Giovanni Battista Tiepolo Allegory of the Planets and Continents 1752

Not sure what to make of this. Is she just selling vaccines?

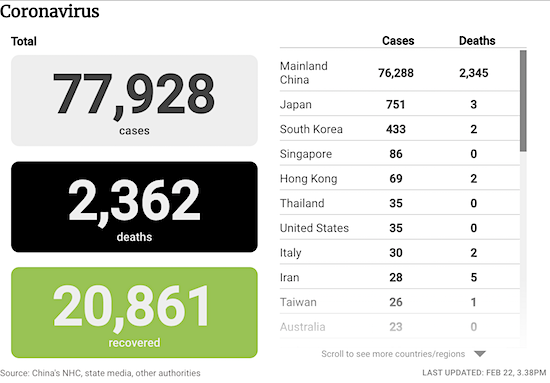

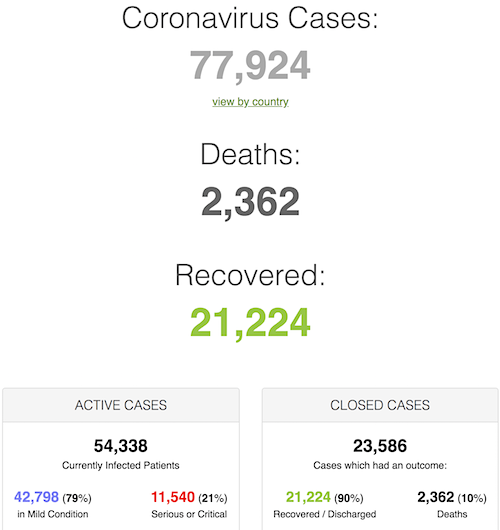

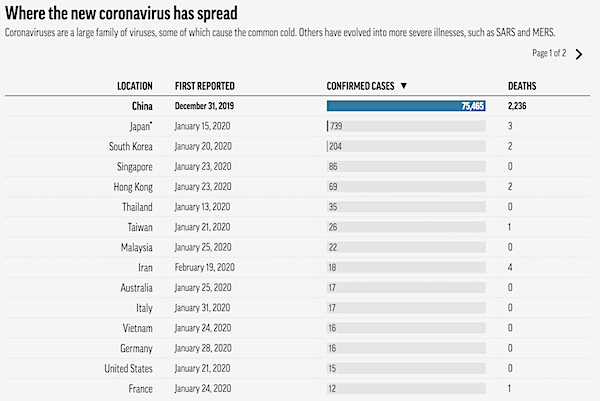

• New Covid Strains ‘May Even Escape The Immune Response’ – Biden Advisor (CNBC)

A member of the Biden-Harris Transition Covid Advisory Board warned about the highly transmissible new Covid variants and vaccine resistance during a Thursday evening interview on CNBC’s “The News with Shepard Smith.” “They’re more virulent, can cause more death, and some of them may even escape the immune response, whether it’s natural or from the vaccine,” said Dr. Celine Gounder. “So it’s really important right now that we do everything possible to preserve the vaccines to make sure they keep working and that means preventing the spread of these new variants.” Three highly contagious mutations of Covid have been detected in at least 33 states across the U.S., according to the Centers for Disease Control and Prevention.

Researchers say these highly transmissible variants could prolong the pandemic and potentially create another surge. Projections out of the CDC even predict the U.K. variant to be the dominant variant in the U.S. by March. Gounder, an epidemiologist at NYU, told host Shepard Smith that she’s “concerned” that people will let their guards down in March and that it could potentially lead to another surge. “That’s a time when you might have some families taking spring break, so you would have the additive effect of, again, a holiday where people might be socializing, not taking all the safety measures, on top of this far more contagious variant,” warned Gounder.

Johnson & Johnson announced that it filed emergency use authorization from the Food and Drug Administration for its coronavirus vaccine. Last week it released data showing it was about 66% effective in protecting against the virus. If J&J’s application is approved, it would be the third vaccine in the arsenal authorized for emergency use in the U.S. behind vaccines developed by Pfizer-BioNTech and Moderna. Unlike the other two shots, however, the J&J vaccine only requires one shot and requires basic refrigeration for storage.

“The abuser says, ‘You can’t go out; you’re not going anywhere,’ and the government also is saying, ‘You have to stay in.’”

