Vincent van Gogh Landscape with snow 1888

KJP

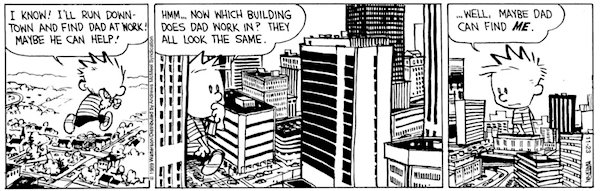

Peter Doocy is a hero: “If the special counsel says President Biden’s got significant limitations on his memory, then who is helping him run the country?”

White House Press Sec. Karine Jean-Pierre: “The president of the United States runs the country.”

— Kambree (@KamVTV) February 9, 2024

Trump ad

https://twitter.com/i/status/1756099327141851444

Trump

https://twitter.com/i/status/1756409781625946376

Begala

PANIC: Top Clinton Advisor Paul Begala ADMITS Defeat LIVE on CNN after Joe Biden proves to the world he's senile hours after federal prosecutors declare him UNFIT for office:

"I slept like a baby last night. I woke up every two hours and wet the bed. This is terrible for… pic.twitter.com/oBYrYkYssq

— Benny Johnson (@bennyjohnson) February 9, 2024

Pentagon files

https://twitter.com/i/status/1756411956813082770

NATO

Watch John Kirby flounder when confronted with facts. It's like garlic to a Vampire.

“The reason Russians are on NATOs border is because NATO has expanded eastwards”

The myth of #NATO as a “defensive alliance” taken apart like a Lego set. pic.twitter.com/PPjkElbcHn

— Chay Bowes (@BowesChay) February 9, 2024

Watters

Jesse Watters Primetime: DC political machine is ready to ditch Joe; Obama world is ready to pull the plug pic.twitter.com/DaiSTfpaY1

— Camus (@newstart_2024) February 10, 2024

Tucker

— The Redheaded libertarian (@TRHLofficial) February 10, 2024

He sleeps better knowing that when he dies of old age, at least there will still be a war happening.

• War With Russia Could Be Decades Long – NATO Chief (RT)

NATO Secretary-General Jens Stoltenberg has called on the bloc’s members to increase defense production in anticipation of “a confrontation” with Russia “that could last decades.” Stoltenberg has repeatedly warned that Western economies are ill-prepared for such a conflict.With Ukraine’s counteroffensive fizzled out and Russian forces poised to capture the key Donbass stronghold of Avdeevka, media reports have for weeks highlighted the worsening shortage of men and ammunition facing Kiev. Amid warnings of “a cascading collapse along the front,” Stoltenberg told Germany’s Die Welt newspaper that NATO members must increase arms production to meet Ukraine’s demand. “We need to restore and expand our industrial base more quickly so that we can increase supplies to Ukraine and replenish our own stocks. That means switching from slow production in times of peace to fast production, as is necessary in conflicts,” he said.

NATO recently signed contracts worth $1.2 billion to produce around 220,000 155-millimeter artillery shells, bringing to more than $10 billion the amount spent by the bloc on ammo deals in the past six months. However, the latest contracts will not be fulfilled until the end of 2025, and earlier ammo pledges to Ukraine – like the million artillery shells promised by the EU – have not been met. Meanwhile, American stockpiles have been depleted by Washington’s effort to arm both Ukraine and Israel, and a $61 billion military aid package promised by the White House remains stalled in Congress.“NATO is not looking for war with Russia. But we have to prepare ourselves for a confrontation that could last decades,” Stoltenberg told Die Welt. “If [Russian President Vladimir] Putin wins in Ukraine, there is no guarantee that Russian aggression will not spread to other countries.”

Stoltenberg is one of multiple Western political and military leaders to predict a looming Russian attack on the bloc. Danish Defense Minister Troels Lund Poulsen, Swedish General Micael Biden, Estonian Prime Minister Kaja Kallas, and British Defense Minister Grant Shapps have all stated in recent weeks that such a conflict could break out in as little as three years. Aside from the fact that attacking NATO territory would enter Russia into a war with the entire alliance, Russian officials have repeatedly stressed that Moscow has no geopolitical, economic, or military interests in Poland or the Baltic states.

“It is absolutely out of the question,” Putin told American journalist Tucker Carlson earlier this week. “You just don’t have to be any kind of analyst, it goes against common sense to get involved in some kind of global war. And a global war will bring all of humanity to the brink of destruction. It’s obvious.” Putin argued that Western leaders are “trying to intimidate their own population with an imaginary Russian threat.” These predictions, he said, “are just horror stories for people in the street in order to extort additional money from US taxpayers and European taxpayers” to keep weapons and ammo flowing to Ukraine.

“..the relentless allocation of public money to prop up a corrupt regime in Kiev..”

• Tucker Carlson Committed Treason to Talk To Putin… and the World Loved It (SCF)

The Western states and their media can deprecate Russia’s perspective as much as they like but there is such a thing as historical truth. Most people around the world, including informed American scholars like John Mearsheimer, diplomats like Jack Matlock, and commentators like Jeffrey Sachs, know that the conflict in Ukraine has a much greater dimension than the Western propagandistic media would try to purvey. There is such a thing as the ring of truth. Most people, even those who have been formerly benighted by misinformation, generally appreciate a version of history that accords with the facts and rational analysis. Western politicians and media cannot deliver such an edifying account because they have systematically lied about and distorted the causes of conflict in Ukraine and more generally on the relations between the West and Russia. Putin went a long way towards setting the record straight in his interview with Tucker Carlson this week. It was by no means the first time that the Russian leader had done so.

