Titian Christ Carrying the Cross 1565

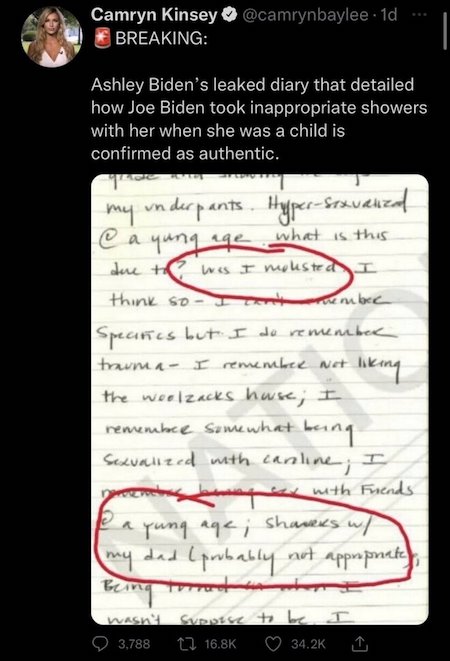

How Joe Biden chooses to celebrate the resurrection of Christ.

Maher Trump

Trump's Truth Social success lives rent free in the minds of liberals everywhere:

Bill Maher: "This is America in a nut shell. They [Democrats] have this big fundraiser there. They have ex-presidents, singers, dancers, Lizzo. They raised 26 million dollars. Trump sold Twitter for… pic.twitter.com/UYen2sQQg6— Eric Abbenante (@EricAbbenante) March 30, 2024

Habba

Trump Attorney Alina Habba SLAMS lawfare trials being weaponized against Trump, Responds DIRECTLY to Hunter Biden after making UNHINGED claim:

"No one is above the law, Hunter!" pic.twitter.com/L7b2Nt19u8

— Benny Johnson (@bennyjohnson) March 29, 2024

Mike Davis Fani

Top Legal Scholar Mike Davis EVISCERATES Fani Willis:

"Why aren't Al Gore, John Kerry, and Hillary Clinton IN PRISON?!" pic.twitter.com/EeMS7ESUf5

— Benny Johnson (@bennyjohnson) March 29, 2024

DeSantis

Gov. DeSantis ENDS "squatting" in Florida after illegal aliens openly BRAG about invading Americans' homes:

"What New York does, what California does, we will do the opposite. The squatters scam is over in Florida." pic.twitter.com/e6SBo2L0pQ

— Benny Johnson (@bennyjohnson) March 29, 2024

Lie

https://twitter.com/i/status/1773809245504278628

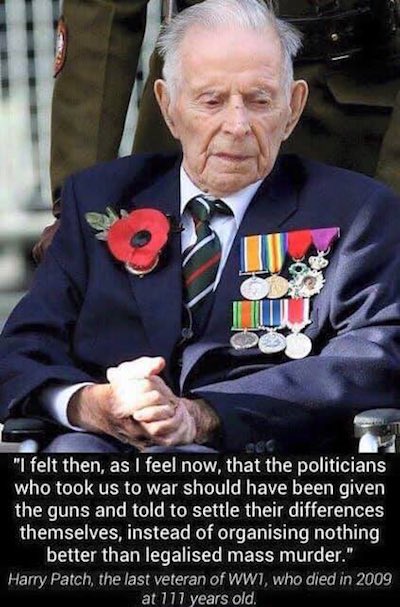

“Not since the Civil War period have the American people witnessed such stark political divisions, and it seems to be just a matter of time before the Blue and Gray battle fatigues are back in style..”

• Why Americans Have Little To Smile About These Days (Bridge)

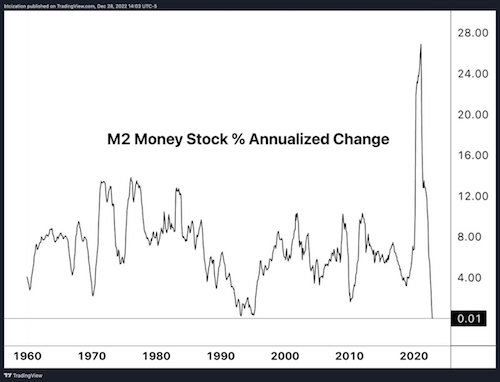

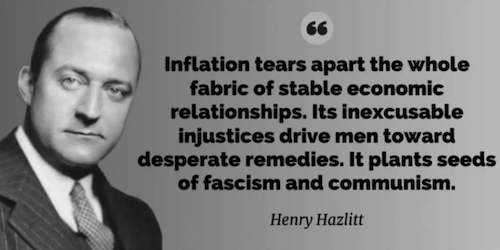

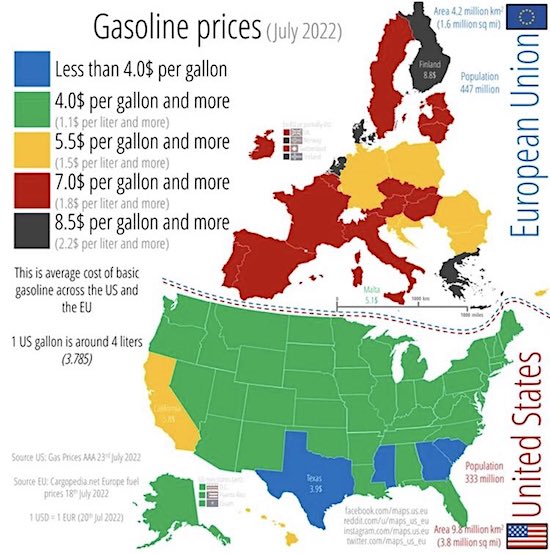

From a sputtering economy and high inflation to a lack of trust in political leadership, Americans are expressing displeasure with many facets of their daily lives. In the annual World Happiness Report, the United States plunged eight places to 23rd, a historic low for the land famous for its pearly white smiles. It’s the first time since the report launched back in 2012 that the US did not feature among the world’s 20 happiest countries. So what’s dragging Americans down? Perhaps the best place to start is with the economy, which has left many people in the dust as the rich just keep getting richer. Consumer prices for basic grocery items remain above what they were in January 2021, when President Joe Biden assumed office. Prices for chicken (+26%), bread (+30%), sugar (+44%), and butter (+27%) are enough to trigger many shoppers, while a simple trip to a restaurant has become a rare luxury for many financially strapped consumers. Meanwhile, rent costs have surged by 20% over the same period.

