Rembrandt An Old Scholar Near a Window in a Vaulted Room 1631

“.. the logical and unavoidable result of the end of QE is that asset prices must fall and excessive debt must be reduced.”

• Asset Prices & Monetary Policy in an Irrational World (Whalen)

[..] Let’s wind the clock back two decades to December 1996. The Labor Department had just reported a “blowout” jobs report. Then-Federal Reserve chairman Alan Greenspan had just completed a decade in office. He made a now famous speech at American Enterprise Institute wherein Greenspan asked if “irrational exuberance” had begun to play a role in the increase of certain asset prices. He said:

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. Indeed, the sharp stock market break of 1987 had few negative consequences for the economy. But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy.”

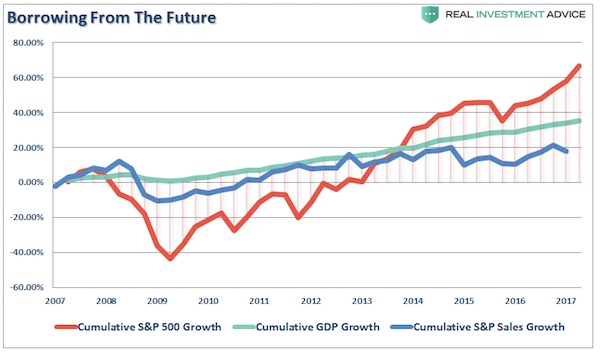

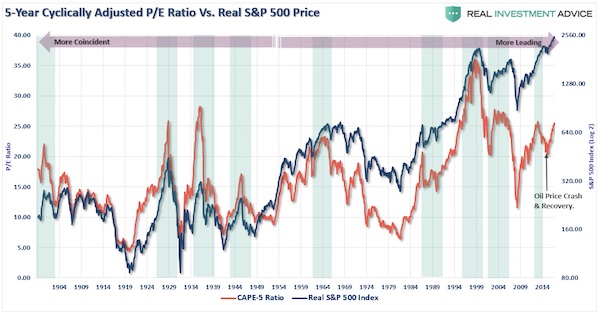

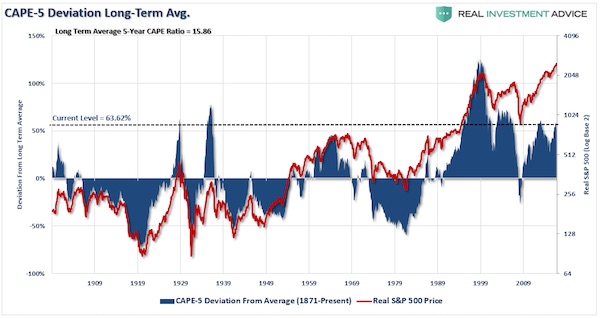

In the wake of the 2008 financial crisis, the FOMC abandoned its focus on the productive sector and essentially substituted exuberant monetary policy for the irrational behavior of investors in the roaring 2000s. In place of banks and other intermediaries pushing up assets prices, we instead have seen almost a decade of “quantitative easing” by the FOMC doing much the same thing. And all of this in the name of boosting the real economy?

The Federal Reserve System, joined by the Bank of Japan and the ECB, artificially increased assets prices in a coordinated effort not to promote growth, but avoid debt deflation. Unfortunately, without an increase in income to match the artificial rise in assets prices, the logical and unavoidable result of the end of QE is that asset prices must fall and excessive debt must be reduced. Stocks, commercial real estate and many other asset classes have been vastly inflated by the actions of global central banks. Assuming that these central bankers actually understand the implications of their actions, which are nicely summarized by Greenspan’s remarks some 20 years ago, then the obvious conclusion is that there is no way to “normalize” monetary policy without seeing a significant, secular decline in asset prices. The image below illustrates the most recent meeting of the FOMC.

Great piece of history.

