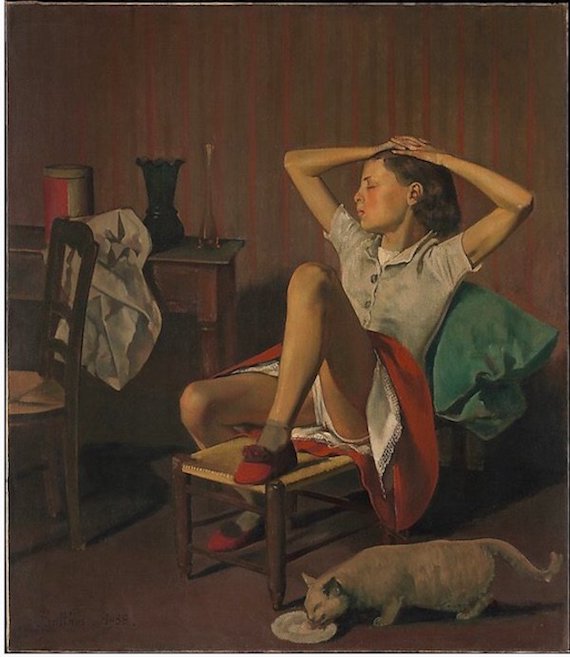

Balthus Therèse dreaming 1938

“Wall Street and the agency that governs it, the SEC have become fat and happy. Fat and Happy makes old school slow and resistant to change.”

• The Store of Value Generation is Kicking Your Ass (Mark Cuban)

[..] there are a growing number of investors and traders who think that the digital goods and CryptoAsset marketplaces are better than old school physical markets and the stock market and most of them are young. They love the fact that NO ONE has power over them. That there is no central authority and they get the results of their own efforts without some government agency or big company fucking with them. Every negative , consequential financial moment in their collective lives has been the result of some massive entity getting greedy and fucking things up for them. On the flipside, they have also been watching some of their peers gain wealth with Crypto and Digital Assets, most starting with not much capital.

Those peers have also been very vocal about the lack of interference by Old Schoolers with Crpto and Digital Assests and much of those gains have come from all of them doing the same thing, buying and Holding On for Dear Life. They have learned that with digital assets, acting in unison can bring wealth to those who otherwise would not have access to it. That is power and they know it and they are learning how to use it. So what does this have to do with Wall Street Bets (WSB) and $GME and the other stocks they are trading ? Well, it’s pretty obvious that the WSB traders are applying the same principles of the digital/CryptoAsset world to the stock market and they are loving the fact that the old schoolers are hating it.

They know that Wall Street hasn’t changed much in generations. Sure it has gone digital in many respects, but the way the game has been played has not changed. Wall Street is 100pct top down controlled and regulated. Which stock is next in the S&P 500 ? Which is removed ? No one knows, but it is provocative and can change fortunes for investors. SEC decides to use their own in-house Administrative Law Judges and prevent defendants from having their constitutional right to a jury trial ? Yup. You can’t afford to fight them. Tough shit. Big brokerages get to have calls and put out notes to their millions of clients with price targets in hopes of moving markets, but think its wrong for Sub Reddits to do the same ? Yup. The ultimate in stock manipulations, corporate stock buy backs were illegal prior to 1982, till the SEC put a former Broker CEO in charge. Wanna guess what has happened to CEO compensation since then ?

Wall Street and the agency that governs it, the SEC have become fat and happy. Fat and Happy makes old school slow and resistant to change. Very resistant. And obviously very unaware of the change that is happening around them.

What hat does Robinhood have on?

“For equity brokers who clear their orders properly, there is no reason to limit $GME purchases to one. There is no reason to limit withdrawals..”

