Albert Freeman Mrs. Alice White at the War Fund Victory Store, Hardwick, VT 1942

It’s Steve’s birthday today!

• The Seven Countries Most Vulnerable To A Debt Crisis (Steve Keen)

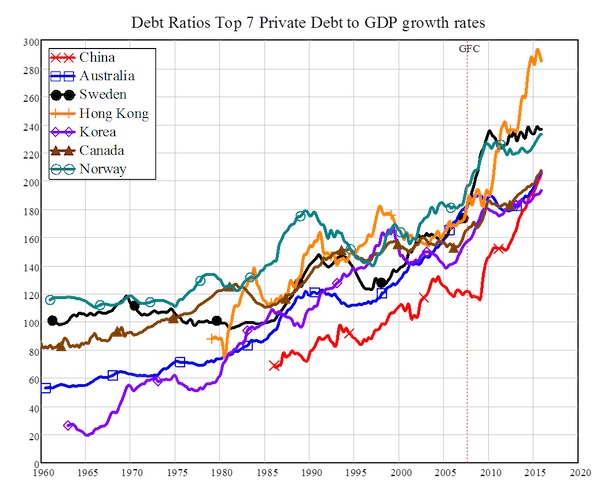

For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by. That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most likely to suffer a debt crisis in the next 1-3 years. They are, in order of likely severity: China, Australia, Sweden, Hong Kong (though it might deserve first billing), Korea, Canada, and Norway. I’ve detailed the logic behind my argument too many times to count, and I won’t repeat it here.

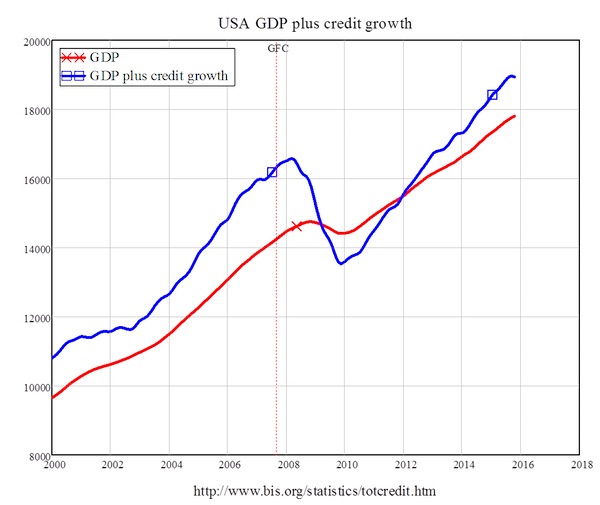

The bottom line is that private sector expenditure in an economy can be measured as the sum of GDP plus the change in credit, and crises occur when (a) the ratio of private debt to GDP is large; (b) growing quickly compared to GDP. When the growth of credit falls—as it eventually must, as growing debt servicing exhausts the funds available to finance it, new borrowers baulk at entry costs to house purchases, and numerous euphoric and Ponzi-based debt-financed schemes fail—then the change in credit falls, and can go negative, thus reducing demand rather than adding to it.

This is what caused the Global Financial Crisis, and the simplest way to simply substantiate my argument—which virtually every other economist on the planet will advise you is crazy (except Michael Hudson, Dirk Bezemer and a few others)—is to show you this data for the USA. The crisis began as the rate of growth of credit began to fall, and the Great Recession was dated as starting in 2008 and ending in 2010. As you can see from Figure 1, the sum of GDP plus credit growth peaked in 2008, and fell till 2010—at which point the recovery began.

Figure 1: America’s crisis began when the rate of growth of credit began to fallThe BIS database lets me identify other countries—several of which managed to avoid a serious downturn during the GFC—which fill these two pre-requisites: a high level of private debt to GDP, and a rapid growth of that ratio in the last few years. The American ex-banker turned philanthropist and debt reformer Richard Vague, in his excellent empirical study of crises over the last 150 years, concluded that crises occur when (a) private debt exceeds 1.5 times GDP and (b) the level grows by about 20% (say from 140% to 160%) over a 5 year period.

America fitted those gloves in 2008, as did many other countries—all of which are either still in a crisis (especially in the Eurozone), or are suffering “inexplicably” low growth after an apparent recovery (as is the case in the USA, the UK, and so on). Using the BIS database, I can identify 21 countries that meet Richard’s first criteria, but to “go for broke” on this forecast, I restricted myself to the 16 countries that had a private debt to GDP ratio exceeding 175% of GDP. To simplify my analysis, I then limited the second criteria to countries where the increase in private debt last year exceeded 10% of GDP. That combination gave me my list.