Amid this sticker shock at the checkout line, Americans have also expressed a heavy amount of skepticism with the political system. A comprehensive Pew Research Center survey reveals high levels of dissatisfaction with the three branches of government, the Democratic and Republican parties, as well as the candidates for office. Among the findings, just 4% of US adults say the political system is working extremely or very well; another 23% report it is working somewhat well. About six in ten (63%) express not too much or no confidence at all in the future of the US political system. A growing proportion of Americans are expressing contempt for both political parties. Nearly three in ten (28%) express unfavorable opinions of both parties, the highest share in three decades of polling. And a comparable share of respondents (25%) do not feel well-represented by either party.

While trust in government has remained near historic lows for much of the last two decades, today it stands among the lowest levels dating back nearly seven decades. And now, three years after the January 6 protests at the Capitol Building, more Americans believe their country is heading for a political smash-up. According to a CBS/YouGov poll released in January, 49% of respondents expect some sort of violence in future political contests, like the upcoming showdown between Donald Trump and Joe Biden on November 4. Meanwhile, a full 70% agreed with the statement that American democracy is ‘threatened’. Not since the Civil War period have the American people witnessed such stark political divisions, and it seems to be just a matter of time before the Blue and Gray battle fatigues are back in style, albeit over entirely different issues.

The Democrats and Republicans are trapped inside of their own iron-clad echo chambers, where they are prevented from hearing their political opponents just across the aisle. This lack of a national dialogue, worsened by an overtly pro-liberal media, is what spawned the so-called insurrection on January 6, and could easily trigger a new bout of violence sometime down the road. Feelings of loneliness is another thing dragging Americans down. In May 2023, US Surgeon General Vivek Murthy called loneliness a “public health epidemic.” The latest Healthy Minds Monthly Poll from the American Psychiatric Association (APA) reveals that, early in 2024, 30% of adults said they have “experienced feelings of loneliness at least once a week over the past year, while 10% say they are lonely every day.”

When you don’t take it as “News”, the MSM is a delight. Take the new Trump gag order, “barring Mr Trump from attacking court staff and their family members”. What happened is Judge Merchan’s daughter uses a pic of Trump behind bars as her avatar. But he cannot say now that that is inappropriate.

“Contrary to the People’s suggestion, the Court cannot ‘direct’ President Trump to do something that the gag order does not require..”

Another gem: “Ms Willis had described Mr Wade as a “trusted friend..”

Michael Cohen boinked Stormy Daniels and paid her for it using Trump’s money. When that ran out, he claimed it was “hush money”. The paper trail was already there. Does that sound about right?

• Trump Pushes Legal Challenges In Two Cases (BBC)

Donald Trump’s attorneys pushed two legal challenges before Easter weekend. His camp is appealing against a verdict from a Georgia judge allowing Fulton County District Attorney Fani Willis to stay on an election subversion case. They also aim to stop the expansion of a gag order, limiting Mr Trump’s speech, in a New York hush money case. The Republican presidential nominee faces four legal cases, and these two are the most likely to be heard in court before the US elections. Mr Trump has pleaded not guilty in all the cases, and claimed he is being politically persecuted. Mr Trump and his co-defendants in the Georgia case, which accuses them of plotting to overturn the 2020 election, have alleged that Ms Willis financially benefitted from an improper romantic relationship with Nathan Wade – a prosecutor she hired to lead the case. Judge Scott McAfee – who is overseeing the case – held two weeks of chaotic hearings that included fiery testimony from Ms Willis.

She admitted to the relationship but denied benefitting from it financially. In the end, the judge sided with Ms Willis, though he said the relationship had the “appearance of impropriety” and demanded Mr Wade or Ms Willis step down. Mr Wade did so within hours. In a 51-page motion filed on Friday before the Georgia Court of Appeals, Mr Trump and eight of his co-defendants argued Ms Willis should also be removed – which would greatly delay the case or could lead to it being dismissed. Mr Trump and other co-defendants’ lawyers said Mr Wade’s resignation did not sufficiently address the “appearance of impropriety” that “cast a pall over these entire proceedings”. “The trial court was bound by existing case law to not only require Wade’s disqualification (which occurred) but also to require the disqualification of DA Willis and her entire office,” the attorneys said in the filing. CBS News, the BBC’s US partner, has reported that Ms Willis intends to play a prominent role in the case, which the judge has ordered to proceed if Mr Trump appeals.

Meanwhile, in New York, Mr Trump is embroiled in other legal battles while he awaits the start of his first criminal trial over the alleged falsification of business records related to a payment made to adult film star Stormy Daniels. This week, the justice in the case, Juan Merchan, granted a request from the Manhattan District Attorney’s Office to impose a gag order on Mr Trump barring him from making statements about jurors and witnesses or intimidating court staff. On Friday, Manhattan District Attorney Alvin Bragg sought to clarify – and possibly expand – the gag order barring Mr Trump from attacking court staff and their family members. His motion came after Mr Trump insulted Justice Merchan’s daughter in a social media post before the gag order was issued.

Mr Bragg asked Justice Merchan to “make abundantly clear” that the gag order applied to “family members of the Court”, the district attorney and other individuals mentioned in the gag order. He also asked the judge to “warn” Mr Trump “and direct him to immediately desist”. If Mr Trump does not, the prosecutor argues, he should face sanctions. The former president’s attorney, Todd Blanche, denied that his client had violated the gag order and argued that the judge’s daughter was not a part of it. He wrote that there was nothing wrong with the social media posts. “Contrary to the People’s suggestion, the Court cannot ‘direct’ President Trump to do something that the gag order does not require,” he said.

“There is no remaining “reasonable dispute between Russia and the West,” Orban added..”

• We Need A Ceasefire In Ukraine – Orban (RT)

