Harris&Ewing Car interior. Washington & Old Dominion R.R. 1930

“The financial inflation is obviously the great bubble that afflicts the entire financial system of the world. It’s becoming increasingly unstable and it will eventually collapse.”

• We Are Now Entering The Terminal Phase Of The Global Financial System (Stockman)

Today David Stockman, the man President Ronald Reagan called upon along with Dr. Paul Craig Roberts to help save the United States from disaster in 1981, warned King World News that we are now entering the “terminal phase” of the global financial system that will end in total collapse. Eric King: “David, I wanted to get your thoughts on gold in the midst of this big deflation you think is in front of us. When you look at the collapse of 2008 – 2009, gold was one of the best performing asset classes. Gold went down but it went down much less relative to virtually everything else. Contrast that to 1973 – 1974, where we had a 47% stock market collapse. But during that time we had skyrocketing gold and silver. What’s in front of us because it looks like gold and silver may be ending a 4 year bear market and ready for a 1973 – 1974-style up-move?”

David Stockman: “Yes. I think the two periods are quite different. Although at the bottom it’s central bank errors that underlie each. But remember that in the 1970s we had just finally exited a semi-stable Bretton Woods Gold Exchange Standard system. There still was, at the end of the day, an anchor on the central banks that was thrown overboard by Nixon in 1971…. “So the first go-round was a rip-roaring price inflation because there had not yet been enough time under the fiat money and balance sheet expansion by the central banks to create excess capacity in the world industrial system. So as the boom in demand took off, commodity prices soared. That fed into domestic costs and labor wages in particular. There weren’t a million cheap workers coming out of the rice paddies in China yet because it was still in the Dark Ages of Mao and not part of the world economy.

And so you had a classic inflation blowoff and flight to gold in the 1970s as a result of that initial money printing cycle. Now, I think 40 years later central banks are erring to much greater extent but the cycle is different. We have now created massive excess industrial shipping, mining and manufacturing capacity in the world. Therefore we don’t have a short-run consumer price blowoff. We still have massive cheap labor in the world and so therefore we don’t have a wage price spiral. The result is that all of the massive stimulus from the central banks has gone into the financial inflation, not goods and services. The financial inflation is obviously the great bubble that afflicts the entire financial system of the world. It’s becoming increasingly unstable and it will eventually collapse. And when it does I think it will mark the complete failure of a monetary system that has basically been metastasizing since 1971.

“.. investors are trapped in this “Twilight Zone”—the transition period between the end of quantitative easing and the first rate hike by the Fed..”

• Bank Of America Is Forecasting A ‘Scary Summer’ For Stock Market (MarketWatch)

Investors might want to add a little cash and some gold to their portfolio’s summer outfit. So say analysts at Bank of America Merrill Lynch, who are forecasting a grim summer for stocks this year. In other words, it might be wise to apply ample dollops of market-correction block in addition to any sunscreen you might wear. While falling short of calling for an outright bear market, which needs a rise in interest rates and a decline in earnings per share, Bank of America is painting a pretty ugly picture for investors over the next several months. The Wall Street firm warns that the market will see a scary summer because investors are trapped in this “Twilight Zone”—the transition period between the end of quantitative easing and the first rate hike by the Fed, as it tries to normalize its fiscal policy.

In the interim, investors can expect mediocre returns, volatile trading, correlation breakdowns and flash crashes, says chief investment strategist Michael Hartnett. Harnett advises reducing risk rather than maximizing return for the midpoint of the year, saying it could be a “lose-lose” summer for risk assets. On the one hand, broad economic trends may improve and the Fed may get to raise rates for the first time in about a decade, which may cause volatility at least temporarily. On the other hand, “more ominously for consensus positioning, the macro doesn’t recover, in which case [earnings-per-share] downgrades drag risk-assets lower,” the Bank of America analyst says.

Bright view: “The goal here is to create a much more secure financial system where you don’t have these giant companies that pose a threat to the whole economy.”

• Pay Bankers No More Than Civil Servants, Says Ex-Cameron Strategist (Guardian)

David Cameron’s former strategy guru Steve Hilton has suggested bankers should be paid no more than senior civil servants as they rely on the implicit backing of the taxpayer. Hilton, who has been working as an academic in the US, floated the idea in an interview with the BBC. He is in the UK promoting his book, More Human, which argues that ordinary people feel shut out of policy-making and increasingly frustrated with the “obscene” pay of those at the very top of companies, which can lead to a dangerous anti-business mood. “We should all be pro-business because it is in all our interests that business succeeds,” he said. “The question is: what kind of business do we want to see?”

