Vincent van Gogh Burning weeds 1883

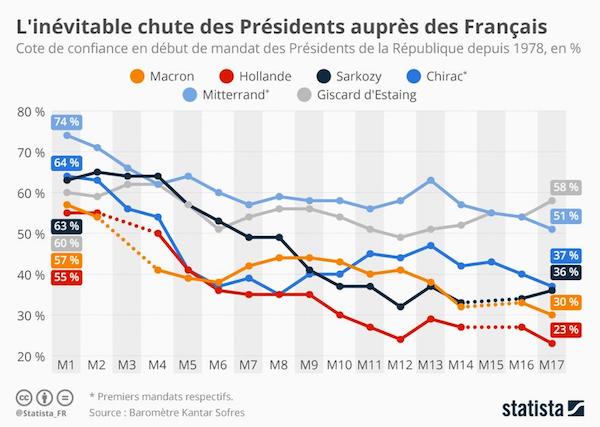

As Macron nears record low approval rating for a French president, he lectures the world through a game of semantics. The ‘brilliance’ is that while not many could have told you the difference between nationalism and patriotism, Macron claims to have it down. Even if it has to be translated into dozens of languages, each of which may have slightly different interpretations of the -local- meaning of the words. Macron has good speech writers, but they don’t write in all the languages involved. So it’s merely semantics. The terms mean to everyone what they want them to mean.

The take-away: according to Macron, patriotism can exist along globalism, nationalism cannot. A jibe against Trump. Which also means that because Xi Jinping touts globalism all the time, we must accept, if we follow Macron, that he is not a nationalist, but a patriot.

• Macron: Nationalism Is A “Betrayal Of Patriotism” (Ind.)

Emmanuel Macron has issued a hard-hitting warning about the dangers of nationalism and of countries that put their interests before the collective good – in front of Donald Trump and Vladimir Putin. The French president denounced those who evoke nationalist sentiment to disadvantage others, calling it a “betrayal of patriotism” and moral values. The US and Russian leaders listened in silence as Mr Macron took a swipe at the rising tide of populism in the US and Europe, warning: “The old demons are rising again, ready to complete their task of chaos and of death.” During a gathering of dozens of world leaders to mark 100 years since the end of the First World War, the French president went on: “Patriotism is the exact opposite of nationalism. Nationalism is a betrayal of patriotism.

“In saying, ‘Our interests first, whatever happens to the others’, you erase the most precious thing a nation can have, that which makes it live, that which causes it to be great and that which is most important: its moral values.” [..] In a speech lasting nearly 20 minutes, Mr Macron also called on fellow leaders to fight for peace. “Ruining this hope with a fascination for withdrawal, violence or domination would be a mistake for which future generations would rightly find us responsible,” he said. The French leader also defended the European Union and the United Nations, which he said guaranteed peace and enshrined “a spirit of cooperation to defend the common property of a world whose destiny is inextricably linked”.

Okay, is Putin a nationalist or a patriot? He seems to like globalism, but he likes Russia better. And he’s been pushed out of globalism through sanctions and tall tales.

• Putin Says Had Good Conversation With Trump In Paris (AFP)

Russian President Vladimir Putin said he had a brief but good conversation with US leader Donald Trump at World War I centenary events in Paris, Russian media reported. When journalists asked Putin whether he managed to speak to Trump on Sunday, he said: “Yes,” Russian state news agency RIA Novosti reported. Asked how it went, Putin said: “Well.” He did not provide further details, but the French presidency said the pair had a wide-ranging discussion during lunch after the commemoration. Host and French President Emmanuel Macron was there and German Chancellor Angela Merkel took part in some of the exchanges, the presidency said.

Subjects discussed included the situation in the Middle East, notably Syria, Iran and Saudi Arabia, and North Korea. White House spokeswoman Sarah Sanders said Trump had sat with world leaders including Putin, Macron and Merkel at lunch and the group had held “very good and productive discussions”. “The leaders discussed a variety of issues, including the INF (nuclear treaty), Syria, trade, the situation in Saudi Arabia, sanctions, Afghanistan, China, and North Korea,” she said. Expectations have been growing for a new Trump-Putin meeting as tensions pile up over the Cold War-era Intermediate-Range Nuclear Forces Treaty (INF) and US sanctions against Moscow.

