Earl Theisen Walt Disney oiling scale model locomotive at home in LA 1951

Watch out below.

• After a Tumultuous 2015, Investors Have Low Expectations for Markets (WSJ)

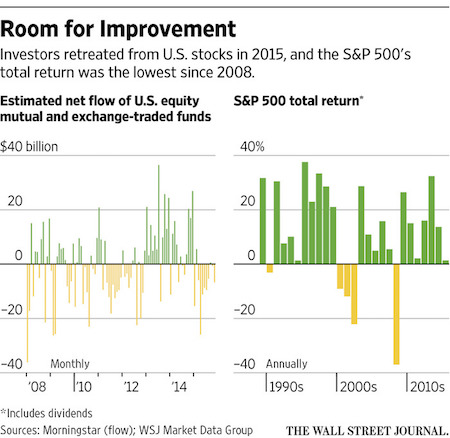

After a year of disappointment in everything from U.S. stocks to emerging markets and junk bonds, investors are approaching 2016 with low expectations. Some see the past year as a bad omen. Two major stock indexes posted their first annual decline since the financial crisis, while energy prices fell even further. Emerging markets and junk bonds also struggled. Others view the pullback as a sensible breather for some markets after years of strong gains. While large gains were common as markets recovered in the years after the 2008 financial crisis, many investors say such returns are growing harder to come by, and expect slim gains at best this year.

“You have to be very muted in your expectations,” said Margie Patel, senior portfolio manager at Wells Fargo Funds who said she expects mid-single percentage-point gains in major U.S. stock indexes this year. “It’s pretty hard to point to a sector or an industry where you could say, well, that’s going to grow very, very rapidly,” she said, adding that there are “not a lot of things to get enthusiastic about, and a long list of things to be worried about.” As the year neared an end, a fierce selloff hit junk bonds in December, while U.S. government bond yields rose only modestly despite the Federal Reserve’s decision to raise its benchmark interest rate in December, showing investors weren’t ready to retreat from relatively safe government bonds.

For the U.S., 2015’s rough results stood in contrast to three stellar years. After rising 46% from 2012 through 2014, the Dow Jones Industrial Average fell 2.2% last year. The S&P 500 fell 0.7%. While most Wall Street equity strategists still expect gains for U.S. stocks this year, they also once again expect higher levels of volatility than in years past. Of 16 investment banks that issued forecasts for this year, two-thirds expect the S&P 500 to finish 2016 at a level less than 10% above last year’s close, according to stock-market research firm Birinyi Associates. Some investors say a pause for stocks is normal for a bull market of this length, which has been the longest since the 1990s. Including dividends, the S&P 500 has returned 249% since its crisis-era low of 2009.

How could they? On what? “This recovery still stinks.”

• Will Corporate Investment and Profits Rebound This Year? (WSJ)

In 2015, the American corporate landscape was dominated by activist investors, buybacks, currencies and deals. This year, the question is whether U.S. businesses will shake off the weight of a strong dollar and lower commodity prices to expand profit growth, end their dependence on boosting returns with buybacks, and turn to investing in their operations. The Federal Reserve had enough confidence in the economic recovery to raise interest rates in December, but it remains unclear whether global growth will be buoyant enough reverse weak business investment. Many big companies are reining in spending. 3M, with thousands of products from Scotch tape to smartphone materials, forecasts capital spending roughly unchanged from 2015.

Telecom companies AT&T and Verizon both plan to hold capital spending generally level in the coming year. Meanwhile, industrial giants like General Electric and United Technologies are aggressively cutting costs and seeking to squeeze more savings from suppliers. Capital expenditures by members of the S&P 500 index fell in the second and third quarters of 2015 from a year earlier, the first time since 2010 that the measure has fallen for two consecutive quarters, according to data from S&P Dow Jones Indices. Another measure of business spending on new equipment—orders for nondefense capital goods, excluding aircraft—was down 3.6% from a year earlier in the first 11 months of 2015, according to data from the U.S. Department of Commerce.

More broadly, only 25% of small companies plan capital outlays in the next three to six months, according to a November survey of about 600 firms by the National Federation of Independent Business. That compares with an average of 29% and a high of 41% since the surveys began in 1974. “Our guys are in maintenance mode,” said William Dunkelberg, chief economist for the trade group. “This recovery still stinks.” Profit growth for the constituents of the S&P 500 index stalled in 2015 thanks to a combination of a strong dollar and falling prices for steel, crude oil and other commodities. Deutsche Bank estimates total net income for companies in the index fell 3% in 2015, while sales declined 4%. For 2016, Deutsche Bank forecasts net income growth of 4.3% and a 4% increase in revenue.

