DPC Harlem River Speedway and Washington Bridge, New York 1905

Excellent metaphor.

• ECB Rings The Bell For Pavlov’s Market Dogs (AFR)

Sharemarkets around the world are as well-trained as Pavlov’s dogs. This time, it was the European Central Bank giving them good news with the pledge of more cheap money – and it didn’t take them long to start salivating again. But in the next few weeks it could just as easily be the Federal Reserve talking about taking that cheap money away, and sharemarkets may well retreat whimpering with their tail between their legs. Friday was definitely a salivating day, however, sparked by the inevitable rally in Europe and on Wall Street after the ECB said it was on alert to adjust the “size, composition and duration” of its quantitative easing policy. Each month the bank buys €60 billion of predominantly government bonds and it will keep doing this until at least September 2016.

It’s now been just over three years since Mario Draghi, the ECB’s president, said he would do whatever it takes to hold the euro together and since then the S&P 500, and a benchmark of Europe’s top 50 stocks, have increased by more than 50%. The major S&P ASX 200 index is up around 30% over that same period. But apart from the United States, economic growth in Europe and Australia has been hard to come by while earnings from companies has been very sluggish. Sharemarkets don’t rise and fall precisely in line with economic activity, they are more a forward-looking indicator and, despite lots of requests to do so, no one rings the bell or waves the white flag when the sharemarket hits the top or bottom. But for the past three years or so growth forecasts have been revised down and bond yields have tumbled, implying that all is not well, and yet there has been no break in the sharemarket’s psychology; shares are the place to be.

The bottom will hurt.

• ECB President Mario Draghi Reignites Currency War Talk (AFR)

Global currency wars are back on in earnest, with the euro tumbling after ECB boss Mario Draghi signalled the bank stood ready to boost the “size, composition and duration” of the bank’s bond-buying program. The ECB’s move to boost its monetary stimulus, which drives down eurozone bond rates and puts downward pressure on the euro, comes as US Federal Reserve board members appear deeply divided on whether to proceed with plans to raise US interest rates this year. While the Fed dithers, the market has already ruled out an interest rate cut this year, which has pushed lower both US bond yields and the greenback. But as it grapples with feeble economic activity and inflation falling into negative territory, the last thing the ECB wants is to see the euro strengthening against the US dollar.

A stronger euro will act as a drag on eurozone growth, because it will make the region’s exports more expensive in global markets. And the ECB cannot stand by idly and watch as the slight progress it has made in terms of boosting economic activity is destroyed by a strong currency. As a result, Draghi has little choice but to fire up the printing presses even more by signalling that the central bank’s €1.1 trillion bond-buying program could be “re-examined” in December, and by refusing to rule out further interest rate cuts. Speaking in Malta, Draghi said the European central bank’s “governing council recalls that the asset purchase programme provides sufficient flexibility in terms of adjusting its size, composition and duration.”

At the moment, the ECB is buying €60 billion of mostly government bonds each month, and many analysts expect this will be increased to €80 billion a month at the ECB’s December meeting. The ECB might also cut the rate charged on banks’ deposits parked at the ECB, which is minus 0.2% at present, even further. “The degree of monetary policy accommodation will need to be re-examined at our December policy meeting when the new … projections will be available,” Draghi told reporters. Not surprisingly, the euro sank against the US dollar on Draghi’s comments and bond yields, which move inversely to prices, dropped sharply. Benchmark 10-year Italian and Spanish bond yields fell to their lowest level since April, while the yield on two-year German bonds hit a record low of 0.32%.

Why does this make me think of alchemy?

• The Great Negative Rates Experiment (Bloomberg)

When the Federal Open Market Committee decided in September to leave its main policy rate where it’s been for seven years—close to zero—it included an extraordinary detail. According to the “dot plot,” the display of unattributed individual policy recommendations, one committee member believed that the rate should be below zero through 2016. That is, rates should go to a place the U.S. has never had them before. In theory, it shouldn’t be possible for a central bank to keep short-term interest rates below zero. Banks would have to pay the Fed to hold reserves. Consumers would have to pay banks to hold deposits. Banks and people can hold physical cash, which charges no interest. This is why economists see zero as the lowest possible rate. It’s just theory, though; real-world experience shows the actual lower bound is somewhere below zero.

Denmark’s key bank rate dipped below zero in 2012 and is at minus 0.75%. Economists recently surveyed by Bloomberg see negative rates in that country continuing at least into 2017. Switzerland has kept the rate at minus 0.75% since early this year, and Sweden’s is minus 0.35%. These countries have a different monetary goal from that of the Fed. Denmark and Switzerland have been working to remove incentives for foreigners to deposit money in their banks. Massive foreign inflows would drive their currencies to appreciate so much they would become seriously misaligned with the euro, the currency of their main trading partners. Sweden has been attempting to create inflation. The strategy has had some success. Denmark has been able to hold on to its peg to the euro.

