René Magritte Where Euclid walked 1955

Trump should be careful about doing underwhelming speeches. But America’s political problems are clear, and will not be solved anytime soon. That is, too many old people in charge. Limit number and length of terms in Washington. Get rid of Schumer and Pelosi.

PS: CNN reports Rod Rosenstein is stepping down.

• Trump Calls Illegal Immigration A ‘Crisis,’ Doesn’t Declare Emergency (AP)

In a somber televised plea, President Donald Trump urged congressional Democrats to fund his long-promised border wall Tuesday night, blaming illegal immigration for the scourge of drugs and violence in the U.S. and framing the debate over the partial government shutdown in stark terms. “This is a choice between right and wrong,” he declared. Democrats in response accused Trump appealing to “fear, not facts” and manufacturing a border crisis for political gain. Addressing the nation from the Oval Office for the first time, Trump argued for spending some $5.7 billion for a border wall on both security and humanitarian grounds as he sought to put pressure on newly empowered Democrats amid the extended shutdown.

Trump, who will visit the Mexican border in person on Thursday, invited the Democrats to return to the White House to meet with him on Wednesday, saying it was “immoral” for “politicians to do nothing.” Previous meetings have led to no agreement as Trump insists on the wall that was his signature promise in the 2016 presidential campaign. Responding in their own televised remarks, Democratic House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer accused Trump of misrepresenting the situation on the border as they urged him to reopen closed government departments and turn loose paychecks for hundreds of thousands of workers. Negotiations on wall funding could proceed in the meantime, they said. Schumer said Trump “just used the backdrop of the Oval Office to manufacture a crisis, stoke fear and divert attention from the turmoil in his administration.”

Better negotiate. Digging in doesn’t help.

• House Democrats To Test Republicans On Trump’s Wall Demand (R.)

As a partial U.S. government shutdown neared the three-week mark, Democrats on Wednesday were set to test Republicans’ resolve in backing President Donald Trump’s drive to build a wall on the border with Mexico, which has sparked an impasse over agency funding. House of Representatives Speaker Nancy Pelosi and her fellow Democrats who took control of the chamber last week plan to advance a bill to immediately reopen the Treasury Department, the Securities and Exchange Commission and several other agencies that have been in partial shutdown mode since Dec. 22. Democrats are eager to force Republicans to choose between funding the Treasury’s Internal Revenue Service – at a time when it should be gearing up to issue tax refunds to millions of Americans – and voting to keep it partially shuttered.

In a countermove, the Trump administration said on Tuesday that even without a new shot of funding, the IRS would somehow make sure those refund checks get sent. But it was the Republican president’s insistence on a massive barrier on the border that dominated the Washington debate and sparked a political blame game. In a nationally televised address on Tuesday night, Trump asked: “How much more American blood must be shed before Congress does its job?” referring to murders he said were committed by illegal immigrants.

79 days to go. The real mess starts now.

• Cross-Party Alliance Of MPs Tells May: We Will Stop No-Deal Brexit (G.)

Theresa May faces a concerted campaign of parliamentary warfare from a powerful cross-party alliance of MPs determined to use every lever at their disposal to prevent Britain leaving the EU without a deal in March. The former staunch loyalist Sir Oliver Letwin signalled that he and other senior Conservatives would defy party whips, repeatedly if necessary, to avoid a no-deal Brexit, as the government suffered a humiliating defeat during a debate on the finance bill in the Commons. Letwin and 16 other former government ministers were among 20 Conservatives who banded together with the home affairs select committee chair, Yvette Cooper, and the Labour leadership to pass an anti no-deal amendment.

They defeated the government by 303 votes to 296 – a majority of seven – making May the first prime minister in 41 years to lose a vote on a government finance bill. The move came after the PM conceded to senior ministers she was on course to lose next week’s historic Brexit vote, as the first cabinet meeting of the new year exposed deep divisions about the best way out of the deadlock. May told her cabinet she would respond swiftly with a statement to the House of Commons if she failed to win MPs’ backing for her deal next Tuesday. But cabinet sources said it was unclear what course she planned to take – and the general mood was of how “boxed in” the government was.

If/when she loses next Tuesday.

• May May Have To Draw Up New Brexit Plan Three Days After Commons Defeat (G.)

