Edward Hopper The Circle Theater, New York 1936

Don’t want to get stuck in semantics, but if it is not now a guarantee, doesn’t that simply mean it never was?

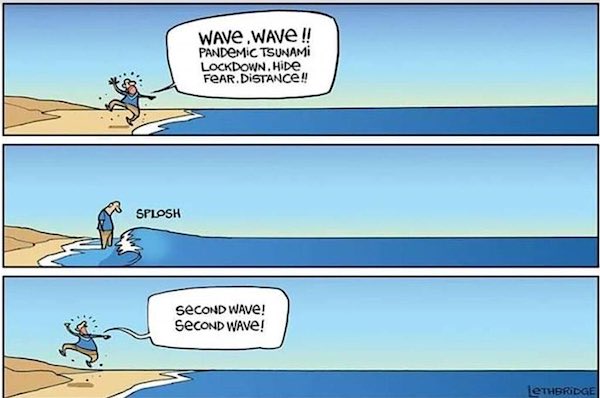

Besides, calling for a global strategy of “maximum suppression” in April 2021 feels a bit like a time warp.

Instead, go figure out what you can do without “suppression”.

• Global Vaccine Rollout Is No Longer A Guarantee Of Victory Over Covid-19 (G.)

If there are high transmission levels, and hence extensive replication of Sars-CoV-2, anywhere in the world, more variants of concern will inevitably arise and the more infectious variants will dominate. With international mobility, these variants will spread. South Africa’s experience suggests that past infection with Sars-CoV-2 offers only partial protection against the B.1.351 variant, and it is about 50% more transmissible than pre-existing variants. The B.1.351 variant has already been detected in at least 48 countries as of March 2021. The impact of the new variants on the effectiveness of vaccines is still not clear. Recent real-world evidence from the UK suggests both the Pfizer and AstraZeneca vaccines provide significant protection against severe disease and hospitalisations from the B.1.1.7 variant.

On the other hand, the B.1.351 variant seems to reduce the efficacy of the AstraZeneca vaccine against mild to moderate illness. We do not yet have clear evidence on whether it also reduces effectiveness against severe disease. For these reasons, reducing community transmission is vital. No single action is sufficient to prevent the virus’s spread; we must maintain strong public health measures in tandem with vaccination programs in every country. Each time the virus replicates, there is an opportunity for a mutation to occur. And as we are already seeing around the world, some of the resulting variants risk eroding the effectiveness of vaccines. That’s why we have called for a global strategy of “maximum suppression”.

Public health leaders should focus on efforts that maximally suppress viral infection rates, thus helping to prevent the emergence of mutations that can become new variants of concern. Prompt vaccine rollouts alone will not be enough to achieve this; continued public health measures, such as face masks and physical distancing, will be vital too. Ventilation of indoor spaces is important – some of which is under people’s control, some of which will require adjustments to buildings.

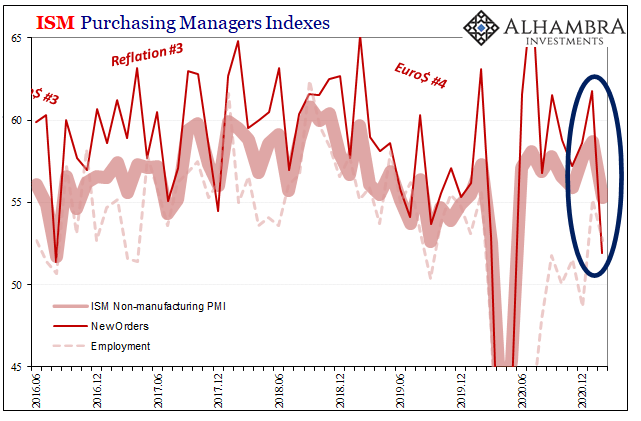

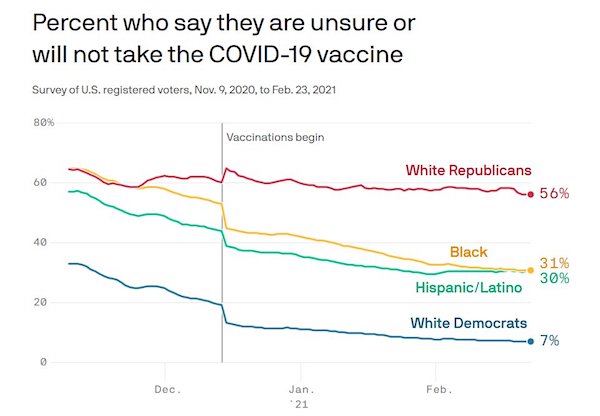

Just one point in time, but not entirely meaningless.

