Paul Klee Pflanze und Fenster Stillleben 1927

There’s a thought.

• The US Should Break The German Lock On The European Economy (CNBC)

Germany may only account for 3.4% of the world economy, but it is more than a quarter of the European Union’s demand and output. The EU, in turn, is close to 20% of the world economy, and, based on last year’s numbers, it takes $283.5 billion of U.S. exports, or 18.3% of America’s total goods sold overseas. What the U.S. sells to the EU is more than 40% of all the goods America exports to China and Japan. That shows that the damage caused to the U.S. economy transcends, by far, Germany’s surplus of $64.2 billion on American trades in 2017. Imagine, for example, what would happen to the EU economy, to the rest of the world — and to U.S. export sales in general — if Germany were not living off its fellow Europeans with a massive €164.4 billion trade surplus.

That German surplus is stifling the economic growth in the rest of Europe, because it is a deficit for countries trading with Germany. You can think of those €164.4 billion as a large wealth transfer to Germany. Indeed, it is a structural foundation of Germany’s export-driven economy, where sales to the rest of the world account for nearly a half of German GDP (compared with 14% in the U.S. case). What Europe, the U.S. and the rest of the world need here is a radical change of German economic policies. Germany should be generating more growth from domestic demand to give an opportunity to its trade partners to sell more of their goods and services on German markets. That would boost intra-European growth and create opportunities for more American sales to Europe — its largest overseas customer.

There is nothing new here. It’s a very old story Germans don’t even want to talk about. And why should they? France is meekly taking it on the chin with annual deficits of 36 to 41 billion euros on its German trades, and the rest of Europe does not dare question what it wrongly sees as a virtuously strong German economy.

There will be no such deal. Not a comprehensive one.

• Merkel Gets Extra Time To Reach Deal With EU Over Asylum Row (G.)

Germany’s interior minister, Horst Seehofer, has signalled he is open to giving Angela Merkel more time to reach a deal with Germany’s EU partners over an asylum row that has threatened to bring down her government. As the German chancellor met leaders of her Christian Democratic Union (CDU) on Sunday in an attempt to divert the collapse of her fledgling administration, Seehofer emerged from emergency talks with his Christian Social Union (CSU) saying he had no intention of toppling Merkel. Seehofer wants police stationed at borders to turn back refugees and migrants arriving from other EU countries but signalled he would give Merkel two weeks’ grace to reach migration agreements with EU partners.

“No one in the CSU is interested in bringing the chancellor down, or dissolving the CDU/CSU parliamentary partnership or destroying the coalition,” Seehofer told the Bild am Sonntag newspaper, adding that he did not want the asylum row to endanger the coalition government, which is less than 100 days old. Seehofer said his party was keen to find a way to limit the number of asylum seekers arriving in Germany. “We finally want to have a solution for the return of refugees at our borders which is fit for the future,” he added. But he was quoted in the Welt am Sonntag as having voiced his scepticism about the future of the CDU/CSU alliance in a meeting of the CSU’s leadership. “I cannot work with this woman any more,” he was quoted as saying.

A row with the IMF, you mean.

• Eurozone Braces For Row With Greece Over Bailout Exit Terms (G.)

Eurozone finance ministers are braced for a row this week with the Greek government over the terms of a “golden goodbye” as the country prepares to exit its third bailout programme. Concerns that Greece will suffer a fourth financial collapse unless an agreement is signed with the EU to write off some of its debt mountain are likely to surface before a showdown in Brussels on Thursday. The IMF, which has lent Greece several billion euros and has taken part in a tripartite monitoring of reforms with the European commission and ECB, is expected to pull out of the arrangement unless Brussels reduces Greece’s debt burden. Without the IMF on board, Germany and other hardline countries such as Finland and Austria could demand stricter clauses in the reform programme due to be imposed on Greece as the price of its final bailout payoff.

“Everyone has an interest to alleviating the burden, for Greece and the rest of the creditors,” said Olivier Bailly, the chief adviser to the EU’s finance commissioner, Pierre Moscovici. “If we leave too much burden, this will slow down Greece’s recovery.” He played down the impact of the IMF pulling out of the first stage of surveillance that will last until at least 2022. “What is important is that the IMF give its view on debt measures. What the markets expect is that it says they are credible enough,” he said, admitting that the lack of involvement by the Washington-based lender of last resort puts pressure on Germany. Finance ministers from the 19-member currency bloc will meet on Thursday to agree a package of measures that will include a final loan payment of between €10bn and €12bn and a cash buffer of up to €20bn. The payments are due to be the last of the €86bn bailout agreed in 2015.