For those who follow the Ukraine conflict outside of the confines of Western media propaganda, what Putin said would have been quite familiar. The powerful effect of Carlson’s interview is that he succeeded in bringing an important perspective to a wider American and Western audience who regrettably have been up to now badly misinformed by Western media. Already, growing numbers of American and European citizens have become wary and critical of the futile war in Ukraine and the relentless allocation of public money to prop up a corrupt regime in Kiev. Carlson deserves immense credit for having the courage and integrity to seek out a perspective that sheds light not just on why there is a bloody conflict in Ukraine but also on the corruption that is endemic in the Western states: the illusions of independent journalism, free speech, and promoting democracy.

Sooner or later, people will realize that the United States and its European vassals are nothing but rogue states whose imperialist crimes know no bounds. The Western media corporate machine plays a vital part in the cover-up of imperial crimes, not just in Ukraine, but also currently in Syria, Gaza, Yemen, Iraq, and beyond. Any lifting of the veil on this naked Western despotism must be shut down immediately. Hence the furious reaction to Carlson’s interview. But it’s too late. The truth is out. The escaping truth will have inevitable political and historical consequences. In regard just to Ukraine, the U.S.-led NATO proxy war is no longer tenable. Elitist Western regimes must be – and will be – held to account for the fueling of this war and the vast squandering and theft of public money to pursue their secretive imperialist interests.

“..Why do we want to be in a state of internal friction and even war with this country? The only answer I come to is money.”

• Tucker-Putin ‘History Lesson’ Shows Russian-US Friendship Possible (Sp.)

On Thursday, US Journalist and former Fox News Contributor Tucker Carlson interviewed Russian President Vladimir Putin, the first such interview by a Western journalist since Russia launched its special operation in Ukraine. One controversial aspect of the interview was Putin’s insistence on starting with an extensive summary of the histories of Russia and Ukraine that lasted for nearly half an hour at the start of the interview. Many observers criticized the decision, fearing that it would cause those with shorter attention spans to tune out the interview before Putin addressed his decision to launch the special operation. Rick Sanchez, an American journalist, former anchor for CNN and current host of two shows on RT, told Sputnik’s Fault Lines that the history lesson was a necessary aspect of the interview to show Americans that the conflict in Ukraine did not start in February 2022 and that the US and Russia could have struck up a partnership in the wake of the Cold War.

“The word that comes to mind is necessary,” Sanchez said of the interview. “For some damn reason in this country, we have decided that we will allow our government officials, our State Department, oftentimes, people who aren’t even elected, to determine whom we are allowed to hear and whom we are allowed to listen to.” Sanchez argued that the segment of the interview that focused on the fall of the Soviet Union and Putin’s rise to the Presidency roughly a decade later illustrated how the United States rebuffed his overtures of friendship, despite verbal support from Presidents Bill Clinton and George W. Bush. “It almost seems as you listen to the man, that we have done everything possible to make sure Russia is not our friend. Even when they came to us offering to embrace and make friendship,” Sanchez explained. ”One can’t help but wonder why… Why do we want to be in a state of internal friction and even war with this country? The only answer I come to is money.”

On the subject of whether the history lesson segment went on too long, Sanchez agreed it might have been off-putting to Americans used to cable news and two-and-a-half minute interviews but noted that is not part of Russian culture and Putin likely wanted to provide the context Americans have been lacking in the conflict. “I think Putin went in saying, ‘I’ve got a long and important story to tell, and it begins with A [and] ends with Z.’ He was hell-bent on taking him through that,” Sanchez explained, noting that Putin’s knowledge of history and geopolitics and his ability to recall them was impressive to watch. “Say what you will about [Putin], you’re allowed to hate him, you’re still allowed to be mad at him about Ukraine or about anything else, but you can’t walk away from that interview and say ‘oh, that guy’s an idiot.’”

This is exactly what happened. pic.twitter.com/QkvPBjI9p9

— DD Geopolitics (@DD_Geopolitics) February 11, 2024

“..might initiate a, quote, ‘surprise attack’” on Russia. “I didn’t say that,” Putin interjected. “Are we having a talk show or a serious conversation?”

• The Real Propagandists Are Those Who Dismiss Tucker-Putin Interview (Marsden)

American establishment media spent the days in the run-up to Tucker Carlson’s interview with Russian President Vladimir Putin pre-judging it as propaganda, and soliciting the opinions of establishment figures, like former US secretary of state, first lady, and presidential candidate, Hillary Clinton, who dismissed Carlson a “useful idiot.” All this before they even had the slightest notion of the interview’s content. All they knew was that Putin would have an opportunity to speak, and that ever since Carlson left Fox News and turned independent, there wasn’t any obvious establishment figure to babysit him or control what went out. Worse, it would air on the X platform (formerly Twitter) owned by Elon Musk, who describes himself as a “free speech absolutist.” So it did not bode well for the kind of propagandistic framing that the Western establishment enjoys when it comes to locking down narratives under the guise of fighting a war on fake news.

The fact that journalists balked at the very notion of Carlson interviewing Putin reeked of professional jealousy. There isn’t a credible journalist out there who wouldn’t leap at the same opportunity if given the chance. Which is why, as journalists from CNN and the BBC confirmed, they’d long sought their own interviews with Putin — unsuccessfully. Presumably, Carlson’s format, audience reach, and freedom from establishment media constraints were appealing enough to land him the opportunity. Good for him. And for the journalistic record that can only benefit from any and all contributions. It’s not like other media outlets don’t also benefit from their Western colleagues questioning Putin. I experienced this myself when invited to ask a question during one of Putin’s marathon press conferences. For the record, no one had any clue what I’d be asking.

Neither did I, actually, as about five or six different themes suddenly went on spin cycle in my mind as I stood to speak. My question ultimately ended up being what Putin thinks about then President Donald Trump’s assertion that Islamic State had been defeated in Syria — Trump’s rationale for announcing the withdrawal of American troops just the day before. Putin’s response, in agreeing with Trump’s assessment, was newsworthy, and was quickly picked up by CNN and other Western media. The difference between me and Carlson? No competitors had to credit me as the source of the question. So the information Putin provided could safely be used without having to credit a “competitor” and denting any egos, as is often the case in press conferences. Not so with exclusive interviews.

