Claude Monet Impression, sunrise 1872

MacGregor

“We will not lose our ‘Irishness’ nor will we lose Ireland…we can’t let that happen.”

A key component of the Republic of Ireland (Eire)’s Constitution is its guarantee for freedom of religion, thereby acknowledging the rightful place of God in public life. America is the same… pic.twitter.com/jUXqMZ0UjG

— General Mike Flynn (@GenFlynn) April 18, 2025

Tucker

Tucker: “They’re not saying China, Africa, and the Middle East need to invite a lot of people from different parts of the world. They’re saying there’s something about a majority White, Christian country that’s inherently threatening and we’re going to destroy it. It’s a tell.” pic.twitter.com/V3yybuR8uf

— Logan Hall (@loganclarkhall) April 17, 2025

Meloni

https://twitter.com/VigilantFox/status/1912952813023297538

Contenta di rivedere a Washington il mio amico @elonmusk pic.twitter.com/phKTwTcXyz

— Giorgia Meloni (@GiorgiaMeloni) April 18, 2025

NGOs

— Elon Musk (@elonmusk) April 17, 2025

Miiller

NOW – Steven Miller NUKES the Democrat Party in Fiery Address About MS-13 and AOC

It’s Miller time—and he brought a flamethrower.@StephenM just incinerated what’s left of the Democrat Party.

“One party, led by President Donald Trump, that fights for Americans and a second… pic.twitter.com/gqd6t6RVPX

— Overton (@overton_news) April 18, 2025

Bondi

Great answer by Pam Bondi to an amazingly stupid question! pic.twitter.com/HqzwQancxN

— Vince Langman (@LangmanVince) April 18, 2025

VDH

Did you know that Harvard lowered their admission standards significantly recently?

Did you know that 95% of the faculty is hard left?

Did you know that they receive enormous amounts of cash from foreign governments like Qatar and don’t disclose all of it?

Did you know that… pic.twitter.com/3TH2I1L1IO

— Insurrection Barbie (@DefiyantlyFree) April 17, 2025

Dowd

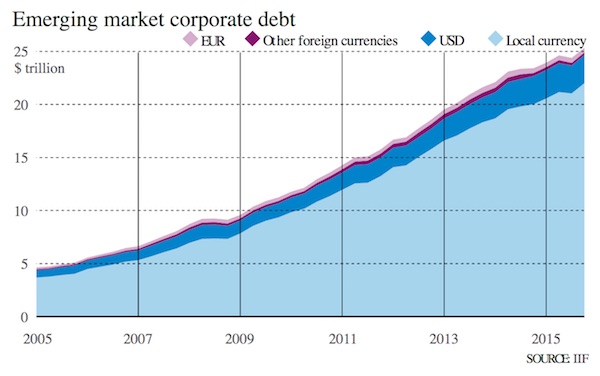

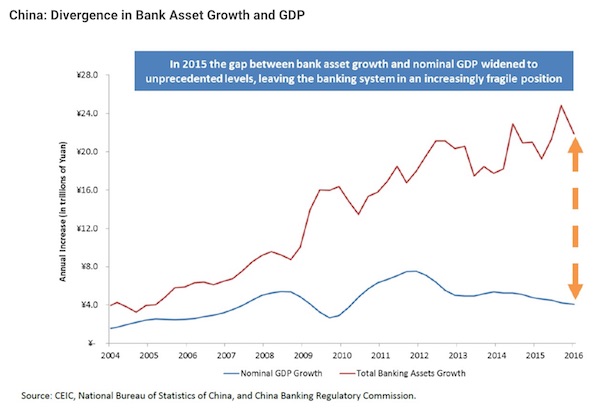

Basel III full implementation — June 30, 2025

Gold is being hardwired into global banking.

Very interesting gold thread. https://t.co/Vm9LLl0HEM

— Edward Dowd (@DowdEdward) April 18, 2025

Much today about Trump leaving the ceasefire talks. Orban is the only voice who’s both right and willing to say it.

“..the West has lost but “European leaders are hesitant to admit” failure. He argued that this outcome will have a big impact on the entire West, as “losing a war is a serious thing.”

“..Trump “saved the US from a serious defeat.”

• West Lost Proxy War To Russia – Orban (RT)

The West has waged a “proxy war” against Russia via Ukraine and lost it, Hungarian Prime Minister Viktor Orban has said. Hungary, a member of the EU, has repeatedly criticized the bloc’s policies on the Ukraine conflict, particularly its sanctions on Moscow and weapons deliveries to Kiev. In an interview with OT YouTube channel published on Thursday, Orban said the whole “Western world” has thrown its weight behind Ukraine in its conflict with Russia, which he described as a “proxy war.” His assessment echoed that of Moscow, which has long characterized the hostilities as a de facto conflict with the West. According to the Hungarian prime minister, the West has lost but “European leaders are hesitant to admit” failure. He argued that this outcome will have a big impact on the entire West, as “losing a war is a serious thing.”

Orban went on to say that European leaders are “offering Ukraine to continue the war and in return receive European Union membership.” He argued that this would be problematic as Ukraine is no longer sovereign and cannot support itself. Regarding the US, the Hungarian prime minister said Washington is in a better position thanks to President Donald Trump’s approach, having broken with the Ukraine policies pursued by his predecessor, Joe Biden. According to Orban, Trump “saved the US from a serious defeat.” Speaking to Hungary’s Kossuth Radio last month, Orban described the EU’s policies on Ukraine as “rudderless.” He warned that Brussels, with its hardline position, risks becoming irrelevant as Trump actively works toward securing a peaceful resolution to the conflict.

Earlier in March, Orban told the YouTube channel Patriota that the EU was feeding Kiev “empty promises” as it “doesn’t have a single penny left… [to] continue arming Ukraine, maintaining the Ukrainian army, and funding the functioning of the Ukrainian state.” His comments came after Budapest refused to endorse a joint EU communique calling for an increase in military aid to Kiev.

A start to the only viable solution. Which EU and Kiev will fight as long as you let them.

• US Proposes Leaving Former Ukrainian Territories Under Russian Control (RT)

The US has presented its allies with the details of its peace plan to bring the conflict between Russia and Ukraine to an end, Bloomberg reported on Friday, citing European officials familiar with the matter. The contours of the plan were outlined during a meeting in Paris on Thursday. The proposal reportedly includes easing sanctions on Russia, as well as terminating Ukraine’s aspirations to join NATO. The roadmap would effectively freeze the war, with the formerly Ukrainian territories held by Russia remaining under Moscow’s control, the sources suggested. One of the officials told Bloomberg that the proposal still had to be discussed with Kiev, adding that the plan would not actually amount to a definitive settlement of the conflict. Moreover, Kiev’s European backers would not recognize the territories as Russian, the source suggested.