Figure 2: Countries with private debt/GDP > 175% & debt growth in 2015 > 10% of GDP, ranked by debt growth

“If all the savings are chased out of banks, what is left for investment for the future?”

• Capital and Credit (Mr. Practical)

Central banks have altered the definition of debt. Debt was once created by banks when they lent out deposits, transferring the liquid capital of the depositor to the debtor; the bank, acting as a clearing house, guaranteed the deposit. The Federal Reserve allows banks to lever that functionality by requiring banks to keep just 10% of the deposit as collateral; ergo, a bank could lend ten times its deposit base. That was the first step in levering capital up in the economy. It was and is called fractional banking. Over the last 30 years, central banks, regulators, and Wall Street have created various methods to increase that leverage even more; in other words, they have taken a modicum of capital and created mountains of debt with it. In other words, financial engineering creates new and different ways to increase leverage.

Most of those vehicles are disguised as derivatives. For example, some stocks allow investors to buy them on margin of 50%: they put up half of the cost and a broker lends them the other half so the investor’s capital is levered two-to-one. Alternatively, through derivatives, they can buy an SP500 futures contract and only put up 5% in capital and the broker will lend them the other 95%, so the investor’s capital is levered twenty to one! The derivatives market has a notional value of ~$1 quadrillion (one thousand trillions; pause to let the enormity of that number sink in); this provides a glimmer of the risk and leverage embedded in the derivatives markets, and by extension the stock and commodity markets. The system imploded under this debt in 2008 because there was not enough income being generated to pay back interest and principal.

Central banks and governments responded by adding $60 trillion of fresh global debt to reflate the bubble. How is that working? Well, we’re now seeing negative interest rates (NIRP) in Europe and Asia and many think they are coming to the U.S. Negative interest rates mean savers are now being charged to keep their money at the bank; there now is a cost to holding cash in a savings account. This is not natural and has revolting consequences. If you buy an Italian government bond you actually have to pay them interest to lend them money. This is ridiculous on its face but especially since Italy is bankrupt. The only reason it is possible is that the central bank of Europe is buying them up to that price. And why is this happening? The bubble is fraying. It is about to pop again for all of the new debt created since 2008; that debt is even less productive than the previous debt and generates even less income to pay it back.

Bureaucrats can either lever capital or re-distribute it. t seems they are having trouble levering it any further so negative rates are an attempt to re-distribute capital. All of the savings in liquid capital within the banks must be chased out to buy increasingly risky assets like stocks and houses to stimulate the economy. This is like Dr. Frankenstein raising the dead. If all the savings are chased out of banks, what is left for investment for the future?

“The JGB market is really in a bubble, when you think about it as an investment vehicle..”

• Japan’s Negative Rates A Looming Headache For Central Bank (Reuters)

Driving interest rates below zero, the Bank of Japan has turned a comatose government bond market into an enormous free-for-all, complicating the central bank’s own efforts to kick-start growth and end deflation. The $9 trillion market for Japanese government bonds had been all but paralyzed since the BOJ began a massive monetary easing three years ago that made the bank the dominant buyer. But in the two months since the BOJ announced it was imposing a negative interest rate, JGBs have become a volatile commodity, with prices swinging wildly as below-zero yields confound investors’ attempts to find fair market value. “The JGB market is really in a bubble, when you think about it as an investment vehicle,” said Takuji Okubo at Japan Macro Advisors. “Their prices have moved away from fundamentals, and people don’t have a traditional way to measure their value.”

As the BOJ’s dominance distorts bond market functions and dries up liquidity, the central bank could have a hard time tapering its buying binge when it eventually chooses to exit its “quantitative and qualitative easing” program. The bank theoretically could just sit on its enormous holdings until the bonds mature, but policymakers are unlikely to want those assets to remain on the balance sheet for decades. On the other hand, it might be difficult to smoothly taper off its asset purchases, much less sell its holdings. So far, the BOJ’s money printing has kept the cost for financing the government’s massive public debt very low. A spike in that cost could stoke market fears Japan may be losing control of its finances, potentially triggering a damaging bond sell-off, some analysts say. “It would be quite tough for the BOJ to taper such an enormous balance sheet without disrupting markets,” said a person familiar with the BOJ’s thinking.

Abe to call snap elections, the opposition melting into blocks to prevent a 2/3 majority.