[..] Hans Vijlbrief, the top EU official advising eurogroup ministers, said: “It’s very important that Greece can stand on its own feet. If it’s not credible, we won’t come out. This is the first condition.” The Eurogroup is seeking to reduce Greek debt payments by extending loans until beyond 2040 and reducing the interest rate to near 1%, well below the rate Greece would need to pay international investors. The IMF, however, has insisted that reducing the overall debt mountain from the outset is the only way to stabilise Athens’ public finances. Vijlbrief said the EU charter prevented the Eurogroup from offering debt write-offs, but this assertion has never been tested and is still the basis for IMF involvement in the next stage of Greece’s recovery.

The bank of banks feels threatened.

• The Bigger Cryptocurrencies Get, The Worse They Perform: BIS (R.)

Cryptocurrencies are not scalable and are more likely to suffer a breakdown in trust and efficiency the greater the number of people using them, the Bank of International Settlements (BIS)said on Sunday in its latest warning about the rise of virtual currencies. For any form of money to work across large networks it requires trust in the stability of its value and in its ability to scale efficiently, the BIS, an umbrella group for the world’s central banks, said in its annual report. But trust can disappear instantly because of the fragility of the decentralized networks on which cryptocurrencies depend, the BIS said.

Those networks are also prone to congestion the bigger they become, according to the BIS, which noted the high transaction fees of the best-known digital currency, bitcoin, and the limited number of transactions per second they can handle. “Trust can evaporate at any time because of the fragility of the decentralised consensus through which transactions are recorded,” the Switzerland-based group said in its report. “Not only does this call into question the finality of individual payments, it also means that a cryptocurrency can simply stop functioning, resulting in a complete loss of value.”

The BIS’ head of research, Hyun Song Shin, said sovereign money had value because it had users, but many people holding cryptocurrencies did so often purely for speculative purposes. “Without users, it would simply be a worthless token. That’s true whether it’s a piece of paper with a face on it, or a digital token,” he said, comparing virtual coins to baseball cards or Tamagotchi. [..] Agustin Carstens, general manager of the BIS, has described bitcoin as “a combination of a bubble, a Ponzi scheme and an environmental disaster”.

The claim is so out there it’s funny.

• May’s NHS ‘Brexit Dividend’ Claim Draws Scepticism And Doubt (G.)

Theresa May’s promise of £400m extra in weekly NHS spending within five years has been overshadowed by scepticism among experts and her own backbenchers over her claim it can be financed through a windfall delivered by Brexit. Ahead of a major speech by the prime minister in which she will pledge a £20bn annual real-terms NHS funding increase by 2023-24, May was ridiculed for arguing that some of the money would come from a so-called Brexit dividend. “At the moment, as a member of the European Union, every year we spend significant amounts of money on our subscription, if you like, to the EU,” she said in an interview on BBC One’s Andrew Marr show.

“When we leave we won’t be doing that. It’s right that we use that money to spend on our priorities, and the NHS is our number-one priority.” The Institute for Fiscal Studies (IFS) said, however, that even the government had accepted the idea of an immediate post-Brexit boost to coffers would not happen. The decision to announce extra spending for the NHS and to frame it specifically as a benefit of leaving the EU has been widely seen as a sop by May to hardline Brexiters in her cabinet and on the Tory backbenches ahead of some potentially crucial votes this week on the EU withdrawal bill.

Finally there’s peace, and now this. Colombia is set to become a NATO member.

• FARC Peace Deal At Risk As Conservative Duque Wins Colombia Presidency (AFP)

Conservative Ivan Duque won Colombia’s presidential election Sunday after a campaign that turned into a referendum on a landmark 2016 peace deal with FARC rebels that he pledged to overhaul. Duque, 41, polled 54 percent to his leftist rival Gustavo Petro’s 42 percent with almost all the votes counted, electoral authority figures showed. Petro, a leftist former mayor and ex-guerrilla, supports the deal. Tensions over the deal became apparent in the immediate aftermath of Duque’s victory, after the president-elect lost no time in pledging “corrections” to the peace deal. “That peace we long for — that demands corrections — will have corrections, so that the victims are the center of the process, to guarantee truth, justice and reparation,” Duque told supporters in his victory speech at his campaign headquarters.