• Is Robinhood On The Brink Of Collapse? (GIH)

The question remains – is Robinhood running a b-book. For those who are not familiar with OTC brokerage, a b-book is where the losers trade. When you open an account, you get flagged either as a winner or a loser, if you are on the A-Server then your trades flow through to the market, this is known in OTC as “Straight Through Processing” minus a small fee, or the “A-Book.” The “B-Book” or “Broker Book” or “Bad Book” depending on who you ask, is where your trades are placed directly against the broker itself – like spread betting. In this case, the customer losses become the brokers profits, and the reverse. This typically works well for brokers as most retail traders lose. But is Robinhood running a b-book? The answer is we don’t know and would not know, because a b-book broker would never disclose it.

According to public data, this may be a complex convoluted b-book. Citadel not only pays Robinhood for order flow data, Citadel Securities also clears orders for Robinhood. Not only that, Robinhood gets 35% of it’s revenue from Citadel: According to a June report from the Financial Times, $39 million of Robinhood’s revenues from equities and options order flow came from Citadel Securities, a market maker sister firm of Citadel. At the time, this represented more than 35% of the trading platform’s revenues. Which looks like the FXCM trick; Robinhood is not operating a b-book. They clear through Citadel Securities, a market maker, who b-books the trades (goes short basically) by not clearing them. In addition to that, Citadel is heavily invested in Melvin Capital, the hedge fund with a massive short position in $GME.

NOTE: It is not possible to short private equity stock. Robinhood is currently a private company, available on private markets. They claim to have plans for an IPO but so did Refco. If Robinhood’s book is as toxic as it seems, there is no way out for the firm other than to drive the prices of these stocks back down, or to simply reverse the positions which never really existed in the first place. They might want to call b-book mastermind Dror “Drew” Niv who was able to mask his b-booking operation by creating an offshore entity who was the sole counterparty of transactions below a certain size. He’s currently chumming it up with his bros in Greenwich, CT since his firm FXCM has been permanently banned by the NFA.

We aren’t saying that Robinhood is a fraud, we are saying that all the signs are there. For equity brokers who clear their orders properly, there is no reason to limit $GME purchases to one. There is no reason to limit withdrawals, or need ‘liquidity’ for net cap requirements. Running a broker-dealer is not so complicated like an OTC desk, orders match up and it’s all exchange traded. Broker dealers don’t take any risk, at least any meaningful risk. Market makers do. This is the question that we should be asking Vladimir – are you acting as an agent or a principal?

WallStreetBets is now setting prices?

• Silver Prices, Miners Surge As Retail Buyers Pile In (R.)

Silver prices leapt to a five-month high on Monday and small silver miners listed in Australia surged after social media calls to buy the metal and emulate the frenzy that has driven GameStop shares up 1,500% in two weeks. Spot silver rose as much as 7.4% to $28.99 an ounce, the highest since mid-August. Shares in a handful of mining firms such as Argent Minerals, Boab Metals and Investigator Resources leapt more than 15%. Coin-selling websites also reported unprecedented demand and flagged delays in delivering bullion. The moves are the latest example of small-time traders buying en masse, particularly of stocks and other assets that were heavily bet against, resulting in large losses for major investors.

“There is this curious situation now where the Reddit crowd has turned its sights on a bigger whale in terms of trying to catalyse something of a short squeeze in the silver market,” said Kyle Rodda, an analyst at brokerage IG Markets in Melbourne. “The most important factor here is that silver is heavily shorted, the paper market is much, much larger than the underlying commodity can justify,” he said. “There’s a lot of commentary on these platforms to pile in to the miners.” Silver prices are up 15% since Wednesday’s close, around when messages began circulating on forums such as Reddit encouraging users to buy the metal and drive up prices.

“..the idea to short GameStop had long been a favorite at exclusive “idea dinners”, where fund managers swap their best trades.”

• To The Brink And Back On GameStop (R.)