• Central Banks Will Cause An Orgy of Blood (Clarmond)

The Bank of Japan’s current path provides an ominous reminder of a similar era 80 years ago. These policies, which are also being followed by the other world central banks, will lead to disaster. “One man – one kill” railed Inoue Nissho, leader of the Ketsumeidan (the Blood Pledge Corps), a Japanese ultranationalist group of the 1930s committed to cleansing the country of ‘traitors’ – the leaders of business and government. The first name on their death list was Inoue Junnosuke, a former Finance Minister, an austerity advocate and former governor of the Bank of Japan (BOJ); he was shot as he visited a nursery school. The next name was Dan Takuma, head of the Mitsui Group, the Japanese Goldman Sachs; he was shot in front of his office in the fashionable Nihonbashi district.

Further attacks on the BOJ and Mitsubishi Bank followed but were unsuccessful. The “world of cosmopolitan finance had collided with nationalist resentment.” The liberal elite was stunned, unable to provide answers to the social turmoil of the time; and with the establishment paralysed, the public began to sympathise with the killers’ aims. Enter Finance Minister Takahashi Korekiyo. He placated the nationalists by championing massive deficit financing, via the BOJ, to pull Japan out of its economic morass. Japan’s economy soon embarked on a period of economic growth with stable prices, full employment and humming factories, an “economic nirvana.” Seven decades later these results were heralded a success by another central banker trying a similar trick – Ben Bernanke. Korekiyo’s plan was to fund government spending by having the BOJ directly purchase all the government-issued bonds.

The hope was that, when conditions and inflation improved, the bonds would be sold back into the market. Four years later, the BOJ’s balance sheet was 90% of GDP, and the economy (and for “economy” read military) was totally dependent on government spending financed by the BOJ. As the first modest hint of inflation arrived Korekiyo attempted to sell government bonds publicly, but the auction failed. With this failure it became clear that the bonds which had been stuffed onto the BOJ’s balance sheet could never be sold. Korekiyo’s struggle to ‘cut up the credit card’ culminated in him suffering a similar fate to Junnosuke and being cut up in an attack of army machetes. As the BOJ’s balance sheet crossed 100% of GDP, there could be no turning back, the road to conflict had been primed by the BOJ’s swollen balance sheet and the money that had flooded into the military.

The current Bank of Japan’s balance sheet has now again crossed that fabled 100% of GDP and it is getting close to owning 45% of outstanding government bonds. There is no end in sight with the BOJ buying $60 billion a month of government debt. At this current pace the modern BOJ will by 2019 be the proud owner of 60% of the local bond market. There is no longer a market price for a Japanese Government Bond, it is an asset whose price is set by the BOJ. The key difference between today and the 1930s is that Japan now has an open capital account, therefore the only untethered market price is the currency. The Yen’s continued devaluation will be deep and comprehensive, while Japanese equities will continue to rise, adjusting to the currency loss.

Musical chairs. Won’t change a thing.

• Global Central Banking Leadership Flux Looms (R.)

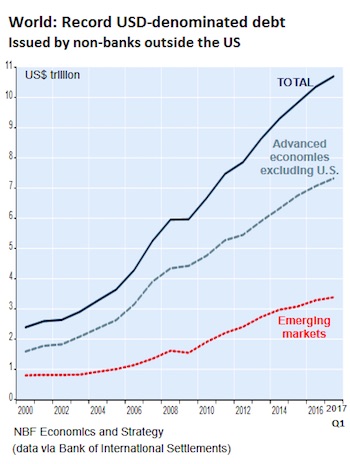

The leaders of the world’s top central banks who risked trillions of dollars and their reputations to rescue the global economy are now set to walk off stage at a time when the lingering effects of the crisis, evolving technology and a combustible political landscape will challenge their successors. The Fed, the Bank of Japan and the People’s Bank of China may all have new bosses in early 2018 and there will be a new head of the ECB the following year. The new leaders will have to deal with the hangover from the 2007-2009 crisis and its immediate aftermath as well as newly emerging risks. Some $10 trillion in assets bought by the Fed, the ECB and the BOJ to prop up their economies remains on the books and will have to be pared back. Stubbornly low global inflation and weak growth complicate the return to more conventional policies.

