Rembrandt Old Man Sitting 1631

One thing nobody seems to be able to figure out. And one more thing that everyone thinks should keep on growing.

• The Great Productivity Slowdown (WSJ)

Equity markets have hit multiyear highs and consumer sentiment is buoyant. Yet economic productivity remains lackluster. The Labor Department announced Thursday that worker productivity fell 0.6% since January, a much bigger drop than expected. This is neither a statistical illusion nor a hangover from the Great Recession. The productivity slowdown began long before the financial crisis, and it has worsened markedly in the past six years. The drop-off extends to wholesale and retail trade, manufacturing, construction, utilities and a host of private and public services. Industries that consume and produce information technology and communications are not immune to the slowdown. From 1950 to 1970, U.S. productivity grew on average by 2.6% annually. From 1970 to 1990 it fell to 1.5%.

The information technology boom of the ’90s interrupted the slide, but since 2010 U.S. productivity growth has been in free fall. It is now roughly 0.6% a year. No wonder Federal Reserve Chair Janet Yellen recently called low productivity a “significant problem.” Various estimates suggest that had U.S. productivity growth not slowed, GDP would be about $3 trillion higher than it is today. How is this happening during a technological revolution? Some think the data are wrong. Economist Joel Mokyr explained in 2014 that metrics devised for a “steel-and-wheat economy” fail to capture adequately transformative advances in information technology, communications and the biosciences. Technology has reduced the cost of information, expanded consumer choice, and provided customization and better price comparison.

This progress has been mostly missed in current statistics. GDP also does not fully capture metrics like time saved from shopping online. Nor does it include the value of leisure and the well-being that technology provides its users. Many economists contend that properly counting free digital services from companies like Google and Facebook would substantially boost productivity and GDP growth. One of the highest estimates, calculated by economists Austan Goolsbee and Peter Klenow, stands at $800 billion. That’s a big number, but not big enough to fill a $3 trillion hole.

Talking about reasons productivity is not growing…

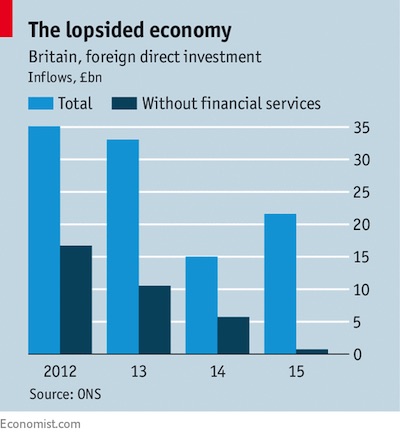

• Take Away Finance, and Britain’s Foreign Investment Figures Collapse (Econ.)

Here is a riddle. Britain, for now at least, is loved by foreign investors. The stock of inward foreign direct investment (FDI) in Britain’s assets and shares is larger than anywhere except America and Hong Kong. In the past decade overseas investors have splurged some £600bn ($772bn), equivalent to a third of British GDP, to acquire over 2,000 British firms. The textbooks say that foreign investments make a country more productive. The new arrivals should bring with them cutting-edge capital assets and best-practice management. So why over the past decade has Britain’s productivity barely improved? The question matters for all Britons. If productivity growth is low, then wage growth will be too. Many factors determine Britain’s weak productivity growth, including creaky infrastructure. But new official data suggest that foreign investors are doing a lot less to improve the economy than commonly assumed.

The figures classify FDI flows into around 100 industries. In 2015 financial services accounted for an astonishing 95% of net inflows. This could include, for instance, foreign funding for Britain’s burgeoning financial-technology sector. Finance was unusually dominant in 2015, though even in 2012-14 the industry made up around 60% of the net figure. Remove financial services, and overall in 2015 a tiny amount of net foreign investment flowed into Britain—a few billion pounds at best. Many industries saw “negative inflows”, suggesting that foreigners were actually disinvesting, selling assets they had acquired back to British firms, for instance. In 2015 they pulled around £20bn from the oil-and-gas sector. Perhaps £1.5bn drained from manufacturing. Finance aside, investors seem to see few profitable opportunities in Britain.

