Paul Gauguin Fatata te Miti (By the sea) �1892

In the absence of price discovery you get unlimited.

• The Stock Market Faces ‘Unlimited Downside Risk,’ Warns Veteran Trader (MW)

The stock market opened with a resounding thud on Tuesday morning, as the Dow Jones, at one point, had shed more than 500 points. The S&P 500 and the Nasdaq Composite endured even harder hits, down more than 2% each. So, you must positioning yourself for that tasty bounce we’ve grown accustomed to over the course of this stubborn bull market. Well, don’t, warns J.C. Parets, the technical analyst behind the All Star Charts blog. “There is unlimited downside risk in the market right now and I don’t think it’s being respected,” he wrote. “It’s not until afterwards that they ask, ‘what happened?’” When the bottom falls out, that’s when the blaming begins.

“The Fed, the Trump, the ebola, or whatever excuse du jour is being regurgitated on the various media outlets,” Parets wrote. “The only one to blame is ourselves.” He pointed to several divergences that should make clear to investors just how precarious the market situation is at these current levels. The first one is what we’re seeing in this chart of the S&P vs. the rest of the world. “The divergence is telling,” Parets explained in his blog post. “The last time we saw this was at the 2015 market top.”

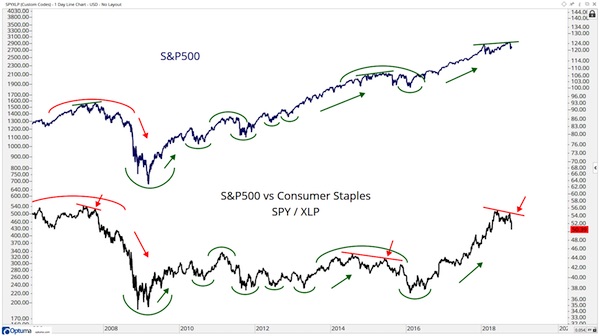

Another divergence we haven’t seen since the 2015 top, and, before that, the 2007 top, is the relationship between consumer staples and the broader market. “When stocks fall, staples get a sympathy bid and outperform due to that very same lower beta and their defensive qualities,” Parets said. “With new highs in stocks, bulls want to see new lows in relative strength for staples. That’s a normal environment. It’s when they diverge that it is evidence of something changing.”

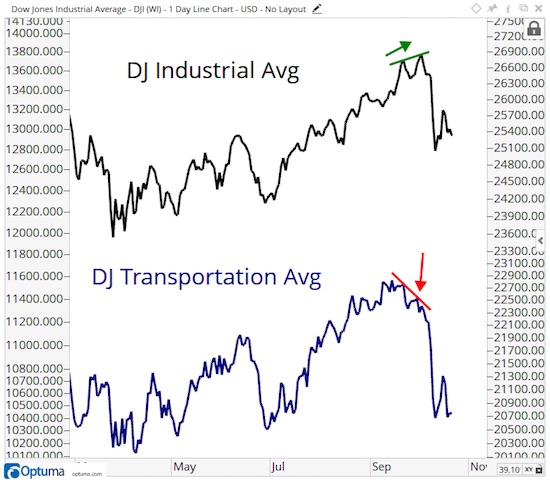

And finally, Parets took a look at what Dow Theory is telling us. This idea here is that when either industrial or transportation stocks make new highs, it’s important for the other to follow. When that confirmation doesn’t come, there’s cause for concern. “We saw these divergences lead to collapses in 2000, 2007 and more recently a severe selloff in 2015,” Parets wrote. “You can see that with new highs in the Dow this month, transports put in a lower high, typical behavior at market tops.”

Mostly critical of the Fed, of which he was the chair.

• Former Fed Chairman Paul Volcker Thinks ‘We’re In A Hell Of A Mess’ (CNBC)

Former Federal Reserve Chairman Paul Volcker, who has reached legend status in the world of central banking, isn’t optimistic about current conditions. When Volcker looks around now, he sees “a hell of a mess in every direction,” including a lack of basic respect for government institutions, a current Fed that seems to be following a completely arbitrary benchmark and a “swamp” in Washington run by plutocrats. “At least the military still has all the respect. But I don’t know, how can you run a democracy when nobody believes in the leadership of the country?” Volcker asks New York Times columnist and CNBC “Squawk Box” co-anchor Andrew Ross Sorkin in a column for the newspaper’s DealBook section.