“The time has come to build real change,” Duque said, promising a future for Colombians “of lawfulness, freedom of enterprise and equity,” after decades of conflict. His vanquished opponent Petro promised to resist any fundamental changes to the deal. “Our role is not to be impotent and watch it being destroyed,” he said. FARC, which disarmed and transformed into a political party after the peace deal but did not contest the election, immediately called on Duque to show “good sense” in dealing with the agreement. “What the country demands is an integral peace, which will lead us to the hoped-for reconciliation,” the FARC said in a statement after Duque’s presidential win. The former rebels also called for an early meeting with Duque.

A US supported coup soon?

• Bolivia’s Morales Condemns US Intervention in Venezuela, Latin America (TSur)

Bolivian President Evo Morales said Saturday that Latin America “is no longer the United States’ backyard” while denouncing the United States’ attempt to convince its South American allies to help it orchestrate a military intervention or coup in Venezuela. In an interview with news agency EFE, Morales explained that several Latin American leaders have confided in him that U.S. Vice president Mike Pence is “trying to convince some United States-friendly countries” help them seize control of the South American country and replace the current government led by Nicolas Maduro. The real target, Morales explained, is not the Venezuelan president but “Venezuelan oil, and Venezuelans know that.”

Drawing parallels to 2011 military intervention in Libya, Morales said the U.S. isn’t interested in helping with alleged humanitarian crisis since, despite the current political and social turmoil in Libya, the U.S. will not intervene there since “the country’s oil is now owned by the U.S. and some European oil companies,” Morales asserted. “One military intervention (in the region) would only create another armed conflict,” he added pointing to Colombia’s membership in the North Atlantic Treaty Organization (NATO) as a general sign of an escalation of “military aggression to all Latin America and the Caribbean” region. Morales explained, however, that U.S. interventionism is not only militaristic.

“When there are no military coups, they seek judicial or congressional coups” as in the case of former Brazilian President Dilma Rousseff’s impeachment and the Luiz Inacio Lula da Silva’s imprisonment, which is barring him from running in the upcoming 2018 elections.

They warned of the last one as well.

• Russia-Syria Warnings of Coming False-Flag Attack Have Ring of Truth (MPN)

In recent days, speculation has swirled regarding whether another chemical-weapons attack will soon take place in Syria, as sources in both Syrian intelligence and the Russian military have warned that U.S.-backed forces in the U.S.-occupied region of Deir ez-Zor are planning to stage a chemical weapons attack to be blamed on the Syrian government. Concern that such an event could soon take place has only grown since the U.S. government announcement this past Thursday that the U.S. would provide $6.6 million over the next year to fund the White Helmets, the controversial “humanitarian” group that has been accused of staging “false flag” chemical weapons attacks in the past.

Notably, the White Helmets were largely responsible for staging the recent alleged chlorine gas attack in Eastern Ghouta, which led the United States, the United Kingdom and France to attack Syrian government targets. That same attack in Eastern Ghouta had been predicted weeks prior by the Russian military and Syrian government, who are warning once again that a similar event is likely to occur in coming weeks. An additional and largely overlooked indication that another staged attack could soon take place has been the recent movements of U.S. military assets to the Syrian coast, particularly the deployment of the Harry S. Truman Carrier Strike Group (HSTCSG). As MintPress previously reported, the deployment of the HSTCSG – which consists of some 6,500 sailors — was first announced in April prior to the U.S., France and U.K. bombing of Syria. However, the group did not arrive until after that bombing had taken place.

While the April bombing was called a “one-time shot” by U.S. Secretary of Defense James Mattis, the fact that the Truman strike group’s deployment to the region was not canceled after the bombings occurred led some to suggest that the U.S. may have been anticipating more strikes against Syria’s government in the coming months. Indeed, soon after the U.S.-led bombing of Syria, U.S. Ambassador to the UN, Nikki Haley, declared the U.S. was “locked and loaded” should the Syrian government again be accused of using chemical weapons. Now, amid claims from both the Syrian and Russian governments of another chemical weapons provocation, as well as the U.S.’ renewed funding of the White Helmets, the strike group’s deployment directly off the Syrian coast has only given greater credence to those previously voiced concerns.

12,000 refugees so far this year.

• Refugee Camps Reopening On Greek Mainland (K.)

