Salvador Dalí The persistence of memory 1931

Will Washington be swallowed whole by the swamp? Might be a good outcome. Endless articles about Trump and Russia and Mueller. But very hard to find anything neutral. Journalism has become opinionism.

Is Papadopoulos a plant? Where did he come from? Did Fusion GPS set up the Trump Tower meeting after consulting with the DNC? Isn’t there a country to run? I’m getting tired, and I’m sure I’m not the only one.

Stockman doesn’t buy it.

• A Monstrous Bubble – The Destroyer Called Amazon (Stockman)

when it comes to wanton destruction we can think of no better evidence than the $63 billion market cap eruption visited upon Amazon owing to its purported “blow-out” earnings report on Friday. Except it wasn’t all that. In the year ago quarter AMZN’s pre-tax earnings came in at $491 million, which was actually alot more than the $316 million figure posted for Q3 2017. In fact, the company’s niggardly current quarter profit represented 36% plunge from prior year, but thanks to the company’s tax cut “selfie” the headline reading robo-machines didn’t even notice this rather dramatic setback. To wit, AMZN effective tax rate plunged from an aberrantly high 46.6% last year to a quite low 18.4% this year. As a result, its reported net income remained flat relative to prior year.

Stated differently, the blow-out earnings figure of $0.53 per share reported Friday was exactly the same the same $0.53 per share reported last year, but the “blow-out” part was due to the “beat” from the $0.02 street consensus. Then again, the street consensus had been for $1.91 per share only 90 days ago! As per usual, it had been “guided “down by 99% in the interim. If nothing else, this proves that the whole SEC “Fair Disclosure” (FD) is an absolute farce and that the SEC itself is an utter waste of taxpayer money. It also proves, of course, that a bevy of high priced advisors are far more efficacious at cutting tax rates than a House (of Representatives) full of Republicans foaming at the mouth about the topic. But how in the world does this kind of hyper-fiddling with accounting statement tax rates justify a market cap gain in one day ($63 billion) that exceeds the entire market cap of GM($61 billion) or Aetna ($57 billion)?

As it happened, Amazon’s LTM net income of $1.926 billion for the quarter might be a slightly better indicator of its profitability because the company’s four-quarter tax rate averaged out close to the US statutory rate, meaning that the company is being valued at 280X under normal tax rates. Moreover, even if you pro forma the results with the GOP’s vaunted 20% tax rate you would get LTM net income of $2.48 billion and a PE multiple of 217X; and for that matter, just go ahead and abolish the corporate tax entirely and AMZN’s PE at the zero bracket would still compute to 174X. We dwell on the absurdity of Amazon’s PE multiple in the first instance because there is absolutely nothing in its financial performance that warrants these massive market cap gains. Thus, way back in Q3 2014, AMZN’s operating income was $510 million. As shown below, it has been staggering around like a drunken sailor ever since – lapsing to just $347 million in the purportedly red hot quarter just ended.

“..house prices rise to meet the amount the lender is prepared to lend, rather than being moored to wages..”

• How The Actual Magic Money Tree Works (G.)

Shock data shows that most MPs do not know how money is created. Responding to a survey commissioned by Positive Money just before the June election, 85% were unaware that new money was created every time a commercial bank extended a loan, while 70% thought that only the government had the power to create new money. The results are only a shock if you didn’t see the last poll of MPs on exactly this topic, in 2014, revealing broadly the same level of ignorance. Indeed, the real shock is that MPs still, without embarrassment, answer surveys. Yet almost all our hot-button political issues, from social security to housing, relate back to the meaning and creation of money; so if the people making those choices don’t have a clue, that isn’t without consequence. How is money created? Some is created by the state, but usually in a financial emergency.

For instance, the crash gave rise to quantitative easing – money pumped directly into the economy by the government. The vast majority of money (97%) comes into being when a commercial bank extends a loan. Meanwhile, 27% of bank lending goes to other financial corporations; 50% to mortgages (mainly on existing residential property); 8% to high-cost credit (including overdrafts and credit cards); and just 15% to non-financial corporates, that is, the productive economy. What’s wrong with that? On the corporate financial side, bank-lending inflates asset prices, which concentrates wealth in the hands of the wealthy. On the mortgage side, house prices rise to meet the amount the lender is prepared to lend, rather than being moored to wages. The lender benefits enormously from larger mortgages and longer periods of indebtedness; the homeowner benefits slightly from a bigger asset, but obviously spends longer in debt servitude; the renter loses out completely.