Focusing on Carlson as some kind of flawed messenger serves as a convenient pretext for ignoring critical information and analysis. The fact that some journalists may think that Carlson’s questioning or approach was misguided — or that he didn’t push back enough for their tastes — doesn’t mean that they can’t subsequently take what Putin said and analyze it themselves. Every bit of information, analysis, or interview of any world leader is a valuable contribution. Litmus tests have no place in objective, impartial journalism. Many of those who criticize Carlson are the same ones who routinely search the Wikileaks database for leaked and dumped classified information to flesh out their own stories about various political issues and events that have since materialized — all while refusing to acknowledge that the publisher, Julian Assange, is as much of a journalist as they are.

Carlson’s flaws arguably even served the American and global public. Much like Carlson erroneously claimed prior to the interview that other journalists couldn’t be bothered to interview Putin before he came along, he also played fast and loose with his very first question to the Russian president, stating that Putin said in his February 22, 2022, national address, at the onset of Russia’s military operation in Ukraine, that he “had come to the conclusion that the United States, through NATO, might initiate a, quote, ‘surprise attack’” on Russia. “I didn’t say that,” Putin interjected. “Are we having a talk show or a serious conversation?” Carlson’s lack of precision, sounding like a guy who thought he was having a chit-chat with another dude over beers in a bar, created an opportunity for Putin to launch a history lesson going back 2,000 years on how the Ukraine conflict came about.

“..Nothing and no one could have stopped those lion-hearted Ukrainians from fighting for their country – and nothing will..”

• Tucker Carlson Is A ‘Traitor’ – Boris Johnson (RT)

Former UK Prime Minister Boris Johnson has denounced journalist Tucker Carlson as a “traitor” for failing to antagonize President Vladimir Putin during his interview with the Russian leader in a video posted on X (formerly Twitter) on Friday. “We must not fall for this tissue of lies, above all the notion that Putin is somehow fated to succeed in Ukraine,” Johnson said. “On the contrary, he is doomed to fail.” The British politician, who resigned in disgrace in 2022 amid mounting scandals regarding his government’s flouting of its own Covid-19 rules, implored his followers to read the lengthy condemnation of Carlson’s sit-down with the Russian leader he penned for the Daily Mail. Johnson’s op-ed repeatedly invoked Adolf Hitler, insisting that Carlson was being “a traitor to journalism” by playing “Dictaphone to the dictator.”

The Russian president’s extended explanation of the history of Ukraine was merely a “mixture of semi-masticated Wikipedia and outright falsehood” – insisting Putin “demolished his own thesis” by “reckless and criminal violence” against Ukraine. Carlson had fallen down on the job by not asking “tough questions” or taking him to task “for the torture, the rapes, the blowing up of kindergartens” supposedly committed by the Russian military – atrocities often invoked by Ukraine’s supporters in the West in the absence of evidence. Johnson especially took issue with what he called the “ludicrous suggestion that the UK government persuaded the Ukrainians to fight on, rather than surrender to Putin’s tender mercies, in the spring of 2022,” claiming that “every member of the Ukrainian government will confirm” that it was Kiev that made the decision to tear up the peace treaty.“ Nothing and no one could have stopped those lion-hearted Ukrainians from fighting for their country – and nothing will,” he wrote.

He likened Carlson’s interview to the American newspapers that published sympathetic interviews with Hitler, insisting Putin was “exactly like” the Nazi bogeyman because he discoursed at length about “the alleged injustices suffered by speakers of his native tongue.” Johnson infamously pressured Ukrainian President Vladimir Zelensky not to accept what he called a “bad peace deal” in May of 2022, insisting that negotiating with Putin was the equivalent of reasoning with “a crocodile when it’s got your leg in its jaws,” given the Russians’ advances through Ukrainian territory. After successfully scuttling the negotiations, the British leader declared through a spokesperson that “the world must avoid any outcome where Putin’s unwarranted aggression appears to have paid off.” The 15-point peace deal negotiated between Russia and Ukraine in Istanbul would have involved Kiev renouncing its efforts to join NATO and committing to neutrality in exchange for a withdrawal of Russian troops from parts of the country.

“The £4.8m in earnings that Mr Johnson has declared since leaving No 10 just over five months ago is more than 50 times his yearly £84,144 MP salary..”

• Boris Johnson Nears £5m In Earnings Since Leaving Office (BBC)

Boris Johnson has registered an advance payment of nearly £2.5m for speaking events, in his latest declaration of outside earnings. It brings the former prime minister’s declared income since leaving office last September to almost £4.8m. He has previously recorded nearly £1.8m in speaking fees since his departure. Mr Johnson has also registered a further £13,500 in accommodation from JCB boss Lord Bamford and his wife Carole for January and February. It brings the total value of accommodation he has registered from the couple for him and his family since leaving Downing Street to £74,000.The nearly £2.5m advance in his latest declaration is from the New York-based Harry Walker speaking agency, for an unspecified number of speeches.

It comes on top of almost £1.8m he has registered since leaving office for nine speeches delivered in the US, India, Portugal, the UK and Singapore. As well as a £510,000 advance for his political memoirs from publisher HarperCollins, he has also declared £1,943 since leaving No 10 in royalty payments for previously written books. Under ministerial rules, former ministers are not allowed to take jobs that involve influencing government for two years after leaving their post. But Mr Johnson’s latest declarations are the latest demonstration of how much former leaders can earn shortly after leaving office through book deals and on the lucrative speaking circuit. The £4.8m in earnings that Mr Johnson has declared since leaving No 10 just over five months ago is more than 50 times his yearly £84,144 MP salary.

