Arthur Rothstein Quarter Circle U Ranch, Big Horn County, MT 1939

Today’s the day UK Chancellor Hammond will present his budget, which will go a long way towards the country’s Brexit plans. So let’s have a few articles that make you wonder why you would want to belong to a club that includes these people.

This first one makes me think: if this is the best piece I read all day, I’m good.

• UK Water Firms Admit Using Divining Rods To Find Leaks And Pipes (G.)

Ten of the 12 water companies in the UK have admitted they are still using the practice of water dowsing despite the lack of scientific evidence for its effectiveness. The disclosure has prompted calls for the regulator to stop companies passing the cost of a discredited medieval practice on to their customers. Ofwat said any firm failing to meet its commitments to customers faced a financial penalty. Dowsers, or water witchers, claim that their divining rods cross over when the presence of water is detected below ground. It is regarded as a pseudoscience, after numerous studies showed it was no better than chance at finding water. Some water companies, however, insisted the practice could be as effective as modern methods.

The discovery that firms were still using water diviners was made by the science blogger Sally Le Page, after her parents reported seeing an engineer from Severn Trent “walking around holding two bent tent pegs to locate a pipe” near their home in Stratford-upon-Avon. Le Page asked Severn Trent why it was still using divining rods to find pipes when there was no evidence that it worked. Replying on Twitter, the company said: “We’ve found that some of the older methods are just as effective than the new ones, but we do use drones as well, and now satellites.” Le Page then asked the other 11 water companies whether they were using water dowsing. Only one, Wessex Water, said it did not use divining rods, and one, Northern Ireland Water had yet to reply. The other nine confirmed the practice was still used in some form in their areas.

The second one defies all belief. What else is appropriate but utter silence?

• UK MPs Vote ‘That Animals Cannot Feel Pain Or Emotions’ (Ind.)

MPs have voted to reject the inclusion of animal sentience – the admission that animals feel emotion and pain – into the EU Withdrawal Bill. The move has been criticised by animal rights activists, who say the vote undermines environment secretary Michael Gove’s pledge to prioritise animal rights during Brexit. The majority of animal welfare legislation comes from the EU. The UK Government is tasked with adopting EU laws directly after March 2019 but has dismissed animal sentience. The Government said during the debate before the vote that this clause is covered by the Animal Welfare Act 2006. The RSPCA disputed the Government’s claim. “It’s shocking that MPs have given the thumbs down to incorporating animal sentience into post-Brexit UK law,” RSPCA head of public affairs David Bowles told Farming UK.

“In addition, 500 reusable or so-called “keep cups” were purchased in 2013, but only four of these have been sold in the last three years.”

• UK Environment Department Using 1,400 Disposable Coffee Cups A Day (G.)

More than 2.5m disposable cups have been purchased by the UK’s environment department for use in its restaurants and cafes over the past five years – equivalent to nearly 1,400 a day. The Liberal Democrats’ environment spokesman, Tim Farron, said the revelation, obtained through a freedom of information request, showed Michael Gove “needs to get his own house in order” in light of his public pledges to tackle the growing scourge of plastic pollution. The Lib Dems revealed that 516,000 disposable cups had been purchased by the Department for Environment, Food and Rural Affairs’ (Defra) catering contractors in the last year alone, under two separate outsourced contracts for use in catering outlets across its sites.

The figure was 589,700 in 2016 and 785,100 the previous year. The catering contractors did not previously provide any reusable cups, but purchased 200 reusable cups on 31 October 2017. Separate figures uncovered by the Lib Dems have revealed the House of Commons itself is also failing to get to grips with disposable cup waste, using almost 4m disposable cups in the past five years. They reveal that 657,000 disposable cups have been purchased by the Commons’ catering service in the last year alone – equivalent to 1,000 per MP – but down from 918,700 in 2013. In addition, 500 reusable or so-called “keep cups” were purchased in 2013, but only four of these have been sold in the last three years.