The Paris meetings involved senior officials from several countries. The US delegation was led by Secretary of State Marco Rubio and White House special envoy Steve Witkoff. They met with French President Emmanuel Macron and also held discussions with top officials and negotiators from France, Germany, the UK, and Ukraine. Earlier on Friday, Rubio signaled Washington was ready to “move on” if a way to end the hostilities between Moscow and Kiev could not be found shortly. “We need to figure out here now, within a matter of days, whether this is doable in the short term. Because if it’s not, then I think we’re just going to move on,” Rubio told reporters before departing from France.

Moscow has signaled a full ceasefire with Ukraine was highly unlikely, citing Kiev’s violations of previous deals. Speaking to reporters at the UN headquarters on Thursday, Russian envoy Vassily Nebenzia said there are “big issues with the comprehensive ceasefire,” recalling the fate of the now-defunct Minsk agreements, which were “misused and abused to prepare Ukraine for the confrontation.” The diplomat also cited repeated Ukrainian violations of a US-brokered 30-day moratorium on energy infrastructure strikes, implemented on March 18. “How close we are to the ceasefire is a big question to me personally, because, as I said, we had an attempt at a limited ceasefire on energy infrastructure, which was not observed by the Ukrainian side. So, in these circumstances, to speak about a ceasefire is simply unrealistic at this stage,” Nebenzia said.

“The war in Ukraine “has no military solution to it” as “neither side has some strategic capability to end this war quickly”, Rubio said.”

He’s wrong.

• Trump Ready To Recognize Crimea As Russian After Warning He May Walk Away (ZH)

President Trump warned he could walk way from efforts to end the war in Ukraine if a deal can’t be found soon, as Russia said a one-month pause on targeting Ukrainian energy infrastructure had ended. “If for some reason, one of the two parties makes it very difficult, we’re just going to say, you’re foolish,” Trump told reporters Friday in the Oval Office. “You’re fools, you’re horrible people, and we’re going to just take a pass. But hopefully we won’t have to do that.” While Trump did not say he has a “specific number of days” in mind by which he wanted to see an agreement before walking away, he needed to see quick progress. “I know when people are playing us, and I know when they’re not,” Trump said. “And I have to see an enthusiasm to want to end it. And I think I see that enthusiasm. I think I see it from both sides.”

His comments followed a meeting of US officials, including Secretary of State Marco Rubio and US special envoy Steve Witkoff, with representatives from France, Germany and the UK in Paris on Thursday, where the US indicated its aim was to secure a full ceasefire in Ukraine within weeks, according to people familiar. Following the meeting, Rubio said the US needed to see in “a matter of days” whether a deal was “doable in the short term…. because if it’s not, then I think we’re just going to move on,” Rubio told reporters at Le Bourget airport outside of Paris on Friday morning, according to a transcript provided by the State Department. Rubio also said the European nations could help “move the ball” to get a resolution and that their ideas had been “very helpful and constructive.” “We had a good meeting yesterday,” he added. “But this isn’t going to go on forever.” The war in Ukraine “has no military solution to it” as “neither side has some strategic capability to end this war quickly”, Rubio said.

Trump, who predicted on the campaign trail that he could quickly secure a ceasefire, hits the 100-day mark of his second stint in the White House on April 30. Trump “has dedicated a lot of time and energy to this, and there are a lot of things going on in the world right now that we need to be focused on,” Rubio told reporters. “There are a lot of other really important things going on that deserve just as much if not more attention.” Bloomberg reports that Thursday’s talks in Paris also included a meeting between Witkoff and French president Emmanuel Macron and were attended by Ukrainian officials. US officials indicated they expected to make significant progress soon, and the participants agreed to work toward that. National security advisers and negotiators from Germany, France, the US and the UK plan to gather again in London next week to follow up on their discussions.

More importantly, Bloomberg also reported that the US presented its allies with details of its peace plan to bring the conflict between Russia and Ukraine to an end. The proposal, outlined during a meeting in Paris on Thursday, includes easing sanctions on Russia, as well as terminating Ukraine’s aspirations to join NATO. The roadmap would effectively freeze the conflict and leave former Ukrainian territories that are part of Russia under Moscow’s control. An official told Bloomberg that the proposal still had to be discussed with Kiev, which will certainly balk, adding that the plan would not actually amount to a definitive conflict settlement as Kiev’s European backers would not recognize the territories as Russian.

The meetings came almost a week after Witkoff traveled to St. Petersburg, where he spoke with Russian President Vladimir Putin for almost five hours. He described the conversation as “compelling,” saying they discussed steps that could end the war and perhaps lead to business opportunities for Russia as well, including dropping sanctions. The US has presented its allies with details of its peace plan to bring the conflict between Russia and Ukraine to an end, Bloomberg reported on Friday, citing European officials familiar with the matter. The proposal, outlined during a meeting in Paris on Thursday, reportedly includes easing sanctions on Russia, as well as terminating Ukraine’s aspirations to join NATO. The roadmap would effectively freeze the conflict and leave former Ukrainian territories that are part of Russia under Moscow’s control, the sources suggested.

European officials have attempted to influence the outcome of peace efforts kicked off by the Trump administration, especially after being sidelined during recent bilateral talks between Russia and the US. So far they are failing: a follow up report from Bloomberg on Friday afternoon confirmed that the US is prepared to recognize Russian control of the Ukrainian region of Crimea as part of a broader peace agreement between Moscow and Kyiv. The concession is the latest signal that Trump is eager to rush through a ceasefire deal, and comes as he and Marco Rubio suggested on Friday that the administration is prepared to move on from its peace-brokering efforts unless progress is made quickly.

“We need to determine very quickly now, and I’m talking about a matter of days, whether or not this is doable,” Rubio said..”

• Ukraine Ceasefire ‘Unrealistic’ For Now – Moscow (RT)

Russia and Ukraine are highly unlikely to agree to a full ceasefire at present, Vassily Nebenzia, Moscow’s envoy to the United Nations, has said. He cited Ukrainian violations of a US-brokered truce on energy infrastructure strikes as among the reasons. Speaking to reporters at the UN headquarters on Thursday, Nebenzia addressed comments by US President Donald Trump, who said he expects a response from Russia on a ceasefire proposal as early as “this week.” “How close we are to the ceasefire is a big question to me personally, because, as I said, we had an attempt on a limited ceasefire on energy infrastructure, which was not observed by the Ukrainian side. So, in these circumstances, to speak about a ceasefire is simply unrealistic at this stage,” Nebenzia said.

