Arthur Rothstein Drought refugees from Glendive, MT, leaving for WA July 1936

It’s common knowledge at this point, even if there’s never a shortage of voices who will insist on denying it, that many of the numbers we see allegedly describing our economic realities, are not real at all. Unemployment, GDP, the issue is familiar. And if the US government, or any government for that matter, thinks it’s such a great idea to “massage” their numbers, then to quite an extent those of us who pay attention can shrug them off as largely irrelevant, even if they greatly distort many people’s views of where we find ourselves. The nonsense comes in so fast and furious we need to realize we can’t win ’em all. But we should never be tempted into thinking much of what we read are anything else than fake, virtual zombie numbers. Still, it’s when fake numbers get real life consequences that we need to raise our voices, even if that’s for the umpteenth time. A report issued yesterday by the Boston Consulting Group (BCG) makes for such a moment. Here’s what the BBC had to say:

Global Private Wealth Rises To $152 Trillion

The amount of private wealth held by households globally surged more than 14% to $152 trillion last year, boosted mainly by rising stock markets. Asia-Pacific, excluding Japan, led the surge with a 31% jump to $37 trillion, a report by Boston Consulting Group says. [..] The report takes into account cash, deposits, shares and other assets held by households. But businesses, real estate and luxury goods are excluded. [..]

The amount of wealth held in equities globally grew by 28% during the year [..] Economies in Asia have been key drivers of global growth in the recent years. China has been the biggest driver – with private wealth in the country surging more than 49% in 2013. The wealth held in the region is expected to rise further, to nearly $61 trillion by the end of 2018.

And since the BBC missed some numbers that Bloomberg caught, and vice versa, here’s the latter as well:

China Riches Fuel Asia as World Wealth Tops $150 Trillion

China leapfrogged Germany and Japan in the past five years to trail only the U.S. in a ranking of countries by private financial wealth. China’s $22 trillion is expected to increase more than 80% to $40 trillion by 2018, while the U.S. may grow to $54 trillion from $46 trillion over the same period, BCG said. Globally, stock-market gains averaged 21% in 2013, providing the primary driver of growth in private wealth, especially in North America, Europe and Japan [..] North America wealth gained 16% to $50.3 trillion.

India, which may more than double private wealth assets to $5 trillion by 2018, and Russia, where wealth may advance more than 80% to $4 trillion. BCG expects rich households to have almost $200 trillion worldwide by 2018, with the Asia-Pacific region contributing about half of global growth.

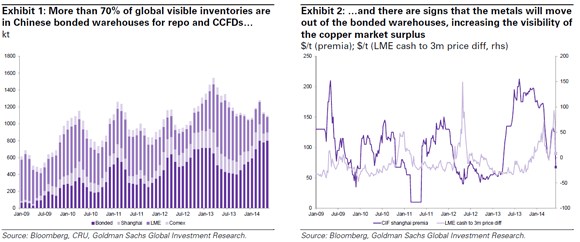

I guess the crucial question here is: how is this wealth? What is wealth to begin with? And how did these huge surges come about in the first place? We know that central banks and governments, who typically these days are as independent from each other as your run of the mill Siamese twin can be, have a role. The Chinese communist party – what’s in a name? – has pumped an estimated $25 trillion into its economy since 2008, and let the shadow banks add another, let’s take a wild guess, $5-$10 trillion or so?! The Qingdao copper, aluminum, timber, peanut oil and what have we scheme seems to indicate a widespread and accepted practice of rehypothecating assets, whether they actually exist or not. The scheme is far too profitable to have remained some small scale thingy. I saw John Mauldin today put the total damage (or is that profit?) at $1.3 billion, but we might as well add a few zeroes.

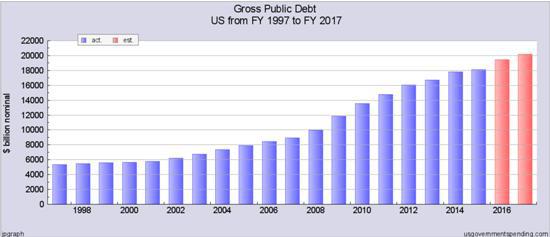

The US added many more trillions in stimulus. I’d say $15 trillion, easily. The ECB has been a bit more cautious – which is why everyone wants them to do more -, but when you add it all up, 28 separate countries, governments and central banks and all that, put them at $10 trillion minimum. And Japan is, well, Japan, they were at it much sooner, early 1990s, and Abenomics is the everything-on-red move; I can’t see that being less than $15 trillion. And that’s just the 4 biggest economies; you think the rest didn’t chime in? This is where you’re inclined to say that before you know it you’re talking real money. But it’s not. That’s exactly what it’s not. The entire thing has been made up out of thin air, and to make matters much worse, it’s been borrowed too.