A company set up to support his activities as a former PM has also received £1m from crypto currency investor Christopher Harborne. Mr Harborne has previously donated more than £15m to the Conservatives, the Brexit Party, and Reform UK. Mr Johnson was forced to resign by his ministers last July after a series of controversies prompted a mass walk-out among his ministers. He attempted a comeback after his successor, Liz Truss, quit within weeks of taking office last September. But despite obtaining enough support from Tory MPs to run in the contest to replace her, he ultimately stood aside, clearing the way for Rishi Sunak to become prime minister in October.

“..EU members “clearly do not want to continue paying for the doomed ‘Ukrainian project’ from their own wallets..”

• Tapping Frozen Russian Assets Is ‘Economic Racketeering’ – Moscow (RT)

The EU’s plan to seize the profits from frozen Russian assets and hand them over to Ukraine would be a gross violation of international law, the Foreign Ministry in Moscow has told RIA Novosti. Belgium-based clearing house Euroclear, which holds an estimated €196.6 billion ($211 billion) in Russian assets, accumulated nearly €4.4 billion in interest from funds in sanctioned Russian accounts last year. EU ambassadors recently agreed to use the profits to support Ukraine. The proposal has yet to be approved by the European Council and would reportedly stop short of touching the assets themselves. Russia, however, regards any actions against its sovereign assets and those belonging to its citizens and companies “as economic racketeering on the part of the collective West,” the Foreign Ministry stated on Saturday.

“[The EU’s] invention of openly fraudulent schemes for the seizure of income from Russian assets is dictated by the need to create the illusion of legitimacy over attacks on our property and thereby camouflage what is in fact an outright theft,” the ministry added. It claimed that EU members “clearly do not want to continue paying for the doomed ‘Ukrainian project’ from their own wallets,” which is “why they are so tempted by the idea of spending funds stolen from our country to support the Zelensky regime.”

Last week, the EU agreed on a €50 billion aid package for Kiev over the next four years, although the decision was reached only after Hungary withdrew its veto amid pressure from Brussels. Meanwhile, a $60 billion US aid package for Ukraine has stalled in Congress, as Washington pushes for the confiscation of Russian assets to secure alternative funding. In total, the US and its allies have frozen an estimated $300 billion in Russian assets and reserves since the start of the Ukraine conflict in 2022. Moscow has condemned the measures, warning of tit-for-tat responses and lawsuits.

“..Kiev only has enough air defense assets to last until March..”

• Ukraine At Risk Of ‘Cascading Frontline Collapse’ – NYT (RT)

Ukraine’s worsening lack of ammunition and battle fatigue will most likely force Kiev to abandon its current frontline positions unless it receives new aid from the West, the New York Times reported on Friday. The paper said that Ukrainian defenses near the key stronghold of Avdeevka in Russia’s Donetsk Region are reeling under relentless attacks, and Kiev’s problems extend beyond one single battle. Ukrainian troops, the NYT added, are exhausted and suffer from a lack of weapons and ammunition, especially with regard to air defense systems. According to unnamed US officials interviewed by the outlet, Kiev only has enough air defense assets to last until March, unless it receives new shipments. This is far from certain, as the US – Ukraine’s main backer – is locked in congressional gridlock over President Joe Biden’s request to approve a $118 billion security bill, $60 billion of which is earmarked for Kiev.

Many Republicans have been reluctant to support the measure, claiming it does too little to improve security on the border with Mexico. Western officials believe that without US aid, “a cascading collapse along the front is a real possibility” in 2024, the article says. Nevertheless, they reportedly estimate that it will take at least a couple of months for the shortages to take a toll. According to analysts, by March, Ukraine could be struggling to carry out local counterattacks, and by summer, Kiev could find it difficult to repel Russian assaults. Without continued US support, NYT sources say “it’s hard to see how Ukraine will be able to maintain its current positions on the battlefield.”

Ukrainian officials have repeatedly complained of a shortage of ammunition, calling it “a very real and pressing problem.” Meanwhile, the Financial Times reported on Friday, citing a senior EU official, that “It will not be easy for the Europeans to substitute for the US” in terms of military assistance. Last year, the EU announced an ambitious plan to provide Ukraine with 1 million shells by the spring of 2024. However, the bloc has struggled to deliver on this pledge, with top EU diplomat Josep Borrell saying Kiev will receive only half of that amount by March. Russia has repeatedly condemned Western arms shipments to Ukraine, warning that they will only prolong the conflict without changing the ultimate outcome.

“..had Garland moved sooner in his investigation into former President Donald Trump’s election interference, a trial may already be underway or even have concluded..”

• White House Frustration With Garland Grows (Pol.)

Joe Biden has told aides and outside advisers that Attorney General Merrick Garland did not do enough to rein in a special counsel report stating that the president had diminished mental faculties, according to two people close to the president, as White House frustration with the head of the Justice Department grows. The report from special counsel Robert Hur ultimately cleared Biden of any charges stemming from his handling of classified documents that were found at Biden’s think tank and his home. But Hur’s explanation for not bringing charges — that Biden would have persuaded the jury that he was a forgetful old man — upended the presidential campaign and infuriated the White House.

Biden and his closest advisers believe Hur went well beyond his purview and was gratuitous and misleading in his descriptions, according to those two people, who were granted anonymity to speak freely. And they put part of the blame on Garland, who they say should have demanded edits to Hur’s report, including around the descriptions of Biden’s faltering memory. In White House meetings, aides have questioned why Garland felt the need to appoint a special counsel in the first place, though Biden has publicly said he supported the decision. While Biden himself has not weighed in on Garland’s future, most of the president’s senior advisers do not believe that the attorney general would remain in his post for a possible second term, according to the two people.