What foreign investment does flow into the “real” economy may make surprisingly little difference. Much of it seems to be about one big company horizontally acquiring another, perhaps with the aim of eliminating overlapping marketing costs (such as in the Kraft-Cadbury deal of 2010) or of acquiring a trophy asset (such as the Tata-Corus steelmaker deal of 2007). A chunk of investment in Britain, meanwhile, is a statistical by-product of big firms moving headquarters for tax purposes rather than anything meaningful. As Britain begins the process of leaving the EU, interest from foreign investors is only likely to shrink. If so, the prospects for the kind of foreign investment that lifts productivity will start to look even gloomier.

Democracy and emergency. Odd pair.

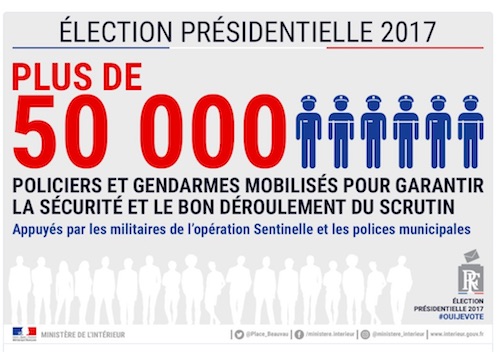

• Round 2 Of French Presidential Elections Held Amid State Of Emergency (RT)

French voters are heading to the polls to choose France’s next president. The presidential runoff between centrist Emmanuel Macron and right-wing Marine le Pen is the first to take place amid an ongoing state of emergency, introduced in the country after 2015 terrorist attacks. French authorities have introduced extra security measures for the poll. This time “more than 50,000 policemen, gendarmes will be deployed [across the country] on Sunday”, French interior ministry spokesman Pierre-Henry Brandet told AFP on Thursday.Soldiers from Operation Sentinel will also “ensure security around polling stations and [will be able] to intervene immediately in case of any incident,” he added. Operation Sentinel was launched by the French Army in the aftermath of the Charlie Hebdo attack in January of 2015 and the subsequent Paris strikes.

Paris police promised that at least 12,000 soldiers and police were to be drafted to Paris and its surrounding suburbs on Sunday, with 5,000 of securing polling stations and guaranteeing public order, as cited by AFP. People on social media have been calling for protests on May 7, regardless of the election result. The hashtags #nimacronnilepen (neither Macron, nor Le Pen) and #SansMoiLe7Mai (May 7 without me) was launched after the first round of the elections on April 23. Macron won the first round by securing 24.01 percent of the votes to le Pen’s 21.3 percent. Demonstrations have rocked France following the 1st round vote with people rallying against both candidates. “Neither fatherland, nor the boss, neither le Pen nor Macron,” banners held by protesters read. The rallies have often resulted in violence with protesters throwing stones and smoke grenades and police and officers responding with tear gas.

“..since they knew they were going to lose the election, they created a guy in a hologram that would run for them and prevent them from losing power.”

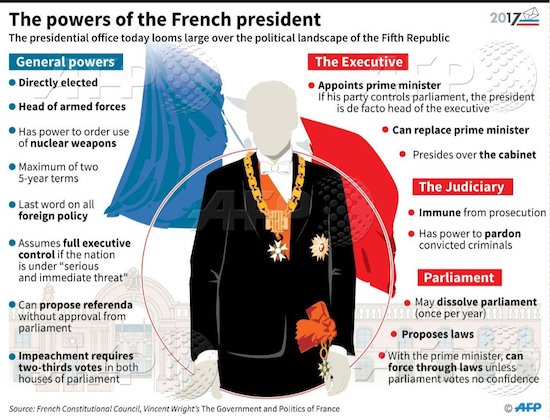

• Charles Gave Expects “Total Mayhem” In France Even If Macron Is Elected (ZH)

Venerable French investor Charles Gave has been managing money and researching markets for over 40 years; as such France’s elder statesman of asset allocation perhaps best captures the mood ahead of the most crucial Presidential election in a generation. In conversation with Dr. Pippa Malmgren, Charles breaks down national politics to understand why voters have rejected the establishment and the market impact of both outcomes, and what to expect from tomorrow’s election. First, Gave, who says “I’m not so sure that Macron will win”, is asked by Malmgren to walk RealVision viewers through what Macron’s agenda would look like in case of a victory. Gave is unable to do so for several simple reasons:

“Well, first, nobody knows. Because during the whole campaign, all these talks were on one hand, on the other. I’m in favor of apple pie, and motherhood, you see. Basically he has, to my knowledge, very little program. So he’s running. That is what Hollande said. That he was going to make some fundamental changes without hurting people. And so Macron is a big, empty suit. That’s what he is. You did the right curriculum vitae, he went to the right schools. And you have the feeling that the guy never had an original idea in his life. He was always a good student.