• Sunday US COVID Death Count Lowest In More Than A Year (JTN)

The number of reported coronavirus fatalities in the U.S. on Sunday was 222, the lowest daily death toll in more than a year. According to the Johns Hopkins University data, this represents the lowest number of deaths since March 23, 2020 when the number was 192. “Many states either did not report over the weekend or did not have any deaths to report,” a Johns Hopkins spokesperson said, according to The Hill. “The California data portal was down yesterday and we are in the process of back-distributing the data,” the person noted. So far 18.8% of the U.S. population has been fully vaccinated against the illness, while 32.4% of the population has received at least one vaccine dose, according to the Centers for Disease Control and Prevention.

An experiment, just as the vaccines are a -much bigger- experiment.

• Nearly 40,000 Fans Attended Texas Rangers Home Opener (JTN)

As the COVID-19 pandemic continues on, thousands of fans flocked to attend the Texas Rangers baseball team’s home opener, though unfortunately for the home team fans, the Rangers did not emerge victorious. The team announced a sellout crowd of 38,283 at the Globe Life Field facility which has an even larger listed capacity of 40,518, according to the Associated Press which noted that the attendance figure does not factor in complimentary tickets. “It felt like a real game. It felt like back to the old days when we had full capacity,” team manager Chris Woodward said. “Was hoping we’d see how loud our stadium got if we gave them something to cheer about. Unfortunately we didn’t do that.”

Texas Rangers

Globe Life Field is at full capacity today.

The Texas Rangers are the first team to allow 100% capacity since the pandemic began

(via @SamGannon87)pic.twitter.com/DTtLqx00Zt

— Bleacher Report (@BleacherReport) April 5, 2021

Prepare for thousands of variants.

• ‘Double Mutant’ COVID-19 Variant Found in the Bay Area (NBCLA)

A new variant of the coronavirus is in the Bay Area and it is believed to be the first of its kind in the United States. It’s a double mutation and it is believed to be responsible for the surge in cases in India. Fresh from a vacation in Hawaii, some travelers mostly families with kids in tow arrived Saturday night in San Jose with the Big Island still on their mind. “We’ve been playing it really safe, but a couple factors really played into the decision. One watching the numbers go down and then Hawaii was really really safe,” said Kristina Barnes. But while Bay Area counties have reported a decline in new COVID-19 infections, a variant of the Coronavirus has been confirmed here in Santa Clara County.

Stanford Health experts have confirmed a new, double mutation of the coronavirus at least one case here in the Bay Area and more suspected. But it is still unclear if this new variant is more dangerous. “There is no definite evidence that this double variant is more virulent or causes more severe disease.,” said Dr. Dean Winslow with Stanford University. The three vaccines are also said to still be effective against the India variant. “Most people will mount an immune response. Maybe it will not protect against an all-out infection but at least it will protect against moderate or severe disease,” Winslow added. The India variant is believed to be more transmissible, leading health experts to reinforce how essential it is to get vaccinated.

Thing is, those 44% want to push them on to others, not just themselves.

• Poll Finds Almost Half Of Americans Want Vaccine Passports (SN)

A Rasmussen poll has revealed that almost half of Americans support the introduction of vaccine passports in order to get “back to normal.” The findings were released over the Easter period, and noted that 44% of Americans said that a government run system requiring proof of vaccination is a “good idea.” Fewer, 41%, said they think vaccine passports are a bad idea. While some described the 44% figure as “weak,” others pointed out it is still far too high.