• Japan Seen Stuck With Negative Yields on 70% of Bonds for 2016 (BBG)

Japanese primary dealers say negative bond yields are here to stay in 2016, and room for capital gains has run out. [..] Three years after the start of the Bank of Japan’s unprecedented quantitative and qualitative easing, or QQE, and two months since the surprise announcement of negative interest rates, bond investors are still trying to adjust to the conditions that have turned yields on 70% of the market negative. Even amid such extreme measures, the central bank has failed to prevent inflation from flatlining for more than a year. Most of the dealers surveyed expect a further expansion of stimulus. “The BOJ has dominated the bond market,” said Takafumi Yamawaki at JPMorgan, who sees the 10-year note yielding minus 0.15% at year-end. “Yields will remain deeply depressed.” An investor would just about break even if the 10-year JGB yield ended the year at minus 0.1%, after accounting for reinvested interest.

The 10-year yield was at minus 0.095% on Friday, the lowest globally after Switzerland’s minus 0.35%. The equivalent U.S. Treasury note yielded 1.9%. JGBs have returned 5.3% over the past six months, the most of 26 sovereign debt markets tracked by Bloomberg, as yields pushed ever lower amid pressure from BOJ easing. “We expect an expansion of stimulus, and if the market happens to rule out any additional boost in stimulus, that would create an opportunity to go long,” said Takeki Fukushima at Citigroup in Tokyo, who predicts the 10-year note will yield about minus 0.15% at year-end. The BOJ owns an unprecedented one-third of outstanding JGBs, more than any other class of investor, as it snaps up as much as 12 trillion yen ($106 billion) of the debt each month. The result has been a loss of liquidity that has heightened volatility and hurt market functionality.

There goes the kitchen sink.

• China’s Pension Fund To Flow Into Stock Market This Year (CD)

China’s massive pension fund may begin investing in the nation’s A-share markets this year, an anticipated move that will channel approximately 600 billion yuan ($92.28 billion) into the equity market and likely improve its liquidity. The target date comes several months after China’s State Council published an investment guideline that would allow the country’s pension fund to invest in more diversified and risker products, with the maximum proportion of investments in stocks and equities set at 30% of total net assets. As of last Friday, the nation’s A-share markets’ combined value totaled about 44 trillion yuan. China’s pension fund, which accounts for approximately 90% of the country’s total social security fund pool, had net assets of 3.98 trillion yuan by the end of 2015.

By the end of last year, total investible pension fund nationwide reached approximately 2 trillion yuan, according to data from the Ministry of Human Resources and Social Security. Yin Weimin, the minister of Human Resources and Social Security, said last week: “Detailed guidelines about how the investments will be conducted are expected shortly and the investments will be made through commissioned institutional investors.” According to a survey by the Shenzhen Stock Exchange, which polled 3,874 small investors from 219 cities around China, more than 77.5% of respondents said they had been anticipating the pension fund investments and that the move will bring a wave of liquidity.

The move is expected to not only benefit the equity market but also the pension fund itself, because yields from investing in equities are normally higher than that from treasury bonds or interest rates from bank accounts. Critics have said that the low yields earned from bank accounts or bonds will not meet the increasing demands of a rapidly growing elderly population. Researchers said it will take time for all of the investible portion of the pension fund to become fully injected into the equity market. Provinces that have already piloted their local pension funds to be invested in the equity market have reported positive yields. South China’s Guangdong province reportedly accrued a combined yield of 17.34 billion yuan from a 100-billion-yuan investment.

China, Turkey, Saudi: what’s the difference? And they’re all our friends…

• China Hunts Source of Letter Urging Xi to Quit (WSJ)

A Chinese news portal’s publication of a mysterious letter calling for President Xi Jinping’s resignation appears to have triggered a hunt for those responsible, in a sign of Beijing’s anxiety over bubbling dissent within the Communist Party. The letter, whose authorship remains unclear, appeared on the eve of China’s legislative session in early March, the most public political event of the year. Since then, at least four managers and editors with Wujie Media—whose news website published the missive—and about 10 people from a related company providing technical support have gone missing, according to their friends and associates, who say the disappearances are linked to a government probe into the letter.

A U.S.-based dissident author said authorities have also taken away his family in southern China over claims that he had helped disseminate the letter – an allegation he denies. The editor of an overseas Chinese website that also published the letter said he has received harassing phone calls and anonymous death threats. Wujie Media -which is based in Beijing and partly owned by the government of China’s far western Xinjiang region- hasn’t published any original news content since mid-March, while its social-media accounts have also gone silent. Many among its more than 100 employees worry that the company may soon be shut down, according to a Wujie employee and two people familiar with the situation.