And moreover, there is a strong suspicion that he’s a kind of golem created by Hollande and all these guys. So since they knew they were going to lose the election, they created a guy in a hologram that would run for them and prevent them from losing power. So to a certain extent, the French political system has been captured by what you can call the Technocratic class. And whether from the left or the right, it didn’t make any difference. And this Technocratic class is presenting Macron as a brand new fellow. He is nothing brand new. These guys have been in power for 50 years for God’s sakes. So this is basically nothing.

If Le Pen wins, it’s pretty simple. The bond market in France, Italy, Spain cannot open on Monday morning. And I suppose the euro is dead in the following week. And then you have to buy Europe like crazy. Southern Europe. Why Southern Europe? Because it is Germany’s markets that would bear the brunt of the selloff, as the dissolution of the euro and European Union would effectively bring about the end of Germany’s economic hegemony (while at the same time benefitting France). The Germans have made a colossal mistake, which is that they have all the production in Germany. So they’re extremely efficient, well-organized, and they have developed massive current account surpluses. Half of that surplus is in cars. The margin on cars is around 4%. Imagine that the euro breaks down.

The deutschmark comes back. The deutschmark goes up 15, 20%. And the whole German industry, all the production base in Germany, becomes bankrupt in no time at all. Compare that to France. France we have magnificent big companies that have been intelligent enough to produce everywhere in the world, to operate from everywhere in the world, and be totally independent from what’s happening in France. What they have in France is their headquarters. And that’s about it. So if Europe breaks, you should be long France on the stock market, and short Germany. Big time.”

Good cop bad cop. Or should I say: here’s how you can tell who’s the boss in Europe?!

• Angry Merkel Slaps Down Juncker For Inflaming Brexit Talks (DM)

A rift emerged between Angela Merkel and Jean-Claude Juncker last night after she reportedly accused him of ‘inflaming’ Brexit talks by leaking details of his row with Theresa May. The German Chancellor’s relations with the EU Commission president are said to have ‘soured’ after Mr Juncker described Mrs May as living in ‘another galaxy’ following a recent dinner. According to German newspaper Der Spiegel, which has close links with Merkel’s government, she believes the leaking of private conversations – blamed on Juncker – ‘is not helpful in heating up the mood in this way’. The Der Spiegel article, headlined ‘Merkel angered by Juncker at Brexit dinner’, said it had made her mood ‘sour’ towards him. Juncker’s ‘another galaxy’ comment was made in a telephone call with Mrs Merkel after he clashed with Mrs May over dinner in Downing Street 11 days ago.

Juncker reportedly told Mrs Merkel: ‘It went very badly. She is in a different galaxy.’ The leak was blamed on Mr Juncker or his formidable German chief of staff, Martin Selmayr. In remarks clearly aimed at Mr Juncker, a furious Mrs May responded to the leaks last week by accusing ‘the bureaucrats of Brussels’ of trying to influence the General Election. But a defiant Mr Juncker took another swipe at Britain on Friday by claiming at a European Union summit in Italy that the English language was already ‘losing its importance in Europe’. The Der Spiegel article echoed public comments made by Mrs Merkel on Friday in which she struck a markedly more conciliatory tone towards Mrs May than outspoken Mr Juncker. She stressed that she would approach Brexit negotiations ‘fairly and constructively’. Mrs Merkel denied she aimed to cause trouble in the Brexit talks and said she wanted ‘clarity and security as quickly as possible’ for EU residents in Britain, including about 100,000 Germans.

Germany’s much less serene than it seems.