The poll dovetails with similar findings in the UK, where a majority of 62% said they would support the mandating of vaccine passports to visit pubs or restaurants, while only 22% opposed the idea.An even higher figure, 78% said they would mandate the vaccine passport for international travel, while 61% said it should be required to attend sports games and 58% said it should be mandated for public transport. The findings in the U.S. come as it was confirmed that the Biden regime is working with major corporations to develop a country-wide vaccine passport, and after New York has begun the rollout of its own vaccine passport system. In addition, the FBI is warning people against fake vaccine passports or COVID-19 vaccination cards. As National File reported, the Biden administration is working with major corporations to develop a vaccine passport system that would require Americans to take one of the controversial vaccines and receive a vaccine passport to engage in commerce.

The passport system is also being pushed by the mainstream media, with the likes of the L.A. Times declaring that vaccine passports are a “good idea” because they will help the Biden administration “break the resistance down.” Some lawmakers have vowed to resist the introduction of vaccine passports, including Florida Governor Ron DeSantis who has signed an executive order banning them in the state, and revealed that he is working with the Florida legislature to institute a permanent ban. Georgia Representative Marjorie Taylor Greene has claimed that the Biden administration aims to force all Americans to have Covid-19 vaccine passports, comparing it to the “mark of the beast” prophesied in the Bible.

The US strategy is to let corporations mandate them.

• Federal Gov’t Will Not Mandate COVID Vaccination Passports – Fauci (Sp.)

The European Union and the United Kingdom are mulling the possibility of vaccination passports, with German Chancellor Angela Merkel announcing that a passport system is currently being established, and UK PM Boris Johnson saying tests of “vaccine passports” could be conducted to ensure that large gatherings can again occur. Dr. Anthony Fauci, the chief medical advisor to the US president and the director of the US National Institute of Allergy and Infectious Diseases (NIAID), on Monday cast doubt on the possibility of the federal government mandating coronavirus vaccination passports in the United States. “I doubt that the federal government will be the main mover of a vaccine passport concept,” Fauci said in a Politico Dispatch podcast.

“They may be involved in making sure things are done fairly and equitably, but I doubt if the federal government is going to be the leading element of that.” Fauci suggested that some independent entities could refuse to deal with anyone who is not vaccinated. “But it’s not going to be mandated from the federal government,” he said. The concept of so-called vaccine passports was introduced as a possible measure that could help to life back to normal following the coronavirus pandemic, particularly for international travel and large gatherings. In the EU, the idea was first vocally supported by Greece, with German Chancellor Angela Merkel later announcing that Germany would implement a vaccine passport system, expressing hope it could then include the entire bloc.

More calling for more restrictions. Nothing learned in an entire year.

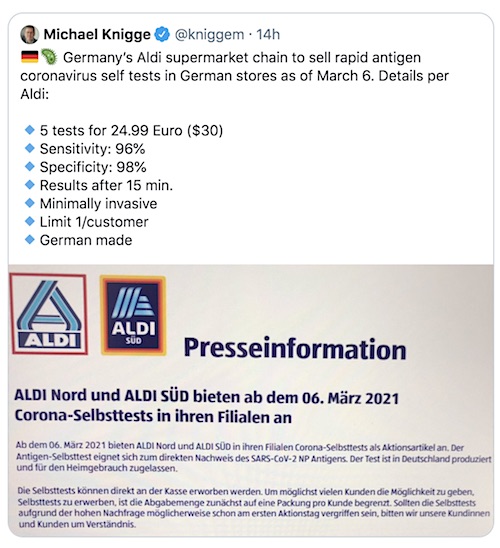

• Vaccination Does Not Prevent 3rd Wave: German Health Minister (RT)

The ongoing vaccination campaign in Germany will not be enough to stop the third wave of the Covid-19 pandemic, Health Minister Jens Spahn has warned, urging the regions to return to lockdown measures if necessary. “Vaccination does not prevent the third wave, the third wave is growing,” the minister said as he visited one of the vaccination centers in Berlin on Monday, following the Easter holidays. Spahn also described the situation in Germany’s intensive care units as “worrying” and said that the number of people treated there increased to more than 4,000 over the Easter weekend. More than half of them are on invasive ventilation.