• Domestic Violence Is a Pandemic Within the COVID-19 Pandemic (Time)

Growing evidence shows the pandemic has made intimate partner violence more common—and often more severe. “COVID doesn’t make an abuser,” says Jacky Mulveen, project manager of Women’s Empowerment and Recovery Educators (WE:ARE), an advocacy and support group in Birmingham, England. “But COVID exacerbates it. It gives them more tools, more chances to control you. The abuser says, ‘You can’t go out; you’re not going anywhere,’ and the government also is saying, ‘You have to stay in.’” That was Sheila’s experience. “The abuse was going to happen anyway,” she says. “Having the excuse of there’s nowhere to go, there’s nothing to do, didn’t help.”

Surveys around the world have shown domestic abuse spiking since January of 2020—jumping markedly year over year compared to the same period in 2019. According to the American Journal of Emergency Medicine and the United Nations group U.N. Women, when the pandemic began, incidents of domestic violence increased 300% in Hubei, China; 25% in Argentina, 30% in Cyprus, 33% in Singapore and 50% in Brazil. The U.K., where calls to domestic violence hotlines have soared since the pandemic hit, was particularly shaken in June by the death of Amy-Leanne Stringfellow, 26, a mother of one and a veteran of the war in Afghanistan, allegedly at the hands of her 45-year-old boyfriend.

In the U.S., the situation is equally troubling, with police departments reporting increases in cities around the country: for example, 18% in San Antonio, 22% in Portland, Ore.; and 10% in New York City, according to the American Journal of Emergency Medicine. One study in the journal Radiology reports that at Brigham and Women’s Hospital in Boston, radiology scans and superficial wounds consistent with domestic abuse from March 11 to May 3 of this year exceeded the totals for the same period in 2018 and 2019 combined. And as the pandemic has dragged on, so too has the abuse. Just as the disease continues to claim more lives, quarantine-linked domestic violence is claiming more victims—and not just women in heterosexual relationships. Intimate partner violence occurs in same-sex couples at rates equal to or even higher than the rates in opposite sex partners.

What’s more, the economic challenges of the pandemic have hit same-sex couples especially hard, with members of the LGBTQ community likelier to be employed in highly affected industries like education, restaurants, hospitals and retail, according to the Human Rights Campaign Foundation. That means higher stress and, concomitantly, the higher risk that that stress will explode into violence. As with so many things, communities of color are affected more severely as well, with systemic inequities often meaning lower income and less access to social and private services. “While one in three white women report having experienced domestic violence [during the pandemic], the rates of abuse increased dramatically to about 50% and higher for those marginalized by race, ethnicity, sexual orientation, gender identity, citizenship status, and cognitive physical ability,” says Erika Sussman, executive director of the Center for Survivor Advocacy and Justice (CSAJ), a support and research organization.

Turley noticed what happened right after I posted the Pierre Kory video -again- in last week’s Criminal COVID Negligence. A few hours later it was gone. I replaced it with a Kory video from Vimeo. Easy. Still, censoring Senate hearings should be out of the question for Big Tech.

• YouTube Censors Senate Testimony From Doctor On Possible Covid Drug (Turley)

We have have been discussing how writers, editors, commentators, and academics have embraced rising calls for censorship and speech controls, including President-elect Joe Biden and his key advisers. The erosion of free speech has been radically accelerated by the Big Tech and social media companies, including YouTube. Now YouTube has censored actual testimony given to the United States Senate by Dr. Pierre Kory, who was testifying on different drug treatment. So now these companies are going to censor what was told to the government and decide what viewers will be allowed to consider from the public debate. It is a continuation of the movement to prevent people from hearing opposing views and to control what is shared or discussed in a growing attack on free speech.

YouTube removed two videos from a December 8th hearing before the Committee on Homeland Security and Governmental Affairs. It featured Kory who discussed the use of Ivermectin as a potential treatment for Covid-19, particularly in the early stages. It is a drug that treats tropical diseases caused by parasites. Kory was calling for a review by National Institutes of Health on trials for the drug. Ultimately, it does appear that the NIH did change the status of the drug. Sen. Ron Johnson (R-WI) has said that the videos were blocked on his account, including Kory’s testimony. The Federalist maintained that YouTube removed the videos to the platform’s COVID-19 Medical Misinformation Policy. That policy stipulates that anything which goes against “local health authorities’ or the WHO medical information about COVID-19” will be removed.