Moscow and Kiev agreed a 30-day moratorium on strikes on energy facilities following a phone call between Trump and Russian President Vladimir Putin last month. Russia, however, has accused Ukraine of repeatedly violating the ceasefire. Kremlin spokesman Dmitry Peskov said on Friday that the moratorium had expired, but that Putin had not yet announced a decision on further steps. Nebenzia noted that there are “big issues with the comprehensive ceasefire,” recalling the fate of the now-defunct Minsk agreements, which were designed to give the regions of Donetsk and Lugansk special status within the Ukrainian state. According to Nebenzia, the deal was “misused and abused to prepare Ukraine for the confrontation [with Russia].” The envoy added that another concern is the feasibility of monitoring any potential ceasefire, as it is unclear who could take on this task.

His comments come amid diplomatic efforts between the US and Russia to resolve the Ukraine conflict. Earlier this month, US Special Envoy Steve Witkoff met with Putin in St. Petersburg, stating after the talks that a potential peace deal hinges on “these so-called five territories,” referring to former Ukrainian regions which overwhelmingly voted to join Russia. However, US Secretary of State Marco Rubio has indicated that Washington could withdraw from peace negotiations if no progress is made soon. “We need to determine very quickly now, and I’m talking about a matter of days, whether or not this is doable,” Rubio said on Friday.

It’s the only place where it can stay alive.

• Europe, You Can’t Sit on the Sidelines Anymore (Victor Davis Hanson)

Hello, this is Victor Davis Hanson for The Daily Signal. I’d like to talk today about the role of China, the United States, and the European Union, or just Europe in general, in the context of these tariffs and the so-called trade wars. Right now, President Donald Trump has given a 90-day reprieve from high tariffs. I think that 10% tariffs are still in existence. And they are negotiating with a number of European countries and particularly, Asian dynamic economies, such as South Korea, Taiwan, and Japan. In addition to that, they are targeting China with tit-for-tat tariffs. And we are maybe on the brink—nobody wants it, but we might be on the brink of a trade war, which we’ve addressed in earlier videos.

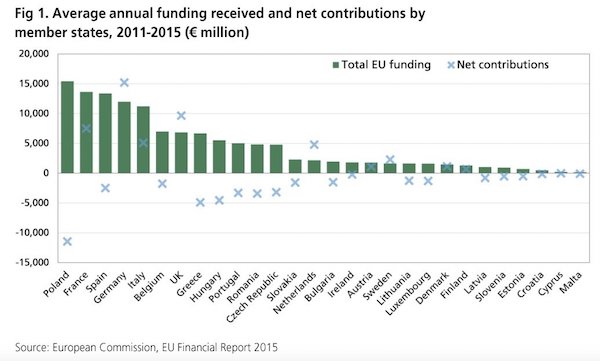

But here’s my point. What is the attitude of Europe? Roughly, China has a $1 trillion deficit with the world. We have about a $1 trillion deficit in trade with the world. But here’s the ratios. About a third of our deficit is with China, which makes up a third of their surplus. In addition to that, Europe makes up about a third of their surplus. So, China has called on Europe to join forces with it to prevent all of the retaliatory tariffs that the United States has threatened Europe, which has a $200 billion surplus with us, and China, which has a nearly high $300 billion, maybe even $400 billion, who knows? It’s kind of crazy, isn’t it, that these illiberal apparatchiks in China would think that a Western democracy would want to join them against the United States? I don’t think that’s gonna happen. But the European Left is very angry at the Trump administration.

So, Choice One might be, “Well, we don’t like the Chinese and we are an ally of the Americans, who subsidize our defense, but we detest the Trump administration. So maybe, (wink and nod) we’ll either be quiet or hope China wins that trade war and the United States, under the Trump administration, backs off all tariffs.” That would be a big mistake given their vulnerabilities they have with the United States vis-a-vis security. The second attitude might be the Europeans will just say, “We’ll lay low. We won’t say much at all. We’ll kind of drag out our tariff negotiations with the Trump administration. And we’ll let the Chinese and the United States battle it out. And if Trump should win and he lowers the amount of trade with China, maybe that will be an opening for us to replace China as the United States chief importer.” That is something that I don’t think will happen.

The third scenario is what I would suggest for the Europeans. They should say the following: “Despite our disagreements with the Trump administration, the United States is an ally. And we know that we have been as victimized by Chinese mercantilism, high tariffs, cheating on patents, copyrights, dumping, financial money manipulation—all the things the United States complains about, we do too. In fact, we as Europeans in a whole have about the same deficit with China as the United States does. So, we are kindred spirits. So, what we will do is, even though we have disagreements on our surplus with the United States and their efforts to reduce it, we will ally with the United States.” And that would represent about two-thirds of China’s total trade action or monetary value. And especially, if Japan and our allies in South Korea, Taiwan would join, then China would find out that about 85% of its trade is in a block. That is, they are united. And they have common complaints against China.

And China would not be able to say to the United States, “We’re going to cut deals with Vietnam and Japan and Taiwan and South Korea and the EU and leave you out in the cold.” Instead, the Europeans and, to a lesser extent, the Asian powerhouses would join the United States and say, “You know what? We’ve been quiet. We’re afraid of China. They’re bullies. But now that you’ve stood up, we’re embolden ourselves to air the same complaints as you are and hope that you win. And maybe a byproduct of reduced trade with China from the United States will open a door. So, even though we might have to lower our tariffs, there will be more opportunity in the American market with a less prominent Chinese trade profile that we can then be welcomed in as a kindred ally.” So, Europe has two or three choices in this proposed Chinese-American trade standoff. Nobody wants a trade war with anybody. No one wants it with China. But this is long overdue. And Europe has to decide what course they’re going to take. And for everybody’s sake, let’s hope they choose wisely.

“Start with a big ask, create a sense of urgency, use leverage, don’t back down, make things happen. That’s how Trump is getting this all done.”

• Trump Takes ‘Art Of The Deal’ To World Stage (Stepman)

President Donald Trump, like one of his heroes Andrew Jackson, was born for a storm. Trump is disrupting national and international systems that no longer work for the American people. In the domestic realm, he’s launched a political counterrevolution on a scale of change not seen since the New Deal. But it isn’t just on the home front that Trump is making the greatest pivot.He’s dramatically shifting the global chess board. Instead of coasting on the “postwar order” that long ago morphed into the failing and incoherent post-Cold War order, Trump is using America’s still-considerable position in the world to reorient the focus of our national security. He’s doing this by using the skill that he long ago became famous for and that so many of his critics misunderstand. Start with a big ask, create a sense of urgency, use leverage, don’t back down, make things happen. That’s how Trump is getting this all done.

