DPC Shoppers on Sixth Avenue, New York City 1903

“Rising interest rates can provide significant headwinds to a bull market..”

• Bull Market Is ‘Closer To The End’ Than Investors Think (MarketWatch)

Spring training has begun, and with it the dreams of baseball fans everywhere that this year their team will win it all. On Wall Street, investors hope that one of the longest bull markets in memory can keep rolling. But one All-Star who called this bull from its outset now thinks we’re in the seventh-inning stretch, possibly the top of the ninth. Jim Stack is the president of Whitefish, Montana-based InvesTech Research, which is on the Hulbert Financial Digest’s Honor Roll of top newsletters over the past 15 years, and Stack Financial Management, which manages more than $1 billion of investors’ money. He’s been cautious for some time, as we wrote last January. Now, in a special alert, he suggests that subscribers cut their equity exposure to 76% of their holdings, from 80%, and put the rest in cash.

That may sound like a lot, but it’s actually the lowest equity and highest cash position he’s recommended since the bull market began in March 2009. “We’re most likely in the later third of the bull market and closer to the end than we think,” Stack said in an exclusive interview with MarketWatch. And maybe even the final year. “We could see this bull market peak this year, whether it’s already done so or could within the next six to nine months.” If the bull continues through May and the S&P 500 Index adds another 5% to its March 2 all-time closing high of 2017.48, this will be the third-longest and third-biggest bull market of the past 80 years, Stack said. But although bull markets don’t die of old age, there are signs “it’s getting ‘late in the bull game,’ ” he wrote.

Stack is troubled by what he sees as the media’s frothy coverage of the economy. The reaction to the latest jobs report — “Jobs Boom Continues” and “Party Like It’s 1999” were two headlines I found — prompted his latest “sell” signal. “The U.S. economy is hitting on all cylinders,” he said. “Bull markets characteristically peak when you have strong economic news and pressures on the Federal Reserve to take away the punch bowl.” He sees anecdotal evidence of mounting wage pressures, putting the Fed on course to raise rates later this year. We may get more clarity after the Fed’s March meeting ends Wednesday. “Rising interest rates,” he explained, “can provide significant headwinds to a bull market,” which he calls “one of the more interest-rate-sensitive bull markets in our lifetime.”

“..the Greek ‘impossible triangle’ can be solved in great style as Alexander the Great had in solving the Gordian Knot.”

• Europe’s Trapdoor Slams Shut (Vilches)

Nothing has changed with the ‘new’ agreement between Greece and its European ‘partners’ because the Greek so-called ‘impossible triangle’ stands in their way. The three mutually incompatible vertices of the Greek ‘impossible triangle’ are : (1) The Syriza ruling party staying in power. (2) Reversing the current Troika austerity programs. (3) Greece staying in the euro. The uncompliable list of promises made to the Greek people by Syriza has now been replaced by an equivalent uncompliable list of promises made to the Troika. The European soul-searching exercise is thus over, leaving no further room for self-correction. The Troika is back in Athens with yet heavier boots on the ground pushing for the very same things it always wanted –and needs– from exemplary Greece.

Meanwhile, government money is running out fast, as we speak. Near term payments of all sorts have been jeopardized with no solution in sight. Major events –including a referendum– are highly probable very soon in Greece, way before the June ‘agreed’ reset date which can’t solve anything anyway. Thus, the stage has been set for the Pan-European Grand Project to come apart at the seams. The 2010 – 2012 press rehearsal is over, now it’s for good. Adrift in European shallow waters, the Greek ship will now run aground into unchartered political rocks. Europe’s own trapdoor has slammed shut. [..]

So here comes the Alexander-the-Great moment for Greece whereby the Gordian knot has to be cut apart, high and dry. Because no matter the rationale or how the problem is sliced… or temporarily postponed… by having Vertex 1 and 2 firmly embodied into the Greek current power structure, the final outcome necessarily means the devaluation of the Greek currency, namely the euro (or rather the Deutsche Mark?) And that means Grexit. Additionally, repudiating the USD $0.5 trillion real, effective sovereign debt (***) would jump start the Greek economy with primary account surplus on the ‘get go’ similarly to what happened in Argentina. Russia and/or China would probably (and eagerly) take it from there for their own good reasons. So with Vertex 3 demolished, the “impossible triangle” is instantly solved and both Greece and Euclidian geometry would find themselves back in business… with a lot of hardship ahead.

There will be no shortage of costs, both inside and outside of Greece, both inside and outside of Europe. But such costs would be far lower for everybody than having Greece turn into an anomic state. Greeks know this already and Europeans are finally finding out. There will also be additional Grexit losses because of the euro area GDP reduction. That’d be another Eurozone problem, not Greece’s, something which Brussels, Paris and Berlin should have thought about long ago. So make no mistake: the Greek ‘impossible triangle’ can be solved in great style as Alexander the Great had in solving the Gordian Knot.

Finally the long overdue invitation.