“This has been building for a while,” said one of those people. “No one is happy”. Frustration within the White House at Garland has been growing steadily. Last year, Biden privately denounced how long the probe into his son was taking, telling aides and outside allies that he believed the stress could send Hunter Biden spiraling back into addiction, according to the same two people. And the elder Biden, the people said, told those confidants that Garland should not have eventually empowered a special counsel to look into his son, believing that he again was caving to outside pressure. In recent weeks, President Biden has grumbled to aides and advisers that had Garland moved sooner in his investigation into former President Donald Trump’s election interference, a trial may already be underway or even have concluded, according to two people granted anonymity to discuss private matters.

That trial still could take place before the election and much of the delay is owed not to Garland but to deliberate resistance put up by the former president and his team. A spokesperson for the Department of Justice declined to comment. But one former senior Justice Department official noted that some of the frustrations being directed at Garland are better directed toward the White House. The president’s team had the option to exert executive privilege over elements of Hur’s report but declined to do so. And had Garland made edits to the report, he would have had to explain those redactions to Congress.

“I am really uncertain that we can halt this trend. Many things would have to change very quickly.”

• Germany on Edge of Ruin Thanks to Energy War Against Russia (Sp.)

In 2022, Berlin dutifully followed the Biden administration’s instructions to cut Germany off from Russian gas and ramp up arms deliveries to Ukraine for NATO’s proxy war against Russia. Two years on, alarming predictions of a major economic crisis and the wholesale deindustrialization of Europe’s biggest industrial economy are coming to pass. Germany’s industrial production has dropped for the seventh-straight month, reaching negative 1.6 percent in December, from negative 0.2 percent in November, according to data released Wednesday by Germany’s national statistics office. Among the sectors most heavily affected was the chemical industry, which faced losses of a whopping 7.6 percent – its worst showing since 1995. Construction suffered a 3.4 percent decline. Business media took the data as a sign of serious problems in the German economy, with Bloomberg running a piece entitled ‘Germany’s Days as an Industrial Superpower Are Coming to an End’, and citing the energy crisis stemming from the loss of Russian energy supplies as the straw that broke the back of the declining European economic powerhouse.

“There’s not a lot of hope, if I’m honest,” Stefan Klebert, CEO of GEA Group AG, a Dusseldorf-headquartered special purpose industrial machinery company, told the outlet. “I am really uncertain that we can halt this trend. Many things would have to change very quickly.” The company Klebert manages is nearly 150 years old, surviving 20th century crises from the two world wars to the 1929 depression. Now, it and its 18,000+ employees face an uncertain future. “Despite the motivation of our employees, we have arrived at a point where we can’t export truck tires from Germany at competitive prices,” Maria Rottger, head of Northern Europe operations at French-headquartered tire-making giant Michelin, said. “If Germany can’t export competitively in the international context, the country loses one of its biggest strengths,” he noted.

Some 5,000 of Michelin’s 66,000+ European employees are based in Germany, Austria and Switzerland. In late 2023, the company announced cuts of over 1,500 jobs to its German operations. Goodyear, the American tire giant, announced the closure of two plants in the country, cutting 1,750 jobs. “You don’t have to be a pessimist to say that what we’re doing at the moment won’t be enough,” Volker Trier, the foreign trade chief at Germany’s Chambers of Commerce and Industry, said. “The speed of structural change is dizzying.” Dozens of other major German businesses have been affected by the energy crisis, with European chemical giant BASF SE recently slashing 2,600 jobs, and Cologne-headquartered specialty chemicals company Lanxess AG cutting 7 percent of its German workforce.

German businesses have spent years sounding the alarm about problems with infrastructure, an aging workforce, bureaucracy, economic costs associated with the pandemic and falling investment in education and other public services. The crisis in economic ties with Russia, combined with efforts by Berlin’s transatlantic “ally” to pluck high-tech industrial manufacturers out of Germany using generous subsidies, and growing competition from China, have combined to create a perfect storm of unprecedented industrial malaise. “We are no longer competitive,” German Finance Minister Christian Lindner admitted at a business event in Frankfurt on Monday. “We are getting poorer because we have no growth. We are falling behind.”

“All that remains of America is an insane government with nuclear weapons.”

• Whom the Gods Would Destroy, They First Make Insane (Paul Craig Roberts)

The prime minister of formerly “Great Britain,” an Indian named Sunak, Scholz and Macron, the non-entities who head Washington’s puppet states of Germany and France, and the non-entities in Norway, Finland, Poland and the rest of the militarily and economically impotent puppet governments that comprise the American Empire, declare their preparation for war with Russia. What a joke! None of these territories–they are so over-run by third world immigrant-invaders that they no longer rank as countries, just territories open for the taking–have confident nationalistic populations willing to lose their lives in defense of their subservience to Washington and their domestic oppression. Can anyone seriously imagine Sweden, whose military-aged ethnic males are afraid to prevent immigrant-invaders’ rapes of ethnic Swedish women because they would be arrested for hate crimes, forming an army capable of facing Russian troops?

Or Germans for that matter, a task beyond the Wehrmacht, possibly the finest army in modern history. Or the French–a task beyond Napoleon. Certainly not the Italians, again over-run, or the Dutch lost in sexual and drug lusts. Or for that matter Americans. Americans, whose main fighting element–Southern White Males–are racially discriminated against by Biden’s black Pentagon chief, who has prevented their promotions because “there are too many white officers,” have ceased to enlist. After all, what Southern “heterosexual white supremacist racist,” as the Biden regime describes its would be recruits, wants to be denied promotion because of his race and, because of his race and “sexual preference,” be lorded over by black female commanders and homosexuals, and soon by transgendered and illegal immigrant-invaders.