The extent of losses has exposed a big weakness on Wall Street. Analytics firm S3 said GameStop short sellers had mark-to-market losses of nearly $20 billion so far this year. Several hedge fund managers said the idea to short GameStop had long been a favorite at exclusive “idea dinners”, where fund managers swap their best trades. Managers also noted traders, many of whom who work at multi-strategy funds that employ pods of portfolio managers, traders and analysts, often know each other well and may compare notes. Gabe Plotkin’s Melvin Capital, one of the funds gored most by GameStop’s gains, took a $2.75 billion bailout from his one-time mentor Steve Cohen and Citadel’s Ken Griffin. The funds involved have taken a dent: Cohen’s Point72 Asset Management lost roughly 15% in January partly because of its investment in Melvin.

Melvin’s assets slid during the month from around $12.5 billion to $8 billion, a source familiar with the situation said. Maplelane Capital, another fund that bet against GameStop, had lost roughly 45% in January, a person familiar with the fund’s returns said. Even Viking Global Investors, one of the world’s best-performing hedge funds, was off some 7%, people familiar with the returns said. “Being short consensus stocks is just bad business,” said Dinakar Singh, a former Goldman Sachs trader who now runs hedge fund Axon Capital and was not short the stock. “It is great while it is working but when it isn’t anymore one guy’s problem triggers everyone’s headache. It becomes a circular disaster.”

This is not over.

• Melvin Capital Loses 53% In January Over Bet Against GameStop (RT)

Hedge fund Melvin Capital felt the effects of the buying spree spurred by individual buyers from the r/WallStreetBets subreddit account, with the group losing 53 percent in January. Despite the loss, Melvin Capital received fresh cash from investors by the end of January after taking heavy losses due to the unexpected and record stock gains for companies like GameStop, according to a source cited by Reuters. Melvin started January with $12.5 billion in assets, but is closing out the month with $8 billion, according to the Wall Street Journal’s report on the losses. It closed out its short position on GameStop in the wake of the massive surge. Other groups like Citron have also felt the squeeze by betting against GameStop and have closed their short positions with heavy losses.

GameStop became the center of controversy after motivated buyers sought to flood the market and increase its stock price aiming to upset Wall Street hedge funds. Trading at a mere $10 a share in October, GameStop closed out Friday at $325 a share. It has seen a total gain of over 1000 percent this year. Redditors also invested into other surprising companies like AMC leading to a frenzy on Wall Street as longtime investors found themselves trading in a quickly fluctuating and unpredictable market. Traders who bought into GameStop mainly did so through the app Robinhood, which controversially stepped in and halted trading on certain companies and then limited it, claiming this was a move to prevent market manipulation.

Rania Khalek: “Too bad there’s so much hatred for bill gates over a conspiracy theory that he wants to micro chip us when actually he’s just a billionaire monster trying to cash in on vaccine profits.”

• Bill Gates, Big Pharma and Entrenching The Vaccine Apartheid (M&G)

In October 2020, diplomats from South Africa and India approached the World Trade Organisation (WTO) with a revolutionary proposal. Together, the two countries argued that countries should be allowed to ignore any patents related to Covid-19 vaccines, for the duration of the pandemic. In other words: everyone should be allowed to manufacture the vaccine, without penalty. In their official communication, the countries said: “As new diagnostics, therapeutics and vaccines for Covid-19 are developed, there are significant concerns [about] how these will be made available promptly, in sufficient quantities and at affordable prices to meet global demand.” Just a few weeks later, Pfizer and BioNTech announced the first successful phase three trials for a Covid-19 vaccine, followed swiftly by Moderna and AstraZeneca.

In developing countries, jubilation at the prospect of a swift end to the devastating pandemic turned quickly into fear and anger, as it became clear that vaccines would only be made available to the rich, with little thought to equitable distribution. Canada, the worst offender, has pre-ordered so many vaccines that it will be able to vaccinate each of its citizens six times over. In the UK and US, it is four vaccines per person; and two each in the EU and Australia. The vaccines that have been made available to the developing world are either untested — such as the Chinese and Russian vaccines, for which insufficient clinical trial data has been released — or expensive. South Africa has ordered 1.5-million doses of the AstraZeneca vaccine, but will pay more than double what the EU is paying per dose.

