Arthur Rothstein Family leaving South Dakota drought for Oregon 1936

“They’re both revolutionary eras..” “This time a ‘Great Leader’ has appeared. The idea is, everything is different.”

• Wall Street Buzz Over Trump Gives Shiller Dot-Com Deja Vu (BBG)

The last time Robert Shiller heard stock-market investors talk like this in 2000, it didn’t end well for the bulls. Back then, the Nobel Prize-winning economist says, traders were captivated by a “new era story” of technological transformation: The Internet had re-defined American business and made traditional gauges of equity-market value obsolete. Today, the game changer everyone’s buzzing about is political: Donald Trump and his bold plans to slash regulations, cut taxes and turbocharge economic growth with a trillion-dollar infrastructure boom. “They’re both revolutionary eras,” says Shiller, who’s famous for his warnings about the dot-com mania and housing-market excesses that led to the global financial crisis. “This time a ‘Great Leader’ has appeared. The idea is, everything is different.”

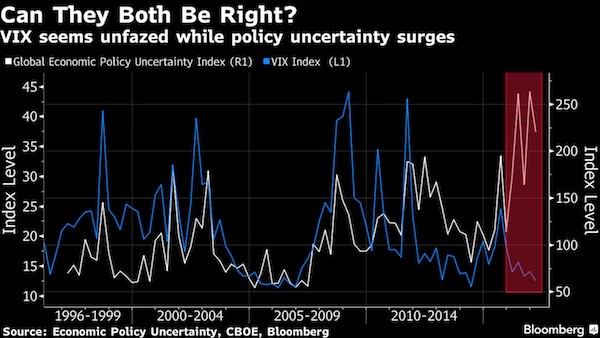

For Shiller, the power of a new-era narrative helps answer one of the most hotly debated questions on Wall Street as stocks set one high after another this year: Why are traders so fixated on the upsides of a Trump presidency when the downside risks seem just as big? For all his pro-business promises, the former reality TV star’s confrontational foreign policy and haphazard management style have bred uncertainty – the one thing investors are supposed to hate most. Charts illustrating the conundrum have been making the rounds on trading floors. One, called “the most worrying chart we know” by SocGen at the end of last year, shows a surging index of global economic policy uncertainty severing its historical link with credit spreads, which have declined in recent months along with other measures of investor fear. The VIX index, a popular gauge of anxiety in the U.S. stock market, has dropped more than 30 percent since Trump’s election.

[..] For Hersh Shefrin, a finance professor at Santa Clara University and author of a 2007 book on the role of psychology in markets, the rally is just another example of investors’ remarkable penchant for tunnel vision. Shefrin has a favorite analogy to illustrate his point: the great tulip-mania of 17th century Holland. Even the most casual students of financial history are familiar with the frenzy, during which a rare tulip bulb was worth enough money to buy a mansion. What often gets overlooked, though, is that the mania happened during an outbreak of bubonic plague. “People were dying left and right,” Shefrin says. “So here you have financial markets sending signals completely at odds with the social mood of the time, with the degree of fear at the time.”

Shiller says when markets are as buoyant as they are now, resisting the urge to pile in is hard regardless of what else might be happening in society. “I was tempted to do it, too,” he says. “Trump keeps talking about a new spirit for America and so you could (A) believe that or (B) you could believe that other investors believe that.” On whether stocks are nearing a top, Shiller can’t say with any certainty. He’s loathe to make short-term forecasts. Despite the well-timed publication of his book “Irrational Exuberance” just as the dot-com bubble peaked in early 2000, the Yale University economist had warned (with caveats) that shares might be overvalued as early as 1996. Investors who bought and held an S&P 500 fund in the middle of that year made about 8 percent annually over the next decade, while those who invested at the start of 2000 lost money. The index sank 49 percent from its high in March 2000 through a bottom in October 2002.

“Don’t be fooled by the booming headline indexes.”

• This Is The Most Overvalued Stock Market On Record – Even Worse Than 1929 (MW)

This is the most dangerous and overvalued stock market on record — worse than 2007, worse than 2000, even worse than 1929. Or so warns Wall Street soothsayer John Hussman in his scariest jeremiad yet. “Presently, we observe the broadest market valuation extreme in history,” writes the chairman of the cautious Hussman Funds investment group, “with the steepest median valuations on record, and the most reliable capitalization-weighted measures within a few percent of their 2000 peaks.” On top of such warning signs as “extreme valuations, bullish sentiment, and consumer confidence,” he adds, “market action has deteriorated in interest-sensitive sectors… As of Friday, more than one-third of stocks are already below their 200-day moving averages.” Don’t be fooled by the booming headline indexes.