Capping pay could be an incentive for the banks to reform, meaning “they might decide to split themselves up or we could do that forcibly”, he said. “The goal here is to create a much more secure financial system where you don’t have these giant companies that pose a threat to the whole economy.” Hilton also called for the competition authorities to be much tougher in challenging dominant companies in a market. “I think the competition authorities need to be much more aggressive generally, and specifically where you have a concentration of power,” he said. “They should be using their powers to make the market more competitive. Now whether that is breaking them up or other means is for others to debate. The system ought to be geared to help the insurgents and not to protect the insiders.”

Hilton, who had a hippyish reputation for wandering around Downing Street in bare feet, is giving a talk this week expanding on his views. He is said to remain close to the prime minister but some of his remarks may be seen as a rebuke to Cameron’s membership of an elite Westminster class. In an article for the Sunday Times, Hilton launched a critique of an “insular ruling class” in which too many of the people who make decisions go to the same dinner parties and send their children to the same schools. “Our democracies are increasingly captured by a ruling class that seeks to perpetuate its privileges,” Hilton wrote. “Regardless of who’s in office, the same people are in power. It is a democracy in name only, operating on behalf of a tiny elite no matter the electoral outcome.”

Incredible. But not surprising.

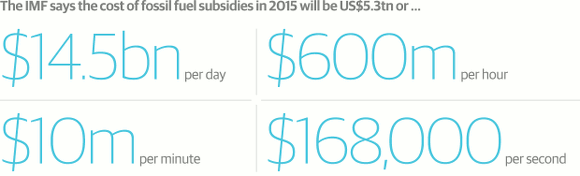

• Fossil Fuel Companies Get $10 Million A Minute In Subsidies: IMF (Guardian)

Fossil fuel companies are benefitting from global subsidies of $5.3tn a year, equivalent to $10m every minute of every day, according to a startling new estimate by the International Monetary Fund. The IMF calls the revelation “shocking” and says the figure is an “extremely robust” estimate of the true cost of fossil fuels. The $5.3tn subsidy estimated for 2015 is greater than the total health spending of all the world’s governments. The vast subsidy derives largely from polluters not paying the costs imposed on governments by the burning of coal, oil and gas. These include the harm caused to local populations by air pollution as well as to people across the globe affected by the floods, droughts and storms being driven by climate change.

Lord Nicholas Stern, an eminent climate economist at the London School of Economics, said: “This very important analysis shatters the myth that fossil fuels are cheap by showing just how huge their real costs are. There is no justification for these enormous subsidies for fossil fuels, which distort markets and damages economies, particularly in poorer countries. Stern said that even the IMF’s vast subsidy figure was a significant underestimate: “A more complete estimate of the costs due to climate change would show the implicit subsidies for fossil fuels are much bigger even than this report suggests.”

The IMF, one of the world’s most respected financial institutions, said that ending the subsidies to fossil fuels would cut global carbon emissions by 20%. That would be a giant step towards taming global warming, an issue on which the world has made little progress to date. Ending the subsidies would also slash the number of premature deaths from outdoor air pollution by 50% – about 1.6m lives a year. Furthermore, the IMF said the resources freed by ending fossil fuel subsidies could be an economic “game changer” for many countries, by driving economic growth and poverty reduction through greater investment in infrastructure, health and education and also by cutting taxes that restrict growth.

Another consequence would be that the need for subsidies for renewable energy – a relatively tiny $120bn a year – would also disappear, if fossil fuel prices reflected the full cost of their impacts. “These [fossil fuel subsidy] estimates are shocking,” said Vitor Gaspar, the IMF’s head of fiscal affairs and former finance minister of Portugal. “Energy prices remain woefully below levels that reflect their true costs.” “When the [$5.3tn] number came out at first, we thought we had better double check this!” said David Coady, who heads the IMF’s fiscal affairs department. But the broad picture of huge global subsidies was “extremely robust”, he said. “It is the true cost associated with fossil fuel subsidies.”

Amid the confusing use of the term ‘inflation’ for any and all pirce rises, the takeaway here is that the British people spend less.