Given the reliance on dollar-denominated low interest loans, it seems all but certain.

• A Year of Sovereign Defaults? (Carmen Reinhart)

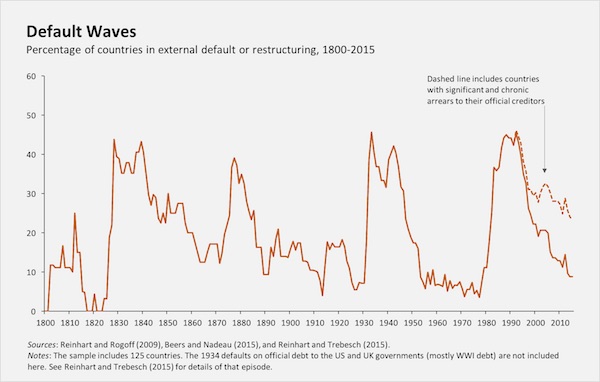

When it comes to sovereign debt, the term “default” is often misunderstood. It almost never entails the complete and permanent repudiation of the entire stock of debt; indeed, even some Czarist-era Russian bonds were eventually (if only partly) repaid after the 1917 revolution. Rather, non-payment – a “default,” according to credit-rating agencies, when it involves private creditors – typically spurs a conversation about debt restructuring, which can involve maturity extensions, coupon-payment cuts, grace periods, or face-value reductions (so-called “haircuts”). If history is a guide, such conversations may be happening a lot in 2016. Like so many other features of the global economy, debt accumulation and default tends to occur in cycles.

Since 1800, the global economy has endured several such cycles, with the share of independent countries undergoing restructuring during any given year oscillating between zero and 50% (see figure). Whereas one- and two-decade lulls in defaults are not uncommon, each quiet spell has invariably been followed by a new wave of defaults. The most recent default cycle includes the emerging-market debt crises of the 1980s and 1990s. Most countries resolved their external-debt problems by the mid-1990s, but a substantial share of countries in the lowest-income group remain in chronic arrears with their official creditors. Like outright default or the restructuring of debts to official creditors, such arrears are often swept under the rug, possibly because they tend to involve low-income debtors and relatively small dollar amounts.

But that does not negate their eventual capacity to help spur a new round of crises, when sovereigns who never quite got a handle on their debts are, say, met with unfavorable global conditions. And, indeed, global economic conditions – such as commodity-price fluctuations and changes in interest rates by major economic powers such as the United States or China – play a major role in precipitating sovereign-debt crises. As my recent work with Vincent Reinhart and Christoph Trebesch reveals, peaks and troughs in the international capital-flow cycle are especially dangerous, with defaults proliferating at the end of a capital-inflow bonanza.

Big call from Dave.

• The Next Big Short: Amazon (Stockman)

If you have forgotten your Gulliver’s Travels, recall that Jonathan Swift described the people of Brobdingnag as being as tall as church steeples and having a ten foot stride. Everything else was in proportion – with rats the size of mastiffs and the latter the size of four elephants, while flies were “as big as a Dunstable lark” and wasps were the size of partridges. Hence the word for this fictional land has come to mean colossal, enormous, gigantic, huge, immense or, as the urban dictionary puts it, “really f*cking big”. That would also describe the $325 billion bubble which comprises Amazon’s market cap. It is at once brobdangnagian and preposterous – a trick on the casino signifying that the crowd has once again gone stark raving mad.

When you have arrived at a condition of extreme “irrational exuberance” there is probably no insult to ordinary valuation metrics that can shock. But for want of doubt consider that AMZN earned the grand sum of $79 million last quarter and $328 million for the LTM period ending in September. That’s right. Its conventional PE multiple is 985X! And, no, its not a biotech start-up in phase 3 FDA trials with a sure fire cancer cure set to be approved any day; its actually been around more than a quarter century, putting it in the oldest quartile of businesses in the US. But according to the loony posse of sell-side apologists who cover the company – there are 15 buy recommendations – Amazon is still furiously investing in “growth” after all of these years.