• Far-Right ‘Terror Plot’ Rocks The German Army (AFP)

The bizarre case of a racist soldier allegedly plotting an attack while posing as a Syrian refugee and several abuse scandals have sparked a war of words between Germany’s defence minister and the military. It is a dangerous political battle for Ursula von der Leyen, the first woman in charge of the armed forces, who is often mentioned as a potential successor to Chancellor Angela Merkel. The mother-of-seven has sternly criticised military “attitude and leadership problems”, highlighted by the case of the soldier and by recent sexual abuse and hazing scandals. This in turn has made her a target of chastened rank-and-file soldiers who charge she is tarring them all while dodging personal responsibility after more than three years on the job.

The escalating conflict started with the arrest a week ago of 28-year-old army lieutenant Franco Albrecht, who was stationed at a Franco-German base near Strasbourg. He came to the notice of the authorities after Austrian police caught him with a loaded handgun at the Vienna airport in February. The subsequent investigation found that, amid Germany’s 2015 mass influx of refugees, he had created a fake identity as a Damascus fruit seller called “David Benjamin”. Incredibly, the German who speaks no Arabic managed to gain political asylum, a spot in a refugee shelter and monthly state benefits for his fictitious alter ego. Prosecutors charge that Albrecht harboured far-right views and, with at least one co-conspirator, plotted an attack with the apparent aim of discrediting foreigners.

Media reports say he kept “death lists” with the names of top politicians, including former president Joachim Gauck, some cabinet ministers and left-leaning, anti-fascist MPs. It has since emerged that the lieutenant had expressed rightwing extremist views in a master’s thesis he submitted in 2014, in which he theorised about the end of Western civilisation through immigration. In the paper seen by AFP, he argued that immigration was causing a “genocide” in western Europe, adding that “this is a mathematical certainty”. However, the paper was buried, without disciplinary action – something the minister attributed to a “misunderstood esprit de corps” and superior officers who “looked the other way”.

I’ve mentioned the power of Chinese shadow banking a thousand times. That power is still growing.

• World Bank Warns Of China Debt Risk From Backdoor Local Borrowing (AFR)

The World Bank has warned that Chinese local governments remain addicted to off-budget borrowing, despite Beijing’s efforts to impose fiscal discipline on localities and curb ballooning debt. Runaway growth of local government debt is widely seen as a huge risk for China’s economy and financial system. Provinces, cities and counties borrowed heavily to spend on infrastructure to keep economic growth humming after the 2008 financial crisis. But the practice has continued and economists warn that returns on new investment are falling and white elephants are common. Many projects do not produce enough cash flow to service their debt. In 2014 China moved to eliminate borrowing through special-purpose vehicles, which local officials had used to circumvent a legal ban on direct borrowing.

Under the moniker of “close the back door, open the front door”, China’s parliament ended the legal ban, enabling localities to borrow within clear limits set by Beijing. Meanwhile, local government finance vehicles were ordered to cease disguised fiscal borrowing. To deal with legacy debt, Rmb8tn ($US1.2tn) in outstanding local government funding vehicle (LGFV) borrowing was converted into on-budget provincial debt through a bond swap. But growth of LGFV debt has actually accelerated since 2015, the World Bank warned in a confidential March presentation obtained by the Financial Times. Despite the swap programme, “LGFVs continued to borrow and increase their liabilities at a very rapid pace” in 2015-16, the bank’s lead China economist John Litwack and analyst Luan Zhao said.

Local governments and their LGFVs account for “the vast majority of public expenditures and public investment”, they noted, adding that “government and LGFV finances [are] intertwined in complicated ways, making separation difficult in practice”. Growth of LGFV liabilities accelerated from 22% in 2014 to 25% in 2015 and stayed high at 22% in the first half of 2016, the authors found. The presentation noted that Beijing’s effort to stop the use of LGFVs as quasi-fiscal entities may have unintentionally encouraged them to increase borrowing. Local fiscal authorities are now forbidden from officially monitoring LGFV finances, since to do so would imply that the government stands behind their debt. “Instructions to no longer even monitor finances of LGFVs can give a dangerous impression of ‘free money’,” the presentation warned.

Especially in euro countries, governments need mortgage loans for money/credit creation. Their governments and central banks lost that ability.