“Tall Paul” is most known for willfully taking the country into recession in the early 1980s to finally defeat the inflation that had been strangling the economy. Since then, he’s lent his name to the “Volcker rule” part of banking reform legislation that restricts risk-taking at big Wall Street institutions. In a book set for release Oct. 30, Volcker laments the current state of conditions, particularly the monied interests eating away at the system of governing. “There is no force on earth that can stand up effectively, year after year, against the thousands of individuals and hundreds of millions of dollars in the Washington swamp aimed at influencing the legislative and electoral process,” he writes, according to Sorkin.

Volcker, in ailing health but not short of opinions, also seems unhappy with the Fed itself. Though it’s unusual for former chairmen to comment on Fed matters, Volcker said there appears to be no “theoretical justification” for its 2 percent inflation target. He said the Fed is just one of the institutions in which people have lost confidence. And he also dispels with the myth that presidents historically haven’t tried to influence interest rates. Recounting a 1984 meeting he had with former President Ronald Reagan, then-chief of staff James Baker flatly told Volcker, “The president is ordering you not to raise interest rates before the election.” “I was stunned,” Volcker said.

Developing as I expected. Adapting as evidence comes in.

• Trump Says Saudi Crown Prince Could Have Been Involved In Khashoggi Killing (G.)

Donald Trump has said for the first time that Saudi crown prince Mohammed bin Salman could have been involved in the operation to kill dissident journalist Jamal Khashoggi noting that “the prince is running things over there” in Riyadh. The comments, in an interview with the Wall Street Journal, appeared to mark a shift in the president’s view of Khashoggi’s murder on 2 October in the Saudi consulate in Istanbul. He has hitherto appeared to take Saudi royal denials of involvement at face value. But on a day the state department announced it would sanction Saudi officials implicated in the writer’s death, the president appeared to give the benefit of the doubt to King Salman but not necessarily to his powerful son.

Asked about the crown prince’s possible involvement, Trump said: “Well, the prince is running things over there more so at this stage. He’s running things and so if anybody were going to be, it would be him.” Trump told the Wall Street Journal he had closely questioned Prince Mohammed about Khashoggi’s murder, posing questions repeatedly and “in a couple of different ways”. “My first question to him was, ‘Did you know anything about it in terms of the initial planning’,” Trump said. Prince Mohammed replied that he didn’t, Trump said. “I said, ‘Where did it start?’ And he said it started at lower levels.” Asked if he believed the denials, the president paused for several seconds. “I want to believe them. I really want to believe them,” he said.

Twenty-one Saudis will have their US visas revoked or be made ineligible for US visas over the journalist’s killing, the state department announced, as the Trump administration struggled to regain the initiative amid the uproar over a murder that has thrown the US-Saudi alliance into question. Mike Pompeo, the US secretary of state, said other measures were being considered, including sanctions: “These penalties will not be the last word on the matter from the United States. “We’re making very clear that the United States does not tolerate this kind of ruthless action to silence Mr Khashoggi, a journalist, through violence,” Pompeo said. “Neither the President nor I am happy with this situation.”

For now, they’re in no position to force anything. They’re in recess. By the time they come back the situation will have changed a lot.

• How Congress Can Force Trump’s Hand On Saudi Sanctions (CNBC)

As the world awaits the truth, or something close to it, about Saudi journalist Jamal Khashoggi’s killing inside the Saudi consulate in Istanbul, one of the Gulf’s most stalwart security relationships hangs in a precarious position. Congress and the White House have sharply different views on how to approach the diplomatic crisis, now in its third week. Legislators are loudly calling for sanctions on weapons sales on Saudi Arabia and a robust response if the government in Riyadh is proven to have been behind Khashoggi’s death. But while President Donald Trump has expressed his desire to get to the bottom of the case, he’s appeared more reluctant to punish his allies in the kingdom, whose support is vital in carrying out his agenda to isolate Iran and keep oil prices stable ahead of the November midterm elections.