I can hardly shed light on the merits of the medical debate but this is the censoring of an actual Senate hearing that is so disturbing. YouTube is preventing citizens from watching testimony on an issue of national importance. It is an example of the slippery slope of censorship and how such speech regulation becomes an insatiable appetite for many. [..] There is ample ability of people to challenge such testimony. However, many do not want to engage in a debate. They want to silence others and control what fellow citizens are allowed to consider. In the meantime, hosts on CNN are assuring people that they do not have to call such acts censorship but “harm reduction.” Sen. Richard Blumenthal recently calling for “robust content modification” on the Internet. Those voices of censorship are only growing stronger in the United States.

Indeed, in the wake of the Capitol riot, Democratic members and others are calling for a crackdown on free speech and punitive actions for those viewed as complicit with Trump. What is striking is how censorship, blacklists, and speech controls are being repackaged as righteous and virtuous. Indeed, the failure to sign such anti-free speech screeds is a precarious choice for many as writers and publishers call for blacklists. We are watching the most successful campaign against free speech in the history of the United States. It is being supported by many in the media and academia. If we allow companies like YouTube to succeed in such speech controls, true free speech could become a quaint historical relic in the United States.

Sounds okay, but this whole thing started when he was VP. And he can still bomb the crap out of them.

• Biden Revokes Terrorist Designation For Yemen’s Houthis (Fox)

President Joe Biden’s administration is moving to revoke the designation of Yemen’s Houthis as a terrorist group, citing the need to mitigate one of the world’s worst humanitarian disasters. President Donald Trump’s administration had branded the Iranian-backed Houthis as a foreign terrorist organization, a move that limited the provision of aid to the beleaguered Yemeni people, who have suffered under a yearslong civil war and famine. A senior State Department official confirmed the move Friday after members of Congress were notified of the administration’s plans. The official, who wasn’t authorized to speak publicly and spoke on condition of anonymity, said the removal changed nothing about the Biden administration’s views of the Houthis, who have targeted civilians and kidnapped Americans.

“Our action is due entirely to the humanitarian consequences of this last-minute designation from the prior administration, which the United Nations and humanitarian organizations have since made clear would accelerate the world’s worst humanitarian crisis,” the official said. The move comes a day after Biden announced an end to offensive support to Saudi Arabia’s campaign against the Houthis. The Obama administration in 2015 gave its approval to Saudi Arabia leading a cross-border air campaign targeting Yemen’s Houthi rebels, who were seizing ever more territory, including Sanaa. The Houthis have launched multiple drone and missile strikes deep into Saudi Arabia. The U.S. says the Saudi-led campaign has entrenched Iran’s role in the conflict, on the side of the Houthis.

Obama kept getting the intelligence briefings while he was colluding with intelligence against Trump.

• Biden: Trump Should No Longer Receive Classified Intelligence Briefings (CNN)

President Joe Biden doesn’t believe former President Donald Trump should receive classified intelligence briefings, as is tradition for past presidents, citing Trump’s “erratic behavior unrelated to the insurrection.” When asked in an interview with “CBS Evening News” anchor Norah O’Donnell if he thought Trump should receive an intelligence briefing if he requested one, Biden said, “I think not.” “I’d rather not speculate out loud,” Biden said when asked what he fears could happen if Trump continued to receive the briefings. “I just think that there is no need for him to have the — the intelligence briefings. What value is giving him an intelligence briefing? What impact does he have at all, other than the fact he might slip and say something?”

Former presidents traditionally have been allowed to request and receive intelligence briefings. A senior administration official previously told CNN that Trump has not submitted any requests at this point. There are many ways intelligence can be presented, the official said, something the intelligence community would formulate should any request come in. White House press secretary Jen Psaki told CNN on Thursday that “the intelligence community supports requests for intelligence briefings by former presidents and will review any incoming requests, as they always have.” Trump was not known to fully or regularly read the President’s Daily Brief, the highly classified summary of the nation’s secrets, when he was in office. He was instead orally briefed two or three times a week by his intelligence officials, CNN has reported.

“As the Supreme Court declared in 1964, it is the embodiment of “many of our fundamental values and most noble aspirations.”

• Trump’s Decision Not To Testify Is Not Evidence Of His Guilt (Turley)

[..] the statement of House manager Rep. Jamie Raskin, D-Md., this week was breathtaking. A former law professor, Raskin declared that the decision of Trump not to testify in the Senate could be cited or used by House managers as an inference of his guilt — a statement that contradicts not just our constitutional principles but centuries of legal writing. Presidents have historically not testified at impeachment trials. One reason is that, until now, only sitting presidents have been impeached and presidents balked at the prospect of being examined as head of the Executive Branch by the Legislative Branch. Moreover, it was likely viewed as undignified and frankly too risky. Indeed, most defense attorneys routinely discourage their clients from testifying in actual criminal cases because the risks outweigh any benefits.

