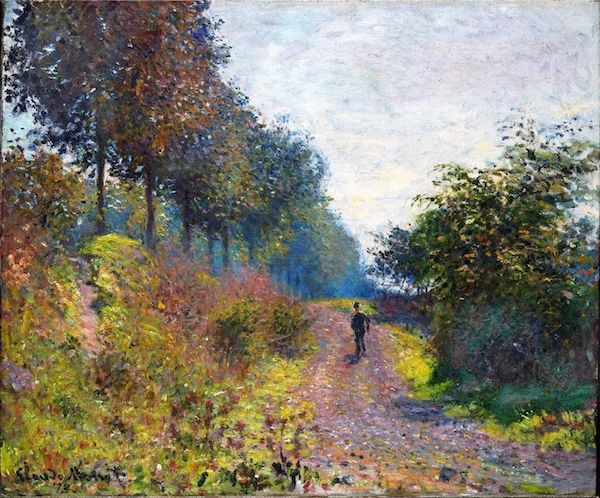

Salvador Dali Cabaret scene 1922

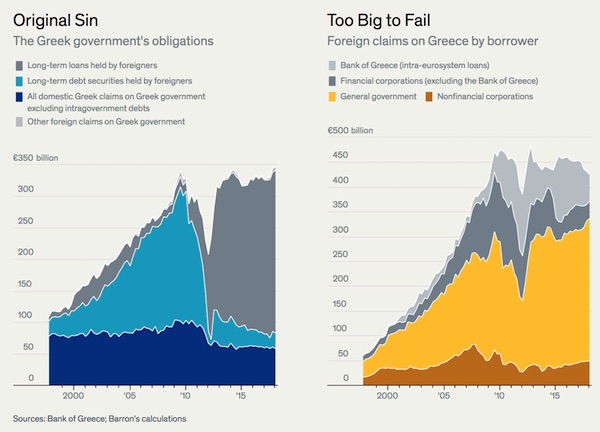

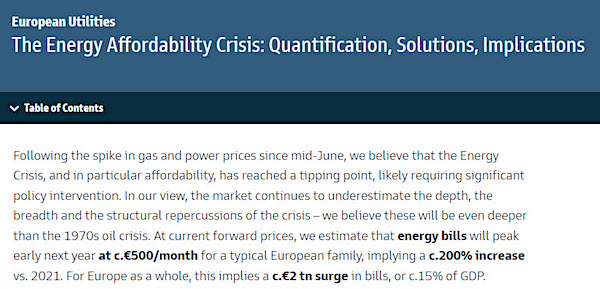

Europe needs to find €2 trillion in energy costs. Good luck.

I followed the science for 1000 days but I only found 99.9% survivability, myocarditis, communism, small business eradication, 574 new billionaires, grandma saying goodbye over FaceTime, penetrated world cabinets, bug-diet advocation, men getting pregnant, 162 genders and 8 mice.

— TY LEMMON (@tuxlemons) September 5, 2022

40% is like a war. Edward Dowd has almost entirely been banned, censored, disappeared. But not 100%.

https://twitter.com/i/status/1566995822616748032

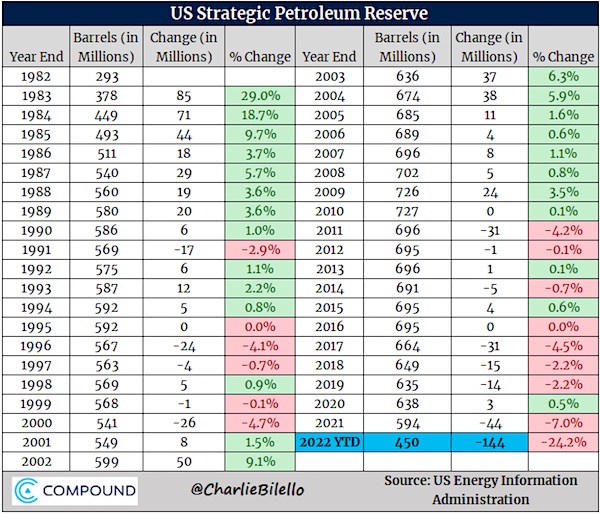

US SPR at lowest level since 1984

Trump – A Nation in Decline

Donald Trump just DROPPED most powerful video you'll see today— CHILLS. pic.twitter.com/rT6AJfs64P

— Benny Johnson (@bennyjohnson) September 6, 2022

Barron Trump is reportedly considering getting into crack cocaine, Russian prostitutes, and corrupt international business dealings to get the FBI to leave him alone.

No, he has not. They did it themselves. That is elementary.