More NYSE stocks hit new 52-week lows last week than new 52-week highs, he notes. In a nutshell: Run. OK, so, it is always easy to criticize. Husssman, a professional economist and well-known Wall Street figure, has been here before. He’s been warning about stock-market valuations for several years. He’s in that camp that the permabulls, wrongly, call “permabears.” He’s been wrong — or, perhaps, just very early — many times. But he was, notably, also correct and prescient about both the 2000 and 2008 crashes before they happened, when few others were. Opinions, of course, are free. But facts are sacred. And more than a few are suggesting caution. According to the World Bank, the total U.S. stock market is now valued at more than 150% of annual GDP. That is way above historic norms, and about the same as it was at the market extreme of 2000.

Where are Americans going to meet now? Online?

• Wall Street Has Found Its Next Big Short in US Credit Market: Malls (BBG)

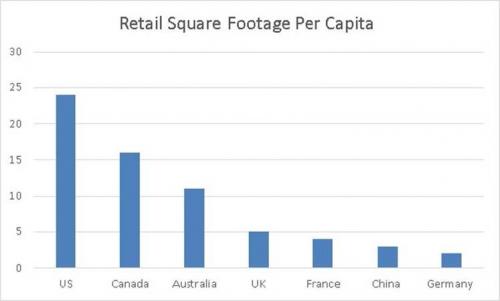

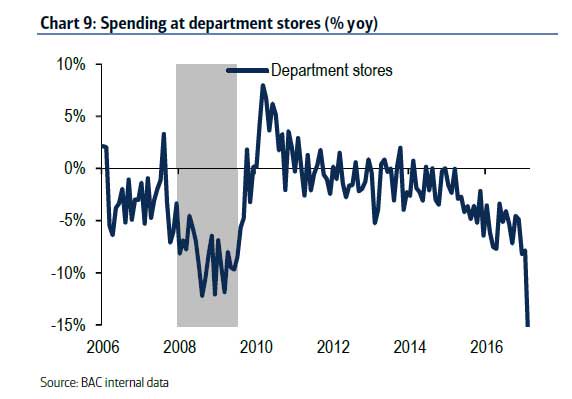

Wall Street speculators are zeroing in on the next U.S. credit crisis: the mall. It’s no secret many mall complexes have been struggling for years as Americans do more of their shopping online. But now, they’re catching the eye of hedge-fund types who think some may soon buckle under their debts, much the way many homeowners did nearly a decade ago. Like the run-up to the housing debacle, a small but growing group of firms are positioning to profit from a collapse that could spur a wave of defaults. Their target: securities backed not by subprime mortgages, but by loans taken out by beleaguered mall and shopping center operators. With bad news piling up for anchor chains like Macy’s and J.C. Penney, bearish bets against commercial mortgage-backed securities are growing.

In recent weeks, firms such as Alder Hill Management – an outfit started by protégés of hedge-fund billionaire David Tepper – have ramped up wagers against the bonds, which have held up far better than the shares of beaten-down retailers. By one measure, short positions on two of the riskiest slices of CMBS surged to $5.3 billion last month – a 50% jump from a year ago. “Loss severities on mall loans have been meaningfully higher than other areas,” said Michael Yannell at Gapstow Capital, which invests in hedge funds that specialize in structured credit. Nobody is suggesting there’s a bubble brewing in retail-backed mortgages that is anywhere as big as subprime home loans, or that the scope of the potential fallout is comparable.

After all, the bearish bets are just a tiny fraction of the $365 billion CMBS market. And there’s also no guarantee the positions, which can be costly to maintain, will pay off any time soon. Many malls may continue to limp along, earning just enough from tenants to pay their loans. But more and more, bears are convinced the inevitable death of retail will lead to big losses as defaults start piling up. The trade itself is similar to those that Michael Burry and Steve Eisman made against the housing market before the financial crisis, made famous by the book and movie “The Big Short.” Often called credit protection, buyers of the contracts are paid for CMBS losses that occur when malls and shopping centers fall behind on their loans. In return, they pay monthly premiums to the seller (usually a bank) as long as they hold the position. This year, traders bought a net $985 million contracts that target the two riskiest types of CMBS. That’s more than five times the purchases in the prior three months.