Switzerland dropped its euro peg, and after an initial runup, the Swiss franc has traded within a predictable band. Sweden’s inflation has seesawed. In all three countries, banks were reluctant to pass negative rates on to their domestic customers. In Denmark deposit rates have fallen, and some banks have raised fees for their services, but “real rates for real people were actually never negative,” says Jesper Rangvid, a professor of finance at the Copenhagen Business School. The same is true for Sweden, according to a paper by the Riksbank, the central bank. In Switzerland, one bank, the Alternative Bank Schweiz, will impose an interest charge on retail deposits starting in January.

There’s no evidence of a flight to cash in any of the three countries. According to central bank data, Danish households have added 28 billion kroner ($4.3 billion) to bank deposits since rates shrank to their record low on Feb. 5. That’s because a sack of bills has to be stashed somewhere safe, and protection costs money. According to Rangvid, rates would have to drop as low as minus 10% before people start “building their own vaults.” In its paper, Sweden’s Riksbank pointed out the same possibility but declined to say how far below zero rates would have to go to trigger depositors’ exit from the banks in the largely cash-free country.

Europe’s crises are only just starting.

• Every Day’s a Crisis for Europe as Merkel Heads Back to Brussels (Bloomberg)

Welcome to Europe, where almost every problem is a crisis. If it’s not Greece’s debt threatening to topple a currency or the largest influx of refugees since World War II, it’s Russian aggression toward its neighbors. The EU’s response: hold another summit. Over the past 10 months, leaders and government finance chiefs have trudged to Brussels for 19 summits and emergency meetings – with a 20th planned for Sunday – as they wrangled over a financial lifeline for Greece, the surge of migrants and Russia’s violent inroads in Ukraine. That tally compares with eight meetings last year and nine in 2013. While summit inflation illustrates the proliferation of crises on Europe’s doorstep, it also underscores the difficulty of doing business when 28 leaders with 28 sets of domestic concerns talk through the night and then blame the EU when they fail to make progress.

“These summits are happening almost permanently because the EU is in the middle of an existentialist crisis,” said Drew Scott, a professor of EU studies at the University of Edinburgh who argues that only national leaders have the legitimacy to take on major challenges. “In a world of euro-skepticism, we’ve seen a major return to domestic politics that we haven’t seen since the sixties.” As the refugee crisis worsens, the next gathering – little over a week after the last fractious summit – will see German Chancellor Angela Merkel join leaders from eight countries in central and southeastern Europe gather in Brussels to focus on the flow of migrants through the Western Balkans. “The EU decision-making itself has become so infuriatingly complex that it becomes a source of crisis itself,” said Fredrik Erixon, director of the European Centre for International Political Economy.

European decision-making has never been straightforward, of course, and there were arguments and crises before – the lifting of the Iron Curtain posed a threat to the EU’s very rationale. The bloc’s last-minute success in preventing Greece’s euro-area exit in July and leaders’ willingness to at least discuss a common solution to the refugee crisis show the system still has enough resilience to avoid a major breakdown. With more than a million migrants set to reach the EU this year, that system faces further tests. Leaders at last week’s summit in Brussels clashed over sharing the cost of refugees from countries riven by violence in the Middle East and Africa and how to police the bloc’s borders.

“It takes years to clear the additional capacity that a bull market generates, meaning a “long winter in commodities” lies ahead..”

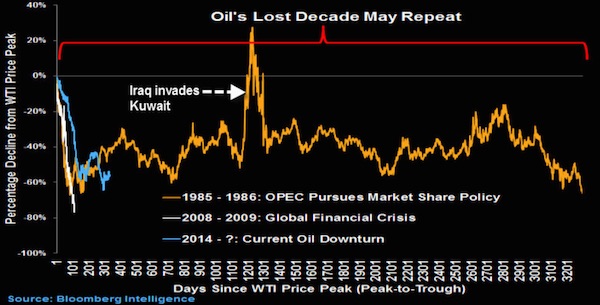

• Oil’s Big Slump Looks Like the 1980s ‘Lost Decade’ (Bloomberg)

Crude oil’s collapse is bringing back memories of the decade of low prices that started in 1985 when Saudi Arabia began targeting market share. Oil has dropped by almost half since last October when crude entered a bear market as the U.S. pumped near record rates and China’s economic growth slowed. Despite the longest decline in decades, some including Shell CEO Ben Van Beurden and Morgan Stanley head of Emerging Markets Ruchir Sharma think there’s more pain to come. The current downturn resembles that of 1985 and 1986, Bloomberg Intelligence analysts Peter Pulikkan and Michael Kay wrote in a report on Thursday. Just as price gains in the 1970s saw new technology open up fields in the North Sea and Alaska, Chinese-led demand in the first decade of this century helped unlock oil and gas from shale rocks in the U.S.

Now, companies such as BP Plc are predicting crude will stay “lower for longer.” “The lower-for-longer scenario will likely be even lower and even longer,” Pulikkan said. “In 1985, Saudi Arabia changed policy to raise its market share, ushering in a lost decade for oil. There’s a possibility there’s another lost decade.” [..] As prices dropped, the Saudis refused to cut production, opting to defend market share instead, Pulikkan said. Oil averaged less than $20 in the 12 years from 1987. In November last year, OPEC, led by Saudi Arabia, adopted a similar strategy and chose not to defend oil prices. A 200-year history of commodity prices shows they typically move between a decade of a bull market and two decades of a bear market, Sharma said last month. It takes years to clear the additional capacity that a bull market generates, meaning a “long winter in commodities” lies ahead, he said.