Creating credit out of thin air equals borrowing from the future. Even though we – prefer to – see that as hardly relevant. Which is a deception all by itself, insult and injury. Everything about our so called recoveries appears to be true only because of stimulus measures. We buy ourselves a feel-good time today at the expense of those who come after us. Well, unless we achieve this magical ‘escape velocity’, but how can we expect to do that when all gains since 2008, dollar for dollar when you look at the ‘stimulating’ numbers, appear to be originating in central bank inputs? Without them, we’re standing still, at best.

But the Chinese, who have issues in their housing industry, and their growth numbers, and their exports, yada yada, saw their private wealth rise by close to 50% in just one year, 2013. Now, I didn’t read the full Boston Consulting Group report, but I know for a fact that neither the BBC nor Bloomberg even hinted at a possible connection between that number and the $25+ trillion Beijing poured into China’s economy. But here’s the clincher: The Chinese can make up as much ‘money’ out of nothing as they want, and the rest of the world will accept it as currency, because they all do the same, albeit on a somewhat smaller scale. So all the zombie Middle Kingdom money gets to buy up half of Africa, the best beaches in Greece, entire streets in London and New York, and no-one in charge is batting an eye because if they doth protest, they’d have to reveal their own out of thin air deception that props up the FTSE and the S&P.

Yeah, sure, but the (not so) funny zombie yuan displaces Greeks and Londoners and New Yorkers and Africans, who if they had access to similar fake funny cash could have just stayed where they are and outbid the Chinese for their tribes’ and parents’ own properties. Now they have to leave because there’s a game or contest going on of who can out-nothing the other.

The world’s private wealth didn’t increase one bit. The entire world borrowing from their children’s future did. And that’s a recipe for zombie disaster. Only not today. Which is what is keeping us fooled, but we do we like it that way? Are we not smart enough, or don’t we want to be? That increase in wealth the BCG ‘study’ reports is a big loud bad red-flashing warning sign, but our once reliable media talk about it as if somehow it’s a good thing. And we gobble that up as gospel because we can’t face the truth about our own lives.

We’d rather have the most audacious zombie printers – both domestic and abroad – take our land and our homes and the chairs we sit in away from under our behinds than fess up that we ourselves screwed up royally. If we observe our place in the world from that angle, how can we possibly claim we do not get what we deserve? Mind you, though, that’s the only thing we’re going to get. But it gets both better and worse: the payload isn’t going to hit us most, but our kids. And I’m wondering: do you find that comforting?

What a report on zombie wealth like this tells us is not that things are getting better, it’s telling us they’re getting worse at a fast clip. The more fake numbers, the further we slip and slide away from having functioning societies. It’s not our wealth that increases, but our debt.

• Global Private Wealth Rises To $152 Trillion (BBC)

The amount of private wealth held by households globally surged more than 14% to $152 trillion (£90tn) last year, boosted mainly by rising stock markets. Asia-Pacific, excluding Japan, led the surge with a 31% jump to $37tn, a report by Boston Consulting Group says. The number of millionaire households also rose sharply. The report takes into account cash, deposits, shares and other assets held by households. But businesses, real estate and luxury goods are excluded. “In nearly all countries, the growth of private wealth was driven by the strong rebound in equity markets that began in the second half of 2012,” the firm said in its report. “This performance was spurred by relative economic stability in Europe and the US and signs of recovery in some European countries, such as Ireland, Spain and Portugal.” The amount of wealth held in equities globally grew by 28% during the year, Boston Consulting Group (BCG) said.

Economies in Asia have been key drivers of global growth in the recent years. And households in the region have benefitted from this growth. Within the region, China has been the biggest driver – with private wealth in the country surging more than 49% in 2013. High saving rates in countries such as China and India has also been a key contributing factor to this surge. The wealth held in the region is expected to rise further, to nearly $61tn by the end of 2018. “At this pace, the region is expected to overtake Western Europe as the second-wealthiest region in 2014, and North America as the wealthiest in 2018,” BCG said. The pace of wealth creation in China was also evident in the growth in the number of millionaire households – in US dollar terms – in the country, rising to 2.4 million in 2013, from 1.5 million a year ago. Overall, the total number of millionaire households in the world rose to 16.3 million in 2013, from 13.7 million in 2012.

