Claude Monet The sheltered path 1888

And there are different ways…

• The Bailouts for the Rich Are Why America Is So Screwed Right Now (Stoller)

In 1933, when FDR took power, global banking was essentially non-functional. Bankers had committed widespread fraud on top of a rickety and poorly structured financial system. Herbert Hoover, who organized an initial bailout by establishing what was known as the Reconstruction Finance Corporation, was widely mocked for secretly sending money to Republican bankers rather than ordinary people. The new administration realized that trust in the system was essential. One of the first things Roosevelt did, even before he took office, was to embarrass powerful financiers. He did this by encouraging the Senate Banking Committee to continue its probe, under investigator Ferdinand Pecora, of the most powerful institutions on Wall Street, which were National City (now Citibank) and JP Morgan.

Pecora exposed these institutions as nests of corruption. The Senate Banking Committee made public Morgan’s “preferred list,” which was the group of powerful and famous people who essentially got bribes from Morgan. It included the most important men in the country, like former Republican President Calvin Coolidge, a Supreme Court Justice, important CEOs and military leaders, and important Democrats, too. Roosevelt also ordered his attorney general “vigorously to prosecute any violations of the law” that emerged from the investigations. New Dealers felt that “if the people become convinced that the big violators are to be punished it will be helpful in restoring confidence.” The DOJ indicted National City’s Charles Mitchell for tax evasion.

This was part of a series of aggressive attacks on the old order of corrupt political and economic elites. The administration pursued these cases, often losing the criminal complaints but continuing with civil charges. This bought the Democrats the trust of the public. When Roosevelt engaged in his own broad series of bank bailouts, the people rewarded his party with overwhelming gains in the midterm elections of 1934 and a resounding re-election in 1936. Along with an assertive populist Congress, the new administration used the bailout money in the RFC to implement mass foreclosure-mitigation programs, create deposit insurance, and put millions of people to work. He sought to save not the bankers but the savings of the people themselves.

Neil Barofsky on Twitter: “No need to write a retrospective on the bailouts, @mtaibbi has got it all covered here.”

Taibbi’s reply: “Wow. Can I unpublish so you will write one? (Neil wrote the definitive book on the subject)”.

(Barofsky was the SIGTARP, the Special United States Treasury Department Inspector General overseeing the Troubled Assets Relief Program from late 2008 till early 2011)

• Ten Years After the Crash, We’ve Learned Nothing (Taibbi)

Too Big To Fail shows Fuld on a rant: “People act like we’re crack dealers,” Fuld (James Woods) gripes. “Nobody put a gun to anybody’s head and said, ‘Hey, nimrod, buy a house you can’t afford. And you know what? While you’re at it, put a line of credit on that baby and buy yourself a boat.” This argument is the Wall Street equivalent of Reagan’s famous Cadillac-driving “welfare queen” spiel, which today is universally recognized as asinine race rhetoric. Were there masses of people pre-2008 buying houses they couldn’t afford? Hell yes. Were some of them speculators or “flippers” who were trying to game the bubble for profit? Sure. Most weren’t like that – most were ordinary working people, or, worse, elderly folks encouraged to refinance and use their houses as ATMs – but there were some flippers in there, sure.

People pointing the finger at homeowners are asking the wrong questions. The right question is, why didn’t the Fulds of the world care if those “nimrods” couldn’t afford their loans? The answer is, the game had nothing to do with whether or not the homeowner could pay. The homeowner was not the real mark. The real suckers were institutional customers like pensions, hedge funds and insurance companies, who invested in these mortgages. If you had a retirement fund and woke up one day in 2009 to see you’d lost 30 percent of your life savings, you were the mark. Ordinary Americans had their remaining cash in houses and retirement plans, and the subprime scheme was designed to suck the value out of both places, into the coffers of a few giant banks.

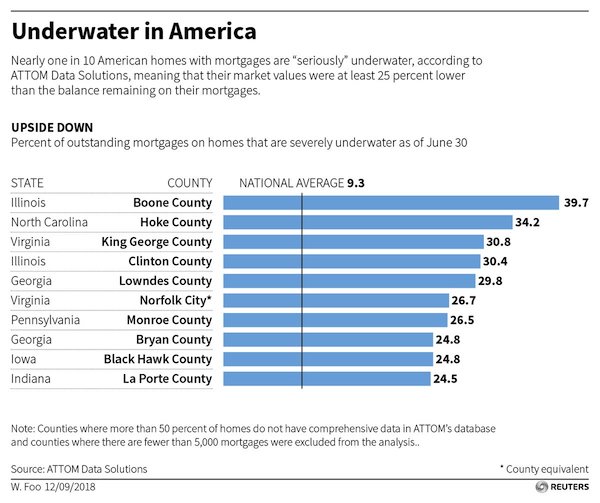

“As of June 30, nearly one in 10 American homes with mortgages were “seriously” underwater..”

• Millions Of Americans Trapped In Underwater Homes 10 Years After Crisis (R.)