• Putin Has Pushed Europe Into Inflationary Depression, Currency Collapse (Every)

As pointed out on Twitter, Russia’s move is so blatant there is no way Europe can fudge an agreement with it the way some might have over ‘technical issues’ with the pipeline. (As was Russian President Putin also approving a new foreign policy doctrine backing a “Russian world” covering all Russian speakers, including some in the EU, while building up relations with all the countries the USSR was friendly with to boot.) This is a gun to the EU’s head. So was OPEC+ agreeing on a token 100,000 barrel a day cut to production. So was Iran saying no to the nuclear deal unless the IAEA backs off from investigating the serious breaches of the last nuclear deal it didn’t stick to.

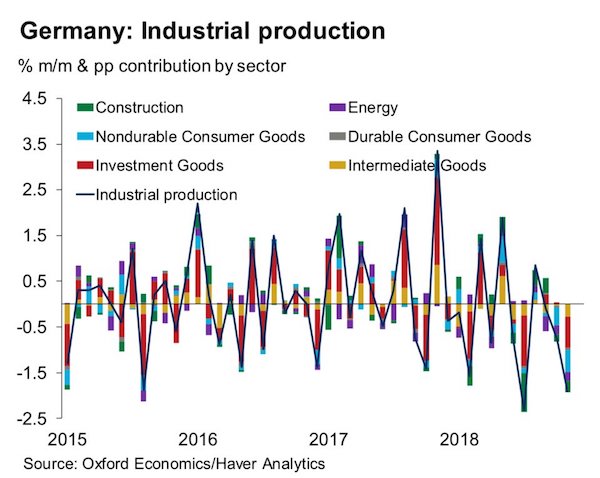

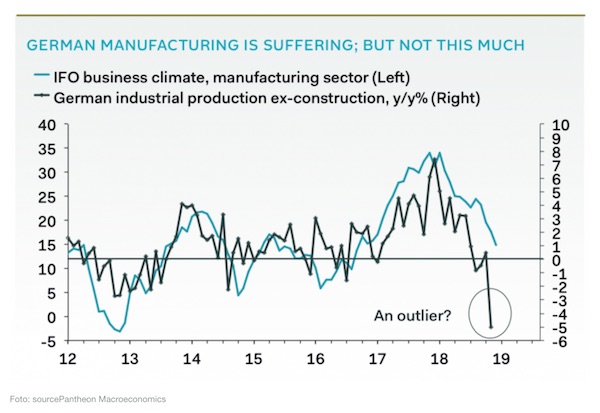

Assuming Europe cannot retreat, that means a severe recession with very high inflation, and if anything were to happen to gas flows via Ukraine, which could easily occur, Europe would need to make swinging cuts to demand in order to avoid unplanned ‘gas outs’. German Economy Minister Habeck just said: “Expect the worst.” As mentioned yesterday, existential choices now need to be made, because there may not enough energy to go round. The choices are obviously unappetising. First, Germany is to delay mothballing some nuclear reactors – so common sense at gunpoint. Yet Europe and the UK will not ration energy by price because it means the staggering bills already being seen, and then stagflation, incession, or ‘inpression’ (an inflationary depression).

They will instead subsidize businesses and households even if that means wholesale energy prices march even higher. Germany’s latest EUR65bn energy bailout will do just that; so will Sweden’s and the Netherlands’ measures, and France’s and Spain’s: and Brussels is talking about an EU-wide energy price cap. Only part of these subsidies will flow from windfall taxes (which also remove the industry capital needed to invest in new energy supply). New UK PM Truss, just selected with an underwhelming 57% mandate of a tiny Tory electorate, has also floated Covid-furlough sized spending to cap business and household energy bills; and huge tax cuts; and a 2.5% trend GDP growth rate target. Good luck with the latter.

https://twitter.com/i/status/1567315217935114241

You would have to put Zelensky on trial, too. And a whole range of western leaders.

• West Reluctant To Put Putin On Trial, Say Ukrainian Officials (G.)

Ukraine’s major western allies have yet to sign up to establish a tribunal to try Vladimir Putin and his inner circle for the crime of aggression, wanting to leave space for future relations with Russia, according to Ukraine’s top officials. “It’s big politics. On the one hand, countries publicly condemn the aggression but on the other, they are putting their foot in the closing door on relations with Russia so that it doesn’t close completely,” said Andriy Smyrnov, deputy head of Ukraine’s presidential administration, who is leading the country’s effort to establish the international tribunal. “They are attempting to keep some space for diplomatic manoeuvres,” said Smyrnov. “We know that agreements with Russia are not worth the paper they are written on.”