Spahn then called on Germany to “break this third wave together” by limiting contacts once again. The minister said that contacts should be primarily restricted “in the private sector, in schools, at work wherever possible.” He also pointed to the UK, Chile and the US as he said that even the nations with a higher vaccination ratio still resort to contact restrictions when necessary. Amid the vaccine shortages and delivery delays, Germany managed to administer the first dose of a Covid-19 vaccine to some 10 percent of its population in the first quarter of this year. Spahn expects this figure to double by the end of April. “We will now be able to do the next ten percent in a month,” he said.

Earlier, the German Standing Vaccination Commission (STIKO) recommended limiting the use of the British Oxford-AstraZeneca vaccine to those over 60 years old due to the jab’s potential serious side effects in younger people, such as blood clots in the brain. Meanwhile, Spahn called on the German states to fight the third wave with lockdowns. Those regions that would see their average seven-day infection rate going over 100 should use the so-called “emergency brake” and re-introduce some restrictions, he said.

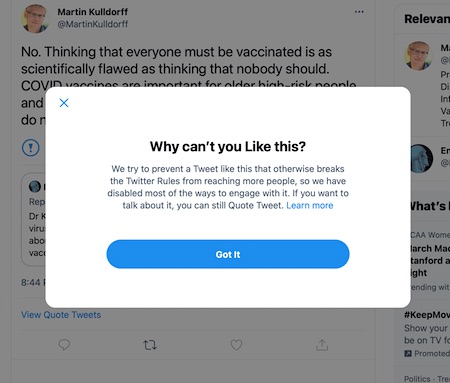

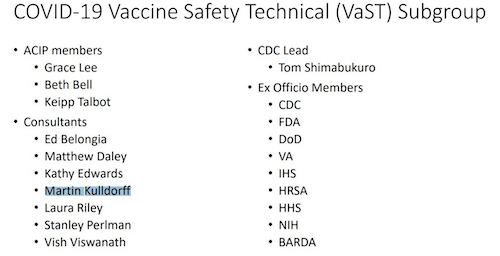

Link from a commenter in yesterday’s thread, immediatedly invoking a “rebuttal” here.

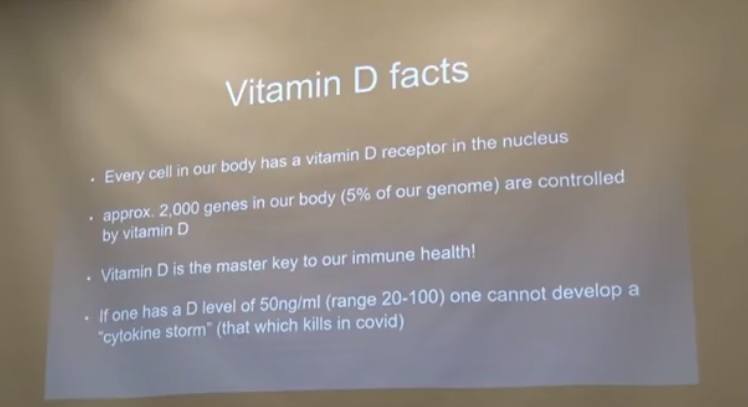

• Cures for COVID and Dangers of COVID “Vaccines” (HIN)

Dr. Ryan Cole is the CEO and Medical Director of Cole Diagnostics, one of the largest independent labs in the State of Idaho. Dr. Cole is a Mayo Clinic trained Board Certified Pathologist. He is Board Certified in anatomic and clinical pathology. He has expertise in immunology and virology and also has subspecialty expertise in skin pathology. He has seen over 350,000 patients in his career, and has done over 100,000 Covid tests in the past year. He recently was invited to speak at the “Capitol Clarity” event in Idaho, apparently sponsored by the Lt. Governor’s office, where he discussed successful outpatient treatments for COVID, and to offer his views on the new COVID “vaccines.”

