Unknown Drowned baby boy, Lesbos Oct 25 2015

At dawn Sunday: “five are women, two are children and four infants..” Four more deaths reported since… (Google translation)

• New Tragedy In The Aegean, Sinking 11 Dead (In.gr)

Without end continues the refugee drama in the Aegean Sea. This time 11 refugees died when the six meter plastic boat, which was carrying them sank while approaching rocky area in Samos Blue, in the six meters from the shore, just before they occupants disembark. From the dead five are women, two are children and four infants. Most of the dead were trapped in the cabin of plastic boat. The new wreck occurred at dawn Sunday. From the new wreck rescued 15 people. The point is boat of the Coast, volunteer groups and divers.

Deaths of single often go unreported: “The ultimate death toll is no doubt even higher, since only families with surviving members were able to report their missing to the coast guard..”

• ‘So Many Of Them Were Babies. We Saw At Least 30 Bodies In The Water’ (HRW)

On Wednesday off the Greek island of Lesbos, a large Turkish fishing boat carrying some 300 people trying to reach Europe sank, causing at least seven to drown, including four children, with at least 34 still missing. The needless loss of life should be enough to outrage us all. But just as outrageous is the reality that months into Europe’s refugee crisis, Europe’s leaders still have not taken the steps necessary to help prevent such unnecessary tragedies, let alone adopt policies that could provide people fleeing war and repression with legal and safe alternatives to seek asylum in Western Europe. Turkish smugglers taking advantage of those desperately fleeing the horrors of war in Syria, Afghanistan, and Iraq promised the victims that the trip aboard a “yacht” would be safer than the more common trips in overloaded rubber dinghies.

They then packed the 300 people like sardines on both decks of the aging fishing vessel. Disaster unfolded as the boat hit rough seas and high winds at about 4 in the afternoon. Suddenly, the sheer weight of those packed on the upper deck caused it to collapse, crashing everyone down onto the lower deck. Spanish volunteer life guards, working on the beaches of Lesbos to bring in the boats safely, watched the tragedy unfold through their binoculars from a beachhead on the Greek island. A Syrian man who survived told one of the doctors who treated the survivors that the collapse of the upper deck injured many people and created a large hole in the bottom of the boat, which began filling with water. The Turkish smuggler driving the boat called his fellow smugglers, and a speedboat came to evacuate him, its occupants firing several times in the air to warn off the panicking people on the boat.

As it evacuated the skipper, the speedboat hit the fishing boat, causing it to sink almost immediately. “Suddenly, we just saw hundreds of lifejackets in the sea,” Gerard, one of the Spanish volunteer lifeguards, told me over the phone. “We rushed down to get our jet skis, and we were in the water in minutes.” For more than four hours, until long after nightfall, three Spanish lifeguards tried to rescue as many of the people in the water as they could, using only their jetskis in the rough water many kilometers offshore. They performed CPR on some right on their jetskis. Several local fishing boats also came to join the rescue efforts, pulling survivors out of the water until their decks were packed with shivering, traumatized survivors.

Both the Greek coast guard and boats under the coordination of FRONTEX, the EU’s external borders agency, joined the effort as well, but their large boats sitting high out of the water made it difficult to hoist survivors unto their decks in the rough seas. The Spanish lifeguards had to risk their lives to scramble onto the Greek coast guard ship to perform CPR on those who had lost consciousness, including a tiny baby. Their jetskis were damaged in the process. Long after nightfall, the Spanish volunteers returned to shore, themselves so chilled to the bone that they were risking hypothermia. “We passed so many lifeless bodies floating in the sea as we left the rescue area,” Gerard said, his voice still shaking a day later.

“So many of them were babies. We saw at least 30 bodies at the scene in the water.” By Thursday, 242 people had been rescued, and the Greek coast guard confirmed that at least 34 people remained missing, in addition to the seven bodies recovered from the water the evening before. The ultimate death toll is no doubt even higher, since only families with surviving members were able to report their missing to the coast guard.

WIll Merkel pull to the right with her country?

• Crunch Talks For Merkel On Refugee Crisis As Thousands More Arrive (Reuters)

Nearly 10,000 refugees continued to arrive in Germany daily, police said on Saturday, highlighting the scale of the challenge facing the country’s stretched border staff ahead of a crunch meeting between Angela Merkel and a Bavarian ally on the crisis. Chancellor Merkel will discuss refugee policy on Saturday evening with Bavarian premier Horst Seehofer, head of the Christian Social Union (CSU) and who has criticized her asylum policy and handling of the crisis. The CSU, sister party to Merkel’s Christian Democratic Union (CDU), has been outspoken about her “open doors” policy towards refugees, in part because its home state of Bavaria is the entry point for virtually all of the migrants arriving in Germany.