“..new orders falling at the fastest pace since early 2009, and inventories piling up..”

• As China Weakens, Recession Stalks North Asia (Reuters)

The slowdown in China’s economy, the world’s second largest, is sucking the growth out of North Asia and tilting some economies toward recession. As China undergoes a painful rebalancing of an economy that accounts for 16% of global GDP – up from below a tenth a decade ago – the IMF predicts 5.5% growth this year for a region that also includes export powerhouses Japan, South Korea, Hong Kong and Taiwan. That would be the weakest growth rate since the global financial crisis. Japan’s exports grew by 0.6% from a year earlier in September, the slowest since August last year, data showed on Wednesday, as shipments to China dropped by 3.5%.

“Without a doubt, as long as China remains in a very soft spot … it’s natural that North Asia, which is very highly oriented to China’s market, whether directly or as a conduit, also takes a knock,” said Vishnu Varathan, a senior economist at Mizuho Bank in Singapore. Japan’s weak export numbers have heightened concerns that its economy may slip into recession in the third quarter, with a weak yen not doing enough to support its overseas shipments. Singapore narrowly missed a third-quarter recession after the export-reliant economy expanded just 0.1% from the previous three months, but Taiwan still looks very close to one.

China’s rapid growth and liberalization, especially after accession to the World Trade Organisation in 2001, gave a tremendous boost to Asian trade. Supply chains spread across the region, sucking in everything from coal to fuel its factories, to electronic components for mobile phones to be shipped to markets in the West. Now, though, things are different. PMI readings are contracting across most of Asia-Pacific, with new orders falling at the fastest pace since early 2009, and inventories piling up, meaning that production may have further to fall before economies shake off spare capacity, according to HSBC.

Only 800-pound gorillas will remain.

• Credit Suisse Exiting Bond Role Sounds Alarm for Debt Market (Bloomberg)

Credit Suisse shook Europe’s bond markets by deciding to drop its role as a primary dealer across the continent, the latest signal that some the world’s biggest banks are scaling back in one of their key businesses. The move coincides with the Zurich-based bank’s overhaul of its trading and advisory services, after fixed-income revenue plunged. Credit Suisse will withdraw from the U.K market on Friday, the nation’s Debt Management Office said. It’s the first time a gilt primary dealer – which buys sovereign debt directly from the government – walked away since December 2011, when State Street’s European division withdrew. “This is a dramatic move for Credit Suisse, and a step back for bond-market liquidity,” said Christopher Wheeler, an analyst at Atlantic Equities in London.

“This is probably designed to reduce costs and capital tied to its investment bank business. I hope it’s not a shape of things to come for the bond market.” The world’s biggest banks are shrinking their bond-trading activities to comply with regulations such as higher capital requirements imposed following the financial crisis. These restrictions have curbed their ability to build inventory or warehouse risk. The result is that prices can be more volatile for money managers and private investors. The situation has worsened in the past five years. The size of U.S. Treasury market, for example, has expanded by more than 45% in five years to $12.9 trillion, according to data compiled by Bloomberg.

At the same time, the five largest primary dealers – those financial institutions that trade with the Treasury – have cut their balance sheets by about 50% from 2010, according to data from Tabb Group. Credit Suisse will remain a primary dealer for the U.S. Treasuries market, according to a London-based company spokesman, Adam Bradbery. “This is part of scaling back the macro business,” Bradbery said. “We are in the process of exiting all our European primary dealer roles.” [..] “You’re seeing pressure at every single bank,” said Harvinder Sian at Citigroup in London. “If you’re not something of a monster in terms of presence and market share, then the economics just don’t stack up.”

Why not say this two years ago?

• US Regulator Raises Red Flag on Auto Lending (WSJ)

A top financial regulator warned of risks in the fast-expanding auto-lending sector, raising the prospect of fresh regulatory pressure in an area that has been a bright spot for banks. While policy makers have generally declared the U.S. banking system recovered from the financial crisis, Comptroller of the Currency Thomas Curry raised a rare red flag, saying in a speech that some activity in auto loans “reminds me of what happened in mortgage-backed securities in the run-up to the crisis.” “We will be looking at those institutions that have a significant auto-lending operation,” he told reporters after the speech. Many mortgage-backed securities thought to be safe turned sour during the financial crisis, leading to heavy losses across Wall Street.

The comments are likely to raise concerns in particular at firms like Wells Fargo and other national banks active in auto lending that are regulated by the comptroller’s office. Mr. Curry’s vow of closer scrutiny wouldn’t affect their competitors at lenders owned by large auto manufacturers. When the comptroller in the past has raised questions about loans being risky—as it has done since 2013 with leveraged loans to heavily indebted corporations—regulators have turned up the heat to the point that banks have dialed back products, even when they were profitable. Auto lenders denied they were taking excessive risks.