So never mind the PE multiple; earnings are being temporarily sacrificed for growth. Well, yes. On its approximate $100 billion in LTM sales Amazon did generate $32.6 billion of gross profit. But the great builder behind the curtain in Seattle choose to “reinvest” $5 billion in sales and marketing, $14 billion in general and administrative expense and $11.6 billion in R&D. So there wasn’t much left for the bottom line, and not surprisingly. Amazon’s huge R&D expense alone was actually nearly three times higher than that of pharmaceutical giant Bristol-Myers Squibb. But apparently that’s why Bezos boldly bags the big valuation multiples.

Not so fast, we think. Is there any evidence that all this madcap “investment” in the upper lines of the P&L for all these years is showing signs of momentum in cash generation? After all, sooner or later valuation has to be about free cash flow, even if you set aside GAAP accounting income. In fact, AMZN generated $9.8 billion in operating cash flow during its most recent LTM period and spent $7.0 billion on CapEx and other investments. So its modest $2.8 billion of free cash flow implies a multiple of 117X.

“Zero interest rates turn monetary policy into a massive weapon that has no ammunition.”

• The Real Financial Risks of 2016 (Taleb)

How should we think about financial risks in 2016? First, worry less about the banking system. Financial institutions today are less fragile than they were a few years ago. This isn’t because they got better at understanding risk (they didn’t) but because, since 2009, banks have been shedding their exposures to extreme events. Hedge funds, which are much more adept at risk-taking, now function as reinsurers of sorts. Because hedge-fund owners have skin in the game, they are less prone to hiding risks than are bankers. This isn’t to say that the financial system has healed: Monetary policy made itself ineffective with low interest rates, which were seen as a cure rather than a transitory painkiller. Zero interest rates turn monetary policy into a massive weapon that has no ammunition.

There’s no evidence that “zero” interest rates are better than, say, 2% or 3%, as the Federal Reserve may be realizing. I worry about asset values that have swelled in response to easy money. Low interest rates invite speculation in assets such as junk bonds, real estate and emerging market securities. The effect of tightening in 1994 was disproportionately felt with Italian, Mexican and Thai securities. The rule is: Investments with micro-Ponzi attributes (i.e., a need to borrow to repay) will be hit. Though “another Lehman Brothers” isn’t likely to happen with banks, it is very likely to happen with commodity firms and countries that depend directly or indirectly on commodity prices.

Dubai is more threatened by oil prices than Islamic State. Commodity people have been shouting, “We’ve hit bottom,” which leads me to believe that they still have inventory to liquidate. Long-term agricultural commodity prices might be threatened by improvement in the storage of solar energy, which could prompt some governments to cancel ethanol programs as a mandatory use of land for “clean” energy.

Yield rises with risk. Risk leads to losses.

• High-Yield Bonds: Worthy of the Name Again (WSJ)

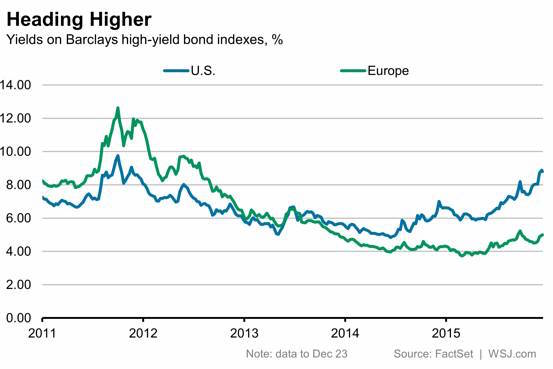

By mid-2014, some were starting to wonder whether the high-yield bond market needed to find a new name for itself. U.S. yields fell below 5%, while European yields dipped beneath 4%, according to Barclays indexes. But at the end of 2015, the market once again has an appropriate moniker. U.S. yields are ending the year at 8.8%, the Barclays index shows, returning to levels last seen in 2011. They have risen by about 2.3 percentage points this year. European yields stand at 5% — not huge in absolute terms, but high relative to ultralow European government bond yields. Of course, for existing investors that has been bad news. The ride—including the high-profile meltdown of Third Avenue Management’s Focused Credit Fund, which shook the market in December—has been rough.