I am confident that it is impossible for any Western country to be capable of fielding an army that would not be wiped out instantly by a Russian force, a Chinese force, or even by an Iranian force. The last wars that the US won were against Spain in the 1890s and against Japan in 1945. After a 20-year effort, the US military was driven out of Afghanistan by a few thousand lightly-armed Taliban, just as it was driven out of Vietnam. I regret that this statement hurts the feelings of those who thought they were fighting for something important, but they were deceived for the profits of the military/security complex and for Washington’s hubris. In the entirety of the Western World the belief system has been destroyed. The destruction of essential beliefs has been going on since the 1960s when university students began their chant “Western Civilization has to go.” Well, it is gone. All that remains of America is an insane government with nuclear weapons.

“Over 43 percent of 2020 votes were cast by mail..”

• Mail-In Ballot Fraud Study Finds Trump ‘Almost Certainly’ Won In 2020 (ET)

The Heartland Institute study tried to gauge the probable impact that fraudulent mail-in ballots cast for both then-candidate Joe Biden and his opponent, President Donald Trump, would have had on the overall 2020 election results. The study was based on data obtained from a Heartland/Rasmussen survey in December that revealed that roughly one in five mail-in voters admitted to potentially fraudulent actions in the presidential election. After the researchers carried out additional analyses of the data, they concluded that mail-in ballot fraud “significantly” impacted the 2020 presidential election. They also found that, absent the huge expansion of mail-in ballots during the pandemic, which was often done without legislative approval, President Trump would most likely have won.

“Had the 2020 election been conducted like every national election has been over the past two centuries, wherein the vast majority of voters cast ballots in-person rather than by mail, Donald Trump would have almost certainly been re-elected,” the report’s authors wrote. Over 43 percent of 2020 votes were cast by mail, the highest percentage in U.S. history. The new study examined raw data from the December survey carried out jointly between Heartland Institute and Rasmussen Reports, which tried to assess the level of fraudulent voting that took place in 2020. The December survey, which President Trump called “the biggest story of the year,” suggested that roughly 20 percent of mail-in voters engaged in at least one potentially fraudulent action in the 2020 election, such as voting in a state where they’re no longer permanent residents.

In the new study, Heartland analysts say that, after reviewing the raw survey data, subjecting it to additional statistical treatment and more thorough analysis, they now believe they can conclude that 28.2 percent of respondents who voted by mail committed at least one type of behavior that is “under most circumstances, illegal” and so potentially amounts to voter fraud. “This means that more than one-in-four ballots cast by mail in 2020 were likely cast fraudulently, and thus should not have been counted,” the researchers wrote. A Heartland Institute research editor and research fellow who was involved in the study explained to The Epoch Times in a telephone interview that there are narrow exceptions where a surveyed behavior may be legal, like filling out a mail-in ballot on behalf of another voter if that person is blind, illiterate, or disabled, and requests assistance. However, the research fellow, Jack McPherrin, said such cases were within the margin of error and not statistically significant.

In addition to reassessing the likely overall degree of fraudulent mail-in ballots in the 2020 election, Heartland analysts calculated the potential impact that fraudulent mail-in ballots might have produced in the six key swing states that President Trump officially lost. This, then, was used to determine the impact of potentially fraudulent mail-in ballots on the overall 2020 election result. First, the researchers analyzed the electoral results for the six swing states—Arizona, Georgia, Michigan, Nevada, Pennsylvania, and Wisconsin—under the 28.2 percent fraudulent mail-in ballot scenario that they estimated based on the raw survey data. Then they calculated the electoral results in the six states under the different scenarios, each with a lower assumed percentage of fraudulent ballots, ranging from 28.2 percent all the way down to 1 percent. For each of the 29 scenarios that they assessed, the researchers calculated the estimated number of fraudulent ballots, which were then subtracted from overall 2020 vote totals to generate a new estimate for vote totals.Overall, of the 29 different scenarios presented in the study, the researchers concluded that President Trump would have won the 2020 election in all but three.

“You kept my trust, and your massive turnout has stunned everyone,” the AI voice said in the video..”

• Jailed Imran Khan Claims Electoral Win (Cradle)

Independent candidates affiliated with imprisoned Pakistani political leader Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party have won the most seats in elections for the National Assembly. Vote counting is ongoing, but the Election Commission of Pakistan announced that independent candidates have won 98 seats so far, with the winners of 22 seats still undetermined. The majority of the independents are affiliated with Khan’s PTI party. Members of the PTI ran as independents after the party was effectively banned last month. The Pakistani Supreme Court ruled that the party could not use its traditional electoral symbol, a cricket bat. Because many PTI supporters in rural areas are illiterate, the symbol would be the only way to identify the party on the ballot for many. Khan was slapped with three jail sentences last week and barred from holding any public post for ten years. The former premier has been the target of lawfare since being ousted in a US-backed legislative coup in early 2022.

The PTI has been the target of harassment and even abductions of its candidates by pro-military elements that do not wish to see Khan or his party return to power. The party has also seen restrictions imposed on rallies and media coverage, as authorities ordered journalists and television stations not to mention Khan’s party as part of their election coverage. The Pakistan Muslim League Nawaz Party (PMLN) has won 69 seats, while the Pakistan People’s Party (PPP) has the third-most with 51 seats. None of the country’s three major parties will win the necessary 169 seats to form a government on their own, meaning a coalition must be formed to determine the next prime minister. Khan used an AI-generated video of himself to claim victory in the election from prison, asking his supporters to “now show the strength of protecting your vote.”

“You kept my trust, and your massive turnout has stunned everyone,” the AI voice said in the video. Khan’s opponent, former Pakistani Prime Minister Nawaz Sharif, was previously deposed in a coup and spent years abroad to avoid prison on corruption charges. However, Sharif is currently viewed as the military establishment’s choice. However, some PTI candidates who ran as independents could be pressured to align with other parties when forming a coalition. According to Michael Kugelman, the director of the South Asia Institute at the Wilson Center, “the military will likely pressure them to do so.” Sharif’s PMLN may also be able to form a coalition with other parties and exclude the PTI from the government, Kugelman added.