MPs will attempt to force the government to return with an alternative to Theresa May’s Brexit deal within three days of her plan being defeated in parliament. Another five-day debate leading up to a vote on May’s deal on 15 January will start on Wednesday, opened by the Brexit secretary, Stephen Barclay. Before that, MPs must approve a business motion to allow the debate and vote to go ahead, which a cross-party group of MPs, led by the Conservative Dominic Grieve, hope to amend if the Speaker allows it. The amendment says that following defeat of the government’s plan, which is widely anticipated, “a minister of the crown shall table within three sitting days a motion … considering the process of exiting the European Union under article 50”.

Other MPs who have signed the amendment include the former Tory cabinet minister Sir Oliver Letwin and ex-Tory ministers Jo Johnson, Guto Bebb and Sam Gyimah. It has also been backed by Labour MPs including Stephen Doughty and Chris Leslie. Sarah Wollaston, the Conservative chair of the health select committee, who also signed the amendment, said the aim was to prevent the government “running down the clock” towards no deal. Previously, the Commons had mandated the government to make a statement within 21 days.

“If and when the PM’s plan is voted down on Tuesday, MPs can’t be made to wait potentially until 12 Feb for the next vote. The situation is too urgent now,” Leslie said. A previous amendment by Grieve that the Commons voted through before Christmas means that any statement the government brings forward after a defeat is in itself amendable – allowing MPs to put forward their own alternatives for the future of the Brexit process.

$1 trillion to leave London, but that still leaves $7-8 trillion.

• Brexit Moment in 80 Days, No One Knows What’ll Happen (DQ)

With just 80 days remaining until Brexit Day, March 29, nerves are fraying on both sides of the English Channel. Nowhere is this more true than in the City of London where the Square Mile’s dominance of the global financial industry faces its biggest threat in decades. In the City’s worst-case scenario — a crash-out Brexit on March 29 — London-based firms that have not prepped properly for this outcome could be cut off from the continent altogether. Since moving key operations and staff across the channel is a costly, complex, timely undertaking, many companies have preferred to play a waiting game. But the clock continues to tick down, and as the risk of a disorderly exit grows, inaction is becoming a risky strategy.

Since the EU Referendum in June 2016, only 36% of the financial services companies in London have said they are considering or have confirmed relocating operations and/or staff to Europe, according to the latest edition of Ernst&Young’s Brexit Tracker (which monitors 222 financial services firms in the UK). This rises to 56% (27 out of 48) among universal banks, investment banks, and brokerages. A total of 20 companies have already announced a transfer of assets out of London to Europe. “Not all firms have publicly declared the value of the assets being transferred, but the Brexit Tracker has followed public announcements worth around £800 billion ($1 trillion),” the report says.

This figure echoes findings by a study published in November by German trade group Frankfurt Main Finance (FMF), which estimated that London is poised to lose €800 billion ($900 billion) in balance-sheet assets by March 29. According to German Bank Helaba, Frankfurt alone has attracted 25 lenders looking to move part of their operations out of the City of London, including Barclays, Lloyds Banking Group, Citigroup, Morgan Stanley, Credit Suisse, UBS, Nomura and Standard Chartered Bank.

“Contrary to the positive foreign narrative about “growth” in China, CBB contends that deflation is the bigger threat compared to inflation.”

“The CCP is happy to tolerate or even encourage wealth creation, but only so long as it does not become a problem.”

• China’s Stability Is at Risk (Christopher Whalen)

The western view of China’s political economy is driven partly by anecdote, partly by accepting Beijing’s propaganda/economic data as fact. Foreign investors have convinced themselves that the Chinese Communist Party (CCP) is superior in terms of economic management, this despite ample evidence to the contrary, thus accepting the official view is easy but also increasingly risky. In a December 15 speech , Renmin University’s Xiang Songzuo warned that Chinese stock market conditions resemble those during the 1929 Wall Street Crash. He also suggested that the Chinese economy is actually shrinking. But this apostate view was quickly rejected by legions of captive western economists and investment analysts whose livelihood depends upon “selling China” to credulous foreign audiences.