His claims come as the US president, Joe Biden, said on Monday that Russia should not be designated as a state sponsor of terrorism, something Ukrainian officials and some US politicians had pushed for. Russia had previously said such a designation would mean Washington had crossed the point of no return. Ukrainian officials say that since April, they have been trying to convince their western allies to establish an ad hoc tribunal which would hold Russia’s senior leadership responsible for the crime of aggression for invading Ukraine. Aggression is viewed as the supreme crime under international law because without the transgression of borders during an invasion, subsequent war crimes would not have been committed.

So far only the Baltic states and Poland have pledged support for the tribunal, said Ukraine’s officials. “We are expecting broader support,” said Ukraine’s prosecutor general, Andriy Kostin. “For us, the support of the UK and the US is very important as well as the rest of the civilised world,” said Smyrnov. The UK’s newly elected prime minister, Liz Truss, told Times Radio in May, when she was foreign secretary, that she would consider supporting the tribunal. The Council of Europe is due to discuss support for such a measure on 13 September.

Just 30 years ago, the official attitude was much less hawkish.

• US Shares Blame In Ruined Ties With Russia – Clinton’s Defense Secretary (RT)

The US antagonized Russia by ignoring its post-USSR suffering and intrinsic security interests and needs to acknowledge this before ties with Moscow can be mended, William J. Perry, who served as secretary of defense under President Bill Clinton has said. Perry, a veteran advocate for the reduction of weapons of mass destruction, called for some introspection in Washington DC in an opinion piece published on Monday by the outlet Outrider. Subsequent US administrations pursued policies that antagonized the Russian people after the collapse of the USSR, Perry argued. The US didn’t care much about the suffering that Russia’s transition to a capitalist economy brought and ignored Russian concerns about NATO’s encroachment on its borders, he said.

“The combination of the West failing to act during Russia’s financial crisis, and ignoring their strongly-held views on NATO expansion, reinforced a prevailing Russian belief that we didn’t take them seriously,” the article said. “Indeed, many in the West saw Russia only as the loser of the Cold War, not worthy of our respect.” Perry, who headed up the Pentagon between 1994 and 1997, was a strong supporter of a program called Partnership for Peace. This was a compromise that allowed Eastern European nations and Russia to train with NATO troops but, in a nod to Russian objections, didn’t bring former Warsaw Pact nations into NATO.

The Clinton administration ultimately pushed for a formal expansion of the military bloc, setting the stage for an increasingly tense relationship with Russia that culminated in the ongoing crisis in Ukraine. The American attitude pushed Russians towards supporting Vladimir Putin, a person he describes as “an autocratic leader who would instead demand respect and power through force.” Perry said he considers the Russian leader an enemy of the US but argued that “there is no organic reason” why Russia itself should be one. “We must work to rebuild connections with Russia, treat the Russian people with respect, and rebuild our relationships, in the hopes that we can once again return to the path of friendship,” he concluded.

“He stood on the election platform of the following promises. • To end the civil war in the East and bring peace to the Donbas and partial autonomy to Donetsk and Luhansk. • And to ratify and implement the rest of the body of the Minsk 2 agreements.”

• Open Letter To Olena Zelenska – Stop The Slaughter (Roger Waters)

Dear Mrs Zelenska,

My heart bleeds for you and all the Ukrainian and Russian families, devastated by the terrible war in Ukraine. I’m in Kansas City, USA. Iread an article on BBC.com apparently taken from an interview you have already recorded for a program called Sunday with Laura Kuenssburg which broadcasted on the BBC on September 4th. BBC.com quotes you as saying that if support for Ukraine is strong the crisis will be shorter. Hmmm? I guess that might depend on what you mean by “support for Ukraine?” If by “support for Ukraine,” you mean the West continuing to supply arms to the Kiev government’s armies, I fear you may be tragically mistaken. Throwing fuel, in the form of armaments, into a firefight, has never worked to shorten a war in the past, and it won’t work now, particularly because, in this case, most of the fuel is (a) being thrown into the fire from Washington DC, which is at a relatively safe distance from the conflagration, and (b) because the “fuel throwers” have already declared an interest in the war going on for as long as possible.

People like you and me actually want peace in Ukraine, don’t want the outcome to be that you have to fight to the last Ukrainian life – and possibly even, if the worst comes to the worst, to the last human life. If we, instead, wish to achieve a different outcome we may have to seek a different route and that route may lie in your husband’s previously stated good intentions. Yes, I mean the platform upon which he so laudably ran for the office of President of Ukraine, the platform upon which he won his historic landslide victory in the democratic election in 2019. He stood on the election platform of the following promises. • To end the civil war in the East and bring peace to the Donbas and partial autonomy to Donetsk and Luhansk. • And to ratify and implement the rest of the body of the Minsk 2 agreements.