Is there a magic money tree? All money comes from a magic tree, in the sense that money is spirited from thin air. There is no gold standard. Banks do not work to a money-multiplier model, where they extend loans as a multiple of the deposits they already hold. Money is created on faith alone, whether that is faith in ever-increasing housing prices or any other given investment. This does not mean that creation is risk-free: any government could create too much and spawn hyper-inflation. Any commercial bank could create too much and generate over-indebtedness in the private economy, which is what has happened. But it does mean that money has no innate value, it is simply a marker of trust between a lender and a borrower. So it is the ultimate democratic resource. The argument marshalled against social investment such as education, welfare and public services, that it is unaffordable because there is no magic money tree, is nonsensical. It all comes from the tree; the real question is, who is in charge of the tree?

Why do they borrow? Is it for essentials?

• UK Debt Averages £8,000 Per Person – Not Including Mortgages (G.)

More than 6 million Britons don’t believe they will ever be debt free, according to new research which has also found the average person in the UK owes £8,000 – on top of any mortgage debt. Almost a quarter of all Britons said they are struggling to make ends meet, while 62% said they were often worried about their levels of personal debt, according to research for Comparethemarket.com. Earlier this month, the price comparison website asked 2,000 adults detailed questions about their personal finances. They found that 10% of respondents had “maxed out” on a credit card, while a similar number said they had been overdrawn within the past 12 months. A third of those interviewed told researchers that they were already planning on taking on additional debt – in the form of credit cards, loans car finance and mortgages – in the next year.

Over a third said they could not see themselves ever being in a financial position to help younger family members, breaking the tradition of the “bank of mum and dad”. The results chime with a recent study by the Financial Conduct Authority which found that that 4.1 million people are already in serious financial difficulty. The survey, the biggest ever by the city regulator, concluded that half of the UK population are financially vulnerable, with 25- to 34-year-olds the most over-indebted. Shakila Hashmi, head of money at Comparethemarket.com, said: “Right now millions of Brits could be in danger of suffering from one of the longest financial hangovers in history. While it may be hard to see an end in sight, the worst thing people in debt can do right now is stick their head in the sand. As well as reining in spending, there are other ways you can reduce debt, like switching to credit cards that help you get on top of debt with interest-free periods.”

If you borrow too much, we’ll make it costlier.

• Surge In UK Consumer Borrowing Fuels Likely Interest Rate Rise (G.)

A near-double-digit increase in lending to households in the year to September has left the Bank of England on track to raise interest rates on Thursday, amid concerns that consumers are creating an unmanageable mountain of unsecured debt. The pace of annual consumer credit growth was 9.9% last month, according to figures from the central bank, as borrowing on credit cards, overdrafts and unsecured loans jumped. The consistent appetite for borrowing is likely to put further pressure on the Bank to raise interest rates this week, with other indicators such as inflation and unemployment already supporting the case for a rise. Last month the Bank said British lenders needed to hold an extra £11bn of capital to guard against consumer loans going sour, due to concerns that banks had overestimated the creditworthiness of their borrowers.

Consumer credit has rocketed since 2014 when it was running at an annual rate of 4%. Last year the annual growth rate hit 12%, with the latest September numbers creating a a consumer debt of more than £204bn. Analysts were unsure whether the increase was a sign of growing confidence among consumers or desperation as wages growth stagnated and inflation rises. Only a steep fall in car loans in recent months has stopped the overall level of consumer credit creeping back to last year’s levels. Joanna Elson, chief executive of the Money Advice Trust, the charity that runs National Debtline, said regulators should monitor the effects of an interest rate rise, which will increase pressure on many household finances.

“With household debt a growing concern and an interest rate rise likely as early as this week, we encourage households to exercise caution before taking on additional borrowing – and consider how they would be able to cope with repayments in the event of a shock to their income. “Millions of people will have never experienced an interest rate rise. We are concerned that a small rise, combined with high levels of borrowing, rising living costs and slow wage growth could be enough to push many households into financial difficulty,” she said.

How Britain goes to the dogs.