Dr. Cole begins by showing statistics that prove Idaho is no longer in a “pandemic,” but an “endemic.” He states that the highest risk factors for contracting COVID are advanced age, obesity, and low Vitamin D levels. He also explains that coronaviruses have historically always followed a 6-9 month life cycle. He gives previous examples such as SARS-1, MERS, etc. One very interesting statistic that he pointed out is that in the U.S. the average annual age of death is 78.6 years old, and the average age of death during COVID has also been 78.6 years old. Dr. Cole is very adamant that proper levels of Vitamin D are essential to fight coronaviruses. He states: There is no such thing as “flu and cold season,” only low Vitamin D season.

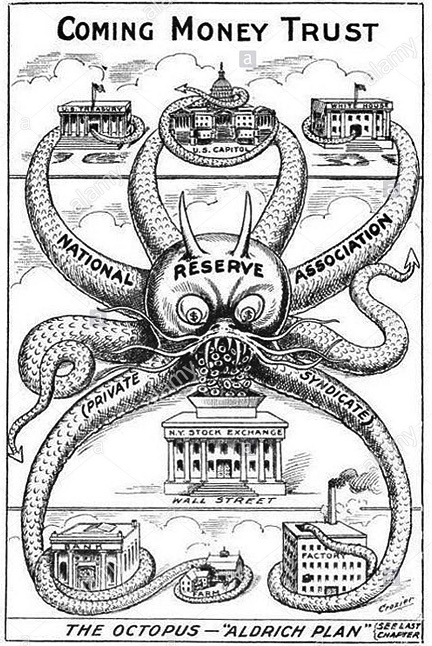

Dr. Cole then goes on to explain that by law, the government cannot use experimental vaccines on the population if there are already effective treatments. So all of the current experimental COVID “vaccines,” which Dr. Cole himself admits do NOT meet the legal definition of a “vaccine” to begin with, are all illegal because there are therapies, such as Vitamin D, that are effective in treating COVID patients, as well as older already FDA-approved drugs like Ivermectin. He points out that the NIH (the National Institute of Health), which is a U.S. government agency involved with approving drugs, holds patents on the Moderna experimental COVID “vaccine,” which is like asking the fox to guard the hen house.

Get Fauci under oath. This is nuts.

• US Grant To Wuhan Lab Was Never Scrutinized By HHS Review Board (DC)

An oversight board created to scrutinize research that would enhance highly dangerous pathogens did not review a National Institutes of Health grant that funded a lab in Wuhan, China, to genetically modify bat-based coronaviruses. Experts say the NIH grant describes scientists conducting gain-of-function research, a risky area of study that, in this case, made SARS-like viruses even more contagious. Federal funding for gain-of-function research was temporarily suspended in 2014 due to widespread scientific concerns it risked leaking supercharged viruses into the human population. Federal funding for gain-of-function research was resumed in late 2017 after the Potential Pandemic Pathogens Control and Oversight (P3CO) Framework was formed within the Department of Health and Human Services (HHS).

The review board is tasked with critically evaluating whether grants that involve enhancing dangerous pathogens, such as coronaviruses, are worth the risks and that proper safeguards are in place. But the NIH subagency that awarded the grant to the nonprofit group EcoHealth Alliance to study Chinese bat coronaviruses opted against forwarding it to the P3CO committee, an NIH spokesperson told the Daily Caller News Foundation, meaning the research received federal funding without an independent review by the HHS board. “This is a systemic problem,” Rutgers University professor of chemical biology Richard H. Ebright told the DCNF, referring to the loophole in the review framework.

Ebright said the offices of the director for the National Institute of Allergy and Infectious Diseases (NIAID) — the subagency that funded EcoHealth — and the NIH have “systematically thwarted–indeed systematically nullified–the HHS P3CO Framework by declining to flag and forward proposals for review.” Dr. Anthony Fauci leads the NIAID and Dr. Francis S. Collins heads the NIH.

Cutting out pieces of video to make him look bad. Typical smear.