One can only assume that your husband’s electoral policies didn’t sit well with certain political factions in Kiev and that those factions persuaded your husband to diametrically change course ignoring the people’s mandate. Sadly, your old man agreed to those totalitarian, anti-democratic dismissals of the will of the Ukrainian people, and the forces of extreme nationalism that had lurked, malevolent, in the shadows, have, since then, ruled the Ukraine. They have, also since then, crossed any number of red lines that had been set out quite clearly over a number of years by your neighbors the Russian Federation and in consequence they, the extreme nationalists, have set your country on the path to this disastrous war.

I won’t go on. If I’m wrong, please help me to understand how? If I’m not wrong, please help me in my honest endeavors to persuade our leaders to stop the slaughter, the slaughter which serves only the interests of the ruling classes and extreme nationalists both here in the West, and in your beautiful country, at the expense of the rest of us ordinary people both here in the West, and in the Ukraine, and in fact ordinary people everywhere all over the world. Might it not be better to demand the implementation of your husband’s election promises and put an end to this deadly war?

Love,

Roger Waters

Kim Dotcom: “The biggest army in the history of the world will soon achieve a decisive victory against the US proxy war in Ukraine: European protesters.”

• Salvini: Russia Sanctions Backfired, Citizens Are ‘On Their Knees’ (Celente)

Matteo Salvini, leader of Italy’s far-Right League party, said Sunday that the economic sanctions that have been leveled against Russia are taking their toll on the average Italian and are leaving citizens “on their knees.” Daniele Franco, Italy’s economy minister, recently announced that the country’s net energy import costs will likely double this year and that Rome will not be able to “indefinitely to cushion the blow on the economy,” Reuters reported. “To keep offsetting, at least in part, rising energy prices through public finances is very costly and we could never do enough,” he said. “What matters is to bring the price of gas and energy back to sustainable levels.”

“Several months have passed and people are paying two, three, even four times more for their bills. And after seven months, the war continues and Russian Federation coffers are filling with money,” he told RTL radio. He tweeted earlier that “those who have been sanctioned are winners and those who put the sanctions in place are on their knees.” He called on the EU to “protect businesses and families” like it did during the COVID-19 outbreak. Russia’s Gazprom announced that it will indefinitely suspend gas flow on its Nord Stream 1 pipeline, which sent the price of the benchmark Dutch TTF hub up to €281 per megawatt hour, up 31 percent. Russia blamed technical issues that cannot be resolved due to sanctions that have been imposed.

EURACTIV said it obtained a leaked paper that outlines the European Commission plan to cap wholesale gas prices that would target Russia. The process would cap the price of imported gas from Moscow and would set up pricing zones for countries that are particularly impacted by the prices. The paper admitted that the pricing zones will be more challenging to implement and “would require significant regulatory and technical complex preparations,” the report said.

Jacques Baud is a former Swiss army colonel, now intelligence & security consultant.

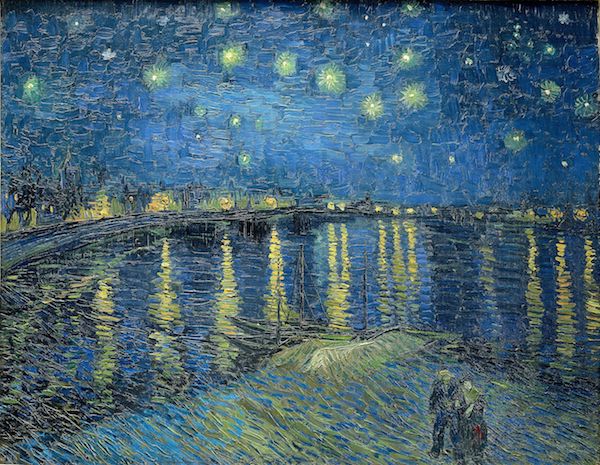

“..the exclusion of disabled athletes, cats, even Russian trees from competitions, the dismissal of conductors, the de-platforming of Russian artists, such as Dostoyevsky, or even the renaming of paintings..”

• Our Latest Interview with Jacques Baud (Postil)

You have just published your latest book on the war in Ukraine—Operation Z. “The aim of this book is to show how the misinformation propagated by our media has contributed to push Ukraine in the wrong direction. I wrote it under the motto “from the way we understand crises derives the way we solve them.” By hiding many aspects of this conflict, the Western media has presented us with a caricatural and artificial image of the situation, which has resulted in the polarization of minds. This has led to a widespread mindset that makes any attempt to negotiate virtually impossible. The one-sided and biased representation provided by mainstream media is not intended to help us solve the problem, but to promote hatred of Russia.

