Max Ernst Inspired hill 1950

Barak Avi

The similarities in the techniques, the manipulations, the lies and the censorship between the Covid and the Climate campaign.

Video is also on Telegram: https://t.co/JFsOlFPnen

And Facebook: https://t.co/1xwcf2TEUa pic.twitter.com/rjlfKtcvR3— Barak Avi (@barak_a_m) December 28, 2022

GVB

"The mass vaccination program is by far the largest and the most precisely targeted gain-of-function experiment ever conducted in vivo … driving the virus in a very targeted way … that will end as a bio-weapon of mass destruction"

-GVB

— Dr. Syed Haider (@DrSyedHaider) December 28, 2022

FBI/Twitter

Exposed: How deeply involved FBI was with Twitter pic.twitter.com/UZ39wOkKgU

— Wittgenstein (@backtolife_2023) December 27, 2022

“Either Russia prevails on its terms,” came the answer, “or there is a nuclear exchange.”

• A War of Rhetoric & Reality (Patrick Lawrence)

Passing through Austin, Texas, the other night, we had drinks with a distinguished observer of global affairs and took the opportunity to ask how he thought the war in Ukraine would conclude. It is a common question these days. While no answer can be definitive, it is always interesting to discover what wise heads see out front. “Either Russia prevails on its terms,” came the answer, “or there is a nuclear exchange.” I do not think this stark assessment would have necessarily held up even a month ago. I may not have agreed with it, in any case. But the war has escalated markedly over the past week or two. And our Austin companion’s either/or prediction seems now to be the terrible truth of new circumstances. There are numerous indications that Russia is preparing to launch a major offensive in coming weeks or months.

With Volodymyr Zelensky’s circus-like visit to Washington last week, the Biden administration and the Democrat-controlled Congress have drastically, recklessly increased their investment in the Ukrainian president’s regime — a good-money-after-bad judgment if ever there was one. This now shakes out as a war between rhetoric and reality. And the former, a war waged with immense volumes of Western weaponry in defense of ideological bombast, is far more dangerous than the latter, a war waged on the ground with clearly defined objectives. As John Mearsheimer and Jack Matlock, two astute students of this conflict, have argued, neither side can afford to lose in Ukraine. But what is at stake for Russia and the West — Ukraine being the latter’s proxy — is very different.

A Russian defeat in Ukraine would be a direct threat to its security, sovereignty, and altogether its survival. These are legitimate causes. What people would not defend themselves against such a threat — especially given Washington’s long record of subterfuge in nations, not least the Russian Federation, that insist on their independence. The Biden administration’s rhetoric since the Ukraine crisis sharpened prior to the outbreak of hostilities in February has cast this conflict as a near-cosmic confrontation between liberalism and authoritarianism. I do not see that this is very different from Bush II’s biblical baloney about Gog and Magog as it prepared to invade Iraq, or Mike Pompeo’s unhinged end-times talk when he was whipping up war fever against Russia and China while serving as Donald Trump’s secretary of state.

This irresponsible rhetoric has painted every breathing, walking-around American into a corner from which the only escape is capitulation. That is why it is dangerous. Russia can win battles and wage extensive artillery and rocket campaigns and remain open to negotiation at any opportunity conditions present. Putin made this point clear once again on Sunday. It is difficult to see, by contrast, how our addled president can find his way to talks given how he and the third-rate neoconservatives who control his foreign policies have cast this conflict. And it is too easy to imagine these people reaching for the nuclear buttons once their follies become evident.

“..an all-out nuclear exchange would send enough dust in the air to block sunlight resulting in “a period of chaos and violence, during which most of the surviving world population would die from hunger.”

• Report Warns Risk of Nuclear War At Its Highest Since US Nuked Japan (Antiwar)

A Swedish group that assesses catastrophic risks warned in its annual report this year that the risk of nuclear weapons use is higher today than at any point since the US dropped nuclear weapons on Japan in 1945, AFP reported on Tuesday. Kennette Benedict, an advisor to the Bulletin of Atomic Scientists who led the report for the Global Challenges Foundation, said the risk of nuclear war was greater than during the 1962 Cuban Missile Crisis. The report warned that an all-out nuclear exchange would send enough dust in the air to block sunlight resulting in “a period of chaos and violence, during which most of the surviving world population would die from hunger.”