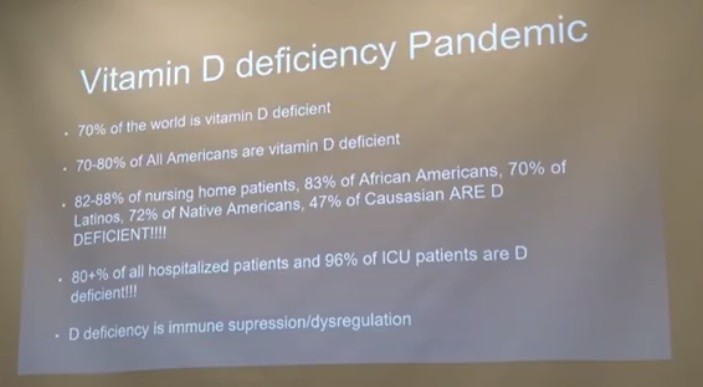

• Publix, Democrat State Official Blast CBS ‘60 Minutes’ Smear Of DeSantis (DW)

Florida’s largest grocery store and a Florida state official, who is a Democrat, slammed CBS’s “60 Minutes” on Sunday evening following a deceptive segment the network aired about Florida Governor Ron DeSantis (R). The segment featured reporter Sharyn Alfonsi ambushing DeSantis at a press conference last month and aggressively questioning him using a misleading narrative about the way that he has responded to the coronavirus pandemic. “60 Minutes” deceptively edited the interaction to remove nearly the entire portion of DeSantis’ response in which he thoroughly answered Alfonsi’s question and defused the central point of the segment. Alfonsi tried to suggest that Publix, the largest grocery store chain in Florida, had engaged in pay to play by donating money to DeSantis’ campaign in exchange for being awarded a contract to distribute vaccines in the state.

“The irresponsible suggestion that there was a connection between campaign contributions made to Governor DeSantis and our willingness to join other pharmacies in support of the state’s vaccine distribution efforts is absolutely false and offensive,” Publix said in a scathing statement slamming the “60 Minutes” segment. “We are proud of our pharmacy associates for administering more than 1.5 million doses of vaccine to date and for joining other retailers in Alabama, Florida, Georgia, South Carolina, Tennessee and Virginia to do our part to help our communities emerge from the pandemic.” Former Florida state Representative Jared Moskowitz, a Democrat, slammed “60 Minutes” over the segment, saying that DeSantis’ office did not push for selecting Publix. Moskowitz is the director of Florida’s Division of Emergency Management and has overseen the state’s response to the pandemic [..]

DeSantis

This is wild. Watch Ron DeSantis’s full answer on Publix, Walgreen’s and CVS vaccine distribution and look at the edited cut 60 Minutes used: pic.twitter.com/FqTRgOZS9Z

— Clay Travis (@ClayTravis) April 5, 2021

“How can you remember details from your period of addiction going back 20 years, detailed in your book, but you cannot remember this laptop?”

• Biden’s Most “Beautiful Thing” May Be Media Collusion (Turley)

News anchor Lester Holt recently declared that “it has become clearer that fairness is overrated,” adding that “the idea that we should always give two sides equal weight and merit does not reflect the world we find ourselves in.” Fortunately for Hunter Biden, that world is the one in which he lives and thrives. In interviews about his memoir “Beautiful Things,” some reporters either misstate the facts of his prior scandals or ignore certain leads, including potential evidence of a federal crime. Facts, like fairness, appear overrated to much of the media today. Hunter Biden spent the last few months evading questions, particularly during the 2020 election, when an abandoned laptop apparently belonging to him was found to have hundreds of embarrassing photos and emails showing drug abuse and raw influence-peddling.

He reportedly is under investigation for possible federal tax violations linked to his foreign dealings. Yet, one of the “beautiful things” in Hunter’s life is a media that imposed a pre-election blackout on the laptop story and continues to wrap him and his father in a protective press cocoon. That was evident in an interview by National Public Radio this week. The article by NPR senior editor and correspondent Ron Elving stated categorically: “The laptop story was discredited by U.S. intelligence and independent investigations by news organizations.” That is entirely and demonstrably false. Widely criticized for that false statement, NPR issued a tepid “correction” for the article that now states: “Numerous news organizations cast doubt on the credibility of the laptop story.”