Richard Hunt, president of the Consumer Bankers Association, said the lenders his group represents “are applying prudent underwriting standards in order for consumers to have access to safe and affordable transportation.” [..] This isn’t the first time regulators have cast a spotlight on auto lenders. In March, the Consumer Financial Protection Bureau raised concerns about consumers taking on too much auto debt, and some large financial firms have faced investigations regarding unfair auto-lending practices. But Mr. Curry’s concerns focused on the risks auto loans may pose to banks’ safety and soundness. Lower-level OCC officials have previously raised similar concerns.

The edge of finance.

• US Junk-Bond Default Rate May Nearly Double in a Year: UBS (Bloomberg)

U.S. junk-bond defaults could nearly double by the third quarter of next year, led by energy, metal and mining companies under pressure from depressed commodities prices, according to UBS. The high-yield default rate may climb as high as 4.8%, UBS analysts wrote in a note to clients Thursday. The default rate for speculative-grade debt in the U.S. was at 2.5% at the end of September, according to Moody’s Investors Service, up from 2.1% in the second quarter and 1.6% a year earlier. The default rate for junk-rated energy and natural-resources companies – which make up the bulk of speculative-grade debt – may increase to 15% over the next year, Zurich-based UBS said, up from the current 10% rate reported by Moody’s.

“The sector is out of whack,” UBS strategist Matthew Mish said. “Capital markets are showing much greater tiering of credit quality. It’s not just energy issuers that can’t tap the market right now.” The default rate increased as the price of oil plunged by about 60% from last year’s June high amid slowing growth in China, the world’s biggest commodity importer. The lowest-rated debt is poised for more pain, said Mish, even as what investors demand to hold debt rated CCC and below versus the broader high-yield market has risen to the highest level since the financial crisis, according to Bank of America Merrill Lynch Indexes. “Valuations there are still too tight for the underlying risk,” Mish said.

Enron redux.

• Valeant Slump Poses Big Threat To Small Hedge Funds (Reuters)

Valeant Pharmaceuticals’ market slide has hurt the returns of several large U.S. hedge funds, but for smaller players with outsized bets on the drug company the fallout could be far more painful, according to industry watchers. Among smaller hedge funds invested in Valeant, at least three had more than 20% of their assets tied up in the stock as of June 30, according to data from Symmetric.IO, a research firm that provided the data to Reuters on Thursday. They include Tiger Ratan Capital Management, Marble Arch Investments, and Brave Warrior Advisors, according to the numbers, which are based on publicly reported stock positions and may not include hedges. It is not known whether the funds have maintained their holdings into this week, but if they did, they could be looking at losses worth hundreds of millions of dollars.

“The major risk is with funds that have an unstable, short- term oriented capital base, where a poor few months of performance can lead to significant capital flight,” said Jonathan Liggett, Managing Member at JL Squared Group, an investment advisor. Smaller hedge funds can quickly collapse if investors demand their money back all at once, forcing managers to exit profitable positions to raise cash quickly. Valeant shares are down 35% this week after a short-seller’s report accused the company of improperly inflating revenues, igniting fears about federal prosecutors’ probes into its pricing and distribution. Valeant has denied the allegations and its Chief Executive Michael Pearson and other board members are due to address them in more detail in a call with investors on Monday.

The slump has trimmed billions of dollars off the ledgers of investors such as hedge fund mogul William Ackman’s Pershing Square Capital Management, activist hedge fund ValueAct Capital, and investment firm Ruane, Cunniff & Goldfarb. But the impact could be far worse at smaller funds that typically have less than $5 billion in assets and also bet on a stock that had been one of this year’s early winners. Nehal Chopra’s Tiger Ratan owned roughly 1 million shares of Valeant at the end of the second quarter, accounting for about one fifth of her $1.6 billion fund. Through August, Chopra had been one of the year’s best performers, showing a gain of 21.6% for the year. But people familiar with her numbers said heavy losses in September wiped out all gains putting the fund into the red for the year. If the firm still held that Valeant position this week its losses on that bet alone would have totaled roughly $370 million for the week.

Because derivatives are so devoid of risk?

• Revised US Swaps Rule to Spare Big Banks Billions in Collateral (Bloomberg)

Wall Street banks will escape billions of dollars in additional collateral costs after U.S. regulators softened a rule that would have made their derivatives activities much more expensive. Two agencies approved a final rule on Thursday that will govern how much money financial firms must set aside in derivatives deals. A key change from recent draft versions of the rule – and the focus of months of debate among regulators – cut in half what the companies must post in transactions between their own divisions. A version proposed last year called for both sides to post collateral when two affiliates of the same firm deal with one another, such as a U.S.-insured bank trading swaps with a U.K. brokerage. The final rule requires that only the brokerage post, cutting collateral demands by tens of billions of dollars across the banking industry.

Those costs would still be significantly higher than the collateral they currently set aside. “Establishing margin requirements for non-cleared swaps is one of the most important reforms of the Dodd-Frank Act,” Federal Deposit Insurance Corp. Chairman Martin Gruenberg said before his agency’s vote, noting that changes were made in response to objections raised by the industry. While the bank regulators’ approach is good news for Wall Street, all eyes now turn to the Commodity Futures Trading Commission, which is writing a parallel rule. Firms also would need that rule to be softened before claiming a clear victory. Like the CFTC, the Securities and Exchange Commission is also drafting a final version of similar requirements to be imposed on separate parts of banks.