• UK Inflation Rate Below Zero for First Time Since 1960 (Bloomberg)

Britain’s inflation rate fell below zero for the first time in more than half a century, as the drop in food and energy prices depressed the cost of living. Consumer prices fell 0.1% from a year earlier, the Office for National Statistics said in London on Tuesday. Economists had forecast the rate to be zero, according to the median of 35 estimates in a Bloomberg News survey. Core inflation dropped to 0.8%, the lowest since 2001. With inflation so far below the Bank of England’s 2% target, policy makers are under little pressure now to raise the key interest rate from a record-low 0.5%.

Governor Mark Carney said last week that any period of falling prices will be temporary and an expected pickup in inflation at the end of the year means the next move in borrowing costs is likely to be an increase. “Inflation is likely to remain close to zero in the near term before starting to trend up gradually from the third quarter,” said Howard Archer, an economist at IHS Global Insight in London. “Nevertheless, inflation is still only seen reaching 1% by the end of 2015.”

We are all discovering that.

• As The UK Has Discovered, There Is No Postindustrial Promised Land (Guardian)

Anyone puzzled by Scotland’s increasing disaffection should take a look at a book called British Enterprise. Written by Alexander Howard and Ernest Newman, and published in 1952, the immediate afterglow of the festival of Britain, it consisted of short descriptions of each of more than 100 then world-beating British manufacturing companies. It strikingly illustrates how much more geographically balanced the British economy was in those days. In common with latter-day Germany, every region of 1950s Britain had plenty of industrial prowess to boast of. The Midlands had the British car industry, the world’s second-largest by total output and No 1 in exports.

Wales had toys, steel, and domestic appliances; Nottingham had bicycles; Newcastle and Belfast led the world in key areas of heavy engineering; and, of course, Lancashire had cotton. Then there was Scotland. Its roll-call of exporting titans included Renfrew-based Babcock and Wilcox, which made boilers for the world’s power stations. Other major Scottish exporters included North British Locomotive and the William Beardmore castings company. In Dundee there was National Cash Register’s major British subsidiary and in Kirkcaldy the Nairn linoleum company. The list went on and on, and at the top was the John Brown company. Although then one of the world’s most technically advanced manufacturers, John Brown is largely forgotten today.

Its products, however, are not. They included the Lusitania, HMS Repulse, the Queen Mary, the Queen Elizabeth, the QE2 and others. John Brown was the cornerstone of a Clydebank shipbuilding industry that built nearly a third of the world’s ships. All this was before the coming of postindustrialism, a superficially attractive but fundamentally disastrous intellectual fad. Espoused by London-based elites in the 1970s and powerfully championed by Margaret Thatcher in the 1980s, postindustrialism postulates that sophisticated states no longer need manufacturing. Instead they should promptly move to a new promised land of postindustrial services.

And this is why there is no postindustrial promised land: meaningful work is disappearing. We don’t even know what gives work meaning anymore.

• The End of Meaningful Work: A World of Machines and Social Alienation (Drew)

Many activists are clamoring for a higher minimum wage. That’s an admirable goal, but is that where the worst problem is? Even at the abysmally low wages of the present moment, we still have 938,000 people being turned away from McDonald’s because there aren’t enough McJobs. The real problem is the lack of meaningful work. In a world of machines and social alienation, meaningful work is as scarce as water in the drought-stricken California Central Valley. One cause of the employment crisis is relentless outsourcing to foreign countries. However, even more insidious has been the replacement of human workers by machines. For hundreds of years, the Protestant work ethic lauded hard work and efficiency as ideals to strive for. It’s not easy to object to those principles.

But what happens when efficiency means eliminating humans? It’s doubtful the early Protestants ever imagined that could be a possibility. Even up to the present day, many view new technology and efficiency as the main drivers of human progress. For awhile, it seemed like this was indisputable. In his book Rise of the Robots, Martin Ford describes the 25 years after World War II as the “golden age” of the American economy. Productivity, employment, and wages were increasing in synchrony. As with many trends, economists assumed they would continue indefinitely. It was the glorious free market at work. Then it all came crashing down at the turn of the century. This time, it really is different. The shift happened when machines transformed from mere tools to actual workers.

Martin Ford explained, “In 1998, workers in the US business sector put in a total of 194 billion hours of labor. A decade and a half later, in 2013, the value of the goods and services produced by American businesses had grown by about $3.5 trillion after adjusting for inflation – a 42% increase in output. The total amount of human labor required to accomplish that was…194 billion hours. Shawn Sprague, the BLS economist who prepared the report, noted that ‘this means that there was ultimately no growth at all in the number of hours worked over this 15-year-period, despite the fact that the US population gained over 40 million people during that time, and despite the fact that there were over thousands of new businesses established during that time.'”