There are unfinished reforms in China and Europe, while the rise of nationalism could erode central bank independence. Further ahead, the spread of cryptocurrencies and other technologies threatens to weaken central bank control over the financial system. “The bad news is that in a crisis people learn by doing,” said Vincent Reinhart, chief economist at investment firm Standish Mellon and a longtime official at the Federal Reserve. “Will the next set of people have the set of experiences that allows them to do that? Will they have a test?” The changing of the guard could veer in unpredictable directions. China’s president is considering a provincial official to succeed Zhou Xiaochuan, a veteran policymaker who has led the central bank since 2002 and whom analysts regard as a champion of reforms that could falter without his leadership.

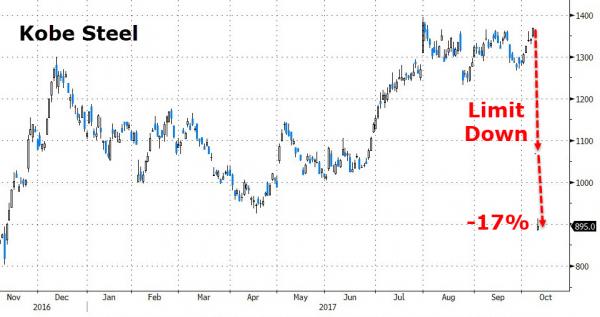

Even had a fraud manual. This keeps growing by the day.

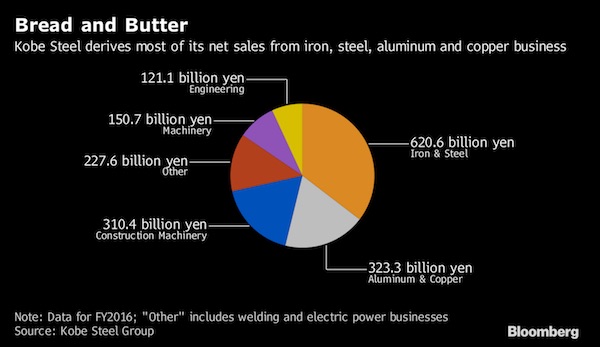

• Kobe Steel Faked Quality Data For Decades (Nikkei)

Product quality data was falsified for decades at some Kobe Steel plants in Japan, well beyond the roughly 10-year time frame given by the steelmaker, a source with knowledge of the situation said Monday. Employees involved in the data manipulation used the industry term tokusai to refer to shipping of products that did not meet the standards requested by customers, the source said. Though tokusai usually refers to voluntary acceptance of such products, plants sometimes sent substandard goods without customers’ consent. The word was apparently in use at some plants for 40 to 50 years. The cheating procedures eventually became institutionalized in what was essentially a tacit fraud manual, allowing the practice to continue as managers came and went. Data manipulation may have occurred with the knowledge of plant foremen and quality control managers. Some shipments even came with forged inspection certificates.

Kobe Steel has tapped senior officials in the aluminum and copper business – where most of the misconduct took place – to serve on its board. How far up the chain of command knowledge of the fraud may have extended in the past remains an open question. Systemic data falsification took place at four Japanese production sites. The scandal has spread to the manufacturer’s mainstay steel business, with revelations Friday that steel wire was also shipped without inspection or with faked certificates. The number of affected customers has swelled from around 200 to roughly 500. Kobe Steel has said it will complete safety inspections for already shipped products in two weeks or so. A report on the causes of the fraud and measures to prevent a recurrence will come out in a month or so. The steelmaker is conducting a groupwide probe that includes interviews with former senior officials.

Yeah, when its Ponzi collapses.