School bus driver Michael Payne was renting an apartment on the 30th floor of a New York City high-rise, where the landlord’s idea of fixing broken windows was to cover them with boards. So when Payne and his wife Gail saw ads in the tabloids for brand-new houses in the Pennsylvania mountains for under $200,000, they saw an escape. The middle-aged couple took out a mortgage on a $168,000, four-bedroom home in a gated community with swimming pools, tennis courts and a clubhouse. “It was going for the American Dream,” Payne, now 61, said recently as he sat in his living room. “We felt rich.” Today the powder-blue split-level is worth less than half of what they paid for it 12 years ago at the peak of the nation’s housing bubble.

Located about 80 miles northwest of New York City in Monroe County, Pennsylvania, their home resides in one of the sickest real estate markets in the United States, according to a Reuters analysis of data provided by a leading realty tracking firm. More than one-quarter of homeowners in Monroe County are deeply “underwater,” meaning they still owe more to their lenders than their houses are worth. The world has moved on from the global financial crisis. Hard-hit areas such as Las Vegas and the Rust Belt cities of Pittsburgh and Cleveland have seen their fortunes improve. But the Paynes and about 5.1 million other U.S. homeowners are still living with the fallout from the real estate bust that triggered the epic downturn.

As of June 30, nearly one in 10 American homes with mortgages were “seriously” underwater, according to Irvine, California-based ATTOM Data Solutions, meaning that their market values were at least 25 percent lower than the balance remaining on their mortgages.

And he just signed up to oversee it till 2020.

• No-Deal Brexit Could Lead To Financial Crisis As Bad As 2008 – Carney (Ind.)

A no-deal Brexit could lead to a financial crisis as bad as the crash in 2008, the governor of the Bank of England has warned. Mark Carney told Theresa May and senior ministers that not getting a deal with the European Union would lead to a number of negative economic consequences. It is also understood that Mr Carney warned house prices could fall by up to 35 per cent over three years in a worst case scenario, an event that could cause the value of sterling to plummet and force the bank to push up interest rates. His bleak prognosis came as France said it could halt flights and Eurostar trains from the UK if there was no agreement when Britain leaves the EU in March 2019.

The Bank of England declined to comment on Mr Carney’s briefing to ministers. Following the three-and-a-half hour meeting of the cabinet, a Downing Street spokesman said ministers remained confident of securing a Brexit agreement, but had agreed to “ramp up” their no-deal planning.

So what changes now?

• Europe’s Top Rights Court Rules Against Britain Over Mass Surveillance (AFP)

Europe’s top rights court ruled Thursday that Britain’s programme of mass surveillance, revealed by whistleblower Edward Snowden as part of his sensational leaks on US spying, violated people’s right to privacy. Ruling in the case of Big Brother Watch and Others versus the United Kingdom, the European Court of Human Rights in Strasbourg, France, said the interception of journalistic material also violated the right to freedom of information. The case was brought by a group of journalists and rights activists who believe that their data may have been targeted. The court ruled that the existence of the surveillance programme “did not in and of itself violate the convention” but noted “that such a regime had to respect criteria set down in its case-law”.

They concluded that the mass trawling for information by Britain’s GCHQ spy agency violated Article 8 of the European Convention on Human Rights regarding the right to privacy because there was “insufficient oversight” of the programme. The court found the oversight to be doubly deficient, in the way in which the GCHQ selected internet providers for intercepting data and then filtered the messages, and the way in which intelligence agents selected which data to examine. It determined that the regime covering how the spy agency obtained data from internet and phone companies was “not in accordance with the law”.

China needs money, badly. Or it wouldn’t open up like this.

• S&P Sees Major Opportunity In China’s $11 Trillion Bond Market (CNBC)

Financial services and ratings giant S&P Global is honing in on China’s $11 trillion bond market, a move that may spell good news for international investors in search of more reliable ratings for bonds. Speaking to CNBC on Friday, S&P Global Chief Financial Officer Ewout Steenbergen explained that it’s a good time to enter China as Asia’s largest economy has lifted foreign ownership restrictions for credit ratings agencies. Elaborating on the company’s plan to offer ratings services for the bond market there, Steenbergen said that S&P Global intends to start a new entity for its mainland business.

“We are expanding our market intelligence business in China, very specific local content, for example for Chinese private company data … But the most attractive opportunity we have is in the ratings business,” he said on CNBC’s “Squawk Box.” “It is the third-largest domestic bond market in the world, we think it will overtake Japan soon to become the second-largest domestic bond market,” added Steenbergen, who is also an executive vice president at S&P Global. [..] Steenbergen said he hopes that S&P Global’s move to enter that market can create more confidence. “Today, Chinese domestic bonds, 2 percent are bought by international investors, 98 percent only by Chinese investors. And I think (how) we can help with the market is to create more maturity, more confidence.

Another way to protest tariffs.

• China Says World Trade System Not Perfect, Needs Reform (R.)

