Willem de Kooning Woman III 1953

Had to include this one just for the headline. Anything goes at the Guardian. And it’s a WaPo poll, so who cares? Still, did they poll him when he was a baby? But good for Trump that he’s been more popular all his life than he is now. Only way is up?!

• Donald Trump Approval Rating At 70-Year Low (G.)

Donald Trump’s approval rating has plunged in a national poll, published on Sunday, that charts Americans’ perceptions of a stalling domestic policy agenda and declining leadership on the world stage. The Washington Post/ABC News poll, which put Trump’s six-month approval rating at a historic 70-year low, came amid mounting controversy over Russian interference in the 2016 election. It emerged on Saturday that Trump’s campaign committee made a payment to the legal firm representing the president’s eldest son almost two weeks before a meeting between Trump Jr and a Russian lawyer promising compromising information on Hillary Clinton was made public.

Trump now has a 36% approval rating, down six points from his first 100 days’ rating. The poll found that 48% believed America’s leadership in the world is weaker than before the billionaire took office, while support for Republican plans to replace Barack Obama’s Affordable Care Act was at just 24% compared with 50% who support the former president’s signature healthcare policy. Trump, who has spent the weekend at his private golf club in Bedminster, New Jersey, attempted to downplay the poll’s findings. On Sunday morning he used Twitter to claim, incorrectly, that “almost 40% [approval] is not bad at this time” and that the poll in question had been “just about the most inaccurate around election time!”.

And while we’re selecting for headlines…

Wait, I just saw another one (not really a headline, but worth citing): “Today could be a good day to sell your tulips.”

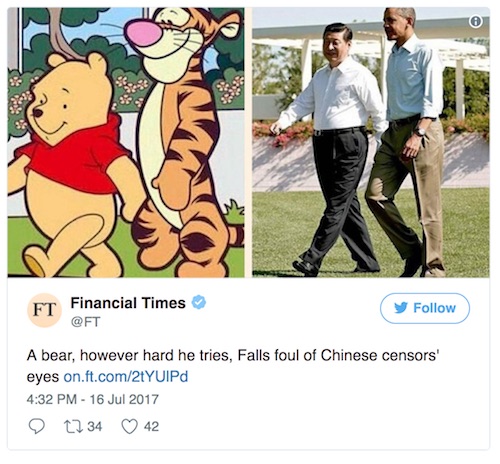

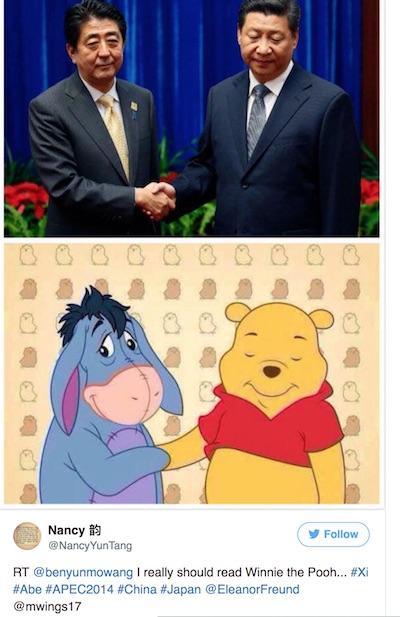

• China Blacklists Winnie the Pooh (CNBC)

Winnie the Pooh has been blacked out from Chinese social media in the lead-up to the country’s 19th Communist Party Congress this fall, the Financial Times reported Sunday. No official explanation was given, but the FT cited observers who said the crackdown may be related to past comparisons of the physical appearance of President Xi Jinping to the fictional bear. One observer said “talking about the president” appeared to be among activities deemed sensitive ahead of the upcoming party congress, when leadership renewal is expected. The following year, the comparison was extended to Xi’s meeting with Japanese Prime Minister Shinzo Abe, who was pictured as Eeyore, the sad donkey, alongside the bear.

Comparisons between Xi and Disney-owned Winnie the Pooh first circulated in 2013 during the Chinese leader’s visit with then U.S. President Barack Obama. A photo of Xi standing up through the roof of a parade car, next to a picture of Winnie the Pooh in a toy car, was named the “most censored image of 2015” by political consultancy Global Risk Insights. The FT report said posts with the Chinese name of the portly character were censored on China’s Twitter-like platform Sina Weibo. A collection of animated gifs featuring the bear were also removed from social messaging app WeChat, according to the FT.

Why am I thinking we’ll see many more of these stories? It ain’t fun if it’s YOUR pension fund.

• Private Equity Fund Once Valued at $2 Billion Is Now ‘Nearly Worthless’ (R.)