Read more …

Could?

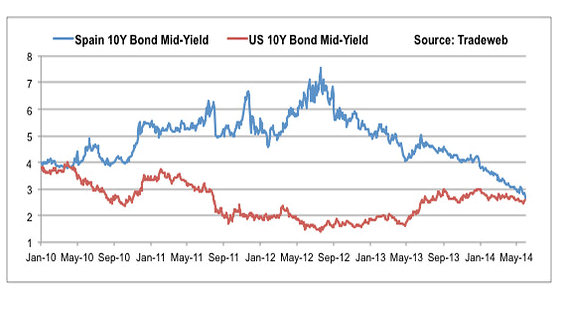

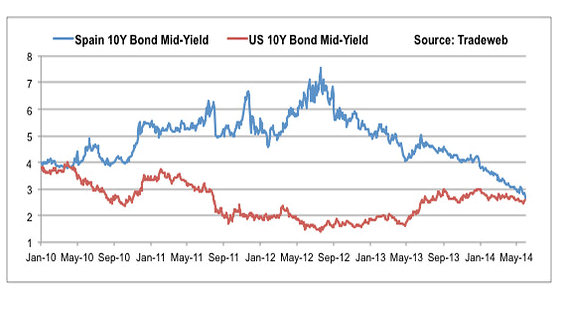

• How Europe’s Amazing Bond Rally Could End In New Crisis (The Tell)

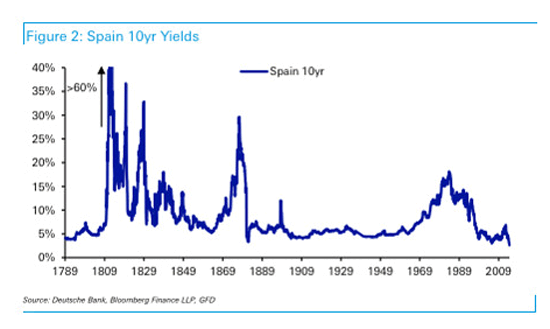

Take a good look at the chart above. It’s a picture of investors going crazy for Spanish government bonds in a low-interest rate, loose monetary-policy environment in Europe. But buyer beware — analysts warn that the rally in peripheral Europe’s sovereign bonds could come to an abrupt end if the region’s sluggish growth rates and worringly low inflation levels don’t pick up. For the first time since April 2010, the yield on 10-year Spanish bonds on Monday fell below the borrowing costs of 10-year U.S. notes as part of a wider rally for European assets. Spain’s 10-year yield slipped to 2.556%, inching below the 2.623% recorded for the U.S. counterpart, according to Tradeweb data.

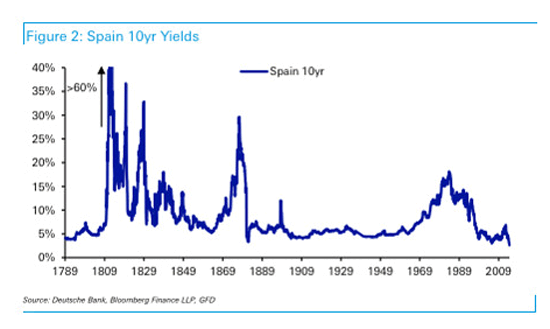

Not only is this a major improvement from Spain’s plus-7% yields from the height of the euro-zone crisis in 2012, but the current trading level is also a fresh multi-century all-time low, according to Deutsche Bank. And Spain isn’t the only euro-zone nation to see its borrowing costs comfortably decline. Irish 10-year borrowing costs fell to a record low of 2.39% on Monday as well, while Italy’s yield on 10-year bonds are around the lowest level since 1945, according to Deutsche Bank.

“If anyone is in any doubt how extraordinary this period is in economic history then please take a look,” said Deutsche Bank’s Jim Reid in a note on Monday morning.

Read more …

Answer: More theft.

• The ECB & The Fed: After 5-Years Of Coordinated Theft, What Next? (Alhambra)

With Japan providing no competition for global bond assets (their 10 year yields a paltry 0.6%), the hands down winner in the global developed bond market rate competition would appear to be the US Treasury. That assumes, of course, that currency values are determined by interest rate differentials, something that is widely believed but hard to square with the available historical data. Rates do matter at some point, but one would probably be better advised to buy currencies based on expectations of economic growth. If the ECB s monetary easing is successful in raising the growth prospects of Europe, stocks there seem likely to attract a bid (not that they ve been lacking for buyers; European stocks are up 160% from the lows). That might derail Draghi’s plans for a lower Euro if the demand for European stocks outstrips the demand for bonds.