Thus, the exclusion of disabled athletes, cats, even Russian trees from competitions, the dismissal of conductors, the de-platforming of Russian artists, such as Dostoyevsky, or even the renaming of paintings aims at excluding the Russian population from society! In France, bank accounts of individuals with Russian-sounding names were even blocked. Social networks Facebook and Twitter have systematically blocked the disclosure of Ukrainian crimes under the pretext of “hate speech” but allow the call for violence against Russians. None of these actions had any effect on the conflict, except to stimulate hatred and violence against the Russians in our countries. This manipulation is so bad that we would rather see Ukrainians die than to seek a diplomatic solution.

As Republican Senator Lindsey Graham recently said, it is a matter of letting the Ukrainians fight to the last man. It is commonly assumed that journalists work according to standards of quality and ethics to inform us in the most honest way possible. These standards are set by the Munich Charter of 1971. While writing my book I found out that no French-speaking mainstream media in Europe respects this charter as far as Russia and China are concerned. In fact, they shamelessly support an immoral policy towards Ukraine, described by Andrés Manuel López Obrador, president of Mexico, as “We provide the weapons, you provide the corpses!”

Still relatively small amounts; $1.6 million. But that will grow.

• Sanctioned Russian Bank Bypasses SWIFT (RT)

One of Russia’s top banks, VTB has become the first lender in the country to launch money transfers to China in yuan, sidestepping the global financial messaging system SWIFT. “The new reality is leading to a massive abandoning of the use of the US dollar and the euro in international payments,” VTB CEO Andrey Kostin said in a statement, highlighting the importance of creating and developing payment systems as an alternative to SWIFT. “We are the first Russian bank to install an alternative cross-border bank transfer service with China and plan to increase the volume of these transactions by five times by next year,”he added.

According to a VTB press release, the maximum amount of a single money transfer was equivalent to 20 million rubles ($325,000) with the maximum monthly limit set at 100 million rubles ($1.6 million). The bank also announced plans to begin lending in the yuan and other non-Western currencies later this year. “The launch of the yuan transfer system is expected to significantly simplify the work of Russian companies and individuals with Chinese partners, increasing the popularity of the yuan in our country,” Kostin added. Ukraine-related sanctions cut Russia’s biggest banks off from SWIFT, limiting their access to the dollar and euro markets. The drastic measures forced Moscow to develop its own financial infrastructure in cooperation with nations that haven’t imposed sanctions.

As goes your gas, so goes your currency.

• Gazprom Signs Gas Deal With China To Convert Payments To Ruble, Yuan (Fox)

Russia’s Gazprom on Tuesday said it had reached an agreement with China to start fulfilling its gas supply contracts with payments made in rubles or yuan instead of euros or dollars. The announcement on Telegram comes just six months after a 30-year deal was signed between Gazprom and the China National Petroleum Corporation in early February, which said Russian gas supplies would be paid in euros as Russia looked to separate itself from the U.S. just weeks before it invaded Ukraine. Gazprom CEO Alexei Miller said the payment arrangement would prove “mutually beneficial” for both state owned energy agencies as Russia and China look to bolster their economies amid flagging relations with the West.

“I believe that it will simplify the calculations, become an excellent example for other companies, and give an additional impetus to the development of our economies,” Miller said. Russian President Vladimir Putin enforced a mandate in March that required all Gazprom sales to Europe be paid in rubles after the U.S. and NATO hit Moscow with steep international sanctions immediately following its invasion in Ukraine. Moscow has since cut gas to several European nations including Germany, Denmark, Poland, Bulgaria, Finland and the Netherlands after they refused to abide by Putin’s mandate. Gazprom, which has repeatedly staunched its supplies to Europe over alleged “maintenance” issues, said Monday it would not resume pumping gas until Germany energy company Siemens Energy adheres to its equipment repair demands.

“To keep the US population at bay, the oligarchy must keep it supplied with vast quantities of junk food, liquor, drugs and pornography…”

• The Case for a New American Civil War (Dmitri Orlov)

Will the USA hold together through 2024? Earlier this year Covid-related complications took the life of Vladimir Zhirinovsky, the bombastic perennial leader of Russia’s Liberal Democratic Party. He was known not just for his inimitable oratory but also for the uncanny accuracy of his predictions. For example, he predicted the start of Russia’s Special Military Operation in the Ukraine almost to the day—months before the fact and at a time when nobody else had much of a clue as to what would happen. Another prediction of his reads as follows: “There won’t be a US presidential election in 2024 because there will no longer be a United States.” Will he turn out to be prescient on this count too? Let’s watch!