President Biden acknowledged the risk back in October when he said the chances of nuclear “armageddon” are higher today than at any point since the Cuban Missile Crisis. Despite his recognition of the danger of his policy of supporting Ukraine against Russia, Biden continues to escalate US involvement in the war, and there is no end in sight to the fighting. Ukraine’s war effort is entirely reliant on Western support, and the US is not just sending weapons but also providing training, intelligence, and other kinds of targeting support. According to recent media reports, the Pentagon now tacitly backs Ukrainian strikes on Russian territory, and the CIA is directing sabotage operations inside Russia.

Russian officials have made clear that they believe they are not just fighting Ukrainian forces in the war but also the US and NATO. This means Russia has the pretext to launch strikes on the US and NATO, although there’s no sign that such a decision has been made. If Russia eventually chooses to retaliate by using conventional weapons against NATO, the conflict could quickly spiral into nuclear war. If Moscow decides to use a tactical nuclear weapon in Ukraine, most experts believe it would lead to a nuclear exchange between the US and Russia.

It was never going to be a quiet New Year’s.

• Russia Steps Up Kherson Shelling, Dismisses Zelenskiy’s Peace Plan (RT)

Ukraine’s recently liberated southern city of Kherson suffered intense mortar and artillery attacks from Russian forces across the Dnipro river, while the Kremlin rejected a Ukrainian peace plan, demanding that Kyiv accept its annexation of four regions. Kherson has remained under bombardment from Russian forces which had retreated to the east bank of the river when the city was retaken in a major victory for Ukraine last month. On Wednesday, the shelling hit the maternity wing of a hospital, though no-one was hurt, according to Kyrylo Tymoshenko, President Volodymyr Zelenskiy’s deputy chief of staff. Staff and patients were moved to a shelter, Tymoshenko said in a post on Telegram. “It was frightening … the explosions began abruptly, the window handle started to tear off … oh, my hands are still shaking,” Olha Prysidko, a new mother, said. “When we came to the basement, the shelling wasn’t over. Not for a minute.”

Macgregor

“..already helping Ukraine to structure the fund for the reconstruction of our state.”

Who’s going to pay? Not BlackRock.

• Zelensky To Join WEF in Davos, Sign New Postwar Loans With BlackRock (PM)

On Wednesday it was revealed that Ukrainian President Volodymyr Zelensky’s government is prepping to participate in January’s World Economic Forum (WEF) in Davos, and that the Ukrainian leader is in talks with BlackRock CEO Larry Fink regarding rebuilding efforts following the war with Russia. According to Bloomberg, Zelensky said in an evening address to the nation, “Specialists of this company are already helping Ukraine to structure the fund for the reconstruction of our state.” Zelensky reportedly had a video call with Fink in September. He did not reveal whether he would be attending the WEF in person or virtually.

According to a Wednesday post on the Ukrainian President’s official website, Zelensky said, “In accordance with the preliminary agreements struck earlier this year between the Head of State and Larry Fink, the BlackRock team has been working for several months on a project to advise the Ukrainian government on how to structure the country’s reconstruction funds.” “Volodymyr Zelenskyy and Larry Fink agreed to focus in the near term on coordinating the efforts of all potential investors and participants in the reconstruction of our country, channeling investment into the most relevant and impactful sectors of the Ukrainian economy,” the post added. “During the conversation, it was emphasized that certain BlackRock leaders plan to visit Ukraine in the new year,” the post continued. “The President thanked Larry Fink for the work of the professional team that BlackRock has allocated to advise on structuring the reconstruction projects.”

“No plan that ignores that reality can pretend to have peace in mind..”