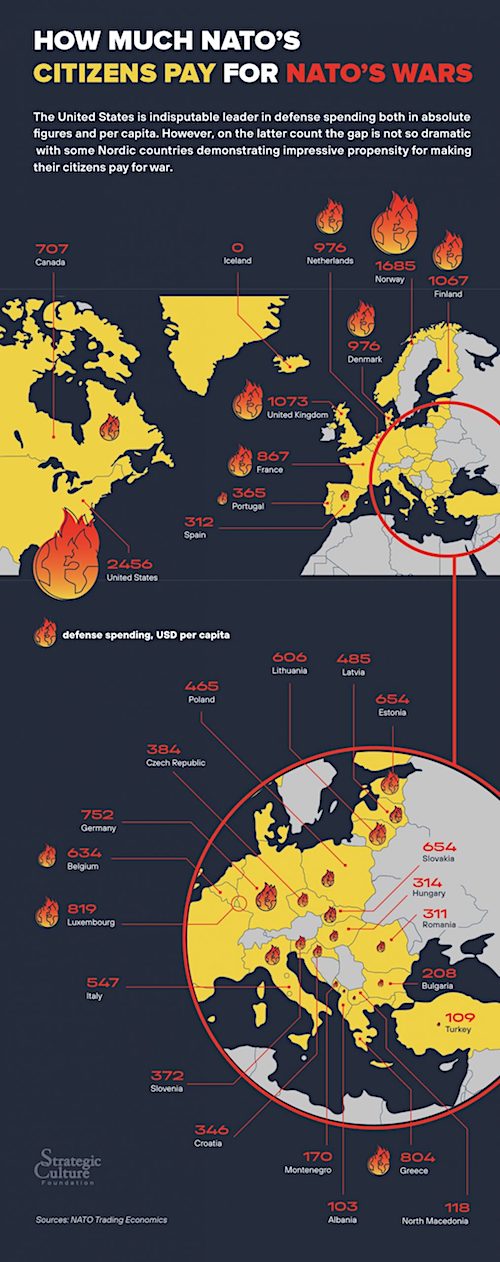

Ukraine’s path to peace and security could lie in establishing a buffer zone next to the Russian border, Hungarian Prime Minister Viktor Orban has said. With the conflict between Moscow and Kiev in its third year, the Western flow of military and financial aid to Ukraine is dwindling, while its army is losing ground. Orban suggested that now is the time for a ceasefire, Hungarian magazine Mandiner wrote on Friday, quoting the prime minister’s interview with former Austrian Chancellor Wolfgang Schussel in Budapest. There is no remaining “reasonable dispute between Russia and the West,” Orban added. “People in Europe are not happy that their governments want to provide more financial assistance to Ukraine,” he said, explaining that Europe cannot provide the kind of support that would result in a military victory for Ukraine. EU states have allocated €77 billion ($83 billion) in aid to Kiev, while pledging €144 billion since the beginning of the conflict in February 2022, according to Germany’s Kiel Institute.

Ukraine has lost several strategically important cities in Donbass in the last month. Officials in Kiev have repeatedly cited the lack of Western-supplied munitions as the reason for their battlefield setbacks. Orban doubled down on his idea of a buffer zone next to the Russian border as Ukraine’s ideal peace solution, provided there are “additional security guarantees.” Without this, he said, “they could lose their country.” He stressed that Russia will never accept Ukraine joining NATO. Moscow has stated that one of the main causes of the conflict was the expansion of the US-led military bloc towards Russia’s borders. President Vladimir Putin has said one of the key goals of the Russian military operation is to force Kiev away from its goal of joining NATO – an ambition enshrined in the country’s constitution in 2019. While the Hungarian prime minister condemned the Russian military operation, he has repeatedly spoken out against the EU’s handling of it. Unlike the other EU states, Hungary has not sent any armaments to Kiev, limiting their contributions to humanitarian aid.

Mearsheimer

Professor John Mearshiemer, who has consistently and fearlessly predicted the disastrous outcome of US Foriegn Policy in Ukraine, has been right all along.

And he's right now.

If only the Think Tank fantasists in Washington and London had listened pic.twitter.com/G3KTAdIicP

— Chay Bowes (@BowesChay) March 30, 2024

“Whether Ukraine loses all access to the Black Sea or not is, in my view, the real remaining question..”

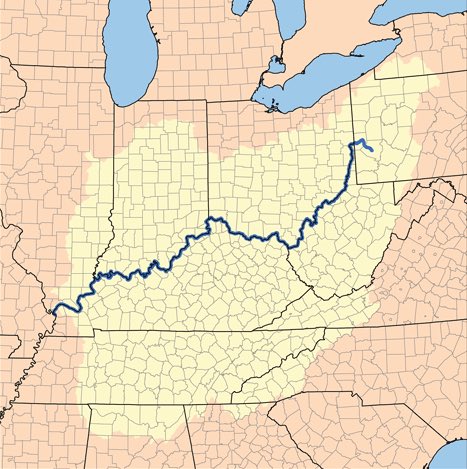

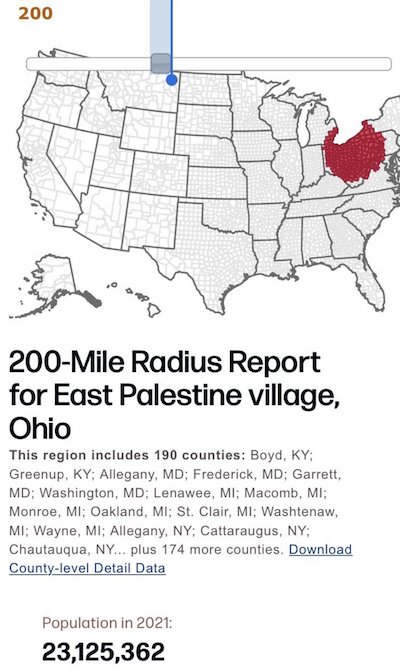

• ‘Odessa Will Fall’, Musk Warns Ukraine (RT)

Tesla and SpaceX CEO Elon Musk has reiterated his belief that Ukraine’s position is weakening with each passing day of the hostilities, warning that the “real question” is how much territory Kiev will lose and how many lives it will waste before sitting for talks with Moscow. The entrepreneur claimed in a post on his X platform on Saturday that “any fool could have predicted” that Kiev’s much-touted counteroffensive last year would fail, adding that even if Kiev had followed his recommendation to “entrench and apply all resources to defense,” it would be “tough to hold land that doesn’t have strong natural barriers.” “It was a tragic waste of life for Ukraine to attack a larger army that had defense in depth, minefields and stronger artillery when Ukraine lacked armor or air superiority!,” Musk wrote. Kiev has lost over 444,000 troops killed and wounded in two years of hostilities against Moscow, including more than 166,000 during last year’s counteroffensive, according to last month’s estimates from the Russian Defense Ministry.

However, Ukrainian President Vladimir Zelensky claimed in February that Kiev’s forces lost only 31,000 soldiers killed since the start of the conflict. The billionaire went on to argue that “the longer the war goes on, the more territory Russia will gain until they hit the Dnepr, which is tough to overcome.” However, if the war lasts long enough, Odessa will fall too… Whether Ukraine loses all access to the Black Sea or not is, in my view, the real remaining question. I recommend a negotiated settlement before that happens. Elon Musk has shifted his position on Ukraine several times since the conflict began in early 2022. He initially supplied Kiev with free Starlink internet terminals and access to the satellite-based network, but declined to activate the service near Crimea for fear that Ukraine would use it to guide drone attacks on Russia’s Black Sea Fleet. If this had happened, he explained last year, SpaceX would have been “complicit in a major act of war and conflict escalation.”

