Paul Gauguin Avenue de Clichy 1889

“What do credit traders look at when they mark their books? Well, these days it is fair to say that they have more than one eye on the equity market.”

• Central Banks “Took Over” Markets In 2009; In December “Unwind” Begins (ZH)

Citigroup’s crack trio of credit analysts, Matt King, Stephen Antczak, and Hans Lorenzen, best known for their relentless, Austrian, at times “Zero Hedge-esque” attacks on the Fed, and persistent accusations central banks distort markets, all summarized best in the following Citi chart… have come out of hibernation, to dicuss what comes next for various asset classes in the context of the upcoming paradigm shift in central bank posture. In a note released by the group’s credit team on March 27, Lorenzen writes that credit’s “infatuation with equities is coming to an end.” “What do credit traders look at when they mark their books? Well, these days it is fair to say that they have more than one eye on the equity market.”

Understandable: after all, as the FOMC Minutes revealed last week, even the Fed now openly admits its policy is directly in response to stock prices. As the credit economist points out, “statistically, over the last couple of years both markets have been influencing (“Granger causing”) each other. But considering the relative size, depth and liquidity of (not to mention the resources dedicated to) the equity market, we’d argue that more often than not, the asset class taking the passenger seat is credit. Yet the relationship was not always so cosy. Over the long run, the correlation in recent years is actually unusual. In the two decades before the Great Financial Crisis, three-month correlations between US credit returns and the S&P 500 returns tended to oscillate sharply and only barely managed to stay positive over the long run..

Rudolf E. Havenstein@RudyHavenstein

Replying to @zerohedge

Here is a chart of the well being of the American middle-class and poor over the same period.

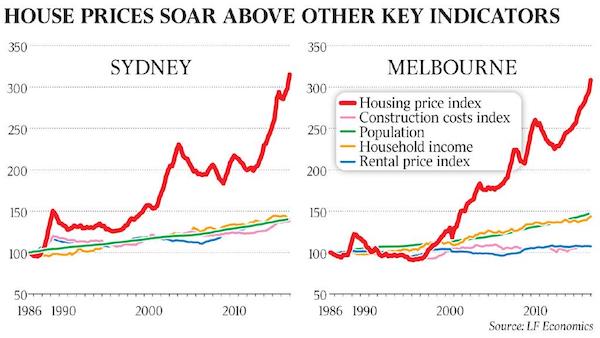

“Tell a European you think there’s a housing bubble and you’ll have a reasonable discussion,” Grantham said. “Tell an Australian and you’ll have World War III…”

• ‘No Bubble, No Pop’: Why Banks Are As Safe As Houses (WAus)

The housing sector is therefore picking up the slack, and as far as the Westpac chair can discern the underlying demand is real. “That’s why I believe there is no bubble — there is huge demand from local and offshore buyers,” he says. “But that doesn’t mean we’re not looking at things like the capacity to pay interest and repay principal, so we don’t have any issues with the measures announced (on March 31). “APRA has its mandate; we have ours. But we have no interest in lending to people who can’t repay.” That’s the reasoned analysis from Norris and Maxsted, and Henry mostly concurs. If you’re after the full Catherine wheel experience, try taking the alternative position as a market-leading fund manager or economist and warning the public about an inflating property bubble. Legendary US investor Jeremy Grantham did just that, vowing in 2012 he would never do it again. “Tell a European you think there’s a housing bubble and you’ll have a reasonable discussion,” Grantham said. “Tell an Australian and you’ll have World War III. Been there, done that!”

Local economist Steve Keen entered the fray in 2009, likening the experience to “having my genitals cut off”, while hedge fund managers have lost so much money short-selling Australian banks because they expected the bubble to pop that it’s been called the “widow maker’s” trade. True to his word, Grantham failed to respond to an email inviting him to trigger World War III. Keen, who has relocated to Britain but was in Australia this week, has no such hesitation, saying it is abundantly clear that we’re in a debt-fuelled housing bubble that has only a year or two to run before it pops. “We’re in hock to the banks and we depend on endless rising levels of credit,” the economics professor says. “Credit can continue rising but eventually you reach a peak and the gas runs out.”