Berlin expects between 800,000 and a million refugees and migrants to arrive in Germany this year, twice as many as in any prior year. The huge numbers have fueled anti-immigration sentiment, with support for Merkel’s conservatives dropping to its lowest level in more than three years. There have also been a spate of right-wing attacks on shelters: police in Dresden reported two more arson attacks on Friday night on a hotel and a container, both of which were planned to house refugees and asylum seekers. On Sunday, Merkel and Seehofer will hold talks with Sigmar Gabriel, who leads the other party in her “grand coalition”, the Social Democrats (SPD).

Conservative officials believe it is likely Seehofer will come away from this weekend’s meetings with Merkel with a deal to introduce so-called ‘transit zones’ at border crossings to process refugees’ asylum requests. SPD politicians have rejected that idea, instead calling for faster registration and processing of asylum applications. The crisis has also prompted squabbling among EU states over how best to deal with the influx. European leaders last weekend agreed to cooperate to manage migrants crossing the Balkans but offered no quick fix. German Defence Minister Ursula von der Leyen said Europe needed to work together to come up with a solution to the crisis but that Germany would continue to welcome refugees. “We will not slam the door in the face of the refugees,” she said at a security conference in Bahrain.

A lot less than was prviously announced.

• Greek Banks Need Extra €14 Billion To Survive Dire Economic Downturn (Guardian)

Greece’s four main banks need to find another €14bn of reserves to ensure they could withstand an economic downturn, the ECB said on Saturday. The four banks – Alpha Bank, Eurobank, NBG and Piraeus Bank – have until 6 November to say how they intend to make up that shortfall, the ECB said. The money could come from private investors or from EU bailout funds. An ECB stress test known as a “comprehensive assessment” identified a capital shortfall of €4.4bn under a best-case scenario and €14.4bn in a worst-case situation. The shortfall is smaller than originally feared, with the most recent bailout deal setting aside up to €25bn to prop up Greece’s banks.

The ECB audit examined the quality of the banks’ assets and considered the “specific recapitalisation needs” of each institution under Greece’s EU bailout. “Overall, the stress test identified a capital shortfall across the four participating banks of €4.4bn under the baseline scenario and €14.4bn under the adverse scenario,” the ECB said. “The four banks will have to submit capital plans explaining how they intend to cover their shortfalls by 6 November. This will start a recapitalisation process under the economic adjustment programme that must conclude before the end of the year.” Increasing the banks’ capital reserves would “improve the resilience of their balance sheets and their capacity to withstand potential adverse macroeconomic shock”, the central bank added.

In August, eurozone finance ministers released €26bn of the €86bn in bailout funds that went to recapitalising Greece’s stricken banking sector and make a debt payment to the ECB. Greek banks have already been bailed out under earlier deals for the country. They suffered further losses as Greece headed towards a third bailout earlier this year. Depositors pulled billions out of the country fearing that Greece would be forced to leave the euro. Limits on withdrawals and transfers imposed in June to prevent Greek banks from collapsing remain in place, although they have been loosened.

Now that’s a real ugly number. And austerity assures the number will get worse. What does that spell for Greek banks?

• Greek Bad Debt Rises Above 50% For The First Time, ECB Admits (Zero Hedge)

According to the FT, “the bill states that bank rescue fund HFSF will have full voting rights on any shares it acquires from banks in exchange for providing state aid. Under the bill the bank rescue fund will have a more active role, assessing bank managements.

The exact mix of shares and contingent convertible bonds the HFSF will buy from banks in exchange for any fresh funds it will provide will be decided by the cabinet. The capital hole has emerged chiefly due to the rising number of Greeks unable or unwilling to repay their debt.

And therein lies the rub, because in the span of three months, Greek NPLs have risen from 47.6% of total to 51%: an increase of just over 1% in bad debt every month. Which means that whether or not the latest attempt to boost confidence by the ECB, ESM, and the Greek parliament succeeds is moot. Yes, a few hedge funds may invest funds alongside the ESM, but in the end, as the NPLs keep rising and as long as Greek debtors refuse – or simply are unable – to pay their debt or interest, the next Greek crisis is inevitable. The biggest wildcard is whether or not the Greek population will accept this latest promise of stability in its banking sector at face value: a banking sector which since July is operating under draconian capital controls.