Despite the historical precedent for presidents not testifying, Raskin made an extraordinary and chilling declaration on behalf of the House of Representatives. He wrote in a letter to Trump that “If you decline this invitation, we reserve any and all rights, including the right to establish at trial that your refusal to testify supports a strong adverse inference regarding your actions (and inaction) on January 6, 2021.” Raskin justified his position by noting that Trump “denied many factual allegations set forth in the article of impeachment.” Thus, he insisted Trump needed to testify or his silence is evidence of guilt. Under this theory, any response other than conceding the allegations would trigger this response and allow the House to use the silence of the accused as an inference of guilt. This is the nature of “the cruel trilemma of self-accusation, perjury or contempt.” Murphy v. Waterfront Commission, 378 U.S. 52, 55 (1964)

The statement was a conflict with one of the most precious and revered principles in American law that such a refusal to testify cannot be used against an accused party. The statement also highlighted the fact that the House has done nothing to lock in testimony of those who could shed light on Trump’s intent. After using a “snap impeachment,” the House let weeks pass without any effort to call any of the roughly dozen witnesses who could testify on Trump’s statements and conduct in the White House. Many of those witnesses have already given public interviews. Of course, the relative passivity of the House simply shows a lack of effort to actually win this case. The Raskin statement is far more disturbing. The Fifth Amendment embodies this touchstone of American law in declaring that “[n]o person . . . shall be compelled in any criminal case to be a witness against himself.” It was a rejection of the type of abuses associated with the infamous Star Chamber in Great Britain. As the Supreme Court declared in 1964, it is the embodiment of “many of our fundamental values and most noble aspirations.”

“It sure won’t be like 1957 again, but it would give an awful lot of idle people more to do when they get up in the morning.”

• The Fire This Time (Kunstler)

The economy won’t be fixed by policy because the things that have to happen to fix it will be resisted to the death by the parasitical entities feeding on what little remains. For instance, Walmart. Do you think it’s unhealthy that all the profit in American commerce is funneled into Bentonville, Arkansas? It used to be distributed in hundreds of thousands of small businesses in tens of thousands of US towns and cities. What do you think will die first: Walmart or the organism its feeding on? Since the dynamic at work is emergent and non-linear, other forces can come between these relationships and change things. We are already in conflict with China, the land that supplies most of the merchandise in Walmart.

The conflict right now is mostly playing out in the capture of US corporate and cultural enterprise, and in cyberwarfare, and it’s liable to hotten up around the continued sovereignty of Taiwan (America’s China). It’s difficult to assign intentions to another country but it appears that China’s China wishes to cancel the USA as the fading hegemon on the world stage, at least neutralize us, and perhaps dominate us. Mr. Trump is no longer in place to resist that, and the country might be forced to consider all those deals that our new president, “China Joe” enjoyed from the Biden family’s business ventures there over the years. Emergently, then, the Big Box business model could fail, and in fairly short order, which would at least give Americans a chance to self-reorganize the production and distribution of goods in our own country.

It sure won’t be like 1957 again, but it would give an awful lot of idle people more to do when they get up in the morning. Wait for it, and plan accordingly. In the meantime, we are treated to the sordid spectacle of Democratic Wokesters endeavoring to destroy what remains of American cultural life. It’s an incomparably stupid and malign distraction from the imperatives of this historical moment. They will not succeed in cancelling those who object to the systematic disassembly of our national language, myth, and meaning, even if we have to go back to the mimeograph machine to keep these things alive. They will not turn a republic into a psychopathic despotism. Politics, they say, is downstream from culture. Truth is the antidote to a culture of lies. The upcoming impeachment trial of former president Trump will be a showcase for that, and it may prove to be a hoax too far.

Everyone just walks back what they’ve said like it never meant a thing.

“On Biden’s Inauguration Day, Sanders vowed to use budget reconciliation to raise the minimum wage to $15 an hour..”

• Sanders Says He Never Intended To Raise Minimum Wage To $15 During Pandemic (JTN)

Independent Sen. Bernie Sanders overnight Thursday helped nix Democrats’ effort to include a hike in the federal minimum wage to $15 an hour, as part of their $1.9 trillion COVID relief package, despite having championed such an increase. However, Sanders made clear that he supported the GOP-backed amendment to keep an immediate wage hike out of the relief measure became he wants a gradual increase. “It was never my intention to increase the minimum wage to $15 immediately and during the pandemic,” Sanders, the chairman of the Senate Budget Committee, said on the Senate floor late Thursday night. “My legislation gradually increases the minimum wage to $15 an hour over a five-year period and that is what I believe we have got to do.”

