Paul Gauguin A Day of No Gods 1894

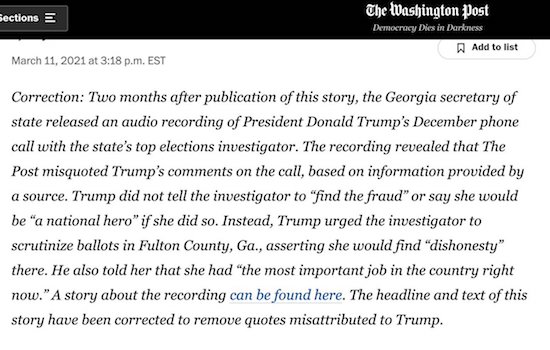

How an anonymous source becomes part of a impeachment trial.

“..a conundrum on how much of the bill should be paid for with tax hikes and what parts should be financed with even more federal borrowing..”

• Biden To Propose First Major Federal Tax Hike Since 1993 (DM)

Joe Biden is planning to propose the first substantial federal tax hike since 1993 for Americans to help pay for his long-term economic program after he signed the largest stimulus package in U.S. history with a price tag of $1.9 trillion. Four people familiar with discussion told Bloomberg that Biden is expected to propose a series of tax increases, including repealing parts of Donald Trump’s 2017 tax law that resulted in most Americans seeing more in their paychecks, to help fund the latest proposal. Trump’s tax cuts led to most Americans receiving more take home pay and resulted in an average increase of $90 in tax returns from 2017 to 2018. With the former president’s income tax cuts, Americans immediately saw somewhere between a 0.4 per cent and 2.9 per cent increase in their paychecks after taxes.

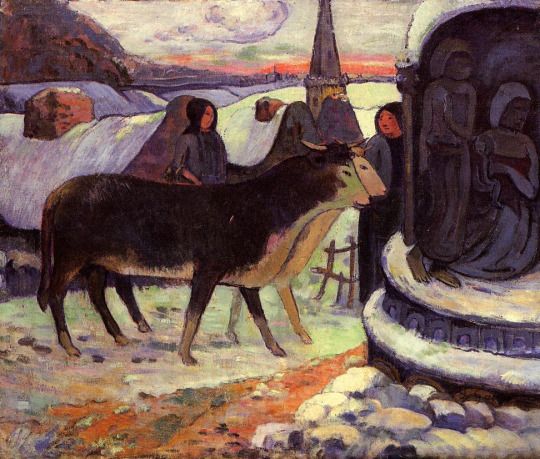

Now the White House is preparing to roll out another sweeping plan to tackle infrastructure and the economic crisis, which some say could fall somewhere between the $2-$4 trillion mark. Biden plans to kick off his cross-country tour this week promoting and seeking to bolster enthusiasm for the coronavirus relief package, where the White House will also ensure he receives credit for benefits included in the bill. First lady Jill Biden, Vice President Kamala Harris and first gentlemen Doug Emhoff will also hit the road this week to promote the sweeping legislation. Next on the president’s docket is getting another pricey funding bill through Congress that addresses infrastructure, climate and education.

Republicans are more than likely to pounce on the plan, painting Democrats as the Party of higher taxes. The tax hike could also blow any chances of lawmakers reaching a bipartisan deal on infrastructure – something Democratic Senator Joe Manchin says is unacceptable and that he will likely block. With a narrow majority in the House and a 50-50 split in the Senate, Democrats must craft the proposal in a way that gains support from nearly every lawmaker in their caucus. White House officials are now facing a conundrum on how much of the bill should be paid for with tax hikes and what parts should be financed with even more federal borrowing.

“Mr. Biden’s “honeymoon” period is about over.”

