How we got here

This is a global issue, the left has moved so far right it has no identity left. Nice detail: The Parti Socialiste of the current president could be bankrupted by its dismal campaign.

• Disintegrating Left-Right Divide Sets Stage For French Political Upheaval (G.)

Do they vote for or against? Do they choose a candidate who represents their politics or one who, opinion polls suggest, is most likely to defeat the woman whose presence as one of two candidates in the second-round runoff in a fortnight seems a given, but whose name still provokes a frisson of fear for many: the far-right Front National leader Marine Le Pen, with her anti-Europe, anti-immigration, “French-first” programme? As election day has approached, and with the added complication of the terrorist threat following the shooting of a police officer on the Champs-Elysées in Paris, the dilemma has caused particular anguish for France’s mainstream leftwing voters, whose candidate is trailing in fifth place.

There are no certainties, but barring all other candidates “dropping from a nasty virus”, as one political analyst put it, Benoît Hamon is facing a crushing defeat in the first round, ending his leadership dreams and putting the future of the country’s Socialist party (PS) in question. In a decline that mirrors that of Britain’s Labour party, the PS is facing years in a political desert, if it survives. If Hamon finishes last among the leading candidates, as polls predict, the party’s only hope of salvaging a thread of power will lie in winning enough parliamentary seats in the legislative elections that follow to form an influential group in the national assembly. Even then it will most likely be part of a coalition rather than a fully functioning opposition.

Even worse, and even more unthinkable, if leftwing voters turn en masse to Jean-Luc Mélenchon as their best hope of a place in the second round against the frontrunners – independent centrist Emmanuel Macron, Le Pen or the conservative François Fillon – and Hamon polls less than 5%, none of Hamon’s campaign expenses will be reimbursed, bankrupting the PS. “Under 5% and the situation is really catastrophic,” Marc-Olivier Padis, of the Paris-based thinktank Terra Nova, told the Observer. “And it’s possible. We are hearing many socialists wondering if they should vote Mélenchon or Macron. The only thing that can save the party in this election is if enough socialists vote for Hamon out of loyalty.”

It’s about the economy, guys. Too many people are left with too little. That’s when they choose to be their own boss -again-.

• The Main Issue in the French Presidential Election: National Sovereignty (CP)