Aluminum.

• The ‘Miserable’ Metal Sinks to Its 2009 Low (Bloomberg)

Dwight Anderson had a point when it came to aluminum. The price sank to the lowest level in more than six years on Friday on concern that a global glut will endure, extending a losing run after the hedge fund manager dubbed the metal as miserable. Three-month futures fell as much as 0.4% to $1,484.50 metric ton on the London Metal Exchange, the lowest level since June 2009. The metal is set for an eighth daily loss. Aluminum fell 20% this year as global supply exceeded demand, with output from top producer China surging even as economic growth slowed, spurring increased exports. Anderson, founder of hedge fund Ospraie Management, described aluminum in an interview this week as “miserable,” probably forcing closures and bankruptcies. BNP Paribas expects a surplus of 1 million tons this year.

“The fundamental outlook is weak for the metal with some miserable factors like oversupply not easing in China even as prices keep falling,” Wang Rong, an analyst at Guotai & Junan Futures Co. in Shanghai, said on Friday. Speculation about government subsidies for local producers worsened sentiment in recent days as smelters were seen continuing producing with the policy encouragement, according to Wang. Primary aluminum production in China expanded 12% in the first nine months of this year while the expansion of the country’s gross domestic product was the weakest since 2009. Shipments of unwrought aluminum and aluminum products from Asia’s top economy surged 18% between January and September.

Alcoa, the top U.S. aluminum maker, said last month it will break itself up by separating manufacturing operations from a legacy smelting and refining business that’s struggling to overcome the booming production from China. While the company forecast a global surplus this year, it sees a shift to a deficit in 2016. A total of 58% of traders and executives picked aluminum as their “favorite short” in a survey by Macquarie at this month’s London Metal Exchange’s annual gathering. It was the only LME metal seen with downside over the coming year, Macquarie said. “Aluminum is miserable and is going to stay miserable and will have to force closures and bankruptcies,” Anderson told Bloomberg. “For most industrial metals, we have a negative outlook for the near term.”

“..because it misrepresented the way markets work..”

• ‘Flash Crash’ Trader’s Lawyer Calls US Extradition Request False (Guardian)

The US request to extradite London-based trader Navinder Sarao, accused of helping to spark the 2010 Wall Street “flash crash”, is “false and misleading” because it misrepresented the way markets work, his lawyer has told a court. Sarao is wanted by US authorities after being charged on 22 criminal counts including wire fraud, commodities fraud, commodity price manipulation and attempted price manipulation. The 36-year-old, who lives and worked at his parents’ modest home near Heathrow airport, is accused of using an automated trading programme to “spoof” markets by generating large sell orders that pushed down prices. He then cancelled those trades and bought contracts at lower prices, prosecutors say.

The flash crash saw the Dow Jones Industrial Average briefly plunge more than 1,000 points, temporarily wiping out nearly $1tn in market value. Sarao’s team are looking to block extradition on the grounds that the US charges would not be offences under English law, and if they are, that he should be tried in Britain. At a court hearing in London on Thursday to consider whether a US trading expert could give evidence when the case is decided next year, Sarao’s lawyer James Lewis said his testimony was needed to debunk the US extradition request because it demonstrated that there was nothing unusual in traders cancelling orders.

“Americans had to create the crime of spoofing,” Lewis told Westminster Magistrates’ court in London, citing a report by Prof Lawrence Harris from the Marshall School of Business at the University of Southern California. “The [US extradition] request is false and misleading,” he added. “It’s simply not the reality of what happens in any market. It’s arrant nonsense.” Mark Summers, representing the US authorities, said they were not suggesting cancelling trades was in itself wrong, but that Sarao had never planned to execute the orders he had posted. “His intention was to manipulate the market process by creating a false impression of liquidity. It was bogus from the outset,” Summers said, adding the US disputed the report by Prof Harris, a former chief economist at the US Securities and Exchange Commission.

How distorted has the US justice system become?

• Inside Massive Injury Lawsuits, Clients Get Traded Like Commodities (BBG)

For all the black robes and ceremony, the American legal system often operates more like a factory assembly line than a citadel of individualized justice. 95% of criminal prosecutions end in plea deals. Many defective-product claims settle in mass pacts that benefit attorneys more than putative victims. Now a legal dispute within a plaintiffs’ law firm that organizes massive torts is threatening to pull back the curtain on the mechanics of high-volume litigation. It’s not a pretty picture. Amir Shenaq, a 30-year-old financier, sued his former employer, the Houston law firm AkinMears, over $4.2 million in allegedly unpaid commissions. To earn those fees, Shenaq says he raised nearly $100 million used to purchase thousands of injury claims from other lawyers.

The suit portrays a claim-brokering marketplace that normally operates in secret, with clients recruited en masse through TV and Internet advertising who are then bundled and traded among attorneys like so many securitized mortgages. AkinMears “is not run like a traditional plaintiffs’ law office, and the firm’s lawyers do not do the types of things that regular trial lawyers do,” according to the Shenaq suit, which was filed in Texas state court in late September by another Houston firm, Oaks, Hartline & Daly. AkinMears doesn’t do “things like meet their clients, get to know their clients, file pleadings/motions, attend depositions/hearings, or, heaven forbid, try a lawsuit,” Shenaq alleges.