Everything bubble. Where’s Tesla, Uber, Airbnb?

Yesterday we presented readers with one of the most pessimistic, if not outright apocalyptic, 2018 year previews, courtesy of BofA’s chief investment, Michael Hartnett who warned that in addition to the bursting of the bond bubble in the first half of the year, the stock market could see a 1987-like flash crash, potentially followed by a sharp spike in (violent) social conflict. However, in addition to his forecast, Hartnett also had one of the more informative, and descriptive, reviews of the year that was, or as he put it: 2017 was the perfect encapsulation of an 8-year QE-led bull market.

Here are his 15 bullet points that show why in 2017 we may have seen the biggest bubble ever (and why we can’t wait to see what 2018 reveals).

• Da Vinci’s “Salvator Mundi” sold for staggering record $450mn

• Bitcoin soared 677% from $952 to $7890

• BoJ and ECB were bull catalysts, buying $2.0tn of financial assets

• Number of global interest rate cuts since Lehman hit: 702

• Global debt rose to a record $226tn, record 324% of global GDP

• US corporates issued record $1.75tn of bonds

• Yield of European HY bonds fell below yield of US Treasuries

• Argentina (8 debt defaults in past 200 years) issued 100-year bond

• Global stock market cap jumped1 $15.5tn to $85.6tn, record 113% of GDP

• S&P500 volatility sank to 50-year low; US Treasury volatility to 30-year low

• Market cap of FAANG+BAT grew $1.5tn, more than entire German market cap

• 7855 ETFs accounted for 70% of global daily equity volume

• The first AI/robot-managed ETF was launched (it’s underperforming)

• Big performance winners: ACWI, EM equities, China, Tech, European HY, euro

• Big performance losers: US$, Russia, Telecoms, UST 2-year, Turkish liraAs Hartnett summarizes, “2017 was a perfect encapsulation of an 8-year QE-led bull market”

Xi needs to start letting zombies die, or he’ll lose control.

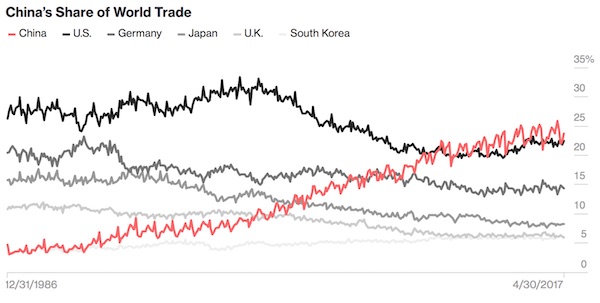

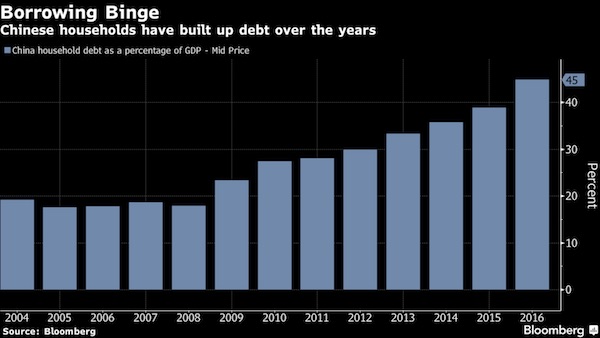

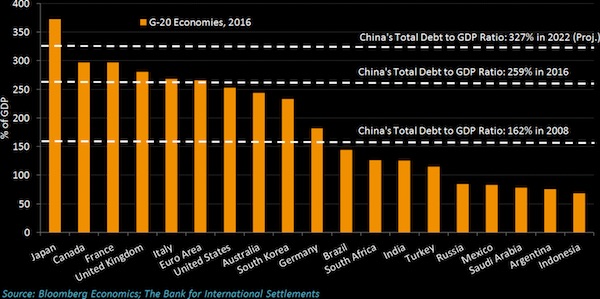

• China Is On Course To Become One Of The World’s Most Indebted Nations (BBG)