Chairman Imran Khan's victory speech (AI version) after an unprecedented fightback from the nation that resulted in PTI’s landslide victory in General Elections 2024. pic.twitter.com/Z6GiLwCVCR

— Imran Khan (@ImranKhanPTI) February 9, 2024

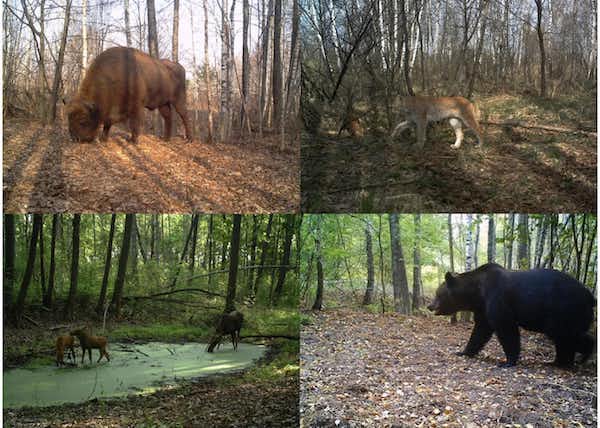

“The density of the wolf population within the Chernobyl Exclusion Zone [..] is estimated to be seven times greater than in surrounding reserves..”

• Chernobyl Wolves Have Anti-Cancer Genome (RT)

Wolves in the irradiated Chernobyl Exclusion Zone have developed resistance to cancer, research which may help fight the disease in humans has shown.Biologists from Princeton University found that wolves are exposed to over 11 millirem of cancer-causing radiation daily for their entire lives. A standard chest X-ray, in comparison, exposes the whole body to around 1 to 2 millirem. In 1986, a nuclear reactor exploded at the power plant in Chernobyl, Ukraine, around 80 miles north of Kiev. The blast released 400 times more radiation than the atomic bomb dropped on Hiroshima, Japan during World War II, and over 100,000 people were evacuated from the city. In the three decades since the accident, Chernobyl has remained abandoned. Local wildlife, however, reclaimed much of the area.

The density of the wolf population within the Chernobyl Exclusion Zone, which is considered unsafe for human habitation, is estimated to be seven times greater than in surrounding reserves. Scientists put radio collars on wolves roaming the wastelands of the zone to monitor their movements and make real-time measurements of the radiation they are exposed to. Researchers also took blood samples to see how the wolves’ bodies respond to cancer-causing radiation. The study found that the reason why the animals are thriving in the radioactive zone is that part of their genetic information is resilient to the increased risk of the disease and their immune systems become similar to those of cancer patients undergoing radiation therapy. Scientists say the bodies of dogs and wolves fight cancer in much the same way as the human body. The research may identify protective mutations that can increase the chances for humans to survive cancer, they added.

“.. On the day the hearing begins, two video cameras in Cauterets, one fitted in a corner of the safe and one outside it, will begin live streaming on YouTube. In the event that Assange should die in prison, a remote-control button will be activated to set off the chemical reaction, and the contents of the safe will disintegrate..”

• The Artist Holding Valuable Art Hostage to Protect Julian Assange (Beard)

One unusually warm January afternoon, I arrived in Cauterets, a small spa town in the Pyrenees, in southwest France, to meet the Russian artist Andrei Molodkin. There was a scattering of fromagerie stalls in the streets. Low-slung cable cars ferried skiers to the mountaintop, casting moving shadows over the families wandering through the town. Walking among them, I wondered what they’d think if they knew what Molodkin was doing up the hill. A few years ago, Molodkin bought a large nineteenth-century sanatorium, a stately, symmetrical, magnolia-yellow building with tiled floors and a gabled roof with a wrought-iron frame. On the day of my visit, Molodkin, who is fifty-seven, was wearing utilitarian black trousers, black work boots, and a black insulated jacket as he ushered me into the sanatorium’s spacious entrance hall. At one end of it was a freestanding, thirty-two-ton Swiss bank safe, about thirteen by nine feet, which Molodkin had imported from Amsterdam.