Rather, AkinMears “is nothing more than a glorified claims-processing center, where the numbers are huge, the clients commodities, and the paydays, when they come, stratospheric.” In court filings, AkinMears denied wrongdoing and said Shenaq had been fired last July 31 for unspecified reasons. Shenaq, a former Wells Fargo Securities leveraged-finance banker, alleges Akin fired him to avoid paying the multimillion-dollar commissions. AkinMears asked the trial judge to seal Shenaq’s suit, saying his disclosures “will cause immediate and irreparable harm to the continued nature of financial and other information belonging to AkinMears and those with whom it does business under terms of confidentiality.” Judge Randy Wilson granted the gag order earlier this month, but only after the original filing had been disseminated online.

He’s right about the problem, but so wrong on the “solution” (forced savings supposed to yield 7-8%) it’s clear all he wants is easy access to all that ‘capital’.

• Millennials Face ‘Great Depression’ In Retirement: Blackstone COO (CNBC)

Americans in their 20s and 30s are facing a retirement crisis that could plunge them back into the Great Depression, Blackstone President and Chief Operating Officer Tony James said Wednesday. “Social Security alone cannot provide enough for these people to retain their standard of living in retirement, and if we don’t do something, we’re going to have tens of millions of poor people and poverty rates not seen since the Great Depression,” he told CNBC’s “Squawk Box.” The solution is to help young people save more by mandating savings through a Guaranteed Retirement Account system, he said. Right now, young people cannot save enough on their own because they face stagnant incomes and heavy student-debt burdens.

The Guaranteed Retirement Account was proposed by labor economist Teresa Ghilarducci in 2007 as a solution to the problem of retirement shortfalls that inevitably arise when contributions are voluntary. A GSA system would require workers to make recurring retirement contributions, which would be deducted from paychecks. Employers would be mandated to match the contribution, and the federal government would administer the plan through the Social Security Administration.

Ghilarducci has proposed a mandatory 5% contribution, but James said a 3% requirement rolled into GRAs could outperform retirement savings vehicles like IRAs and 401(k)s. He noted that a 401(k) typically earns 3 to 4%, while a pension plan yields 7 to 8%. The average American pension plan has a 25% allocation to alternative investments — including real estate, private equity and hedge funds — with the remainder invested in markets, he said. “The trick is to have these accounts invested like pension plans, so the money compounds over decades at 7 to 8%, not at 3 to 4,” he said.

We’re going to need robot farmers.

• American Farmers Want Student Loans Forgiven (MarketWatch)

Are the farmers who grow the nation’s food public servants? Not according to the government — but some advocates and bipartisan legislators are trying to change that, pushing a proposal to add farming to the list of public service fields entitled to student debt forgiveness. The effort is an indication that the student debt crisis has fueled concerns about the future of one of the country’s oldest professions and, perhaps, even endangered the food supply. Advocates say that debt may be keeping young Americans from starting farms, buying land, or even considering farming to begin with, perhaps meaning there won’t be enough farmers to take over when the current generation retires.

“We’re increasingly moving toward a system where the barriers to entry in farming as a young person are too high,” said Eric Hansen, a policy analyst at the National Young Farmer’s Coalition, the advocacy group behind a push to include farming in the Public Service Loan Forgiveness Program. But some question whether characterizing for-profit farming as a public service is the right way to tackle issues facing potential farmers — and, more broadly, whether the program, meant to encourage educated workers to enter relatively low-paying professions such as social work, early childhood education and government — is in need of refinement, rater than expansion.

It’s hard to find precise statistics on the share of farmers who have student loan debt, but available data nevertheless suggests a sizable population. Nearly a quarter of principal farm operators had completed college in 2007, according to a U.S. Department of Agriculture survey, and more than 70% of bachelor’s degree recipients graduate with student debt. Just 6% of the nation’s approximately 2.1 million farmers were under 35 in 2012, according to the U.S. Department of Agriculture, down from nearly 16% 20 years earlier. Mechanization has allowed farmers to work longer, raising average ages, and farm families often struggle to convince their children to stay in the business. But student loan debt is also a large part of the problem, some say.

MO.

• Inside Swiss Banks’ Tax-Cheating Machinery (WSJ)

Some Swiss banks loaded funds onto untraceable debit cards. At another, clients who wanted to transfer cash used code phrases such as “Can you download some tunes for us?” One bank allowed a client to convert Swiss francs into gold, which was then stored in a relative’s safe-deposit box. Dozens of Swiss banks have been spilling their secrets this year as to how they encouraged U.S. clients to hide money abroad, part of a Justice Department program that lets them avoid prosecution. It is part of a broader U.S. crackdown on undeclared offshore accounts that has ensnared big Swiss banks such as UBS, but has received scant attention because it mostly involves little-known firms and relatively small fines.