[..] Analysts said the incident highlights the party’s concerns over the letter and a broader pushback against Mr. Xi’s domineering style of leadership. The response “shows a real brittleness of power and of high levels of nervousness,” said Kerry Brown, professor of Chinese studies at King’s College London. “If this sort of complaint spreads, then there could be real problems,” he said. [..] “The concentration of power in Xi’s hands, as well as the budding personality cult, have come to arouse dissent among party circles,” said Daniel Leese, a professor of Chinese history and politics at Germany’s University of Freiburg. Over the past two months, divisions between the disgruntled party members and Mr. Xi’s camp have spilled out into the open. After prominent real-estate tycoon and party member Ren Zhiqiang questioned Mr. Xi’s demands for loyalty from the media, party news outlets savaged the retired businessman.

“These firms have come to rely on selling new shares to pay down debt and keep rigs drilling..”

• US Energy Companies Pay Up to Raise Cash (WSJ)

Energy companies tapping the stock market to fill their coffers are deepening the pain for shareholders. These firms have come to rely on selling new shares to pay down debt and keep rigs drilling since oil and gas prices began tumbling in late 2014. The further commodity prices and energy stocks slid, the more shares that companies have had to sell at ever lower prices to raise the desired proceeds. This has further diluted the stakes held by existing shareholders, who are already suffering from falling share prices. North American oil and gas producers have raised more than $10 billion selling new shares this year. That’s in line with the amount raised over the same period last year, which went on to be a record year for so-called follow-on stock offerings with about $18 billion raised.

The cash injections haven’t guaranteed stability for the companies selling shares, though. Emerald Oil, which sold $27.5 million of new shares last year, filed Tuesday for chapter 11 bankruptcy protection. Wunderlich Securities estimates that a prearranged sale of Emerald’s North Dakota drilling fields will yield roughly enough to pay back its bank lenders, leaving little for other creditors and nothing for shareholders. Those who bought roughly $50 million of stock that Goodrich Petroleum sold last March have been basically wiped out. The Houston company’s stock, which ended the week trading at 8 cents, was delisted from the New York Stock Exchange earlier this year. Earlier this month Goodrich said that when it discloses its 2015 financial results, its auditors are likely to express “substantial doubt” about its ability to stay in business.

Much of the money raised by oil and gas producers this year has been through deals that involve banks putting up their own capital to buy a chunk of the company’s stock—below the market rate because of the risk they are taking on—before selling it to investors. A bigger discount in these so-called block, or bought, deals reflects the risk perceived by banks when it comes to energy companies at a time when the price of oil has been fluctuating and large U.S. banks have said they are seeing more energy loans go bad. Last June, Energen raised about a net $400 million in a sale of 5.7 million shares, according to Dealogic. Following the offering, shares declined by nearly 70% by Feb. 16, more than the nearly 60% decline of the SIG Oil Exploration and Production stock index, an industry benchmark, in the same period.

Australia is belatedly waking up. It won’t stop the pain.

• Negative Gearing Has Created Empty Houses And Artificial Scarcity (SMH)

A major myth that permeates the recent debate on housing affordability is that the present level of housing supply is not meeting demand. Scarcity of housing, we are repeatedly told, is driving up prices. The same voices simplistically suggest, reduce the barriers caused by planners and housing supply will respond, bringing affordability back into the market. But more reasoned voices can be heard above the clamour, focussing on the perverse effects of our highly skewed housing taxation and subsidy system, as well as a complete lack of a national housing policy framework to support affordable housing. Nevertheless, throughout this debate there is little recognition of the broader shifts in housing stock, tenure and housing opportunity that these policies have created.

At the last census there were nearly 120,000 empty dwelling in the greater Sydney region alone, representing nearly one fifth of the projected new housing demand to be met by 2031, or equivalent to nearly five years of projected dwelling need. When this is combined with under-utilised dwellings, such as those let out as short-term accommodation, the total number of dwellings reaches 230,000 in Sydney, and 238,000 in Melbourne. There is a possibility that these aggregate figures could be accounted for by a spatial mismatch between supply and demand. That is, they are in places that people simply don’t want to live. But this isn’t the case. When these numbers are mapped there is a clear concentration of unoccupied dwellings in central parts of all our metropolitan areas. In Sydney there is a clear bias towards inner, eastern suburb and north shore locations.