It’s the art of the deal, and it’s funny that so many commentators miss this given that Trump wrote a famous book about it and has been pulling off deals in the public eye for decades. What the 47th president is doing is renegotiating America’s position vis-à-vis both our international rivals and our allies. Whether it be on tariffs, or acquiring Greenland, or securing the Panama Canal, or peace with Russia and Iran, Trump is clearly aiming to reset America’s international situation. He’s doing this, I believe, to ensure that the United States and not Communist China will remain the most dominant country globally going forward. Let’s take the Greenland issue for instance. Greenland may seem irrelevant, but its position on the globe and considerable natural resources vital to a modern economy make it extremely important for U.S. security. Acquiring it would send a message to Americans that we are thinking big once again and a message to Russia and China that the U.S. means to prevent them from dominating the Arctic and threatening the U.S. mainland.

The U.S. has sought to acquire the massive Arctic island since at least the 1860s. When William H. Seward bought Alaska, he really wanted Greenland too. The U.S. became close to buying Greenland a few other times, but ultimately Denmark held onto it. Trump’s aggressive words may have unsettled U.S. relations with Denmark in the short term, but maybe that’s what’s needed to create pressure and a sense of urgency to get a deal done. Trump knows that the U.S. can offer Greenland more than any other nation, he can make the territory rich and provide long-term defense. It’s now more likely than ever that Greenland will go independent and fall under U.S. sway in one way or another. Now consider Panama. The Panama Canal has long been critical for American national security. Perhaps we should have never given it to Panama after building it in the first place, but here we are.

It’s clear that China has made major inroads into subtly influencing Panama. A Hong Kong-based company controls ports on both sides of the canal. What would happen if they even just delayed U.S. ships during a sudden military conflict in the Pacific? Not good. Trump’s strong rhetoric about retaking the canal and putting immediate pressure on the country has forced them to act. The Hong Kong company sold those ports (and over 40 others around the globe) to an American-led group of companies. China has blocked the sale, but there is a good chance that a deal will go through at some point. Panama has abandoned China’s Belt and Road investments and even recently agreed to allow some U.S. troops to be stationed in the country. The Panamanian government would clearly rather remain in the good graces of the U.S. rather than kowtow to China. The Monroe Doctrine is back and it should have never gone away.

Now consider Panama. The Panama Canal has long been critical for American national security. Perhaps we should have never given it to Panama after building it in the first place, but here we are. It’s clear that China has made major inroads into subtly influencing Panama. A Hong Kong-based company controls ports on both sides of the canal. What would happen if they even just delayed U.S. ships during a sudden military conflict in the Pacific? Not good. Trump’s strong rhetoric about retaking the canal and putting immediate pressure on the country has forced them to act. The Hong Kong company sold those ports (and over 40 others around the globe) to an American-led group of companies. China has blocked the sale, but there is a good chance that a deal will go through at some point.

Panama has abandoned China’s Belt and Road investments and even recently agreed to allow some U.S. troops to be stationed in the country. The Panamanian government would clearly rather remain in the good graces of the U.S. rather than kowtow to China. The Monroe Doctrine is back and it should have never gone away. Of course, where Trump has operated most dramatically and has taken the greatest risk is on trade. Trump threatened to put significant tariffs on virtually every nation on earth. This sent markets and countless political commentators into a panic. But at seemingly the last minute, Trump adjusted and froze the highest tariffs. He kept an enormous 145% tariff on China.

The turbulent tariff talk has resulted in China being economically singled out. U.S. trade partners around the globe are offering to reduce their tariffs on U.S. goods out of concern about losing access to the American domestic market. Countries are now being pushed into the position of doing business with China or America. And they can’t go back to being pass-throughs for Chinese goods.

“While Biden was preaching “unity” from his teleprompter, his administration was quietly crafting plans to turn Big Tech into their personal censorship machine.”

• Tulsi Exposes a Terrifying Biden-Era Program Meant To Be Secret (Margolis)

They thought they could keep it hidden forever. Buried under layers of classification and bureaucratic doublespeak, the Biden administration’s masterplan for undermining American liberty was supposed to stay safely locked away from public scrutiny. But they didn’t count on Tulsi Gabbard. In a stunning move that has the DC establishment scrambling, Director of National Intelligence Gabbard just declassified what might be the most disturbing government document of the Biden era: their deceptively-named “Strategic Implementation Plan for Countering Domestic Terrorism.” Let’s cut through the bureaucratic noise and call this what it really is: a systematic blueprint for targeting and silencing conservative Americans. While Biden was preaching “unity” from his teleprompter, his administration was quietly crafting plans to turn Big Tech into their personal censorship machine.

The scheme reads like a progressive wish list: monitoring “suspicious” online speech (translation: conservative viewpoints), expanding federal watchlists to include Americans with the “wrong” political beliefs, and – you guessed it – finding new ways to chip away at Second Amendment rights. Don’t be fooled by their carefully crafted language about “protecting democracy.” The Government Accountability Office has confirmed these weren’t just ideas on paper—they were actively being implemented. How many Americans have already been labeled “suspicious” for nothing more than expressing conservative views? Heck, Tulsi Gabbard ended up on the Transportation Security Administration’s (TSA) terrorist watchlist under Joe Biden. Enough said.

The plan’s centerpiece? A comprehensive strategy to leverage federal power for pushing red flag laws and restricting access to firearms, all under the guise of preventing “lethal means.” Because apparently, in Biden’s America, exercising your Constitutional rights made you a potential threat under the guise of combating domestic terrorism. The strategic implementation plan (SIP) pushed agencies to crack down on what it labels “DT (domestic terrorism)-related content” online, encouraging collaboration with Big Tech to monitor, report, and censor speech—raising serious First Amendment concerns about free speech and assembly. You may remember that this practice was exposed after Elon Musk acquired Twitter, when the Twitter Files showed “extensive government efforts to silence dissenting views” on everything from COVID-19 to elections.

As promised, I have declassified the Biden Administration’s Strategic Implementation Plan for Countering Domestic Terrorism.

Read it here: https://t.co/VAXDHkgZTK https://t.co/oNXjKDqamc pic.twitter.com/p9co00Scge— DNI Tulsi Gabbard (@DNIGabbard) April 16, 2025

The report further reveals that agencies were told to “Share with relevant technology and other private-industry companies… relevant information on DT-related and associated transnational terrorist online content.” This wasn’t just government overreach, it was a calculated assault on the fundamental rights that make America exceptional. While the left was hyperventilating about “threats to democracy,” they were building the infrastructure for genuine governmental tyranny. Thanks to Gabbard’s courage in bringing this to light, we can finally see what Biden’s “moderate” administration was really planning behind closed doors. The question now isn’t just who approved this un-American scheme—it’s how many other similar programs are still hiding in classified files, waiting to be exposed.

