Harris&Ewing Red Cross Motor Corps, Washington, DC 1917

There are no markets and there are no investors.

• The Central Bank Bubble And The Suspension Of Reality (CNBC)

In the middle of a prolonged period of negative real interest rates and loose monetary policy aimed at managing inflation and helping economies, fears are rising that asset bubbles are being created. “We’ve lost our way so we look to central banks, who give us massively loose monetary policy and that’s the little bubble we’re living in,” David Bloom, head of currency strategy at HSBC, told CNBC. New records are constantly being set in the markets, with Thursday’s close of the S&P, up 0.47 percent at 2,185.79, yet another new top. This is happening despite low productivity and growth in the U.S. economy. Analysts at UBS see “scope for the markets to run further still over the near-term” because of central banks’ policies in the developed world.

And it’s not just their own economies which are being helped by these actions. Emerging markets are benefitting too, as investors search for better returns on their money than in the low-growth developed economies and safe havens like U.K. bonds (gilts) and U.S. bonds (Treasurys). “All markets are running – that’s what happens when you have ultra-loose monetary policy and the central banks are handing over money,” Bloom said. “QE distorts markets completely.” Asset classes which are usually closely correlated have lost their usual connections. Examples include cash and equities, both at record highs despite one usually being strong while the other is weak, and oil and gold, which usually move together as they are both pegged to the U.S. dollar, but have diverged as investors pile in to gold.

Falling land ‘value’ is one thing, falling income is another.

• US Farmland Bubble Bursts As Ag Credit Conditions Crumble (ZH)

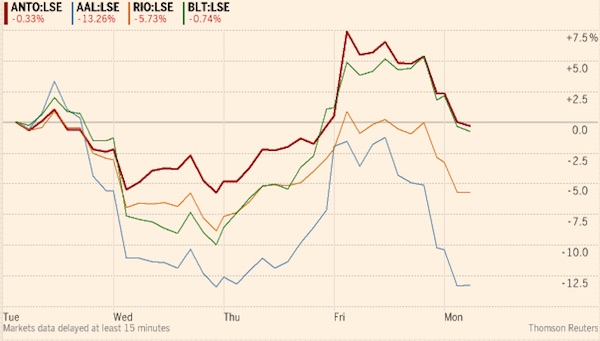

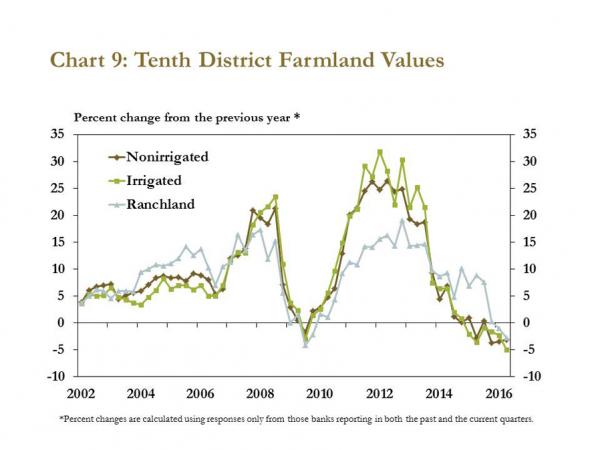

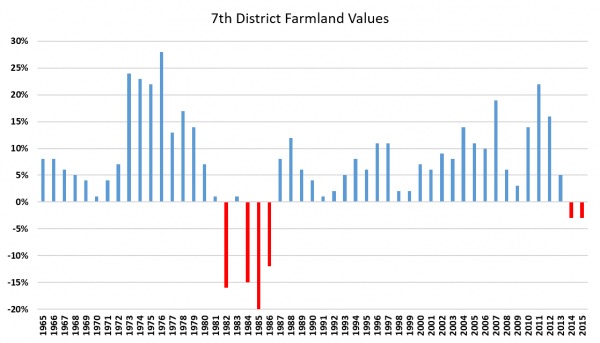

Aside from a brief pause during the “great recession” of 2009, Midwest farmland prices have been bubbling up for over a decade with annual price increases of 15%-30% in many years. Private Equity and low interest rates no doubt played a role in creating the farmland bubble as “excess cash on the sidelines” sought out investments in hard assets. No matter the cause, data continues to indicate that the farmland bubble is bursting. 2Q 2016 agricultural updates from the Federal Reserve Banks of Chicago, Kansas City and St. Louis indicate continued income, credit and farmland price deterioration for Midwest farmers. Lender surveys also suggest that as many as 30% of Midwest farmers are having problems paying loan balances.