This aligns with established areas of highest rents and prices. This picture is repeated in the other cities. If you chose to accept that there is a housing shortage in Sydney, then the sheer scale and location of these figures strongly suggest that this is an artificially produced scarcity. The number of empty dwellings could more than account for the notional supply shortfalls. Why, then, are these homes left vacant when they could command the highest prices or rents? To answer this, we mapped rental yields for the same period. What it reveals is that rental yields tend to be highest in the outer suburbs, where residential property is cheaper to purchase. Where rental yields are lowest is in the inner city and eastern and north shore suburbs, where capital values (and therefore gains) are highest. And this is where we also see higher rates of vacant properties. This is not a coincidence.

There’s a lot more bursting in the offing.

• Has The Brics Bubble Burst? (Guardian)

The political crisis in Brazil over economic mismanagement and high-level corruption, likely to come to a head next week, has reinforced the fashionable view, popular among western governments and businesses, that the Brics bubble has burst. Members of the exclusive Brics club of leading developing countries – Brazil, Russia, India, China and South Africa – are failing to justify predictions that, separately and together, they will dominate the 21st century world, or so the argument goes. The Brics concept, plus acronym, was dreamed up in 2001 by Jim O’Neill, chairman of Goldman Sachs Asset Management. He highlighted the combined potential of non-western powers controlling one quarter of the world’s land mass and accounting for more than 40% of its population. O’Neill’s idea morphed into a formal association, with South Africa joining the original Bric group in 2011.

The five nations, with a joint estimated GDP of $16tn, set up their own development bank in parallel to the US-dominated IMF and World Bank and hold summits rivalling the G7 forum. Their next meeting will be in Goa, India, in October. But ambitious plans to create an alternative reserve currency to the US dollar and challenge American dominance in IT and global security surveillance have come to little. Meanwhile, adverse economic conditions compounded by falling global demand and lower oil and commodity prices are taking their toll. Last November, Goldman Sachs, where the idea originated, closed its Bric investment fund after assets reportedly declined in value by 88% from a 2010 peak. The bank told the SEC it did not expect “significant asset growth in the foreseeable future”. “The promise of Bric’s rapid and sustainable growth has been challenged very much for the last five years or so,” Jorge Mariscal at UBS told Bloomberg Business. “The Bric concept was popular. But nothing is eternal.”

“..Yahoo, if it had invested that same amount of money in its operations, would have had to generate only a 3.2% after-tax return to produce overall net profit growth of 16% annually over those years.”

• In Yahoo, Another Example of the Buyback Mirage (NY Times)

It is one of the great investment conundrums of our time: Why do so many stockholders cheer when a company announces that it’s buying back shares? Stated simply, repurchase programs can be hazardous to a company’s long-term financial health and often signal a management that has run out of better ways to invest in the business. And yet investors love them. Not all stock repurchases are bad, of course. But given the enormous popularity of buybacks nowadays, those that are harmful probably outnumber the beneficial. Those who run companies like buybacks because they make their earnings look better on a per-share basis. When fewer shares are outstanding, each one technically earns more. But a company’s overall profit growth is unaffected by share buybacks.

And comparing increases in earnings per share with real profit growth reveals the impact that buybacks have on that particular measure. Call it the buyback mirage. Consider Yahoo. The company bought back shares worth $6.6 billion from 2008 to 2014, according to Robert L. Colby, a retired investment professional and developer of Corequity, an equity valuation service used by institutional investors. These purchases helped increase Yahoo’s earnings per share about 16% annually, on average. But a good bit of that performance was the buyback mirage. Growth in Yahoo’s overall net profits came in at about 11% annually. Given these figures, Mr. Colby reckoned that Yahoo, if it had invested that same amount of money in its operations, would have had to generate only a 3.2% after-tax return to produce overall net profit growth of 16% annually over those years.

Some companies argue that the money they spend repurchasing stock is a shrewd use of their capital. And given Yahoo’s track record in recent years, its management team seems to have had a hard time identifying profitable investments. But Mr. Colby pointed out that buybacks provide only a one-time benefit, while smart investments in a company’s operations can generate years of gains. This analysis may be of interest to Starboard Value, an activist investor that is a large and unhappy Yahoo shareholder. On Thursday, Starboard nominated nine directors to replace the company’s entire board, saying its current members lack “the leadership, objectivity and perspective needed to make decisions that are in the best interests of shareholders.”

“Sure, the French may have day care and five-week vacations and 35-hour work weeks,” we’ve argued. “But we’ve got flat-screen TVs, $5 footlongs and big cars.”