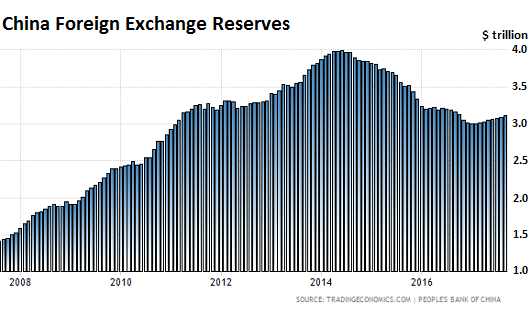

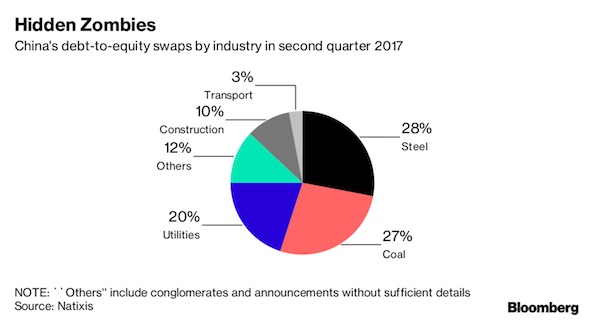

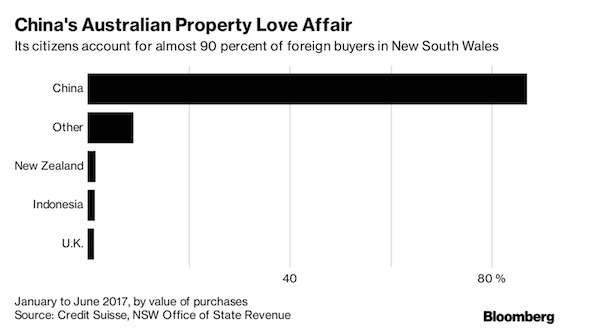

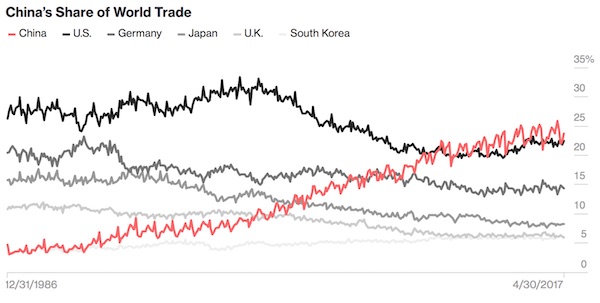

• China’s Impact on Global Markets is About to Get Much Bigger (BBG)

China’s ascension as an economic superstar over the past three-plus decades is out of sync with its heft in global financial markets. But things are starting to change, and investors around the world will feel the difference. China makes up more than one-seventh of the global economy, yet its footprint in international portfolios is ludicrously small, with overseas investors owning less than 2% of its domestic stocks and bonds. But its insulated markets are slowly becoming more integrated, as President Xi Jinping loosens rules on foreign participation. That push could get further backing at the Communist Party’s twice-a-decade congress this month, where the leadership will set policy priorities for the coming five years.

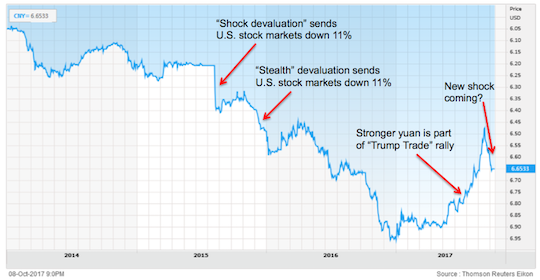

China’s capacity to influence global financial markets has been growing incrementally, but the pivotal moment came in 2015, when the yuan’s unexpected devaluation rocked assets worldwide, showing investors beyond Asia that China’s markets are a force to be reckoned with. The surprise move saw the yuan slide the most in two decades on Aug. 11, 2015, as Beijing sought to shore up economic growth and make China’s exports more competitive. Following on from a Chinese stock rout in mid-2015 that also had a ripple effect globally, the devaluation rattled risk assets for weeks as it was seen as an admission the economy was struggling. Fast forward to 2017, and China’s clout has only expanded, with its lion’s share of global trade making the managed yuan an anchor for currencies throughout Asia.