• March 23 Tsipras, Merkel Talks Could Be Chance To Break Impasse (Kathimerini)

Prime Minister Alexis Tsipras is to meet German Chancellor Angela Merkel in Berlin on March 23 for talks expected to focus on Greece’s looming cash crunch even as bilateral tensions remain high. Tsipras is expected to use the meeting, proposed by Merkel on Monday, to seek a “political solution” to the current deadlock that would allow the release of much-needed funding. However, sources close to Merkel indicated that Athens should not foster high hopes for the meeting. “Our aim is the implementation of the February 20 agreement and to keep Greece in the eurozone,” a source said. In the meantime, technical experts from the Greek side and the creditors will continue talks in Brussels on Wednesday as diplomats prepare for an EU leaders’ summit on Thursday and Friday.

Tsipras had been planning to raise the matter of Greece’s funding needs and reform proposals with the German chancellor on the sidelines of the summit. Sources conceded that the meeting is likely to be “difficult,” adding that Tsipras may also seek a meeting with European Commission President Jean-Claude Juncker and European Central Bank President Mario Draghi. Sources close to Tsipras welcomed Merkel’s overture to the Greek premier, noting that she had so far rejected the prospect of a bilateral meeting. During a phone call with Tsipras on Monday, Merkel underlined the critical nature of the current situation and suggested that a face-to-face meeting would be a good idea, sources said.

The meeting could be the last chance for the two leaders to avert an impasse which some prominent Greek government officials blame on “circles in the EU” that want the current administration to fall and are pushing it to implement measures the previous conservative-led coalition had agreed to. In an interview with Ethnos newspaper published on Monday, Tsipras insisted that further tough measures were out of the question. “Whatever obstacles we may encounter in our negotiating effort, we will not return to the policies of austerity,” Tsipras told Ethnos. One reason that creditors appear to be holding a hard line is the Greek government’s delay in enforcing economic reforms. Another is a series of initiatives that have been interpreted as aggressive vis-a-vis Greece’s creditors, notably Tsipras’s decision to resurrect the country’s demands for war reparations from Germany.

And he means it too.

• Greek PM Tsipras Says There Is No Going Back To Austerity (Reuters)

Greece will not accept any return to austerity, leftist Prime Minister Alexis Tsipras said on Monday, adding that he was convinced he would strike a deal with international partners to keep finances afloat. “The key for an honorable compromise (with the EU/IMF creditors) is to recognize that the previous policy of extreme austerity has failed, not only in Greece, but in the whole of Europe,” Tsipras told daily Ethnos in an interview. Greece’s left-wing government won elections in January on a pledge to roll back budget rigor and renegotiate the terms of a €240 billion bailout. But it has faced resistance from euro zone partners who are unwilling to offer major compromises.

Although Athens has been granted a four-month extension to the bailout deal, the Feb. 20 accord did not give Greece access to aid pledged to it from the euro zone and the International Monetary Fund, which has led to a cash crunch. To obtain the remaining aid, Athens must agree on a revised package of reforms. With cash running low, the government has sought to issue more short-term debt, but the European Central Bank has so far refused to give its green light. Tsipras said the bailout policies of the last five years had led to an unprecedented recession, record unemployment and a humanitarian crisis. Athens could find common ground with its partners based on its proposed reforms, but talks remain tough.

“Whatever obstacles we may encounter in our negotiating effort, we will not return to the policies of austerity,” the prime minister said. Asked whether the government had an alternative plan if its partners continued to refuse it any leeway on its funding needs, Tsipras said he expected the issue would be resolved at this week’s EU summit, scheduled for March 19 and 20. “I don’t believe we will need to apply alternative plans because the issue will be solved at a political level by the end of the week in the run up to the EU summit, or, if necessary, at the EU summit (itself),” he told the paper.

And here’s why.

• Austerity Policy Failed In Whole Of Europe, Not Just Greece – Tsipras (RT)

The policy of extreme austerity has failed not only in Athens, but in the whole of Europe, Greek Prime Minister Alexis Tsipras has said. His comments come as the standoff with key creditor Germany mounts. “The key for an honorable compromise (with the EU/IMF creditors) is to recognize that the previous policy of extreme austerity has failed, not only in Greece, but in the whole of Europe,” Tsipras said in an interview to daily Ethnos, Reuters reports. The prime minister is convinced he’ll reach an agreement with international creditors to keep the country’s finances afloat. Tsipras’ pre-election promise to drop austerity helped him win support from Greeks, but the prime minister’s anti-austerity tone has slightly faded since then.

His reform plan worked out in late February to get a bailout extension caused protests against the Tsipras cabinet. People were angry as they felt the new government had failed to fulfill its anti-austerity election pledge. On Monday, the prime minister reaffirmed his government would not return to austerity whatever it takes. “Whatever obstacles we may encounter in our negotiating effort, we will not return to the policies of austerity,” Tsipras was cited as saying by Reuters. He also expressed hopes that the issue would be resolved at the EU summit, scheduled for March 19 and 20.