Denmark, according to Keen, reached its world-record peak in 2010 at a household debt-to-GDP ratio of 139 per cent. While Australia is currently at 123 per cent, the country has some headroom because the corporate sector has deleveraged and the RBA still has some policy ammunition with the 1.5 per cent cash rate. Keen reckons we have two years, at most, before unravelling in a similar, catastrophic way to Ireland in the financial crisis. However Phil Ruthven, the experienced forecaster and founder of IBISWorld, says low interest rates mean that debt servicing is the lowest it’s been in 50 years. “But we do need to increase supply, and we do need to warn home buyers of the dangers of going too deep into debt when interest rates are rising,” Ruthven says.

“They no longer have the means to meet basic needs, with consumption of milk and bread right down and payment of electricity bills at an all-time low.”

• Greek Gloom As Economy Stalls Amid Latest Bout Of EU Wrangling (G.)

Eight years into Greece’s ordeal to escape bankruptcy, thousands of Communist party sympathisers packed into Syntagma Square in Athens on Friday to protest at the latest concessions made by Alexis Tsipras’s leftist government to keep the country afloat. Massed before parliament in the fading light of day, they did what they had come to do: rail against the cuts that loom in return for further disbursement of the emergency aid now needed to avert economic collapse. The serial drama of Greece’s debt repayments will reach a climax again when loans of €7.5bn mature in July. That communist-aligned unionists can still muster such protests is testament to the party’s zealous determination to make itself heard. Most Greeks gave up demonstrating long ago.

Two years short of a decade in freefall, and with little prospect of recovery, the nation has succumbed to protest fatigue. With the exception of pensioners – the great losers in Greece’s assault by austerity – anger has been replaced by malaise, the lassitude that strikes when loss becomes commonplace. Friday’s protest, one of more than 60 nationwide, came within hours of Europe escaping another dose of Greek drama after eurozone finance ministers announced that bailout talks – stalled as Athens bickered over the terms of its latest compliance review with lenders – could finally resume. International auditors representing the bodies behind the three bailout packages the country has received since May 2010 are expected to return to Greece on Monday. Once technical issues are addressed, the delayed bailout payment will be disbursed, ensuring default is averted in July.

In exchange, the once fiercely anti-austerity Tsipras has signed up to further reforms worth €3.6bn, the equivalent of 2% of GDP, to be put into effect once the current programme ends next year. “It is in the nature of every agreement for there to be compromises,” said Greek finance minister Euclid Tsakalotos, who faces the thankless task of having to sell the prospect of more pension cuts and tax rises to sceptical leftists in the ruling Syriza party when it convenes on Sunday. “There are things that will upset … the Greek people.” After more than a year of hard talk and bluster – the review was meant to have been concluded in February 2016 – the government once again conceded on its own red lines, reflecting Athens’s overarching policy of keeping Greece in the heart of the eurozone. Tsipras, who fought hard to ensure countermeasures can also be taken to offset losses if economic indicators are better than expected, was quick to sound optimistic. “The Greek economy,” he announced, “is ready to leave the crisis behind it.”

But the breakthrough falls far short of the all-inclusive package the government was hoping for. Once again, promises of reducing the country’s staggering debt pile – at 180% of GDP, the biggest impediment to real economic recovery – will have to wait. [..] Unemployment has increased from 23.2% to 23.5%, with investors – the only guarantee of soaking up such an oversupply of labour – staying away. In a repeat of the chaos that beset the country’s financial system at the height of the crisis in 2015, an estimated €2.5bn of deposits left Greek banks in January and February. Consumption is also down. “The 37% of Greeks at risk of poverty and social exclusion really cannot make ends meet,” said Aliki Mouriki, a leading Greek sociologist. “They no longer have the means to meet basic needs, with consumption of milk and bread right down and payment of electricity bills at an all-time low.”

That’s what you get for publishing made-up reports all the time, NYT.

• The Picture Of Our Economy Looks A Lot Like A Rorschach Test (NYT)

Economics has a foundation in hard numbers – employment, inflation, spending – that has largely allowed it to sidestep the competing partisan narratives that have afflicted American politics and culture. But not anymore. Since Donald J. Trump’s victory in November, consumer sentiment has diverged in an unprecedented way, with Republicans convinced that a boom is at hand, and Democrats foreseeing an imminent recession. “We’ve never recorded this before,” said Richard Curtin, who directs the University of Michigan’s monthly survey of consumer sentiment. Although the outlook has occasionally varied by political party since the survey began in 1946, “the partisan divide has never had as large an impact on consumers’ economic expectations,” he said.