• Ukrainian Proposal Is Not ‘A Peace Plan’ – Kremlin (RT)

No proposal that refuses to account for reality can pretend to aim for peace, the Kremlin spokesman Dmitry Peskov told reporters on Wednesday, responding to a question about Russia’s official position on a “peace plan” floated by the Ukrainian government. “No plan that ignores that reality can pretend to have peace in mind,” Peskov said. Ukrainian President Vladimir Zelensky’s proposal, floated earlier this month, envisioned a UN-sponsored “Global Peace Summit” taking place in February 2023. According to Zelensky, the agenda would be based on his ten-point “peace formula,” which includes the withdrawal of Russian troops from all territories claimed by Ukraine, Moscow paying reparations, and holding war crimes trials for individuals that Kiev accuses of aggression.

Zelensky’s Foreign Minister Dmitry Kuleba brought up the proposal anew on Monday, insisting that Russia must face judgment by an “international court” before being allowed at the table. Moscow’s First Deputy Permanent Representative to the UN Dmitry Polyansky dismissed Kuleba’s statement as “nonsense,” commenting that there can be no peace talks without Russia, while the actions of Ukraine’s government may result in such a meeting eventually taking place without their participation. Russian President Vladimir Putin has said Kiev must recognize the status of Donetsk, Lugansk, Kherson, and Zaporozhye as parts of Russia as a prerequisite for any peace talks. In addition to the four regions, Moscow seeks to “prevent the creation and continuation of any threats to our security from Ukrainian territory,” Foreign Minister Sergey Lavrov said in an interview on Wednesday.

Russia sent troops into Ukraine on February 24, citing Kiev’s failure to implement the Minsk agreements, designed to give the regions of Donetsk and Lugansk special status within the Ukrainian state. Former Ukrainian President Pyotr Poroshenko has since admitted that Kiev’s main goal was to use the 2014 ceasefire, brokered by Germany and France, to buy time and “create powerful armed forces.” Moscow demands that Ukraine officially declare itself a neutral country that will never join any Western military bloc. Kiev insists the Russian offensive was completely unprovoked.

Good thing then that it won’t be defeated.

• Italian Minister: Russia Will Dare Use Nuclear Weapons If It Is Defeated (RT)

“Russia will dare to use nuclear weapons if it is defeated,” Italian Defense Minister Guido Crosetto said in an interview with the local media, Report informs.He said that the use of tactical nuclear power is foreseen by Russia: “For us, it is inconceivable, but for Moscow, yes. But if Moscow understands that there is no return, it will go for it.” The minister assured that Rome will stand by Kyiv until the last Russian soldier leaves the sovereign lands of Ukraine: “We will help Ukraine to protect itself. Russia has crossed the border it should not have crossed.”

“rashists”

• Ukraine Law Firm Runs Campaign Targeting Ordinary People In Western Europe (RT)

Boutique Ukrainian law firm T&M has launched an appalling new service allowing residents of Western European countries to “cleanse Europe of rashists,” a reference to the derogatory neologism used by officials in Kiev, which combines the words “Russian” and “fascist.” Titled “give in charge rashist” (apparently a bad translation of the Ukrainian title “turn in a rashist”), the webportal invites visitors who are “tired of potential invaders living near you” to “let us know and we will try to solve this issue in the legal field.” “We are a team of lawyers who decided to use legal methods to cleanse Europe of potential invaders,” the site explains. “No one will know who surrendered the rashist. It’s completely free. You pay nothing, but you get a bonus to karma. You are making a personal contribution to a peaceful future.”

Reporting a “possible aggressor” is said to be “easy.” Concerned citizens can easily use a form to anonymously submit the names and social media accounts of Russian citizens living in any European country, who may be “potentially dangerous” and a “carrier of propaganda and violence.” In return, the Lviv-based T&M “do everything to ensure that the relevant European authorities check the legality of such a person’s stay in Europe,” and “send a corresponding statement to the state authorities of the country in which the presence of a potentially dangerous rashist was reported.” The obvious desired end result is that the Russian in question will be arrested and deported, or perhaps even worse. A disclaimer at the bottom of the page states the service “is not intended to incite ethnic, racial, religious or other enmity,” and only serves to bring its stated targets “to justice.”