The founding fathers would be rolling in their graves. But perhaps this revelation is exactly what America needs right now – a wake-up call about what happens when we let power-hungry bureaucrats operate in the shadows, far from public scrutiny and accountability. Remember this the next time you hear Democrats pontificating about “defending democracy.” They’ve shown us exactly what they mean by “democracy,” and it looks nothing like the Constitutional Republic our founders envisioned.

”Everyone sees on the news where the Trump admin stands; you don’t want to do anything that shoots yourself in the foot..”

• NATO To Abandon ‘Woke Language’ – Politico (RT)

NATO staff are softening language related to climate, gender, and diversity, equity, and inclusion (DEI) to avoid a potential backlash from the administration of US President Donald Trump, Politico has reported, citing sources familiar with the situation. Phrases concerning climate, as well as gender diversity and security, have been reworded in new NATO legislation drafted by its committees and working groups, using language deemed more palatable to Washington, the outlet said on Thursday. The Trump administration took sweeping action aimed at dismantling gender and DEI programs shortly after Trump assumed office in January. The new administration is working to cut funding for universities and dismantle federal programs that include DEI practices. It is also carrying out a purge within the Pentagon to eliminate these programs.

”Everyone sees on the news where the Trump admin stands; you don’t want to do anything that shoots yourself in the foot,” one NATO official told Politico. ”Green technologies” have reportedly been replaced with “innovative technologies,” while “climate” has been described as an “operational environment,” another official said. NATO officials are steering clear of any language referencing “gender” or “women, peace, and security” in an effort to secure approval from all 32 member countries, including the US, the outlet said. ”Everyone knows that the worst thing you can do is present it as a diversity issue,” one of the officials said. “It’s not a woke agenda, it’s part of a military agenda, and now more people are pricking up their ears to make sure it is spoken about in military terms.” The fight against “woke policies,” such as the promotion of gender reassignment treatment among minors, was a key part of Trump’s presidential campaign. He has signed multiple executive orders rolling back DEI initiatives since taking office.

Trump has also consistently criticized NATO countries, accusing them of “freeloading” on US military support. He has pushed for members to increase their defense spending target from the current 2% of GDP to 5%. On Tuesday, the Trump administration unveiled a plan to slash the State Department’s budget by nearly 50%, a reduction that would deeply affect contributions to NATO’s internal operations, the UN, and roughly 20 other international bodies. The proposal, put forward by the White House’s Office of Management and Budget, seeks to reduce combined funding for the State Department and USAID from $54.4 billion to $28.4 billion for the next fiscal year. Among the most significant changes is the proposed elimination of financial support for nearly all international organizations, including the UN and NATO headquarters.

“Autistic people contribute every day to our nation’s greatness.” —Senator Elizabeth Warren

• Kilmar for President! (James Howard Kunstler)

So, you wonder why Democrats are so anxious to bring Kilmar Abrego Garcia back to the USA. Is it to lead the national ticket in 2028? Who else have they got? Pete Buttigieg doesn’t have half of Kilmar’s charisma. AOC is just pretending to be Sandy-from-the-block — and everybody knows it. Who else best represents the party’s newest constituency: the undocumented (people unfairly deprived of documents by a cruel and careless bureaucracy)? Who best represents the Democratic Party’s number one policy goal: diversity fosterization! Kilmar, of course! Viva Kilmar!

It’s also pretty obvious by his recent actions, that Judge “Jeb” Boasberg is angling to be Kilmar’s running mate in ‘28. Perfect! He could fulfil the traditional role of vice-president by doing nothing for four years, which is exactly what people of non-color should do in the Democratic Party’s new national order. (Haven’t they already done enough?) Boasberg could set an example for the rest of America’s dwindling color-deficient population: quit hogging all the action, stop collecting all those dividends and annuities, step aside and give the other a chance at the American Dream!

Did you happen to notice how enterprising Kilmar Abrego Garcia has been since he boldly breached the border in 2011, fleeing persecution from the vicious gangs of his native El Salvador? Running a one-man jobs program, he crossed the country countless times indefatigably from Maryland to California in his mobile office — the legendary KAG SUV — seeking employment opportunities for young women of color otherwise condemned to clean hotel rooms and labor in senior care facilities filled with abusive people of non-color clinging pointlessly to life only to oppress their caretakers with never-ending demands for medication and extra portions of Jello.

Kilmar’s gritty organization, Mara Salvatrucha-13, has been among the Democratic Party’s most effective NGOs in a greater galaxy of justice-seeking ventures marshaled under the USAID umbrella — recently vandalized by Elon Musk’s DOGE band of pillaging oligarchs. MS-13, for short, was beloved among the undocumented for its fund-raising abilities, its networking expertise, and its relentless search for the missing documents the undocumented have been looking high-and-low for lo these many decades — rumored to be concealed in a vast underground complex in the Catoctin Mountains of Frederick County, MD. (More white peoples’ mischief!)

Thus, it came to pass that Kilmar Abrego Garcia, Maryland Dad-of-the-Year, was cruelly snatched from an MS-13 board meeting last month and transported without benefit of due process to the Salvadorean hell-hole known as CECOT (Centro de Confinamiento del Terrorismo). And so, his Senator, Chris Van Hollen (D-MD) traveled this week to Central America on his one-man rescue mission. The Senator claimed he was detained miles from the gate of CECOT, and yet we have this photograph of Mr. Van Hollen meeting with Kilmar (and an unidentified aide) over Margaritas and pupusas at a cantina in the nearby town of Tecoluca. Asked to comment on the photo, El Savador’s Presidente, Nayib Bukele, declared: “Kilmar Abrego Garcia, miraculously risen from the ‘death camp’ & ‘torture!’ Now that he’s been confirmed healthy, he gets the honor of staying in El Salvador’s custody,” Mr. Bukele added.

Oh, so you say Señor Presidente! But not if “Jeb” Boasberg can help it. The dauntless super-judge has ordered Kilmar to be returned the USA pronto expressimo, or else he, the judge, is laying criminal contempt charges on the entire West Wing staff of Donald Trump’s White House. They will go to jail just like Steve Bannon and Peter Navarro, two capos regime of Trump’s MAGA gang, did last year for the insolence of refusing to testify in Congress. Only, they will get life-without-parole! Lessons to be learned, ye miserable color-deficient, oppressors!