The EU says that it is entitled to a lower price because it invested in the vaccine’s development — nevermind that the AstraZeneca vaccine was literally tested on the bodies of South Africans who volunteered to be part of the clinical trial in Johannesburg. In lower income countries, the situation is even worse. As of 18 January, 39-million vaccine doses had been administered in the world’s 50 richest countries, compared to just 25 individual doses in low-income countries. It appears that South Africa and India were right. Under the current rules, the vaccine cannot be made quickly or cheaply enough to meet global demand, which vaccines are only going to those countries that can afford it. This is a “catastrophic moral failure”, said the head of the World Health Organisation (WHO), Tedros Adhanom Ghebreyesus.

Some activists have described the situation as a “vaccine apartheid”. Nonetheless, the proposal for a patent waiver has been repeatedly rejected at the WTO by wealthier countries including the European Union, the United Kingdom, US and Switzerland; countries which, as Reuters wryly noted, are “all home to major pharmaceutical companies”. They also all enjoy early access to the vaccine. Nor has South Africa and India’s proposal received support from the most influential non-state actor in global public health: Bill Gates. The pandemic has been good to Gates. In 2020, the Microsoft cofounder added $18-billion to his fortune, which now stands at a cool $131-billion (the annual GDP of Ethiopia, a country of 112-million people, is $96-billion). He is the fourth-richest person in the world.

The Bill and Melinda Gates Foundation has since its inception in 2000 spent more than $54-billion combating diseases such as polio and malaria and bolstering the health systems of developing countries. It funds everything from governments to civil society organisations to health journalism outlets, which means it has an enormous say in how health policy is shaped and communicated. It also contributes 12% of the WHO’s total budget. But despite Gates’ stated commitment to an equitable distribution of the Covid vaccine, he is refusing to back South Africa and India’s calls for a waiver on patents.

The wrong fight.

• France & Germany Threaten AstraZeneca With Legal Action (RT)

Tensions in a row between AstraZeneca and the EU over vaccine shortages have heightened further as Paris and Berlin said the company should face penalties or even legal action if it turns out it preferred Britons to Europeans. “I am not saying that there is a problem but if there is a problem and that [they] have favored other destinations, other countries – for example the UK – over us then we will defend our interests,” France’s Secretary of State for European Affairs Clement Beaune told the French Radio J on Sunday, adding that the company is now facing “serious accusations” and that is not something that Brussels treats “lightly.” The official then said that the British-Swedish vaccine manufacturer could face “penalties or sanctions” if found to have prioritized its British clients over the European ones.

Beaune added that Brussels could punish the company by refusing to order any supplementary doses or imposing penalties “foreseen by the contract.” The EU has struck an advance purchase agreement with AstraZeneca worth €336 million ($407.8 million) but not all of the money has been paid to the company. Beaune admitted that there is an investigation into AstraZeneca that is still ongoing and the Europeans first need “clarity and transparency.” Still, he said, “if there has been a preference granted to the British, then that’s a problem.” A similarly stark rebuke came from Germany, where the Economy Minister Peter Altmaier told Die Welt daily that “if it turns out that individual companies are not complying with their obligations, a decision must be made about legal consequences.”

Biden promised the $2,000 checks “immediately”. Where are they? Why try and blame this on the GOP instead?

• GOP Tries To Gut Survival Checks (DP)

A group of Republican senators is pushing to cut the size of the next round of COVID-19 relief checks and significantly limit who’s eligible to receive the payments, as the Biden administration continues to indicate that it would be open to further restricting who’s eligible for survival checks. Last month, President Joe Biden promised that $2,000 checks would “go out the door immediately” if Democrats managed to win the two Georgia senate runoff races and claim control of the Senate. After Democrats pulled off two miracle victories in Georgia, Biden quickly narrowed his pledge to new $1,400 checks, asserting that the $600 checks authorized by Congress in December were a down payment on his plan.