“I don’t believe we will need to apply alternative plans because the issue will be solved at a political level by the end of the week in the run up to the EU summit, or, if necessary, at the EU summit (itself),” he said. Greece’s bailout program extension was approved by the so-called troika of lenders in February; nevertheless, Greece hasn’t received the aid from the ECB. Athens must agree on a revised package of reforms in order to obtain the remaining aid from the eurozone and IMF. The prime minister also blames eurozone austerity for the country’s unprecedented recession. Since 2010, when Greece undertook the austerity measures, the economy has lost a quarter of its value, a third of Greeks live below the poverty line and the unemployment rate has reached 30%.

They’re all looking for escape velocity…

• ECB Reports Only €9.8 Billion In Bond Purchases In First Full Week Of Q€ (ZH)

Unlike the Fed, the ECB’s Q€ program is far more opaque, far more ad-hoc, and far more improvised (and at the rate it is soaking up already negligible collateral as JPM explained yesterday, soon to be far more abbreviated). In fact, without a daily POMO preview (such as what the Fed used to provide) nobody has any idea what is going or what the ECB will be buying until a week after the fact. Today, for the first time, the ECB provided the bare minimum data on its “Public sector purchase program” i.e., how much debt it had purchased in the first week of the ECB’s QE. The answer: only €9.8 billion.

This being the central bank which refused to respond to a Bloomberg FOIA seeking to uncover what the ECB knew when, about Goldman’s Greek FX swaps, don’t expect any additional data breakdown, such as which CUSIPs the ECB has purchased, or which nations benefitted the most from the ECB’s money printing generosity. All of that information may lead to the heads of ordinary European peasants exploding, and who can blame the ECB. After all this comes from a central bank servicing a current Commissioner who said “there can be no democratic choice against the European treaties” and whose former Commissioner said “democratic governments are often wrong. If you trust them too much they make bad decisions.”

In fact, it is best to not give any information to these “democratic governments” and their constituent peasantry at all. Because a few central-planning BIS bankers always know best. Snyde comments about Europe’s democratic union aside, the take home, and why we said “only”, is that a mere €9.8 billion in bond purchases was enough to break the European bond market, to expose the complete lack of collateral and in the process soak up all available liquidity. So less than €10 billion down, €1.1 trillion to go, and the ECB hopes to have something resembling a bond market left afterwards? Good luck.

“Because the fundamentals in Italy have very much strengthened over the recent past..” Yeah, right. Wait till you see the artcile below this one.

• If Greece Exits, Don’t Expect Us To Follow: Italy (CNBC)

No matter what the Greeks may say, Italy is not at risk of leaving the euro if Greece does, Italy’s Finance Minister told CNBC. “I think that any relationship between ‘Grexit’ and Italy is out of place,” said Pier Carlo Padoan, using the parlance for a Greek exit from the currency zone while speaking on the sidelines of the Ambrosetti conference on Lake Como. “Italy has significantly strengthened its position. Italy is gaining a lot of confidence in the markets.” Greece and its European partners are in the middle of tough negotiations over the conditions Greece must meet in order to secure billions more in bailout money.

Without those funds, Greece is at high risk of having to put capital controls in place, which would significantly raise the likelihood that the country would leave the 19-member currency union. New Greek Finance Minister Yanis Varoufakis has repeatedly told reporters, hedge fund managers, and anyone else who will listen that if Greece were to leave the Euro, the markets would start to price in the risk of Italy leaving the currency zone as well. When asked if Varoufakis is right, he responded: “I don’t know whether it is right. I think that any ‘Grexit’ option would be very bad, and I think it’s [in the] interest of everybody to be united within the euro and to move toward a stronger growth prospect for Greece.”

Padoan added that he does not believe that Italy would face substantially higher interest rates in the face of Greek exit. “I don’t think so, because to the extent that [interest rates] price risk, the Italian risk will not increase as a consequence of a Greece accident,” he said, then adding, “Because the fundamentals in Italy have very much strengthened over the recent past as for instance the assessment by the commission of our fiscal and growth position shows.”

Nothing much has improved, has it?

• Italy’s Debt Burden Now At Record High 132% Of GDP (RT)

Italy’s debt load is now €2.1659 trillion, the Bank of Italy said Friday. The country’s public debt increased by €31 billion in January, bringing the total close to the record-high of €2.1677 billion euro recorded in July 2014. Italy’s public debt is only second to Greece in the eurozone. The main reason debt spiked in January is because the Treasury increased its available liquidity, or money supply, by €36.3 billion euro, bringing the total to €82.6 billions, Italy’s ANSA news agency reported Friday. Gross domestic product to debt in Italy is near 132%, compared to 127.9% in 2013, or 102% two years ago.