Zhirinovsky is by no means alone with making such a prediction. Recent opinion polls show over 40% of Americans expressing apprehensions that a new civil war is likely to break out over the next decade or so. Perish the thought that the good people surveyed had performed an independent analysis, based on which they were able to compute the probability of a civil war! By now, the vast majority of the people in the US have been conditioned to perceive reality as a mosaic composed of short news clips, sound bites, scenes no longer than can fit between two television commercials and miniature narratives that present this or that imaginary object in a positive or a negative light. They think that a civil war is likely because that’s what they have been told through mass media or the invisibly yet relentlessly chaperoned social media.

The oligarchy, which controls all of the above, is toying with two alternative business plans. Plan A, which is more profitable and less risky, doesn’t feature a civil war while Plan B, risky though still profitable, does. In either case, the profits accrue from confiscating wealth from the population; with Plan A, less of that wealth gets blown up, hence more profit. But Plan A requires securing complete obedience and docility from an increasingly distressed and restive population. Paraphrasing Klaus Schwab, they have to put up with having nothing and pretend to be happy (as a condition for being allowed to stay indoors and fed).

To keep the US population at bay, the oligarchy must keep it supplied with vast quantities of junk food, liquor, drugs and pornography. And in spite of all the propaganda urging people to sort themselves into a rainbow of genders, most of them sterile, some women may still manage to get pregnant, refuse to have an abortion and actually give birth to children, preventing the population from shrinking as fast as the dwindling resource base. “Listen, women are getting pregnant every day in America, and this is a real issue,” quoth VP Kamala Harris. In spite of the politically incorrect term “women”—wombed men, that is—her message is crystal clear: her fellow-Americans should be spayed and neutered like the proper domestic animals she thinks they are. Your pets aren’t sterilized, don’t you now; they are transgender! Doesn’t that sound much more fashionable?

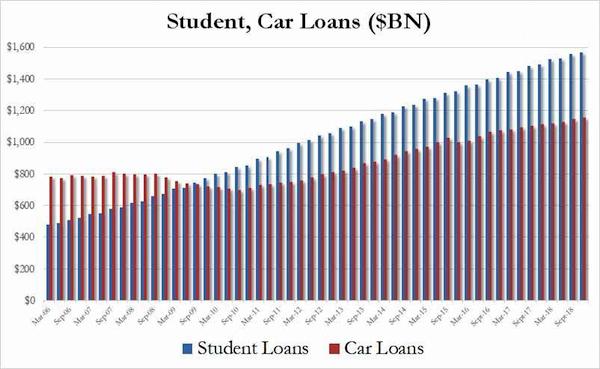

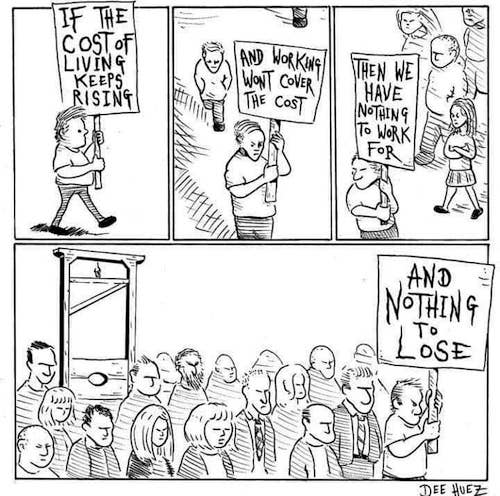

“..the poorer and more vulnerable you are, the more you are exploited, thrust into a hellish debt peonage from which there is no escape..”

• Stop Pretending US Is a Functioning Democracy (Chris Hedges)

The U.S. continues to posit itself as a champion of opportunity, freedom, human rights and civil liberties, even as half the country struggles at subsistence level, militarized police gun down and imprison the poor with impunity, and the primary business of the state is war. This collective self-delusion masks what America has become — a nation where the citizenry has been stripped of economic and political power and where the brutal militarism practiced overseas is practiced at home. In classical totalitarian regimes, such as Nazi Germany or Stalin’s Soviet Union, economics was subordinate to politics. But under inverted totalitarianism, the reverse is true. There is no attempt, unlike fascism and state socialism, to address the needs of the poor.

Rather, the poorer and more vulnerable you are, the more you are exploited, thrust into a hellish debt peonage from which there is no escape. Social services, from education to health care, are anemic, nonexistent or privatized to gouge the impoverished. Further ravaged by 8.5 percent inflation, wages have decelerated sharply since 1979. Jobs often do not offer benefits or security. In my book America: The Farewell Tour, I examined the social indicators of a nation in serious trouble. Life expectancy in the U.S. fell in 2021, for the second year in a row. There have been over 300 mass shootings this year. Close to a million people have died from drug overdoses since 1999. There are an average of 132 suicides every day. Nearly 42 percent of the country is classified as obese, with one in 11 adults considered severely obese.