Alas, the DC federal district court is a bit short of enforcement officers, so Judge “Jeb” has enlisted the Harvard rowing crew to bring Kilmar back home. Kilmar will take the coxswain’s place in the racing shell as the crew rows up the Pacific Coast to their planned landing spot at Las Olas, CA, just south of San Diego. Joy will reign in Wokeville.

Having displayed such pluck at diplomacy, unnamed sources say Senator Van Hollen is under consideration for Secretary of State when Kilmar wins the 2028 election. Up until now, we’d been hoping for Senator Adam Schiff to fill that spot, but he has his hands full fighting the influence of the Soviet Union on the Trump cabinet. Looking forward, though, to the bold prosecutor, New York AG Letitia ‘Tish” James, moving into the top spot at DOJ, if her term for mortgage fraud ends before Jan-20, 2029. The Democratic Party — such bright prospects! Forward together, with Kilmar and company! Documents for all, at long last!

That was fast! Trouble in the ranks?!

• IRS Hunter Biden Whistleblower Gary Shapley Ousted As Acting Commissioner (NYP)

Gary Shapley, who became a folk hero to conservatives when he revealed the Justice Department played favorites in its investigation of former first son Hunter Biden, was ousted from his role as acting IRS commissioner just days after being elevated to the position, sources familiar with the shake-up told The Post Friday. Treasury Secretary Scott Bessent has replaced Shapley with deputy treasury secretary Michael Faulkender following a power struggle with key Trump adviser Elon Musk over the appointment. The reorganization was first reported by the New York Times. Musk’s Department of Government Efficiency (DOGE) had pressed the White House for Shapley to take over the IRS. But Bessent felt left out of the decision-making — and asked President Trump if he could install Faulkender instead.

The acting commissioner will only be in place until former GOP congressman Billy Long can be vetted and confirmed by the Senate to lead the tax collection agency. “It’s no secret President Trump has put together a team of people who are incredibly passionate about the issues impacting our country,” White House press secretary Karoline Leavitt said in a statement. “Disagreements are a normal part of any healthy policy process, and ultimately everyone knows they serve at the pleasure of President Trump.” Shapley, who last month was tapped as a senior adviser to Bessent, was named acting IRS head after the departure of Melanie Krause, who resigned due to disagreements with the treasury secretary over the sharing of tax information on illegal immigrants with the Department of Homeland Security. While Krause left the IRS on Tuesday, Shapley remains in a senior position in the commissioner’s office despite being removed from the top interim role.

Musk had been lashing out at Bessent publicly before Shapley’s apparent demotion. On Thursday evening, the Tesla and SpaceX CEO posted on X in response to right-wing provocateur Laura Loomer that Bessent’s meetings with a purported “Trump hater” earlier this month were “troubling.” The line of attack came after Loomer had a White House meeting that precipitated the mass firing of several National Security Council staffers due to a lack of perceived loyalty to the president’s agenda. Musk had backed current Commerce Secretary Howard Lutnick for the Treasury role, criticizing Bessent as a “business-as-usual choice.” Lutnick, by contrast, would “actually enact change,” Musk wrote on X before Bessent’s nomination.

Shapley and fellow IRS whistleblower Joseph Ziegler had testified before Congress in July 2023 that former President Joe Biden’s Justice Department had slow-walked a criminal probe of his son Hunter and blocked their tax team from taking certain investigatory steps. Among the damning claims were that Biden-appointed US attorneys based in Washington DC and Los Angeles had declined to bring charges against the then-first son, while then-Assistant Delaware US Attorney Lesley Wolf discouraged investigators from pursuing lines of questioning related to Joe Biden, saying at one point that there was “no specific criminality.”

“Following the February meeting between Modi and Musk in Washington, the company started hiring in India..”

• Indian PM Modi Dials Musk Ahead of Vance’s Visit (RT)

Indian Prime Minister Narendra Modi said on Friday that he has had a phone call with Elon Musk during which they discussed several issues, including collaboration on technology and innovation. The call comes ahead of a visit to New Delhi next week by US Vice President J.D. Vance as the two nations aim to resolve trade issues. “India remains committed to advancing our partnerships with the US in these domains,” Modi said on X. During a two-day visit to the US in February, Modi met with Musk, whose business empire includes Tesla and SpaceX. India’s Ministry of External Affairs stated at the time that Modi and Musk discussed enhancing collaboration between Indian and US entities in areas such as innovation, space exploration, artificial intelligence, and sustainable development. They also explored opportunities for increased cooperation in emerging technologies, entrepreneurship, and good governance, the ministry said.

Musk’s SpaceX has already signed agreements with the top two telecom operators in India – Reliance Jio and Airtel to start Starlink internet services to India. Tesla has also made a move toward entering the Indian market. Following the February meeting between Modi and Musk in Washington, the company started hiring in India, advertising 13 job openings on LinkedIn for various positions, including back-end and customer-facing roles, according to local media reports. Meanwhile, India is one of the first countries to have initiated formal discussions with Washington on a trade deal that would allow it to avoid being charged a higher reciprocal tariff. The two countries have agreed on a deadline for completing an agreement, according to a government official cited by Reuters.

They should use their money and clout for something positive.

• Soros-Funded Groups Go To War Against DOGE (Tyler O’Neil)

The far-left groups that staffed and advised the Biden administration—a network that I call the Woketopus—are going to war against DOGE’s efforts to root out waste, fraud, and abuse in the federal government. Activist groups like the Center for American Progress and the ACLU are working alongside unions like the AFL-CIO and the American Federation of Teachers to block DOGE through lawsuits or public campaigns. My book, “The Woketopus: The Dark Money Cabal Manipulating the Federal Government,” exposes how these activist groups—bankrolled through the Left’s dark money network by big donors like Hungarian American billionaire George Soros and his son, Alex—used the administrative state to force their woke agendas on the American people. The Trump administration is rooting woke ideology out of the federal government, so the Woketopus’ opposition comes as no surprise. Yet the campaign against DOGE seems particularly noteworthy, since DOGE represents an effort to tighten the government’s belt and make it more accountable to the people.