On Sunday, ten moderate Republicans proposed new $1,000 checks instead as part of their own scaled-down coronavirus relief package. Under their proposal, survival checks would go to far fewer Americans than in previous relief bills — only to “families who need assistance the most,” according to a letter they sent to the White House. While the details haven’t been released yet, one Republican involved in the effort, Sen. Rob Portman of Ohio, told CNN on Sunday that direct payments should only go to individuals earning less than $50,000 and families earning less than $100,000. In previous COVID relief bills, full rounds of survival checks have gone to individuals earning up to $75,000 and couples earning up to $150,000. Limiting assistance the way Portman described would cut off relief to millions of Americans who have previously received economic impact payments.

Like the spotlight?

• Trump Announces New Lawyers To Lead Impeachment Defense Team (JTN)

Lawyers David Schoen and Bruce L. Castor Jr. will lead former President Trump’s impeachment trial defense team, according to an announcement on Sunday from the Office of Donald J. Trump. The announcement notes that the two attorneys consider the impeachment unconstitutional and that Schoen had already been working with Trump and other advisors to get ready for the approaching Senate trial. “It is an honor to represent the 45th President, Donald J. Trump, and the United States Constitution,” Schoen said in a statement included in the announcement. “I consider it a privilege to represent the 45th President,” Castor said. “The strength of our Constitution is about to be tested like never before in our history. It is strong and resilient. A document written for the ages, and it will triumph over partisanship yet again, and always.” The House of Representatives voted in favor of impeaching Trump earlier this month during the waning days of his term in office.

110 years after Standard Oil.

• ExxonMobil and Chevron Held Merger Talks In 2020 (G.)

The chief executives of American oil companies ExxonMobil and Chevron held preliminary talks in early 2020 to explore combining the two largest US oil producers in what would have been the biggest merger of all time, according to people familiar with the matter. The discussions, which are no longer ongoing, are being seen as having tested the waters for the huge corporate marriage after the coronavirus pandemic shook the world last year, the Wall Street Journal reported on Sunday. Such consequential discussions are indicative of the pressure the energy sector’s most dominant companies faced as Covid-19 took hold and crude prices plunged. The talks between Exxon chief executive, Darren Woods, and Chevron CEO, Mike Wirth, were serious enough for legal documents involving certain aspects of the merger discussions to be drafted, one of the sources told Reuters.

[..] The discussions were described as preliminary and although were not ongoing could come back in the future. Such a deal would reunite the two largest descendants of John D Rockefeller’s Standard Oil monopoly, which was broken up by US regulators in 1911, and reshaped the oil industry, the Journal reported. A combined company’s market value could top $350bn, creating the world’s second largest oil company by market capitalization and production, second only to Saudi Arabia’s state oil producer, Aramco. Such a big American oil merger could run into regulatory and antitrust hurdles in the new Biden [presidency], which has taken the US back into the Paris climate accords.

Last week Biden signed new environmental orders, saying the climate crisis was an existential threat demanding urgent remedies and introduced his team, including former secretary of state John Kerry as the new US climate global envoy. During the election campaign last October, Biden said he would push the US to “transition away from the oil industry”.

Huawei.

• China Building Digital Silk Road From Asia Through Africa To Europe (RT)

The final stretch of a cross-border fiber optic cable is set to be laid by China in Pakistan to create the Digital Silk Road (DSR), Nikkei Asia reports. The DSR is part of the broader Chinese Belt and Road Initiative (BRI).