Musk has also used his X account to speak extensively about the trajectory of the conflict. More than a year ago, he proposed that Kiev abandon its claim to Crimea, declare neutrality, and allow the four new Russian regions – Donetsk, Lugansk, Kherson, and Zaporozhye – to hold fresh referendums on joining the Russian Federation. This proposal is similar to the terms offered by Russia to Kiev and the Western powers before the conflict began, except Moscow initially called only for autonomy in Donetsk and Lugansk. Moscow has stressed that it remains open to meaningful talks with Kiev and has blamed the lack of a diplomatic breakthrough on the Ukrainian authorities, who refuse to accept the “reality on the ground.” Ukraine must take into account the fact that its borders have changed drastically since 2022, Kremlin spokesman Dmitry Peskov said on Saturday, commenting on Zelensky’s suggestion that a return to 1991 borders was no longer a precondition for negotiations.

Biolabs.

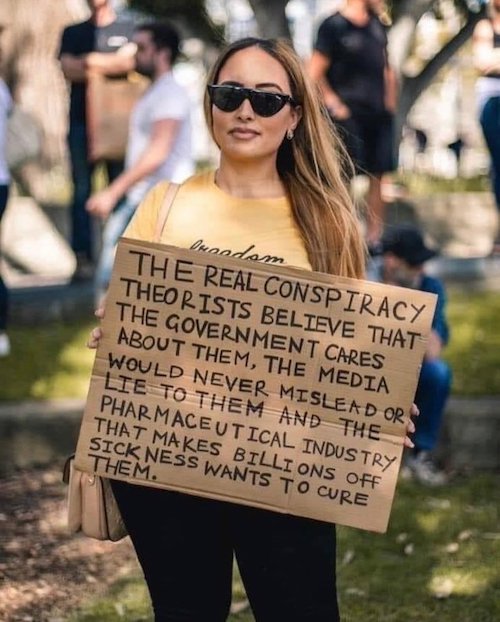

• Ukraine Was Testing Ground for Western Big Pharma (Sp.)

Ukraine was one of the main testing grounds for trials of a drug that could potentially cause various forms of cancer and that was used on patients in the psychiatric ward of Mariupol Hospital No. 7 with the support of local officials in the interests of Western pharmaceutical companies, according to documents seen by Sputnik. In particular, the trial involved the experimental drug SB4 for the treatment of rheumatoid arthritis. The drug inhibits the action of molecules of the so-called tumor necrosis factor alpha (TNF), which plays an important role in the immune system, and its use creates the possibility of developing various forms of cancer, including in the lymphatic and hematopoietic systems, as well as skin. The manufacturers of SB4 were Biogen Idec Denmark Manufacturing ApS (Denmark), Catalent Pharma Solutions (Belgium), and Fisher Clinical Services UK Limited (UK). The study was sponsored by South Korea’s Samsung Bioepis, the documents read.

An application from Quintiles Ukraine for approval by the state expert center of the Ukrainian Ministry of Health and the Ethics Commission at the medical and preventive institution for conducting clinical trials of SB4 was found among the documents. Quintiles Ukraine was established as a division of the US outsourcing pharmaceutical company Quintiles Transnational. According to the application, signed in February 2013, at that time it was planned to test the drug in Ukraine on 152 patients (later this number increased to 180), and in total on almost 500 patients around the world. According to the periodic report of the SB4-G31-RA project on SB4 trials, by November 2013, 777 patients had been selected for testing, including 285 in Poland, 143 in Ukraine, 108 in the Czech Republic, 77 in Bulgaria, 60 in Lithuania, 37 in the Republic of Korea, 34 in Mexico, 17 in Hungary, 14 in Colombia, and two in the United Kingdom.

The documents found in Mariupol Hospital No. 7 were collected between 2008 and 2016. The results of the initial inspection show that drugs with numbers and without names were tested on people, with the tests also conducted on toddlers. Companies such as Pfizer (US), AstraZeneca (UK, Sweden), Celltrion (South Korea), Novatris International AG (Switzerland, US), IQVIA (formerly Quintiles and IMS Health Inc., US, UK), Sanofi (France), Galapagos NV (Belgium), Janssen Pharmaceuticals (now Johnson & Johnson Innovative Medicine, Belgium), Abbott Laboratories (US), Covance (now Labcorp Drug Development, US), and Merck KGaA (Germany) are mentioned in the documents.

“..In order to save face, and to hide the fact that Ukraine itself is a huge terrorist organization..”

• Money Transfers Proof That Crocus Terrorists Followed Orders From Ukraine (Sp.)

It is of paramount importance that data in the technical devices seized from the suspects in the Crocus City Hall terrorist attack has confirmed their connection with the Ukrainian side, Kirill Kabanov, chairman of the National Anti-Corruption Committee, told Sputnik. Initial data received from those detained in the case related to the terrorist attack indicated Ukraine pulled the strings. However, the fresh report by the Russian Investigative Committee points to the Ukrainian special services, and “we must understand that they are directly connected with the CIA and MI6 and MI5,” Kabanov said. “That is why the West is trying to cover this up, blaming an outlawed international terrorist organization for everything. In order to save face, and to hide the fact that Ukraine itself is a huge terrorist organization,” Kabanov, who is also a member of the Human Rights Council, said.

The ongoing investigation into the attack at Crocus City Hall has discovered proof of the connection of the terrorists who carried out the heinous crime with Ukrainian nationalists, the Russian Investigative Committee said on March 28.”The initial results of the investigation fully confirm the planned nature of the terrorists’ actions, careful preparation and financial support from the organizers of the crime. As a result of working with the detained terrorists, analyzing the technical devices seized from them, analyzing information about financial transactions, evidence of their connection with Ukrainian nationalists has been obtained,” the Russian Investigative Committee said on Telegram.

The terrorists received significant amounts of money and cryptocurrency from Ukraine, Russian investigators added. Russia’s special services have completed their task by uncovering this proof, yet they “refuse to hear us in the West, the world’s mechanisms don’t work,” said Kirill Kabanov. “The Americans can get away with brandishing an empty vial and using it as a pretext for starting a war and destroying an entire state, as was the case with Iraq. Unfortunately, I am not at all sure that our evidence of cryptocurrency transfers will be heard. Although for citizens of many countries this might add to their perception of reality,” the expert noted. For people in Western countries whose leaders remain committed to supporting the regime holed up in Kiev, a reality check as to what is really happening in Ukraine is long overdue, the analyst believes.

“..the United States has deployed its military forces almost 400 times during its short history..”