China’s debt is poised to soar over the next five years, severely reducing the chances the nation can avoid a financial crisis. Bloomberg Economics economists Fielding Chen and Tom Orlik estimate China’s total debt will reach 327% of GDP by 2022, double the level in 2008. That will put China among the most indebted countries in the world. “The rapid growth and high level of China’s debt have already placed them in the danger zone for a financial crisis,” said the economists in a note published Tuesday. “Adding debt equivalent to almost 70% of GDP in the next five years wouldn’t mean a crisis is inevitable, but it would severely reduce the chances of avoiding one.”

Central bank Governor Zhou Xiaochuan, who has hinted he’ll soon retire, recently warned of the risks in company and household debt, saying that corporate borrowing was “very high” and that the nation needs to be on guard against excessive optimism that could spark a sudden drop in asset prices. The Bloomberg estimates of future debt levels are based on a new model that assumes a moderate slowdown in growth, continued rebalancing of the structure of the economy toward services, a stabilization in the credit intensity of growth, and continued large-scale write-offs of bad loans. Economic expansion is expected to slow to 5.8% in 2022 from 6.7% in 2016, the economists said. Nominal growth, more relevant for calculating the debt-to-GDP ratio, is expected to edge down to 7.9% in 2022 from 8% in 2016, they said.

Bridges to nowhere and ghost cities account for a large part of China GDP growth.

• China’s Growth Miracle Has Run Out Of Steam (Pettis)

China’s 19th Communist party congress ended last month with an indication that Xi Jinping’s new administration plans to rein in debt by abandoning the country’s long-term economic targets and allowing gross domestic product growth to fall. Typically, analysts assume that changes in reported GDP reflect movements in living standards and productive capacity. In China, however, this is not the case. Local governments are expected to boost spending by whatever amount is needed to meet the country’s targets, whether or not it is productive. GDP growth is not the same as economic growth. Consider two factories that cost the same to build and operate. If the first factory produces useful goods, and the second produces unwanted ones that pile up as inventory, only the first boosts the underlying economy.

Both factories, however, will increase GDP in exactly the same way. Most economies, however, have two mechanisms that force GDP data to conform to underlying economic performance. First, hard budget constraints, which set spending limits, drive companies that systematically waste investment out of business before they can substantially distort the economy. Second, there is a market-pricing factor in GDP accounting that when bad debts caused by wasted investment are written down, the value-added component of GDP and the overall level of reported growth are reduced. In China, however, neither mechanism works. Bad debt is not written down and the government is not subject to hard budget constraints.

It is the government sector that is mainly responsible for the investment misallocation that characterises so much recent Chinese growth. The implications are obvious, even if most economists have been surprisingly reluctant to acknowledge them. Anyone who believes there has been a significant amount of wasted investment in China must accept that reported GDP growth overstates the real increase in wealth by the failure to recognise the associated bad debt. Were it correctly written down, by some estimates GDP growth would fall below 3%.

Anyone buying into Tesla will get what they deserve.

• Tesla’s Burning Through Nearly Half a Million Dollars Every Hour (BBG)

Elon Musk said last week that Tesla is designing a new sports car that could go from zero to 60 mph in 1.9 seconds. Not bad, but here’s a speed number that investors might want to focus on instead: Over the past 12 months, the electric-car maker has been burning money at a clip of about $8,000 a minute (or $480,000 an hour), Bloomberg data show. At this pace, the company is on track to exhaust its current cash pile on Monday, Aug. 6. (At 2:17 a.m. New York time, if you really want to be precise.) To be fair, few Tesla watchers expect the cash burn to continue at quite such a breakneck pace, and the company itself says it’s ramping up output of its all-important Model 3, which will bring money in the door. But still, its need for fresh cash came into high relief last week when Musk unveiled his latest plan to raise funds. He’s asking customers to pay him upfront to order vehicles that may not be delivered for years.