It has taken its toll on borrowers too. The U.S. high-yield bond market has recorded the slowest pace of fourth-quarter issuance since 2008, when the collapse of Lehman Brothers essentially shut the market down, according to data firm Dealogic. Global issuance has fallen 23% this year to $366.5 billion, the lowest level since 2011. The market is likely to face further tests in 2016. Defaults are set to rise, and companies may find it tougher to get financing. But at least investors will now get chunkier rewards for taking risk. Arguably, high-yield investors should always be focused on absolute rather than relative yields, given the need to compensate for defaults. From that point of view, 2015 was the year high-yield bonds got their mojo back.

China will find it much harder to keep up appearances in 2016.

• Slowdown In Chinese Manufacturing Deepens Fears For Economy (Guardian)

A further slowdown in China’s vast manufacturing sector has intensified worries about the year ahead for the world’s second largest economy. The latest in a string of downbeat reports from showed that activity at China’s factories cooled in December for the fifth month running, as overseas demand for Chinese goods continued to fall. Against the backdrop of a faltering global economy, turmoil in the country’s stock markets and overcapacity in factories, Chinese economic growth has slowed markedly. The country’s central bank expects growth in 2015 to be the slowest for a quarter of a century. After growing 7.3% in 2014, the economy is thought to have expanded by 6.9% in 2015 and the central bank has forecast that it may slow further in 2016 to 6.8%.

A series of interventions by policymakers, including interest rate cuts, have done little to revive growth and in some cases served only to heighten concern about China’s challenges. Friday’s figures showed that the manufacturing sector limped to the end of 2015. The official purchasing managers’ index (PMI) of manufacturing activity edged up to 49.7 in December from 49.6 in November. The December reading matched the forecast in a Reuters poll of economists and marked the fifth consecutive month that the index was below 50, the point that separates expansion from contraction. “Although the PMI slightly rebounded this month, it still lies below the critical point and is lower than historic levels over the same period,” Zhao Qinghe, a senior statistician at the national bureau of statistics, said.

Analysts said the latest manufacturing PMI pointed to falling activity, but that some hope could be taken from the improvement on November’s three-year low. The small rise “suggests that growth momentum is stabilising somewhat … however, the sector is still facing strong headwinds,” said Zhou Hao at Commerzbank. “In order to facilitate the destocking and deleveraging process, monetary policy will remain accommodative and the fiscal policy will be more proactive.”

Can China let go of the peg and let the yaun plunge, while it’s in the IMF basket?

• Opinion Divided On State Of Chinese Economy, But Not Its Importance (Guardian)

It was perhaps fitting that China’s latest lacklustre industrial survey was the first fragment of financial data to greet the new year. Economists are divided about the risks facing the vast Chinese economy, but agree that how they play out will have profound consequences for the rest of the world in 2016. The optimists point to China’s large and growing middle class, the vast foreign currency reserves that give Beijing ample ammunition to respond to any crisis that emerges, and the authoritarian regime that allows its policymakers to force through economic change. And official figures do suggest that economic growth may have stabilised at about 6.5% – considerably weaker than the double-digit pace that was the norm before the financial crisis, but not the feared “hard landing”.

Yet pessimists argue that the official figures radically overestimate the true pace of growth: using alternative indicators such as freight volumes and electricity usage, City analysts Fathom calculate that growth could be below 3%. And last summer’s share price crash, and the chaos that surrounded Beijing’s decision to devalue the yuan, suggested there is no reason to think Chinese policymakers are any more in control of the forces of capitalism than their western counterparts were in the run-up to the financial crisis. China’s latest five-year plan involves a conscious attempt to switch growth away from the export-led model that has driven its rise to the economic premier league, and towards more sustainable, domestic consumption-led growth.

But with many of the country’s powerful state-owned enterprises loaded up with debt, property bubbles deflating and the knock-on effects of the share price crash still being felt, domestic demand has so far failed to pick up the slack. The challenge of maintaining politically acceptable rates of economic growth may become tougher in 2016, particularly if the US Federal Reserve presses ahead with its bid to return interest rates to somewhere near normal. The value of the Chinese yuan is not allowed to move too far out of line with the dollar, under a “crawling peg” – effectively a semi-fixed exchange rate.

But as the greenback moves upwards to reflect the strengthening US economy and rising rates, it is taking the yuan with it, and making it harder for Chinese exporters to compete. As the dollar continues to appreciate, it may become increasingly tempting for policymakers to abandon the peg and let the currency plunge, returning to the familiar export-led pattern of growth. And if Beijing does devalue sharply, it would damage China’s exporting rivals, and send deflation rippling out through the global economy, increasing the risk of a lengthy period of economic weakness. China’s true fragility is impossible to gauge; but it matters.