[..] a former U.S. national security official with extensive experience in the Gulf, who preferred to remain anonymous due to the sensitivity of the situation, warned that after the midterm elections, the mood toward the Saudis would be much more aggressive than in the past. Whatever the election’s outcome, “I think either way there will be a more skeptical — if not hostile — relationship with Saudi Arabia in the legislature,” the former official said. “And the relatively free hand that the administration gave is going to be a little more constrained. “The Saudis are very lucky that Congress is in recess for campaigning — if Congress were in session there would be hearings, and they would not be good hearings.”

“$40 trillion worth of credit, somewhere between 40 and 50, no one knows, in a system with only a couple trillion dollars’ worth of equity..”

• Trump Has “Strongest Negotiating Position Ever” With China – Kyle Bass (ZH)

The Trump administration needs to level the playing field on trade, Bass said, and “it looks like they are doing so.” And it certainly helps that Trump’s trade push, while initially reviled by globalists in both parties, has since won the reluctant support of both Democrats and Republicans as the US economy has largely escaped any serious repercussions so far. But ultimately, the arbiter of government money and influence over the domestic economy is the yuan-dollar exchange rate. And as the yuan sinks, foreign ownership of Chinese assets is falling as the PBOC runs “a structural and more permanent” current-account deficit with the rest of the world as the US continues to institute trade barriers.

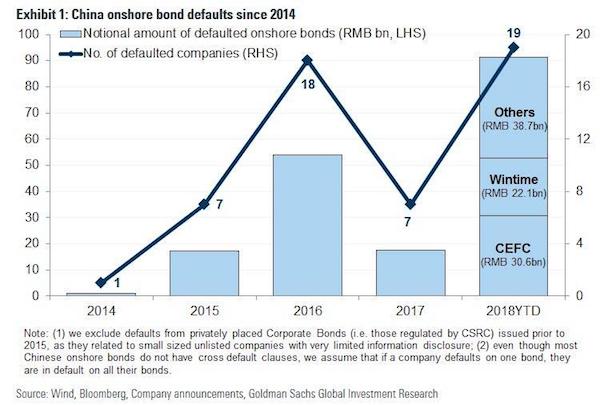

“So they can change a lot of things domestically, but their – the arbiter of the Chinese plan is their cross rate or their exchange rate with the rest of the world. China Inc.’s working capital account is now going South because they’re running what we believe to be a structural and more permanent deficit on the current account. And so, ie, their working capital, their dollar balance whether it’s dollars, euros, yen or pounds, it’s mostly dollars.” All of this instability risks toppling the mountain of bad debt upon which China’s economic growth in recent years has depended. Already, corporate defaults have surged in 2018 to the highest level on record.

With all of these factors at play, China is running what Bass described as “the largest financial experiment the world has ever seen.” “And they’ve got, you know, $40 trillion worth of credit, somewhere between 40 and 50, no one knows, in a system with only a couple trillion dollars’ worth of equity. And so China is running the largest financial experiment the world has ever seen. And the economic tides have turned negative for them. If you notice the narrative amongst the United States, it’s actually a bipartisan narrative whereby you’re seeing both sides of the aisle pushing back on China taking advantage of the US.”

Financial innovation.

• China Talks Up Stock Market Amid Concerns About Share-Backed Loans (CNBC)

A flurry of comments from Chinese officials over the last few days have been aimed at pledging support for private businesses with financing problems, as Beijing seeks to ease fears of a sell-off in stocks. The worry is that a drop in stock prices would force the selling of shares used as collateral, and lead to further market declines in China. In one of Beijing’s latest interventions, the Securities Association of China announced Monday night that 11 securities firms will form a $100 billion yuan ($14.5 billion) asset management plan to take some pressure off “share pledges” for companies with good development prospects.