The Founders Series Roadster will cost buyers a $250,000 down payment even though it’s not coming for more than two years. Orders of those cars are capped at 1,000, meaning they alone could generate $250 million. Tesla is charging a total of $50,000 for reservations of the regular Roadster. Companies can also pre-order electric Semi trucks for $5,000, though they don’t go into production until 2019. But all this is a pittance compared with Tesla’s financial needs. It’s blowing through more than $1 billion a quarter thanks to massive investment in making the Model 3, a $35,000 car that’s looking less likely to generate a return anytime soon. “Whether they can last another 10 months or a year, he needs money, and quickly,” said Kevin Tynan, senior analyst with Bloomberg Intelligence, who estimates Tesla will be required to raise at least $2 billion in fresh capital by mid-2018.

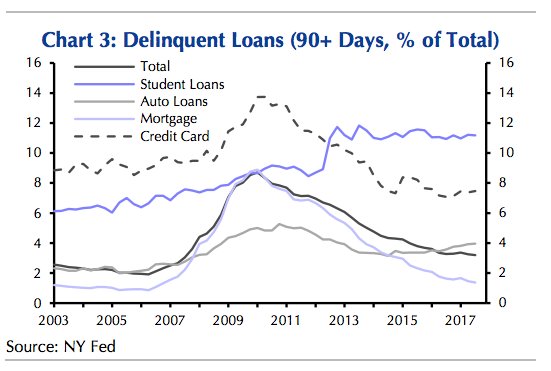

Oh, puhlease… “The rise in new delinquencies is difficult to square with the continued strength of the labor market.”

• US Credit Card Delinquencies Spike (BI)

Americans are having increasing trouble paying their credit card bills, a potentially ominous sign for an economy reliant on consumer spending for some two-thirds overall activity. US credit card debt recently surged to new record highs, surpassing peaks seen before the 2008 financial crisis. Several large US banks and credit card companies reported a rise in credit card delinquency rates for August, the second consecutive monthly rise. Michael Pearce, economist at Capital Economics, does not see the spike as a major threat to the growth outlook for now. But given the prospect of higher interest rates from the Federal Reserve next year, it could become a growing problem. “The increase in new delinquencies may be an early sign of stress in household finances,” he wrote in a note sent out to clients on Friday.

“After all, credit card lending is one of the most expensive forms of borrowing, and missing a credit card payment doesn’t carry the same risk of repossession as falling behind on mortgage or car payments might,” Pearce added. “The rise in new delinquencies is difficult to square with the continued strength of the labor market.”

Feature not flaw.

• Too-Big-To-Fail Banks Keep Getting Bigger (CNN)

Many too-big-to-fail banks have grown even larger during the decade since the financial crisis. The 2008 meltdown showed how big banks that get into trouble can hold the entire global economy hostage. Hoping to avoid another round of unpopular bailouts, financial watchdogs have forced too-big-to-fail banks to make themselves less dangerous by adding lots of capital that safeguards against losses. But regulators continue to monitor these financial institutions, creating a list of 30 “systemically important” banks that deserve extra scrutiny. JPMorgan Chase sits atop that list of banks that could threaten global stability, according to new rankings published on Tuesday by international regulators. While JPMorgan has been required to take significant steps to make itself less risky, America’s leading bank has nonetheless gotten much bigger over the past decade.

JPMorgan has amassed an incredible $2.56 trillion in assets. That’s nearly twice as much as at the end of 2006 when the subprime mortgage bubble was beginning to burst. A chunk of JPMorgan’s growth is due to its government-backed rescues of failing Bear Stearns and Washington Mutual. Bank of America and Deutsche Bank are ranked one level below JPMorgan on the “systemically important” list published by the Financial Stability Board. BofA’s asset footprint has soared by 56% since the end of 2006 to $2.28 trillion. Deutsche Bank’s asset size has increased by 21% over that span, according to FactSet. Wells Fargo, which acquired failing Wachovia during the financial crisis, is sitting on $1.93 trillion. That’s up nearly 300% since the end of 2006.