Run! Hide!

• Fed, In Shift, May Move To Faster Pace Of Rate Hikes (R.)

The Federal Reserve, which has struggled to stoke inflation since the financial crisis and up until now raised rates less frequently than it and markets expected, may be about to hit the accelerator on rate hikes. On Wednesday, the U.S. central bank is almost universally expected to raise its benchmark interest rates, a move that just a few weeks ago was viewed by the markets as unlikely. And with inflation showing signs of perking up, Fed policymakers may signal there could be more than the three rate rises they have forecast for this year. “They do not have as much room to be patient as they did before,” said Tim Duy, an economics professor at the University of Oregon, who expects Fed policymakers to lift their rate forecasts this week.

Policymakers have their eyes on achieving full employment and 2-percent inflation. The faster the economy approaches those goals, Duy said, the quicker the Fed will want to tighten policy to avoid getting behind the curve. “That’s an acceleration in the dots,” he said, referring to forecasts published by the Fed that show policymakers’ individual rate-hike forecasts as dots on a chart. The economy already appears closer to its goals than the Fed had expected in December, the last time it released forecasts. The jobless rate, at 4.7%, is below what policymakers see as the long-run norm, and inflation, at 1.7%, is already in the range they had expected by year end. As Fed policymakers prepare to raise rates this week for the second time in three months, the inflation terrain they face looks steeper than it has been since the financial crisis when one of the central bank’s policy aims was to generate inflation.

There are signs of more inflation globally, the dollar is pushing down less on U.S. prices, domestic inflation expectations have picked up and Friday’s closely watched monthly jobs report showed wages rising 2.8% year-on-year in February, with payrolls rising a sturdy 235,000. The Fed’s preferred inflation measure, the so-called core PCE price index, recorded its biggest monthly increase in five years in January and was up 1.7% year-on-year after a similar gain in December. Most Fed policymakers say such data gives them increasing confidence that inflation will eventually reach the Fed’s goal after years of undershooting.

“..the bureaucrats have apparently decided to sabotage what they undoubtedly believe to be the usurper in the White House.”

• The Mystery of the Treasury’s Disappearing Cash (Stockman)

As of October 24, the U.S. Treasury was flush with $435 billion of cash. That was because the department’s bureaucrats had been issuing debt hand-over-fist and piling up a cash hoard, apparently, for the period after March 15, 2017 when President Hillary Clinton would need to coax another debt ceiling increase out of Congress. Needless to say, Hillary was unexpectedly (and thankfully) retired to Chappaqua, New York. But the less discussed surprise is that the U.S. Treasury’s cash hoard has virtually disappeared in the run-up to the March 15 expiration of the debt ceiling holiday. That’s right. As of the Daily Treasury Statement (DTS) for March 7, the cash balance was down to just $88 billion — meaning that $347 billion of cash has flown out the door since October 24.

And I find that on March 8 alone the Treasury consumed another $22 billion of cash — bringing the balance down to $66 billion! To be sure, there has been no heist at the Treasury Building — other than the normal larceny that is the stock-in-trade of the Imperial City. What’s different this time around is that the bureaucrats have apparently decided to sabotage what they undoubtedly believe to be the usurper in the White House. To this end, they’ve been draining Trump’s bank account rather than borrowing the money to pay Uncle Sam’s monumental bills. This has especially been the case since the January 20 inauguration. The net Federal debt on March 7 was $19.802 trillion — up $237 billion since January 20th. But that’s not the half of it. During that same 47 day period, the Treasury bureaucrats took the opportunity to pay-down $57 billion of maturing treasury bills and notes by tapping its cash hoard.

In all, they drained $294 billion from the Donald’s bank account during that brief period — or about $6.4 billion per day. You wouldn’t be entirely wrong to conclude that even Putin’s alleged world class hackers couldn’t have accomplished such a feat. At this point I could don my tin foil hat because this massive cash drain was clearly deliberate. Last year, for example, during the same 47 day period, the operating deficit was even slightly larger — $253 billion. But the Treasury funded that mainly by new borrowings of $157 billion, which covered 62% of the shortfall. Its cash balance was still $223 billion on March 7. Again, that cash balance is just $66 billion right now. Moreover, the Trump Administration has only a few business days until its credit card expires on March 15 — so it’s also way too late for an eleventh hour borrowing spree to replenish its depleted cash account. (Besides that, I’m predicting a very dangerous market event will start on the 15th.)