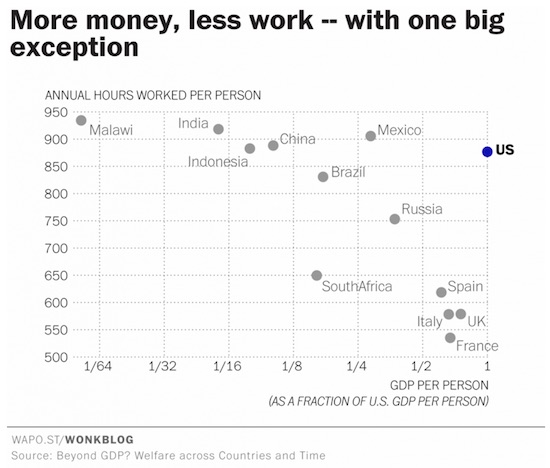

• Wealthier Countries Have More Leisure Time – With One Big Exception (Wef)

The American work ethic can basically be boiled down to one well-worn phrase: “Work hard, play hard.” But new research from a pair of Stanford University economists suggests we are failing, miserably, at the latter half of that maxim. Take a look at the chart below. It’s a plot of hours worked per capita versus GDP, and one country really stands out. As countries get wealthier, their annual hours worked per capita tend to decrease, at least in the sample examined here by economists Charles Jones and Peter Klenow. They measure GDP in fractions of U.S. GDP, because they’re most interested in how other countries stack up to the United States in terms of economic well-being. For instance, Russia’s GDP per capita is less than half of that in the United States, so it lands halfway down the chart’s X axis.

The relationship between GDP and working hours harkens back to economist John Maynard Keynes’ famous prediction that his grandchildren would be working 15-hour work weeks – thanks, in part, to increased productivity from new machines and technology. Since you’re probably reading this story at your office or on your commute, you’re well aware that things didn’t exactly work out this way. We didn’t trade our productivity gains for more time, we traded them instead for more stuff. But the extent of that trade-off -time versus stuff- hasn’t been the same in all countries, as the chart above illustrates. “Average annual hours worked per capita in the U.S. are 877 versus only 535 in France: the average person in France works less than two-thirds as much as the average person in the U.S.,” Jones and Klenow write. You see similar numbers in Spain, Italy and the UK.

For a long time we’ve used our stuff to justify our workaholism. “Sure, the French may have day care and five-week vacations and 35-hour work weeks,” we’ve argued. “But we’ve got flat-screen TVs, $5 footlongs and big cars.” Or, in strictly economic terms: “France’s per capita GDP is only 67% of ours. Who’s living the good life now?” But in their new research, forthcoming in the American Economic Review, Jones and Klenow attempt to devise a “a summary statistic for the economic well-being” that goes beyond GDP. Economists have proposed alternative measures incorporating everything from “greenness” to “gross national happiness.” The Stanford economists make the latest contribution to the genre with their measure that “combines data on consumption, leisure, inequality, and mortality.”

They find that when you throw these other qualities into the mix, the economic well-being gap between the United States and other wealthy countries shrinks – but it doesn’t disappear completely. “Living standards in Western Europe are much closer to those in the United States than it would appear from GDP per capita,” Jones and Klenow conclude. “Longer lives with more leisure time and more equal consumption in Western Europe largely offset their lower average consumption vis a visthe United States.” So, even when you factor in our ridiculously long work weeks, the things we miss out on when we work long hours, and the myriad ways that overwork iskilling us, the United States is still No. 1! Which is irksome, I’m sure, to the millions of French workers who spend literally the entire month of August at the beach.

Monsanto counts on the TPP and TTiP.

• Is Monsanto Losing Its Grip? (WS)

Monsanto is not having a good year. The company recently slashed its 2016 earnings forecast from the $5.10-$5.60 per share it had forecast in December to $4.40-$5.10, claiming that about 25-30 cents of the reduction was due to the stronger dollar. But judging by recent trends, a strong dollar could soon be the least of its concerns. Across a number of key markets, the company is facing growing resistance, not only from farmers and consumers but also, amazingly, governments. In India, the world’s biggest cotton producer, the Ministry of Agriculture accuses Monsanto of price gouging. It even imposed a 70% cut in the royalties that the firm’s Indian subsidiary could charge farmers for their crop genes, prompting Monsanto to threaten that it would withdraw its biotech crop genes from the country. If Monsanto’s threat was a bluff, it’s just been called.

According to Mandava Prabhakara Rao, the president of the National Seed Association of India (NSAI), Monsanto’s threat came as a big relief: All these years, the company has restrained us from using technologies other than the one developed by it. It forced the seed firms to sign the licence agreements that barred them from using other technologies. India’s government also seems unconcerned by the prospect of Monsanto’s withdrawal.“It’s now up to Monsanto to decide whether they want to accept this rate or not,” said Minister of state for agriculture and food processing, Sanjeev Balyan. “We’re not scared if Monsanto leaves the country, because our team of scientists are working to develop (an) indigenous variety of (GM) seeds.” India’s pushback against Monsanto is part of a gathering global backlash against Monsanto and the GMO industry as a whole.