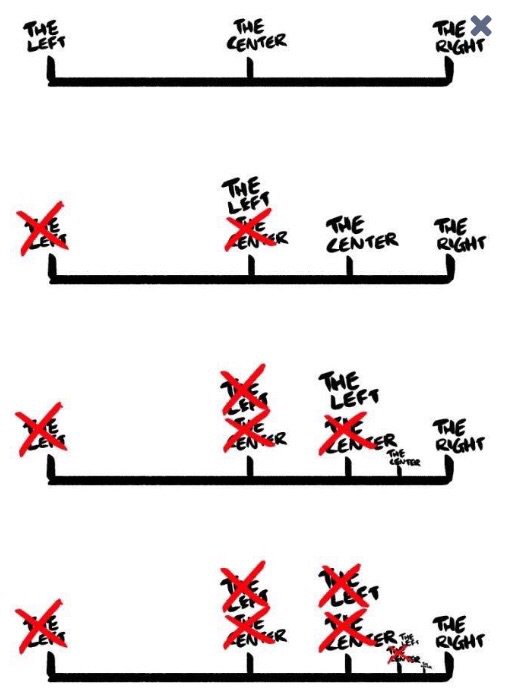

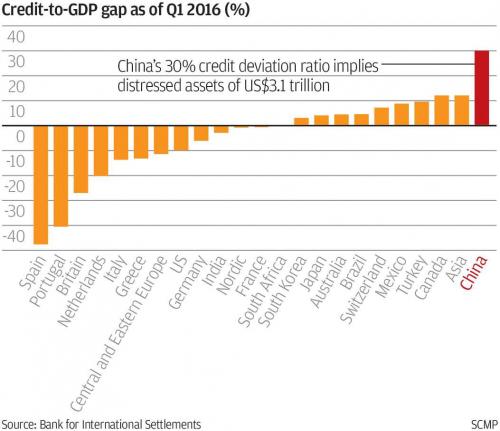

The 2017 French Presidential election marks a profound change in European political alignments. There is an ongoing shift from the traditional left-right rivalry to opposition between globalization, in the form of the European Union (EU), and national sovereignty. Standard media treatment sticks to a simple left-right dualism: “racist” rejection of immigrants is the main issue and that what matters most is to “stop Marine Le Pen!” Going from there to here is like walking through Alice’s looking glass. Almost everything is turned around. On this side of the glass, the left has turned into the right and part of the right is turning into the left. Fifty years ago, it was “the left” whose most ardent cause was passionate support for Third World national liberation struggles.

The left’s heroes were Ahmed Ben Bella, Sukarno, Amilcar Cabral, Patrice Lumumba, and above all Ho Chi Minh. What were these leaders fighting for? They were fighting to liberate their countries from Western imperialism. They were fighting for independence, for the right to determine their own way of life, preserve their own customs, decide their own future. They were fighting for national sovereignty, and the left supported that struggle. Today, it is all turned around. “Sovereignty” has become a bad word in the mainstream left. National sovereignty is an essentially defensive concept. It is about staying home and minding one’s own business. It is the opposite of the aggressive nationalism that inspired fascist Italy and Nazi Germany to conquer other countries, depriving them of their national sovereignty.

The confusion is due to the fact that most of what calls itself “the left” in the West has been totally won over to the current form of imperialism – aka “globalization”. It is an imperialism of a new type, centered on the use of military force and “soft” power to enable transnational finance to penetrate every corner of the earth and thus to reshape all societies in the endless quest for profitable return on capital investment. The left has been won over to this new imperialism because it advances under the banner of “human rights” and “antiracism” – abstractions which a whole generation has been indoctrinated to consider the central, if not the only, political issues of our times.

The fact that “sovereignism” is growing in Europe is interpreted by mainstream globalist media as proof that “Europe is moving to the right”– no doubt because Europeans are “racist”. This interpretation is biased and dangerous. People in more and more European nations are calling for national sovereignty precisely because they have lost it. They lost it to the European Union, and they want it back. That is why the British voted to leave the European Union. Not because they are “racist”, but primarily because they cherish their historic tradition of self-rule.

French government debt could become ineligible as collateral if Le Pen and/or Melenchon do too well.

• ECB Stands Ready to Support Banks If Needed After France Vote (BBG)

ECB officials signaled that their liquidity facilities remain available to counter any market tension that may arise in the aftermath of France’s presidential election, the first round of which takes place Sunday. “The central bank should be ready for any shocks that should materialize,” Governing Council member Ignazio Visco said at a press conference during the IMF spring meetings in Washington on Saturday. “And if there were to be such a shock, the instruments are the instruments that a central bank should use, which are liquidity provision, refinancing when needed. And intervening very quickly is really very easy now given the instruments we have.” Like the U.K.’s vote on whether to continue its membership of the EU in June, central bank readiness to support the banking system has been sought given the potential for such political events to create market turmoil.

In this case, a strong showing in the first round by anti-euro candidate Marine Le Pen could cast doubt over the future of the single currency. Visco argued that the presence of central bank facilities makes it less likely they’ll actually be needed. [..] The euro area has years of experience with banking freeze-ups and has multiple instruments to address liquidity shortages that strike otherwise solvent banks. In particular, in the event a sudden credit-rating downgrade made French government debt ineligible as collateral for normal ECB refinancing operations, so-called Emergency Liquidity Assistance may be available from the Bank of France. “If there should be problems for specific French banks, liquidity-wise, then the ECB has instruments to help solvent banks with liquidity problems,” Governing Council member Ewald Nowotny said on Saturday. “This is ELA, emergency liquidity assistance. That could be given of course. But we don’t expect any special movements.”