• This Is What You Voted For (Kunstler)

Meanwhile, up in Minneapolis, where jury selection is underway in the trial of former police officer Derek Chauvin in the death of George Floyd, the City Council approved 13-to-0 a $27-million wrongful death civil settlement to Mr. Floyd’s family. Say, what…? The way it’s supposed to work is that a civil case for wrongful death follows the criminal trial — for how would you know what’s rightful or wrongful in a matter before the facts in the case have been adjudicated? Sounds like Hennepin County, MN, may not be the right venue for these proceedings.

Should Mr. Chauvin face a jury that will likely have heard news reports that the city council already decided the verdict, and in the most imprecise terms possible? “Mr. Floyd died because the weight of the entire Minneapolis Police Department was on his neck,” Floyd family Attorney Ben Crump said when the suit was filed. Systemic racism, you see. Following the George Floyd riots last year, the Minneapolis City Council announced its plan to defund the police. In February 2021, the council announced the release of $6.4-million to hire more police, following a dramatic uptick in crime. Such are the strange inconsistencies of life under the crypto-Jacobin revolution in America today.

Speaking of Joe Biden, alleged to be president, he was oddly absent altogether on the front page of Monday’s New York Times, leading the curious to wonder if last Tuesday night’s Coronavirus Action speech drained his dwindling mojo for the rest of the month. The curious might also seek to know why Mr. Biden’s “team” is still so wound up about eradicating Coronavirus, yet eager to let tens of thousands cross the border illegally from Mexico, many of them live vectors of the virus, who are then bussed all over the USA under the revived “catch-and-release” policy. Mr. Biden’s “honeymoon” period is about over. The country had not quite discovered just how leaderless it is. Will it come as a shock to find out? After all, isn’t this what you voted for?

Snake oil salesmen?

• White House Set To Unveil Sweeping Vaccine-Confidence Campaign (STAT)

The White House will soon unveil a wide-reaching public relations campaign aimed at boosting vaccine confidence and uptake across the U.S., Biden administration aides told STAT. This television, radio, and digital advertising blitz, set to kick off within weeks, will focus on Americans outright skeptical of vaccines’ safety or effectiveness as well as those who are potentially more willing to seek a Covid-19 immunization but don’t yet know where, when, or how. Specifically, the campaign will target three groups in which access, apathy, or outright skepticism may pose a barrier to vaccinations: young people, people of color, and conservatives, according to a Biden aide. Congress and the administration have set aside over $1.5 billion for the effort.

The effort highlights a looming and underappreciated public health challenge: Though millions of Americans are currently clamoring to receive a Covid-19 vaccine, in a few short months, or even weeks, the opposite may be true. Instead of scrambling to manufacture doses, the government may soon be scrambling to find arms willing to receive them. While the administration Covid response advisers organizing the effort are broadly optimistic, they and many public health experts fear that without winning buy-in from a critical, final slice of the population, the effort could fall short of its goal: effectively ending the country’s coronavirus crisis. “I’m worried about the 15% of Americans who say they will not take the vaccine,” said Sten Vermund, the dean of the Yale School of Public Health.

“And about 8% or 9% of Americans say, ‘I will take it if they make me, if my job forces me to.’ So that’s about 23% or 24%, and that’s flirting with the level we need to get to herd immunity.” The rollout fulfills one of Biden’s first promises in office. He pledged on Jan. 21 to kick off an “unprecedented vaccination public health campaign” aimed at convincing every American adult to seek a Covid-19 immunization.= As for the specific content, administration officials said they were mindful that appeals directly from President Biden or Anthony Fauci are not likely to sway vaccine-hesitant people. As a result, they are expected to recruit both celebrities and trusted local officials to advance the pro-vaccine message.

“..politicians cannot bear the possibility that they might have to give up some of that power over us they have grabbed for themselves..”