Even in the U.S., where GMOs are estimated to represent more than 90% of corn, soybean, and cotton acres, the trend is no longer Monsanto’s friend. Earlier this year the company filed a lawsuit against the state of California for its intent to label glyphosate, the main chemical used in Monsanto’s flagship Roundup herbicide, as a probable carcinogen, in accordance with the World Health Organization’s recent findings. There’s also growing pressure on major food outlets to stop using GMO ingredients. After the USDA’s 2015 approval of genetically modified apples and potatoes, companies including McDonald’s and Wendy’s claimed they didn’t plan to use them, saying they were happy with non-GMO suppliers. Even more importantly, the Orwellian-titled Deny Americans the Right to Know (DARK) act, aimed at prohibiting mandatory GMO labelling, was defeated in the Senate last week.

Meanwhile, in Mexico, Monsanto’s fourth biggest market after the U.S., Brazil, and Argentina, a moratorium remains in place on the granting of licenses for GMO seed manufacturers like Monsanto, Dow, and Du Pont. In the face of growing public and judicial opposition, Monsanto & Friends have pinned their hopes on the Peña Nieto government’s upcoming agrarian reform act. Manuel Bravo, Monsanto’s director for Latin America, recently told El País that he is confident that once the legal problems in the courts are “resolved,” the issue will become a central plank in the current administration’s agenda. “The Government has been very clear about the importance of these technologies,” he said. Across the Atlantic, Monsanto’s problems are somewhat more intractable. Already more than half of EU countries have moved to bar GMO cultivation, while a last-minute mutiny by four EU states (France, Sweden, Italy, and the Netherlands) recently forced the postponement of a vote in Brussels on re-licensing glyphosate.

“This is a complicated, multi-sided war where our options are severely limited..”

• Pentagon, CIA-Armed Militias Fight Each Other In Syria (LA Times)

Syrian militias armed by different parts of the U.S. war machine have begun to fight each other on the plains between the besieged city of Aleppo and the Turkish border, highlighting how little control U.S. intelligence officers and military planners have over the groups they have financed and trained in the bitter five-year-old civil war. The fighting has intensified over the last two months, as CIA-armed units and Pentagon-armed ones have repeatedly shot at each other while maneuvering through contested territory on the northern outskirts of Aleppo, U.S. officials and rebel leaders have confirmed. In mid-February, a CIA-armed militia called Fursan al Haq, or Knights of Righteousness, was run out of the town of Marea, about 20 miles north of Aleppo, by Pentagon-backed Syrian Democratic Forces moving in from Kurdish-controlled areas to the east.

“Any faction that attacks us, regardless from where it gets its support, we will fight it,” Maj. Fares Bayoush, a leader of Fursan al Haq, said in an interview. Rebel fighters described similar clashes in the town of Azaz, a key transit point for fighters and supplies between Aleppo and the Turkish border, and on March 3 in the Aleppo neighborhood of Sheikh Maqsud. The attacks by one U.S.-backed group against another come amid continued heavy fighting in Syria and illustrate the difficulty facing U.S. efforts to coordinate among dozens of armed groups that are trying to overthrow the government of President Bashar Assad, fight the Islamic State militant group and battle one another all at the same time. “It is an enormous challenge,” said Rep. Adam Schiff (D-Burbank), the top Democrat on the House Intelligence Committee, who described the clashes between U.S.-supported groups as “a fairly new phenomenon.”

“It is part of the three-dimensional chess that is the Syrian battlefield,” he said. The area in northern Syria around Aleppo, the country’s second-largest city, features not only a war between the Assad government and its opponents, but also periodic battles against Islamic State militants, who control much of eastern Syria and also some territory to the northwest of the city, and long-standing tensions among the ethnic groups that inhabit the area, Arabs, Kurds and Turkmen. “This is a complicated, multi-sided war where our options are severely limited,” said a U.S. official, who wasn’t authorized to speak publicly on the matter. “We know we need a partner on the ground. We can’t defeat ISIL without that part of the equation, so we keep trying to forge those relationships.”

More refugees.

• Saudi Arabia Campaign Leaves 80% Of Yemen Population Needing Aid (G.)