“Donald Trump and the GOP need an easy, highly visible legislative victory. Breaking up the Fed meets this criteria.”

• It Is Time To Break Up The Fed (IFT)

Donald Trump and the GOP need an easy, highly visible legislative victory. Breaking up the Fed meets this criteria. In the aftermath of the Great Financial Crisis, policymakers rushed out the Dodd-Frank Act. This Act increased the Fed’s responsibilities. However, policymakers did this without examining the Fed’s performance in the run-up to the financial crisis. Had they done so, they would have seen the Fed failed as a bank supervisor and regulator. This failure alone mandates breaking up the Fed. After all, why should the Fed be given a second chance given how much its failure hurt the global real economy and taxpayers? Furthermore, this failure strongly suggests policymakers shouldn’t have rewarded the Fed with additional responsibilities. After all, there is no reason to believe the Fed’s failure as a bank supervisor and regulator won’t be repeated with any new responsibilities.

To the extent these new responsibilities exist in the Dodd-Frank Act, they too should be stripped away. What the Fed should be left with is responsibility for monetary policy and the payment system. All of the Fed’s bank supervision and regulatory responsibility should be transferred to the FDIC. There are many significant benefits from doing this including it reinforces market discipline on the banks. Unlike the Fed, the FDIC is responsible for protecting the taxpayers and has the authority to close a bank. The FDIC’s primary responsibility is minimizing the risk of loss by the taxpayer backed deposit insurance fund. It achieves this initially through regulation and supervision, but more importantly by a willingness to step in and close a bank that threatens to cause a loss to the fund.

Shareholders and unsecured bank creditors are keenly aware they are likely to lose their entire investment should the FDIC step up and close the bank they are invested in. As a result, they have an incentive to exert discipline on bank management to limit its risk taking so the bank is never taken over by the FDIC. For those who would argue that it is important to keep bank supervision and regulation together with monetary policy, I would point out there is no evidence showing this produces a better outcome. In the run-up to the Great Financial Crisis, the Bank of England and the ECB did not have supervision and regulation responsibility. The Fed did. Talk about a perfect controlled experiment.

China needs more than $13 to create $1 of growth.

• China’s Credit Excess Is Unlike Anything The World Has Ever Seen (Brown)

From a global macroeconomic perspective, we encourage readers to consider that the world is experiencing an extended, rolling process of deflating its credit excesses. It is now simply China’s turn. For context, Japan started deflating their credit bubble in the early 1990s, and has now experienced more than 20 years of deflation and very little growth since. The US began its process in 2008, and after eight years has only recently been showing signs of sustainable recovery. The euro zone entered this process in 2011 and is still struggling six years onward. We believe China is now entering the early stages of this process. Having said that, we believe that Chinese authorities have a viable plan for deflating their credit excess in an orderly fashion.

Please stay posted as we will review this multi-pronged, market-based approach in our next column. For now, let’s turn our attention to the size of the credit excess that China created and why we estimate it to be the largest in the world. A credit excess is created by the speed and magnitude of credit that is created – if too much is created in too short a time period, excesses inevitably occur and non-performing loans (NPLs) emerge. To illustrate the credit excess that has been created in China, let’s review several key indicators, including the: 1) flow of new credit; 2) stock of outstanding credit; 3) credit deviation ratio (i.e., excess credit); 4) incremental capital output ratio (efficiency of credit allocation).