At the same time, familiar economic data points have become Rorschach tests. That was evident after the government’s monthly jobs report on Friday; Republicans’ talking points centered on a 10-year low in the unemployment rate, while Democrats focused on a sharp decline in job creation. “I find it stunning, to be honest. It’s unreal,” said Michael R. Strain, director of economic policy studies at the conservative American Enterprise Institute in Washington. “Things that were less politicized in the past, like how you feel about the economy, have become more politicized now.” Indeed, the night-and-day views underscore yet another front on which Americans remain polarized five months after the election, and with President Trump nearing his 100th day in office.

[..] The University of Michigan researchers have their own way of measuring the gulf between the two viewpoints and how quickly it has flipped. Among Republicans, the Michigan consumer expectations index was at 61.1 in October, the kind of reading typically reported in the depths of a recession. Confident that Mrs. Clinton would win, Democrats registered a 95.4 reading, close to the highs reached when her husband was in office in the late 1990s and the economy was soaring. By March, the positions were reversed, with an even more extreme split. Republicans’ expectations had soared to 122.5, equivalent to levels registered in boom times. As for Democrats, they were even more pessimistic than Republicans had been in October.

As at the voting booth, the split in perceptions could have real-world consequences. If behavior tracks the recession-era sentiment among Democrats, who account for 32% of respondents in the survey, prophecies could quickly become self-fulfilling by affecting spending and investing decisions. “If one-third of the population cut their consumer spending by 5%, you get a recession,” said Alan Blinder, a Princeton economist who served in the Clinton administration and advised Al Gore and Hillary Clinton on economic policy during their Democratic presidential campaigns. “I don’t think it will happen, but it’s not beyond the realm of the possible.”

To be sure, even if Democratic consumers pulled back, that wouldn’t necessarily bring on a recession. A burst of spending by bullish Republicans, who equal 27% of those polled by the Michigan researchers, could counteract much of that drag. And independents, who are the largest cohort in the survey, at 41%, remain fairly optimistic about future growth. It is rare for “rising optimism to coexist with increasing uncertainty,” said Mr. Curtin, the Michigan expert. “The current level of optimism clearly indicates that no economywide spending retrenchment is underway, but the prevailing level of uncertainty will limit growth in discretionary spending.”

Great conversation between two great economists. Very much worth a full read.

• Steve Keen And Michael Hudson: Fixing The Economy (EI)

Michael Hudson: If you don’t cancel the debts, they’re going to keep growing, and all of the growth and national income is going to go to the creditors. So the fact is that the debts aren’t owed to the “we” – the 99%. The debts are owed to the 1%. 1% of the population has 75% of the financial assets. All their growth has occurred since 1980. So the question is, who are you going to save? The economy or the banks? If you don’t cancel the debts, they’re going to keep growing, and all of the growth and national income is going to go to the creditors. When President Obama came in, he promised that he was going to write down the debts – especially the junk mortgages – to the actual real value of the homes that the junk mortgage people had taken out.

Or and set the debt service – the money you have to pay every month to pay the mortgage, amortization, and principal, and interest to what the normal rental value of this would be. Well, as soon as he was elected, he dropped it all. He invited the bankers to the White House and said, boys, I’m the only guy standing between you and the pitchforks out there. Don’t worry, I can deliver my constituency to you. So, basically, the Democratic Party broke its voters into a black constituency, a women’s constituency, a LGBTQ constituency, and they’re all for Wall Street. Instead of saving the economy, Obama bailed out and saved the banks by keeping the debts in place. And once you have to pay that, it’s curtains. In the end, everybody’s going to end up in Greece. Greece is where you’re going, if you don’t.

“I’m hearing from sources on the ground in the Middle East, people who are intimately familiar with the intelligence that is available who are saying that the essential narrative that we’re all hearing about the Syrian government or the Russians using chemical weapons on innocent civilians is a sham.”