T&M has been operating in Lviv since 2014, specializing in sports law, road traffic accidents, IT and technology transfer, and corporate relations. “Give in charge rashist” is a sub-page of T&M’s main site and links back to it in its disclaimers section. “We do not collect your personal data in any way, and we use the personal data of rashists that you provide us exclusively for contacting state authorities,” it concludes. It is unknown if any “rashists” have been reported to authorities as a result of this abhorrent resource, or where they are located or what has happened to them if so. This is just the latest example of how a highly hostile environment for Russians is being created abroad, in which they are, regardless of their political leanings and beliefs, viewed as one and the same. The purpose is to ensure all Russians are falsely considered “the enemy within” by local citizens in their host countries, plotting misdeeds and wrongdoing in support of the Kremlin’s devilish plans for global domination.

“..the West should be engaged in the “permanent strengthening of our common security in the face of Russia.”

• Berlin Promises To Ramp Up Sanctions Against Moscow (RT)

Any business as usual with Russia is impossible in the near future due to the Ukraine conflict, German Foreign Minister Annalena Baerbock said on Tuesday. She also vowed that Berlin and its allies would intensify sanctions pressure against Moscow. Speaking to Romania’s Digi 24 TV Channel, the minister emphasized that “there can be no normal relations with this Russia” amid the fighting between Moscow and Kiev’s forces and the stand-off with the West. EU would prefer “a peaceful and democratic Russia that does not pose a threat to its neighbors,” Baerbock stated, adding that she harbors “no illusions” on the matter. “We are living in a different reality right now.” Against this backdrop, the minister noted that the West should be engaged in the “permanent strengthening of our common security in the face of Russia.”

According to Baerbock, as long as Moscow wages “the brutal war of aggression,” the West will gradually tighten its sanctions policy. However, she did not clarify what additional restrictions could be in the offing. She went on to add that Western capitals would support Ukraine “as long as necessary,” providing it with arms, as well as humanitarian and financial aid, because the nation “defends the freedom of Europe.” However, she struck a more cautious tone about Kiev’s aspirations to join the EU. While hailing the bloc’s decision to grant Ukraine candidate status in June as a “historic moment,” Baerbock admitted that “the road there will still be long and certainly sometimes difficult.” To pave the way for Kiev’ accession, Western countries are doing their best to help the nation harmonize its legal system with EU standards, she said.

Following the start of Russia’s military operation against Ukraine in late February, Germany has provided Ukraine with large amounts of weaponry and joined Western sanctions against Moscow. The restrictions targeted entire sectors of the Russian economy, particularly energy exports, while hundreds of senior officials were blacklisted, and about half of the nation’s foreign exchange reserves were frozen, a move that was denounced by Moscow as essentially “theft.” On Tuesday, Russian Foreign Minister Sergey Lavrov reiterated that the EU is waging a “hybrid war” against Moscow, arguing that Brussels’ policies have only hurt the interests of the bloc’s citizens while bringing its relations with Russia to their “lowest point.”

What a catastrophic failure. Do call it was it is.