• Spain’s Government Presses Property-Bubble Rewind Button (DQ)

After spending the last few years groggily getting back onto its feet following the collapse of one of the most spectacular — and destructive — real estate bubbles of this century, Spain’s economy is once again being primed for another property boom. In the last quarter prices registered a year-on-year rise of 4.5%. Rents are also surging, though the country is still home to over half a million vacant properties. The cost of renting in Madrid and Barcelona, which between them account for 16% of those vacant properties, has reached historic highs, according to a new study by the online real estate market place Idealista. In Madrid, rents have risen on average by 27% since 2013; in Barcelona they’ve surged over 50%.

This trend is being driven by two main factors: the recent explosion in tourist rentals, as well as a general shift in consumer behavior as more and more people choose (or have little choice but) to rent rather than buy property. While rents soar, Spain’s mortgage market, the biggest source of profits for the nation’s banks, is also showing signs of life. In 2016 the number of mortgages issued rose by just over 10% to 281,328. But that’s merely a fraction of the 1,324,522 mortgages signed in 2006, just before the bubble burst. The banks would like nothing better than to issue more and bigger mortgages, but even with interest rates at their lowest point in history, most people either can’t afford the current prices or don’t want to take on more debt. Spain’s fragile coalition government is determined to change that.

In its latest budget announcement it revealed plans to set aside billions of euros in 2018 for publicly funded mortgage subsidies. Young people under the age of 35 who are earning gross incomes of less than €1,600 per month will be eligible for payments of up to €10,800 to help them buy their first home. There will also be rental subsidies for people under the age of 35, for up to half the price of the rent. [..] In Spain today there are roughly two million fewer people under the age of 40 in full-time employment than there were in 2006, due to a variety of factors: demographics (i.e. there are now fewer people under the age of 40), rampant job destruction, and the mass exodus of young Spaniards to greener pastures. Even for many of those that chose to stay behind and actually found work, the reality is still alarmingly bleak.

According to the Spanish daily ABC, of the 1.7 million job contracts signed in December last year, over 92% were for temporary jobs. Since the Financial Crisis, precarity has become the ubiquitous reality for most young Spaniards. Many end up earning so little in jobs that offer scant, if any, financial security that they have little choice but to stay at home with their parents, sometimes well into their thirties. According to data released this week by Eurostat, the average Spaniard does not move out of the family residence until they are 29 years old. If Spain’s new, dwindling generation of “workers” cannot afford to leave home, who will buy or rent the properties sitting idle on the balance sheets of the banks, “bad bank” Sareb, and the global private equity firms that piled into the market a few years ago?

We are designed to ignore distant danger, so we can better prepare for what’s near.

• We Are On The Edge Of The Abyss But We Ignore It (G.)

[..] the evidence tells us that so powerful have humans become that we have entered this new and dangerous geological epoch, which is defined by the fact that the human imprint on the global environment has now become so large and active that it rivals some of the great forces of nature in its impact on the functioning of the Earth system. This bizarre situation, in which we have become potent enough to change the course of the Earth yet seem unable to regulate ourselves, contradicts every modern belief about the kind of creature the human being is. So for some it is absurd to suggest that humankind could break out of the boundaries of history and inscribe itself as a geological force in deep time. Humans are too puny to change the climate, they insist, so it is outlandish to suggest we could change the geological time scale.

Others assign the Earth and its evolution to the divine realm, so that it is not merely impertinence to suggest that humans can overrule the almighty, but blasphemy. Many intellectuals in the social sciences and humanities do not concede that Earth scientists have anything to say that could impinge on their understanding of the world, because the “world” consists only of humans engaging with humans, with nature no more than a passive backdrop to draw on as we please. The “humans-only” orientation of the social sciences and humanities is reinforced by our total absorption in representations of reality derived from media, encouraging us to view the ecological crisis as a spectacle that takes place outside the bubble of our existence.

It is true that grasping the scale of what is happening requires not only breaking the bubble but also making the cognitive leap to “Earth system thinking” – that is, conceiving of the Earth as a single, complex, dynamic system. It is one thing to accept that human influence has spread across the landscape, the oceans and the atmosphere, but quite another to make the jump to understanding that human activities are disrupting the functioning of the Earth as a complex, dynamic, ever-evolving totality comprised of myriad interlocking processes.