“People in both the agency [the CIA] and in the military who are aware of the intelligence are freaking out about this because essentially Trump completely misrepresented what he already should have known – but maybe he didn’t – and they’re afraid that this is moving toward a situation that could easily turn into an armed conflict..”

• Trump’s ‘Wag the Dog’ Moment (Robert Parry)

On Thursday night, Secretary of State Rex Tillerson said the U.S. intelligence community assessed with a “high degree of confidence” that the Syrian government had dropped a poison gas bomb on civilians in Idlib province. But a number of intelligence sources have made contradictory assessments, saying the preponderance of evidence suggests that Al Qaeda-affiliated rebels were at fault, either by orchestrating an intentional release of a chemical agent as a provocation or by possessing containers of poison gas that ruptured during a conventional bombing raid. One intelligence source told me that the most likely scenario was a staged event by the rebels intended to force Trump to reverse a policy, announced only days earlier, that the U.S. government would no longer seek “regime change” in Syria and would focus on attacking the common enemy, Islamic terror groups that represent the core of the rebel forces.

The source said the Trump national security team split between the President’s close personal advisers, such as nationalist firebrand Steve Bannon and son-in-law Jared Kushner, on one side and old-line neocons who have regrouped under National Security Adviser H.R. McMaster, an Army general who was a protégé of neocon favorite Gen. David Petraeus. In this telling, the earlier ouster of retired Gen. Michael Flynn as national security adviser and this week’s removal of Bannon from the National Security Council were key steps in the reassertion of neocon influence inside the Trump presidency. The strange personalities and ideological extremism of Flynn and Bannon made their ousters easier, but they were obstacles that the neocons wanted removed.

[..] Alarm within the U.S. intelligence community about Trump’s hasty decision to attack Syria reverberated from the Middle East back to Washington, where former CIA officer Philip Giraldi reported hearing from his intelligence contacts in the field that they were shocked at how the new poison-gas story was being distorted by Trump and the mainstream U.S. news media. Giraldi told Scott Horton’s Webcast: “I’m hearing from sources on the ground in the Middle East, people who are intimately familiar with the intelligence that is available who are saying that the essential narrative that we’re all hearing about the Syrian government or the Russians using chemical weapons on innocent civilians is a sham.” Giraldi said his sources were more in line with an analysis postulating an accidental release of the poison gas after an Al Qaeda arms depot was hit by a Russian airstrike.

“The intelligence confirms pretty much the account that the Russians have been giving … which is that they hit a warehouse where the rebels – now these are rebels that are, of course, connected with Al Qaeda – where the rebels were storing chemicals of their own and it basically caused an explosion that resulted in the casualties. Apparently the intelligence on this is very clear.” Giraldi said the anger within the intelligence community over the distortion of intelligence to justify Trump’s military retaliation was so great that some covert officers were considering going public. “People in both the agency [the CIA] and in the military who are aware of the intelligence are freaking out about this because essentially Trump completely misrepresented what he already should have known – but maybe he didn’t – and they’re afraid that this is moving toward a situation that could easily turn into an armed conflict,” Giraldi said before Thursday night’s missile strike. “They are astonished by how this is being played by the administration and by the U.S. media.”

The picture is pretty clear by now.

• Former DIA Colonel: “US Strikes On Syria Based On A Lie” (IntelT)

Donald Trump’s decision to launch cruise missile strikes on a Syrian Air Force Base was based on a lie. In the coming days the American people will learn that the Intelligence Community knew that Syria did not drop a military chemical weapon on innocent civilians in Idlib. Here is what happened.

• The Russians briefed the United States on the proposed target. This is a process that started more than two months ago. There is a dedicated phone line that is being used to coordinate and deconflict (i.e., prevent US and Russian air assets from shooting at each other) the upcoming operation.

• The United States was fully briefed on the fact that there was a target in Idlib that the Russians believes was a weapons/explosives depot for Islamic rebels.

• The Syrian Air Force hit the target with conventional weapons. All involved expected to see a massive secondary explosion. That did not happen. Instead, smoke, chemical smoke, began billowing from the site. It turns out that the Islamic rebels used that site to store chemicals, not sarin, that were deadly. The chemicals included organic phosphates and chlorine and they followed the wind and killed civilians.