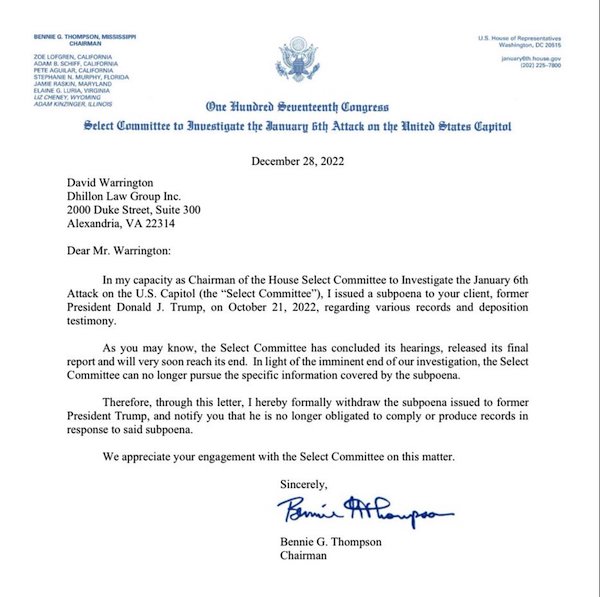

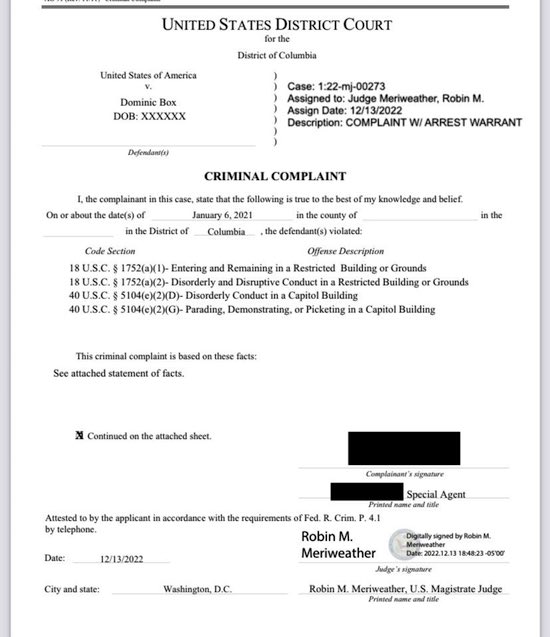

But they still keep arresting people two years later.

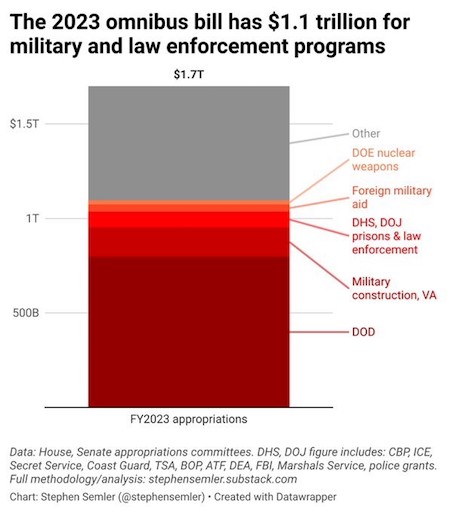

Julie Kelly: “And Senate GOP just handed FBI a half-billion dollar raise and gave DOJ $212 million just to prosecute Trump supporters.”

• Jan. 6 Committee Withdraws Trump Subpoena (ZH)

The January 6th special committee has formally withdrawn its subpoena of former President Donald Trump. “In light of the imminent end of our investigation, the Select Committee can no longer pursue the specific information covered by the subpoena,” wrote Rep. Bernie Thompson (D-MI) in a Wednesday night letter sent to Trump’s attorneys, which was obtained by CNN. “Therefore, through this letter, I hereby formally withdraw the subpoena issued to former President Trump, and notify you that he is no longer obligated to comply or produce records in response to said subpoena,” the letter continues.

Trump took a victory lap on Truth Social, writing: “Was just advised that the Unselect Committee of political Thugs has withdrawn the Subpoena of me concerning the January 6th Protest of the CROOKED 2020 Presidential Election. They probably did so because they knew I did nothing wrong, or they were about to lose in Court. Perhaps the FBI’s involvement in RIGGING the Election played into their decision. In any event, the Subpoena is DEAD!” As CNN notes, the committee has already dropped several subpoenas against other witnesses, and has wrapped up its investigation by referring Trump to the DOJ for potential criminal prosecution on four separate charges. The referrals, however, hold no legal weight.

“evidence that the finances, credit cards, and bank accounts of Hunter and Joe Biden were co-mingled, if not shared.”

• ‘Just Take A Look At’ Biden’s Accounts’: Trump Tells GOP (DCE)

Former President Donald J. Trump shared a campaign video to Truth Social providing a stern rebuke to the release of his 2015-2020 tax returns by the Democrat-led House Means and Ways Committee on Tuesday. He further called for the new Republican-led House to “immediately obtain the financial records of Joe Biden and his entire criminal enterprise.” The dramatic legal battle over the former president’s tax records ended in November when the United States Supreme Court declined to overturn an appellate court ruling that ordered Trump to hand over the records to Congress. The sole Republican candidate to announce for the 2024 presidential race denounced the move as “an outrageous abuse of power” from “radical Democrats” Friday.