A Wall Street Journal analysis of Justice Department documents from more than 40 settlements with these banks provides a rare window into foreign firms’ tax-haven techniques and their myriad methods of keeping clients’ accounts under wraps. The offenders range from international banks to small-town mortgage lenders, which together helped secrete more than 10,000 U.S-related accounts holding more than $10 billion, according to the analysis. “Helping Americans conceal assets from the IRS was a big business for many sizes and types of firms in Switzerland, and now we’re seeing how extensive it was,” said Jeffrey Neiman, who led the Justice investigation of UBS in 2009 that pierced the veil of Swiss-bank secrecy. He is now at law firm Marcus Neiman & Rashbaum LLP in Fort Lauderdale, Fla.

The firms that have admitted to the misconduct have paid a total of more than $360 million to resolve the cases and avoid criminal charges. Lawyers for U.S. account holders and Swiss banks estimate that 40 other firms in this program are in talks with the Justice Department. “Banks large and small are naming individuals and firms that helped U.S. taxpayers hide foreign accounts and evade taxes,” said acting Assistant Attorney General Caroline Ciraolo. “It is now clear that asset-management firms, investment-advisory groups, insurance companies and corporate service providers—not just banks—facilitated this criminal conduct.” More than 54,000 U.S. taxpayers with undeclared accounts have paid more than $8 billion to the Internal Revenue Service to resolve their cases and avoid criminal prosecution.

It’s now Putin’s monologue.

• Vladimir Putin Accuses US Of Backing Terrorism In Middle East (Guardian)

The Russian president, Vladimir Putin, has launched a stinging attack on US policy in the Middle East, accusing Washington of backing terrorism and playing a “double game”. In a speech on Thursday at the annual gathering of the Valdai Club, a group of Russian and international analysts and politicians, Putin said the US had attempted to use terrorist groups as “a battering ram to overthrow regimes they don’t like”. He said: “It’s always hard to play a double game – to declare a fight against terrorists but at the same time try to use some of them to move the pieces on the Middle Eastern chessboard in your own favour. There’s no need to play with words and split terrorists into moderate and not moderate. I would like to know what the difference is.”

Western capitals have accused Moscow of targeting moderate rebel groups during its bombing campaign in Syria, which Russia says is mainly aimed at targets linked to Islamic State. However, Putin’s talk of “playing with words” and other statements by government officials suggest Moscow believes all armed opposition to Bashar al-Assad is a legitimate target. Putin received Assad at the Kremlin on Tuesday, and on Thursday he underlined that he considered the Syrian president and his government to be “fully legitimate”. He said the west was guilty of shortsightedness, focusing on the figure of Assad while ignoring the much greater threat of Isis. “The so-called Islamic State [Isis] has taken control of a huge territory. How was that possible? Think about it: if Damascus or Baghdad are seized by the terrorist groups, they will be almost the official authorities, and will have a launchpad for global expansion. Is anyone thinking about this or not?”

“Greece has become synonymous with a country that cannot meet its obligations. It has become a unit of measure. Like Richter, decibels, kilos…”

• Greece, A Unit For Measuring Catastrophe (Konstandaras)

“Is Kenya Africa’s Greece?” a newspaper poster in South Africa asked a few days ago in a photo on Twitter that caused a stir in Greece. Kenya is finding it difficult to pay its state employees, raising questions about the state of its finances. A couple of days later, Paulo Tafner, an economist and authority on Brazil’s pension system, described his country’s problems to the New York Times in this way: “Think Greece but on a crazier, more colossal scale.” Greece has become synonymous with a country that cannot meet its obligations. It has become a unit of measure. Like Richter, decibels, kilos…

Our prime minister, Alexis Tsipras, boasts that his government made the Greek problem an international issue. He may believe that the resistance he put up against our creditors for several months gained the international public’s sympathy – and, up to a point, he is right – but our country’s international image is not his achievement alone. Greece became a symbol because of decades of mismanagement, waste and populism. The SYRIZA-Independent Greeks coalition inherited these problems but it differed from previous governments in that it made no effort to correct Greece’s failings; instead, it presented them as virtues that could be maintained and imposed on those who lend us money. This effort resulted in resounding defeat and has not won any admirers.

Even SYRIZA’s Spanish brethren, Podemos, are trying to persuade their compatriots that they are very different from the Greeks. It is sad and humiliating to see Greece being used as a symbol of failure. After having inherited so much, it is a heavy burden to be known chiefly for an inability to manage the present. But the very fact that our country is a unit for measuring failure reveals the only comforting fact in this sorry tale: Obviously we are not the only country to screw up so badly. The problems that we face challenge other countries, too, whether in Europe or Africa or South America, whether they are small and poor or emerging giants.

Mismanagement, waste, corruption and supporting specific groups at the expense of the general public are not exclusively Greek phenomena. Our problem here is that we allowed them to grow without any serious effort to control them. For decades. Like investors thrilled by bubbles, we were seduced. We forgot that what goes up comes down. And when we crashed and needed help we still behaved as if we did not need a radical change of mentality. It was as if we did not want to save ourselves.

But by no means the lowest.