Not a good sign for gold.

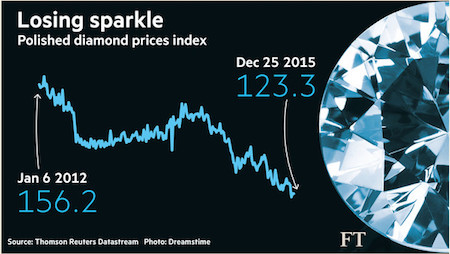

• ‘Indigestion’ Hits Diamond Companies: Too Much Supply, Too Little Demand (FT)

De Beers was hoping its “Live your love today” campaign would entice Chinese consumers to buy diamond jewellery this holiday season. It is unlikely to be enough to turn round the miner’s fortunes. While auction prices set records for some big gems in 2015 — Lucara Diamond found one of the largest stones to date — the sector has had its toughest year since the global financial crisis as it struggles with too much supply and too little demand. Miners including De Beers, which is owned by Anglo American, and Canada’s Dominion Diamond have acknowledged falling revenues and lower prices for rough diamonds. In China, the big jewellers are suffering. Chow Tai Fook, the largest by market value, reported a 42% fall in net profits in interim results.

But the pain has been most acute for the trade’s “midstream”, the hundreds of cutters and polishers, mostly in India, which buy rough stones from miners and supply retailers. “The raw [rough] diamond price is still high but the polishers [like us] have to sell cheaper because of the drop in demand,” said Chirag Kakadia of Sheetal, an Indian diamond polisher, speaking at a Hong Kong trade show. “We are forced to purchase higher but sell lower. Our production has dropped 40% from 2014 but our sales are 50% less.” Companies such as Sheetal have been hit by a bout of what Johan Dippenaar, chief executive of Petra Diamonds, has described as industry “indigestion”, stemming from an over-optimistic assessment of demand from China.

Retailers that had geared up for years of growth were caught out by a slowing economy and an anti-corruption drive, with officials banned from receiving gifts. A person in the industry who asked not to be named said demand in Hong Kong and Macau had been “absolutely mullered” by the corruption crackdown. The lack of interest from consumers has left cutters and polishers holding too much stock. In turn, their need to buy from miners has declined, forcing down rough prices. Analysts said that, even if midstream groups wanted to restock, many would find it hard to do so. Much of the credit in the sector has been withdrawn as banks have grown wary of lending to businesses that are family-owned and tend to be opaque. The question is whether the market will bounce back or be altered for good.

De Beers, which has lost much of its power as a supplier but remains a dominant participant, says the industry does not face a long-term bust and once the temporary oversupply is dealt with equilibrium will be restored. Philippe Mellier, chief executive, told industry analysts in December: “This is a stock crisis, not a demand crisis.” De Beers has allowed midstream companies to put regular purchases on hold. “We just want our customers to buy what they need and not increase the stock problem,” said Mr Mellier. The miner has also cut production and closed two diamond mines. Consultants at Bain say the diamond pipeline should return to normal functioning once midmarket businesses and retailers clear excess inventories, provided that miners and polishers manage supplies adroitly.

And now Iran will follow.

• Iraq Says It Exported More Than 1 Billion Barrels of Oil in 2015 (BBG)

Iraq said it exported 1.097 billion barrels of oil in 2015, generating $49.079 billion from sales, according to the oil ministry. It sold 99.7 million barrels of oil in December, generating $2.973 billion, after selling a record 100.9 million barrels in November, said oil ministry spokesman Asim Jihad. The country sold at an average price of $44.74 a barrel in 2015, Jihad said. Iraq, with the world’s fifth-biggest oil reserves, needs to keep increasing crude output because lower oil prices have curbed government revenue. Oil prices have slumped in the past year as OPEC defended market share against production in the U.S. OPEC’s second-largest crude producer is facing a slowdown in investment due to lower oil prices while fighting a costly war on Islamist militants who seized a swath of the country’s northwest. The nation’s output will start to decline in 2018, Morgan Stanley said in a Sept. 2 report, reversing its forecast for higher production every year to 2020.