• US Marines Struggle to Adapt to Fighting Adversary That Can Fight Back (Miles)

After killing at least 3.6 million people in its so-called “War on Terror,” US armed forces are regrouping to combat adversaries capable of mounting a resistance. In a hagiographic article entitled “Preparing for a China war, the Marines are retooling how they’ll fight,” ruling class stenographer Ellen Nakashima blithely considers the prospect of fighting a war against a nuclear-armed country of 1.4 billion people. The piece, appearing in The Washington Post, details the US Marine Corps’ efforts to adapt to what she appears to believe is an inevitable, and desirable, conflict with China. “The Marines are striving to adapt to a maritime fight that could play out across thousands of miles of islands and coastline in Asia,” writes Nakashima, admitting the armed service has devoted the last 20 years to fighting less capable forces in the Middle East. “Instead of launching traditional amphibious assaults… nimbler groups are intended as an enabler for a larger joint force.”

“Their role is to gather intelligence and target data and share it quickly — as well as occasionally sink ships with medium-range missiles,” it is explained, “to help the Pacific Fleet and Air Force repel aggression against the United States and allies and partners like Taiwan, Japan and the Philippines.” The country she imagines launching this aggression has not been at war since 1979, while the United States has deployed its military forces almost 400 times during its short history. “New regiments are envisioned as one piece of a broader strategy to synchronize the operations of US soldiers, sailors, Marines and airmen, and in turn with the militaries of allies and partners in the Pacific,” the piece continues. “Their focus is a crucial stretch of territory sweeping from Japan to Indonesia and known as the First Island Chain. China sees this region, which encompasses an area about half the size of the contiguous United States, as within its sphere of influence.” Naturally, China needs to understand its coastal waters are not its own concern, but the United States’, Nakashima’s logic suggests.

“China not only has the region’s largest army, navy and air force, but also home-field advantage,” Nakashima writes, apparently under the impression the United States will be allowed to attack China without suffering retribution on its own shores. “Taiwan, a close US partner, is most directly in the crosshairs.” China’s links with Taiwan go back hundreds of years. In the 1950s the United States attempted to cleave the island off from the country after the Chinese Civil War. As the defeated Kuomintang retreated to Taiwan the US threatened to use nuclear bombs if leader Mao Zedong crossed the Taiwan Strait, seeking to balkanize China as the US did in Korea and attempted to do in Vietnam. Nakashima writes of the disastrous consequences for shareholder profits of a war over Taiwan: “A successful invasion would… have catastrophic economic consequences due to disruption of the world’s most advanced semiconductor industry and of maritime traffic in some of the world’s busiest sea lanes — the Taiwan Strait and the South China Sea.”

“..either a “multinational force” or a “Palestinian peacekeeping team” to oversee the affairs of a post-war Gaza..”

No use without involving Russia and China.

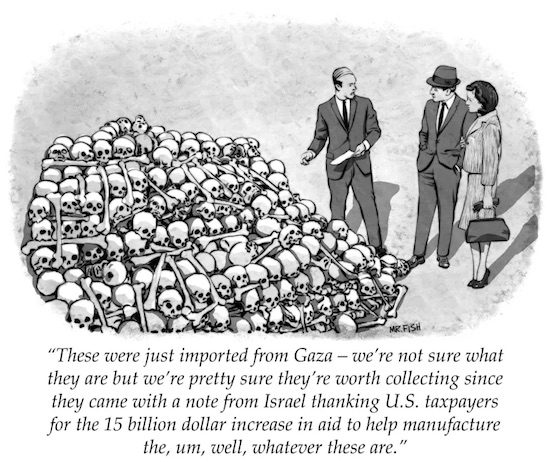

• Biden Claims Saudi Arabia, Qatar ‘Ready To Normalize’ With Israel (Cradle)

US President Joe Biden said at a campaign event on 28 March that Arab states, including Saudi Arabia and Qatar, are ready for a full normalization of ties with Israel. During the event – which was meant to show unity in the Democratic Party ahead of US elections in November this year – Biden was joined on stage by former presidents Barack Obama and Bill Clinton. “I’ve been working with the Saudis and with all the other Arab countries, including Egypt and Jordan and Qatar. They’re prepared to fully recognize Israel. There has to be a post-Gaza plan, and there has to be a trade to a two-state solution. It doesn’t have to occur today. It has to be a progression and I think we can do that,” Biden said. Since the outbreak of the war in Gaza, which has seen Israel kill over 32,000 civilians, Saudi Arabia has repeatedly stated that normalization with Tel Aviv is still on the table.

However, Riyadh has doubled down on its demands for concessions to the Palestinians, including, most prominently, the demand for the eventual realization of statehood. Washington has been devising a plan for post-war Gaza, which includes the idea of a “reformed” Palestinian Authority (PA) assuming control over administration in the strip. In late February, Israeli Prime Minister Benjamin Netanyahu unveiled a similar plan, which included demilitarizing Gaza, forming a local governing authority, and a broader normalization pact with Arab states, including the Saudis. Politico reported on the same day as Biden’s campaign event that the White House, State Department, and Pentagon are discussing the potential establishment of either a “multinational force” or a “Palestinian peacekeeping team” to oversee the affairs of a post-war Gaza.

Yet Israel has yet to achieve its goal of dismantling the Palestinian resistance and is continuing brutal and incessant airstrikes daily. “There are too many innocent victims, Israelis and Palestinians,” Biden added at the event. “We’re in a position where Israel’s very existence is at stake. You had all those people massacred,” the president said about 7 October, adding: “It’s understandable Israel has such a profound anger and Hamas is still there, but we must in-act, stop the effort that is resulting in significant deaths of innocent civilians and particularly children.” Several pro-Palestine activists erupted in chants throughout the campaign event, accusing Biden of complicity in the genocide being carried out against the Palestinian people in Gaza.

How many Palestinian hostages?

• Israel Believes Only 60-70 Out Of 134 Hostages Are Still Alive (ZH)

Israel’s official count for the number of people still being held hostage in the Gaza Strip remains at 134 mostly Israeli citizens as well as some foreigners, which includes possibly deceased victims. Amid stalled truce negotiations in Qatar, the Israeli newspaper Haaretz has revealed that Israeli officials believe only 60 to 70 Israeli hostages in Gaza are still alive. “According to the IDF, a total of 134 hostages and bodies are being held in Gaza,” Haaretz wrote Thursday. “Thirty-six of the people were confirmed by the army as killed – some on October 7, when their bodies were taken into the Strip. Of the 98 living hostages, 10 are foreigners (eight Thais, one Nepalese national, and one man with Mexican and French citizenship).” What’s more is that a month ago some of the families of the hostages were informed that 20 captives were in life-threatening condition.

An unnamed source close to the crisis told Haaretz, “I hope I’m mistaken, but the number may even be lower”—suggesting there may be even fewer that are alive. Given the intense battles unfolding across most of the Gaza Strip, it is widely speculated that the hostages are being held somewhere within the miles of underground tunnels below, where Hamas also has command and control centers. There’s a possibility that some of the hostages could have been killed by Israeli’s relentless bombing campaign which has decimated entire neighborhoods. A horrifically tragic incident last December saw three Israeli hostages shot dead by Israeli forces who mistook them for Palestinian militants. Israeli leadership under Netanyahu has been accused by the hostages’ families of prioritizing the military operation to defeat Hamas far and above hostage recovery.