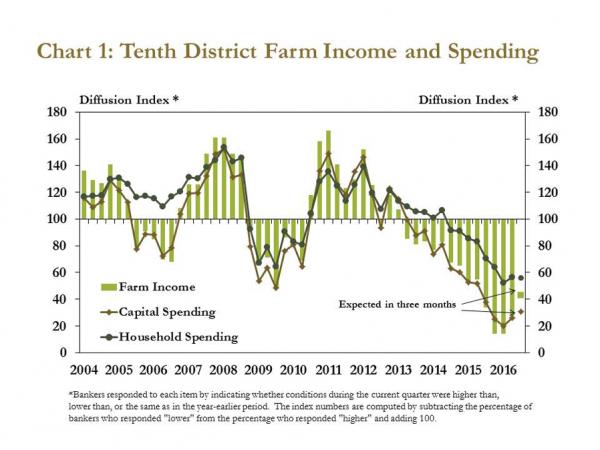

Declining asset values and incomes have also caused banks to tighten lending standards which has only served to accelerate the decline. In Kansas’ 10th District (which includes MO, OK, KS, NE), values of non-irrigated and irrigated cropland declined 3% and 5%, respectively, in 2Q 2016. In fact, 2Q 2016 marks the 6th consecutive quarter of YoY declines for irrigated cropland values. Between 2002 to 2014, the value of both irrigated and non-irrigated cropland declined in only one other time in 3Q 2009. Farmland prices in Chicago’s 7th District (IL, IN, IA, MI, WI) paint a similar picture. Before price declines in 2014 and 2015, farmland prices in the 7th District had only declined YoY in 4 other years since 1965.

Respondents to the Tenth District Survey of Agricultural Credit Conditions indicated farm income in the quarter continued to tighten. Nearly 75% of surveyed bankers reported farm income was less than a year ago, although the% of bankers that reported weaker farm income declined slightly from the first quarter (Chart 1). Respondents also noted that agricultural producers continued to reduce capital and household spending as profit margins generally remained weak. Bankers also indicated they expect farm income to remain weak in the third quarter. Similar to last year, a significant number of bankers in each District state expect farm income in the third quarter to be less than a year earlier.

Whack-a-mole Beijing-style.

• China Property Oversupply Dampens Growth Outlook (R.)

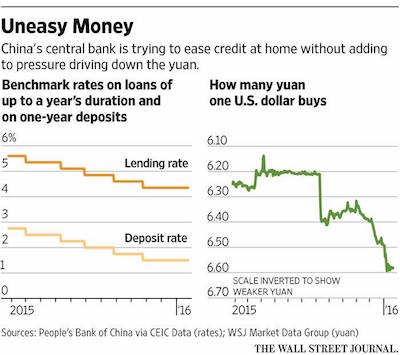

Growth in China’s property investment slowed over January to July, even as the government scrambled to balance an increasingly stratified sector, clouding the outlook for China’s economic expansion in the second half of the year. Property investment in January-July rose 5.3% from a year earlier, data from the National Bureau of Statistics (NBS) showed on Friday, slowing from an increase of 6.1% in January-June, while property sales by floor area grew 26.4%, down from 27.9%. Some analysts believe an oversupply problem still remains largely unresolved, especially in China’s smaller cities. “Today’s data shows that a nation-wide oversupply problem still exists, which will continue putting downward pressure on future growth,” Wendy Chen, macroeconomist at Nomura told Reuters.

China’s property sector had a hot start to the year after slowing in 2015, as monetary easing and stimulus measures took effect. However, the upward trend in investment and sales is proving to be unsustainable, as more first and second tier cities adopt stiffer measures to dampen fast-rising prices, while smaller Chinese cities struggle to clear overhanging housing inventory. Home price gains also have started to slow, as cities start to tighten policies amid signs of overheating in the largest cities. With property investment growth losing momentum and private investment growth remaining stubbornly sluggish, China’s economic growth outlook for the second half looks increasingly gloomy. “China’s property sector is extremely unbalanced, which leads to more control in overheated first and second tier cities while less developed third and fourth tier cities are struggling to clear inventory,” said Liao Qun, chief economist at CITIC Bank International.