The real rate rise is still substantially lower than 0.25%, though.

• The Federal Reserve’s Brave New Interest Rate World (Coppola)

On December 17th, 2015, the FOMC raised interest rates for the first time since the 2008 financial crisis. To be sure, it had little choice. The Fed had been signalling an interest rate rise persistently for months, and had already disappointed markets twice by delaying rate rises in September and October. It had painted itself into the same corner as the ECB did over QE earlier in the year. The ECB signalled for months that it was going to start QE, and backed off several times, to the disappointment of market participants. Eventually, ECB was forced to start QE for the simple reason that NOT doing so threatened financial stability, because markets had already priced it in. So with the FOMC. Encouraged by broadly good economic data, and by the Fed’s approving noises, markets priced in a 25bps interest rate rise.

The FOMC was all but obliged to act, simply to avoid sparking a market rout. It was yet another fine example of markets being willing to let the Fed guide them along the road that they were already travelling. Since that small but oh-so-significant rate rise, the Fed Funds rate has obediently remained firmly within its new 25 to 50 bps corridor. Indeed, it has hovered persistently around the midpoint of the range. Given that the system is still awash with excess reserves and the Fed Funds rate therefore has little effect on bank lending, it is remarkable that the rate has stayed both elevated and stable. How has this been achieved? Yesterday, the FT reported that the Fed absorbed $475bn of excess reserves through overnight reverse repo operations in its last monetary operation of 2015, a record amount.

Overnight reverse repos allow certain non-bank financial institutions to place funds at the Fed overnight in return for USTs (yes, the ones bought in the Fed’s QE programs) and 25bps interest. The interest rate is no accident: it is the floor of the target Fed Funds rate range. These reverse repos provide competition for banks in the funding markets, forcing banks to offer higher interest rates on funds they lend to non-banks. The Fed said in December that it would make $2tn worth of USTs available as collateral for reverse repo transactions: it is actually needing to use considerably less to maintain the Fed Funds rate well above its floor. But reverse repos are only half the story. The Fed also set the interest rate it pays on excess reserves (IOER) to the top of the Fed Funds target range. This pulls the funding rate upwards, since banks will not lend reserves to each other at less than the IOER rate.

Ambroze has been smoking. A lot. The sudden surge in China M1 in the graph looks like panic to me, and moreover, it hasn’t done any good either.

• Economic Sweet Spot Of 2016 Before The Reflation Storm (AEP)

Sunlit uplands beckon. Almost $2 trillion of annual stimulus from cheap oil has been accumulating for months, pent up and waiting to be spent. It will soon come flooding through in a burst, catching the world by surprise. But beware: the more beguiling it is over coming months, the more traumatic it will be later as the reflation scare comes alive. Since the rite of New Year predictions is to stick one’s neck out, let me hazard hopefully that this treacherous moment can be deferred until 2017. The positive oil shock will hit just as austerity ends in the US, and big-spending states and cities ice the cake with a fiscal boost worth 0.5pc of GDP. Americans broke records with the purchase 1.7m new cars and trucks in December, a foretaste of blistering sales to come. There is a ‘deficit’ of 20m cars left from the Long Slump yet to be plugged.

The eurozone is nearing the sweet spot, a fleeting nirvana of 2pc growth, conjured by the trifecta of a cheap euro, budgetary break-out, and the end of bank deleveraging. Mario Draghi’s printing presses are firing on all cylinders. The ‘broad’ M3 money supply is growing at turbo-charged rates of 5pc in real terms. This is a 12-month leading indicator for the economy, so enjoy the ride, at least until the demonic Fiscal Compact returns at the dead of night to smother Europe once again. In China, the dogs bark, the caravan moves on. There will be no devaluation of the yuan this year, because there is no urgent need for it. Premier Li Keqiang has vowed to keep the new exchange basket stable. Armed with a current account surplus of $600bn, $3.5 trillion of reserves, and capitol controls, that is exactly what he will do.

The lingering hangover from the Great Chinese Recession of early 2015 has faded. The PMI services gauge has just jumped to a 15-month high of 54.4, and this is now the relevant index since the Communist Party is systematically winding down chunks of the steel, shipbuilding, and chemical industries. China’s money supply is also catching fire. Growth of ‘real true M1’ has spiked to 10pc, a giddy shot of caffeine not seen since the post-Lehman spree. Combined credit and local government bond issuance is surging at a rate of 14pc. The Communist Party cranked up fiscal spending by 18.9pc in November. Whether or not you think this recidivist stimulus is wise – given that the law of diminishing returns set in long ago for debt-driven growth – it will paper over a lot of cracks for the time being.