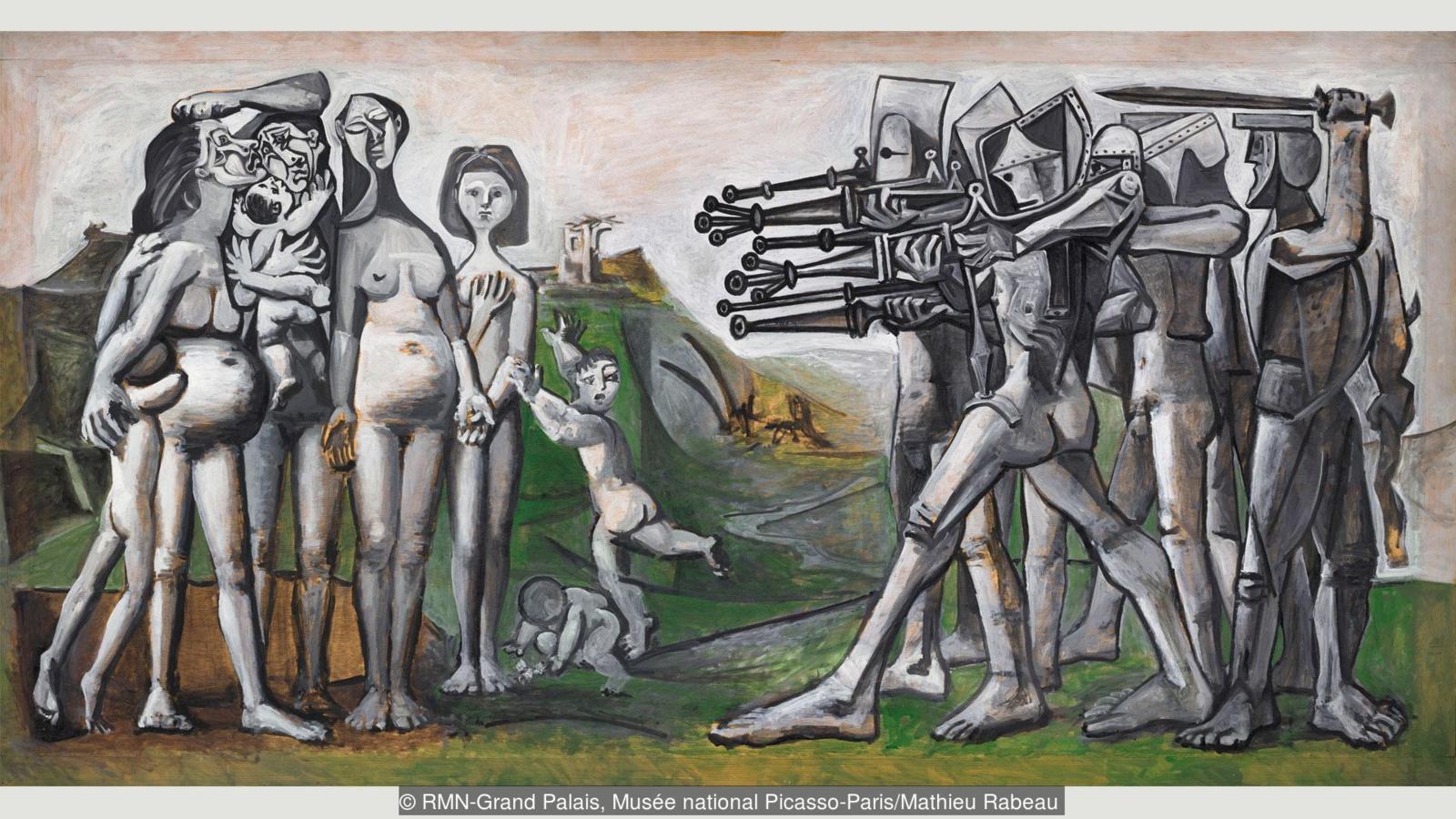

It had been brought into the building piecemeal, via forklift, last fall; the artist, along with several men who worked in a nearby factory, guided panels of the safe inside, then bolted them together with the help of two security advisers from Berlin. As Molodkin strained to open the heavy metal door of the safe, I counted five different locks. Inside were a handful of custom-built plywood crates, which will eventually hold a group of works donated by artists and collectors. There will be pieces by Picasso, Rembrandt, and Andy Warhol, as well as more contemporary works by artists such as Andres Serrano, Santiago Sierra, and Sarah Lucas, which Molodkin estimates at a collective value of around forty million dollars. “We have sixteen art works so far, but people keep offering to donate more,” he said, a note of satisfaction detectable in his voice.

A Swiss safe, part of Molodkin’s project “Dead Man’s Switch,” stands in the entrance hall of a former sanatorium in Cauterets, France.

In the middle of the crates was a small pneumatic pump connecting two white barrels, one containing acid powder and the other an accelerator that could cause a chemical reaction strong enough to turn the entire contents of the safe to debris within two hours. The project is called “Dead Man’s Switch,” and the “dead man” in question is the Australian WikiLeaks founder, Julian Assange, who is currently jailed on remand in London’s high-security Belmarsh Prison. In 2010, WikiLeaks published a spate of leaks from the Army private Chelsea Manning about U.S. military activity in Iraq and Afghanistan. After Sweden issued a European arrest warrant for Assange in connection to sexual-assault allegations (a case that has since been dropped), Assange took refuge at the Ecuadorian Embassy in London in 2012, where he remained for seven years. A hacking charge against Assange was unsealed in April, 2019; one month later, the U.S. government added new charges, indicting him for violating the Espionage Act for his part in WikiLeaks’ disclosure of secret military and diplomatic documents.

The indictment has raised concerns over its implications for First Amendment rights and journalists who report on national-security issues. On February 20 and 21, 2024, Assange will face a court hearing on what may be his final bid to appeal the United States’ order to extradite him. On the day the hearing begins, two video cameras in Cauterets, one fitted in a corner of the safe and one outside it, will begin live streaming on YouTube. In the event that Assange should die in prison, a remote-control button will be activated to set off the chemical reaction, and the contents of the safe will disintegrate. Only if Assange is released as a free man, Molodkin said, will the art be returned to its owners. Molodkin believes that Assange’s extradition to the United States and incarceration there would put his life “in great danger.” “Assange is a red line,” he said.

Molodkin met Stella Assange and members of WikiLeaks last March, in London, at an exhibition by a/political, an art organization. The organization was launched, in 2013, by the Kazakhstan-born entrepreneur and art collector Andrei Tretyakov (who helped Molodkin buy the sanatorium), and it supports the work of a number of artists who often engage with provocative political subjects. The members of WikiLeaks “are not involved,” Molodkin said.

CO2

"WE ARE IN A CO2 FAMINE"

William Happer, Professor Emeritus of Physics at Princeton University, ex director of the US Department of Energy's Office of Science:pic.twitter.com/kAAjkcPnX2— Robin Monotti (@robinmonotti) February 10, 2024

Hercules beetle

https://twitter.com/i/status/1756303584499576860

Love is the answer

https://twitter.com/i/status/1756245509306564893

Parrot

https://twitter.com/i/status/1756327412428570966

Epstein

Jeffrey Epstein was a fake billionaire set up by intelligence services. His private island functioned as a massive child sex trafficking ring that was used to collect blackmail on the global elite (billionaires, celebrities and politicians, etc) pic.twitter.com/P4YjQF7Kzb

— illuminatibot (@iluminatibot) February 10, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.