“..non-financial state-owned enterprises accounted for half of bank credit but only a fifth of industrial output..”

• IMF Says China’s Credit Growth Is Unsustainable (R.)

The IMF on Friday said China needed to slow its unsustainable credit growth and stop financing weak firms. China’s corporate debt is still manageable, but at approximately 145% of GDP, it is high by any measure,” said James Daniel, IMF Mission Chief for China, in the fund’s annual review of the country. The IMF has urged China to tackle the root causes of its credit growth risk by easing back on unsustainably high growth targets and lax budget constraints, particularly on local governments and state-owned enterprises. “This in turn requires a comprehensive strategy and decisive measures to address the corporate debt problem,” the IMF’s Daniel said.

China’s non-financial state-owned enterprises accounted for half of bank credit but only a fifth of industrial output, the report said, suggesting non-viable SOEs be liquidated and viable ones restructured. Defaults and downgrades have increased and around 14% of debt was held by firms with profit levels below their interest payments, the report said, with credit growth growing twice as fast as nominal GDP. The report reflected views provided by Chinese policymakers who agreed with the IMF that corporate debt had increased “excessively”. However, they argued China’s large pool of domestic savings, banking system buffers, and continued equity market development would ensure a smooth adjustment, the report said.

Stuffed.

• Negative Rates Reduce Japan Big Banks’ Profits By $2.96 Billion (R.)

Japan’s financial watchdog estimates that negative interest rates under the Bank of Japan’s monetary easing policy will reduce profits for the country’s three big banks by at least 300 billion yen ($2.96 billion) for the year through March 2017, the Nikkei business daily reported on Saturday. The Financial Services Agency (FSA) expressed concern to the BOJ regarding the situation as it sees reduced profits weakening the banks’ ability to extend loans, the Nikkei said. If the BOJ was to take interest rates deeper into negative terrain, the agency reckoned that the banks would suffer substantial further drops in profit as their interest rate income would suffer.

Discussing IMF ‘mistakes’ without paying attention to the victims is dishonest.

• Airing The IMF’s Dirty European Laundry (Eichengreen)

[..] the report goes on to criticise the IMF for acquiescing to European resistance to debt restructuring by Greece in 2010; and for setting ambitious targets for fiscal consolidation – necessary if debt restructuring was to be avoided – but underestimating austerity’s damaging economic effects. More interestingly, the report then asks how the IMF should coordinate its operations with regional bodies such as the European commission and the ECB, the other members of the so-called troika of Greece’s official creditors. The report rejects claims that the IMF was effectively a junior member of the troika, insisting that all decisions were made by consensus.

That is difficult to square with everything we know about the fateful decision not to restructure Greece’s debt. IMF staff favoured restructuring, but the European commission and the ECB, which put up two-thirds of the money, ultimately had their way. He who has the largest wallet speaks with the loudest voice. In other words, there are different roads to “consensus”. The Fund encountered the same problem in 2008, when it insisted on currency devaluation as part of an IMF-EU program for Latvia. In the end, it felt compelled to defer to the EU’s opposition to devaluation, because it contributed only 20% of the funds.

The implication is that the IMF should not participate in a programme to which it contributes only a minority share of the finance, but expecting it to provide majority funding implies the need to expand its financial resources. This is something that the IEO report evidently regarded as beyond its mandate – or too sensitive – to discuss. Was the ECB even on the right side of the table in the European debt discussions? When negotiating with a country, the IMF ordinarily demands conditions of its government and central bank. In its programmes for Greece, Ireland and Portugal, however, it and the central bank demanded conditions of the government. This struck more than a few people as bizarre.

What you can do when you have your own currency.

• UK Treasury To Guarantee Post-Brexit Funding For EU-Backed Projects (G.)

Philip Hammond is to guarantee billions of pounds of UK government investment after Brexit for projects currently funded by the EU, including science grants and agricultural subsidies. The chancellor’s funding commitment is designed to give a boost to the economy in what he expects to be a difficult period after the surprise result of the EU referendum in June. The Treasury is expected to continue its funding beyond the UK’s departure from the EU for all structural and investment fund projects, as long as they are agreed before the autumn statement. If a project obtains EU funding after that, an assessment process by the Treasury will determine whether funding should be guaranteed by the UK government post-Brexit.