The vote took place during a “vote-a-rama” session in which senators voted on amendments to President Biden’s $1.9 trillion coronavirus relief package, which fellow Democrats are seeking to pass through “budget reconciliation” without GOP votes. Sen. Joni Ernst, an Iowa Republican, proposed the amendment that would prohibit an increase of the federal minimum wage during the global COVID-19 pandemic. “A $15 federal minimum wage would be devastating for our hardest-hit small businesses at a time when they can least afford it,” she said. After Sanders spoke up, the measure to keep the hike out of the COVID relief package was then approved through a voice vote, helping avoid a partisan showdown on the issue.

However, Democrats and Sanders, who caucuses with Democrats, are expected to reinsert the wage hike into the package as a gradual increase. On Biden’s Inauguration Day, Sanders vowed to use budget reconciliation to raise the minimum wage to $15 an hour if the GOP does not support the move.

“The parliament did the same in 2014, when the NGO launched a similar probe. A letter sent by the parliament’s president at that time claimed itself to be “extremely transparent” and so saw no need to cooperate. It has now sent the very same letter to its most recent study.”

• EU Parliament Snubs Anti-Corruption Researchers (EUO)

The European Parliament refused to cooperate with an EU institutional-wide study on integrity and ethics by Transparency International, one of the world’s most prestigious anti-corruption NGOs. “The European Parliament, despite its publicly-stated support for greater transparency was, in fact, the only institution that refused to cooperate,” said Michiel van Hulten, who heads Transparency International’s EU office in Brussels. The parliament did the same in 2014, when the NGO launched a similar probe. A letter sent by the parliament’s president at that time claimed itself to be “extremely transparent” and so saw no need to cooperate. It has now sent the very same letter to its most recent study.

“They unfortunately did not go through the trouble of writing a new letter,” noted the lead author of the reports, Transparency International’s Leo Hoffmann-Axthelm. He ascribed the parliament’s decision as an overall lack of accountability within its administrative leadership. This includes the ‘Bureau’, composed of the secretary general and the vice presidents. “Honestly we are not sure what ultimately the reason is,” he said, noting that the initial response had been positive. But the final study, also published on Thursday, noted almost zero penalties whenever an MEP breaks internal house conduct rules.

Lenin Moreno is outta here.

• Ecuador Gov’t Scrambles to Privatize the Central Bank Before Elections (MPN)

With just days until Ecuador’s February 7 presidential election and four months remaining on President Lenin Moreno’s mandate, the Ecuadorian government and right-wing elites are still scrambling to privatize the country’s central bank. The process involves fast-tracking an emergency law dubbed the Humanitarian Support Organic Law, which will “lockdown” the central bank, siphon it from the public sector, and place Ecuador’s financial sovereignty at the whims of private interests. According to right-wing figures and the country’s mainstream media apparatus that protects and serves its interest, the unconstitutional move is being touted as a necessity. Both parties have claimed that the measure would “safeguard” the country’s dollarization.

In 2000, the U.S. dollar was implemented as part of the country’s national monetary system during the neoliberal administration of Jamil Mahuad. Sixteen financial institutions were bailed out by his government at a whopping cost of $2.6 billion. Ecuador’s dollarization occurred just months after the infamous “bank holiday,” in which 70% of all banking institutions declared bankruptcy, hurling the Andean Republic into its worst economic crisis in a century. Millions of people lost their life savings during the chaos and the former national currency, the sucre, plummeted in value by 195%. A migrant crisis accompanied the economic downturn. More than 267,000 Ecuadorians fled the country during a two year period (1999 and 2000), eventually leading to a total of 2.2 million Ecuadorians migrating, a figure that at the time represented nearly 20% of the country’s population.

Even more lost their life savings. The middle class was obliterated and inequality worsened. The current claim that the country’s dollarization needs to be “safeguarded,” a claim repeated by the political and economic elites, local media, and the bulk-some of the 15 presidential hopefuls, is rooted in the work of the leading presidential candidate, Andrés Arauz. Since the end of Rafael Correa’s term in office, Arauz has been in charge of the Dollarization Observatory. This organization informs the public on economic matters, often focusing on the ways in which neoliberal interests threaten Ecuador’s economy. The myth claiming that Arauz wants to forcibly remove the dollar as the national currency comes from an article he wrote last April in which he gave examples of “good and bad” de-dollarization processes.