Wells Fargo and a number of other lenders are negotiating to take control of a hedge fund previously valued at more than $2 billion that is now worth close to nothing, according to a report from the Wall Street Journal. EnerVest, a Houston private equity firm that focuses on energy investments, manages the private equity fund that focused on oil investments. The fund will leave clients, including major pensions, endowments and charitable foundations, with at most pennies on the dollar, WSJ reported. The firm raised and started investing money beginning in 2013 when oil was trading at around $90 a barrel and added $1.3 billion of borrowed money to boost its buying power. West Texas Intermediate crude prices closed at $46.54 a barrel on Friday. “We are not proud of the result,” John Walker, EnerVest’s co-founder and chief executive, wrote in an email to the Journal.

Only seven private – equity fund s worth more than $1 billion have ever lost money for investors, according to data from investment firm Cambridge Associates cited in the report. Among those of any size to end in the red, losses greater than around 25% are extremely rare, though there are several energy-focused fund s in danger of doing so, according to public pension records. Clients included the J. Paul Getty Trust, John D. and Catherine T. MacArthur and Fletcher Jones foundations, which each invested millions in the fund , according to their tax filings, the Journal reported. Michigan State University and a foundation that supports Arizona State University also disclosed investments in the fund. The Orange County Employees Retirement System was also an investor and has reportedly marked the value of its investment down to zero.

Story of our lives: “The Bank is trapped between rock-bottom rates and a hard place. So are the rest of us.”

• The Credit Bubble Only Seems To Blow Larger And Larger (Exp.)

The decision by the Bank of England and other central bankers to slash interest rates to near zero after the financial crisis may have averted financial meltdown, but only by triggering another debt binge. British household debt recently soared to a record high of more than £1.5 trillion, after growing at the fastest pace since before the credit crunch, according to The Money Charity. The Bank of England is now forcing banks to strengthen their financial position by another £11.4 billion in the face of rapid growth in borrowing on credit cards, car finance and personal loans, up another 10 per cent over the last year. Record low mortgage rates have also driven house prices to dizzying highs.

The average UK property now costs 7.6 times earnings, more than double the figure 20 years ago, squeezing the next generation off the property ladder. The problem is getting more acute as rising inflation is pushing the Bank ever closer to hiking base rates for the first time in a decade. It needs to do something to deter yet more borrowing, and to offer some hope for hard-pressed savers. Its dilemma is that higher borrowing costs could finally prick the consumer debt bubble it has helped to create. The Bank is trapped between rock-bottom rates and a hard place. So are the rest of us.

Why do I think I smell CIA? Then again, this is about a WaPo report, and who believes them? Anyway, can’t be the Russians, pretty sure they were otherwise occupied.

• United Arab Emirates Behind Hacking Of Qatari Media That Incited Crisis (AP)

The United Arab Emirates orchestrated the hacking of a Qatari government news site in May, planting a false story that was used as a pretext for the current crisis between Qatar and several Arab countries, according to a Sunday report by The Washington Post. The Emirati Embassy in Washington released a statement in response calling the Post report “false” and insisting that the UAE “had no role whatsoever” in the alleged hacking. The report quotes unnamed U.S. intelligence officials as saying that senior members of the Emirati government discussed the plan on May 23. On the following day, a story appeared on the Qatari News Agency’s website quoting a speech by Qatar’s emir, Sheikh Tamim Bin Hamad al Thani, in which he allegedly praised Iran and said Qatar has a good relationship with Israel. Similarly incendiary statements appeared on the news agency’s Twitter feed.

The agency quickly claimed it was hacked and removed the article. But Saudi Arabia, the UAE, Bahrain and Egypt all blocked Qatari media and later severed diplomatic ties. The ongoing crisis has threatened to complicate the U.S.-led coalition’s fight against the Islamic State group as all participants are U.S. allies and members of the anti-IS coalition. Qatar is home to more than 10,000 U.S. troops and the regional headquarters of the U.S. Central Command while Bahrain is the home of the U.S. Navy’s 5th Fleet. President Donald Trump has sided strongly with Saudi Arabia and the UAE in the dispute, publicly backing their contention that Doha is a supporter of Islamic militant groups and a destabilizing force in the Middle East. Secretary of State Rex Tillerson recently concluded several days of shuttle diplomacy in the Gulf, but he departed the region without any public signs of a resolution.

Horses, barns and fake news.

• Australia Moves To Dial Down Financial Stability Risks In Home Loans (R.)

The Australian government is seeking to broaden the powers of the country’s prudential regulator to include non-bank lenders as concerns about financial stability take center stage amid bubble risks in the nation’s sizzling property market. A draft legislation released by the government on Monday, if passed, will help the Australian Prudential Regulatory Authority (APRA) dial down some of the risky lending in the A$1.7 trillion ($1.33 trillion) mortgage market, the size of the country’s economic output. Australia’s four biggest banks have already cut back on home loans in recent months and pulled away from institutional lending to real estate developers, as regulators force them to keep aside more capital and slow lending to speculative property investors.