Current levels of agriculture funding will also be guaranteed until 2020, when the Treasury says there will be a “transition to new domestic arrangements”. Universities and researchers will have funds guaranteed for research bids made directly to the European commission, including bids to the EU’s Horizon 2020 programme, an €80bn (£69bn) pot for science and innovation. The Treasury says it will underwrite the funding awards, even when projects continue post-Brexit. Hammond said the government recognised the need to assuage fears in industry and in the science and research sectors that funding would be dramatically reduced post-Brexit.

“We recognise that many organisations across the UK which are in receipt of EU funding, or expect to start receiving funding, want reassurance about the flow of funding they will receive,” he said. “The government will also match the current level of agricultural funding until 2020, providing certainty to our agricultural community, who play a vital role in our country.” The chancellor added: “We are determined to ensure that people have stability and certainty in the period leading up to our departure from the EU and that we use the opportunities that departure presents to determine our own priorities.”

You cannot taper a Ponzi scheme.

• The Scandalous Changes To Company Pension Schemes (G.)

A man in his 40s receives a pension projection that tells him his retirement income is going to collapse from the £38,000 he was expecting to £18,000. His company is having to find a sum equal to 45% of his salary to keep the pension scheme going, a crucifying amount for any employer, and the costs will keep on spiralling. It says it has no choice but to slash the scheme to ribbons. This is the sort of dilemma facing the workers, and bosses, of Royal Mail and the Post Office. Strike action is looming – and quite rightly too, because the cuts are equivalent to someone losing £200,000 or even £300,000 over the course of their retirement.

We are about to enter a new era of trench warfare over pensions. The early battles were easy victories for the employers. They decided to close their final-salary schemes to new entrants, but existing workers were protected and were able to carry on chalking up their entitlement to, let’s face it, rather generous retirement payouts. Nobody seemed to care too much about the millennials who were missing out on what their parents took for granted. Next came the more thorny shift from paying out pensions based on final salaries at age 60 or 65 to cheaper ones based on a “career average” salary. Again the employers won, but it was more bruising.

But now we’re moving into far more dangerous territory. The employers have begun to target existing workers, many in their 40s and 50s, who are in these career average schemes, saying: “You can keep what you’ve built up so far, but nothing beyond that.” In pensions terminology it’s called stopping “future accruals”; Royal Mail, the Post Office and Marks & Spencer are all considering it. To these companies it’s a foregone conclusion. They can’t possibly afford 45% of salary as a pension contribution, or in M&S’s case 34%. The snarky retort is that they’ll always find the money to pay silly sums into their chief executive’s pension, but not for the workers.

This is just the last paragraph of another long and detailed piece by Kevin Dowd on Deutsche.

• Is Deutsche Bank Kaputt? (Dowd)

So what’s next for the world’s most systemically dangerous bank? At the risk of having to eat my words, I can’t see Deutsche continuing to operate for much longer without some intervention: chronic has become acute. Besides its balance sheet problems, there is a cost of funding that exceeds its return on assets, its poor risk management, its antiquated IT legacy infrastructure, its inability to manage its own complexity and its collapsing profits — and thepeak pain is still to hit. Deutsche reminds me of nothing more than a boxer on the ropes: one more blow could knock him out. If am I correct, there are only three policy possibilities. #1 Deutsche will be allowed to fail, #2 it will be bailed-in and #3 it will be bailed-out.

We can rule out #1: the German/ECB authorities allowing Deutsche to go into bankruptcy. They would be worried that that would trigger a collapse of the European financial system and they can’t afford to take the risk. Deutsche is too-big-to-fail. Their preferred option would be #2, a bail-in, the only resolution procedure allowed under EU rules, but this won’t work. Authorities would be afraid to upset bail-in-able investors and there isn’t enough bail-in-able capital anyway. Which consideration leads to the policy option of last resort — a good-old bad-old taxpayer-financed bail-out. Never mind that EU rules don’t allow it and never mind that we were promised never again. Never mind, whatever it takes.

“.. it also aims to boost the youth vote by persuading the company developing Pokémon Go in Iceland to turn polling stations into Pokéstops.”

• Polls Suggest Iceland’s Pirate Party May Form Next Government (G.)