Italy, the third largest economy in Europe, has had its economic woes overshadowed by the looming crisis in Greece. Rome hasn’t seen quarterly growth since mid-2011, and the economy is in need of economic resuscitation. Though the European Commission isn’t monitoring Italy as strictly as Greece, Rome’s budget is still under “special surveillance.”The European Commission mandated debt-to-GDP target is 60%. Italy’s growth forecast for 2015 is 0.5%, a much rosier picture after the economy’s less than stellar performance in 2014, when growth stagnated in the fourth quarter. In 2016, Italy’s central bank expects 1.5% expansion.

The $8+ trillion elephant in the China shop.

• China Trust Firms Shift, Rather Than Reduce, Shadow Banking Risk (Reuters)

China’s trust firms, with total assets of $2.2 trillion, are shifting more cash into frothy capital markets and over-the-counter (OTC) instruments instead of loans – blunting regulators’ efforts to reduce shadow banking risk. By redirecting money into capital markets and OTC products like asset-backed securities (ABS) and bankers’ acceptances, trusts are acting less like lenders and more like hedge funds or lightly regulated mutual funds. And the shift – a response to a clampdown last year on trust lending to risky real estate and industrial projects – means a significant chunk of shadow banking risk is migrating rather than shrinking. China trusts take in funds from retail and institutional investors and re-lend or reinvest that money, often in parts of the economy that struggle to obtain bank credit, like mid-sized private enterprises or municipal industrial projects.

As of end-2014, total trust assets were 14 trillion yuan, according to China Trust Association data. Previously, people who bought into opaque wealth management products, many of which were peddled by banks but actually backed by trust assets, found themselves heavily exposed to real estate loans. Trust firms’ changing asset mix means these investors may now instead find themselves exposed to high-yield corporate debt (junk bonds), volatile stock funds or risky short-term OTC debt instruments. While this could help keep the wealth management industry running, and by extension help the trust industry stay afloat, it could delay efforts to properly price risk. A Reuters analysis of China Trust Association data shows that while loans outstanding grew just 8% last year – far below the 62% growth in 2013 – growth in obscure asset categories including “tradable financial assets” and “saleable fixed-term investments” was 77% and 47%, respectively.

Just what we needed. But CNBC says it’s all just fine: they have evolved…

• A US Shadow Banking Sector Has Gotten 65 Times Larger (CNBC)

Shadow banking in general has come back to life after getting hammered during the financial crisis, but one segment has been especially rampant. Peer-to-peer (P2P) lending, in which loans are made privately through individuals who most often connect through a network of relatively new websites, has exploded over the past five years. It is now the fastest-growing sector of non-bank lending, according to an exhaustive Goldman Sachs report on the shadow banking industry. The P2P industry had just $26 million in loan issuance back in 2009, as the worst of the banking crisis passed; but that figure now stands at a robust $1.7 billion.

While that’s still a fraction of the total $12 trillion in loans across the U.S., and even pales in comparison to the $4 trillion in total shadow bank loans, it represents a growth of 65 times during the period. “Personal lending (installment and card) is likely to continue to see disruption as the benefits of a lesser regulatory burden, lower capital requirements and a slimmer cost structure [over time] drive pricing advantages for new players…leading to share moving away from traditional players,” Goldman said in its report. Broadly speaking, shadow banking refers to nonbank lending, with total liabilities in the industry put at $15 trillion. That’s a decline from the 2007 peak of $22 trillion.

The name originated from former Pimco executive Paul McCulley, who used it to describe the myriad institutions that helped provide the easy-money financing that led to the subprime mortgage market crash, which in turn triggered the financial crisis. While the term became a pejorative closely tied to the crisis, the industry has evolved. As banks find themselves under tighter regulatory scrutiny, customers are turning back to nonbank lenders for financing. The shadow firms don’t face the same regulatory burdens as banks, because they don’t take deposits and are thus less constrained when making loans.

What a surprise, right?!

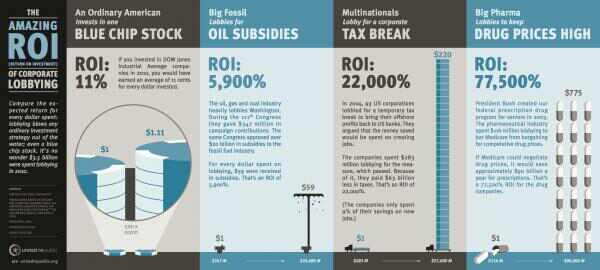

• Corporations Get $760 Back For Every $1 of US Political Donations (Zero Hedge)

The first time we read the recent analysis by the Sunlight Foundation in which it combed through 14 million corporate records, including data on campaign contributions, lobbying expenditures, federal budget allocations and spending, in order to determine the “rate of return” on lobbying and spending to buy political goodwill, we were left speechless. To be sure, we had previously shown that when it comes to the rate of return on lobbying, the rates were simply staggering, and ranged anywhere between 5,900% for oil subsidies, to 22,000% for multinational tax breaks and even higher for America’s legal drug dealers.