• A New Low: Czech Authorities Strip-Searched Refugees To Find Money (Quartz)

The Czech Republic is locking up refugees and migrants in degrading conditions, according to a scathing criticism by the United Nations High Commissioner for Human Rights released Oct. 22. Not only are new arrivals kept involuntarily in detention centers, but many are being forced to pay $10 per day for it. In some cases, refugees have been strip-searched by authorities looking for the money. The required payment does not have “clear legal grounds,” said UNHCR commissioner Zeid Ra’ad Al Hussein in the release. It leaves many of the detainees destitute by the end of their stay, which in some cases can last 90 days. Children have also been detained, a violation of minors’ rights by UN standards.

“International law is quite clear that immigration detention must be strictly a measure of last resort,” emphasizes Zeid. “According to credible reports from various sources, the violations of the human rights of migrants are neither isolated nor coincidental, but systematic: they appear to be an integral part of a policy by the Czech Government designed to deter migrants and refugees from entering the country or staying there.” Zeid points out in his statement that the Czech Republic’s own Minister of Justice Robert Pelikán has described conditions in the Bìlá-Jezová detention facility as “worse than in a prison.”

Can things get any worse? You bet.

• Rights Group Reports Fresh Assaults On Migrants In Aegean Sea (AFP)

Human Rights Watch on Thursday reported fresh assaults by unidentified gunmen in the Aegean Sea endangering the lives of migrants trying to reach Europe. The rights group said witnesses had described eight incidents in which assailants “intercepted and disabled the boats carrying asylum seekers and migrants from Turkey toward the Greek islands, most recently on October 7 and 9.” A 17-year-old Afghan called Ali said a speedboat with five men armed with handguns had rammed their rubber dinghy on October 9. “At first when they approached, we thought they had come to help us,” Ali told HRW.

“But by the way they acted, we realised they hadn’t come to help. They were so aggressive. They didn’t come on board our boat, but they took our boat’s engine and then sped away,” he said. The Afghan teen said the masked men attacked three other boats in quick succession before speeding off toward the Greek coast “They spoke a language we didn’t know, but it definitely was not Turkish, as we Afghans can understand a bit of Turkish,” he said. Similar allegations had been made by migrants and rights groups during the summer. The latest attacks had occurred near the island of Lesvos, HRW said. A Greek coastguard source said the claims were under investigation but despite a search for the alleged perpetrators on land and at sea, no evidence had been found.

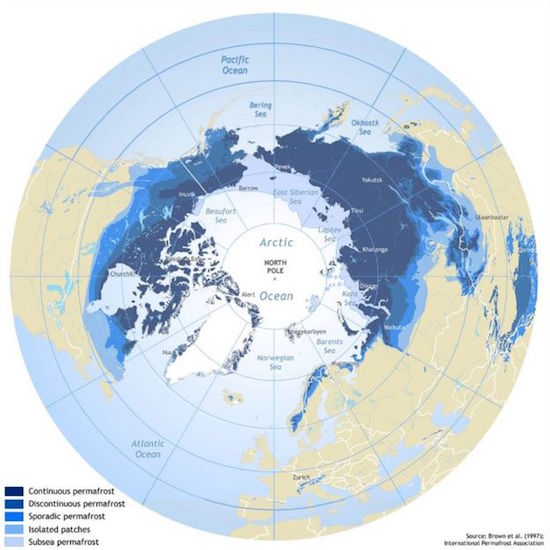

One word: methane.

• Permafrost Thawing In Parts Of Alaska ‘Is Accelerating’ (BBC)

One of the world’s leading experts on permafrost has told BBC News that the recent rate of warming of this frozen layer of earth is “unbelievable”. Prof Vladimir Romanovsky said that he expected permafrost in parts of Alaska would start to thaw by 2070. Researchers worry that methane frozen within the permafrost will be released, exacerbating climate change The professor said a rise in permafrost temperatures in the past four years convinced him warming was real. Permafrost is perennially frozen soil that has been below zero degrees C for at least two years. It’s found underneath about 25% of the northern hemisphere, mainly around the Arctic – but also in the Antarctic and Alpine regions.

It can range in depth from one metre under the ground all the way down to 1,500m. Scientists are concerned that in a warming world, some of this permanently frozen layer will thaw out and release methane gas contained in the icy, organic material. Methane is a powerful greenhouse gas and researchers estimate that the amount in permafrost equates to more than double the amount of carbon currently in the atmosphere. Worries over the current state of permafrost have been reinforced by Prof Romanovsky. A professor at the University of Alaska, he is also the head of the Global Terrestrial Network for Permafrost, the primary international monitoring programme.

He says that in the northern region of Alaska, the permafrost has been warming at about one-tenth of a degree Celsius per year since the mid 2000s. “When we started measurements it was -8C, but now it’s coming to almost -2.5 on the Arctic coast. It is unbelievable – that’s the temperature we should have here in central Alaska around Fairbanks but not there,” he told BBC News. In Alaska, the warming of the permafrost has been linked to trees toppling, roads buckling and the development of sinkholes. Prof Romanovsky says that the current evidence indicates that in parts of Alaska, around Prudhoe Bay on the North Slope, the permafrost will not just warm up but will thaw by about 2070-80.

Home › Forums › Debt Rattle October 23 2015