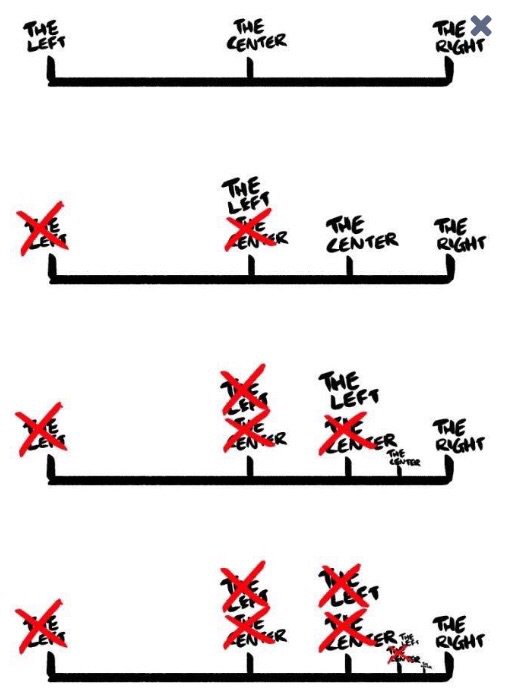

The US created 58% of GDP between 2002-07, and the global financial crisis followed. Japan created credit equivalent to the entire size of its economy between 1985-90 and subsequently experienced more than 20 years of deflation (admittedly reflecting the lack of restructuring). Thailand created a significant real estate bubble between 1992-97 and ended up with about 45% NPL ratios. Spain created credit equivalent to 116% of GDP between 2002-07 and still is trying to address a 20% unemployment rate. China created 139% of GDP in new credit between the first quarter of 2009 and the third quarter of 2014 (when GDP growth peaked), far greater than what was created in other major credit bubbles globally.

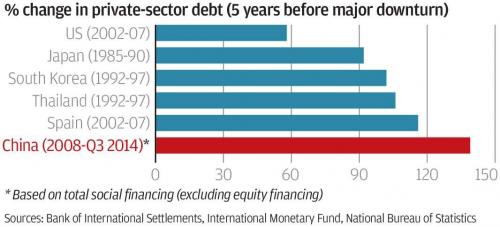

[..] Another important measure to assess the amount of credit in the economy which is “excessive” is the credit-to-GDP gap, as reported by the Bank of International Settlements. This ratio measures the difference between the current credit-to-GDP ratio in an economy against its long-term trend of what is necessary to optimally support long-term GDP growth. It is akin to measuring the amount of credit that is productively deployed into an economy. This metric is used by the Basel III framework in determining countercyclical capital buffers for a country’s banking system when credit creation becomes too fast (i.e., high credit growth requires higher capital ratios for banks).

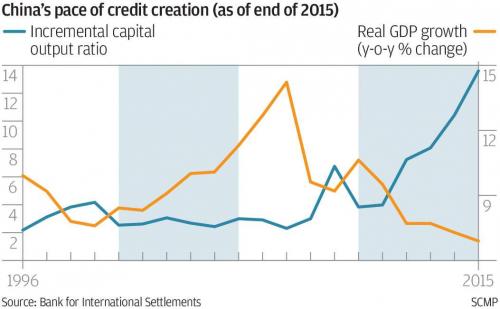

Finally, to show that the pace of credit creation will necessarily slow, thereby exposing misallocated credit and driving the emergence of new NPL formation, we turn to the deterioration in China’s incremental capital output ratio. This ratio is the measure of the number of units of input required to produce one unit of GDP. For the 15 years prior to the credit impulse in 2009-14, China’s incremental capital output ratio has been consistently between two and four. Meaning that two to four yuan in fixed asset investment created one yuan in GDP. But as a result of the credit-driven economic growth model, and the excessive credit that has been created (and the subsequent excess capacity in the industrial economy), China’s investment efficiency has deteriorated to the point that its incremental capital output ratio is now over 13. Said another way, every 1 yuan in new fixed asset investment is now creating only 7 fen in GDP.

Full employment, anyone?