In share pledge financing, companies use a percentage of their equities as collateral to obtain loans. If the stock price falls far below a level that was agreed upon, the lender will sell the shares to obtain funds, leading to the destabilization of equity markets. Despite Beijing’s latest move and other recent measures to support local businesses, stocks closed sharply lower Tuesday, giving back some gains from the rally in the previous two sessions. [..] The prevalence of share pledges is partly the result of Beijing’s own actions. Chinese banks prefer to lend to state-owned enterprises, while the government continues to crack down on shadow banking — the primary alternative for private businesses. As a result, many Chinese companies, especially small and mid-sized businesses, have turned to share pledges.

I don’t see it either. And Rickards is right about media coverage of Trump.

• A “Blue Wave” in Midterm Elections? Not So Fast (Rickards)

Tuesday, Nov. 6, is the date of the U.S. midterm elections that will determine control of the U.S. House of Representatives and U.S. Senate. The outcome of those contests will determine whether Trump is allowed to finish his term or not (see below for more on that, and which outcome is most likely). Let’s dive in… Whatever you think of Trump personally, we all know how the mainstream media treat Donald Trump. The coverage from The Washington Post, The New York Times, NBC and other outlets is relentlessly and exclusively negative. The media campaign against Trump is not normal bias; it’s more like a political jihad. Trump gets no credit for reducing unemployment, cutting taxes, boosting growth, achieving a breakthrough with North Korea, defeating ISIS and standing up to the dictators in Syria and Venezuela.

Meanwhile, Trump is hammered continually on the bogus Russia collusion story while Robert Mueller is cheered on in his fishing expedition into Trump’s personal finances and unrelated problems of Trump associates. The mainstream pundits are predicting a “blue wave” that will put the Democrats in control of the House of Representatives and lead directly to impeachment proceedings early in 2019. That’s been the mainstream narrative for months. Basically, the idea is that Democratic voters are more motivated than Republican voters because their hatred of Trump is more powerful than support for Trump among Republican voters. The Kavanaugh confirmation process only inflamed Democratic passions even further and should help the turnout.

It’s too late for many things.

• It’s Too Late To Prepare UK Borders For No-Deal Brexit – Watchdog (Ind.)

Britain has left it too late to prepare its borders for a no-deal Brexit, which would be a gift for organised criminals and chaotic for traders, the UK’s spending watchdog warns Theresa May today. Only one of 12 new “critical systems” is likely to be ready after planning was undermined by “political uncertainty and delays in negotiations”, the National Audit Office (NAO) has concluded. The failure would open up “weaknesses or gaps in the enforcement regime” which “organised criminals and others are likely to be quick to exploit”, its highly-critical report says. And the problem will be made worse by the UK losing full access to EU security databases after Brexit, which police chiefs have already warned will weaken the fight against crime.

Meanwhile, firms would be hit with delays for goods crossing the border while rogue operators would escape tax and regulatory checks, the report predicts. Diane Abbott, Labour’s shadow home secretary, seized on the findings as “painting a damning picture on the government’s lack of security preparation for Brexit”. She said: “The British people will never forgive this government if its in-fighting and political jockeying led them to neglect border security and the international co-operation needed to tackle serious, organised crime and terrorism.” And the Federation of Small Businesses said ministers were living in “dreamland” if they believed the ability to track and examine goods at the border would be in place for leaving the EU next March.

No-deal Brexit will be disastrous, much more than anyone realizes. Everything still looks normal, after all.

• UK Could Be Forced To Charter Ships To Bring In Food And Supplies (Ind.)

The UK could be forced to charter ships to bring in supplies in the event of a no-deal Brexit, ministers have been warned. The cabinet was briefed on plans for alternatives if new customs controls in France block the Dover-Calais route, potentially causing chaos in the English Channel, according to the Financial Times. Transport secretary Chris Grayling reportedly discussed the possibility of hiring entire ships, or securing cargo space in vessels, to bring food, medicines and other supplies in through alternative ports. David Lidington, the cabinet office minister, told his colleagues the Dover-Calais route could only run at a maximum of 25 per cent of its capacity under a no-deal scenario.