“There is no legitimate legislative purpose for their action, and if you look at what they’ve done, it’s so sad for our country,” he said, after sharing the video with Breitbart. The former president called the action “unconstitutional.” “It’s nothing but another deranged political witch-hunt, which has been going on from the day I came down the escalator in Trump Tower,” he added. “Although these tax returns contain relatively little information and not information that almost anybody would understand — they’re extremely complex — the radical Democrats’ behavior is a shame upon the U.S. Congress,” Trump added. He then called upon the House GOP to aggressively acquire Biden’s financial records, as reported by Breitbart:

“The new Republican House should immediately obtain the financial records of Joe Biden and his entire criminal enterprise because that’s exactly what it is. Biden is a corrupt politician who spent years selling out America all over the world, including to Communist China. Just take a look at his accounts, take a look at all of his homes, and take a look at what his son, Hunter, has contributed to the family. The American public deserves to know the truth. We should also get to the bottom line on how Biden, on a salary of a U.S. Senator, was able to buy one mansion after another, all these different locations. When I’m president, we will expose the Washington cartel, and we will Make America Great Again.”

Incoming Republican Chairman Rep. James Comer of the U.S. House Oversight Committee told CNN in November that Hunter Biden is expected to be subpoenaed about his father’s involvement in his business dealings overseas. Comer explicitly told reporters “This is an investigation of Joe Biden.” “This committee will evaluate whether this president is compromised or swayed by foreign dollars,” Comer added. He explained, as previously reported by Newsweek, that the investigation will have “evidence that the finances, credit cards, and bank accounts of Hunter and Joe Biden were co-mingled, if not shared.”

“Musk argues that “‘Gain-of-function’ in this context is just another way of saying ‘bioweapon.'”

• Elon Musk Says Gain-of-function Research In Wuhan Was Bioweapon Research (PM)

Elon Musk went on the Fauci attack on Wednesday, insinuating that the gain-of-function (GoF) work the doctor was advocating for was essentially bioweapon research. “‘Gain-of-function’ should be called ‘bioweapon’ research, as the function referred is death!” Musk tweeted. The Twitter CEO points to a Yahoo News article from last year that unearthed a paper that Fauci wrote a decade ago, where he argues that the benefits of GoF research outweigh the potential pandemic risk. GoF research consists of genetically altering an organism, such as a virus, in order to gain an increased understanding of its function, work that was taking place at the infamous Wuhan Institute of Virology in China. “In an unlikely but conceivable turn of events, what if that scientist becomes infected with the virus, which leads to an outbreak and ultimately triggers a pandemic?,” Fauci asks in his 2012 paper.

He goes on to say that GoF research is “important work,” clearly stating that the benefits “outweigh the risks.” Musk argues that “‘Gain-of-function’ in this context is just another way of saying ‘bioweapon.'” He also points out that Fauci’s wife, Christine Grady, is the head of bioethics at the National Institutes of Health, where she is “the person who is supposed to make sure that Fauci behaves ethically.” There is mounting evidence pointing to the fact that the COVID-19 virus originated from a leak at the Wuhan lab, despite insistence from the government and from Fauci himself that this was not the case. It was revealed earlier this year that many scientists in Britain and the United States were more concerned about keeping “international harmony” than with opening the debate regarding the lab-leak theory.

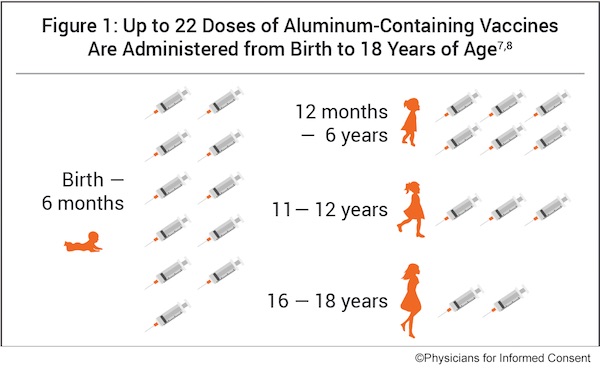

“..up to 22 doses of aluminum-containing vaccines are administered to children..”