One thing that will not happen is a housing revival in the mid-sized T3 and T4 cities of the hinterland. It will be a long time before the latest reform of the medieval Hukou system unleashes enough rural migrants to fill the ghost towns. The stock of 4.5m unsold homes on the books of developers is frightening to behold. The epic dollar rally has come and gone. The world’s currency will drift down over coming months, and that will be a reprieve for the likes of Brazil, Turkey, South Africa, Indonesia, and Colombia. Those at the wrong end of $9 trillion of off-shore debt in US dollars may breath easier: they will not escape. The MSCI index of emerging market stocks will return from the dead, clawing back most of the 28pc in losses since last April, but only to lurch into a greater storm.

Barely a start. But a strong sign of how much less ‘new’ jobs pay.

• New Year Brings Minimum Wage Hikes For Americans In 14 States (Reuters)

As the United States marks more than six years without an increase in the federal minimum wage of $7.25 an hour, 14 states and several cities are moving forward with their own increases, with most set to start taking effect on Friday. California and Massachusetts are highest among the states, both increasing from $9 to $10 an hour, according to an analysis by the National Conference of State Legislatures. At the low end is Arkansas, where the minimum wage is increasing from $7.50 to $8. The smallest increase, a nickel, comes in South Dakota, where the hourly minimum is now $8.55.

The increases come in the wake of a series of “living wage” protests across the country, including a November campaign in which thousands of protesters in 270 cities marched in support of a $15-an-hour minimum wage and union rights for fast food workers. Food service workers make up the largest group of minimum-wage earners, according to the Bureau of Labor Statistics. With Friday’s increases, the new average minimum wage across the 14 affected states rises from $8.50 an hour to just over $9. Several cities are going even higher. Seattle is setting a sliding hourly minimum between $10.50 and $13 on Jan. 1, and Los Angeles and San Francisco are enacting similar increases in July, en route to $15 an hour phased in over six years.

Backers say a higher minimum wage helps combat poverty, but opponents worry about the potential impact on employment and company profits. In 2014, a Democratic-backed congressional proposal to increase the federal minimum wage for the first time since 2009 to $10.10 stalled, as have subsequent efforts by President Barack Obama. More recent proposals by some lawmakers call for a federal minimum wage of up to $15 an hour. Alan Krueger, an economics professor at Princeton University and former chairman of Obama’s Council of Economic Advisers, said a federal minimum wage of up to $12 an hour, phased in over five years or so, “would not have a noticeable effect on employment.”

Many such banks did the same.

• Swiss Bank Admits Cash and Gold Withdrawals Cheated IRS (BBG)

Large cash and gold withdrawals were one way Bank Lombard Odier & Co allowed U.S. clients to sever a paper trail on their assets and cheat the Internal Revenue Service, the Swiss lender admitted, agreeing to pay $99.8 million to avoid prosecution. That penalty is the second-largest paid under a program to help the U.S. clamp down on tax evasion through Swiss banks. Total penalties have reached more than $1.1 billion as banks have revealed how they helped clients hide money and where the assets went. DZ Privatbank (Schweiz) AG will also pay almost $7.5 million under accords released Thursday. The U.S. has struck 75 such non-prosecution agreements this year, with the tempo and dollar amount increasing in recent weeks as it rushes to finish. Geneva-based Lombard Odier, founded in 1796, had 1,121 U.S. accounts with $4.45 billion in assets from 2008 through 2014, according to the agreement, announced Thursday.

The bank adopted a policy in 2008 to force U.S. clients to disclose undeclared assets to the IRS or face account closures. However, the policy authorized large cash or gold withdrawals, donations to U.S. relatives or charitable institutions, resulting in further wrongdoing, according to the statement. In 2009 alone, the bank processed 14 cash withdrawals of more than $1 million each for clients closing 11 accounts, according to the non-prosecution agreement. One client closed an account by withdrawing more than $3 million in gold, the bank admitted. “These withdrawals of cash and precious metals enabled U.S. persons to sever the paper trail for their assets and further conceal their income and assets from U.S. authorities,” according to the agreement. The bank also closed at least 12 U.S. accounts worth $15.7 million with “fictitious donations” to other accounts at the bank, Lombard Odier admitted.