A department for transport spokesperson said: “We remain confident of reaching an agreement with the EU, but it is only sensible for government and industry to prepare for a range of scenarios. “We are continuing to work closely with partners on contingency plans to ensure that trade can continue to move as freely as possible between the UK and Europe.” Labour MP David Lammy, who is pushing for Britain to stay in the European Union, said: “Brexit has become like a declaration of war on ourselves. Emergency ships will be chartered for food and medicine if we leave the EU with no deal. “But at least when we’re using ration books and running out of drugs, we’ll have taken back control.”

Not the first time Correa says this.

• Ecuador Likely To Turn Assange Over To US – Ex-President Correa (RT)

The Ecuadorian government might eventually hand the Wikileaks co-founder Julian Assange to Washington even though it is legally obliged to protect him, former Ecuadorian president Rafael Correa told RT. “I believe they are going to turn over Assange to the US government,” Correa, who was leading the Latin American country at the time when it granted the Wikileaks co-founder asylum, told RT, calling the policy of the current Ecuadorian government “a shame.” “The Ecuadorian state has to protect Assange’s rights, he is not just an asylum [seeker]; he is a citizen,” Correa said. Granted Ecuadorian citizenship back in 2017, Assange is now supposed to be protected by the Ecuadorian constitution. But the current government is too desperate for Washington’s favor, Correa believes.

The Wikileaks co-founder might be a bargaining chip in an agreement between the Ecuadorian authorities and US Vice President Mike Pence, who visited the Latin American country and met with President Lenin Moreno earlier this year. Quito’s behavior shows that it has “absolutely submitted” to Washington without actually earning any favor, Correa said. His comments came a week after two US lawmakers called on Moreno to “hand Assange over to the proper authorities,” calling him “a dangerous criminal and a threat to global security.” In the letter, representatives Eliot Engel (D-NY) and Ileana Ros-Lehtinen (R-FL) spoke about the US willingness “to move forward in collaborating” with Moreno’s government, mulling enhanced economic cooperation and development aid from the US. They portrayed Assange as an obstacle on the way to a bright future together for the two nations.

Wondering why his lawyers sued Ecuador. Who sues their host? Looks like they know something’s afoot.

• Ecuador Won’t Help Assange Leave UK Embassy Safely – Foreign Minister (RT)

Ecuador will not help Julian Assange leave the UK, the country’s foreign minister said, claiming its only duty was to look after the WikiLeaks founder’s “well-being” after Assange sued them for restricting his rights and freedoms. Ecuadorian FM Jose Valencia told Reuters that Ecuador was not responsible for helping Assange leave the London embassy safely, even though the Inter-American Court on Human Rights recently found them responsible for protecting him from US extradition. UK authorities are poised to apprehend Assange should he step outside the building. Assange accused the Ecuadorian government of violating his rights after they drew up a “Special Protocol” barring him from speaking about politics or involving himself in the political affairs of other countries.

The list of restrictions runs to nine pages and permits authorities to confiscate the property of visitors, who must be approved in advance, submit their social media profiles, and turn over the make, model, serial and IMEI numbers of their mobile devices. The conditions added insult to injury with a threat to turn Assange’s cat over to a shelter if he fails to clean up after it adequately. The cat has been Assange’s only companion during nearly seven months in which the Ecuadorian government has kept him cut off from the outside world, jamming his phone lines, scrambling wifi signals, and banning almost all visitors. The “Special Protocol” also states that Ecuador will cease paying for Assange’s food, medical care, laundry, and all but the most basic needs on December 1.

Between this deadline, the limitations on his speech, and the Foreign Minister’s statement, the government appears to be stepping up the pressure to force Assange to leave on his own. In July, the Inter-American Court on Human Rights ruled that Ecuador must protect Assange from US extradition. The ruling came just weeks after a meeting between Ecuadorian President Lenin Moreno and US VP Mike Pence during which they were rumored to have reached an agreement regarding handing over the WikiLeaks founder.

Home › Forums › Debt Rattle October 24 2018