It might also depend on the effectiveness of the newly announced policies, something that is far from assured. Like the US, Europe s growth problems are mostly structural and potentially impervious to more monetary easing. And certainly, Japan s experience with unconventional monetary policy would not seem to provide any reason for optimism about its ultimate effectiveness. They’ve been trying for over two decades to escape the malaise of poor demographics, high taxation and a coddled corporate culture through monetary pumping only to find themselves deeper in debt and still searching for consistent growth. Notably, the lack of growth and the lowest interest rates in the world hasn’t been conducive to a cheaper yen (until recently) and Draghi may find himself facing the same conundrum.

Indeed, there has been a plethora of research released over the recent past suggesting that too easy monetary policy is itself causing the very deflationary tendency it is designed to combat. The Minneapolis Fed chief, Narayana Kocherlakota first mentioned the possibility way back in 2011 but quickly backed off. The St. Louis Federal Reserve s Stephen Williamson published a paper last November arguing that the Fed s purchase of so many Treasuries was actually pulling down inflation rates. Last but not least the Bank for International Settlements (the central banks central banker), taking a longer term view, said recently that the world s addiction to monetary stimulus may be expansionary in the short term but contractionary over the long term as it just steals growth from the future.

Read more …

Where the money is these days.

• Currency Carry Trades Rise in ECB’s Negative-Rate World (Bloomberg)

Mario Draghi is becoming one of currency traders’ only friends. With the $5.3 trillion-a-day foreign-exchange market poised to deliver its worst first-half returns on record, the carry trade is about the only way traders are making money by exploiting differences in global borrowing costs as volatility tumbles. That strategy became more profitable after the European Central Bank president cut interest rates on June 5. “The ECB has signaled risk is on again,” Eric Busay, a Sacramento-based money manager at the California Public Employees’ Retirement System, the largest U.S. public pension fund with $294 billion in assets, said in a June 6 phone interview. “People are concerned when to exit the trade and they understand the rush to exit could be crowded. But at the same time, you have to be in it to win it.”

A Deutsche Bank AG index that measures returns from a trade that buys the world’s five highest-yielding currencies, including South Africa’s rand and the New Zealand dollar, has jumped 1.3% since Draghi’s announcement, bringing its advance to 4.4% this year. Deutsche Bank’s Currency Valuation Excess Return index that makes investments based on relative purchasing power was little changed since Draghi cut rates, while the Currency Momentum Excess Return gauge, which buys assets that are rising the fastest, declined 0.6%. The indexes gained 0.7% and lost 4.6% this year. Draghi’s announcement of rate cuts and hints of further measures to come gave markets the confidence that global central banks aren’t finished with the policies that are suppressing volatility and allowing carry trades to thrive.

Read more …

A dumb-ass assessment from Mo. Get a life …

• What If the Fed Has Created a Bubble? (El-Erian)

Investors might be surprised to learn that they have a lot riding on something that they pay very little attention to: macro-prudential regulation, or what central banks and other government agencies do to reduce the risk of systemic financial disasters. The aim of such regulation is to lower both the probability and potential costs of financial accidents. It does so by enhancing the resilience of the system, establishing circuit breakers to prevent problems in one area from contaminating others and, at the extreme, containing the detrimental impact on the broader economy when failures occur.

Macro-prudential regulation has been significantly enhanced in the aftermath of the global financial crisis. Authorities around the world have imposed higher and more intelligent capital requirements, required financial institutions to value their assets more conservatively and to hold more easy-to-sell assets, placed constraints on allowable risk-taking, insisted on more stable funding, and demanded greater provisions against bad loans. The impact of the revamped regulation has gone far beyond the targeted banks and other financial companies. It has allowed central banks to be bolder in maintaining and evolving exceptional monetary and credit stimulus, which in turn has significantly bolstered the prices of stocks, bonds and other assets as a means of stimulating the economy.

The more confident central bankers are in their macro-prudential approach, the greater their willingness to persist with stimulus policies today that could involve a bigger risk of financial instability down the road — a trade-off that has been noted recently by Minneapolis Fed President Narayana Kocherlakota, Boston Fed President Eric Rosengren and former Fed Governor Jeremy Stein. Essentially, the Fed has been pushing stock and bond prices up to “bubblish” levels, in the expectation that they will inspire the kind of consumer spending, physical investments and hiring required to subsequently justify them. The hope is that the convergence will occur in the context of full employment and inflation near the Federal Reserve’s target of 2%. So far, though, the wedge between asset prices and economic reality remains large, as last week’s juxtaposition of new stock-market highs and still-anemic wage-inflation data demonstrated.