But nothing could prepare us for this. According to the foundation’s analysis, between 2007 and 2012, 200 of America’s most politically active corporations spent a combined $5.8 billion (with a B) on federal lobbying and campaign contributions. What they gave pales compared to what those same corporations got: $4.4 trillion (with a T) in federal business and support. Putting that in context, the $4.4 trillion total represents two-thirds of the $6.5 trillion that individual taxpayers paid into the federal treasury. Said otherwise, by “spending: a paltry $6 billion to bribe the US government, or just a little more than what GM will spend on stock buybacks alone, US corporations are getting the direct benefit of two-thirds of US taxpayers’ labor!

“Yellen had a seat at the Clinton administration banking deregulation table when Glass-Steagall was summarily dismantled..”

• The Volatility / Quantitative Easing Dance of Doom (Nomi Prins)

What began with the US Federal Reserve became a global phenomenon of subsidizing the financial system and its largest players. Most real people – that don’t run hedge funds or big banks or leverage other peoples’ money in esoteric derivatives trades – have their own meager fortunes at risk. They don’t have the power of ECB head, Mario Draghi to issue the ‘buy’ order from atop the ECB mountain. Nor do they reap the benefits. Retail sales are down because people have no extra money and can’t take on excess debt through credit cards forever. They aren’t governments or central banks that can print when they want to, or big private banks that can summon such assistance at will. Federal Reserve Chair, Janet Yellen recently chastised these bankers. This, while the Fed has become their largest client and the world’s biggest hedge fund.

While she wags her finger, the Fed is paying JPM Chase to manage the $1.7 trillion portfolio of mortgage related assets that it purchased from the largest banks. In other words, somewhere along the line, the public is both paying to buy nefarious assets from the big banks at full value, thereby supporting an artificially higher price and demand for these and similar assets, and paying the nation’s largest bank for managing them on behalf of the Fed. Yellen says things like “poor values may undermine bank safety” and all of a sudden she’s on an anti-bank rampage? What about the fact that just six banks control 97% of all trading assets in the US banking system and 95% of derivatives? Or that 30 banks control 40% of lending and 52% of assets worldwide?

Think about the twilight zone squared logic of this. Yellen’s predecessors, Alan Greenspan and Ben Bernanke, enabled the path of the US banking system to become more concentrated in the hands the Big Six banks, which have legacy connections to the Big Six banks that drove the country to disaster during the 1929 Crash, and have been at the forefront of the nexus of political-financial power polices for more than a century. Yellen had a seat at the Clinton administration banking deregulation table when Glass-Steagall was summarily dismantled thereby enabling big banks to become bigger and more complex and risky. Those commercial banks that didn’t hook up with investment banks back then, got their chance in the wake of the financial crisis of 2008. They also concocted 75% of the toxic assets that were spread globally and the associated leverage behind them in the lead up to 2008.

An alternative worth contemplating/

• Public Banking: Ayn Rand’s Worst Nightmare (Phillip Doe)

A few weeks ago a Colorado grassroots group, Be the Change, of which I am a board member, sponsored an all -day conference on public banking. I know, it sounds like the equivalent of an all- day climate debate between aging Republican Senators, but the public banking concept may have some value, it might even surprise you. Indeed, it could provide a source of funding for desperately needed infrastructure, particularly at the local level. Over 20 states are looking into the public banking option. But only one, North Dakota has a public bank, and it dates from the populist era, early in the last century. In a recent WSJ article the North Dakota bank was lauded for having a return on investment of almost 20%, a 70% greater return than either Goldman-Sachs or J.P. Morgan, two of Wall Street’s best bullies.

From a short-term perspective, a public bank’s chief advantage is that revenues generated at the city, county, and state level from taxes and fees, stay in the state. They would no longer be sent to the grand casino that has become Wall Street where the prospects of another melt down grow. The recent actions of Congress make it likely that giant retirement funds such as Colorado’s public employee’s retirement plan, PERA, can be appropriated to cover Wall Street speculative losses should a melt down occur. Even FDIC insured personal accounts might be at risk. Moreover, the high management fees Wall Street charges for using our money to gamble with would be eliminated, thus greatly increasing the amount available for local and regional projects of wide public support and interest.

Critical to a public bank is its structure. If it looks like just another bank, public support and interest will be ho hum, at best. But if it is chartered so that management rests with a citizen advisory board, with a professional banking staff answering to them, interest will be sustained, with the public interest more likely to be served. And if the banking management is paid on a scale consistent with prevailing professional salaries within the state or region it serves, a sense of common or shared interest might be possible.

Adopting anything resembling Wall Street’s outrageous self-dealing in salary and bonus structures would be self-defeating. Salaries based on public sector pay for professionals should be the model. After all bankers are no better than engineers, teachers, and scientists, as the numerous bank failures throughout our history clearly demonstrate. Teachers have a much better success ratio and a much tougher work environment. In the long term, city and regional banks, the latter called mutual banks by public banking advocates, hold more promise. The closer to home the decision-making, the better the potential outcome is a truth self-evident. A dithering, science denying, money-corrupted, war-mongering Washington provides the mother of all counterpoints.