Mussolini smiles.

• Nevada Bill Would Allow Tech Companies To Create Governments (AP)

Planned legislation to establish new business areas in Nevada would allow technology companies to effectively form separate local governments. Democratic Gov. Steve Sisolak announced a plan to launch so-called Innovation Zones in Nevada to jumpstart the state’s economy by attracting technology firms, Las Vegas Review-Journal reported Wednesday. The zones would permit companies with large areas of land to form governments carrying the same authority as counties, including the ability to impose taxes, form school districts and courts and provide government services. The measure to further economic development with the “alternative form of local government” has not yet been introduced in the Legislature.

Sisolak pitched the concept in his State of the State address delivered Jan. 19. The plan would bring in new businesses at the forefront of “groundbreaking technologies” without the use of tax abatements or other publicly funded incentive packages that previously helped Nevada attract companies like Tesla Inc. Sisolak named Blockchains, LLC as a company that had committed to developing a “smart city” in an area east of Reno after the legislation has passed. The draft proposal said the traditional local government model is “inadequate alone” to provide the resources to make Nevada a leader in attracting and retaining businesses and fostering economic development in emerging technologies and industries.

The Governor’s Office of Economic Development would oversee applications for the zones, which would be limited to companies working in specific business areas including blockchain, autonomous technology, the Internet of Things, robotics, artificial intelligence, wireless, biometrics and renewable resource technology.

“The forum’s current agenda and its past track record of hosting prophetic simulations demands that the exercise be scrutinized.”

• The WEF’s Simulation of a Coming “Cyber Pandemic” (Webb/Vedmore)

On Wednesday, the World Economic Forum (WEF), along with Russia’s Sberbank and its cybersecurity subsidiary BI.ZONE announced that a new global cyberattack simulation would take place this coming July to instruct participants in “developing secure ecosystems” by simulating a supply-chain cyberattack similar to the recent SolarWinds hack that would “assess the cyber resilience” of the exercise’s participants. On the newly updated event website, the simulation, called Cyber Polygon 2021, ominously warns that, given the digitalization trends largely spurred by the COVID-19 crisis, “a single vulnerable link is enough to bring down the entire system, just like the domino effect,” adding that “a secure approach to digital development today will determine the future of humanity for decades to come.”

The exercise comes several months after the WEF, the “international organization for public-private cooperation” that counts the world’s richest elite among its members, formally announced its movement for a Great Reset, which would involve the coordinated transition to a Fourth Industrial Revolution global economy in which human workers become increasingly irrelevant. This revolution, including its biggest proponent, WEF founder Klaus Schwab, has previously presented a major problem for WEF members and member organizations in terms of what will happen to the masses of people left unemployed by the increasing automation and digitalization in the workplace.

New economic systems that are digitally based and either partnered with or run by central banks are a key part of the WEF’s Great Reset, and such systems would be part of the answer to controlling the masses of the recently unemployed. As others have noted, these digital monopolies, not just financial services, would allow those who control them to “turn off” a person’s money and access to services if that individual does not comply with certain laws, mandates and regulations. The WEF has been actively promoting and creating such systems and has most recently taken to calling its preferred model “stakeholder capitalism.” Though advertised as a more “inclusive” form of capitalism, stakeholder capitalism would essentially fuse the public and private sectors, creating a system much more like Mussolini’s corporatist style of fascism than anything else.

Yet, to usher in this new and radically different system, the current corrupt system must somehow collapse in its entirety, and its replacement must be successfully marketed to the masses as somehow better than its predecessor. When the world’s most powerful people, such as members of the WEF, desire to make radical changes, crises conveniently emerge—whether a war, a plague, or economic collapse—that enable a “reset” of the system, which is frequently accompanied by a massive upward transfer of wealth.

In recent decades, such events have often been preceded by simulations that come thick and fast before the very event they were meant to “prevent” takes place. Recent examples include the 2020 US election and COVID-19. One of these, Event 201, was cohosted by the World Economic Forum in October 2019 and simulated a novel coronavirus pandemic that spreads around the world and causes major disruptions to the global economy—just a few weeks before the first case of COVID-19 appeared. Cyber Polygon 2021 is merely the latest such simulation, cosponsored by the World Economic Forum. The forum’s current agenda and its past track record of hosting prophetic simulations demands that the exercise be scrutinized.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.