• The US Retail Bubble Has Now Burst (ZH)

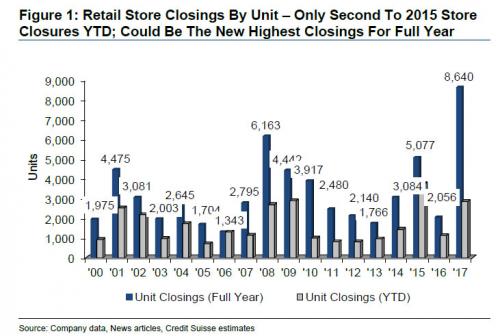

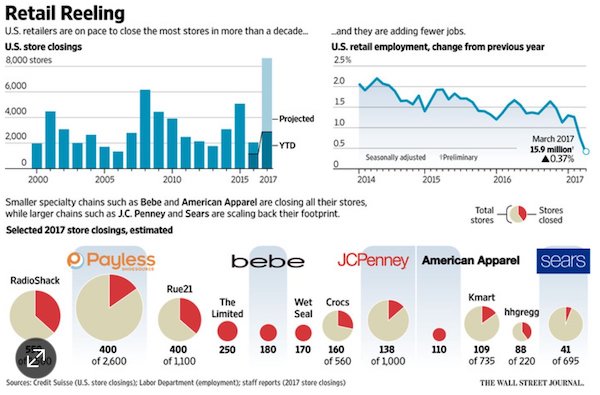

The devastation in the US retail sector is accelerating in 2017, and in addition to the surging number of brick and mortar retail bankruptcies, it is perhaps nowhere more obvious than in the soaring number of store closures. While the shuttering of retail stores has been a frequent topic on this website, most recently in the context of the next “big short”, namely the ongoing deterioration in the mall REITs and associated Commercial Mortgage-Backed Securities and CDS, here is a stunning fact from Credit Suisse:”Barely a quarter into 2017, year-to-date retail store closings have already surpassed those of 2008.”

According to the Swiss bank’s calculations, on a unit basis, approximately 2,880 store closings were announced YTD, more than twice as many closings as the 1,153 announced during the same period last year. Historically, roughly 60% of store closure announcements occur in the first five months of the year. By extrapolating the year-to-date announcements, CS estimates that there could be more than 8,640 store closings this year, which will be higher than the historical 2008 peak of approximately 6,200 store closings, which suggests that for brick-and-mortar stores stores the current transition period is far worse than the depth of the credit crisis depression.

As the WSJ calculates, at least 10 retailers, including Limited Stores, electronics chain hhgregg and sporting-goods chain Gander Mountain have filed for bankruptcy protection so far this year. That compares with nine retailers that declared bankruptcy, with at least $50 million liabilities, for all of 2016. On Friday, women’s apparel chain Bebe Stores said it would close its remaining 170 shops and sell only online, while teen retailer Rue21 Inc. announced plans to close about 400 of its 1,100 locations. Another striking fact: on a square footage basis, approximately 49 million square feet of retail space has closed YTD. Should this pace persist by the end of the year, total square footage reductions could reach 147M square feet, another all time high, and surpassing the historical peak of 115M in 2001.

There are several key drivers behind the avalanche of “liquidation” signs on store fronts. The first is the glut of residual excess retail space. As the WSJ writes, the seeds of the industry’s current turmoil date back nearly three decades, when retailers, in the throes of a consumer-buying spree and flush with easy money, rushed to open new stores. The land grab wasn’t unlike the housing boom that was also under way at that time. “Thousands of new doors opened and rents soared,” Richard Hayne, chief executive of Urban Outfitters Inc., told analysts last month. “This created a bubble, and like housing, that bubble has now burst.”

No matter how you try to explain it away, in the end it’s just people having less to spend.