“The transparent truthlessness of the Fed’s basic premises go far to explain the chasm between official policy and reality..”

• American Amoeba (Jim Kunstler)

The money-moving world waits on tenterhooks for the Wednesday appearance of America’s oracle, Janet Yellen, to step out of her grotto and state whether or not she feels twinges of patience. Wikipedia notes that Pythia, the original priestess of Delphi “…delivered oracles in a frenzied state induced by vapors rising from a chasm in the rock, and that she spoke gibberish which priests interpreted as the enigmatic prophecies preserved in Greek literature.” Some things never change. Patience for what? Well, whether to raise the Federal Reserve’s benchmark short-term interest rate from near-zero to something microscopically above zero. This is what the world foolishly turns on. And, of course, also some oracular hint as to whether this momentous move might occur in April, June, September, or not at all.

Some canny observers of the vaudeville that US money policy has become — namely, Jim Rickards, David Stockman, Peter Schiff — maintain that Yellen and her Fed are boxed in and can really do nothing. Their policies and interventions regarding the flows of capital have done nothing so far but disable the normal operations of markets and distort the valuation of everything, especially the cost of renting money itself — for that is what happens when you take out a loan. The net result of all that is a financial picture that no longer reflects anything truthful about the actual economy, being a trade in goods and services.

The transparent truthlessness of the Fed’s basic premises go far to explain the chasm between official policy and reality — though it does not explain the appetite for plain lying of the supposedly informed minority cohort of the public, the deciders among us in business, politics, and media. For instance, the employment numbers that came out of the federal government ten days ago saying that the jobless rate is just over 5%. Everybody not in a special ed class in America knows that this is a barefaced lie. But nobody except a few mavericks on the web (see above) object to it. Lesser official oracles such as The New York Times and the Wall Street Journal report the lie without reservation and it gets absorbed into the body politic like any other morsel of protoplasm into the mindless amoeba that America has become.

Comprehensive history of MH17 intel. US ‘intelligence’ hasn’t updated its data since July. Wonder why. Could it be that…?

• US Intel Stands Pat on MH-17 Shoot-Down (Robert Parry)

Despite the high stakes involved in the confrontation between nuclear-armed Russia and the United States over Ukraine, the US intelligence community has not updated its assessment on a critical turning point of the crisis – the shooting down of Malaysia Airlines Flight 17 – since five days after the crash last July 17, according to the office of the Director of National Intelligence. On Thursday, when I inquired about arranging a possible briefing on where that US intelligence assessment stands, DNI spokesperson Kathleen Butler sent me the same report that was distributed by the DNI on July 22, 2014, which relied heavily on claims being made about the incident on social media. So, I sent a follow-up e-mail to Butler saying: “are you telling me that US intelligence has not refined its assessment of what happened to MH-17 since July 22, 2014?”

Her response: “Yes. The assessment is the same.” I then wrote back: “I don’t mean to be difficult but that’s just not credible. US intelligence has surely refined its assessment of this important event since July 22.” When she didn’t respond, I sent her some more detailed questions describing leaks that I had received about what some US intelligence analysts have since concluded, as well as what the German intelligence agency, the BND, reported to a parliamentary committee last October, according to Der Spiegel. While there are differences in those analyses about who fired the missile, there appears to be agreement that the Russian government did not supply the ethnic Russian rebels in eastern Ukraine with a sophisticated Buk anti-aircraft missile system that the original DNI report identified as the likely weapon used to destroy the commercial airliner killing all 298 people onboard.

Butler replied to my last e-mail late Friday, saying “As you can imagine, I can’t get into details, but can share that the assessment has IC [Intelligence Community] consensus” – apparently still referring to the July 22 report. Last July, the MH-17 tragedy quickly became a lightning rod in a storm of anti-Russian propaganda, blaming the deaths personally on Russian President Vladimir Putin and resulting in European and American sanctions against Russia which pushed the crisis in Ukraine to a dangerous new level. Yet, after getting propaganda mileage out of the tragedy – and after I reported on the growing doubts within the US intelligence community about whether the Russians and the rebels were indeed responsible – the Obama administration went silent.

In other words, after US intelligence analysts had time to review the data from spy satellites and various electronic surveillance, including phone intercepts, the Obama administration didn’t retract its initial rush to judgment – tossing blame on Russia and the rebels – but provided no further elaboration either. This strange behavior reinforces the suspicion that the US government possesses information that contradicts its initial rush to judgment, but senior officials don’t want to correct the record because to do so would embarrass them and weaken the value of the tragedy as a propaganda club to pound the Russians.

Haven’t reached the bottom of this pit by a long shot.