The nation’s status as both the world’s biggest exporter and the largest market of consumers means policy tweaks in Beijing can affect prices for everything from beef to bitcoin. Trading on Shanghai’s commodity futures market is taking on increasing influence beyond China’s borders. The country’s pivot away from the smokestack industries that have been its growth engine for decades toward high-tech production is already shifting the global landscape for manufacturing and consumption. At the same time, China is looking to draw in more foreign capital by opening conduits to its equity and bond markets, among the largest in the world. That makes the 19th party congress, where Xi will unveil the party’s vision for China over the next five years, key for even the most peripheral of investors.

It’s almost funny.

• China’s Banks Are Bingeing on Bonds Despite Debt Crackdown (BBG)

China’s banks are still bingeing on short-term financing, defying analyst predictions that they would wean themselves off such debt as regulators intensify a crackdown on leverage. Sales of negotiable certificates of deposit — a key funding source for medium and smaller banks — surged 49% from a year ago in the third quarter to a record 5.4 trillion yuan ($819 billion), according to data compiled by Bloomberg. While strategists had predicted in June that the NCD market would shrink, it turned out to be one of the few funding channels left as officials drained cash from the interbank market and asked lenders to strengthen risk controls. China’s deleveraging looms large in debt-market dynamics these days, with government bond yields at two-year highs and the one-week Shanghai Interbank Offered Rate not far from the most expensive since 2015.

Still, officials are also trying to keep the economy humming: they’ve tweaked the rules governing NCD issuance, but haven’t shut off the taps as credit growth accelerates. “The short-term debt is an indispensable fundraising channel for smaller banks,” said Shen Bifan, head of research at First Capital Securities Co.’s fixed-income department in Shenzhen. “As other channels get squeezed, and lenders’ books continue to expand, as is the case now amid solid economic growth, it’d be difficult to see the NCD market size shrink.” Net financing – sales minus maturities – through such securities was at 333 billion yuan in the third quarter, versus a total of 1.7 trillion yuan in the first half, data compiled by Bloomberg show. With more than 8 trillion yuan of contracts outstanding, it’s now the fourth-largest type of bond in China, after sovereign, local government and policy bank debt.

Xi only talks the talk.

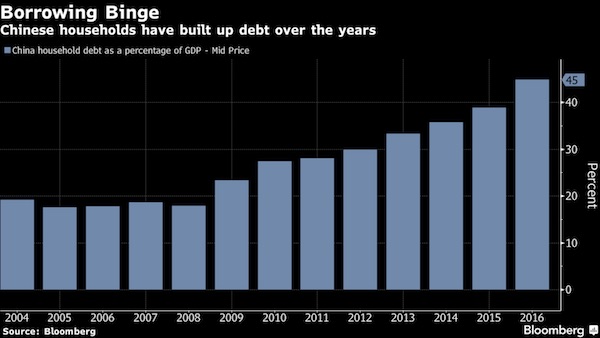

• China Has Only Taken Baby Steps to Cut Leverage (BBG)

China has taken “baby steps” toward cutting leverage as lending from banks slows, but progress has been uneven as borrowing by households and the government has risen, according to S&P Global Ratings. Authorities are adopting both tight and loose policies to try to reduce the country’s dependency on debt without causing a hard landing, analysts led by Christopher Lee wrote in a note dated Oct. 16. S&P last month cut China’s sovereign rating for the first time since 1999, saying it didn’t believe enough was being done to contain credit growth.

The next big test is whether companies can withstand higher funding costs as financial conditions tighten, according to S&P. “Smaller and less-capitalized banks may feel the liquidity squeeze and pressures on their capital, leading to distress; and default risks could also increase for the local government financing vehicles,” the analysts wrote. “Passing the baton of credit-fueled growth in recent years to households also has many obvious risks,” such as a correction in the property market hurting consumption, they said.

One system.

• Investigations of Wall Street Have Disappeared from Corporate Media (Martens)

Rupert Murdoch’s News Corp. bought Dow Jones & Company in late 2007 after a century of ownership by the Bancroft family. The purchase just happened to come at a time when the Federal Reserve had secretly begun to funnel what would end up totaling $16 trillion in cumulative low-cost loans to bail out the Wall Street mega banks and their foreign counterparts. In 2011, the Pew Research Center released a study on how front page coverage had changed since the News Corp. purchase of the Wall Street Journal. Pew found that “coverage has clearly moved away from what had been the paper’s core mission under previous ownership—covering business and corporate America. In the past three and a half years, front-page coverage of business is down about one-third from what it had been in 2007, the last year of the old ownership regime.”