While European Union countries shut their doors to migrants – Italy and Malta last week refused to allow a rescue ship carrying more than 600 migrants to dock at their ports – Greek authorities are reopening unused camps and facilities across the mainland to accommodate the swelling number of asylum seekers. Following a series of meetings last week, sources told Kathimerini, the Ministry for Migration Policy decided to reopen four camps, first set up at the peak of the refugee crisis in 2015, raising the total number of operational centers to 25. More specifically, tents have been set up again at the Malakasa camp, north of Athens, to house 300 people.

The Vagiochori camp near Thessaloniki, in northern Greece, is also expected to open in the coming days, providing accommodation for 400 individuals. The facility at Elefsina, west of the capital, has been hosting 250 refugees since late April, while another 350 migrants and refugees were transferred to the reception center at Oinofyta, north of Attica. A drop in the migrant population at the Skaramangas refugee center, meanwhile, was reversed after September last year, with the current number estimated at more than 2,000. An average 75 migrants land daily on Greece’s Aegean islands. A total of 12,065 people had entered the country until June 11 this year.

“..the plant is heavily cloned so if you have a disease that can kill one tree, it can potentially wipe out the entire industry.”

• Scientists Scramble To Stop Bananas Being Killed Off (G.)

A British company has joined the race to develop a banana variety resistant to diseases and climatic changes that threaten to disrupt the availability of the country’s favourite fruit – or even kill it off altogether. The UK alone consumes more than 5bn bananas a year, while the fruit is a staple food in many poor countries and accounts for an export industry worth $13bn (£9.8bn) a year. But the global supply chain is threatened by a virulent disease that has been attacking plantations in Australia, south-east Asia and parts of Africa and the Middle East. As experts warn the fungus known as “fusarium wilt”, or Panama disease, could spread to Latin America, from where the majority of bananas are exported, scientists are scrambling to create a more robust variety that could help sustain the crop.

A single type of banana, called the Cavendish, accounts for 99.9% of bananas traded globally. It replaced a tastier variety wiped out by disease in the 1950s. Now researchers at the Norwich-based startup Tropic Biosciences are using gene editing techniques to develop a more resilient version of the Cavendish after securing $10m from investors. The company’s CEO, Gilad Gershno, : “In the developed world we tend to take bananas for granted. A banana found in your local supermarket grown in Costa Rica and shipped to the UK probably costs less than an apple grown 20 miles away. “If you look at the broader consumption on top of exports, the banana industry is worth a massive $30bn a year. However,people have been getting increasingly worried because the plant is heavily cloned so if you have a disease that can kill one tree, it can potentially wipe out the entire industry.”

“10,000,000,000,000,000,000. 10 quintillion. That equals more than 1500 million insects for every person.”

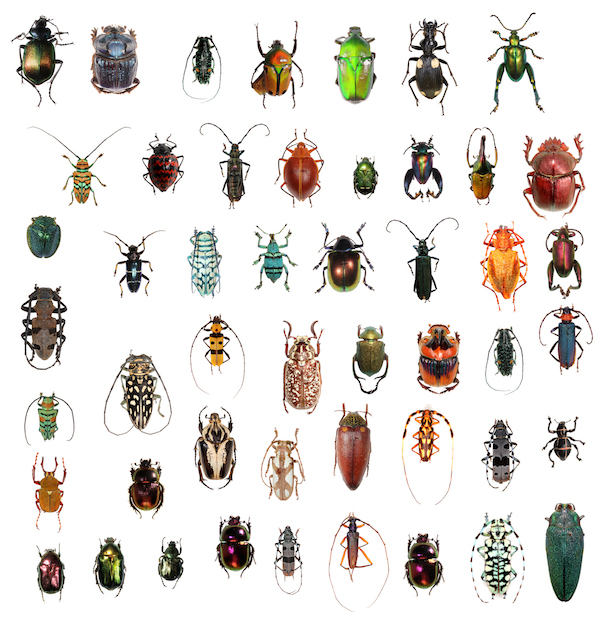

He starts at the beginning, with a black and white photocopy of a pie chart representing the animal kingdom and its various, speciated slices of pie. 80 percent of all known species of animals are insects, he says. You can tell an insect – if you can get it to hold still for long enough – by its six legs, exoskeleton divided into a head, thorax and abdomen and its two waggling antennae. By far the biggest orders of insects are the coleoptera (beetles) and the hymenoptera (wasps, bees and ants), followed by the lepidoptera (butterflies and moths), then diptera (flies and mosquitoes) and, finally, other insects, such as grasshoppers and silverfish. “The total number of individual insects alive worldwide today is …” He writes it out. 10,000,000,000,000,000,000. “… 10 quintillion. That equals more than 1500 million insects for every person.”