Macron and Merkel: “These so-called elections undermine the territorial integrity and sovereignty of Ukraine..”

Wasn’t it John McCain and Vcitoria Nuland who undermined it back in 2014 on Maidan Square?

• Eastern Ukraine Elects Separatist Leaders As West Rejects Polls (AFP)

People in Russian-backed areas of eastern Ukraine re-elected separatist leaders at the weekend, according to results released Monday of polls condemned as illegal by Kiev and Western countries. Elections in the Donetsk and Lugansk “People’s Republics”, controlled by separatists since breaking away from Ukraine’s pro-Western government in 2014, took place after the killing of the rebel Donetsk “president” in a bomb attack in August. Security was tight for Sunday’s vote with gun-toting, camouflage-clad guards deployed to ensure order. Denis Pushilin, the 37-year-old acting Donetsk leader, was elected with 61 percent of the vote with almost all ballots counted, the local electoral commission said. Leonid Pasechnik, the acting Lugansk leader, took 68 percent of the vote.

French President Emmanuel Macron and German Chancellor Angela Merkel branded the vote “illegal and illegitimate” following a meeting with Ukraine President Petro Poroshenko on the sidelines of World War I commemorations also attended by Russian leader Vladimir Putin on Sunday. “These so-called elections undermine the territorial integrity and sovereignty of Ukraine,” the pair said in a joint statement. Washington and Brussels had asked Russia not to allow the polls to go ahead, arguing they would further hamper efforts to end a conflict that has killed more than 10,000 people since 2014. “The people in eastern Ukraine will be better off within a unified Ukraine at peace rather than in a second-rate police state run by crooks and thugs, all subsidized by Russian taxpayers,” tweeted Kurt Volker, the US special envoy to Ukraine, on the day of the polls.

if only they confess to the narratives Britain has spouted without evidence.

• May Says Britain Open To ‘Different Relationship’ With Russia (R.)

Prime Minister Theresa May will say on Monday Britain is “open to a different relationship” with Russia if Moscow takes a new path and stops “attacks” that undermine international treaties and security. Just a year ago, May used her annual speech at the Lord Mayor’s Banquet to accuse Moscow of military aggression and of meddling in elections, some of her strongest criticism even before the poisoning of a former Russian spy in Salisbury. This year, she will tell London’s financial center that the action taken since – including the largest ever coordinated expulsion of Russian intelligence officers – has deepened her belief in a “collective response” to such threats.

“We will continue to show our willingness to act, as a community of nations, to stand up for the rules around the world,” May will say, according to excerpts of her speech. Describing evolving threats, May will say the past year, including Salisbury, has “shown that while the challenge is real, so is the collective resolve of likeminded partners to defend our values, our democracies, and our people.” “But, as I also said a year ago, this is not the relationship with Russia that we want … We remain open to a different relationship – one where Russia desists from these attacks that undermine international treaties and international security,” she will say.

Boris still wants to be King.

• Boris Johnson Says Britain On Verge Of ‘Total Surrender’ In Brexit Talks (R.)

Former British foreign minister Boris Johnson accused Prime Minister Theresa May on Sunday of forcing through a deal that would keep the country locked in the European Union’s customs union after Brexit in what he described as a “total surrender”. “I really can’t believe it but this government seems to be on the verge of total surrender,” he wrote in his weekly column in the Telegraph newspaper. “I want you to savour the full horror of this capitulation … we are on the verge of signing up for something even worse than the current constitutional position. These are the terms that might be enforced on a colony.”

Unsolved issues.

• May Shelves Crunch Brexit Talks With Cabinet (Ind.)