Not that we can’t make it even worse.

• Countries With National Health Insurance Spend Less, Live Longer Than US (M&B)

We see health as a basic human right. Every society should provide medical care for its citizens at the level it can afford. And, while the United States has made some progress in improving access to care, the results do not justify the costs. So, while we agree with President Trump’s statement that the U.S. health care system should be cheaper, better and universal, the question is how to get there. In this post, we start by setting the stage: where matters stand today and why they are unacceptable. This leads us to the real question: where can and should we go? As economists, we are genuinely partial to market-based solutions that allow individuals to make tradeoffs between quality and price, while competition pushes suppliers to contain costs.

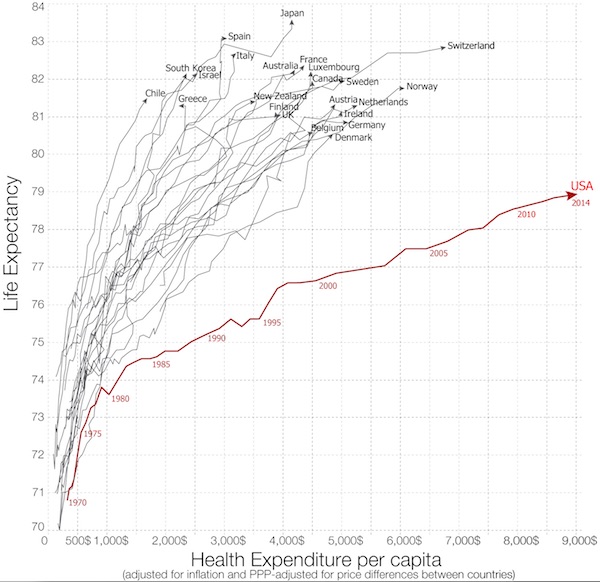

But, in the case of health care, we are skeptical that such a solution can be made workable. This leads us to propose a gradual lowering of the age at which people become eligible for Medicare, while promoting supplier competition. Before getting to the details of our proposal, we begin with striking evidence of the inefficiency of the U.S. health care system. The following chart (from OurWorldInData.org) displays life expectancy at birth on the vertical axis against real health expenditure per capita on the horizontal axis. The point is that the U.S. line in red lies well below the cost-performance frontier established by a range of advanced economies (and some emerging economies, too). Put differently, the United States spends more per person but gets less for its money.

Life Expectancy and Health Expenditure per capita, 1970-2014

It really doesn’t matter how you measure U.S. health care outlays, you will come away with the same conclusion: the U.S. system is extremely inefficient compared to that of other countries. Today, for example, health expenditures account for more than 17% of U.S. GDP. This is more than twice the average of the share in the 42 other countries shown in the figure, and more than 40% higher than the next highest (which happens to be Sweden at 12%).

“..considering the Trump administration is directly sending American troops to fight in Syrian territory, perhaps the various rebel groups on the ground have outlived their usefulness..”

• Rand Paul, Tulsi Gabbard Introduce Bill To Stop The US Arming Terrorists (TAM)

According to a press release released Friday by the office of Rep. Tulsi Gabbard, Sen. Rand Paul has introduced their bill, the Stop Arming Terrorists Act, in the U.S. Senate. The bipartisan legislation (H.R.608 and S.532) aims to prohibit any federal agency from using taxpayer dollars to provide weapons, cash, intelligence, or any support to al-Qaeda, ISIS, and other terrorist groups. It would also prohibit the government from funneling money and weapons through other countries that are directly or indirectly supporting terrorists.

Gabbard said: “For years, the U.S. government has been supporting armed militant groups working directly with and often under the command of terrorist groups like ISIS and al-Qaeda in their fight to overthrow the Syrian government. Rather than spending trillions of dollars on regime change wars in the Middle East, we should be focused on defeating terrorist groups like ISIS and al-Qaeda, and using our resources to invest in rebuilding our communities here at home.” [..] “The fact that American taxpayer dollars are being used to strengthen the very terrorist groups we should be focused on defeating should alarm every Member of Congress and every American. We call on our colleagues and the Administration to join us in passing this legislation.