• Theresa May Faces Snap Election If Defeated By Parliament On Brexit Deal (ES)

Theresa May was threatened with a snap general election today if she is defeated by Parliament on her Brexit deal. Tory right wingers raised the “nuclear threat” of a forced election in what was seen as an attempt to see off calls to empower the Commons to amend the deal or call for fresh negotiations. Iain Duncan Smith, the former Conservative leader and leading Brexit-backer, said it would be on “a confidence issue” and defeat would make the Government “head towards” a general election. “It will be the most important vote of the entire Parliament and if the Government loses it you head towards that conclusion,” he told the Evening Standard. Mrs May is aiming to hammer out a leaving deal with the EU by October or November next year.

The decision on whether Parliament gets a “take it or leave it” vote or the right to amend the deal is shaping up to be the key battle of Brexit. John Whittingdale, the former Culture Secretary, claimed the vote itself would be “a vote of confidence in government” that would trigger an election if defeated. “I think for the Government to come to Parliament and say we have a deal … and for Parliament then to turn around and say, ‘well, actually, we don’t agree it’s a good deal and we’re going to throw it out’, that is a vote of confidence in government,” he told The Westminster Hour. “I can’t see how the government could say ‘oh alright then, we’ll go and have another go’. I think there would have to be a general election.”

But MPs backing a softer pro-business Brexit said Mrs May must keep Parliament involved. Nicky Morgan, the chair of the Treasury Select Committee, said: “Ministers have promised Parliament a meaningful vote. They need to keep Parliament informed and involved to avoid problems at the end. “They resisted a Parliamentary vote on Article 50 until compelled to give way. They should do all they can to avoid a repetition.” Former minister Bob Neill said the eurosceptic threat smacked of “desperation”.

Where will the US be?

• Russia Could Hold Congress Of Syrian Peoples In Mid-November (DS)

A Moscow-backed congress of all Syria’s ethnic groups could take place in Russia as soon as next month and launch work on drawing up a new constitution, the RIA news agency reported Monday, citing a source familiar with the situation. RIA said the Congress of Syrian peoples, the idea of which President Vladimir Putin first mentioned at a forum with foreign scholars earlier this month, could take place in mid-November in the Russian Black Sea resort of Sochi. According to the source, 1,000-1,300 participants from the Assad regime and pro-regime forces as well as various opposition groups will participate. The source added that representatives of various ethnic groups, including Kurds and Turkmens, and religious clergy are also expected. Special U.N. envoy for Syria Staffan de Mistura agreed to participate in the congress but set out a list of terms and conditions that have to be met before the event. Putin says the congress could be an important step toward a political settlement and could also help draft a new constitution for the country.

Permanent austerity. Strong by Bill Mitchell.

• Europhile Left Deluded On EU Reform Process (Bilbo)

The Europhiles maintain a blind faith in what they claim to be a reform process, which when carried through will reduce some of the acknowledged shortcomings (I would say disastrously terminal design flaws). They don’t put any time dimension on this ‘process’ but claim it is an on-going dialogue and we should sit tight and wait for it to deliver. Apparently waiting for ‘pigs to fly’ is a better strategy than dealing with the basic problems that this failed system has created. I think otherwise. The human disaster that the Eurozone has created impacts daily on peoples’ lives. It is entrenching long-term costs where a whole generation of Europeans has been denied the chance to work.

That will reverberate for the rest of their lives and create dysfunctional outcomes no matter what ‘reforms’ are introduced. The damage is already done and remedies are desperately needed now. The so-called ‘reforms’ to date have been pathetic (think: banking union) and do not redress the flawed design. And to put a finer point on it: Germany will never allow sufficient changes to be made to render the EMU a functioning and effective federation. The Europhile Left is deluded if it thinks otherwise.

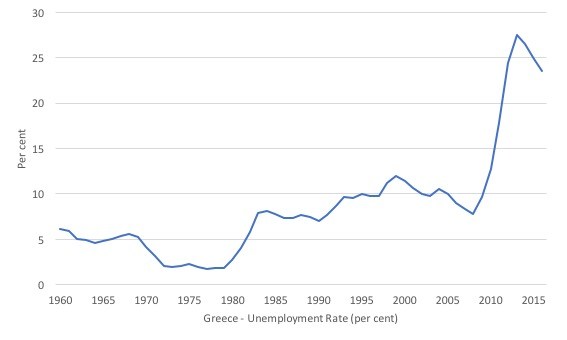

[..] here is the OECD Economic Outlook data (from 1960 to 2016) for the Greek unemployment rate, which confirms the veracity of the tweet statement (at least as far as Greek unemployment goes). The fact that the Greek unemployment averaged just 6.6% prior to the crisis (from 1960 to 2008) and has averaged 20.9% since then (2009-2016) and has been above 20% since 2012 tells me that the policy structures in place have failed badly since the GFC. That means – the austerity imposed under the Stability and Growth Pact, the lack of a federal fiscal capacity and the lack of a ‘federal sentiment’ which would have eased the way for generous funds transfers to Greece to allow it to restore domestic demand relatively quickly.