Theresa May has been forced to abandon plans for an emergency cabinet meeting to approve a Brexit deal, after fresh opposition at home and abroad plunged her timetable into turmoil. The prime minister shelved the meeting, pencilled in for Monday, slamming on the brakes after fierce resistance in her cabinet and in Brussels threatened to derail the path to an agreement. A government source conceded that an outline deal might not be ready by Tuesday – making it increasingly unlikely that a special EU summit to sign it off can be held in November, as hoped.

That would leave the UK having to ramp up hugely expensive no-deal preparations and in danger of being unable to pass all necessary legislation before the Brexit deadline next March. At home, Ms May faced an open challenge to her plans from Andrea Leadsom, the Commons leader, who vowed the UK “cannot be held against its will” by the backstop plan for the Irish border. Ms Leadsom became the second cabinet minister to insist on a unilateral power to escape being bound in the EU customs union – something explicitly ruled out by Brussels.

1.35 billion packages delivered.

• Alibaba Has Record $30.8 Billion In Sales In 24 Hours On Singles Day (CNBC)

Alibaba on Sunday tore through last year’s Singles Day sales record, racking up more than $30.8 billion in the 24-hour shopping event. Gross merchandise value (GMV), a figure that shows sales across the Chinese e-commerce giant’s various shopping platforms, surpassed last year’s $25.3 billion record at around 5:34 p.m. SIN/HK (4:34 a.m. ET) on Sunday, and kept marching higher through the rest of the day. In Chinese currency terms, GMV totaled 213.5 billion yuan, easily beating last year’s figure of 168.2 billion yuan and representing a nearly 27 percent year-on-year rise. That was, however, smaller than the 39 percent year-on-year growth recorded in 2017.

Alibaba’s Singles Day GMV beat last year’s figure in yuan terms earlier than it toppled the dollar record. The Chinese currency is weaker against the greenback from a year ago, which means more sales in yuan are required to get the same dollar amount. It was the 10th edition of the annual Singles Day event, which is also called the Double 11 shopping festival because it falls on Nov. 11. During the 24-hour period, Alibaba offered huge discounts across its e-commerce sites such as Tmall. Alibaba’s Singles Day sales haul easily exceeded the spending by consumers during any single U.S. shopping holiday.

Wait! Shadows?

• Foreign Capital Has Propped Up China’s Currency. What If It Leaves? (CFR)

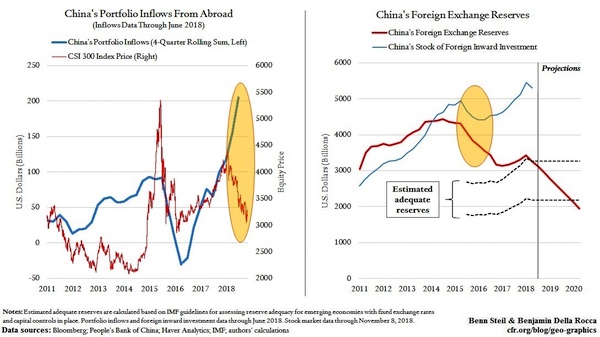

“I think China’s manipulating their currency, absolutely,” President Trump said back in August. Yet the People’s Bank of China (PBoC) was, and has been, intervening to keep the RMB up, and not to push it down, as Trump was alleging. And we believe such interventions are about to get much larger. Here is why. Over the past two years, as our left-hand figure below shows, foreign portfolio investors have piled prodigiously into Chinese assets, helping to support the RMB. But history suggests this trend is about to reverse. While inflows have been rising, Chinese stocks have been tumbling—they are down over 20 percent from their January peak. Dreadful performance like this typically drives funds out of emerging markets. We may be seeing the beginning of such outflows in China.

Repatriation of liquid foreign capital will make it far more challenging for China to keep its currency up. Of course, China could change course and let it fall, but that risks exacerbating the foreign-debt burden of its highly leveraged corporates. It could raise interest rates, but that would further slow a slowing economy. It could, to keep capital at home, demand higher returns on its foreign lending, but that would mean sacrificing its efforts to subsidize its companies operating abroad, as well those aimed at putting dollars to the service of geostrategic objectives—like Belt and Road. n short, then, there is every reason to expect that the PBoC will boost its support for the RMB by selling dollar reserves.