Granted, we should point out that in the past two months the deposit outflow from banks has stopped, and even reversed modestly adding about €900 million in deposits in the past two months, although that is mostly due to the inability of households and corporations to withdraw any sizable amount of funds. The real answer whether Greek banks have been “saved” will wait until the shape of the final bank recapitalization takes place, even as NPLs continue to mount. Remember: Greek lenders are currently kept afloat only by the ECB’s ELA but there is a rush to get the recapitalization finished. If it is not done by the end of the year, new EU rules mean large depositors such as companies may have to take a hit in their accounts.

If the proposed recap is insufficient – and it will be since under the surface the Greek economy continues to collapse and NPLs continue to mount – and a bank bail-in of depositors takes place (a bail-in which took place immediately in the case of Cyprus back in 2013 when Russian oligarch savings were “sacrificed” to bail out the local insolvent banking system), the next leg in the Greek bank crisis will promptly unveil itself, only this time Greece will have some 200% in debt/GDP to show for its most recent, third, bailout. Finally, the real question is: having read all of the above, dear Greek readers, will you hand over what little cash you have stuffed in your mattress to your friendly, neighborhood, soon to be recapitalized bank?

The entire western world get bogged down under this pressure.

• Cash Crisis ‘Could Close 50% Of UK Care Homes’ (Observer)

Ministers are under mounting pressure to pump more money into care for the elderly as investigations by the Observer reveal how some of the largest providers may have to pull out of supplying services because of an escalating financial crisis. Before chancellor George Osborne’s autumn statement on 25 November, Sarah Wollaston, the Conservative chair of the all-party Commons select committee on health, is calling for the government to act, saying that social care providers are reeling from rising costs and declining fees from cash-strapped local authorities. Meanwhile, the head of Care England, which represents independent care providers, claims that the care home sector is heading for a bigger crisis than the steel industry, while Chai Patel, the boss of one of Britain’s largest care home operators, HC-One, says half of Britain’s care homes could go bust.

The warnings come as residents in the 470 homes and specialist centres run by leading provider Four Seasons face uncertainty about the future of the company. Four Seasons has to make a £26m interest payment in December, but is losing money under the weight of £500m of debt. Four Seasons has insisted that it can make the payment, but bosses at rival companies warned that the industry was under unsustainable pressure. In the home care sector, where specialists look after the elderly in their own properties, the United Kingdom Homecare Association cautioned that leading providers could pull out of 55,125 care hours and 33 contracts because of the shortfall between the cost of care and the amount local authorities were paying for the service. Wollaston, a former GP, said she supported the new national living wage and moves to pay transport costs to carers, but added that the government had to recognise that both measures would increase the costs of care.

“There has been a longstanding gap in funding for social care and this will become much more severe if there is not adequate recognition of the rising costs the sector will face as a result of the living wage. Otherwise, we will see more care providers pulling out of the sector,” she said. Many problems result from the fact that local authorities, which have suffered funding cuts of more than 40% since 2010, cannot offer enough to make contracts attractive or, in many cases, viable. Many providers are turning to the private market as an alternative, where they can. Martin Green, the head of Care England, said the crisis would lead to more people ending up in hospitals and Patel, whose company runs 250 care homes, said he had given research to the government that showed that half of care homes could disappear.

So who’s going to pay, now and in 5 years, 10 years?

• Crisis In UK Care Homes Set To ‘Dwarf The Steel Industry’s Problems’ (Observer)

The ghost of Southern Cross hangs over Britain’s care home industry. Four years ago the country’s largest care home group collapsed, sparking months of uncertainty and worry for its 31,000 residents and their families, until Southern Cross’s rivals stepped forward to agree rescue deals for its 750 homes. Now, however, the industry could be rewarded by facing an even bigger crisis. While it was a set of circumstances unique to Southern Cross that laid it low in 2011 – particularly high rents for its properties and the costs of a debt mountain left by its private equity owners – today care homes across the country are feeling the squeeze. Four Seasons, which has more than 22,000 beds spread among 470 homes nationwide, is at forefront of the new crisis.