• PIC Updates Its ‘Aluminum – Vaccine Risk Statement’ (PIC)

The document explains that both the FDA and ATSDR have raised concerns about the negative effects of aluminum exposure in humans. Scientific studies have shown that small amounts of aluminum can interfere with cellular and metabolic processes in the nervous system. Some of the most damaging effects of aluminum range from motor skill impairment to encephalopathy (altered mental state, personality changes, difficulty thinking, loss of memory, seizures, coma, and more). Studies have also shown that adverse effects of aluminum may not be restricted to neurological conditions.* A study referenced in the PIC document and published in Academic Pediatrics found that asthma occurred in 1 in 183 vaccinated children for every 1 mg (1,000 mcg) increase in aluminum exposure.

In the United States, up to 22 doses of aluminum-containing vaccines are administered to children, with 11 doses administered from birth to 6 months of age. “Overexposure to aluminum may lead to significant harm,” said Dr. Shira Miller, founder and president of Physicians for Informed Consent. “In California, where PIC is headquartered, since Senate Bill 277 (SB 277) was enacted in 2015, numerous doses of aluminum-containing vaccines are mandated for public and private K-12 school attendance — with no exceptions for religious or personal belief exemptions. PIC asserts that vaccine mandates are unscientific and unethical and a threat to public health. SB 277, and any other law that coerces vaccination, needs to be repealed.”

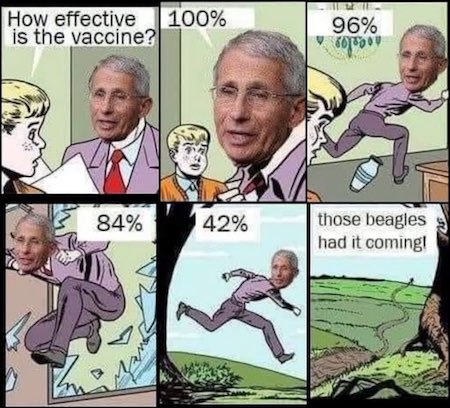

“..decades of established procedure designed to ensure the safety and efficacy of the vaccines..”

• ‘Health Experts’ Slam DeSantis’ Probe into Moderna, Pfizer (FlV)

After the Florida Supreme Court accepted Gov. Ron DeSantis’ request to impanel a statewide grand jury to investigate mRNA COVID-19 vaccine manufacturers, “health experts” fear the move “betrays decades of established procedure designed to ensure the safety and efficacy of the vaccines, and only serves to stoke further immunization fears.” Brian Castrucci, president and CEO of public health group the de Beaumont Foundation, told The Hill that the governor “appears to be focused on creating fear around vaccines that have been shown to be safe and effective.” “These vaccines have been tested and scrutinized more than any other vaccine, and they continue to save lives. Vaccine safety is not a partisan issue and attempting to make it one puts lives at risk,” he went on.

At a roundtable earlier in December, DeSantis was joined by Surgeon General Joseph Ladapo and other health experts telling their personal stories and experience dealing with adverse effects of the mRNA vaccines. Doctors warned that more research should have been conducted to weigh the risk and benefits for certain age groups and between men and women. For example, Ladapo’s Department of Health warn of a higher risk of cardiac death particularly among young males. “It is against the law to mislead and to misrepresent, particularly when you’re talking about the efficacy of a drug,” DeSantis said of the mRNA vaccine manufacturers. The petition to the Court argued it is “likely” the companies and those who benefit from the vaccines made misleading claims to consumers “for financial gain.”

It specifically points out Moderna and Pfizer’s claims about preventing the COVID-19 disease with “94.1% efficacy” and “91.3% vaccine efficacy.” Earlier in December, DeSantis also announced that a public health integrity committee will be established. The board will advise the public and provide oversight moving forward of the public health establishment. Joshua Sharfstein, vice dean for public health practice and community engagement at Johns Hopkins University and former principal deputy commissioner of the Food and Drug Administration, told The Hill that DeSantis’ request is not a good example of a “legitimate avenue” for scrutinizing vaccine recommendations.