This is what it did back in 2015, when a plunging stock market scared away foreign capital. So in spite of President’s Trump’s repeated charges that China is manipulating its currency for competitive advantage in trade, all evidence suggests that it will continue to do the opposite. But if China were to sell reserves at the same pace as in 2015, its reserve levels would, by mid-2020, actually fall below the safety threshold implied by the IMF’s framework for reserve adequacy—as shown in the right-hand figure above.

Not much for now. Oil rising this morning on Saudi cuts promised.

• What Plunging Oil Prices Tell Us About The Stock Market And Global Economy (MW)

What the heck happened to oil prices? But more significantly, what does it mean for the broader stock market and the global economy? That is what has some Wall Street investors scratching their noggins, as crude futures and U.S. stocks staged a tandem tumble this week, just when investors thought the worst was over following a bruising October for risk assets. Now, oil futures are unraveling, down at least 20% after putting in a 52-week high early last month. And it isn’t so much the descent into bear-market territory—as the recent slump for crude can be characterized—as it is the celerity of the selloff that has market participants unsettled.

About five weeks: That’s all it took for bulls to pivot from cavalierly pondering if $100-a-barrel oil was a genuine possibility before the end of 2018 on the back of Iranian oil export sanctions imposed by the U.S. on Nov. 4, to wondering how ugly the current implosion in black gold could get before finding a bottom. On Friday, West Texas Intermediate crude for December delivery lost 48 cents, or 0.8%, to settle at $60.19 a barrel on the New York Mercantile Exchange, for the lowest front-month contract settlement since March 8, according to FactSet data. Prices lost 4.7% for the week, tallying their fifth straight weekly drop. The 10th session decline in a row matched the longest skid since 1984.

But beyond that, the most important question is this: What does oil’s decline really mean? That is the query that Yves Lamoureux, president of macroeconomic research firm Lamoureux & Co., posed to MarketWatch via email last week as the decline in oil was gaining steam. “Very large monthly down moves in crude oil has often heralded something more ominous,” he wrote on Nov. 1. “Most market observers think there is enough damage to see a bottom in stocks. Consensus therefore looks for new record highs or a solid bounce back. We strongly disagree with this perspective.”

No doubt there. But it’ll start somewhere.

• A Worldwide Debt Default Is A Real Possibility (Mauldin)

Is debt good or bad? The answer is “Yes.” Debt is future spending pulled forward in time. It lets you buy something now for which you otherwise don’t have cash yet. Whether it’s wise or not depends on what you buy. Debt to educate yourself so you can get a better job may be a good idea. Borrowing money to finance your vacation? Probably not. The problem is that many people, businesses, and governments borrow because they can. It’s been possible in the last decade only because central banks made it so cheap. It was rational in that respect. But it is growing less so as the central banks start to tighten. Earlier this year, I wrote a series of articles predicting a debt “train wreck” and eventual liquidation. I dubbed it “The Great Reset.”

I estimated we have another year or two before the crisis becomes evident. Now I’m having second thoughts. Recent events tell me the reckoning could be closer than I thought just a few months ago. Central banks enable debt because they think it will generate economic growth. Sometimes it does. The problem is they create debt with little regard for how it will be used. That’s how we get artificial booms and subsequent busts. We are told not to worry about absolute debt levels so long as the economy is growing in line with them. That makes sense. A country with a larger GDP can carry more debt. But that is increasingly not what is happening. Let me give you two data points.

Lacy Hunt tracks data that shows debt is losing its ability to stimulate growth. In 2017, one dollar of non-financial debt generated only 40 cents of GDP in the US. It’s even less elsewhere. This is down from more than four dollars of growth for each dollar of debt 50 years ago. This has seriously worsened over the last decade. China’s debt productivity dropped 42.9% between 2007 and 2017. That was the worst among major economies, but others lost ground, too. All the developed world is pushing on the same string and hoping for results. Now, if you are used to using debt to stimulate growth, and debt loses its capacity to do so, what happens next? You guessed it: The brilliant powers-that-be add even more debt.