What is not down but “up” at the Wall Street Journal is its defense of the Wall Street banking giants’ indefensible practices on its editorial and opinion pages. One of the most striking examples of the changing face of corporate media coverage of Wall Street was an October 20, 2013 editorial in the Wall Street Journal headlined:“The Morgan Shakedown.” The unsigned editorial began with this: “The tentative $13 billion settlement that the Justice Department appears to be extracting from J.P. Morgan Chase needs to be understood as a watershed moment in American capitalism. Federal law enforcers are confiscating roughly half of a company’s annual earnings for no other reason than because they can and because they want to appease their left-wing populist allies.”

Actually, there was a very good reason for the $13 billion settlement – but the intrepid investigative reporting on that subject would be done by Matt Taibbi for Rolling Stone – not by the paper still calling itself the “Wall Street” Journal. Taibbi revealed that the U.S. Justice Department had actually settled on the cheap and had failed to reveal to the public that it had the most credible of eyewitnesses to mortgage fraud at JPMorgan Chase – a securities attorney who worked there and had reported the fraud to her supervisors. The attorney, Alayne Fleischmann, told Taibbi that what she witnessed in JPMorgan’s mortgage operations was “massive criminal securities fraud.”

Taibbi’s in-depth report on the matter made the editorial board at the Wall Street Journal appear naïve or captured by Wall Street. It raised the added embarrassing question as to why the Wall Street Journal was out of touch with the details of the Justice Department’s investigation.

This year’s Fauxbel for human behavior, next year’s for animal behavior?

• MIT Economist Andrew Lo Wants You To Realize That Traders Are Animals (BW)

Every reigning theory of finance has holes. The efficient-markets hypothesis says markets are rational and self-regulating, but it doesn’t account for crashes and crises; behavioral finance blames market breakdowns on investors’ short-term thinking, but it fails to account for group dynamics or predict future markets. Andrew Lo spent his early career studying these flaws. Lo, 57, is the Charles E. and Susan T. Harris professor of finance at the MIT Sloan School of Management, but he’s always been a multidisciplinarian. At the Bronx High School of Science, he excelled in biology, physics, chemistry, and mathematics and liked solving broad problems. “I just really enjoyed the dynamics across all these fields,” he says. “I never thought of myself as, I am an economist or I’m a statistician.”

Eighteen years into his research, Lo had a major insight. One day in 1999 his 4-year-old son took off running toward a gorilla cage at the Smithsonian’s National Zoo. “The mother gorilla jumped right in and growled,” he says. “And as soon as she did that, I did the same thing. I ran to my child and brought him back.” The similarity of their reactions startled Lo and caused him to wonder: Could there be other similarities in the way people and animals react to danger and risk? The insight eventually led to the adaptive-markets hypothesis. “Right now, we tend to collect prices and assume that those are the only things that matter” to predict investor behavior, Lo says, whereas an ecologist would try to understand investors as a population—which means accounting for their animal instincts. Lo’s hypothesis says people act in their own self-interest but frequently make mistakes, figure out where they’ve erred, and change their behaviors.

The broader system also adapts. These complex interactions contribute to our booms and busts. Lo’s book-length exploration of the idea, Adaptive Markets, came out in February. Says Ben Golub, a founding partner at BlackRock Inc. and now co-head of the company’s risk and quantitative analysis group: “It makes you realize that at any time in the market, the people who are there are not there by accident.” Some people survived the last financial crisis and might be more risk-averse, and some people who’ve joined since might be more risk-tolerant. “The cautious guys survive for a while and then get pushed out by the more aggressive risk takers, who then get thrown out when the thing blows up in their faces,” Golub says. He’s made the book required reading for many BlackRock employees.