• Is Biden Holding America Hostage Until ‘Independence’ Day? (Ron Paul)

Last week President Biden addressed the nation on the first anniversary of the coronavirus being declared a “pandemic.” It was a disturbing speech, warning us that the “hopeful spring” will only emerge “from a dark winter” if all Americans “stick with the rules.” Whose rules? His rules. The message from the president was clear: he will only allow us to have some of our freedoms back if we do exactly as he tells us. It was the language of extortion, of a bank robber who demands you do what he says or face the consequences. It was not the language of someone we are told is the leader of the free world. In the speech Biden laid out a list of what was taken from us over the past year, “weddings, birthdays, graduations…family reunions, the Sunday night rituals.”

It was as if somehow the virus, instead of authoritarian government officials, prevented us from enjoying these normal human activities. Though we continue to see Covid disappear across the country with the end of the winter season, Biden was not about to let go of his perceived power to control our lives. He said, “if we do all this, if we do our part, if we do this together, by July the 4, there’s a good chance you, your families and friends, will be able to get together in your backyard or in your neighborhood and have a cookout or a barbecue and celebrate Independence Day. That doesn’t mean large events with lots of people together, but it does mean small groups will be able to get together.” Imagine our Founders hearing this speech. The US president might – just might – allow small family gatherings at home in four months if we follow all of his rules.

King George looked benevolent by comparison! As Rep. Thomas Massie Tweeted shortly after the speech, “If you’re waiting for permission from the chief executive to celebrate Independence Day with your family, you clearly don’t grasp the concept of Independence.” It seems like yesterday – it almost was – that Biden “asked” us to just wear the mask for 100 days. “Just 100 days to mask, not forever. 100 days,” he said. So from “just 100 days” to maybe you can have a small gathering by July 4th? Perhaps he just forgot his earlier speech? As usual, the goalposts keep being moved because politicians cannot bear the possibility that they might have to give up some of that power over us they have grabbed for themselves.

Fauci made the usual mainstream media rounds over the weekend and was asked by the fawning host when Americans might have permission to hold weddings again! So now Americans need Fauci’s permission to get married? What is happening to this country? The propaganda is so relentless that it seems most Americans don’t see how not normal this is! In saner times, Fauci would be laughed off the stage. Now, he’s treated as some sort of divine source of truth. Biden promised he was “using every power…as the president of the United States to put us on a war footing.” Of that I have no doubt. But Biden’s war is not against the virus. It’s against the US Constitution and liberty itself.

The very same people who advocated we “listen to the science”, have now abandoned the science and advocate untested substances.

• Germany, France And Italy Suspend Oxford Covid Vaccine (G.)

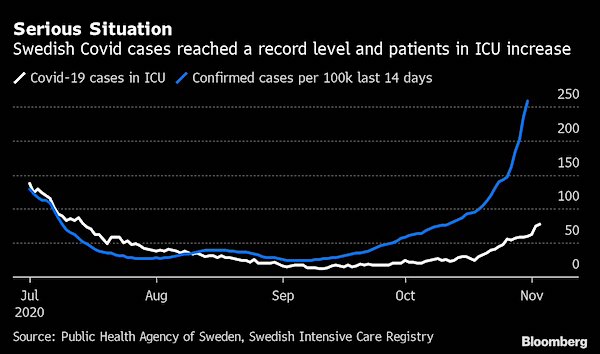

Germany, France and Italy have suspended the Oxford/AstraZeneca’s Covid vaccine as the World Health Organization said it had seen no evidence the shot had caused incidents of blood clots and a low platelet count in some people who received it. The German health ministry said the country’s vaccine authority, the Paul Ehrlich Institute, “considers further investigation necessary after new reports of cerebral brain thrombosis in connection with vaccination in Germany and Europe”. The European Medicines Agency (EMA) should decide “whether and how the new findings will affect the approval of the vaccine”, the ministry said. The health minister, Jens Spahn, said seven cases of cerebral vein thrombosis had been reported.