Big banks in China are also growing at a rapid pace. China’s four systemically important banks have more than tripled their asset sizes over the last 10 years, according to S&P Global Market Intelligence. Industrial and Commercial Bank of China is the world’s largest bank, with $3.76 trillion in assets. That’s up from $1.11 trillion at the end of 2006. “If and when another crisis hits, the biggest players will be far larger than they were in the last crash,” S&P Global Market Intelligence wrote in a report.

“Roughly 8 million Americans are on long-term opioid therapy for chronic pain, and as many as a million are taking dangerously high doses..”

• US Doctors Cut Off Opioids, Leaving Millions in Pain and Withdrawal (BBG)

Six months after surgery to repair a damaged urinary tract in 1998, computer technician Doug Hale woke one morning with excruciating, burning pain. Hale’s suffering persisted for years, despite all sorts of treatments. Finally, in 2006, he was prescribed strong doses of opioids. Fast-forward 10 years. Still on his pain killers, Hale was popping so many of the highly addictive pills that he regularly ran out of his prescription early. His doctor cut off his supply and urged Hale to enter a detox program. That didn’t work. Hale, still in agonizing pain and now suffering from intense withdrawal symptoms, returned to his doctor and pleaded to get back on his opioid regime. The doctor refused. The next day, Hale put the barrel of a small-gauge gun in his mouth and pulled the trigger.

It would be tempting to view Hale’s death, at 53, as one more sad entry in the never-ending national tragedy of opioid deaths. In fact, it’s much more than that. Hale’s story is a window into the country’s silent majority of opioid sufferers. These are the millions of painkiller-dependent users inhabiting a vast gray zone somewhere between medical patient and drug addict, who are finding themselves suddenly abandoned in droves by the medical system. Under threat of lawsuits and government and insurance industry crackdowns, doctors have been cutting off the supply of painkillers, forcing many of their patients to quit cold turkey after years or even decades of dependence, sometimes with catastrophic consequences. Worst of all, those left suddenly without their meds often have nowhere to turn for help.

[..] Roughly 8 million Americans are on long-term opioid therapy for chronic pain, and as many as a million are taking dangerously high doses, said Michael Von Korff, a senior researcher at the Kaiser Permanente Washington Health Research Institute. In the Medicare program alone, 500,000 patients were on high opioid doses in 2016, according to a 2017 report from the U.S. Department of Health and Human Services.

Close it down. Or lawsuits will.

• Uber Concealed Cyberattack Exposing Data Of 57 Million Users, Drivers (BBG)

Hackers stole the personal data of 57 million customers and drivers from Uber Technologies Inc., a massive breach that the company concealed for more than a year. This week, the ride-hailing firm ousted its chief security officer and one of his deputies for their roles in keeping the hack under wraps, which included a $100,000 payment to the attackers. Compromised data from the October 2016 attack included names, email addresses and phone numbers of 50 million Uber riders around the world, the company told Bloomberg on Tuesday. The personal information of about 7 million drivers was accessed as well, including some 600,000 U.S. driver’s license numbers. No Social Security numbers, credit card information, trip location details or other data were taken, Uber said.

At the time of the incident, Uber was negotiating with U.S. regulators investigating separate claims of privacy violations. Uber now says it had a legal obligation to report the hack to regulators and to drivers whose license numbers were taken. Instead, the company paid hackers to delete the data and keep the breach quiet. Uber said it believes the information was never used but declined to disclose the identities of the attackers. “None of this should have happened, and I will not make excuses for it,” Dara Khosrowshahi, who took over as CEo in September, said in an emailed statement. “We are changing the way we do business.” After Uber’s disclosure Tuesday, New York Attorney General Eric Schneiderman launched an investigation into the hack, his spokeswoman Amy Spitalnick said. The company was also sued for negligence over the breach by a customer seeking class-action status.