“This is turning a matter of health and science into a political wedge issue, with the likely consequence that many people will be misled into placing themselves and their families at risk of serious illness and death,” he said. At the roundtable, DeSantis slammed ‘experts’ for dismissing dissenting opinions. “Part of the reason I think it’s been a bad response is because from the very beginning, you had a lot of arrogance, that it’s our way or the highway, and anyone that offers any type of a dissenting opinion, and they were censoring from day one, people that would write anti lock down things in March of 2020, April 2020, some of those would get taken down off some of these big tech platforms,” DeSantis said. “Anything [the CDC will] put out, you just assume, at this point, that it’s not worth the paper that it’s printed on.”

Jessica Rose is one of many -but never enough- doctors reinstated on Twitter.

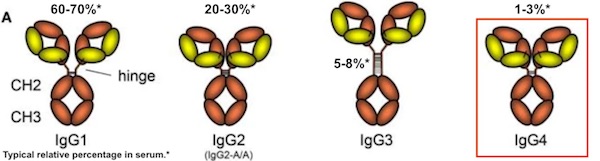

• IgG4-Related Disease (IgG4RD) Means Fibrosis And Organ Destruction (Rose)

A recent paper published in Science confirms what many of us have been saying for well over a year now: repeated injections with modified mRNA encapsulated by LNPs messes up your immune system. It messes it up in a specific way. We have evidence from this work that the fibrosis and organ destruction we are witnessing in countless numbers of folks post COVID injection, is due to the shots and more specifically, likely due to the eventual class switching to IgG4 and subsequent prevalence (perhaps dominance) of this antibody subclass. Just so that you know, the typical relative percentages of the four subclasses of IgG in the blood are the following: 60-70% IgG1, 20-30% IgG2, 5-8% IgG3, 1-3% IgG4. So if IgG4 percentages are much higher than 1-3% in the blood, then something is out of the ordinary.

It may even manifest pathologically. To reiterate from my last Substack article, the authors found a 48,075% increase (from 0.04% – 19.27%) in spike-specific IgG4 antibodies in test subjects between the 2nd and 3rd injections of the Comirnaty product, so I suppose this would translate to a presence of IgG4 in the blood at levels higher than 1-3%. Probably closer to 20%? In any case, the shift in IgG subclass ratios is notable following the 2nd and 3rd injections. Before I dig into IgG4RD, I want to make something clear. The role of IgG4 as a ‘tolerizing antibody’ is inherently linked to T regulatory cells (Tregs) – the immune ‘tolerancers’: IgG4 is not directly responsible for tolerization. This means that IgG4 is not so much the tolerizer, as it is a medium for tolerization via Tregs.

I think calling it a tolerizing antibody is appropriate. I have provided background on Tregs in a previous Substack, but I will give a very quick summary here of their role in immunological tolerance – and also what immunological tolerance is! Immunological tolerance is the process of making sure that your immune system doesn’t turn on you. Imagine if you didn’t have a system in place to ensure that your immune cells only recognized foreign antigens as bag guys? Imagine what would happen, therefore, if your immune cells recognized your antigens as bad guys? Maybe… autoimmunity? An antigen (Ag) is a molecule that can bind to a specific antibody or T-cell receptor. Antigens can be proteins, peptides (amino acid chains), polysaccharides (chains of monosaccharides/simple sugars), lipids, or nucleic acids.

BBee woman

Spelling Bee Contestant Asks The Definition of “Woman” pic.twitter.com/gOgDj9Oxsg

— The Babylon Bee (@TheBabylonBee) December 28, 2022

Throwback to subprime. John Bird (smaller of the two Johns) died aged 86 yesterday.

Big art

Artist Guillaume Legros paints on grass and mostly on hill & mountain sides: he has to wait for sunny days, but when this happens, slopes become immense artworks. And his paint is safe for the environment

[read more: https://t.co/fEyq6d6Z6h]pic.twitter.com/jRjshD0EDY

— Massimo (@Rainmaker1973) December 28, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.