There was, of course, an easy way to confirm the facts, rather than citing other news organizations which also failed to pursue the story. Elving and NPR were interviewing Hunter — so why not simply ask him if the laptop was his? CBS News did ask that question and received a bizarre answer from Hunter that it might be his, or it might not be: “There could be a laptop out there that was stolen from me. It could be that I was hacked. It could be that it was the — that it was Russian intelligence.” Or, perhaps, it could be alien technology from the Andromeda Galaxy. Hunter is denying any knowledge of the laptop’s authenticity, roughly seven months after its existence was disclosed by the New York Post and even longer since it reportedly was seized by the FBI. During that time, the story presumably was researched by the Biden campaign and by Hunter’s own lawyers.

U.S. intelligence concluded it was not Russian disinformation, even though Joe Biden claimed it was. His campaign brought forward 50 former national security officials to endorse this unsupported claim. The other parties on many of these emails have confirmed the authenticity and the FBi seized the laptop as evidence (which Hunter and his lawyers have been addressing in months of discussions with prosecutors). Yet, Hunter claims that he is entirely unsure if the laptop is his or possibly the work of Russian intelligence. One might expect some effort to explore that issue with a followup question: “How can you remember details from your period of addiction going back 20 years, detailed in your book, but you cannot remember this laptop?” Or: “Even if you cannot remember your own laptop, you’ve seen the pictures and emails — are those authentic?” Instead, the media showed the flag and then left the field.

Richard Werner: “Bank of Japan, one of the bank regulators in Japan, moves further towards stepping into the arena to compete with the banks it regulates, by preparing to offer direct current accounts to the public (named central bank digital currency to get you off track)”

• Japan’s Central Bank Kicks Off Experiments On Issuing Digital Currency (R.)

The Bank of Japan (BOJ) began experiments on Monday to study the feasibility of issuing its own digital currency, joining efforts by other central banks that are aiming to match the innovation in the field achieved by the private sector. The first phase of experiments, to be carried out until March 2022, will focus on testing the technical feasibility of issuing, distributing and redeeming a central bank digital currency (CBDC), the BOJ said in a statement. The BOJ will thereafter move to the second phase of experiments that will scrutinise more detailed functions, such as whether to set limits on the amount of CBDC each entity can hold.

If necessary, the central bank will launch a pilot programme that involves payment service providers and end users, BOJ Executive Director Shinichi Uchida said last month. “While there is no change in the BOJ’s stance it currently has no plan to issue CBDC, we believe initiating experiments at this stage is a necessary step,” Uchida told a committee of policymakers and bank lobbies looking into CBDC. Global central banks are looking at developing digital currencies to modernise their financial systems, ward off the threat from cryptocurrencies and speed up domestic and international payments.

While their corporate lobbying groups in Washington fight the plans. Divide and rule?!

• CEOs Tell Investors $15 Minimum Wage Won’t Hurt Business (NW)

Big restaurant chains are telling investors that a national minimum wage hike wouldn’t be a big deal—even as their corporate lobbying groups in Washington fight plans for a $15 minimum wage. “We share your view that a national discussion on wage issues for working Americans is needed—but the Raise the Wage Act is the wrong bill at the wrong time for our nation’s restaurants,” the National Restaurant Association wrote in a letter to congressional leaders in February. “The restaurant industry and our workforce will suffer from a fast-tracked wage increase and elimination of the tip credit.”

The following day, a top executive at Denny’s, one of the association’s members, told investors that gradual increases in the minimum wage haven’t been a problem for the company at all. In fact, California’s law raising the minimum wage to $15 by 2023 has actually been good for the diner chain’s business, according to Denny’s chief financial officer, Robert Verostek. “As they’ve increased their minimum wage kind of in a tempered pace over that time frame, if you look at that time frame from us, California has outperformed the system,” Verostek said on an earnings call. “Over that time frame, they had six consecutive years of positive guest traffic—not just positive sales, but positive guest traffic—as the minimum wage was going up.”

Denny’s is one of several publicly-traded restaurant chains whose executives have told investors in recent months that Democrats’ proposed minimum wage hike is not a real threat to their business and may even be a net positive, according to a Daily Poster review of corporate earnings calls. All of the companies have historically belonged to the restaurant association, which has led the fight against the Raise the Wage Act, legislation from Democrats that would gradually increase the minimum wage to $15 by 2025.