It is difficult to view Saudi Arabia’s relentless war of attrition in Yemen as anything other than a destructive failure. The military intervention that began one year ago has killed an estimated 6,400 people, half of them civilians, injured 30,000 more and displaced 2.5 million, according to the UN. Eighty per cent of the population, about 20 million people, are now in need of some form of aid. The Saudis’ principal aim – to restore Yemen’s deposed president, Abd Rabbuh Mansur Hadi – has not been achieved. If they hoped to contain spreading Iranian regional influence, that has not worked, either. If the US-backed coalition’s campaign was intended to combat terrorism, that too has flopped. Al-Qaida in the Arabian Peninsula (AQAP), in particular, and Islamic State (Isis) have profited from the continuing anarchy.

The conflict pits Aden-based Hadi government forces and their Sunni Arab allies against Houthi Shia militias, backed by Tehran, who control the capital, Sana’a, and much of central and northern Yemen. Already one of the world’s poorest countries before fighting escalated last year, Yemen now faces widespread famine. Food shortages are being exacerbated by a growing bank and credit crisis, Oxfam warned this week. “The destruction of farms and markets, a de facto blockade on commercial imports, and a long-running fuel crisis have caused a drop in agricultural production, a scarcity of supplies and exorbitant food prices,” Oxfam said. Sajjad Mohamed Sajid, Oxfam’s country director, said: “A brutal conflict on top of an existing crisis … has created one of the biggest humanitarian emergencies in the world today – yet most people are unaware of it. Close to 14.4 million people are hungry and the majority will not be able to withstand the rising prices.”

Inevitable. Refugee streams flow like water. Impossible to stop.

• Smugglers Prepare New Human Trafficking Route To Italy (DW)

Trafficking gangs are arranging a new way to ship migrants from Turkey to the EU by sailing to Italy, a leading German newspaper reports. Demand for alternative routes has been rising for weeks, according to the article. The smugglers intended to start transporting refugees via the new Italian route in the first week of April, according to the Sunday edition of the “Frankfurter Allgemeine Zeitung” newspaper. They would reportedly use small cargo vessels and fishing ships to ferry their customers from the seaside resort Antalya in Turkey, the Turkish city of Mersin near the Syrian border, and the Greek capital Athens. According to the paper, the price for such trip is between 3,000 and 5,000 euros ($3,400 -$5,600), which is much more expensive than traveling the usual route from Turkish shores to one of the Greek islands.

However, refugees face growing obstacles attempting to reach Western Europe through Greece, with several countries along the Balkan route closing their borders to migrants. Last week, the EU also forged an agreement with Ankara about shipping migrants back to Turkey, slowing the influx to a trickle. The traffickers responded to growing demand for alternative routes in recent weeks by preparing their new venture, according to the Sunday article. Some of the smugglers aimed to offer two trips per week, and at least one claimed he could fit 200 people on a boat. They also advised migrants to stay below deck until the vessels reached international waters. In addition to migrants in Turkey and Greece, hundreds of thousands of people were waiting to cross to Italy from Libya, EU officials said. The Italian interior ministry has registered almost 14,000 arrivals this year.

“..In August [2015], we had 40-50 Moroccans, and in November, their number was over 7,000.”

• EU Prepares For Massive Migration Flows From Libya (EurActiv)

EU leaders will discuss the critical situation in Libya and potential waves of immigrants trying to reach Europe on 18 April, EurActiv Greece has been informed. The discussion will take place following the regular Foreign Affairs Council meeting and ahead of Foreign Affairs Council Defence on 19 April, in Luxembourg. French Defence Minister Jean-Yves Le Drian said yesterday (24 March) that some 800,000 migrants are in Libya hoping to cross to Europe. Le Drian told Europe 1 radio that “hundreds of thousands” of migrants were in Libya, having fled conflict and poverty in the Middle East and elsewhere, adding that the figure of 800,000 was “about right”. In an interview with EurActiv in December, Greece’s Alternate Foreign Minister for European Affairs, Nikos Xydakis, noted that new routes and new compositions [in migration flows] were found.

“The people who now come from the Turkish coast to the Greek islands are from the Maghreb. Let me give you an example. In August [2015], we had 40-50 Moroccans, and in November, their number was over 7,000.” “The route we have identified is the following: Moroccans and Algerians can travel without a visa from Maghreb countries, with a very cheap ticket with Turkish Airlines, directly to Constantinople [Istanbul], and then they easily reach the coast and go to the other side [Greece],” Xydakis said. But the presence of NATO in the Aegean Sea combined with a possible “isolation” in Greece due to the closed borders on the north might have discouraged migrants and re-directed the routes.

Home › Forums › Debt Rattle March 28 2016