Read more …

Farrell thinks the climate will carry Hillary to the White House in a throne. What has she done lately?

• The 1 Big Reason GOP Will Lose The Presidency In 2016 (Paul B. Farrell)

Warning to GOP: A new poll says you can kiss the presidency goodbye for 10 more long years: Why? “Voters have little tolerance for a presidential candidate in 2016 who doesn’t believe that climate change is caused by human activity.” More on that below. But that means the GOP is destined to be on the outside of the White House for 10 more years, playing by the same total-defense playbook that didn’t work the last two presidential elections. Why? You can’t blame the tea party. Nor voter suppression and self-defeating immigration policies. Not minimum wages, debt, taxes, abortion, gun laws, pipelines nor same-sex marriage. Not health care, inequality nor the weak recovery. Not even rapidly shifting demographics. Yes, these trends will increase your handicap, radically changing the GOP’s next-generation base. But that’s not why the GOP won’t win back the presidency.

And what about taking back the Senate? Don’t cheer too loudly. That advantage won’t last long. More defensive battles fighting an incumbent president with veto power. Bad for the image. And then, in 2016, not only the presidency is up from grabs, 23 GOP senators and only 10 Dems are up for re-election. It gets worse: From now till the 2014 elections, the GOP will double down with the same hard-right strategy that plays well to a conservative base. But then from 2014 to 2016 you must shift to a center-left strategy to appeal to the emerging new American voter if you want to win over a national fan base for 2016. But that doubling-down also puts the GOP in a double-bind: By 2016, any left-leaning candidate will anger the hard-right base that wins back the Senate in 2014. A huge dilemma.

GOP’S biggest problem 2014-2024? The one and only … Big Oil Yes, Big Oil will be the GOP’s biggest problem for years. And the big reason the GOP can kiss the presidency goodbye. Why? Big Oil won’t change. For one, they’ll fight any carbon tax. But to win the presidency, the GOP must change. A classic double bind. That’s why no Republican will occupy the White House likely till 2024. One reason: Big Oil, ExxonMobil, Shell, BP, ConocoPhillips, Chevron, and, of course, the Koch billionaires. Yes, the GOP’s in love with Big Oil. The money keeps them in Washington. They’re mutually dependent, addict-and-supplier, obsessed-and-object, master-and-servant, trapped in a symbiotic dance of death. So blindly dependent they can’t see, cannot break free of their dependency.

One has the money and power, needs to manipulate the law. The other craves money, status and an illusion of power. A classic dependency syndrome. Both hold tight, won’t wake up, till it’s too late after they bottom-out, trigger a collapse, like 2000 and 2008, that takes down the economy, forces them to create a new business model, new political game strategy. Unfortunately, the collapse will be traumatic, painful, not only for Big Oil, the GOP, also a million car owners, and the world economy. So for years to come, the so-called “Party of Big Business” will keep losing the presidency because their Big Oil suppliers control the GOP votes, dictate how to vote, and when the GOP gets its fix. But for now, Big Oil’s game plan is profitable: A pittance to politicians yields billions in tax breaks, favorable regulations, a fabulous return on investment for Big Oil.

Read more …

I have a fourth: QE.

• 3 Reasons The Dow Doesn’t Deserve To Be At 17,000 (MarketWatch)

We’re straddling 17,000 on the Dow Jones Industrial Average. But it just doesn’t feel right. It has to be the most unenthusiastic rally in a generation — maybe more. It’s not that there isn’t reason to be buying stocks. We are now five years into an economic recovery that began in mid-2009, according to the National Bureau of Economic Research. It’s been a slow slog. It’s been paced. Those are actually good reasons to be buying stocks. A rapidly growing economy, which coincided with the dot-com boom and the housing bubbles, usually go belly up as quickly as they rise.

And the stock market always leads the economy. Investors tend to buy cheap and ride the wave of ever-increasing earnings and premiums added to their holdings. But a 155% rise in the Dow since the 2009 nadir of the financial crisis? A 31% rise in the past 18 months? Yes, the gains look that more striking because of the lows we hit in the Great Recession. Still, that’s a fantastic run considering that last week we finally recovered the jobs lost since the financial and housing crises hit. At that point the Dow was 18% lower than it is today. There are many reasons this rally feels empty. But here are the biggest, most obvious reasons:

No one is really buying. Stock prices are edging higher, but it’s not retail investors driving the trend. Lipper reported that investors last week actually pulled $921 million from U.S. stock mutual funds in the week ended June 4, and $451 million the previous week.