Non-bank lenders have been quick to pick up the slack, with their loan-books expanding at a much faster clip than the banking sector’s 6.5 percent overall credit growth. This development is stoking concerns for authorities as a combination of record-high property prices and stratospheric household debt sit uncomfortably with slow wages growth. “APRA does not have powers over the lending activities of non-bank lenders, even where they materially contribute to financial stability risks,” Treasurer Scott Morrison and financial services minister Kelly O’Dwyer said in a joint statement. “Today, the government is releasing draft legislation for public consultation that will provide APRA with new powers. These new powers will allow APRA to manage the financial stability risks posed by the activities of non-bank lenders, complementing APRA’s current powers.”

Brussels smells blood.

• EU: May Should Make Corbyn Part Of Brexit Negotiating Team (Ind.)

Theresa May should make Jeremy Corbyn a member of her Brexit negotiating team, a top EU official has suggested. Guy Verhofstadt, the European Parliament’s Brexit coordinator, said the Prime Minister losing her majority in the general election was a “rejection” of her hard Brexit plan and other voices should be listened to as negotiations with the European Union get into full swing. The former Prime Minister of Belgium was critical of Ms May and described the election result as an “own goal”. He said it was now the Government’s responsibility to determine whether or not they would take the result into account when determining their negotiating position. “Brexit is about the whole of the UK. It will affect all UK citizens, and EU citizens in the UK. This is much bigger than one political party’s internal divisions or short term electoral positioning. It’s about people’s lives.”

“I believe the negotiations should involve more people with more diverse opinions. Some recognition that the election result was, in part, a rejection of Theresa May’s vision for a hard Brexit would be welcome.” Asked if that meant Ms May should include other party leaders in her negotiating team, a spokesman for Mr Verhofstadt said: “Absolutely.” Mr Verhofstadt was also highly critical of the manner in which Ms May has handled the negotiations thus far, describing her actions as “somewhat chaotic”, but stopped short of offering any advice. “I am not going to give Theresa May advice on the Brexit negotiations,” he told The Independent. “That is a matter for her and her government. However, in line with the European Parliament’s resolution, I do think that the negotiations need to be conducted with full transparency. But that is a general point.

I think people just love the China miracle too much to let it go.

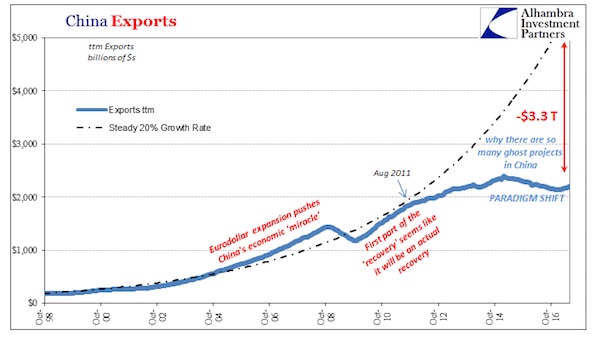

• China: Ghost Cities and Ghost Recovery (Snider)

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with. Moving a quarter of a billion people into cities in an historically condensed time period calls for radical thinking, and radical doing. In one official party plan, it was or has to happen before 2026. The idea has been to build 20 new cities for this urbanization, and then maybe 20 more. It led to places like Yujiapu in Tianjin. China’s answer to Manhattan was to include a replica Lincoln Center, a Rockefeller Center and even twin towers. Built to fit half a million, barely 100,000 live there. There are numerous other examples of these ghost cities, including Kangbashi dug out of the grassy plains of Inner Mongolia.

It is in every sense a modern marvel, 137 sq. miles of tower blocks and skyscrapers that sit almost entirely empty. There are now plans to build yet another one, south of the capital Beijing this time, to supposedly relieve pressure and pollution of that city’s urban sprawl. In the Xiongan New Area, this newest city will be three times the size of NYC, enough, if plans were ever to actually work out, to draw almost 7 million Chinese. These are mind-boggling numbers and end up making truly eerie places for the few times when their existence is allowed to be acknowledged in the mainstream. The reasons for them are really not hard to comprehend, however. The older ghost cities started out as pure demographics, a place for China’s new middle class to urbanize and economize. The more the rest of the world demanded for China to produce and ship, the more Chinese (cheap) labor it would all require.

And there had to be something other than slums for this to happen, else any such intrusive transformation risked what was and remains a delicate power balance. Then in 2008 suddenly the world paused in its love affair of Chinese-made goods. No problem, though, as Chinese officials assuming it was temporary merely sped up the process of building for the future, getting ahead of the curve, as it were. Surely China would need to after the full global recovery get right back on the same trajectory as before. That never happened, and though some economists in particular still believe it will, there isn’t the slightest sign of global demand getting nearly that far back. What do you do, then, if you are China? There is logic to keeping up the illusion, that the future will eventually look a lot like the “miracle” past, because what else would China Inc. otherwise do? If it won’t be building stuff for export to the West, then it will have to be building something.