“A person always could choose to avoid the toll bridge or train and instead swim the Charles River or hike the Oregon Trail..” “..what matters is whether the alternatives are comparable. For many of today’s digital platforms, nothing is.”

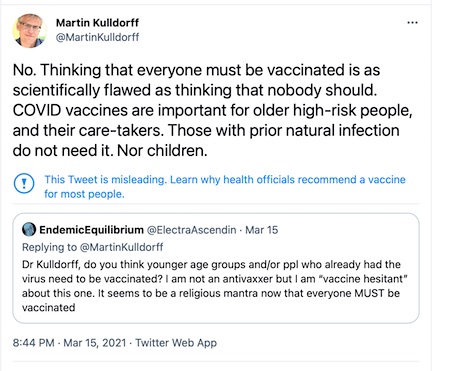

• Clarence Thomas: Facebook, Twitter Could Be Regulated Like Utilities (ET)

Supreme Court Justice Clarence Thomas appeared to signal that Big Tech firms could be regulated after Facebook and Twitter suspended President Donald Trump earlier this year. Thomas, considered a conservative on the high court, made the point during a 12-page submission as the Supreme Court issued an order that rejected a lawsuit over Trump’s blocking of certain Twitter users from commenting on his posts before his account was taken down. The Supreme Court said the lawsuit ultimately should be dismissed as Trump isn’t in office anymore and was blocked from using Twitter, coming after the Second Circuit Court of Appeals had ruled against Trump.

“Today’s digital platforms provide avenues for historically unprecedented amounts of speech, including speech by government actors. Also unprecedented, however, is control of so much speech in the hands of a few private parties,” Thomas wrote Monday. “We will soon have no choice but to address how our legal doctrines apply to highly concentrated, privately owned information infrastructure such as digital platforms.” Thomas also noted there are arguments suggesting digital platforms such as Twitter or Facebook “are sufficiently akin to common carriers or places of accommodation to be regulated in this manner.” Thomas made reference to the respective owners of Facebook and Google by name—Mark Zuckerberg, Larry Page, and Sergey Brin.

“Although both companies are public, one person controls Facebook (Mark Zuckerberg), and just two control Google (Larry Page and Sergey Brin),” he wrote. Thomas agreed that Trump’s Twitter account did “resemble a constitutionally protected public forum” in certain aspects, he noted that “it seems rather odd to say that something is a government forum when a private company has unrestricted authority to do away with it,” possibly referring to Twitter’s ban against Trump following the Jan. 6 incident. “Any control Mr. Trump exercised over the account greatly paled in comparison to Twitter’s authority, dictated in its terms of service, to remove the account ‘at any time for any or no reason,’” he added. “Twitter exercised its authority to do exactly that.”

[..] “A person always could choose to avoid the toll bridge or train and instead swim the Charles River or hike the Oregon Trail,” he wrote. “But in assessing whether a company exercises substantial market power, what matters is whether the alternatives are comparable. For many of today’s digital platforms, nothing is.”

Putin is afraid Russia will be overrun by the West as soon as he retires. That’s what occupies him, not hunger for power.

• Putin Signs Law That Could Keep Him In Kremlin Until 2036 (R.)

Russian President Vladimir Putin has signed a law that could keep him in office in the Kremlin until 2036, the government said on Monday. The legislation allows him to run for two more six-year terms once his current stint ends in 2024. It follows changes to the constitution last year. Those changes were backed in a public vote last summer and could allow Putin, 68, to potentially remain in power until the age of 83. He is currently serving his second consecutive term as president and his fourth in total.

The reform, which critics cast as a constitutional coup, was packaged with an array of other amendments that were expected to garner popular support, such as one bolstering pension protections. The law signed by Putin limits any future president to two terms in office, but resets his term count. It prevents anyone who has held foreign citizenship from running for the Kremlin. The legislation was passed in the lower and upper houses of parliament last month.

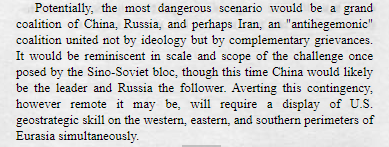

Zbigniew Brzezinski 1997

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.