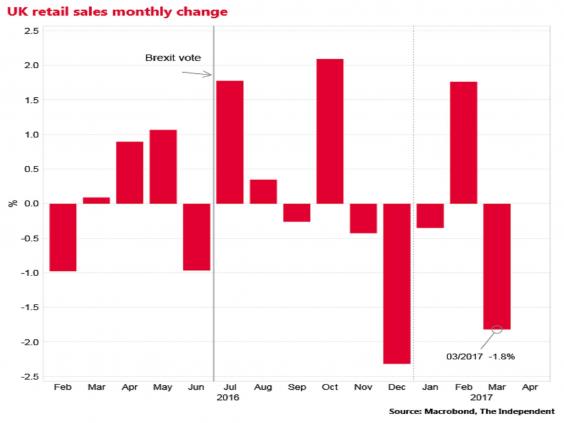

• UK Retail Sales Volumes Fall At Fastest Rate In Seven Years (Ind.)

Retail sale volumes slumped in March, seeming to confirm doubts about the robustness of the consumer-led economy in the wake of last summer’s Brexit vote. According to the Office for National Statistics, sales were down 1.8% in the month, against City expectations of a 0.2% decline. The monthly data can be volatile and March’s decline follows a 1.7% spike in February, but the ONS itself highlighted the weakening trend this year and noted that over the three months to March there was the first quarterly decline in volumes since 2013. In the first quarter of 2017 sales were down 1.4%, the biggest decline since the first three months of 2010 when they fell 2%.

Retail sales performed much better than expected in the immediate wake of last June’s Brexit vote, helping to boost overall GDP growth and confounding widespread expectations that the economy would fall into recession. But economists said the latest data suggested gravity was now asserting itself as inflation, stemming from the sharp depreciation of the pound since last June, eats into incomes and wage growth remains chronically weak. “We should see these retail sales figures as the start of a period of much weaker consumer spending growth – which will act as a drag on the overall progress of the UK economy over this year and next,” said Andrew Sentance, senior economic adviser at PwC.

“This is the clearest indication yet that the expected slowdown in the UK economy has begun, and we should expect to see this confirmed in other economic data over the next few months.” James Knightley, an economist at ING described the figures as “dreadful”. “The story for the household sector isn’t great right now. Inflation is eating into household spending power with wages once again failing to keep pace with the rising cost of living. There is also a growing sense of job insecurity highlighted in some surveys, which may also be making households a little nervous,” he said. The household saving ratio, the gap between the sector’s aggregate income and spending, fell to just 3.3% in the final quarter of 2016, the weakest on record, prompting questions about the sustainability of the rate of consumer spending. Retail sales account for around 30% of household consumption, which in turn accounts for 60% of UK GDP.

“..1.5 million people work in low-paid UK retail jobs..” They can’t afford the products they sell. Henry Ford had a solution to that.

• BHS Crash Sets Trend For A Chain Of Store Closures On UK High Streets (G.)

The fact that Britain’s unemployment rate has fallen to its joint lowest level since 1975 belies the experience of thousands of BHS staff, who have struggled to find an equivalent job with a contract and regular hours. The jobless rate may be just 4.7% but official records show the number of people on zero-hours contracts hit a record high of 905,000 in the final three months of 2016. That was an increase of 101,000, or 13%, compared with the same period a year earlier. Last year, research by industry trade body the British Retail Consortium (BRC) identified a “lost generation” of predominantly female shop workers who – as thousands of BHS staff would find out – risk losing their jobs as structural change chews up the high street. It estimated there were nearly 500,000 retail workers, aged between 26 and 45, many of whom have children and need to work close to their family home, who would find it hard to find alternative jobs.

Using the benchmark of those earning less than £8.05 an hour, the BRC says 1.5 million people work in low-paid UK retail jobs. About 70% are female and one in five receive means-tested working age tax credits. Norman Pickavance, chair of the Fabian Society taskforce on the future of retail, says the majority of companies in the sector are trying to save money by moving towards less secure employment models. “There are more and more zero-hours-type contracts and self employment,” he says. “A year on from the demise of BHS, most retailers are continuing down that route of flexibility but there is a risk to them from Brexit. They have only been able to use these methods because of the abundance of labour and might have to rethink.”