China is a major factor in this, as much as growing population is.

• The End of Wild Elephants: Africa To Become One Giant Food Farm (G.)

Elephants are in big trouble. Even if we beat poaching and illegal trade, their potential doom has been sealed in projections for population growth, and has already been priced into the commonly accepted solutions to how we humans plan to feed ourselves well into the century – by looking to Africa to be our next big breadbasket. Africa is home to 1.2 billion people, but by 2050 that number is likely to double, and may well double again by the end of the century to reach well over 4 billion. Globally, we may exceed 11 billion souls. This is of course a cause for celebration and a testament to the huge strides we’ve made in public health. We’ve all but beaten polio and yellow fever, mother and child mortality has plummeted, and we’re making headway in the fight against malaria.

Another cause for celebration is the confidence, energy and entrepreneurship in many parts of the African continent – a spirit that is unmatched anywhere in the world. It’s easy to see we’re on the cusp of enormous positive change. The obvious flipside is the environmental disaster waiting to happen. This has been compounded by number crunchers who are leaving the future of our planet’s fragile ecosystems out of the equation as they try to come up with answers about how to fill billions of bellies. Several scenarios for cropland expansion – many of them focusing on Africa’s so-called “spare land” – have already effectively written off its elephants from having a future in the wild. These projections have earmarked a huge swathe of land spanning from Nigeria to South Sudan for farming, or parts of west Africa for conversion to palm oil plantations.

Economies are already being structured for the future, and are locking us into an unsustainable path to the tune of Feed the World – but with Africa providing the food. Some models suggest that 29% of the existing elephant range is affected by infrastructure development, human population growth and rapid urban and agricultural expansion; that may rise to 63% by 2050. If we continue like this, elephants will see more of their migration routes become narrow corridors before being eventually severed. Inevitably, as competitors for space, elephants will fight it out with us. But being the dominant species on this planet, we will win. And Africa will become a giant farm.

ROund 2 of democracy and emergency.

• IMF Wants Greek Opposition To Promise Not To Reverse Agreed Measures (K.)

The European Commission will bring down its 2017 growth estimate for Greece next week, a eurozone official said on Friday, adding that the IMF wants main opposition New Democracy to make a commitment not to reverse the reforms that the government has agreed to in the context of the bailout review should it come to power. “This is important for them,” the official said of the IMF’s demand, while adding that the eurozone has not asked for such a commitment, although it agrees it is always better to have consensus on the reforms applied. The same official said that the Commission will reduce its estimate for the Greek economic recovery this year from 2.7% “to around 2%” on May 11.

Sources say that a downward revision by the Commission of its forecast to 1.9% would not lead to a shift in its general estimate regarding Greece’s fiscal course, so it does not entail the risk of any new measures. The latest IMF forecast regarding the Greek economy was for a 2.2% expansion. If all goes well, the disbursement of the next bailout tranche will take place just before the July repayment deadline, when Greece must pay €7.4 billion to its creditors. As the European official said, if there is a final agreement at the May 22 Eurogroup, which is the optimum scenario, it will take four to five weeks for the tranche payment to clear the parliaments of eurozone member-states where necessary.

If one also takes into account the time needed for the approval by the IMF council, it will take up to six weeks, which means early July. The amount of the tranche will come to about 7 billion euros, plus the funds needed for the state to pay off its expired debts to suppliers and taxpayers until the next review comes up. The disbursement will be paid in a lump sum, but only after all prior actions have been ratified by Greece. The second review had no fewer than 140 prior actions required, of which 40 have been satisfied. Of the remainder there are about 80 that either require new legislation or presidential decrees.

“..what should have happened was the standard IMF programme: a haircut on the debt, devalue the currency and a bit of a loan to tide things over until growth returned.”

• Greece Can Never Pay Its Debts. So Why Not Admit It? (Worstall)

Peace, sweetness and light break out in the Balkans as we’re told that the EU, the eurogroup, the IMF, Greece, the ECB and Uncle Tom Cobley agree over a Greek debt deal. Except, of course, that agreement hasn’t been reached, because the major point at issue is still being glossed over. That major point being that Greece simply isn’t going to repay all of that debt. So we still need to work out who is going to lose money, and when. Debts which cannot be repaid will not be repaid. That’s why we have bankruptcy in the first place. Or, when it comes to sovereign nations, we have debt rescheduling and IMF programmes instead of bankruptcy. When the Greek crisis first blew up, what should have happened was the standard IMF programme: a haircut on the debt, devalue the currency and a bit of a loan to tide things over until growth returned.