The Dark Money Playbook

A little-known and once secretive nonprofit called Governing for Impact appears to have orchestrated the Left’s campaigns against DOGE. As I document in the book, Governing for Impact began as a project of New Venture Fund, one of the nonprofit entities created by the for-profit company Arabella Advisors. Governing for Impact’s website did not even appear on Google in 2022, but the nonprofit bragged about hosting a “listening tour” that involved some of the most influential regulators in the Biden administration. The Open Society Foundations, which George Soros founded and which his son Alex now runs, funneled $9.98 million into Governing for Impact through New Venture Fund between 2019 and 2021. Rachel Klarman, Governing for Impact’s executive director, previously worked as a legal policy analyst at Democracy Forward, identifying and developing litigation challenging the first Trump administration’s actions on health care, labor, and education.Perhaps it should be no surprise, then, that Governing for Impact published a series of memos laying out legal strategies to sue the second Trump administration, particularly on DOGE. The memo titled “Challenging DOGE,” published in February, lays out a strategy to claim that DOGE “lacks lawful authority to act as an agency.” “One potential legal claim would assert that DOGE, as embodied in [the U.S. Digital Service, the department Trump re-tasked to house DOGE], lacks any statutory authority,” since Congress did not pass a law explicitly creating DOGE. The memo admits that Trump has an alternate explanation for DOGE’s involvement, but it insists that the effort is unlawful. It goes on to state that since DOGE “lacks lawful authority to act as an agency,” it “cannot enter Economy Act agreements.” The Economy Act, signed in 1932, allows federal agencies to share resources.

The AFL-CIO, America’s largest union, filed a lawsuit against DOGE that same month, arguing that DOGE lacks the authority to place orders with other federal agencies under the Economy Act, The Washington Examiner reported. Not only did the AFL-CIO—one of the unions with influence in the Biden administration—bring this lawsuit, but its legal representation comes from none other than the Democracy Forward Foundation, Klarman’s former employer. Democratic lawyer Marc Elias, who recently challenged the U.S. Senate election results in Pennsylvania and who helped orchestrate the Trump-Russia hoax, chairs Democracy Forward’s board. Democracy Forward is representing many of the lawsuits against the Trump administration.

Other Woketopus Lawsuits Against DOGE

The American Federation of Government Employees—the largest public-sector union in the federal government and a member of the AFL-CIO—has filed multiple lawsuits against DOGE. In the first anti-DOGE lawsuit filed on Trump’s first day in office, AFGE joined Public Citizen and State Democracy Defenders Fund (a group led by Democratic lawyer Norm Eisen) in suing to make sure DOGE complies with the requirements of the Federal Advisory Committee Act. AFGE teamed up with the American Federation of State, County and Municipal Employees to sue Acting DOGE Administrator Charles Ezell to block the Trump administration’s offer for federal employees to resign in a buyout.

“The ‘tariff solution’ had been pre-prepared by his team over recent years, and formed an integral part to a more complex framework..”

• Trump Axes A Stricken World Order (Alastair Crooke)

The Trump ‘shock’ – his ‘de-centring’ of America from serving as pivot to the post-war ‘order’ via the dollar – has triggered a deep cleavage between those who gained huge benefit from the status quo, on the one hand; and on the other, the MAGA faction who have come to regard the status quo as inimical – even an existential threat – to U.S. interests. The sides have descended into bitter, accusatory polarisation. It is one of the ironies of the moment that President Trump and right-wing Republicans have insisted on decrying – as a “resource curse” – the benefits of the Reserve Currency status that precisely brought the U.S. the wave of inward global savings that has permitted the U.S. to enjoy the unique privilege of printing money, without adverse consequence: Until now that is! Debt levels finally matter, it seems, even for the Leviathan.

Vice-President Vance now likens the Reserve Currency to a “parasite” that has eaten away the substance of its ‘host’ – the U.S. economy – by forcing an overvalued dollar. Just to be clear, President Trump believed there was no choice: Either he could upend the existing paradigm, at the cost of considerable pain for many of those dependent on the financialised system, or he could allow events to wend their way towards an inevitable U.S. economic collapse. Even those who understood the dilemma the U.S. faces, nonetheless have been somewhat shocked by the self-serving brazenness of him simply ‘tariffing the world’. Trump’s actions, (as many claim), were neither ‘spur of the moment’, nor whimsical. The ‘tariff solution’ had been pre-prepared by his team over recent years, and formed an integral part to a more complex framework – one that complemented the debt-reduction and revenue effects of tariffs, by a programme to coerce the repatriation of vanished manufacturing industry back to America.

Trump’s is a gamble that may, or may not, succeed: It risks a bigger financial crisis, as financial markets are over-leveraged and fragile. But what is clear is that the de-centring of America that will follow from his crude threats and humiliation of world leaders ultimately will cause a counter-reaction both for relations with the U.S., and also in global willingness to continue to hold U.S. assets (such as U.S. Treasuries). China’s defiance of Trump will set a ‘tone’, even for those who lack China’s ‘heft’. Why then should Trump take such a risk? Because, behind Trump’s boldfaced actions, notes Simplicius, lies a harsh reality facing many MAGA supporters:

“it remains inarguable that the American workforce has been gutted by the triple threat of mass migration; general worker anomie as consequence of cultural decay – and in particular, by the mass alienation and disenfranchisement of conservatively-minded men. These have been strongly contributing factors to the current crisis of doubt about the ability of ‘American manufacturing’ to ever return to a semblance of its previous glory, no matter how big an axe Trump takes to the stricken ‘World Order’”. Trump is mounting a Revolution in order to invert this reality – an end to the American anomie – by (Trump hopes) bringing back U.S. industry.

There is a current of western public opinion – “by no means limited to intellectuals”, nor to Americans alone – that despairs of their own country’s ‘lack of will’, or its inability to do what needs to be done – its fecklessness and its ‘crisis of competence’. These people hanker for a leadership believed to be tougher and more decisive – a longing for unconstrained power and ruthlessness.

One highly-placed Trump supporter puts it quite brutally: “We are now at a very important inflection point. If we are going to face ‘The Big Ugly’ with China, we cannot afford divided loyalties … It’s time to get mean, brutally, harshly mean. Delicate sensibilities must be dispatched like a feather in a hurricane”. It is no surprise that, against the general context of western nihilism, a mindset that admires power and ruthless technocratic solutions – almost ruthlessness for its own sake – could take hold. Take note – we are all in for a turbulent future.

“..then the Left will say, “Well, how can we appeal to the public and get them all angry and frenzy and hysterical when some of our major celebrities, our political figures are in Mar-a-Lago?”

• Trump’s Counterrevolution: Flood the Zone, Drain the Swamp (Victor Davis Hanson)

We’re about—getting close to 90 days and even coming up close, in a week, 10 days, to the first 100 days of the Trump administration and this counterrevolution that he’s waging. I thought it might be wise just to see where we are as far as the political landscape and the dynamics of the progress of this counterrevolution. What is President Donald Trump trying to do? I think I would sum it up as flooding the zone. And that is, he’s going to try to propose and enact so many radical corrections or revolutions or reforms or recalibrations that his opposition doesn’t know where to start. So, abroad, he is looking at the Iran deal and he got rid of it. He put sanctions. He’s got maximum pressure. And now, the Iranian economy is about defunct. And they want to negotiate about this nuclear weapon. I don’t think they’re going to negotiate it away, but we’ll see.