Some recent testimony of hostages freed in last year’s truce and exchange with Hamas said the following: Echoing this sense of an indiscriminate and haphazard policy, testimonies from newly freed Israeli hostages, who were released as part of exchange deals for Palestinian prisoners during a temporary ceasefire in late November, as well as from some of the hostages’ families, indicate that one of the main fears of those held captive in Gaza was the threat of being hit by Israeli airstrikes and shelling. Many of the hostages, according to these testimonies, were held above ground rather than in tunnels, and were therefore particularly vulnerable to such attacks. Large-scale anti-Netanyahu protests led by victims’ families have persisted in Tel Aviv and Jerusalem. Pressure has also mounted on Washington to strike a ceasefire. Prime Minister Netanyahu is currently facing accusations from within his own government of ‘sabotaging’ the truce process with an aim to prolong the war, and also thus his political future in the top office.

“..a much more lenient standard for wiretaps than the Constitution permitted for American citizens..”

• The Never-Ending Federal Surveillance Crime Spree (Bovard)

Last December, one of the most intrusive provisions in the federal statute book was set to expire. Section 702 of the Foreign Intelligence Surveillance Act (FISA) authorizes the National Security Agency to vacuum up trillions of emails and other data. A bevy of bipartisan members of Congress called for radically curtailing those nullifications of Americans’ privacy. But the effort to put a leash on the federal surveillance failed dismally. Congress voted for a four-month extension of FISA, which will likely be followed in April by a much longer extension. There was a bipartisan congressional conspiracy to entitle the Deep State to continue trampling the Constitution. In 1978, Congress passed the Foreign Intelligence Surveillance Act to outlaw political spying (such as the FBI had committed) on American citizens. FISA created a secret court to oversee federal surveillance of suspected foreign agents within the United States, permitting a much more lenient standard for wiretaps than the Constitution permitted for American citizens.

The FISA court “created a secret body of law giving the National Security Agency the power to amass vast collections of data on Americans,” the New York Times reported in 2013 after Edward Snowden leaked court decisions. The court rubber-stamped FBI requests that bizarrely claimed that the telephone records of all Americans were “relevant” to a terrorism investigation under the Patriot Act, thereby enabling National Security Administration (NSA) data seizures later denounced by a federal judge as “almost Orwellian.” In 2017, a FISA court decision included a 10-page litany of FBI violations, which “ranged from illegally sharing raw intelligence with unauthorized third parties to accessing intercepted attorney-client privileged communications without proper oversight.” The latest controversy involved FISA Section 702, first enacted by Congress in 2008.

That section authorizes the National Security Agency to surveil targets in foreign nations regardless of how many Americans’ privacy is “incidentally” destroyed. The NSA collects vast amounts of information as part of that surveillance and then permits the FBI to sift through its troves. The Electronic Frontier Foundation warned more than a decade ago that Section 702 “created a broad national-security exception to the Constitution that allows all Americans to be spied upon by their government while denying them any viable means of challenging that spying.” Professor David Rothkopf explained in 2013 how Section 702 worked: “What if government officials came to your home and said that they would collect all of your papers and hold onto them for safe-keeping, just in case they needed them in the future. But don’t worry … they wouldn’t open the boxes until they had a secret government court order … sometime, unbeknownst to you.” Actually, the law in practice is much worse.

From the beginning, federal agencies brazenly lied about the number of Americans whose privacy was ravaged. In 2014, former NSA employee Edward Snowden provided the Washington Post with a cache of 160,000 secret email threads that the NSA had intercepted. The Post found that nine out of ten account holders were not the “intended surveillance targets but were caught in a net the agency had cast for somebody else.” Almost half of the individuals whose personal data was inadvertently commandeered were American citizens. The files “tell stories of love and heartbreak, illicit sexual liaisons, mental-health crises, political and religious conversions, financial anxieties and disappointed hopes,” the Post noted. If an American citizen wrote an email in a foreign language, NSA analysts assumed they were foreigners who could be surveilled without a warrant.

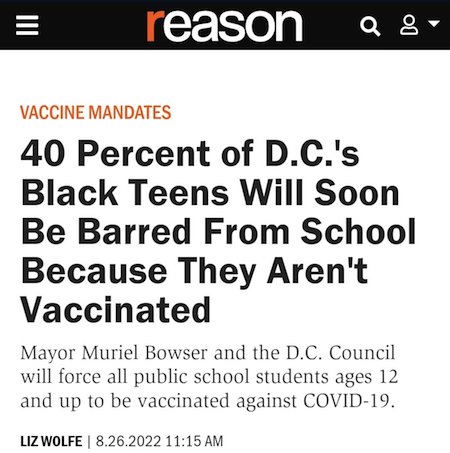

“..this 3rd Circuit ruling roundly rejects unlawful left-wing attempts to count undated or incorrectly dated mail ballot..”

• Republicans Score Win In Court Battle Over Pennsylvania Mail-In Ballots (ET)

Pennsylvania rules that require mail-in ballots to be dated are legal, a federal appeals court has ruled. A state law that says voters must fill out, date, and sign envelopes containing the ballots is not prevented by the Civil Rights Act of 1964, a majority said in the March 27 ruling. The act bans denying “the right of any individual to vote in any election because of an error or omission on any record or paper relating to any application, registration or other act requisite to voting.” But that provision “only applies when the state is determining who may vote,” U.S. Circuit Court Judge Thomas Ambro, appointed by former President Bill Clinton, wrote for the majority of a U.S. Court of Appeals for the Third Circuit panel. “In other words, its role stops at the door of the voting place. The provision does not apply to rules, like the date requirement, that govern how a qualified voter must cast his ballot for it to be counted.”

The same court ahead of the 2022 election ruled that state officials must count undated ballots but the U.S. Supreme Court vacated that order. After the state’s acting secretary of state said counties should still count undated ballots, the Pennsylvania Supreme Court ruled that counties could not count mail-in ballots with missing or incorrect dates. About 7,900 ballots were not counted in the 2020 election because they were missing a signature or date, or had an inaccurate date, according to state officials. U.S. District Judge Susan Paradise Baxter later ruled that the Pennsylvania law violated the Civil Rights Act provision, meaning Pennsylvania officials had to count mail-in ballots even if they lacked dates, or contained inaccurate dates. “Federal law prohibits a state from erecting immaterial roadblocks, such as this, to voting,” Judge Baxter, appointed by former President Donald Trump, wrote at the time, referring to the Pennsylvania law.