Corporate earnings are flat. You’d think that as the market reaches this milestone, corporate profits would be churning, or a least growing. They aren’t. The Bureau of Economic Analysis reports that its measure of corporate profits declined 9.8% in the first quarter. It was the largest drop since the fourth quarter of 2008, and during the past four quarters, corporate profits have fallen 3%. Market analyst and adviser Doug Short noted last week that the market SPX is overvalued in the range of 51% to 85% when measured by price-to-earnings ratios and the lesser known Q ratio (total price of the market divided by replacement cost).

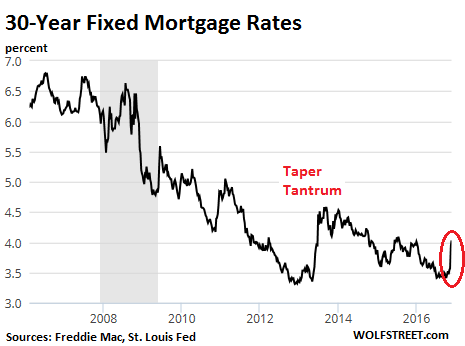

There are no alternative investments. Rather than higher prices for goods and services and a devalued currency, the real consequence of the Federal Reserve’s efforts to stimulate the economy through lower interest rates, bond buying and easy credit seems to be inflation in the stock market.

Read more …

Not that hard a guess to make.

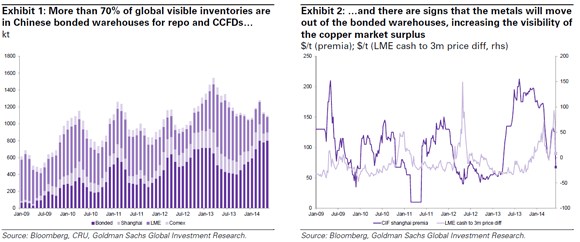

• Goldman Explains How The China Commodity Unwind Will Happen (Zero Hedge)

Over a year ago we were the first to bring the topic of China’s shadow banking system’s problematic rehypothecation issues to the general trading public. In “The Bronze Swan Arrives: Is The End Of Copper Financing China’s “Lehman Event”?” we explained how the Chinese commodity financing deals (CCFDs) worked and how they would inevitably be a systemic event for the nation so dependent on the shadow banking system for its credit (and its “growth”). The day has arrived when the Bronze Swan is landing (and it’s unlikely to be soft). As we have discussed recently, the probe into ‘missing’ collateral (or multiple-used collateral) at China’s Qingdao warehouse is a major problem… and now Goldman confirms, the Qingdao situation likely to continue ongoing CCFD unwind and has the potential to leave foreign banks with undercollateralized loans and/or losses. Via Goldman Sachs:

Qingdao situation and the copper market outlook – According to reports, an onshore trading company is being investigated for allegedly pledging commodities (aluminium and copper) multiple times with different banks in order to gain access to cheap FX funding (specifically via repurchase agreements, or “repo” business). This has the potential to leave foreign banks with undercollateralized loans and/or losses. Given this, a number of foreign banks may suspend their repo business in China, as well as shrink their commodity financing positions in China in general. The Qingdao issue could be a catalyst for further CCFD unwinding In our view the developments in Qingdao are likely to continue the significant scaling back of FX inflows from foreign banks into China via commodity financing business.

This would disincentivize the physical holding of commodities in bonded warehouses, increasing ‘visible’ inventories and placing more downward pressure on physical (cash prices) than upward pressure on futures prices. As foreign banks reduce their exposure to Chinese commodity financing deals (CCFDs), the profitability of these could be reduced meaningfully (via an increase of US rates and/or a lower FX loan quota to CCFD participants), more physical metal previously tied up in financing deals would be freed up for the physical market, helping ease the current temporary regional tightness. With respect to copper in particular, we expect more copper will either flow back to China or LME, depending on which market is relatively stronger. Indeed, there are signs of unwinding in near-dated tightness in the market recently, as indicated by the significant easing of both Shanghai premia and LME time spreads (Exhibits 2).

Read more …

We don’t know the half of it.