The company is owned by private equity group Terra Firma, the organisation led by financier Guy Hands that has, at various times, controlled companies as diverse as Méridien hotels, Odeon cinemas and record label EMI. It is losing millions of pound a year and struggling under £500m of debt. Four Seasons needs to make a £26m interest payment in December to satisfy creditors who could put it into administration. Terra Firma insists it will be able to make the payment, but the private equity group, trade unions, and local authorities all agree this is only the start of the problems for the care home industry. Justin Bowden, national officer at the GMB union, which represents thousands of care home employees, said: “You are looking potentially at several Southern Crosses in the next 12 months if something drastic is not done.”

Martin Green, chief executive of Care England, the body that represents independent care providers, warned that the crisis in the sector would dwarf the problems in the steel industry. “We are looking at Redcar happening twice a month if care homes go down,” he said. “These people can only be looked after in care homes and hospitals. If Jeremy Hunt thinks he has a problem with bed blocking now, it is nothing on what it is going to be like if these care homes start to close. Hospitals won’t be able to do elective care because they will be full of old people.” The problems for care homes are rooted in the gap between the costs of care and the amounts local authorities are paying for residents. There are staggering variations in fees across the country, ranging from £350 a week to as high as £750, according to consumer watchdog Which?

The Local Government Association itself estimates that there will be a £2.9bn annual funding gap in social care by the end of the decade. This gap will widen with the introduction of the national living wage next April, which will add another £1bn to the costs of care homes between now and 2020.

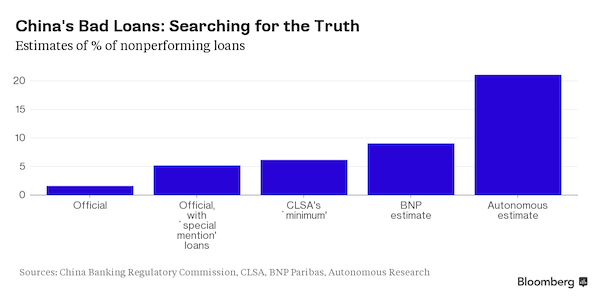

“China is confronting a massive debt problem, the scale of which the world has never seen.”

• China Bad Loans Estimated At 20% Or Higher vs Official 1.5% (Bloomberg)

Corporate investigator Violet Ho never put a lot of faith in the bad loan numbers reported by China’s banks. Crisscrossing provinces from Shandong to Xinjiang, she’s seen too much — from the shell game of moving assets between affiliated companies to disguise the true state of their finances to cover-ups by bankers loath to admit that loans they made won’t be recovered. “If I have one piece of advice for people worrying about the financial status of Chinese companies, it’s this: it’s right to be worried,” said Ho, senior managing director in Hong Kong for Kroll Inc., a U.S. risk consultancy. “Often a credit report for a Chinese company is not worth the paper it’s written on.”

As China’s banking industry persists with publishing delinquent-debt numbers that few have faith in – a survey in 2014 indicated that even lenders didn’t believe them – some financial analysts, too, have turned detectives to try to work out what the real numbers may be. The amount of bad debt piling up in China is at the center of a debate about whether the country will continue as a locomotive of global growth or sink into decades of stagnation like Japan after its credit bubble burst. Bank of China Ltd. reported on Thursday its biggest quarterly bad-loan provisions since going public in 2006. While the analysts interviewed for this story differ in their approaches to calculating likely levels of soured credit, their conclusion is the same: The official 1.5% bad-loan estimate is way too low.

Charlene Chu, who made her name at Fitch Ratings making bearish assessments of the risks from China’s credit explosion since 2008, is among those crunching the numbers. While corporate investigator Ho relies on her observations from hitting the road, Chu and her colleagues at Autonomous Research in Hong Kong take a top-down approach. They estimate how much money is being wasted after the nation began getting smaller and smaller economic returns on its credit from 2008. Their assessment is informed by data from economies such as Japan that have gone though similar debt explosions. While traditional bank loans are not Chu’s prime focus – she looks at the wider picture, including shadow banking – she says her work suggests that nonperforming loans may be at 20% to 21%, or even higher.

The Bank for International Settlements cautioned in September that China’s credit to gross domestic product ratio indicates an increasing risk of a banking crisis in coming years. “A financial crisis is by no means preordained, but if losses don’t manifest in financial sector losses, they will do so via slowing growth and deflation, as they did in Japan,” said Chu. “China is confronting a massive debt problem, the scale of which the world has never seen.”

But there’s still plenty voices willing to paint rosy picstures.