While this was a “very low risk” compared with the 1.6 million jabs already given in the country, Spahn said, it would be above average if a link to the vaccine was confirmed. “The decision today is a purely precautionary measure,” he said. The French president, Emmanuel Macron, said France would also stop administering the AstraZeneca shot pending an EMA assessment due on Tuesday, while the Italian medicines authority, Aifa, said it was temporarily halting inoculations as a “precautionary and temporary measure” before the EMA decision. The three countries join a growing number in Europe to have temporarily suspended use of the AstraZeneca vaccine in recent days.

Denmark and Norway last week reported incidents of bleeding, blood clots and a low count of blood platelets in people who had received the AstraZeneca shot, prompting Ireland and the Netherlands to join them on Sunday in temporary suspensions. Karl Lauterbach, a professor of health economic and epidemiology at the University of Cologne and a German MP, criticised the decision. “Based on the data available, I consider this to be a mistake,” Lauterbach said. “Testing without suspension of vaccination would have been better because of the rarity of the complication. In the third wave, which is now picking up speed, the first vaccinations with the AstraZeneca vaccine would be lifesavers.”

Scary, but why try to scare us?

• UK Coronavirus Variant Significantly More Deadly Says New Study (F.)

The U.K. coronavirus variant known as B.1.1.7 is not only more transmissible, but also more deadly than other coronavirus variants, according to a new study. B.1.1.7 was first identified in the U.K. last fall and by December it was detected in several other countries including the U.S. The variant is known to be substantially more transmissible than other SARS-CoV2 coronavirus lineages and quickly took over as the dominant variant in the U.K., late last year, sparking off a damaging and deadly second wave. Scientists had suspected that B.1.1.7 might be more deadly, as well as more transmissible following a higher-than-expected number of deaths in the U.K. during the third wave this winter, which saw the U.K’s worst daily death total in January claim over 1,800 lives.

But, the new study published in the journal Nature, led by researchers at the London School of Hygiene and Tropical Medicine all but confirms that this correlation is genuine. The study looked at viral genetics data from almost 5,000 people in the U.K. who died from Covid-19, with two-thirds of those being confirmed to have the B.1.1.7 variant. It found that people who were infected with B.1.1.7 had a 55% higher risk of dying within 28 days of being tested positive for Covid-19. “England has suffered an enormous toll from B.1.1.7 in the last few months, with 42,000 COVID-19 deaths in January and February 2021 alone,” said Nick Davies, PhD, lead author from LSHTM’s Centre for the Mathematical Modelling of Infectious Diseases.

“In spite of substantial advances in COVID-19 treatment, we have already seen more deaths in 2021 than we did over the first eight months of the pandemic in 2020. Our work helps to explain why,” Davies added. The new work follows another study from the U.K. published last week, which showed that people who tested positive for B.1.1.7 in a community setting were also more likely to die within 28 days of a positive test than those with other variants.

What a lovely prospect.

• Regular ‘Booster’ Shots Will Become Commonplace As New Variants Emerge (RT)

The head of Britain’s Covid-19 genomics programme has warned that there will be a need for regular booster jabs to protect people against the virus as new potentially vaccine-busting variants emerge. “We have to appreciate that we were always going to have to have booster doses; immunity to coronavirus doesn’t last forever,” Sharon Peacock, UK Covid-19 Genomics (COG-UK) chief, told Reuters at the Wellcome Sanger Institute’s Cambridge campus on Monday. Peacock, whose COG-UK programme has sequenced half of the world’s mapped Covid-19 genomes, said she was confident new variants would emerge that would render the current vaccines ineffective.

“We already are tweaking the vaccines to deal with what the virus is doing in terms of evolution – so there are variants arising that have a combination of increased transmissibility and an ability to partially evade our immune response,” she said. The genomics chief said the “cat and mouse” battle with the virus will require international cooperation. COG-UK was set up a year ago by Peacock and the British government’s chief scientific adviser, Patrick Vallance, and has sequenced 346,713 genomes out of a total of 709,000 genomes mapped worldwide. To date, more than 24 million people in the UK have received at least their first vaccine dose; all vaccines being used have demonstrated considerable efficacy against the virus variants prevalent in Britain.