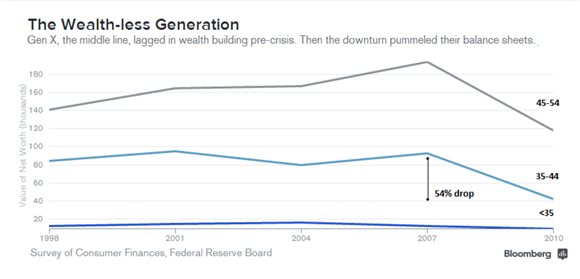

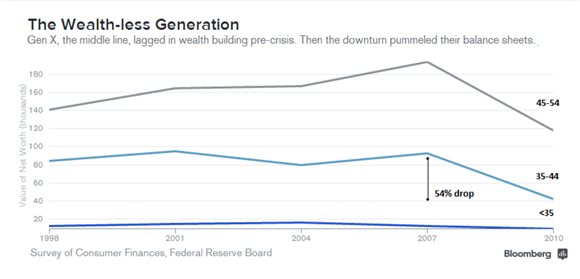

• Lean Retirement Faces U.S. Generation X as Wealth Trails (Bloomberg)

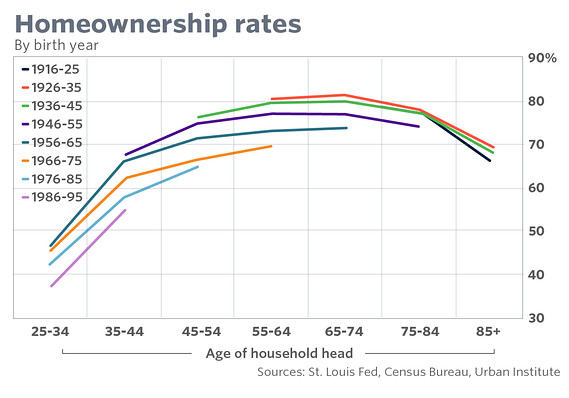

Good timing is not the age group’s forte. Many took out mortgages just before prices plunged, making them the most disadvantaged by the housing crisis, while the 2008 stock-market slump dealt them a further setback. Only one-third of Generation X households had more wealth than their parents held at the same age, even though most earn more, The Pew Charitable Trusts found. When their working years end, Gen-Xers might have to live on just half of their pre-retirement income, compared with 60% for the Baby Boom generation, Pew said last year. “Generation X is at this really critical historical spot,” said Diana Elliott, a research officer in financial security and mobility at Pew, a non-profit global research and public policy organization in Washington. “They are not doing well relative to the last generation. It should give us concern as a country.” [..]

Gen-Xers lost about half of their wealth between 2007 and 2010, according to a Pew Economic Mobility analysis last year. Even before the housing collapse, they were having trouble keeping up with their parents in building assets, according to Pew, which defines Generation X as people born between 1966 and 1975. “Gen-Xers are the least financially secure and the most likely to experience downward mobility in retirement,” the Pew analysis found last year. The bursting of the dot-com bubble, which culminated in a 67% drop in the Nasdaq from 2000 to 2002, was a particularly severe blow to Gen-Xers just starting their careers. While most didn’t directly own stocks, the economy slipped into recession and unemployment for 25- to 34-year-olds in 2003 hit its highest level in almost a decade.

Student loans also slowed asset-building, said Signe-Mary McKernan, an economist at the Washington-based Urban Institute. “Under the impact of successive booms and busts, many Xers have struggled to afford a family or keep their home, much less do better than their parents,” Neil Howe, co-author with William Strauss of books on generations in American history, said at a May 8 research symposium in St. Louis. “Then came the Great Recession, which hit Xers much harder.” The median income for 35- to 44-year-olds dropped 9.1% in the three years ended in 2010, according to the Federal Reserve’s Survey of Consumer Finances. Incomes of those age 35 or less, including the youngest Gen-Xers and Millennials, fell 10.5%. While incomes of 35- to 44-year-olds deteriorated less than those of younger Americans, their net worth slumped by 54%, the most for any age group, as the value of stock holdings and properties declined. The median net worth of those younger than 35 declined 25%.

Read more …

• Jobs Friday: What The Bubblevision Revelers Missed (David Stockman)

Yes, the nonfarm payroll clocked in at 138.5 million jobs and thereby retraced for the first time the point at which it stood 77 months ago in December 2007. This predictably elicited another milestone of progress squeal from the mainstream media. So you have to wonder. Did these people skip history class? Do they understand the vital idea of context ? Are they so mesmerized by paint-by-the-numbers agit prop from Wall Street and Washington that they have come to mindlessly embrace the notion that any number that is better than the last print is all that it takes regardless of composition, quality or longer-term trend? Thus, consider the ancient days of the Reagan era. Back then there were actually 15.0 million new jobs by the time that 77 months had elapsed after the June 1982 bottom.