Rand Paul provided much-needed support for the bill, stating: “One of the unintended consequences of nation-building and open-ended intervention is American funds and weapons benefiting those who hate us. This legislation will strengthen our foreign policy, enhance our national security, and safeguard our resources.” The legislation is currently co-sponsored by Reps. John Conyers (D-MI); Scott Perry (R-PA); Peter Welch (D-VT; Tom Garrett (R-VA); Thomas Massie (R-KY); Barbara Lee (D-CA); Walter Jones (R-NC); Ted Yoho (R-FL); and Paul Gosar (R-AZ). It is endorsed by Progressive Democrats of America (PDA), Veterans for Peace, and the U.S. Peace Council.

One of Trump’s campaign narratives that resonated deeply with his voter base was an anti-radical Islam agenda, which separated him from Clinton’s campaign as he vowed to “bomb the shit” out of ISIS-controlled oil fields. However, his voter base may or may not be somewhat disillusioned now given that he just approved an arms sale to Saudi Arabia that was so controversial it was even blocked by Obama, a president who made a literal killing from arms sales to the oil-rich kingdom (ISIS adheres to Saudi Arabia’s twisted form of Wahhabist philosophy). In the context of recent events, whether or not the Trump administration will get fully behind Gabbard’s bill remains to be seen. But considering the Trump administration is directly sending American troops to fight in Syrian territory, perhaps the various rebel groups on the ground have outlived their usefulness and the bill will be allowed to proceed unimpeded.

“The first hurdle for the lawsuits will be proving “standing,” which means finding someone who has been harmed by the policy. With so many exemptions, legal experts have said it might be hard to find individuals who would have a right to sue..”

• Several States Jointly Sue To Block Trump’s Revised Travel Ban (R.)

A group of states renewed their effort on Monday to block President Donald Trump’s revised temporary ban on refugees and travelers from several Muslim-majority countries, arguing that his executive order is the same as the first one that was halted by federal courts. Court papers filed by the state of Washington and joined by California, Maryland, Massachusetts, New York and Oregon asked a judge to stop the March 6 order from taking effect on Thursday. An amended complaint said the order was similar to the original Jan. 27 directive because it “will cause severe and immediate harms to the States, including our residents, our colleges and universities, our healthcare providers, and our businesses.” A Department of Justice spokeswoman said it was reviewing the complaint and would respond to the court.

A more sweeping ban implemented hastily in January caused chaos and protests at airports. The March order by contrast gave 10 days’ notice to travelers and immigration officials. Last month, U.S. District Judge James Robart in Seattle halted the first travel ban after Washington state sued, claiming the order was discriminatory and violated the U.S. Constitution. Robart’s order was upheld by the 9th U.S. Circuit Court of Appeals. Trump revised his order to overcome some of the legal hurdles by including exemptions for legal permanent residents and existing visa holders and taking Iraq off the list of countries covered. The new order still halts citizens of Iran, Libya, Syria, Somalia, Sudan and Yemen from entering the United States for 90 days but has explicit waivers for various categories of immigrants with ties to the country.

[..] The first hurdle for the lawsuits will be proving “standing,” which means finding someone who has been harmed by the policy. With so many exemptions, legal experts have said it might be hard to find individuals who would have a right to sue, in the eyes of a court. To overcome this challenge, the states filed more than 70 declarations of people affected by the order including tech businesses Amazon and Expedia, which said that restricting travel hurts their revenues and their ability to recruit employees. Universities and medical centers that rely on foreign doctors also weighed in, as did religious organizations and individual residents, including U.S. citizens, with stories about separated families.

That’s the whole idea.

• Shadow Banking Has Made China’s Credit Markets More Complex And Opaque (BI)

A research note from Goldman Sachs highlights how large, complex and opaque China’s credit market has become over the last decade. In a report called Mapping China’s Credit, analysts Kenneth Ho and Claire Cui write that the rise in China’s total debt started with a RMB 4 trillion ($AU770 billion) stimulus package in 2009 to counter the global financial crisis. Since late 2008, debt to GDP (excluding financial debt) has risen from 158% to 262%. Including financial debt bumps the figure up to 289%. The rise in China’s debt to GDP follows a similar increase in America, where last week bond fund manager Bill Gross discussed the risks associated with the US debt to GDP ratio, which sits at around 350%. The analysts note they’re struggling to break down and make sense of the country’s credit market.