• Petrobras Scandal Widening as Braskem Named in Morass (Bloomberg)

The staggering reach of Petroleo Brasileiro SA’s corruption scandal is getting even bigger. Braskem, Latin America’s biggest petrochemicals maker by sales, became the latest company implicated in testimony alleging it paid bribes to the state-controlled oil producer in return for contracts. While Braskem denied the accusations, its $750 million of bonds due 2024 plummeted 7.9% last week, the most among high-grade emerging-market debt. The allegations against Braskem underscore how pervasive the alleged kickbacks were in Brazil. The federal investigation has already embroiled the nation’s biggest builders and rig makers while fueling losses in the bonds of banks, the government and even a state pension fund.

“The whole scandal is damaging more and more Brazilian companies from all segments, and Braskem can be seen as the latest example,” Leonardo Kestelman, a money manager at Dinosaur Securities, said by telephone from Sao Paulo. “People just prefer to hit the sell button instead of waiting.” Sao Paulo-based Braskem denied any irregularities in its dealings with Petrobras in e-mail to Bloomberg News on March 11. “All the payments and contracts between Braskem and Petrobras followed the legal requirements and were approved in a transparent manner in accordance with the governance rules of both companies,” Braskem said. Braskem’s 6 billion reais ($1.8 billion) in cash and revolving credit facilities are enough to cover debt payments for the next 47 months, the company said.

“Braskem understands that the oscillation of its securities doesn’t reflect its credit quality,” the company said. Braskem also said that most of its revenue is tied to the dollar, which has surged against the real. Braskem paid annual bribes, initially set at $5 million, to buy crude derivatives such as naphtha and propylene at low prices from 2006 to 2012, ex-Petrobras executive Paulo Roberto Costa and admitted money launderer Alberto Youssef said in testimony published on the Supreme Court’s website on March 6.

China prints monopoly money and has its people buy up America with it. And Australia, New Zealand etc.

• A $250,000 Tour With One Aim: Get Chinese to Buy a Home

Just how confident is Los Angeles property broker Erik Coffin that he can interest Chinese clients in high-end Las Vegas villas? He’s charging $4 million a month for a quick glimpse. It isn’t just any tour. The marketing push is set to start next month for these twice-monthly journeys that cost $250,000 a pop for a seven-day, private jet and Rolls Royce-chauffeured trip to the American heartland. Eight-person groups also will be offered consultations on plastic surgery, picking the sex of a child and wealth-management.

“It’s already a win for us,” said Coffin, 42, who employs 18 Mandarin speakers, almost a third of his staff, at Gotham Corporate, which recently opened an office in Beijing Wealthy Chinese have been stocking up on overseas real estate for at least the past five years, according to SouFun, China’s biggest real estate website.Now, entrepreneurs such as Coffin are banking on that demand to create an entirely new industry to cater to their needs – everything from websites and brokers to developers, lawyers and international marketers. “Chinese consumers used to come to us and say, ‘Where can I buy with $500,000?,’’ said Andrew Taylor, 44, who helps run Juwai.com, a four-year-old Shanghai-based real estate platform catering to Chinese clients seeking homes overseas. ‘‘Now they are looking at three or four countries at the same time.’’ Juwai, which means ‘‘Live Abroad,’’ says it has more than 4.8 million property listings in 58 nations. There’s no shortage of clients: 60% of China’s wealthiest are contemplating a move, the site says.

In Beijing, a marketing campaign sponsored by SouFun touts a 12-day ‘‘Gold-Digging U.S. tour.” The Chinese capital was also host last weekend to a three-day foreign property and immigration exhibition, the second of its kind in four months. Among destinations on offer: Portugal (“get a residence permit for the whole family”); Japan (“pass on your ownership for generations”); and the U.S. (again, “invest by one person, get a green card for the whole family”). “We used to think these buyers are local tycoons,” said Ben Liu, Shanghai-based marketing director at the American Regional Center for Entrepreneurs, which helps Chinese buyers invest in U.S. properties through the EB-5 program. “They are now entrepreneurs or higher mid-class professionals, such as doctors and engineers.”

Five eyes squared.

• Nationwide Protests In Canada To Denounce New Anti-Terror Law (RT)

Thousands of demonstrators have united across Canada to take action against proposed anti-terrorism legislation known as Bill C-51, which would expand the powers of police and the nation’s spy agency, especially when it comes to detaining terror suspects. Organizers of the ‘Day of Action’ said that “over 70 communities” across Canada were planning to participate on Saturday, according to StopC51.ca. The biggest gatherings were reported in Montreal, Toronto, Vancouver, Ottawa and Halifax. “I’m really worried about democracy, this country is going in a really bad direction, [Prime Minister Stephen] Harper is taking it in a really bad direction,” protester Stuart Basden from Toronto, the Canadian city which saw hundreds of people come out, told The Star. “Freedom to speak out against the government is probably [in] jeopardy…even if you’re just posting stuff online you could be targeted, so it’s a really terrifying bill,” Basden added.