According to the law, a voter casting a ballot by mail must mark the ballot, then place it inside a provided envelope. That envelope must then be placed into a second envelope, which contains the areas for the date and signature. “The elector shall then fill out, date and sign the declaration printed on such envelope,” the law states. The Republican National Committee (RNC) and other groups appealed Judge Baxter’s ruling, arguing that her conclusion was wrong. “This is a crucial victory for election integrity and voter confidence in the Keystone State and nationwide. Pennsylvanians deserve to feel confident in the security of their mail ballots, and this 3rd Circuit ruling roundly rejects unlawful left-wing attempts to count undated or incorrectly dated mail ballot,” Michael Whatley, the RNC’s chairman, said in a statement after the new ruling was handed down.

“This is Zuckerbucks on steroids because instead of $400 million, it’s unlimited funding and resources and the reach of the federal government and all its offices located across the country..”

“..the president’s unprecedented effort to deploy federal agencies in support of partisan voting operations and fortify politically aligned private organizations working to circumvent state election integrity laws.”

• Behind Massive Mail-in Ballot Push Is a Little-Noticed Executive Order (ET)

A federal effort to register voters using the government’s vast reach, including throughout the U.S. prison system, is raising concerns from critics who have said it won’t benefit Democrats and Republicans equally. Mississippi Secretary of State Michael Watson wrote to U.S. Attorney General Merrick Garland on March 6 alleging that agencies under the attorney general’s charge are “attempting to register people to vote, including potentially ineligible felons, and to co-opt state and local officials into accomplishing this goal.” The allegation relates to President Joe Biden’s Executive Order 14019, which states, “The head of each agency shall evaluate ways in which the agency can, as appropriate and consistent with applicable law, promote voter registration and voter participation.”

Among other things, this order has forced U.S. Marshals to modify more than 900 contracts with prisons and jails to provide voter registration documents and facilitate mail-in voting for inmates, Mr. Watson wrote. “We have worked extremely hard to restore the confidence of Mississippi voters in our election process,” Mr. Watson told The Epoch Times. “To have the Biden administration and the DOJ purposefully undermine these efforts and jeopardize the integrity of Mississippi’s elections is unacceptable.” The secretary of state is the chief election officer in Mississippi. The work by the Department of Justice to register voters in prisons, critics say, is just the tip of the iceberg. Other agencies, including the Department of Education, the Department of Agriculture, the Department of Health and Human Services, and the Department of Housing and Urban Development, are also carrying out campaigns to sign up new voters.

On Feb. 26, Vice President Kamala Harris lauded a federal plan to use work-study grants to pay students to register voters. In addition, President Biden’s executive order directed federal agencies to select “approved, nonpartisan third-party organizations and state officials to provide voter registration services on agency premises.” President Biden’s executive order was called “visionary“ by Ceridwen Cherry, a former staff attorney on the American Civil Liberties Union (ACLU) Voting Rights Project, who said, ”In a democracy, governments at all levels should be doing everything they can to help eligible people register to vote.” However, critics say elections are under the purview of states, not the federal government.

“The reason it’s such a big problem is that, with the president, it’s only one political party that’s in power,” Stewart Whitson, legal director of the Foundation for Government Accountability (FGA), a conservative think-tank, told The Epoch Times. “If you allow the president to be the one to decide where all these massive resources are channeled, that’s problematic,” he said, adding that this is why the Founders gave election authority to states and not to the federal executive. The plan has been called “Bidenbucks” by some of its detractors, referencing the injection into state election programs of $400 million in 2020 from Facebook co-founder Mark Zuckerberg, dubbed “Zuckerbucks.” “This is Zuckerbucks on steroids because instead of $400 million, it’s unlimited funding and resources and the reach of the federal government and all its offices located across the country,” Mr. Whitson said.

[..] In July 2021, the FGA filed a FOIA request regarding President Biden’s Voting Access plan. The group sought information about what federal agencies were doing to implement the plan, as well as records from planning and strategy meetings among President Biden’s staff, federal agencies, and the architects of EO 14019. “These documents, in any other context, would be handed over much more quickly,” Mr. Whitson said. “So this indicates to us that there’s something there the Biden administration really does not care to share, because they’ve withheld it for nearly three years now.” The America First Legal foundation, another plaintiff in a FOIA suit, characterized EO 14019 as “the president’s unprecedented effort to deploy federal agencies in support of partisan voting operations and fortify politically aligned private organizations working to circumvent state election integrity laws.” More than two years later, court battles over the information requests are ongoing. The administration has brought in White House counsel and the Department of Justice to fight the requests.

Can’t find anywhere what he’s supposed to have done, other than: “obstructing an official proceeding among other charges..”

“..the appeal raises a substantial question likely to result in a significantly lesser sentence or reversal..”

That will be true for most. But then they will have been locked up for years.

• Judge Rebukes DOJ Arguments Against Release Of Jan. 6 Defendant (ZH)

A Jan. 6 defendant seeking to be released from prison was granted in part by the United States District Court for the District of Columbia this week. The order, signed by U.S. District Judge Trevor McFadden on March 26, will grant the release of Kevin Seefried, a defendant convicted for his role in the Jan. 6, 2021, Capitol breach, pending the appeal of his conviction. This decision comes despite stark warnings from the Justice Department regarding the implications of such a move. Mr. Seefried received a three-year prison sentence for obstructing an official proceeding among other charges, facing a potential maximum sentence of 23 years. After his conviction, he appealed and requested release pending appeal, a request that gained new relevance when the Supreme Court decided to review a related case, Fischer v. United States, which could impact many Jan. 6 defendants.

The high Court’s decision on this case may influence the outcome of Mr. Seefried’s conviction, suggesting it could be vacated depending on the justices’ ruling. The decision to release Mr. Seefried is grounded in the ongoing legal debate over the application of 18 U.S.C. § 1512(c), the obstruction of an official proceeding statute, beyond the context of “evidence impairment.” “Seefried’s current motion is déjà vu all over again,” Judge McFadden wrote. This legal question is currently under review by the Supreme Court in a related case, Fischer v. United States, which directly challenges the scope of § 1512(c) and its application to the Jan. 6 defendants. Judge McFadden, in his memorandum order, outlined that the release is premised on two conditions mandated by 18 U.S.C. § 3143(b): a defendant is not likely to flee or pose a danger to the community if released, and that the appeal raises a substantial question likely to result in a significantly lesser sentence or reversal.