• China’s Official Factory Gauge Signals Contraction Continues (Bloomberg)

China’s first key indicator this quarter, an official factory gauge, missed analysts’ estimates, signaling that the manufacturing sector has yet to bottom out as global demand falters and deflationary pressures deepen. The official purchasing managers index was unchanged at 49.8 in October, the National Bureau of Statistics said Sunday, compared with the median estimate of 50 in a Bloomberg survey. It was the third straight reading below 50, the line between expansion and contraction. The official non-manufacturing PMI, a barometer of services and construction, fell to 53.1 from 53.4 in September, the weakest since December 2008. “The manufacturing sector is still contracting, though stabilizing,” and the report indicates economic momentum remains sluggish, said Liu Ligang at Australia & New Zealand Banking Group.

“We still believe the Chinese economy will experience modest rebound supported by faster infrastructure investment in November and December.” The newest data highlight the challenges confronting China’s old growth drivers. The nation’s leaders have reiterated priorities of both reforming the economy and maintaining medium- to high-speed growth in the next five years, according to a communique released by Xinhua News Agency on Thursday. The readings suggest continued monetary easing by the central bank hasn’t yet boosted smaller businesses as much as their larger, state-owned counterparts, which are able to borrow at reduced rates. “Big companies are stabilizing, while smaller ones continue to perform below the contraction-expansion line,” Zhao Qinghe, a senior statistician at NBS, wrote in a statement interpreting the data on Sunday.

“The percentage of small companies facing a financial strain is considerably higher than that of bigger companies.” The unchanged manufacturing PMI suggests “managed stabilization” as policy makers strive to balance growth, reform, and market stability, according to Zhou Hao at Commerzbank in Singapore. The manufacturing sector stabilized “somewhat” due to monetary policy easing, Zhou said, while slowing power generation, steel production and housing sales are “suggesting that the overall economy is still under downward pressure.” The employment gauges of both manufacturing and non-manufacturing sectors remained mired in contraction zone, Sunday’s report showed. China’s survey-based unemployment rate picked up slightly to around 5.2% in September, while a ratio of job supply and demand rose in the third quarter.

Stop confusing inflation with rising prices, and things get a lot clearer.

• ‘Lipstick’-ing The GDP Pig Amid An Epochal Global Deflationary Swoon (Stockman)

The talking heads were busy yesterday morning powdering the GDP pig. By averaging up the “disappointing” 1.5% gain for Q3 with the previous quarter they were able to pronounce that the economy is moving forward at an “encouraging” 2% clip. And once we get through this quarter’s big negative inventory adjustment, they insisted, we will be off to the ‘escape velocity’ races. Again. No we won’t! The global economy is in an epochal deflationary swoon and the US economy has already hit stall speed. It is only a matter of months before this long-in-the-tooth 75-month old business expansion will rollover into outright liquidation of excess inventories and hoarded labor. That is otherwise known as a recession.

Its arrival will be a thundering repudiation of the lunatic monetary policies of the last seven years; and it will send into panicked shock all those buy-the-dip speculators and robo-traders who still presume the central bank is omnipotent. So forget all the averaging and seasonally maladjusted noise in yesterday’s report and peak inside at the warning signs. To begin, the year/year gain of just 2.0% was the weakest result since the first quarter of 2014. And that’s only if you believe that inflation during the last 12 months was just 0.9%, as per the GDP deflator used by the Commerce Department statistical mills. Needless to say, there are about 90 million households in America below the top 20%, which more or less live paycheck to paycheck, that would argue quite vehemently that their cost of living including medical care, housing, education, groceries, utilities and much else – has gone up a lot more than 0.9%.

So put a reasonable “deflator” on the reported “real” GDP number, and you are getting pretty close to stall speed – even before you look inside at the internals. Indeed, even before you get to the components of the “deflated” GDP figure, you need to examine an even more important number contained in yesterday’s report that was not mentioned by a single talking head. To wit, the year/year gain in nominal GDP was only 2.9%, and it represented a continuing deceleration from 3.7% in the year ending in Q2 2015 and 3.9% in the years ending in Q1 2015 and Q4 2014, respectively. In short, the US economy is sitting there with $59 trillion of credit market debt outstanding, but owing to the tides of worldwide deflation now washing up on these shores, nominal GDP growth is sinking toward the flat line.

QE accelerates deflation.