And then, he’s dealing with Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin and trying to get a ceasefire. He’s basically dealt with the Houthis.On the domestic front, there is no more illegal immigration. He’s basically stopped it. Now, the task is what to do with the 12 million illegal aliens that came under former President Joe Biden. And what do you do with the 20 million-plus, maybe 30 million that were here already illegally but for a longer period of time? At the same time, he’s had a blanket mandate that in every Cabinet they will eliminate diversity, equity, inclusion and, by association, things like transsexual, biological males competing in women’s sports. Women—lowering the physical standards so women could compete and pass these very rigorous endurance physical tests so that they would be in combat units on an equal level. No problem that they can’t. But they have to have the same physical requirements as men.

I could go on, but you see what he is doing. He’s doing so many radical corrections in a way that a Romney or a McCain or the Bushes, even Ronald Reagan would not have dreamed of that he feels the opposition will say, “Well, what do we do? Should we reply here? Do we put our interest here? Should we do this?” And so, what is the strategy that the Left is using? They’re flooding the zone, too. But they’re doing it not with counterproposals. They don’t say, “This is what’s wrong with closing the border and we wanna reopen it. This is what’s wrong with the Houthis policy. This is what’s wrong with the trade deficit. This is what’s wrong”—no specific proposal. They’re just flooding it with hysteria, the Spartacus talk, late-night comedy trashing him, another person arrested saying that he wants to kill Donald Trump, keying Teslas, firebombing Tesla agencies, outrageous things from Hollywood stars, videos from Congress. All of a sudden—we didn’t even know who Rep. Jasmine Crockett was. She’s filled that void.

But what I’m saying is they want to be so rambunctious, so crazy, so 360 degrees unhinged that they’ll create an image or a malu—where everybody wants to get almost in a fetal position: “Please, please make it all go away. I don’t know what Trump is doing but it’s so disturbing. Everybody’s so angry.” That is their strategy. Now, what is Trump’s counterstrategy? His counterstrategy is to actually get people on the other side of the aisle in Congress or in the country at large or in the popular culture and try to at least be friendly to them so then they can say, “I don’t agree with Trump but what he’s doing might be needed.” So, we have Bill Maher going to Mar-a-Lago and actually saying very nice things about Donald Trump.

On the one hand, we have Health and Human Services Secretary Robert F. Kennedy Jr. fighting with a bulwark of the Left at one time, fighting with left-wing people who were calling him all sorts of names and saying that he is illiberal. We had Gretchen Whitmer, the governor of Michigan. She was in the White House. Can you believe it? She was so embarrassed about a photo-op. She had to almost cover her face.But you can see what Trump is doing. He’s trying to get people from all sides of the Democratic and liberal progressive movement and not compromise them, but get in the picture, so then the Left will say, “Well, how can we appeal to the public and get them all angry and frenzy and hysterical when some of our major celebrities, our political figures are in Mar-a-Lago?”

‘Tis the season.

• There’s Real Evidence for Easter (Joecks)

If you think politicians make outlandish claims, consider what Christians celebrate at Easter. They believe a man named Jesus was brutally tortured, murdered, and buried for three days before rising from the dead. Furthermore, they assert this man was also fully God and that your belief or lack of belief in him determines your eternal destiny. Christians have no video evidence or DNA tests to prove this. That’s understandable since Christians say the event Easter celebrates took place almost 2,000 years ago. Americans can’t even agree on things that happened two weeks ago. Isn’t Easter an ancient example of “fake news,” a myth propagated by people putting faith over historical realities? It’s a valid question. The answer starts with looking at the books of the New Testament. How can you determine if what you read today is what the author wrote 2,000 years ago?

That question isn’t unique to the Bible. There are no original copies of any ancient work. Historians use a twofold test to determine how accurately copyists transmitted a manuscript throughout the ages. Scholars look at how many copies exist and the number of years between the original and the earliest surviving copy. For example, Julius Caesar fought and won a series of battles against the Gauls from 58 to 50 B.C. He chronicled his conquests in “On the Gallic War.” Historians have 251 manuscripts of this book, and the earliest is from the ninth century, a gap of over 850 years. Plato was one of the most important ancient philosophers. He wrote a series of dialogues before he died in 348/347 B.C. Scholars have 210 manuscripts of those writings. The oldest is from 895 A.D., a gap of over 1,200 years.

Aside from the Bible, the ancient work with the greatest number of copies is Homer’s “Iliad,” created around 800 B.C. There are over 1,800 copies of it, and the earliest is from around 400 B.C., a gap of just 400 years. The books of the New Testament were written between 50 and 100 A.D. There are over 5,800 New Testament manuscripts in Greek and over 18,500 New Testament manuscripts in other languages. The time gap between authorship and the earliest manuscript is just 50 years. All statistics are from a 2014 review by Josh McDowell and Clay Jones. Try telling a history professor that there isn’t enough historical evidence to confirm Julius Caesar conquered the Gaels or that Plato wrote philosophy. Yet there is a much greater track record for the accurate transmittal of the books depicting the life, death, and resurrection of Jesus Christ.

An accurate transmission doesn’t mean what is written is true. “The Iliad” is, after all, a work of fiction. A key group, however, did believe the events recorded in the writings that became the New Testament—its authors. Some even explicitly emphasized that their writings were trustworthy and accurate recordings. It wasn’t just idle talk. Their actions changed too.Jesus’ disciples abandoned him when he was arrested. Within weeks, however, those cowards became bold preachers of a gospel message that would transform the world. They didn’t preach to get rich. Rather their preaching led to imprisonments and executions. Faith doesn’t have to mean turning off your brain. Rather, having faith can be the step one takes based on the evidence, including the historical documentation of an empty tomb.

Happy Easter.

Vax

True double blind tests on children…

How many percent more likely are they to die after vaccination? 5%, 20%… ?

Not even close. It’s 8200%!❗❗"Once the envelope was opened, and I'm sure the ONS thought they'd have a nice 10% benefit for getting the jabs, but they had to… pic.twitter.com/XOySbLxLsI

— “Sudden And Unexpected” (@toobaffled) April 17, 2025

Makary

https://twitter.com/TheChiefNerd/status/1912947217473626610

Solari

https://twitter.com/ChildrensHD/status/1913019646862643353

Stem cells

https://twitter.com/Rainmaker1973/status/1913200483205800187

Pelican

https://twitter.com/Rainmaker1973/status/1913080045389697360

Aeroponic

https://twitter.com/Rainmaker1973/status/1913149496256614820

Retriever

https://twitter.com/catshealdeprsn/status/1912891302414287214

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.