These diseases of despair are rooted in the disconnect between a society’s expectations of a better future and the reality of a system that does not provide a meaningful place for its citizens. Loss of a sustainable income and social stagnation causes more than financial distress. As Émile Durkheim points out in The Division of Labor in Society, it severs the social bonds that give us meaning. A decline in status and power, an inability to advance, a lack of education and adequate health care, and a loss of hope result in crippling forms of humiliation. This humiliation fuels loneliness, frustration, anger and feelings of worthlessness.

Erdogan has elections next year. His base is nationalists. Inflation in Turkey is 90+%. Nuff said.

• Greece Braces For Tougher, Bolder Erdogan As Turkish Media Enters ‘War Mode’ (ZH)

Both Turkish and Greek media reports over the last days have been filled by heightened speculation that the two Mediterranean powers (and NATO “allies”… ironically enough) could be headed to war. This follows Saturday comments from President Recep Tayyip Erdogan wherein he issued a thinly veiled threat of military action against Greece. Charging that Greece is “occupying” islands off Turkey’s coast and militarizing them, Erdogan said in a fiery speech aimed at Athens that “When the time comes, we’ll do what’s necessary. As we say, we may come down suddenly one night.” He added: “Look at history, if you go further, the price will be heavy.”

An English-language publication covering Greece, The National Herald, observed on Monday in follow-up to Erdogan’s threat: “Greece is bracing for what’s expected to be an emboldened Turkish President Recep Tayyip drawing lines in the sea and becoming more aggressive in asserting his claims to areas in the Aegean and East Mediterranean.” Via Anadolu Agency: In his message, Erdogan mentions Izmir, a province on Türkiye’s western Aegean Sea coast that the Turkish army liberated from Greek occupation in 1922 during its War of Independence. The publication notes that something seems different this time compared to prior threatening rhetoric coming from top Turkish officials over the past two years: Erdogan typically mouths off against Greece with fiery rhetoric that frequently is followed by him backing away from threats but he’s been upping the ante and the volume, raising tension and growing worries of a conflict.

Seeing the European Union, NATO, United Nations and United States reluctant to provoke him, the hard-line Turkish leader has demanded Greece remove troops from islands near Turkey’s coast and said it would be a cause for war if Greece doubles its maritime boundaries to 12 miles. All of this comes also as Ankara has lodged a formal complaint with NATO headquarters, saying that Greece last month achieved radar lock on its F-16s which had been flying over the Mediterranean. Further, Turkey has charged that Greek jets have violated its airspace over 250 times in harassing maneuvers. “The ministry also informed that the Greek warplanes violated the Turkish airspace 256 times since the beginning of 2022,” Hurriyet reported. “In addition, they harassed the Turkish jets 158 times this year, the ministry said. On the sea, the Greek coastal guards violated the Turkish territorial waters 33 times, it added.”

“We might come suddenly one night..”

• Greece Tells Erdogan: “We Completely Reject Neo-Ottoman Bullies” (KTG)

“It is unacceptable for Greece to be receiving threats that reach the point of disputing Greek sovereignty from a country that is an ally within NATO, Prime Minister Kyriakos Mitsotakis said at noon on Tuesday as Ankara has increased his escalating hostile rhetoric and threats and thus via the president himself Recep Tayyip Erdogan. “Greece’s fixed position supports dialogue on the basis of international law, the international law of the sea and good-neighbor relations, the PM said during a meeting with the President of Slovakia, Zuzana Caputova who is officially visiting Greece. “Turkey creates tension undermining security and stability in the region,” the PM underlined.

Tuesday afternoon, it was the turn of Foreign Minister Nikos Dendias to respond to Erdogan’s unprecedented threats “We completely reject the Neo-Ottoman bullies,” Dendias stressed during a meeting with his French counterpart Catherine Colonna. The FM said that Greece daily faces a series of threats and statements that he described as “outrageous”, pointing out to “maps that are periodically published depicting Greek islands as Turkish territory.”

Recalling Erdogan’s latest threat “We might come suddenly one night” that is a clear statement implying an invasion of Greek territory, Dendias “advised” “anyone who dreams of attacks and conquests to think 3 or 4 times, adding “we are sufficient to defend the integrity and territorial independence.” He recalled also that Turkey threatens Greece with a casus belli if Athens exercises its rights as they derive from the International Law. The Greek FM sent a clear message to Turkey saying that Greece has faced much more serious threats in its history and stressed “we completely reject the neo-Ottoman bullies.”

“We have never had this much power and this much propaganda . . . never the same story being told to the entire globe at the same time and the same lie.”