• There was a strong wind blowing that day and the cloud was driven to a nearby village and caused casualties.

• We know it was not sarin. How? Very simple. The so-called “first responders” handled the victims without gloves. If this had been sarin they would have died. Sarin on the skin will kill you. How do I know? I went through “Live Agent” training at Fort McClellan in Alabama.

• There are members of the U.S. military who were aware this strike would occur and it was recorded. There is a film record. At least the Defense Intelligence Agency knows that this was not a chemical weapon attack. In fact, Syrian military chemical weapons were destroyed with the help of Russia.

This is Gulf of Tonkin 2. How ironic. Donald Trump correctly castigated George W. Bush for launching an unprovoked, unjustified attack on Iraq in 2003. Now we have President Donald Trump doing the same damn thing. Worse in fact. Because the intelligence community had information showing that there was no chemical weapon launched by the Syrian Air Force. Here’s the good news. The Russians and Syrians were informed, or at least were aware, that the attack was coming. They were able to remove a large number of their assets. The base the United States hit was something of a backwater. Donald Trump gets to pretend that he is a tough guy. He is not. He is a fool.

Tulsi is being drowned out by the trigger happy Democrats. But she actually served in the Middle East.

• Congresswoman Tulsi Gabbard On Syria (Fox)

The cost of war is profound. I’m opposed to the escalation of the counterproductive regime change war in Syria because it will lead to the deaths of more innocent men, women and children. Terrorist groups like al-Qaeda and ISIS, the strongest forces on the ground in Syria, will continue to increase their strength and influence over the region in the vacuum of a central government.

The French detest their political system even more than Americans do theirs. It’s very possible abstentions will decide the elections. And Le Pen voters WILL go to the ballot box.

• How Marine Le Pen Could Win (Pol.)

Could Marine Le Pen become France’s next president? A quick look at polling trends suggests that at first blush at least, the answer is “no.” [..] But for Serge Galam, a French physicist who predicted Donald Trump’s election in the United States, polls are missing out on an important factor: abstention — and specifically, how it affects voter turnout for different candidates. He argues that abstention, which a poll by CEVIPOF showed could be as high as 30%, is likely to be decisive in a “dirty” campaign dominated by scandals. “Obviously, nothing is done yet but her election is becoming very likely,” said Galam, a researcher with the French National Center for Scientific Research who also studies public opinion at the CEVIPOF political science institute. “I’m taking a scientific view of this — she needs a turnout differential of about 20% to win.”

[..] If Le Pen is projected to lose the runoff by 41 to 59%, for example, Galam argues that Le Pen could still win if the turnout rate for her voters is 90% versus 70% for her rival, for an overall turnout rate of 79%. In other words, the National Front leader could benefit because a substantial number of people who say they will vote for her rival may not actually go to the polls. Equally, if Le Pen is projected to lose by 45 to 55% in the runoff, she could win if turnout for her is 85% versus 70% for her rival, for an overall turnout of 77%. If overall turnout is 76%, then Le Pen would need a turnout of 90% versus 65% for her rival, and so on.

Some polls have Le Pen lagging behind Macron or Fillon by more than 30 percentage points, which would make her victory near impossible. But others show her within striking distance, with a lag of less than 20 points. If she can shrink the gap, then the challenge for Le Pen will be to mobilize a greater proportion of her supporters than her rivals. In this regard, Galam argues that Le Pen has a shot. For different reasons, he says, both Macron and Fillon aroused intense feelings of “aversion” among some voters, with a large proportion of Macron voters saying they could change their mind on election day. Negative or ambivalent feelings could translate into weaker turnout for them on election day.

Newsweek wakes up to a 2 week old report from IBT.

• Privacy Experts Say CIA Left Americans Open To Cyber Attacks (IBT)

WikiLeaks release of the latest cache of confidential C.I.A. documents as part of an ongoing “Vault 7” operation exposed some of the U.S. government’s hacking and digital espionage capabilities—this time having to do with iPhones and other smart devices used by hundreds of millions of people across the globe. But cyber security experts and computers scientists are raising concerns over the C.I.A.’s disregard of safety measures put in place for discovering these dangerous flaws in smart gadgets. The federal agency has kept its discovery of many exploits (software tools targeting flaws in products, typically used for malicious hacking purposes) a secret, “stockpiling” that information rather than reporting it to multinational corporations, throwing millions of Americans into the crosshairs of a dangerous, intergovernmental spying game in the process.