“Varoufakis plans to run for the 2019 European elections, even if he says the European Parliament “is not a real parliament.” But he wants to run in Germany, “to show that federalism is possible, and also that Germany’s current politics is harmful for Germans.”

• Varoufakis Tells Macron To Adopt The ‘Empty-chair’ Tactic (EuA)

More than fifty years ago, in 1965, French President Charles de Gaulle withdrew his ministers from the Council of the EU, de facto vetoing all decisions. According to Yanis Varoufakis, former finance minister for Greece, Macron should consider refreshing this tactic – but for the opposite reason. De Gaulle was defending nation states, while Macron wants to push federalism forward. “Macron has got some good ideas, but he already lost, he is done, belittled by Germany” who refuses to create a budget for the Eurozone, according to the economist, who spoke to the French press in Paris. According to him, the success of the far-right party AfD in September’s parliamentary election gives Germany the perfect excuse to retrench on this dossier. And the European Monetary Fund, proposed by Germany as an alternative to a Eurozone budget, is a sham and not a real compromise, according to Varoufakis.

The only way to force Germany into siding with France on relaunching the federalist process is the empty-chair tactic, he says. A form of “constructive disobedience” [..] “Trying to achieve a permanent reduction of the public deficit under 3% of GDP is nonsensical. It is not a problem to run a public deficit: Arizona will always have one, especially if compared to California. In a federation, this happens a lot. But in the case of France, current public spending will condemn the country to permanent stagnation, because the German industry has a monopoly of numerous markets”, he says. The real priority according to him is investment, which should be raised to €500 billion per year. “The Juncker plan is a farce,” he said.

Without a eurozone budget to relaunch the federalist project, the economist proposes that the European Investment Bank (BEI) issue green bonds to finance large infrastructure projects in clean energy and transport – and that the ECB buys them. “We don’t need to change the treaties. It is already feasible – it is just a question of achieving the consensus of the EIB’s board.” On the type of projects that should be financed, Varoufakis echoes Macron who spoke about a way to cross the old continent without polluting: he would like to develop a railway network from the East to the West as well as invest in clean energy. While he sides with Macron’s federalist elements, including a transnational list for the 2019 European elections, Varoufakis is also very critical of his first steps.

“The speech he gave in Greece was pathetic. Coming to tell us that Greece is out of the crisis is an insult, and speaking from [Athens’ Acropolis] where countless dictators spoke to Greeks adds insult to injury,” said the economist. Varoufakis plans to run for the 2019 European elections, even if he says the European Parliament “is not a real parliament.” But he wants to run in Germany, “to show that federalism is possible, and also that Germany’s current politics is harmful for Germans.”

Excellent and very educational.

• The Kurds Have No Friends But The Mountains (David Graeber)

“The Kurds have no friends but the mountains” — that’s what Mehmet Aksoy used to say. But Mehmet, who was killed Sept. 26 during an attack by the Islamic State in northern Syria, was my friend, and a tireless advocate of the Kurdish freedom movement. He was working on an essay that began with those words when he died. He often used that adage to explain the plight of his people, who have long been used or mistreated by the very powers that claim to spread democracy and freedom through the world. I first met Mehmet at a Kurdish demonstration in London, where he lived. I had come because of my interest in direct democratic movements like the one the Syrian Kurds were building, but ended up feeling as if I was lurking, out of place at the fringe of the gathering, until he walked up and introduced himself.

I came to know him as I’ve now heard many in the community did, as kind and unassuming but somehow larger than life, always juggling a dozen projects, films, essays, events and political actions. Now I think it’s important to tell people about his last project, his writing on the conflict in Kurdistan, so that more of us understand what’s at stake there. He was writing in the shadow of a referendum taking place in neighboring Iraqi Kurdistan that everyone knew would end with a strong endorsement of an independent Kurdish state. But the Syrian Kurdish freedom movement that Mehmet represents has pursued an entirely different vision from that of the Kurds in Iraq: It does not wish to change the borders of states but simply to ignore them and to build grass-roots democracy at the community level.