This is similar to the approach taken by Iceland – which has already recovered while Greece languishes – and is what the IMF has been doing for decades in other places. The one thing standing between Greece and this approach was the euro. In order to protect the integrity of the single currency, debts to the private sector banks were refinanced by public money from varying combinations of the EU itself, the ECB, the eurogroup (the group of eurozone finance ministers), the IMF and so on. This is the crucial point. There are no private sector capitalists left. If there were, we could simply say “you lost your money, better luck next time”. Instead there are only official creditors, run by politicians, who have their voters wondering what has happened or will happen to their money. For it is still true that Greece cannot repay those debts, and therefore Greece will not repay them.

All that can change is who will lose money and when. Unsurprisingly, politicians are keen to delay the inevitable until they have retired and are collecting their pensions. That the Greeks have to see theirs cut in the interim is just bad luck. This may sound terribly cynical but allow me explain the thinking. There are the true federalists happy to sacrifice a country on the altar of the euro and ever closer union, as long as the losses – losses of their own voters’ money – come to light later.

But Merkel will not, and that’s what counts.

• EU’s Moscovici: Macron Will Be Greece’s Ally (Ana)

French presidential candidate Emmanuel Macron will support Greece and be Athens’ ally if he is elected, European Commissioner for Economic and Financial Affairs, Pierre Moscovici told the Athens-Macedonian News Agency in an exclusive statement, one day before the second round of the elections in France. “I have no doubt that with Emmanuel Macron as President, yes, Greece will continue to have a friend in France, a president friend and a government friend, and this is why these elections are also important for the Greeks,” Moscovici said, adding he has worked with Macron in the past for the Greek program.

“I know Emmanuel Macron very well. We worked together when I was finance minister, when he was deputy secretary-general next to Francois Hollande, to find positive positions concerning Greece, for Greece. France is a country who’s a friend of Greece. It will remain [a friend]” he continued. Moscovici said that being friend of Greece means, on the one hand, to encourage and follow the efforts for reforms until the end but it also means solidarity from its partners.

Europe must find an actual response to this, or face a lot of struggle. There are too many people living in all these countries.

• Bangladesh Now Single Biggest Country of Origin for EU-Bound Migrants (Ind.)

As the refugee crisis enters its fourth year, the demographics of the men, women and children arriving on Europe’s shores are undergoing an unprecedented shift. Syrians have so far made up the largest group of migrants attempting treacherous journeys across the Mediterranean Sea, followed by Afghans, Iraqis, Eritreans and sub-Saharan Africans. But as smugglers in Libya continue to expand their ruthless human trade, their counterparts in Asia are seeing an opportunity. In the first three months of last year just one Bangladeshi arrived in Italy, but the number for 2017 stands at more than 2,800, making the country the largest single origin of migrants currently arriving on European shores.

Those rescued in the Mediterranean Sea have told aid workers they paid more than $10,000 each to be taken from Dhaka to Dubai or Turkey and onwards to Libya, where the violence and chaos engulfing the fractured country is fuelling powerful smuggling networks. The International Organisation for Migration (IOM) said the emerging route had dramatically changed the demographics of asylum seekers arriving in Italy, who until now have largely hailed from sub-Saharan Africa. “The thing that’s really changing is the main nationality of the migrants, and the number coming from Bangladesh,” IOM’s Flavio di Giacomo told The Independent.

“By the end of March last year only one Bangladeshi had arrived in Italy – and this year the number is more than 2,831 for the same period.” Some migrants taken ashore in Sicily and Apulia said their trip to Libya was organised by an “agency” that provided them with a working visa for between $3,000 and $4,000. “From Bangladesh, they first travelled to Dubai and Turkey, and finally reached Libya by plane,” an IOM spokesperson said. “At the airport, an ‘employer’ met them and took their documents.”