“What’s critical to understand is that these vulnerabilities can be exploited not just by our government but by foreign governments and cyber criminals around the world, and that’s deeply troubling,” said Ashley Gorski, an American Civil Liberties Union staff attorney working on the civil rights group’s national security project. “Our government should be working to help the companies patch vulnerabilities when they are discovered, not stockpiling them.” The C.I.A. knew its own classified documents had been floating around the dark web for at least a year and was well aware the hacking capabilities it was using to break into everyday tech could also have been employed by hostile foreign networks. Russian President Vladimir Putin’s Kremlin reportedly orchestrated a sprawling governmental operation in an attempt to influence the 2016 U.S. presidential election, which featured several cyber attacks on email servers and devices used by members of the Democratic Party.

The government enacted the Vulnerabilities Equities Process to reduce the unnecessary stockpiling of exploits. The procedure was meant to provide guidelines for agencies like the C.I.A. for notifying companies when dangerous issues are discovered in their devices. The measure was put in place during the Obama administration to prevent cyber attacks from terrorist networks and foreign governments, including Russia and China. But the C.I.A. completely ignored the Vulnerabilities Equity Process, instead exploring ways to use exploits for their own purposes, according to the Electronic Frontier Foundation, an international nonprofit digital rights group that reviewed a copy of the practice after filing a Freedom of Information Act request. “It appears the CIA didn’t even use the [Vulnerabilities Equity Process],” said Cindy Cohn, executive director of the Electronic Frontier Foundation. “That’s worrisome, because we know these agencies overvalue their offensive capabilities and undervalue the risk to the rest of us.”

There is so much wrong in China’s urbanization it’s hard to decide where to start.

• Rising Waters Threaten China’s Rising Cities (NYT)

The rains brought torrents, pouring into basements and malls, the water swiftly rising a foot and a half. The city of Dongguan, a manufacturing center here in the world’s most dynamic industrial region, was hit especially hard by the downpour in May 2014. More than 100 factories and shops were inundated. Water climbed knee-high in 20 minutes, wiping out inventory for dozens of businesses. Next door in Guangzhou, an ancient, mammoth port city of 13 million, helicopters and a fleet of 80 boats had to be sent to rescue trapped residents. Tens of thousands lost their homes, and 53 square miles of nearby farmland were ruined. The cost of repairs topped $100 million. Chen Rongbo, who lived in the city, saw the flood coming. He tried to scramble to safety on the second floor of his house, carrying his 6-year-old granddaughter. He slipped. The flood swept both of them away.

Flooding has been a plague for centuries in southern China’s Pearl River Delta. So even the rains that May, the worst in the area in years, soon drifted from the headlines. People complained and made jokes on social media about wading through streets that had become canals and riding on half-submerged buses through lakes that used to be streets. But there was no official hand-wringing about what caused the floods or how climate change might bring more extreme storms and make the problems worse. A generation ago, this was mostly farmland. Three vital rivers leading to the South China Sea, along with a spider’s web of crisscrossing tributaries, made the low-lying delta a fertile plain, famous for rice. Guangzhou, formerly Canton, had more than a million people, but by the 1980s, China set out to transform the whole region, capitalizing on its proximity to water, the energy of its people, and the money and port infrastructure of neighboring Hong Kong.

Rushing to catch up after decades of stagnation, China built a gargantuan collection of cities the size of nations with barely a pause to consider their toll on the environment, much less the future impact of global warming. Today, the region is a goliath of industry with a population exceeding 42 million. But while prosperity reshaped the social and cultural geography of the delta, it didn’t fundamentally alter the topography. Here, as elsewhere, breakneck development comes up against the growing threat of climate change. Economically, Guangzhou now has more to lose from climate change than any other city on the planet, according to a World Bank report. Nearby Shenzhen, another booming metropolis, ranked 10th on that World Bank list, which measured risk as a percentage of GDP.

Shenzhen was transformed in a few decades from a small fishing village into a city of millions.

Home › Forums › Debt Rattle April 9 2017