“Given the development of the shadow banking sector, and the introduction of a number of retail investment channels such as wealth management products, it has become much more difficult to analyse and monitor China’s credit growth,” they say. In 2006, 85% of China’s credit was supplied by bank loans (offset by deposits). According to Ho and Cui’s estimates, the share of credit from bank loans has reduced to 53%. In its place, approximately 31% of debt is now supplied through bond and securities markets, and 16% through the shadow banking sector (more on that later). Ho and Cui write that as China’s debt pool has grown, larger state-related companies have seen a significant increase in leverage through traditional loans from state-affiliated banks. In addition, however, a decrease in domestic interest rates has encouraged smaller companies and individual investors to shift savings away from bank deposits.

“The Democrats reduced themselves to a gang of sadistic neo-Maoists seeking to eradicate anything that resembles free expression..”

• The Pause That Refreshes (Jim Kunstler)

Let’s take a breather from more consequential money matters at hand midweek to consider the tending moods of our time and place — while a blizzard howls outside the window, and nervous Federal Reserve officials pace the grim halls of the Eccles Building. It is clear by now that we have four corners of American politics these days: the utterly lost and delusional Democratic party; the feckless Republicans; the permanent Deep State of bureaucratic foot-soldiers and errand boys; and Trump, the Golem-King of the Coming Greatness. Wherefore, and what the fuck, you might ask. The Democrats reduced themselves to a gang of sadistic neo-Maoists seeking to eradicate anything that resembles free expression across the land in the name of social justice.

Coercion has been their coin of the realm, and especially in the realm of ideas where “diversity” means stepping on your opponent’s neck until he pretends to agree with your Newspeak brand of grad school neologisms and “inclusion” means welcome if you’re just like us. I say Maoists because just like Mao’s “Red Guard” of rampaging students in 1966, their mission is to “correct” the thinking of those who might dare to oppose the established leader. Only in this case, that established leader happened to lose the sure-thing election and the party finds itself unbelievably out-of-power and suddenly purposeless, like a termite mound without a queen, the workers and soldiers fleeing the power center in an hysteria of lost identity.

They regrouped briefly after the election debacle to fight an imaginary adversary, Russia, the phantom ghost-bear, who supposedly stepped on their termite mound and killed the queen, but, strangely, no actual evidence was ever found of the ghost-bear’s paw-print. And ever since that fact was starkly revealed by former NSA chief James Clapper on NBC’s Meet the Press, the Russia hallucination has vanished from page one of the party’s media outlets — though, in an interesting last gasp of striving correctitude, Monday’s New York Times features a front page story detailing Georgetown University’s hateful traffic in the slave trade two centuries ago. That should suffice to shut the wicked place down for once and for all!

What does it say that only one small island can get it right?

• Iceland’s Recovery Shows Benefits Of Letting Over-Reaching Banks Go Bust (Tel.)

It looks set to be a week packed with big financial milestones. In the US, the Federal Reserve will raise interest rates, putting the country on a path towards getting back to a normal price for money. In the Netherlands, a tense election may deal the fragile eurozone another blow. In this country, Theresa May could finally trigger Article 50, starting the process of taking the UK out of the European Union. The most significant event, however, as is so often the case, may well be something that hardly anyone is paying attention to. On Sunday, Iceland ended capital controls, finally returning its economy to normal after a catastrophic banking collapse back in 2008 and 2009. Why does that matter? Because Iceland was the one country that defied the global consensus and did not bail out its bankers.

True, there was shock to the system. But it was relatively short, and once the pain was dealt with, the country has bounced back stronger than ever. There is, surely, a lesson in that. It might well be better just to let banks go to the wall. Next time around, we should follow Iceland’s example. The crash of 2008 hit every country in the world. And yet none was quite so completely destroyed as Iceland. A tiny country, home to just 323,000 people, with cod fishing and tourism as its two major industries, it deregulated its finance sector and went on a wild lending spree. Its banks started bulking up in a way that might have made Royal Bank of Scotland’s Fred Goodwin start to wonder if his foot wasn’t pressed too hard on the accelerator. When confidence collapsed, those banks were done for.

In every other country in the world, the conventional wisdom dictated the financiers had to be bailed out. The alternative was catastrophe. Cash machines would stop working, trade would grind to a halt, and output would collapse. It would be the 1930s all over again. The state had no option but to dig deep, and pay whatever it took to keep the financial sector alive. But Iceland did not have that option. Its banks had run up debts of $86bn, an impossible sum for an economy with a GDP of $13bn in 2009. Even Gordon Brown, in full “saving the world’” mode, might have baulked at taking on liabilities of that scale. Iceland did the only thing it could do under the circumstances. It let its banks go bust: as British depositors quickly found out to their cost.