And these were honest-to-goodness new jobs that had never before existed, not born again jobs of the type that CNBC has made a jobs Friday fetish out of ever since the Great Recession was officially declared over in June 2009. So if you want to try a little context absurdity recall this. So far we have created a trifling 100k new jobs since the last cyclical peak. During the equivalent 77 months in the Reagan era the US economy actually generated 150 times more jobs! And, no, that wasn t due to a demographic windfall of new employable bodies. During that 77 month period the civilian population age 16 and over increased by 8% or 13.3 million. This means that 113% of the growth in the pool of employable adults was converted into job-holders.= This time around, the pool of working age adults grew by quite respectable 14.4 million; and that amounted to a not shabby gain of 6% from December 2007.

But self-evidently, during the 77 months since then virtually zero percent of the labor pool growth was converted into job holders. So the yawning difference between the Reagan era and now is not a surfeit of demography, but a dearth of job creation. And this has nothing to do with Ronald Reagan hagiography since the jobs gains of the 1980s were purchased in part with grotesque peacetime deficits of a magnitude never seen previously. Nor would they be seen again until the Bush-Obama era showed what real fiscal profligacy looks like. But the larger point is that each cycle since the 1980s has generated net new jobs, albeit at a steadily declining rate. The truth of the matter is that we have now reached the point where no new payroll jobs have appeared for 77 months which is to say, over the entire span of a historically ordinary peak-to-peak business cycle. Rather than a cause for celebration, therefore, the Friday jobs print ought to stand out as a wake-up call.

Read more …

And even that …

• Britain Readies ‘Last Resort’ Measures To Keep The Lights On (Telegraph)

Britain may be forced to use “last resort” measures to avert blackouts in coming winters, Ed Davey, the energy secretary, will say on Tuesday. Factories will be paid to switch off at times of peak demand in order to keep households’ lights on, if Britain’s dwindling power plants are unable to provide enough electricity, under the backstop measures from National Grid. The Grid is expected to announce that it will begin recruiting businesses that will be paid tens of thousands of pounds each simply to agree to take part in its scheme. They will receive further payments if they are called upon to stop drawing power from the grid. It is also expected to press ahead with plans to pay mothballed gas power plants to ready themselves to be fired up when needed. “Both the new demand and supply balancing services will be used only as a last resort – and are a safety net to protect households in difficult circumstances, such as a hard winter or very high surges in demand,” Mr Davey will say.

Critics have suggested the measures, which were first mooted last summer, would represent a return to 1970s-style power rationing. But Mr Davey will refute this, saying: “It is entirely voluntary. Nobody will get cut off. No economic activity will be curtailed.” Mr Davey is on Tuesday also expected to publish a new gas “risk assessment” in response to the Ukraine crisis. He said this would show Britain could “comfortably” withstand extreme cold weather or the loss of key supplies. Energy regulator Ofgem warned last summer that Britain’s spare power capacity margin – the difference between peak demand and supply – could fall as low as 2pc in winter 2015-16 as old power plants close and new ones are not yet built. The risk of blackouts could be as high as one in four unless consumers cut demand, it said.

Read more …

Your world.

• Thousands Of Irish Orphans Were Used As ‘Drug Guinea Pigs’ (RT)

Over 2,000 care-home kids were secretly vaccinated against diphtheria in the 1930s in medical trials undertaken by international drugs giant Burroughs Wellcome, Irish media reveal. Among the testing sites was a recently discovered mass grave. The medical records cited by the Irish Daily Mail show that some 2,051 children and babies across several Irish care homes may have been subjected to the practice. Michael Dwyer, of Cork University’s School of History, found the data after foraging through tens of thousands of archive files and old medical journals. What he did not find is whether any consent was gained for these alleged illegal drug trials or any records of the effects on the infants involved.

Dwyer discovered that the tests were carried out shortly before the drugs were made readily available in the UK. The homes involved included Bessborough, County Cork, and Sean Ross Abbey in Roscrea, County Tipperary. “What I have found is just the tip of a very large and submerged iceberg,” Dwyer told the paper. “The fact that reports of these trials were published in the most prestigious medical journals suggests that this type of human experimentation was largely accepted by medical practitioners and facilitated by authorities in charge of children’s residential institutions.” The Newstalk Breakfast on Monday show also found out that nearly 300 children living in care homes in the 1960s and 70s were used as guinea pigs in medical trials. Ireland had no laws pertaining to medical testing until 1987.

Read more …