat.” Even Salon.com is finding it difficult to stomach the odious Samantha Power,

calling her a “brazen hypocrite.” What other word could be used to describe the sickening silence from the White House and State Department as their allies burn unarmed protesters alive in Odessa (warning!), murder civilians at random in Slavyansk, and shoot Victory Day celebrators in the head in Mariupol? Hypocrisy. Sickening hypocrisy.

Read more …

• Russia Banks Should Be Targets in Sanctions, Boehner Says (Bloomberg)

Russian banks should bear some economic penalties for Vladimir Putin’s government and President Barack Obama needs to push harder to get a tougher response from European nations, House Speaker John Boehner said. “You go after their banks,” Boehner said on Fox News Channel’s “Sunday Morning Futures with Maria Bartiromo” in an interview airing today. “I’m concerned that we’ve not pushed the Europeans hard enough to take a firmer line against the Russians. And our allies in the region are scared to death.”

While U.S. officials have discussed targeting sectors of the Russian economy, such as energy and finance, they have so far only sanctioned 45 individuals and 19 entities, including SMP Bank and Bank Rossiya. The European Union is preparing to punish Russian companies that expropriated assets in Crimea, and may approve a list early next week, EU officials said. “What Putin is doing is making the world less safe, and certainly making Europe less safe,” Boehner said.

Read more …

• Lessons of World War II Forgotten: Will Germany Be The Peacemaker? (RT)

Some 69 years ago, the world celebrated its deliverance from some of the darkest forces in human history. At least 27 million Russians, Ukrainians and other Soviet citizens as well as hundreds of thousands of American and British servicemen paid with their lives in the unprecedented struggle to overthrow that monstrous power. Yet today, we are allowing our country to be sucked into a potentially catastrophic confrontation with Russia in defense of violent forces that openly revere the Nazi collaborators that tortured the Ukrainian people all those years ago. Judging from the statements coming from the White House, Congress and the State Department, it looks unlikely that there is any consideration in these high places for compromise. We only hear about the demand for new sanctions which must ruin the Russian economy.

Appealing to moral principles in the foreign policy where cynicism is often prevailing is a pretty naïve undertaking, but if one understands that the current horror in Ukraine is only the beginning of much more devastating events, perhaps there are some people who can offer a way out of this doomsday scenario? As Hans Werner Sinn, president of the Ifo Institute for Economy Research in Germany, wrote in the Wall Street Journal on May 2: “It must be borne in mind that the present crisis was triggered by the West… after killing millions of Russians in World War II and enjoying the good fortune of a peaceful reunification thanks also to Russia’s support, it is the duty of Germany in particular to de-escalate the conflict with Russia.”

We live in Alice’s Wonderland: Reason and common sense have fled and the bitterly won lessons of history have been thrown overboard. Who can save us from our own ignorance and stupidity? So far the only things we hear from President Obama are demands for sanctions, sanctions, and more sanctions against Russia. It sounds more like an invitation to dance on the brink of a very frightening precipice. Wouldn’t it be the greatest historical irony if it turns out to be German Chancellor Angela Merkel who can do it? At least her first name sounds like an invitation to peace.

Read more …

• 400 US Mercenaries ‘Deployed On Ground’ In Ukraine Military Op (RT)

About 400 elite mercenaries from the notorious US private security firm Academi (formerly Blackwater) are taking part in the Ukrainian military operation against anti-government protesters in southeastern regions of the country, German media reports. The Bild am Sonntag newspaper, citing a source in intelligence circles, wrote Sunday that Academi employees are involved in the Kiev military crackdown on pro-autonomy activists in near the town of Slavyansk, in the Donetsk region. On April 29, German Intelligence Service (BND) informed Chancellor Angela Merkel’s government about the mercenaries’ participation in the operation, the paper said, RIA Novosti reported. It is not clear who commands the private military contractors and pays for their services, however.

In March, media reports appeared suggesting that the coup-imposed government in Kiev could have employed up to 300 mercenaries.That was before the new government launched a military operation against anti-Maidan activists, or “terrorists” as Kiev put it, in southeast Ukraine. At the time, the Russian Foreign Ministry said then that reports claiming Kiev was planning to involve “involve staff from foreign military companies to ‘ensure the rule of law,’” could suggest that it wanted “to suppress civil protests and dissatisfaction.”

In particular, Greystone Limited, which is currently registered in Barbados and is a part of Academi Corporation, is a candidate for such a gendarme role. It is a similar and probably an affiliated structure of the Blackwater private army, whose staff have been accused of cruel and systematic violations of human rights in various trouble spots on many occasions. “Among the candidates for the role of gendarme is the Barbados-registered company Greystone Limited, which is integrated with the Academi corporation,” the Foreign Ministry said in a statement. “It is an analogue, and, probably and affiliated body of the Blackwater private army, whose employees have repeatedly been accused of committing grievous and systematic human rights abuses in different troubled regions.”

Read more …

• Russia Signals ‘Respect’ for Ukraine’s Separatist Ballots

Russia said it’s treating “with respect” the results of referendums held by separatists in eastern Ukraine and called on the government in Kiev to engage in dialogue with representatives from Donetsk and Luhansk. The votes yesterday had high turnout despite the “use of heavy weapons against peaceful civilians, leading to people’s deaths,” according to a statement e-mailed by Russian President Vladimir Putin’s press service today. Russia “assumes that the practical implementation of the referendums will be realized in a civilized manner, without any relapses of violence.”

Russia is breaking with the central government in Kiev and its U.S. and European allies, who’ve criticized the ballots as illegitimate. Pro-Russian groups said large majorities voted in favor of secession, with final results due later today. The votes went ahead amid violent clashes between government troops and pro-Russian rebels. Putin has been accused by Kiev and its allies of stoking the separatist unrest. Russia would welcome any efforts, including through mediation by the Organization for Security and Cooperation in Europe, to facilitate dialogue in Ukraine, according to today’s statement.

Read more …

• Ukraine Regional Vote Deemed Illegal by European Leaders (Bloomberg)

EU leaders say the [situation] may be spiraling out of Putin’s control. “Armed thugs with modern weapons are stirring old tensions and stoking new hatreds,” U.K. Foreign Secretary William Hague said in an interview yesterday in the Daily Telegraph. Putin “seems to have unleashed forces that he cannot control.” [..]

The U.S. rejected the votes as “illegal under Ukrainian law” and “an attempt to create further division and disorder,” U.S. State Department spokeswoman Jen Psaki said in a statement. “The Russian leadership must know that if it continues to destabilize eastern Ukraine and disrupt this month’s presidential election, we will move quickly to impose greater costs on Russia.”

“The Russian president must send out more signals of de-escalation so the elections can take place,” German Chancellor Angela Merkel said yesterday after talks with French President Francois Hollande in Stralsund, Germany. “We’ve had first signs, but these have to get stronger so eastern and southern Ukraine also get the message that everyone wants free and general presidential elections.”

Read more …