One of Europe’s most radical political parties is expected to gain its first taste of power after Iceland’s ruling coalition and opposition agreed to hold early elections caused by the Panama Papers scandal in October. The Pirate party, whose platform includes direct democracy, greater government transparency, a new national constitution and asylum for US whistleblower Edward Snowden, will field candidates in every constituency and has been at or near the top of every opinion poll for over a year. As befits a movement dedicated to reinventing democracy through new technology, it also aims to boost the youth vote by persuading the company developing Pokémon Go in Iceland to turn polling stations into Pokéstops.

“It’s gradually dawning on us, what’s happening,” Birgitta Jonsdottir, leader of the Pirates’ parliamentary group, told the Guardian. “It’s strange and very exciting. But we are well prepared now. This is about change driven not by fear but by courage and hope. We are popular, not populist.” The election, likely to be held on 29 October, follows the resignation of Iceland’s former prime minister, Sigmundur David Gunnlaugsson, who became the first major victim of the Panama Papers in April after the leaked legal documents revealed he had millions of pounds of family money offshore. In the face of some of the largest protests the small North Atlantic island had ever seen, the ruling Progressive and Independence parties replaced Gunnlaugsson with the agriculture and fisheries minister, Sigurdur Johansson, and promised elections before the end of the year.

Founded four years ago by a group of activists and hackers as part of an international anti-copyright movement, Iceland’s Pirates captured five per cent of the vote in 2013 elections, winning three seats in the country’s 63-member parliament, the Althingi. “Then, they were clearly a protest vote against the establishment,” said Eva Heida Önnudóttir, a political scientist at the University of Iceland who compares the party’s appeal to Icelandic voters to that of Spain’s Podemos, or Syriza in Greece. “Three years later, they’ve distinguished themselves more clearly; it’s not just about protest. Even if they don’t have clear policies in many areas, people are genuinely drawn to their principles of transforming democracy and improving transparency.”

Propelled by public outrage at what is widely perceived as endemic cronyism in Icelandic politics and the seeming impunity of the country’s wealthy few, support for the party – which hangs a skull-and-crossbones flag in its parliamentary office – has rocketed. A poll of polls for the online news outlet Kjarninn in late June had the Pirates comfortably the country’s largest party on 28.3%, four points clear of their closest rival, Gunnlaugsson’s conservative Independence party. That lead has since narrowed slightly but most analysts are confident the Pirates will return between 18 and 20 MPs to the Althingi in October, putting them in a strong position to form Iceland’s next government.

“One man told him no one had said a kind word to him in 25 years.”

• An Incredibly Simple Idea To Help The Homeless (WaPo)

Republican Mayor Richard Berry was driving around Albuquerque last year when he saw a man on a street corner holding a sign that read: “Want a Job. Anything Helps.” Throughout his administration, as part of a push to connect the homeless population to services, Berry had taken to driving through the city to talk to panhandlers about their lives. His city’s poorest residents told him they didn’t want to be on the streets begging for money, but they didn’t know where else to go. Seeing that sign gave Berry an idea. Instead of asking them, many of whom feel dispirited, to go out looking for work, the city could bring the work to them.

Next month will be the first anniversary of Albuquerque’s There’s a Better Way program, which hires panhandlers for day jobs beautifying the city. In partnership with a local nonprofit that serves the homeless population, a van is dispatched around the city to pick up panhandlers who are interested in working. The job pays $9 an hour, which is above minimum wage, and provides a lunch. At the end of the shift, the participants are offered overnight shelter as needed. In less than a year since its start, the program has given out 932 jobs clearing 69,601 pounds of litter and weeds from 196 city blocks. And more than 100 people have been connected to permanent employment. “You can just see the spiral they’ve been on to end up on the corner. Sometimes it takes a little catalyst in their lives to stop the downward spiral, to let them catch their breath, and it’s remarkable,” Berry said in an interview.

”They’ve had the dignity of work for a day; someone believed in them today.” Berry’s effort is a shift from the movement across the country to criminalize panhandling. A recent National Law Center on Homelessness & Poverty report found a noticeable increase, with 24% of cities banning it altogether and 76% banning it in particular areas. There is a persisting stigma that people begging for money are either drug addicts or too lazy to work and are looking for an easy handout. But that’s not necessarily the reality. Panhandling is not especially lucrative and it’s demoralizing, but for some people it can seem as if it’s the only option. When panhandlers have been approached in Albuquerque with the offer of work, most have been eager for the opportunity to earn money, Berry said. They just needed a lift. One man told him no one had said a kind word to him in 25 years.