Judge McFadden found that Mr. Seefried met both conditions, noting a lack of evidence to suggest Mr. Seefried would flee or pose a danger, and that the Supreme Court’s review of Fischer represents a substantial question of law that could materially affect Mr. Seefried’s conviction. Judge McFadden noted the argument of the Justice Department that, in their belief, he now knew the “day-to-day reality of confinement in prison” and was therefore “more likely” to flee than return to prison. Judge McFadden also noted U.S. Attorney Matthew Graves’s argument of 2024 being an election year involving “what will likely be another fiercely contested presidential election” and if released, the Court “would be releasing defendant into the same political maelstrom that led him to commit his crimes in the first place.”

Why not focus on preventing diabetes? Easier, healthier and cheaper.

• $935 Diabetes Jab Ozempic Costs Less Than $5 To Make (ET)

It costs Novo Nordisk less than $5 per month to produce its top-selling diabetes injection, Ozempic, even as it charges nearly $1,000 for a month’s supply before insurance, according to a new study. The study, published Wednesday in the journal JAMA Network Open, raises questions about the prohibitive cost of the popular diabetes treatment and other weight loss drugs that belong to a pricy class of medications based on GLP-1 technology. Those medicines work by mimicking a hormone called glucagon-like peptide-1 (GLP-1), which stimulates the pancreas to release insulin when blood sugar rises too high, slows down the emptying of the stomach, and targets brain receptors involved in reducing appetite. Over the past year, demand for GLP-1 agonists has exploded despite soaring costs and limited insurance coverage.

For their study, researchers at Yale University, King’s College Hospital in London, and the nonprofit Doctors Without Borders looked at the cost of manufacturing insulin and compared it with that of GLP-1 agonists. They estimated those prices by combining manufacturing costs for the weekly injection with costs of formulation and other operating expenses, plus a profit margin with an allowance for tax. The foundational price for a weekly dose of injectable semaglutide—the generic name for Ozempic—ranges from $0.89 to $4.73 per month, the study found. By contrast, a vial of human insulin can be manufactured at a cost between $2.37 and $5.94 per month. A month’s supply of Ozempic is $935.77 for those in the United States without health insurance, according to Novo’s website.

The Danish company’s GLP-1 weight loss drug, Wegovy, is listed as $1,349 per month. Wednesday’s study concluded that GLP-1s “can likely be manufactured for prices far below current prices, enabling wider access.” “High prices limit access to newer diabetes medicines in many countries,” the researchers wrote. “The findings of this study suggest that robust generic and bio-similar competition could reduce prices to more affordable levels and enable expansion of diabetes treatment globally.” Citing the findings, Sen. Bernie Sanders (I-Vt.) called on Novo to slash prices for both Ozempic and Wegovy, highlighting the price gap for the identical drugs sold in America and other developed countries.

“A new Yale study found that Ozempic costs less than $5 a month to manufacture. And yet, Novo Nordisk charges Americans nearly $1,000 a month for this drug, while the same exact product can be purchased for just $155 a month in Canada and just $59 in Germany,” the senator said in a statement. “As Chairman of the Senate Committee on Health, Education, Labor, and Pensions, I am calling on Novo Nordisk to lower the list price of Ozempic—and the related drug Wegovy—in America to no more than what they charge for this drug in Canada,” he continued. “The American people are sick and tired of paying, by far, the highest prices in the world for prescription drugs while the pharmaceutical industry enjoys huge profits.”

Kim has promoted Bitcoin Cash for a while now.

• Why is $BCH So Hot Right Now? (Kim Dotcom)

Bitcoin Cash is launching a new innovation on May 15th. The adaptive blocksize limit algorithm. This is an important step for BCH in preparation for substantial growth and one of the reasons why BCH is gaining popularity with Miners and Investors. The algorithm automatically adjusts Bitcoin Cash’s block size limit to reduce infrastructure costs during periods of lower usage while enabling up to a doubling of the maximum block size per year at peak growth. The block size limit caps the technical requirements of network infrastructure, enables reliable infrastructure cost projection, and prevents attacks that increase the cost of participating in the network. Excessively large blocks could require users and businesses to waste resources on unnecessary infrastructure, switch to cheaper and less secure validation strategies, or even to abandon running their own infrastructure and instead rely on third-party service providers – reducing the overall privacy, independence, and financial freedom of all users.

To limit block size, most bitcoin-like networks employ a static block size limit. For Bitcoin Cash this limit is currently 32MB. If a payment network is growing, usage will eventually approach any previously established static limit. If this limit is reached before a successfully coordinated upgrade, network service degrades, transaction fees and confirmation times become less predictable as size-limited blocks become more common. Uncorrected, market actors begin to adapt to this artificial scarcity by using alternatives to on-chain transactions, custodians, intermediaries, and competing networks. This in turn compromises the long-term economics of mining, cumulative transaction fee revenue is suppressed, and long-term network security grows to rely on continuous inflation via block subsidies.

Because static block size limits can only be changed as part of a widely coordinated network upgrade, they present a focal point for network interruption or capture by motivated attackers, rent seeking institutions, competing networks, opponents of peer-to-peer cash, etc. To make matters worse, the attackers have a significant coordination advantage – while honest network participants must achieve near-unanimous consensus to activate an upgrade, attackers must only create sufficient uncertainty among the honest participants to delay limit increases, as inaction results in degradation of the network’s functionality and long-term security.

Adaptive block size limits resolve the economic vulnerability of static limits by automatically adjusting the maximum block size over time. While an adaptive block size limit could still diverge from a hypothetical “ideal” size due to significant changes in the rate of technological advancement or the availability of capital, such divergences would likely remain much smaller than with static limits, and attackers are no longer afforded an advantage. Bitcoin Cash’s Adaptive Algorithm is conservative and based on observed usage. In cooling-off periods of falling network usage, the limit slowly decreases to preserve the resources of infrastructure operators. On the other hand, during periods of rapid growth, the limit can increase at a rate of up to 2x per year.

Exciting times for Bitcoin Cash.

Kory

Dr. Pierre Kory advice to people who got a Covid-19 vaccine: "Do not get vaccinated ever again with an mRNA vaccine. Do not let family members get vaccinated…From epidemiologic data it's my sense that the farther you are out from your last vaccine, the more likely you're gonna… pic.twitter.com/FQ0l5YVxZ0

— Camus (@newstart_2024) March 30, 2024

Denier

https://twitter.com/i/status/1774045305509446045

Coyote

id watch an entire movie based on this pic.twitter.com/zf30jm46O2

— non aesthetic things (@PicturesFoIder) March 29, 2024

God jump

God's most perfect creature pic.twitter.com/Fbk10R1EVI

— Why you should have a cat (@ShouldHaveCat) March 30, 2024

Girl power

Male lion tries to sneak up on sleeping lionesses with their cubs pic.twitter.com/KKRbfVkfKP

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 30, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.