[..] The total biomass, that is the total weight of all organisms on earth, is estimated at 545.2 Gt C (gigatons of carbon), the researchers say. More than 80% of this, 452.5Gt C, is plants. Next comes bacteria (16%, 87.2Gt C) and fungi (2%, 10.9 Gt C). Animals make up just 0.4% of the total biomass. The globe’s 7.6 billion people account for just 0.01% of all living things. And yet our impact on the globe has been enormous – some would say catastrophic. According to the Proceedings article, humans are responsible for the possibly irreparable loss of large chunks of the animal and plant kingdoms; more than 80% of all wild animals and half of all plants.

Anthony Harris finds it deeply disturbing. “Farmed poultry now makes up 70% of all birds on the planet, with just 30% wild,” he says with a shocked tone. “The picture for mammals is worse. 60 percent of all mammals on earth are livestock, mostly cattle and pigs, 36% are humans and just 4% of all mammals are wild.’ [..] Without insects, we face total ecological collapse and global famine. It is being called the Sixth Mass Extinction. The Fifth Mass Extinction was the one that killed off the dinosaurs, 66 million years ago. Harvard entomologist Prof E.O. Wilson has estimated that, without insects and other land-based invertebrates, humanity would only last a few months. Land-based plants and animals would be next to go. The planet would fall quiet and still. The last time the earth was like that was 440 million years ago.

Anyone seen any initiative to stop this?

• Where Have All Our Insects Gone? (G.)

Certainly, the statistics are grim. Native ladybird populations are crashing; three quarters of butterfly species – such as the painted lady and the Glanville fritillary – have dropped significantly in numbers; while bees, of which there are more than 250 species in the UK, are also suffering major plunges in populations, with great yellow bumblebees, solitary potter flower bees and other species declining steeply in recent years. Other threatened insects include the New Forest cicada, the tansy beetle and the oil beetle. As for moths, some of the most beautiful visitors to our homes and gardens, the picture is particularly alarming. Apart from the tiger moth, which was once widespread in the UK, the V-moth (Marcaria wauaria) recorded a 99% fall in numbers between 1968 and 2007 and is now threatened with extinction, a fate that has already befallen the orange upperwing, the bordered gothic and the Brighton wainscot in recent years.

An insect Armageddon is under way, say many entomologists, the result of a multiple whammy of environmental impacts: pollution, habitat changes, overuse of pesticides, and global warming. And it is a decline that could have crucial consequences. Our creepy crawlies may have unsettling looks but they lie at the foot of a wildlife food chain that makes them vitally important to the makeup and nature of the countryside. They are “the little things that run the world” according to the distinguished Harvard biologist Edward O Wilson, who once observed: “If all humankind were to disappear, the world would regenerate back to the rich state of equilibrium that existed 10,000 years ago. If insects were to vanish, the environment would collapse into chaos.”

Beginning and end of a speech by Pilger in Sydney. Tomorrow there are many rallies for Assange, especially in Australia. There is also a UN Human RIghts Commission meeting in Genava.

• Bringing Julian Assange Home (John Pilger)

The persecution of Julian Assange must end. Or it will end in tragedy. The Australian government and prime minister Malcolm Turnbull have an historic opportunity to decide which it will be. They can remain silent, for which history will be unforgiving. Or they can act in the interests of justice and humanity and bring this remarkable Australian citizen home. Assange does not ask for special treatment. The government has clear diplomatic and moral obligations to protect Australian citizens abroad from gross injustice: in JulianE’s case, from a gross miscarriage of justice and the extreme danger that await him should he walk out of the Ecuadorean embassy in London unprotected. We know from the Chelsea Manning case what he can expect if a US extradition warrant is successful — a United Nations Special Rapporteur called it torture.

[..] Malcolm Turnbull is now the Prime Minister of Australia. Julian Assange’s father has written to Turnbull. It is a moving letter, in which he has appealed to the prime minister to bring his son home. He refers to the real possibility of a tragedy. I have watched Assange’s health deteriorate in his years of confinement without sunlight. He has had a relentless cough, but is not even allowed safe passage to and from a hospital for an X-ray . Malcolm Turnbull can remain silent. Or he can seize this opportunity and use his government’s diplomatic influence to defend the life of an Australian citizen, whose courageous public service is recognised by countless people across the world. He can bring Julian Assange home.

Home › Forums › Debt Rattle June 18 2018