The current world trade system is not perfect and China supports reforms to it, including to the World Trade Organization, to make it fairer and more effective, Beijing’s top diplomat said. China is locked in a bitter trade war with the United States and has vowed repeatedly to uphold the multilateral trading system and free trade, with the WTO at its center. But speaking late on Thursday to reporters after meeting French Foreign Minister Jean-Yves Le Drian, Chinese State Councillor Wang Yi said some reforms could be good. While certain doubts have been raised about the current international trading system, China has always supported the protection of free trade and believes that multilateralism with the WTO at its core should be strengthened, Wang added.

[..] China will not buckle to U.S. demands in any trade negotiations, the major state-run China Daily newspaper said in an editorial on Friday, after Chinese officials welcomed an invitation from Washington for a new round of talks. The official China Daily said that while China was “serious” about resolving the stand-off through talks, it would not be rolled over, despite concerns over a slowing economy and a falling stock market at home. “The Trump administration should not be mistaken that China will surrender to the U.S. demands. It has enough fuel to drive its economy even if a trade war is prolonged,” the newspaper said in an editorial.

Brussels still feels superior.

• ‘Little Mussolinis’: EU Chief Angers Italy With Comment On Far Right (R.)

The EU’s top economic official has voiced fears that “little Mussolinis” might be emerging in Europe, drawing a furious response from Italy’s far-right interior minister who accused him of insulting his country and Italians. Pierre Moscovici, a Frenchman who is the European Union’s economics affairs commissioner, said the current political situation, with populist, far-right forces on the rise in many nations, resembled the 1930s when Germany’s Adolf Hitler and Italian fascist chief Benito Mussolini were in power. “Fortunately there is no sound of jackboots, there is no Hitler, (but maybe there are) small Mussolinis. That remains to be seen,” he told reporters in Paris, speaking in a jocular fashion.

Moscovici, a former French finance minister, mentioned no names, but Matteo Salvini, who is a deputy prime minister and heads Italy’s anti-immigrant League, took it personally. “He should wash his mouth out before insulting Italy, the Italians and their legitimate government,” Salvini said in a statement released by his office in Rome. Salvini took advantage of the spat to set out once again his grievances with France, which he accuses of not doing enough to help deal with migrants from Africa and of having plunged Libya into chaos by helping to oust former strongman Muammar Gaddafi. “EU commissioner Moscovici, instead of censuring his France that rejects immigrants … has bombed Libya and has broken European (budget) parameters, attacks Italy and talks about ‘many little Mussolini’ around Europe,” Salvini said.

Yeah. Not going to happen.

• Third Of Earth’s Surface Must Be Protected To Prevent Mass Extinction (Ind.)

Two leading scientists have issued a call for massive swathes of the planet’s land and sea to be protected from human interference in order to avert mass extinction. Current levels of protection “do not even come close to required levels”, they said, urging world leaders to come to a new arrangement by which at least 30 per cent of the planet’s surface is formally protected by 2030. Chief scientist of the National Geographic Society Jonathan Baillie and Chinese Academy of Sciences biologist Ya-Ping Zhang made their views clear in an editorial published in the journal Science.

They said the new target was the absolute minimum that ought to be conserved, and ideally this figure should rise to 50 per cent by the middle of the century. “This will be extremely challenging, but it is possible,” they said. “Anything less will likely result in a major extinction crisis and jeopardise the health and wellbeing of future generations.” Most current scientific estimates have the amount of space needed to safeguard the world’s animals and plants at between 25 and 75 per cent of land and oceans.

Nervous weekend ahead. In the Philippines too.

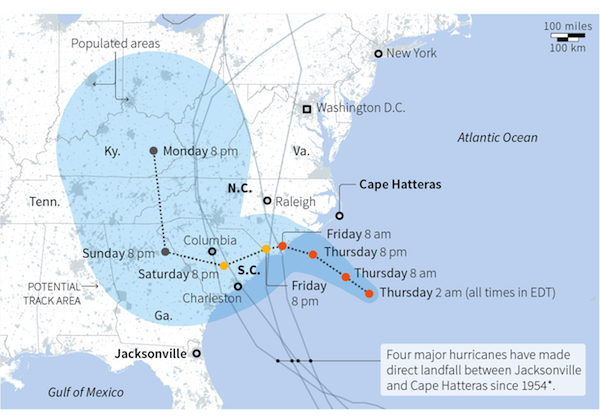

• Hurricane Florence Deluges Carolinas Ahead Of Landfall (R.)

Heavy rain, wind gusts and rising floodwaters from Hurricane Florence swamped the Carolinas early on Friday as the massive storm crawled toward the coast, threatening millions of people in its path with record rainfall and punishing surf. Florence was downgraded to a Category 1 storm on the five-step Saffir-Simpson scale on Thursday evening and was moving west at only 6 mph (9 km/h). The hurricane’s sheer size means it could batter the U.S. East Coast with hurricane-force winds for nearly a full day, according to weather forecasters. Despite its unpredictable path, it was forecast to make landfall near Cape Fear, North Carolina, at midday on Friday.

Home › Forums › Debt Rattle September 14 2018