Halting fragmentation seems futile.

• Four Trajectories for Europe’s Future (Turchin)

Scenario 1. The disintegrative trends that I and others have written about are just a “blip”, a temporary set-back that will be soon overcome. The grand project of European integration will soon recover and by 2027 everybody will look back and have fun at the expense of “doomsayers”. I think that this trajectory is extremely unlikely. First, because of the shift in the social mood of the Germans, to which I referred above. Second, because all across Europe the well-being of large segments of the population is declining. To give just two examples, think of the extraordinary high unemployment rates for the young workers in countries like Spain, and of declining real wages of UK workers over the past decade.

Scenario 2. The EU continues to muddle through. Neither integrative, nor disintegrative trend dominates over the next decade, and in 2027 we are pretty much where we are now. In my opinion, this inertial scenario is more likely than the optimistic Scenario 1, but still not too likely. An equilibrium is a dynamic process, it can maintain itself only when two opposite forces cancel each other out. I don’t see any compelling signs of an integrative force that would cancel the disintegrative forces. Empirically, history doesn’t stand still. So things will either improve, or get worse. [..] my money is on the disintegrative trend prevailing (although personally I wish it was otherwise). Incidentally, the governing elites of the EU behave as though they all believe in Scenario 1 (or, at worst, Scenario 2).

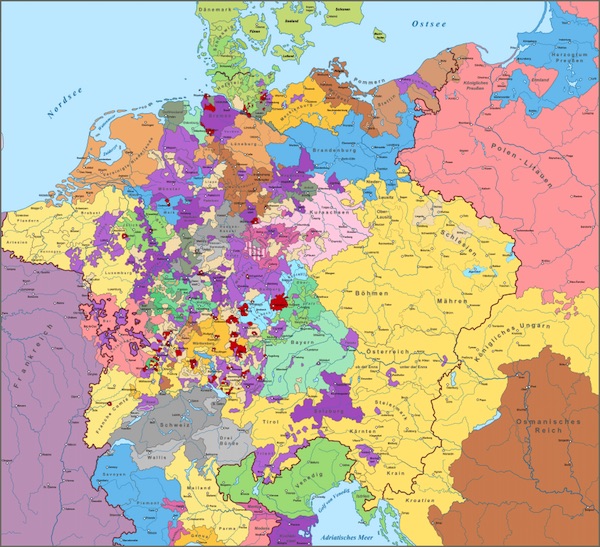

Scenario 3. The next 10 years will see an increasingly fragmented European landscape. The EU will not be formally abolished, but it will increasingly lose its capacity to influence constituent countries. Led by Hungary and Poland, other small and medium-sized countries will increasingly set their national policies without much regard for Brussels. This fragmentation will be accomplished largely in a nonviolent way. Perhaps not in ten years, as it may take longer, but eventually the EU will look much like the Holy Roman Empire. This “HRE” scenario is probably the most likely, at least in my opinion.

Scenario 4. Like in the previous scenarios, the disintegrative trend will dominate, but dissolution of the EU will not be peaceful. I think (I hope) that the violent disintegration scenario is much less likely than the Scenario 3. And I know that almost nobody believes that a violent break-up is possible. Very few people remain who fought in World War II. And this is the danger. The government of Mariano Rajoy apparently can’t imagine that one result of their push to suppress the Catalonian independence movement could be a bloody civil war.

The Holy Roman Empire in 1618

“We are creating chaos in our own backyard and there will be a high price to pay if we don’t fix it..”