No matter how many times in the Western media they say demand is robust, catching up, or resilient, the Chinese know better. “China’s overseas shipments rose from a year earlier as global demand held up and trade tensions with the U.S. were kept in check amid ongoing talks. At home, resilient demand led to a rise in imports. Demand for Chinese products has proven resilient this year as global demand holds up.” Chinese exports in June 2017 are estimated (currently) to have risen 11.3% year-over-year. It sounds like what was written above about the global condition. But in truth, 11% growth, as 15% or even 20% growth at this stage, keeps China in the ghost city state. It isn’t anything close to “resilient”, let alone enough to make up for lost time and absorb the empty cities already built.

Angela Merkel owns Christine Lagarde.

• IMF To Insist On ‘Unsustainable Debt’, Says Greek Banks Need €10 Billion (K.)

The IMF has again found that Greece’s debt is unsustainable under every scenario, according to the report the Executive Council will be discussing on Thursday to decide on the Fund’s participation in the Greek program, sources say. The word from Washington is that the Fund’s technocrats have included various scenarios in their debt sustainability analysis (DSA), including one that incorporates the eurozone’s commitments for short-term measures and a high primary surplus, but none see Greece’s debt becoming sustainable. Washington sources suggest that the Executive Council will tell the eurozone that unless creditors offer more debt-relief measures, the IMF will not be able to participate in the Greek program with funds.

The IMF’s baseline scenario is identical to the one presented in February, with the debt being unsustainable after 2030, as servicing it will require more than 20% of GDP. The IMF will also likely warn about weaknesses in the Greek credit system, claiming it will need additional funding of €10 billion. An IMF source said that the chances of the fund disbursing the €1.6 billion Athens has requested “are limited.” However, what it seems the Fund is really waiting for is whether a government more amenable to Greek debt relief will emerge from September’s elections in Germany, something that is not at all certain right now.

As things stand, we are probably heading for the worst combination, as Finance Minister Euclid Tsakalotos said in May: that the IMF is heeded only in its demands for more austerity and not for debt relief. This is why, according to IMF sources, the report to be discussed includes no time limit for the review of the debt’s sustainability that would determine the Fund’s definitive participation in the program.

Tax arrears to the state are a huge problem in Greece. The EU is hellbent on aggravating the issue.

• Greek Taxpayers Have A Mountain Of Taxes To Climb (K.)

Greek taxpayers are being stunned by the realization that demands concerning their 2016 incomes are up to twice as high as last year. Changes to the tax system have sent rates soaring for the 40% of taxpayers that have been notified of the additional tax they will have to pay. Changes in income brackets as well as in the brackets used for calculating the solidarity tax are mainly responsible for increasing taxpayers’ burden this year. This mainly concerns salaried workers and freelance professionals, as well as taxpayers with revenues from properties. In some cases the annual difference in the tax due is more than the difference between the incomes of 2015 and 2016.

For instance, a taxpayer with incomes of €66,000 in 2015 and €76,000 in 2016 is now forced to pay tax amounting to €21,646, against €10,692 last year. This means that the extra €10,000 he or she managed to earn last year is being siphoned off by the taxman. The huge amounts of tax due are virtually impossible to pay in the three installments (in July, September and November) foreseen by the government. Many taxpayers are considering signing up now for the 12-installment pay plan, while others fear they will simply fail to meet their obligations, particularly as the Single Property Tax (ENFIA) is also coming soon.

Greece tax policy is decided in Brussels, not Athens. So how is it possible people pay much more in Greece than in other EU nations?

• Other EU Nations Are Inviting Rich Greeks (K.)

Ever more European states are trying to attract rich Greeks and other European Union nationals suffering from overtaxation at home. Cyprus, Malta, Ireland, Luxembourg, Monaco, Portugal and the Netherlands, as well as bigger countries such as France, Spain and Italy, are offering generous incentives to bring on to their registers people with high incomes that would benefit their economies in a number of ways. The relocation “invitation” concerns Greek entrepreneurs as well, given the excessive taxation the government has imposed on them and the uncertainty regarding the future tax situation that high incomes will face.

The concept behind the tax policies adopted in other countries so as to attract wealthy citizens is focused on a steady annual lump sum tax and their exemption from any other burdens, except for those concerning their activities at their new tax home. Italy’s case is interesting, as it is a country in the hard core of the EU that has created a favorable framework: It allows rich individuals with large international incomes to become “non-doms” (ie paying tax without being residents) by paying an annual levy of €100,000 plus €25,000 for each family member. They are relieved of any other tax on incomes abroad or imported into Italy and only pay regular tax on activities within the country. This boosts revenues, the property market and consumption.

Home › Forums › Debt Rattle July 17 2017