The ruling Conservative government tabled the legislation back in January, arguing that the new law would improve the safety of Canadians. Demonstrators across the nation held signs and chanted against the bill, which they believe violates Canadian civil liberties and online privacy rights. Protester Holley Kofluk told CBC News that the legislation “lacked specificity…it’s just so much ambiguity, it leaves people open [and] vulnerable.” One of the protest organizers in Collingwood, Jim Pinkerton, shared with QMI Agency that he would like to see the Canadian government “start over with Bill C-51 with proper safeguards and real oversight.” “We need CSIS to be accountable. It’s not OK for CSIS to act as the police, which is what’s indicated in Bill C-51. We need accountability and Canadians deserve that,” Pinkerton said.

Yay! New nukes!

• Nuclear Expert Arnie Gundersen Warns Of ‘Chernobyl On Steroids’ In UK (Ind.)

An American nuclear expert has warned that Westinghouse’s proposed reactor for Cumbria needs a $100m (£68m) filter to safeguard against a leak that would turn the region into “Chernobyl on steroids”. Arnie Gundersen lifted the lid on safety violations at a nuclear firm in 1990 – he claimed to have found radioactive material in a safe – and was CNN’s resident expert during the Fukushima nuclear disaster in Japan in 2011. Mr Gundersen told The Independent that he is concerned by designs for three reactors proposed for a new civil nuclear plant in Cumbria. A nuclear engineering graduate by background, Mr Gunderson believes that the AP1000, designed by the US-based giant Westinghouse, is susceptible to leaks.

The reactor has been selected for the proposed £10bn Moorside plant, a Toshiba-GDF Suez joint venture that will power six million homes. It is going through an approval process with the Office for Nuclear Regulation (ONR). Mr Gundersen, who visited the Sellafield nuclear facility in Cumbria last week, warned that any leak would be like “Chernobyl on steroids”, referring to the 1986 nuclear disaster that killed 28 workers within four months. He passed on some of these fears to MPs at an event in Parliament during his visit to the UK. He said: “Evacuation of Moorside would have to be up to 50 miles. You could put a filter on the top of the AP1000 to trap the gases – that would cost about $100m, which is small potatoes. “If this leaks it would be a leak worse than the one at Fukushima. Historically, there have been 66 containment leaks around the world.”

Good.

• Great Barrier Reef Wins Protection With Ban on Waste Dumping (Bloomberg)

Australia will ban companies from dumping waste in the Great Barrier Reef marine park, a victory for environmental groups that have long campaigned to protect the World Heritage-listed area. The entire 345,000 square kilometer (133,200 square mile) park will be protected under the plan to stop the disposal of dredging waste, Environment Minister Greg Hunt said Monday. “Improving the Great Barrier Reef’s health and resilience requires governments and the community to work together,” Hunt said in a statement. The move will ensure the reef “remains one of the most biologically diverse places on Earth,” he said.

Environmental groups have campaigned against dredge dumping near the reef and last year lodged a legal challenge after North Queensland Bulk Ports Corp. was given the right to dispose of spoil from a coal port expansion at sea. Ports Australia said in a statement Monday the ban would threaten the nation’s economy and the long-term viability of ports in the northeastern state of Queensland. The government has “allowed misguided activism aimed at closing down Australian coal exports” to influence policy, Ports Australia CEO David Anderson said.

And counting.

• Earth Has Exceeded Four Of The Nine Limits For Hospitable Life (Ind.)

Humanity has raced past four of the boundaries keeping it hospitable to life, and we’re inching close to the remaining five, an Earth resilience strategist has found. In a paper published in Science in January 2015, Johan Rockström argues that we’ve already screwed up with regards to climate change, extinction of species, addition of phosphorus and nitrogen to the world’s ecosystems and deforestation. We are well within the boundaries for ocean acidification and freshwater use meanwhile, but cutting it fine with regards to emission of poisonous aerosols and stratospheric ozone depletion. “The planet has been our best friend by buffering our actions and showing its resilience,” Rockström said. “But for the first time ever, we might shift the planet from friend to foe.”

Rockström came up with the boundaries in 2007, and since then the concentration of greenhouse gases in the atmosphere has risen to around 400 parts per million (the ‘safe’ boundary being 350 parts per million), risking high temperatures and sea levels, droughts and floods and other catastrophic climate problems. The research echoes a recent debate over whether the Earth has moved from the Holocene epoch to a new one scientists are calling the Anthropocene, named after the substantial effect mankind has had on the Earth’s crust. It’s not all doom and gloom though. “Ours is a positive, not a doomsday, message,” Rockström insisted. He is confident that we can step back within some of the boundaries, for example through slashing carbon emissions and boosting agricultural yields in Africa to soothe deforestation and biodiversity loss. “For the first time, we have a framework for growth, for eradicating poverty and hunger, and for improving health,” he said.

Home › Forums › Debt Rattle March 17 2015