• Fed Admits: ‘Something’s Going On Here That We Maybe Don’t Understand’ (ZH)

In a somewhat shocking admission of its own un-omnipotence, or perhaps more of a C.Y.A. moment for the inevitable mean-reversion to reality, Reuters reports that San Francisco Fed President John Williams said Friday that low neutral interest rates are a warning sign of possible changes in the U.S. economy that the central bank does not fully understand. With Japan having been there for decades, and the rest of the developed world there for 6 years… Suddenly, just weeks away from what The Fed would like the market to believe is the first rate hike in almost a decade, Williams decides now it is the time to admit the central planners might be missing a factor (and carefully demands better fiscal policy)… (as Reuters reports)

“I see this as more of a warning, a red flag that there’s something going on here that isn’t in the models, that we maybe don’t understand as well as we think, and we should dig down deep deeper and try to figure this out better,” said San Francisco Federal Reserve President John Williams on Friday pointing out that low neutral interest rates are a warning sign of possible changes in the U.S. economy that the central bank does not fully understand.

Williams, who is a voting member of the Fed’s policy-setting panel through the end of the year, has said the central bank should begin to raise interest rates soon but thereafter go at a gradual pace; ironically adding that the low neutral interest rate had “pretty significant” implications for monetary policy, and put more focus on fiscal policy as a response.

“If we could come up with better fiscal policy, find a way to have the economy grow faster or have a stronger natural rate of interest, then that takes the pressure off of us to try to come up with other ways to do it, like through a large balance sheet or having a higher inflation target,” Williams said. “It also means we don’t have to turn to quantitative easing and other policies as much.”

As long as the investors are not the big banks?!

• Fed Looks At Way To Shift Big-Bank Losses To Investors (AP)

In their latest bid to reduce the chances of future taxpayer bailouts, federal regulators are proposing that the eight biggest U.S. banks build new cushions against losses that would shift the burden to investors. The Federal Reserve’s proposal put forward Friday means the mega-banks would have to bulk up their capacity to absorb financial shocks by issuing equity or long-term debt equal to prescribed portions of total bank assets. The idea is that the cost of a huge bank’s failure would fall on investors in the bank’s equity or debt, not on taxpayers. The Fed governors led by Chair Janet Yellen voted 5-0 at a public meeting to propose the so-called “loss-absorbing capacity” requirements for the banks, which include JPMorgan Chase, Citigroup and Bank of America.

The eight banks would have to issue a total of about $120 billion in new long-term debt to meet the requirements of the proposal, the Fed staff estimates. If formally adopted, most of the requirements wouldn’t take effect until 2019, and the remainder not until 2022. The new cushions would come atop rules adopted by the Fed in July for the eight banks to shore up their financial bases with about $200 billion in additional capital — over and above capital requirements for the industry. And they would be in addition to 2014 rules directing all large U.S. banks to keep enough high-quality assets on hand to survive during a severe downturn. Combined with the regulators’ previous actions, the new proposal “would substantially reduce the risk to taxpayers and the threat to financial stability stemming from the failure of these (banks),” Yellen said at the start of the meeting.

Problem is: Australia would need to address its own role.

• Australia Should ‘Tell The Story Of The Pacific To The World’ (Guardian)

Australia should “tell the story of the Pacific to the world” when global leaders sit down to climate change talks in Paris at the end of this month, Labor has said. The impact of climate change on the nations of the Pacific is a focus for both the government and opposition ahead of COP21, where governments of more than 190 nations will gather to discuss a possible new global climate accord. The opposition leader, Bill Shorten, accompanied by foreign affairs spokeswoman Tanya Plibersek and immigration spokesman Richard Marles, will visit Papua New Guinea, the Marshall Islands, and Kiribati over four days this week, while the government’s minister for international development and the Pacific, Steve Ciobo, will travel to New Caledonia, Fiji and Niue. The Labor leaders said climate change was an existential threat to some countries in the region.

“The dangerous consequences of climate change is no more evident than in the Pacific region. Pacific leaders have consistently identified climate change as the greatest threat to their livelihoods, food production, housing, security and wellbeing. “This is a serious problem that demands serious attention.” Marles, the former parliamentary secretary for Pacific island affairs, told Guardian Australia that it was important for Australia to have strong and constructive relations with its Pacific neighbours. He praised Pacific leaders, in particular Kiribati’s president, Anote Tong, for highlighting the issues being faced by Pacific nations on the international stage. “It is crucial that, in the lead-up to Paris, the world understands the problems being faced by the Pacific. And it’s important that Australia plays a role in telling that story of the Pacific to the world.”

Home › Forums › Debt Rattle November 1 2015