It frustrated Mehmet that the endless sacrifices of Kurdish fighters against the Islamic State in cities across Syria are being mistakenly seen as justification of more borders and more divisions rather than for less. Too often in the Western news media, the Kurds are grouped together as one homogeneous people, with Syrian Kurds often an afterthought of late because of the attention the Iraqi Kurds have received for their referendum. But the Kurds in these two countries have built very different political systems. The Syrian Kurds have built a coalition with Arabs, Syriacs, Christians and others in the northern slice of Syria that they call Rojava (or, more officially, the The Democratic Federation of Northern Syria.).

RIP. May your courage shine on others.

• Malta Car Bomb Kills Panama Papers Journalist (G.)

The journalist who led the Panama Papers investigation into corruption in Malta was killed on Monday in a car bomb near her home. Daphne Caruana Galizia died on Monday afternoon when her car, a Peugeot 108, was destroyed by a powerful explosive device which blew the vehicle into several pieces and threw the debris into a nearby field. A blogger whose posts often attracted more readers than the combined circulation of the country’s newspapers, Caruana Galizia was recently described by the Politico website as a “one-woman WikiLeaks”. Her blogs were a thorn in the side of both the establishment and underworld figures that hold sway in Europe’s smallest member state.

Her most recent revelations pointed the finger at Malta’s prime minister, Joseph Muscat, and two of his closest aides, connecting offshore companies linked to the three men with the sale of Maltese passports and payments from the government of Azerbaijan. No group or individual has come forward to claim responsibility for the attack. Malta’s president, Marie-Louise Coleiro Preca, called for calm. “In these moments, when the country is shocked by such a vicious attack, I call on everyone to measure their words, to not pass judgment and to show solidarity,” she said. After a fraught general election this summer, commentators had been fearing a return to the political violence that scarred Malta during the 1980s.

In a statement, Muscat condemned the “barbaric attack”, saying he had asked police to reach out to other countries’ security services for help identifying the perpetrators. [..] Caruana Galizia, who claimed to have no political affiliations, set her sights on a wide range of targets, from banks facilitating money laundering to links between Malta’s online gaming industry and the Mafia. Over the last two years, her reporting had largely focused on revelations from the Panama Papers, a cache of 11.5m documents leaked from the internal database of the world’s fourth largest offshore law firm, Mossack Fonseca.

This is theater. And it’s empty.

• IMF Chief Calls For Implementation Of Greek Program, Debt Relief (K.)

Managing Director of the IMF, Christine Lagarde, has praised Greece’s progress on reforms while saying that implementation of the adjustment program coupled with an agreement on debt relief are key to leading the debt-wracked country out of the crisis. The IMF chief made the comments after a meeting with Greek Prime Minister Alexis Tsipras in Washington Monday to discuss recent developments in Greece and key issues ahead. “I was very pleased to welcome Prime Minister Tsipras to the IMF today. I complimented him and the Greek people on the notable progress Greece has achieved in the implementation of difficult policies, including recent pension and income tax reforms. We had an excellent and productive meeting,” Lagarde said in a statement after the meeting.

“The IMF recently approved in principle a new arrangement to support Greece’s policy program. Resolute implementation of this program, together with an agreement with Greece’s European partners on debt relief, are essential to support Greece’s return to sustainable growth and a successful exit from official financing next year,” Lagarde said. “The prime minister and I are committed to working together towards this goal,” she said. In his comments, Tsipras said that “after several years of economic recession Greece has turned a page.” The Greek prime minister said that it is in everyone’s interest to wrap up the third bailout review as swiftly as possible.

Numbers rising as we speak.

• 2,000 Refugees, Migrants Landed in Greece Since October 1 (GR)

A total of 1,877 migrants and refugees crossed into the northern Aegean islands from the Turkish coast during the first 15 days of October. According to official figures, 1,148 have arrived in Lesvos; 572 in Chios, and 117 in Samos. In addition to this, on Monday morning, 44 people arrived in Lesvos and 157 in Chios. Between October 1 and 13, the Turkish coast guard announced that it had located 25 incidents involving dinghies with migrants and refugees on board, that had attempted to reach the Greek waters. 907 people have been returned back to Turkey.