Much more to come. See my article yesterday, Caesar, Turkey and the Ides of March

• Merkel Calls Erdogan Attack ‘Absurd’ as Tensions Escalate (BBG)

Chancellor Angela Merkel derided as “clearly absurd” Turkish President Recep Tayyip Erdogan’s accusation that Germany supports terrorism, as Ankara announced retaliatory measures against the Dutch government amid escalating tensions with Europe. After Erdogan excoriated Merkel’s government for “openly giving support to terrorist organizations” on Monday, the Turkish government announced it would block the Dutch ambassador from re-entering the country. Erdogan has blasted European leaders, including accusing Germany of using “Nazi practices,” after a string of rallies by Turkish ministers on European soil were canceled. “The chancellor has no intention of participating in a competition of provocations” with Erdogan, her chief spokesman, Steffen Seibert, said in an emailed statement on Monday. “She’s not going to join in with that. The accusations are clearly absurd.”

Erdogan is seeking votes from Turkish expatriates in a referendum next month on constitutional changes that would make the presidency his country’s highest authority. He has lashed out at the EU and risked deepening tensions, particularly with Merkel. In an interview on Monday, he said Merkel’s government “mercilessly” supported groups such as the Kurdish PKK group, which has waged a separatist war with the Turkish military for more than three decades. “I don’t want to put all EU countries in the same basket, but some of them can’t stand Turkey’s rise, primarily Germany,” Erdogan told A Haber television. The standoff came to a head over the weekend when the Dutch government prevented Turkish ministers from participating in referendum campaign rallies. Some 3 million Turks outside their country can vote, though fewer than half of them did so in the last general election in 2015.

Merkel struck an unusually strident tone earlier this month, slamming Erdogan for trivializing World War II-era crimes by using a Nazi comparison to censure Germany for canceling ministers’ appearances. Such a tone “can’t be justified,” Merkel said March 6 after Erdogan’s previous outburst. European leaders have been vocal in their disapproval of the referendum, saying the executive-centered system that Erdogan is planning to introduce will concentrate power in the president’s hands at the expense of democracy in a NATO member state and EU membership applicant.

The fight’s only just starting.

• UK Parliament Passes Brexit Bill And Opens Way To Triggering Article 50 (G.)

Theresa May’s Brexit bill has cleared all its hurdles in the Houses of Parliament, opening the way for the prime minister to trigger article 50 by the end of March. Peers accepted the supremacy of the House of Commons late on Monday night after MPs overturned amendments aimed at guaranteeing the rights of EU citizens in the UK and giving parliament a “meaningful vote” on the final Brexit deal. The decision came after a short period of so-called “ping pong” when the legislation bounced between the two houses of parliament as a result of disagreement over the issues. The outcome means the government has achieved its ambition of passing a “straightforward” two-line bill that is confined simply to the question of whether ministers can trigger article 50 and start the formal Brexit process.

It had been widely predicted in recent days that May would fire the starting gun on Tuesday, immediately after the vote, but sources quashed speculation of quick action and instead suggested she will wait until the final week of March. MPs voted down the amendment on EU nationals’ rights by 335 to 287, a majority of 48, with peers later accepting the decision by 274 to 135. The second amendment on whether to hold a meaningful final vote on any deal after the conclusion of Brexit talks was voted down by 331 to 286, a majority of 45, in the Commons. The Lords then accepted that decision by 274 to 118, with Labour leader Lady Smith telling the Guardian that continuing to oppose the government would be playing politics because MPs would not be persuaded to change their minds.

“If I thought there was a foot in the door or a glimmer of hope that we could change this bill, I would fight it tooth and nail, but it doesn’t seem to be the case,” she said. But the decision led to tensions between Labour and the Lib Dems, whose leader, Tim Farron, hit out at the main opposition. “Labour had the chance to block Theresa May’s hard Brexit, but chose to sit on their hands. Tonight there will be families fearful that they are going to be torn apart and feeling they are no longer welcome in Britain. Shame on the government for using people as chips in a casino, and shame on Labour for letting them,” he said.

We can be independent, but you can not.

• Theresa May Rejects Scotland’s Demand For New Independence Vote (G.)