[..] This trend is writ larger in the US, where analysts are talking about a “retail apocalypse”, as main street veterans like Macy’s and Sears line up to announce major store closure programmes. With American Apparel, Abercrombie & Fitch and JCPenney also axing stores, hundreds of American shopping mall outlets are closing for good. The cost in job terms has been stark, with more than 89,000 retail positions eliminated over the last six months. New York-based Global Data analyst Neil Saunders says the US and UK retail markets are not mirror images, with the American woes resulting from the fallout from a belated move by store chiefs to address the threat posed by the internet.

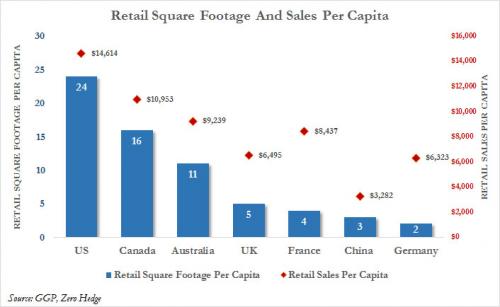

With more than five times more retail square footage per person than the UK, American store chiefs have also got a bigger problem on their hands than their British counterparts. “In terms of online penetration, the US is where the UK was five or so years ago,” continues Saunders. “What we are seeing is large US retailers scrabbling to adjust.” He adds: “Generally, UK retail is at a much later evolutionary stage than the US. There has already been quite a lot of adjustment in terms of the closure and adaptation of physical space.

Everyone spies on everyone. Growth industry.

• German Intelligence Spied On Interpol In Dozens Of Countries (R.)

Germany’s BND foreign intelligence agency spied on the Interpol international police agency for years and on the group’s country liaison offices in dozens of countries such as Austria, Greece and the United States, a German magazine said. Der Spiegel magazine, citing documents it had seen, said the BND had added the email addresses, phone numbers and fax numbers of the police investigators to its sector surveillance list. In addition, the German spy agency also monitored the Europol police agency Europol which is based in The Hague, the magazine said. Der Spiegel reported in February that the BND also spied on the phones, faxes and emails of several news organizations, including the New York Times and Reuters.

The BND’s activities have come under intense scrutiny during a German parliamentary investigation into allegations that the US National Security Agency conducted mass surveillance outside of the United States, including a cellphone used by Chancellor Angela Merkel. Konstantin von Notz, a Greens party member who serves on the investigative committee, described the latest report about the BND’s spying activities as “scandalous and unfathomable.” “We now know that parliaments, various companies and even journalists and publishers have been targeted, as well as allied countries,” von Notz said in a statement. He said the latest reports showed how ineffective parliamentary controls had been thus far, despite new legislation aimed at reforming the BND. “It represents a danger to our rule of law,” he said.

So what as the Pope done to alleviate the issue? How has he used the Vatican’s opulent riches to make life better for refugees?

• Pope Likens Refugee Holding Centers To ‘Concentration Camps’ (G.)

Pope Francis urged governments on Saturday to get migrants and refugees out of holding centers, saying many had become “concentration camps”. During a visit to a Rome basilica, where he met migrants, Francis told of his visit to a camp on the Greek island of Lesbos last year. There he met a Muslim refugee from the Middle East who told him how “terrorists came to our country”. Islamists had slit the throat of the man’s Christian wife because she refused to throw her crucifix the ground. “I don’t know if he managed to leave that concentration camp, because refugee camps, many of them, are of concentration (type) because of the great number of people left there inside them,” the pope said.

Francis praised countries helping refugees and thanked them for “bearing this extra burden, because it seems that international accords are more important than human rights”. He did not elaborate but appeared to be referring to agreements that keep migrants from crossing borders. In February, the European Union pledged to finance migrant camps in Libya as part of a wider European Union drive to stem immigration from Africa. Humanitarian groups have criticized efforts to stop migrants in Libya, where – according to a U.N. report last December – they suffer arbitrary detention, forced labor, rape and torture.

Home › Forums › Debt Rattle April 23 2017