“The life of just one person is worth more than the private property of the richest man.”

• Cuba Working on a ‘People’s Vaccine’ (CP)

“The life of just one person is worth more than the private property of the richest man.” This is what’s written on the Calixto Garcia public hospital in Havana Cuba as a testament to the country’s commitment to free public healthcare, and to putting people before profit. I know this about Cuba because in March, at the onset of the global Covid-19 pandemic, I spent a week in the ICU at Calixto Garcia. I had been hit by a speeding ambulance, and Cuban doctors saved my life, operated on me twice, and nursed me to stability before putting me on a private medical evacuation flight back to the U.S. All of this, including the flight, was free of cost to me- covered by Cuba’s government-run insurance for foreign visitors.

From my hospital bed, as the global emergency around me escalated, I witnessed how the Cuban government swiftly mobilized resources to protect its citizens from Covid-19: at-home testing for anyone with symptoms, door to door preventative education in the most vulnerable neighborhoods, and coordinated isolation when necessary. While deaths soared toward 100,000 in the U.S., Cuba was able to get the average daily Covid-19 related deaths close to zero for most of May-August. Cuba’s humanist approach when it comes to health was not new to me. In 2013, I co-directed a documentary on a free hospital in northern Honduras. The doctors there, all from afro-indigenous Garifuna communities, had been trained in Cuba at the Latin American School of Medicine (ELAM) for free.

Cuba created the ELAM in 1999 to train doctors from the poorest regions of countries around the world (including the U.S.), providing full scholarships of six years tuition, room, and board, with the hope that these doctors would return and provide accessible and preventative healthcare in their communities. The ELAM was born as a response to the devastation of Hurricane Mitch in 1998, and has trained tens of thousands of doctors from over 110 countries since then. Cuba is now poised to play an important role in global efforts to curb the pandemic. New variants in South Africa and Brazil, all with yet unknown implications for vaccine effectiveness, have shown us that any effort to achieve herd immunity is only as good as it is accessible equitably across the globe. Yet, as predicted, the global north is outpacing the global south dramatically in vaccination.

On February 3, Anthony Fauci said, in an event hosted by the Journal of the American Medical Association (JAMA) network, that developing COVID-19 vaccines “is not a race.” “We want everybody to get over the finish line,” he assured. Dr. Fauci mentioned the Russian and the Chinese vaccines and later suggested that the U.S. should help other countries strengthen their vaccine manufacturing capacity to promote more vaccinations globally. At no point did he mention Cuba. Thanks to an established publicly-funded biotechnology program, Cuba currently has four vaccine candidates. One of those vaccines, Soberana 02, started Phase 3 clinical trials in early March. Another candidate, Abdala, started Phase 2 trials in February. Both vaccines are being developed by public research institutions and are the most promising candidates in Latin America. The fact that Dr. Fauci failed to mention these candidates is disappointing.

“No King in the History of the World has been the Ruler of Two Billion People, but Mark Zuckerberg is”

• Facebook Will Add Labels To All Posts About Covid-19 Vaccines (F.)

Facebook will soon add labels to all posts about coronavirus vaccines that points people to its Covid-19 Information Center, the company said in a blog post on Monday as part of its plans to promote vaccination efforts on its platforms, amidst continued criticism from health experts and lawmakers for allowing misinformation about vaccines to spread on its platform. In a blog post, Facebook said it is already adding labels to posts that discuss the safety of the Covid vaccines, pointing people to credible information from the World Health Organization both on its main platform and Instagram. In the coming weeks, labels will be added to all posts generally about Covid-19 vaccines and the company also plans to add additional targeted labels about other specific Covid-19 vaccine subtopics..