Theresa May has faced down Nicola Sturgeon’s demand for a second referendum on Scottish independence, accusing the SNP leader of “tunnel vision” and rejecting her timetable for a second vote. The prime minister said that the Scottish leader’s plan to hold a second referendum between the autumn of 2018 and spring 2019 represented the “worst possible timing,” setting the Conservative government on a collision course with the administration in Holyrood. The first minister’s intervention had been timed a day ahead of when May had been predicted to trigger article 50, but No 10 later indicated that it would not serve notice to leave the EU until the end of the month. The confirmation of the later date, in the aftermath of the speech, fuelled speculation the prime minister had been unnerved by Sturgeon.

Buoyed by three successive opinion polls putting support for independence at nearly 50/50, Sturgeon said that she had been left with little choice than to offer the Scottish people, who voted to remain in the EU, a choice at the end of the negotiations of a “hard Brexit” or living in an independent Scotland. “The UK government has not moved even an inch in pursuit of compromise and agreement. Our efforts at compromise have instead been met with a brick wall of intransigence,” the first minister said, claiming that any pretence of a partnership of equal nations was all but dead. Downing Street denied that it had ever planned to fire the starting gun on Brexit this week, but critics pointed out that ministers had failed to deny the widespread suggestion in media reports over the weekend. The Guardian understands that May will now wait until the final week of March to begin the process, avoiding a clash with the Dutch elections and the anniversary of the Rome Treaty, and giving the government time to seek consensus in different parts of the country.

This should be so obvious, and implemented in law everywhere. It already is in France.

• ‘1st In Canada’ Supermarket Donation Plan Aids Food Banks, Tackles Waste (G.)

Supermarkets in Quebec will now be able to donate their unsold produce, meat and baked goods to local food banks in a program – described as the first of its kind in Canada – that also aims to keep millions of kilograms of fresh food out of landfills. The Supermarket Recovery Program launched in 2013 as a two-year pilot project. Developed by the Montreal-based food bank Moisson Montréal, the goal was to tackle the twin issues of rising food bank usage in the province and the staggering amount of edible food being regularly sent to landfills. Provincial officials said the pilot – which last year saw 177 supermarkets donate more than 2.5m kg of food that would have otherwise been discarded – would now begin expanding across the province.

“The idea behind it is: ‘Hey, we’ve got enough food in Quebec to feed everybody, let’s not be throwing things out,’” Sam Watts, of Montreal’s Welcome Hall Mission, which offers several programs for people in need, told Global News on Friday. “Let’s be recuperating what we can recuperate and let’s make sure we get it to people who need it.” Recent years have seen food bank usage surge across Canada, with children making up just over a third of the 900,000 people who rely on the country’s food banks each month. In Quebec, the number of users has soared by nearly 35% since 2008, to about 172,000 people per month.

The program’s main challenge was in developing a system that would allow products such as meat and frozen foods to be easily collected from grocers and quickly redistributed, said Watts. “There is enough food in the province of Quebec to feed everybody who needs food. Our challenge has always been around management and distribution,” he added. “Supermarkets couldn’t accommodate individual food banks coming to them one by one by one.” More than 600 grocery stores across the province are expected to take part in the program, diverting as many as 8m kg of food per year.

Austerity. Germans can now buy Greek homes on the cheap. Insane.

• Stock Of Properties Conceded To The Greek State Or Confiscated Grows (G.)

The austerity measures introduced by the government are forcing thousands of taxpayers to hand over inherited property to the state as they are unable to cover the taxation it would entail. The number of state properties grew further last year due to thousands of confiscations that reached a new high. According to data presented recently by Alpha Astika Akinita, real estate confiscations increased by 73 percent last year from 2015, reaching up to 10,500 properties. The fate of those properties remains unknown as the state’s auction programs are fairly limited. For instance, one auction program for 24 properties is currently ongoing. The precise number of properties that the state has amassed is unknown, though it is certain they are depreciating by the day, which will make finding buyers more difficult.

Financial hardship has forced many Greeks to concede their real estate assets to the state in order to pay taxes or other obligations. Thousands of taxpayers are unable to pay the inheritance tax, while others who cannot enter the 12-tranche payment program are forced to concede their properties to the state. Worse, the law dictates that any difference between the obligations due and the value of the asset conceded should not be returned to the taxpayer. The government had announced it would change that law, but nothing has happened to date. Property market professionals estimate that the upsurge in forfeiture of inherited property will continue unabated in the near future as the factors that have generated the phenomenon, such as high unemployment, the Single Property Tax (ENFIA) etc, remain in place.