“..It’s not going to start in America because this is the United States of Pharma.”

• Global Covid19 Vax Propaganda Means Mass Casualties – Dr. Pierre Kory (USAW)

Dr. Kory is actively trying to find treatments for people harmed by the CV19 vax, but that is not the biggest problem he faces. Dr. Kory says, “People are being told things (like getting CV19 booster shots) that are putting them at grave risk. I don’t know how to combat a global technological propaganda instrument. We have never had that before. I don’t think we have ever had the same messages and the same stories being shot out 24/7. I have been saying this for a while, and the world has gone mad because of unrelenting propaganda and censorship. We have never had this much power and this much propaganda . . . never the same story being told to the entire globe at the same time and the same lie.”

Dr. Kory says, “Not only no more shots, but I would say we need a national cry to stop the vaccine campaign. . . It’s not going to start in America because this is the United States of Pharma.” This is why cheap, effective drugs such as Ivermectin are being banned here in America and around the world. Dr. Kory says, “We are at war here. You cannot have Ivermectin in the marketplace. It threatens the vaccine, Paxlovid, monoclonal-antibodies and Remdesivir. Ivermectin is a drug that is the biggest financial threat to the biggest market in pharmaceutical history.”

Google translate.

• BioNtech Sued For Vaccine Damage For 1st Time In Germany (R24)

A Dusseldorf law firm has filed six-figure lawsuits against vaccine manufacturer Biontech for damage to health caused by their vaccine. The lawyers denounce the company’s disrespectful and irresponsible treatment of people who have been vaccinated. According to media reports, the law firm Rogert and Ulbrich stated that they could not reach an out-of-court agreement with Biontech. As a result, lawsuits in the six-figure range have now been filed in several matters. The lawyers sharply criticize the behavior of the vaccine manufacturer: Instead of reacting correctly to claims for damages and information and dealing with the respective facts, they merely referred to a Pfizer form. Marco Rogert stated: “The victims feel that they are not being taken seriously.

They are not only plagued by significant, life-limiting health problems since the vaccination. Now the company responsible is arrogantly giving them the cold shoulder instead of fulfilling their responsibility.” The lawyer’s clients had usually already described their tale of woe elsewhere, for example to the EMA or the PEI. “Especially in cases involving significant damage to health, the least the victims can expect would be for the facts to be dealt with seriously.” Tobias Ulbrich sees a clear connection between Covid vaccination and various diseases: “More and more vaccine damage is coming to light worldwide and many vaccinated people are only now beginning to realize that their current diseases are related to the mRNA injection,” he stated.

In fact, Ulbrich has already commented on this topic several times before on Twitter – he tweeted on August 28 that “VAIDS” is not a disease, but a description of the condition, because the values of those affected confirmed an impairment of the immune system after the vaccination. He sees the vaccine manufacturers as having a duty to prove that there is no connection between the health problems and the vaccination – and not the vaccinees. This is regulated in the Medicines Act. The law firm Rogert and Ulbrich in Düsseldorf has specialized in the legal processing of vaccination damage and its consequences. Those affected by the facility-related vaccination requirement are also advised and represented.

Puzzle

Ok, my brain hurts.pic.twitter.com/xNaNdwrZut

— Sahil Bloom (@SahilBloom) September 6, 2022

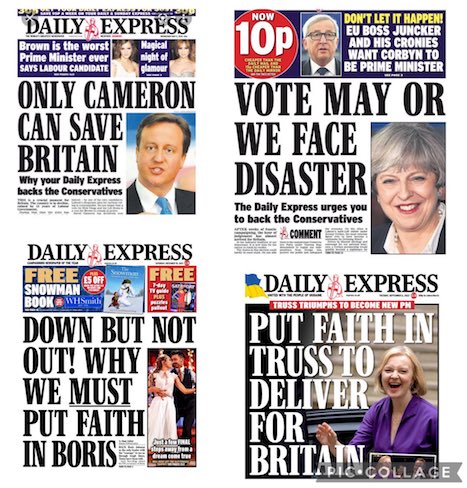

Prophet 2020

This commentary was dismissed as a wild conspiracy theory back in 2020. It now looks like a prophetic warning.pic.twitter.com/QUjAP0ZkYH

— James Melville (@JamesMelville) September 6, 2022

Peacock

https://twitter.com/i/status/1567262158295076866

Kookaburra

The laughing kookaburra is known as the “bushman’s alarm clock” because it has a very loud call, usually performed by a family group at dawn and dusk, that sounds like a variety of trills, chortles, belly laughs, and hoots [source: https://t.co/kQQLUzJnXW] pic.twitter.com/P9aWewacvL

— Massimo (@Rainmaker1973) September 6, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.