Users who share a post about Covid-19 vaccines on Facebook or Instagram will see an additional popup with an informational label which the company says will offer people “context they need to make informed decisions about what to share.” Facebook has also rolled out its Covid-19 Information Center on Instagram for the first time on Monday, nearly a year after it appeared on the main platform. The company also disclosed that it has implemented several temporary measures to limit the spread of vaccine misinformation including reducing distribution of content from users who have violated the platform’s policies on COVID-19 and vaccine misinformation.

In addition to tackling misinformation Facebook has promised to share real-time aggregate trends on Covid-19 vaccinations, intent to get vaccinated and reasons for hesitancy with public officials. Facebook is also working with health authorities and governments to expand their chatbots on the messaging service WhatsApp to enable it to allow registration for vaccinations. Facebook also announced it is rolling out a tool in the U.S. that will help people identify nearby places where they can get a vaccine. The tool, which is part of Facebook’s Covid-19 Information Center will include details about hours of operation, contact info and links to make an appointment. Announcing some of the new measures in a Facebook post, the company’s CEO Mark Zuckerberg wrote: “The data shows the vaccines are safe and they work. They’re our best hope for getting past this virus and getting back to normal life. I’m looking forward to getting mine, and I hope you are too.”

‘No King in the History of the World has been the Ruler of Two Billion People, but Mark Zuckerberg is’

BREAKING: @Facebook Global Planning Lead Benny Thomas Reveals Dire Need for Government Intervention

'The Single Biggest Thing is this Company Needs to be Broken Up’

'No King in the History of the World has been the Ruler of Two Billion People, but Mark Zuckerberg is'#KingZuck pic.twitter.com/HdwCl9Sz06

— James O'Keefe (@JamesOKeefeIII) March 15, 2021

Growing numbers.

• Immigrant Teens To Be Housed At Dallas Convention Center (AP)

The U.S. government plans to house up to 3,000 immigrant teenagers at a convention center in downtown Dallas as it struggles to find space for a surge of migrant children at the border who have strained the immigration system just two months into the Biden administration. American authorities encountered people crossing the border without legal status more than 100,000 times in February — a level higher than all but four months of Donald Trump’s presidency. The spike in traffic poses a challenge to President Joe Biden at a fraught moment with Congress, which is about to take up immigration legislation, and has required the help of the American Red Cross.

The Kay Bailey Hutchison Convention Center will be used for up to 90 days beginning as early as this week, according to a memo obtained by The Associated Press that was sent Monday to members of the Dallas City Council. Federal agencies will use the facility to house boys ages 15 to 17, according to the memo, which describes the soon-to-open site as a “decompression center.” The Health and Human Services Department is rushing to open facilities across the country to house immigrant children who are otherwise being held by the Border Patrol, which is generally supposed to detain children for no more than three days. The Border Patrol is holding children longer because there is next to no space in the HHS system, similar to the last major increase in migration two years ago.

A tent facility operated by the Border Patrol in Donna, some 500 miles (804 kilometers) south of Dallas, is holding more than 1,000 children and teenagers, some as young as 4. Lawyers who inspect immigrant detention facilities under a court settlement say they interviewed children who reported being held in packed conditions in the tent, with some sleeping on the floor and others not able to shower for five days. Homeland Security Secretary Alejandro Mayorkas on Saturday directed the Federal Emergency Management Agency to help manage and care for children crossing the border. “I am incredibly proud of the agents of the Border Patrol, who have been working around the clock in difficult circumstances to take care of children temporarily in our care,” Mayorkas said in a statement. “Yet, as I have said many times, a Border Patrol facility is no place for a child.”

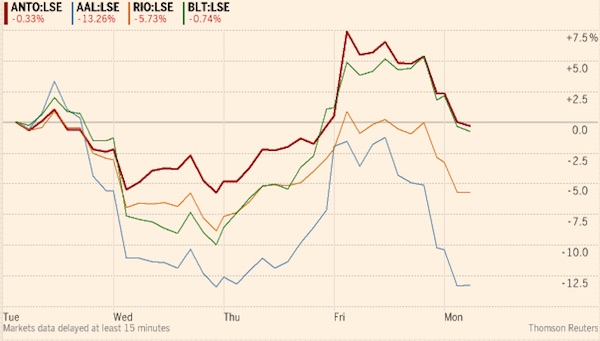

Where’s Jack Ma these days?