The fiber cable will link to the Pakistan East Africa Connecting Europe (PEACE) submarine cable in the Arabian Sea, to service countries participating in BRI, and Europe. It is currently being laid between Pakistan’s Rawalpindi city and the port cities of Karachi and Gwadar. The $240-million project, which is in partnership with China’s Huawei Technologies, was approved by the government last week.The laying of sea cable in Pakistan’s territorial waters will begin in March, following government approval this month for Cybernet, a local internet service provider, to construct an Arabian Sea landing station in Karachi. The Mediterranean section of the cable is already being laid, and runs from Egypt to France. The 15,000 kilometer-long cable is expected to go into service later this year. The PEACE cable will provide the shortest direct internet route between participating countries, and will drastically reduce internet data transfer speeds.

It is expected to help reduce Pakistan’s exposure to internet outages from damaged submarine cables by providing an additional route for internet connectivity. According to Eyck Freymann, author of ‘One Belt One Road: Chinese Power Meets the World,’ the BRI is evolving to place less emphasis on traditional heavy infrastructure, and more on high-tech cooperation and digital services. He told Nikkei Asia that “Beijing wants to dominate the physical infrastructure underlying global communications, particularly the internet,” adding: “This will give it an advantage in internationalizing its tech sector and pursuing future tech-related deals with partner countries.”

“..some unexplained process is compromising the foundation of the Earth’s food web by depleting ecosystems of this critical nutrient.”

• Vitamin B1 Deficiencies Are Plaguing Fish and Birds (Atl.)

Disoriented little fish caught the attention of staff members at the Coleman National Fish Hatchery in Red Bluff, California, in early January 2020. Looking down into the outdoor tanks—called raceways—the facility’s employees noticed that among the dark, olive-colored clouds of live fish, there were occasional slivers of silver from the undersides of tiny fry that were struggling to swim. These small fish would roll onto their sides, sink to the bottom for a moment, spring back upright, swim a few strokes, and then roll over again. Many were dying, too. While a few hundred mortalities daily in a facility containing millions of fish is normal, something was definitely amiss. Daily mortality “was in the thousands, and it didn’t go down,” says Brett Galyean, complex manager at the hatchery.

Galyean and his team had already hatched and released into the raceways between six and seven million fish—about half of Coleman’s annual production—and the prospect of losing many or most of them began to seem very real. Biologists at the California-Nevada Fish Health Center, an on-site lab at the hatchery, which is located on a tributary of the Sacramento River, inspected the fish but couldn’t make a diagnosis. A few samples were sent to the University of California, Davis, for more testing. Around that time, Galyean recalls, other salmon hatcheries in the state began reporting unusually high mortality rates in their fish. Whatever was afflicting Coleman’s salmon was evidently impacting fish across Northern California. Short of better explanations, Galyean and his colleagues grew concerned that a virus was sweeping through their brood.

Grasping for ideas as thousands of fish expired each day, they turned to the internet, where they dug up research on nutritional deficiencies in trout from the Great Lakes, as well as Atlantic salmon on the East Coast. Several decades ago, sick and dying fish in these regions had been found to be deficient in thiamine, or vitamin B1—a basic building block of life, critical to the functioning of cells and in converting food into energy. Encouraged by this finding, biologists at the Fish Health Center ran a trial, submerging about half of the fry in a bath of water and dissolved thiamine powder. It worked like a charm, Galyean says. After several hours, nearly all of the treated fish were behaving normally, while symptoms continued in an untreated control group.

Coleman, as well as the other hatcheries, scaled up the treatment and applied it to more than a million fry. It did the job in the short term, but it didn’t solve the underlying problem. Because the fish acquire thiamine by ingesting it through their food, and females pass nutrients to their eggs, the troubling new condition indicated that something was amiss in the Pacific Ocean—the last place the fish eat before entering fresh water to spawn. Now, California researchers investigating the source of the salmon’s nutritional problems find themselves contributing to an international effort to understand thiamine deficiency, a disorder that seems to be on the rise in marine ecosystems across much of the planet. It’s causing illness and death in birds, fish, invertebrates, and possibly mammals, leading scientists to suspect that some unexplained process is compromising the foundation of the Earth’s food web by depleting ecosystems of this critical nutrient.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.

Home › Forums › Debt Rattle February 1 2021