[..] In January 2016, the New York attorney general fined Uber $20,000 for failing to promptly disclose an earlier data breach in 2014. After last year’s cyberattack, the company was negotiating with the FTC on a privacy settlement even as it haggled with the hackers on containing the breach, Uber said. The company finally agreed to the FTC settlement three months ago, without admitting wrongdoing and before telling the agency about last year’s attack.

Airbnb gambles that it’s above and beyond the law. Let’s see.

• Airbnb Locks Horns With Athens (K.)

In its first public statement on Greek tax affairs, Airbnb took a tough stance against the Greek government and refused to share the tax details of the property owners with whom it cooperates with the Greek state. The short-term property lease website announced a few days ago that “hosts on Airbnb want to pay their share of tax and we want to help but in respect of their privacy. Personal data are subject to strict rules to protect privacy and we want to work together on a better way forward. Airbnb routinely shares information with Greece on the impacts of home sharing. Personal data is shared only through a valid legal request pursuant to national and European data privacy laws.”

The US-headquartered home-sharing firm therefore refuses to supply the tax registration numbers of its property owners, even though it knows that multiple property entries by the same owner aimed at tax-free investment utilization concerns at least 40% of its customers in Greece. According to Greek law, owners are not allowed to lease out more than two properties per tax registration number unless they set up a company for that purpose and are taxed accordingly. This is why it is crucial to distinguish owners who just top up their income from those who let properties for short periods as a professional/investment activity.

According to Airbnb, the average annual takings of Greek owners last year came to €2,375, while the average occupancy stood at just three days per month. However, this is far from representative as it also includes thousands of properties listed without having a single visitor and therefore no revenues, as they have been incorrectly registered or are simply located in unpopular areas. The vast majority of Greek owners on Airbnb appear to “forget” to declare their revenues from this activity to the tax authorities, knowing that the monitoring mechanism is unable to cross-check and inspect their revenues because their guests are typically foreign citizens who would not declare their expenditure to the Greek authorities.

Guess which one of the three will actually pan out.

• Greek Budget For 2018 Sees High Growth, Surplus And More Taxes (K.)

The government on Wednesday submitted the 2018 budget in Parliament, predicting a higher-than-expected primary surplus, of 3.8% of GDP, and a growth rate of 2.5%, as well as additional austerity with some 1 billion euros in new taxes. The strong growth rate of 2.5% is projected to follow a 1.6% expansion this year – a figure that has been downwardly revised twice following an original forecast of 2.7%. In a report accompanying the budget, the Finance Ministry looked forward to an “exit from a long period of programs of macroeconomic adjustment,” referring to Greece’s anticipated exit from its third foreign bailout in the summer of next year. The budget – which is to be voted on in Parliament on December 22 – foresees a primary surplus of 2.4% of GDP for this year, significantly above a target of 1.75%, and 3.8% for 2018.

“The significant overshooting of the targets… has contributed to restoring international trust in Greek public finances and created the preconditions for the country’s return to international capital markets in a sustainable way,” the ministry noted in its report. The budget also provides details about a “social dividend,” heralded by Prime Minister Alexis Tsipras last week, for 1.4 million households. The handout is worth an average of 483 euros, the ministry said, adding that a projected increase in growth rates in the coming years should allow the government to broaden its initiatives for social protection. The budget also includes a list of 12 measures that were passed in Parliament earlier this year but have yet to be implemented.

They include increases in social security contributions, cuts to heating and oil subsidies, higher tax rates for medium-sized and large properties, the elimination of value-added tax breaks for dozens of Aegean islands that had enjoyed a reduced rate of VAT, and a new hotel stayover levy. There are fears that the latter could have an impact on tourism, which remains one of Greece’s few dynamic economic sectors. The government hopes that the 12 measures will raise around 1 billion euros in revenue.