• Beijing Orders Alibaba To Dump Media Assets (ZH)

Beijing is reviving its crackdown on the country’s biggest tech firms, reminding the world that the CCP is still focused on neutralizing any and all threats to its control of the Chinese economy and its people. Even after amending China’s official ideology to include entrepreneurs among the protected classes represented by the CCP (in addition to workers, farmers and soldiers), Beijing, with President Xi at its center, has apparently decided that Chinese tech firms won’t follow the American model after all. Instead, their growth and competitive capabilities will be curtailed for the sake of stability at home.

After Tencent was censured and strict new requirements weren officailly imposed on Alibaba-owned Ant Group that will prevent the company from growing, the Wall Street Journal reports that next up on Beijing’s to-do list is to force Alibaba to dump its array of media outlets. Presumably, Beijing sees these outlets as an unwelcome competitor to Beijing’s own propaganda machine. Alibaba’s media portfolio includes ownership of the South China Morning Post, Hong Kong’s most widely read English-language newspaper, which has an audience far outside of Hong Kong. The paper often struggled with its coverage of the unrest in Hong Kong, occasionally adopting the language of the CCP (like referring to the demonstrators as “rioters”) while still managing to rankle Beijing with its detailed coverage of the demonstrations.

According to WSJ, the CCP has been “discussing” whether to force the divestitures since early this year. Chinese regulators have been “reviewing” a list of media assets owned by Hangzhou-based Alibaba, which earns most of its money via an online retail business. Officials were appalled at how expensive Alibaba’s media interests have become. Now, Beijing is asking Alibaba to devise a plan to “curtail” its media holdings. Now, just imagine if President Trump tried to force Amazon to sell the Washington Post.

Botched UBI?

• The Stockton Experiment: How a Guaranteed Income Can Actually Solve Inequality

An ongoing study conducted in Stockton, California, examines how the lives of low-income Americans can improve if they are simply given money—a modest, but reliable source of income with no strings attached. The Stockton Economic Empowerment Demonstration (SEED) randomly chose 125 participants from poverty-stricken residential areas and gave them $500 per month to simply use for whatever they wanted over the last two years. A majority of the participants were women (69 percent) and people of color (53 percent). Preliminary results from the first year are tantalizing for anyone interested in solutions to address rising inequality in the United States, especially as they manifest along racial and gender lines.

Within the first year, the study’s participants obtained jobs at twice the rate of the control group. At the beginning of the study, 28 percent of the participants had full-time employment, and after the first year, that number rose to 40 percent. Sukhi Samra, the director of SEED, explained to me in an interview that although Andrew Yang, the former presidential candidate now running for mayor of New York City, helped popularize the idea of a universal basic income (UBI), the Stockton study of a “guaranteed basic income” (GBI) is subtly different from Yang’s proposal. “Where guaranteed income differs,” said Samra, “is that it’s usually targeted along income lines,” rather than given to everyone.

“It’s more often touted as a tool for equity, especially racial and gender equity,” she added. Samra said it was important to frame the idea of GBI within the “racial justice and social justice movements of the 1960s when you had Dr. Martin Luther King Jr., the National Welfare Rights Organization and the Black Panthers all advocating for a guaranteed income as the simplest and most effective way to abolish poverty.” Indeed, Dr. King wrote in his last book, Where Do We Go From Here: Chaos or Community?, that he was “convinced that the simplest approach will prove to be the most effective—the solution to poverty is to abolish it directly by a now widely discussed measure: the guaranteed income.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

“You know, if baseball umpires were on the front page of the sports section every week, you’d know something was desperately wrong with the game.”

– Jim Grant, on Central Bankers

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.