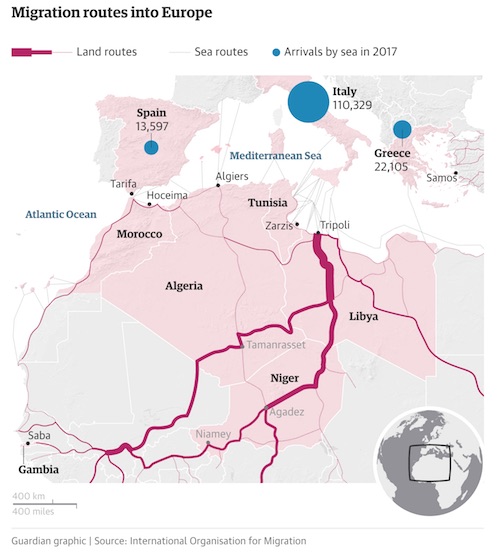

• How Europe Exported Its Refugee Crisis To North Africa (G.)

Something happened to the deadly migrant trail into Europe in 2017. It dried up. Not completely, but palpably. In the high summer, peak time for traffic across the Mediterranean, numbers fell by as much as 70%. This was no random occurrence. Even before the mass arrival of more than a million migrants and refugees into Europe in 2015, European policymakers had been desperately seeking solutions that would not just deal with those already here, but prevent more from coming. From Berlin to Brussels it is clear: there cannot be an open-ended invitation to the miserable millions of Europe’s southern and eastern periphery. Instead, European leaders have sought to export the problem whence it came: principally north Africa.

The means have been various: disrupting humanitarian rescue missions in the Mediterranean, offering aid to north African countries that commit to stemming the flow of people themselves, funding the UN to repatriate migrants stuck in Libya and beefing up the Libyan coastguard. The upshot has been to bottleneck the migration crisis in a part of the world least able to cope with it. Critics have said Europe is merely trying to export the problem and contain it for reasons of political expediency, but that this approach will not work. “We are creating chaos in our own backyard and there will be a high price to pay if we don’t fix it,” said one senior European aid official, who did not wish to be named.

The new hard-headed approach crystallised with the EU-Africa trust fund in November 2015, when European leaders offered an initial €2bn to help deport unwanted migrants and prevent people from leaving in the first place. Spread between 26 countries, the fund pays for skills training in Ethiopia and antenatal care in South Sudan, as well as helping migrants stranded in north Africa return home on a voluntary basis. Separately the European commission has signed migration deals with five African countries, Niger, Mali, Nigeria, Senegal and Ethiopia. These migration “compacts” tie development aid, trade and other EU policies to the EU’s agenda on returning unwanted migrants from Europe. For instance, in the first year of the compact, Mali took back 404 voluntary returnees and accepted EU funds to beef up its internal security forces and border control and crack down on smugglers.

Europe is feeding gangs.

• Libyan Path To Europe Turns Into Dead End For Desperate Migrants (G.)

UNHCR, the UN’s refugee agency, estimates that there are about 30 government-run detention centres in Libya, but that doesn’t include clandestine facilities run by traffickers and militias. Several hundred thousand migrants are thought to be in the country. “In general, conditions are really bad in these detention centers,” says UNHCR Libya chief Roberto Mignone. “At best, they are more or less functional, but serious human rights violations and sexual assaults are committed there.” UNHCR is trying to help migrants move out of the illicit detention centres and into facilities that it manages. But the agency’s freedom to operate is limited by a parlous security situation: Mignone and his staff operate out of neighbouring Tunisia, with the help of a few dozen Libyan associates.

“The security situation is very complicated and it is frustrating not to have free access to all in need. We have no overview of the militias’ or traffickers’ detention centres or prisons,” says Mignone. Since Muammar Gaddafi was ousted in 2011, Libya has served as both a magnet and a funnel for migrants desperate to start new lives in Europe. After record-breaking numbers of arrivals in Italy in 2016 and unprecedented numbers dying in the Mediterranean over the past two years, the EU signalled a new determination to head of the migration problem closer to the source with a series of deals with Libya earlier this year. One part of the strategy involved the south of the country – where more than 2,500km (1,550 miles) of desert borders with Algeria, Chad, Niger and Sudan provide multiple channels north.

A series of consultations was established between the Italian interior minister, Marco Minniti, and south Libyan mayors, who represent local groups and tribes. The deal pinpointed seven “elements” to pacify the different factions, from the Tebu to the Beni Suleiman, in the name of a common commitment to halt migrant trafficking. This project was heavily supported by Ahmed Maetig, vice-president of the Libyan presidential council, and greeted warmly in southern Libya, by the mayor of Sebha, Hamed Al-Khayali. “The project we are carrying forward now with Italy involves the development and growth of southern Libya within the framework of the fight against illegal immigration,” Khayali said.

Home › Forums › Debt Rattle October 31 2017