“..Mr. Hugh insisted time and again that economists and policy makers were glossing over the extent to which swift austerity measures in countries like Greece, Ireland, Spain and Portugal would result in devastating recessions..”

• Edward Hugh, Economist Who Foresaw Eurozone’s Struggles, Dies At 67 (NY Times)

Edward Hugh, a freethinking and wide-ranging British economist who gave early warnings about the European debt crisis from his adopted home in Barcelona, died on Tuesday, his birthday, in Girona, Spain. He was 67. The cause was cancer of the gallbladder and liver, his son, Morgan Jones, said. Mr. Hugh drew attention in 2009 and 2010 for his blog posts pointing out flaws at the root of Europe’s ambition to bind together disparate cultures and economies with a single currency, the euro. In clear, concise essays, adorned with philosophical musings and colorful graphics, Mr. Hugh insisted time and again that economists and policy makers were glossing over the extent to which swift austerity measures in countries like Greece, Ireland, Spain and Portugal would result in devastating recessions.

Mr. Hugh’s insights soon attracted a wide and influential following, including hedge funds, economists, finance ministers and analysts at the IMF. “For those of us pessimists who believed that the eurozone structure was leading to an unsustainable bubble in the periphery countries, Edward Hugh was a must-read,” said Albert Edwards, a strategist based in London for the French bank Société Générale. “His prescience in explaining the mechanics of the crisis went almost unnoticed until it actually hit.” As the eurozone’s economic problems grew, so did Mr. Hugh’s popularity, and by 2011 he had moved the base of his operations to Facebook. There he attracted many thousands of additional followers from all over the world.

If Santa Claus and John Maynard Keynes could combine as one, he might well be Edward Hugh. He was roly-poly and merry, and he always had a twinkle in his eye, not least when he came across a data point or the hint of an economic or social trend that would support one of his many theories. His intellect was too restless to be pigeonholed, but when pressed he would say that he saw himself as a Keynesian in spirit, but not letter. And in tune with his view that economists in general had become too wedded to static economic models and failed their obligation to predict and explain, he frequently cited this quotation from Keynes: “Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past, the ocean is flat again.”

3 million forecast for 2016.

• As 2016 Dawns, Europe Braces For More Waves Of Refugees (AP)

Bitter cold, biting winds and rough winter seas have done little to stem the seemingly endless flow of desperate people fleeing war or poverty for what they hope will be a brighter, safer future in Europe. As 2016 dawns, boatloads continue to reach Greek shores and thousands trudge across Balkan fields and country roads heading north. More than a million people reached Europe in 2015 in the continent’s largest refugee influx since the end of World War II – a crisis that has tested European unity and threatened the vision of a borderless continent. Nearly 3,800 people are estimated to have drowned in the Mediterranean last year, making the journey to Greece or Italy in unseaworthy vessels packed far beyond capacity.

The EU has pledged to bolster patrols on its external borders and quickly deport economic migrants, while Turkey has agreed to crack down on smugglers operating from its coastline. But those on the front lines of the crisis say the coming year promises to be difficult unless there is a dramatic change. Greece has borne the brunt of the exodus, with more than 850,000 people reaching the country’s shores, nearly all arriving on Greek islands from the nearby Turkish coast. “The (migrant) flows continue unabated. And on good days, on days when the weather isn’t bad, they are increased,” Ioannis Mouzalas, Greeces minister responsible for migration issues, told AP. “This is a problem and shows that Turkey wasn’t able – I’m not saying that they didn’t want – to respond to the duty and obligation it had undertaken to control the flows and the smugglers from its shores.”

Europe’s response to the crisis has been fractured, with individual countries, concerned about the sheer scale of the influx, introducing new border controls aimed at limiting the flow. The problem is compounded by the reluctance of many migrants’ countries of origin, such as Pakistan, to accept forcible returns. “If measures are not taken to stop the flows from Turkey and if Europe doesn’t solve the problems of the returns as a whole, it will be a very difficult year,” Mouzalas warned. “It’s a bad sign, this unabated flow that continues,” Mouzalas said. “It creates difficulties for us, as the borders have closed for particular categories of people and there is a danger they will be trapped here.”

Home › Forums › Debt Rattle January 2 2016