Facts aside, the perception of China is what matters to global investors, part of a larger pathology of hope-based investment allocation that eschews those rare bits of hard data that disagree with the positive narrative. China growth, Tesla profitability, or the mystical blockchain all require more credulity than ever before. For example, in the first half of 2016 global capital markets stopped due to fear of a Chinese recession. Credit spreads soared and deal flows disappeared. But was this really a surprise? In fact, the Chinese government had accelerated official stimulus in 2015 and 2016 to counter a possible slowdown and, particularly, ensure a quiet domestic scene as paramount leader Xi Jinping was enshrined into the Chinese constitution.

Today western audiences are again said to be concerned about China’s economy and this concern is justified, but perhaps not for the reasons touted in the financial media. The China Beige Book (CBB) fourth-quarter preview, released December 27, reports that sales volumes, output, domestic and export orders, investment, and hiring fell on a year-over-year and quarter-over-quarter basis. Headed by Leland Miller, CBB is a research service that surveys thousands of companies and bankers on the ground in China every quarter.

Contrary to the positive foreign narrative about “growth” in China, CBB contends that deflation is the bigger threat compared to inflation. “Because of China’s structural problems, deflation has very clearly emerged as the bigger threat in a slowing economy than inflation. Consumer demand has weakened, and you see that reflected in retail and services prices,” CBB Managing Director Shehzad Qazi said in an interview.

Groundhog Day. China’s been promoting domestic stuff for years, but that only really ever worked in real estate loans. Domextic spending is even falling right now.

• China To Introduce Policies To Strengthen Domestic Consumption (R.)

China plans to introduce policies to boost domestic spending on items such as autos and home appliances this year, state television CCTV quoted a senior state planning official as saying on Tuesday. Ning Jizhe, vice chairman of National Development and Reform Commission (NDRC), said in an interview with CCTV that the policies will be part of wider efforts to strengthen domestic consumption in China, the world’s second largest economy. The state planner will also introduce policies in house leasing and services, as well as elderly and child care, with plans to also lower investment barriers in other sectors such as culture and sports. He also said that the NDRC planned to move ahead with a second batch of major foreign-invested projects in the first quarter of 2019, which could include new energy ventures, according to an interview transcript published by state news agency Xinhua.

China mobile phone shipments down 16%.

• Apple Cuts Q1 Production Plan For New iPhones By 10% (R.)

Apple, which slashed its quarterly sales forecast last week, has reduced planned production for its three new iPhone models by about 10 percent for the January-March quarter, the Nikkei Asian Review reported on Wednesday. That rare forecast cut exposed weakening iPhone demand in China, the world’s biggest smartphone market, where a slowing economy has also been buffeted by a trade war with the United States. Many analysts and consumers have said the new iPhones are overpriced. Apple asked its suppliers late last month to produce fewer-than-planned units of its XS, XS Max and XR models, the Nikkei reported, citing sources with knowledge of the request. The request was made before Apple announced its forecast cut, the Nikkei said.

Tim, credibility is a big issue in your position. Be careful. Besides, just because you talk to Jim Cramer doesn’t mean you have to sound like him.

• Tim Cook Says Apple’s ‘Ecosystem Has Never Been Stronger’ (MW)

Apple Inc. stock has taken a beating in recent months, but Chief Executive Tim Cook defended his company Tuesday, and expressed optimism that trade tensions with China would soon ease. Apple shares have fallen by more than one-third since their peak on Oct. 3, and tumbled further last week after the tech giant warned of disappointing iPhone sales in its holiday quarter. But in an interview Tuesday with CNBC’s Jim Cramer, Cook said the company was still going strong, and its naysayers were full of “bologna.” “Here’s the truth, what the facts are,” Cook said about reports of slow iPhone XR sales, according to a CNBC transcript.

“Since we began shipping the iPhone XR, it has been the most popular iPhone every day, every single day, from when we started shipping, until now. . . . I mean, do I want to sell more? Of course I do. Of course I’d like to sell more. And we’re working on that.” Slower sales in China also contributed to Apple’s lowered forecast, and Cook said Tuesday he believes that situation to be “temporary.” “We believe, based on what we saw and the timing of it, that the tension, the trade-war tension with the U.S. created this more-sharp downturn,” he said. Cook said he’s “very optimistic” a trade deal between the U.S. and China will be reached. “I think a deal is very possible. And I’ve heard some very encouraging words,” he said.

On top of Merkel stepping down.

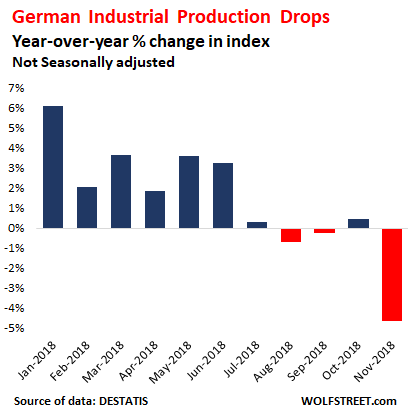

• Germany Heads for a Technical Recession (WS)

OK, this is embarrassing in the land of super-stimulus via the ECB’s negative-interest-rate policy and years of QE that were supposed to perform miracles: Production in Germany’s industry, which includes construction, dropped 1.9% in November from the prior month (seasonally adjusted), the German statistical agency Destatis reported this morning. This drop is also embarrassing because economists polled by The Wall Street Journal had expected a 0.3% gain. The agency also downwardly revised October, to a monthly decline of 0.8%. This makes three months in a row of declines. In November, compared to a year earlier (adjusted for inflation and calendar differences, but not for seasonality), the production index dropped an ugly 4.7%:

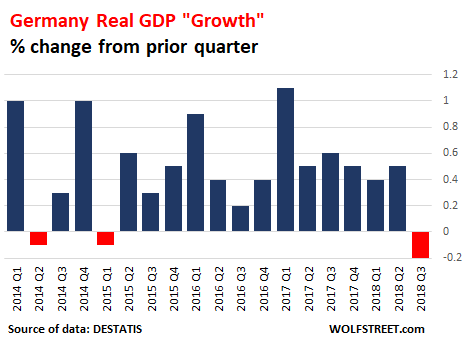

Production was down in all major segments, including energy and construction which are focused on Germany itself, rather than exports. [..] Industrial production is a big power in the German economy. And the trend is not good. Germany’s GDP already declined in the third quarter:

The declines in production in October and November put Germany a step closer to “negative economic growth,” as it’s called euphemistically, for two quarters in a row. If this occurs, it would be a technical recession. And it’s not going to get a lot better soon: Destatis reported yesterday that new orders in manufacturing – a harbinger for future production – dropped 4.3% in November from a year ago (adjusted for inflation and calendar differences); and it revised down October’s orders to a year-over-year drop of 3.0%.

[..] this economic slowdown is occurring despite, or perhaps because of, the mother of all stimuli engineered by a major central bank – negative interest rates and massive QE – that has benefited a few hedge funds who were able to front run the ECB’s bond buys and make a quick buck, and bond traders for a while, as bond prices were rising due to falling yields. And it has allowed even junk-rated companies to borrow money for a song from beaten down investors, savers, and pension funds. But this stopped a year ago.

France does everything wrong.

• France Moves To Ban All Protests, Major Crackdown On Yellow Vests (ZH)

France is signaling it’s making preparations for a massive new crackdown on the gilets jaunes or “yellow vests” anti-government protests that have gripped the country for seven weeks. A new law under consideration could make any demonstration illegal to begin with if not previously approved by authorities, in an initiative already being compared to the pre-Maiden so-called “dictatorship law” in Ukraine. In the name of reigning in the violence that has recently included torching structures along the prestigious Boulevard Saint Germain in Paris, and smashing through the gates of government ministry buildings, the French government appears set to enact something close to a martial law scenario prohibiting almost any protest and curtailing freedom of speech.

Prime Minister Edouard Philippe presented the new initiative to curtail the violence and unrest while targeting “troublemakers” and banning anonymity through wearing masks on French TV channel TF1 on Monday. He said the law would give police authority crack down on “unauthorized demonstrations” at a moment when police are already arresting citizens for merely wearing a yellow vest, even if they are not directly engaged in protests in some cases. PM Philippe said the government would support a “new law punishing those who do not respect the requirement to declare [protests], those who take part in unauthorized demonstrations and those who arrive at demonstrations wearing face masks”.

Philippe’s tone during the statements was one of the proverbial “the gloves are off” as he described the onus would be on “the troublemakers, and not taxpayers, to pay for the damage caused” to businesses and property.

Home › Forums › Debt Rattle January 9 2019