If this trend continues a few more years, it will be two lost decades, which means an entire generation has gone by with no net new jobs created. This might be somewhat permissible if the population had stagnated or declined, but with 40 million new people, it sets the stage for a national disaster. It is truly a new era. Ford confirmed, “There has never been a postwar decade that produced less than a 20% increase in the number of available jobs. Even the 1970s, a decade associated with stagflation and an energy crisis, generated a 27% increase in jobs. This new reality is nothing less than the end of progress and the Protestant work ethic. Efficiency can no longer be held up as something that is unambiguously good. The Protestants were wrong. There is something much more important than efficiency: survival.

Bold statement. And this morning, Labour Minister Panos Skourletis said on Greek TV: “De facto, in the coming days.”

• Varoufakis: Deal With Creditors ‘A Matter Of One Week’ (Bloomberg)

Greek leaders expressed optimism a deal to unlock bailout funds is within reach, in the face of continuing warnings by creditors that the country has yet to comply with the terms of its emergency loans. “We are very close” to an agreement, Finance Minister Yanis Varoufakis said in an interview late Monday with Greece’s Star TV Channel. “I’d say it is a matter of one week.” Earlier Monday, Prime Minister Alexis Tsipras had told Greek industrialists that “we are now at the final stretch before striking a mutually beneficial agreement, after long and painful negotiations.” Greece’s anti-austerity government has repeatedly expressed confidence a deal was imminent, only to be rebuffed by creditors seeking more concrete actions in areas including labor market deregulation and pension-system overhaul.

Even though Greece has made some progress in meeting its bailout commitments, “we’re not there yet,” EU Economic Affairs Commissioner Pierre Moscovici said, just a few hours before Tsipras’s and Varoufakis’s assurances that an agreement is close. The country’s liquidity situation is “obviously tense,” and the time left to reach an agreement is “very limited,” Moscovici told reporters in Berlin. [.] The four-month standoff between Europe’s most indebted state and its lenders has triggered an unprecedented liquidity squeeze, which pulled the Mediterranean nation’s economy into a double-dip recession. Record deposit withdrawals, and the state’s increasing difficulty in meeting debt payments have sparked renewed doubts about the country’s place in the euro area.

Adopting a new currency is not “on our radar,” Varoufakis said in his Star TV interview, which started at 11:30 p.m. and was still dragging on at about 2 in the morning, in Athens. Euro-area member states haven’t made proposals to the Greek government to leave the currency bloc, according to Varoufakis. After months of brinkmanship, Varoufakis said Greece and its creditors still disagree on budget targets, labor market regulations and pension system reform. Negotiations continue, and Greece has suggested streamlining its sales tax by setting a 15% rate for most goods and a 6.5% rate for basic goods, according to Varoufakis.

Note: there doesn’t seem to be agreement in the press on what the VAT rates will be. The Bloomberg piece above says 15% and 6.5%, this Kathimerini one says 18% and 9.5%. A curious difference.

• Greece Sends Reform Proposals For Lenders’ Scrutiny (Kathimerini)

Athens sent its proposals to creditors on Monday for an overhaul of the value-added tax regime as Greek officials indicated that an agreement on a reforms-for-cash deal was close. In a bid to secure progress on the technical level of negotiations to enable a political decision that would unlock rescue loans, officials of the so-called Brussels Group were to hold a late-night teleconference on Monday that was expected to address these proposals. Greece’s VAT proposal is said to foresee two rates of value-added tax instead of the current three. The highest would be set at 18% and relate to virtually all services and commodities except food and medicines, with a discount of 3 percentage points for non-cash transactions. The lower rate would be set at 9.5% and would relate to food, drugs and books, with the same discount applying to cash-free transactions.

The proposals appear to be part of a broader bid by the government to boost non-cash transactions while curbing tax evasion. VAT evasion in Greece is estimated at 9.5 billion euros per year. The Greek proposal was sent to creditors at around the time that To Vima reported that European Commission President Jean-Claude Juncker had pitched a compromise proposal to Greece, foreseeing low primary surpluses and some 5 billion euros in reforms, chiefly tax measures. The report was quickly rebuffed by Greek and EC officials. Speaking generally and apparently not referring to a rumored Juncker proposal, European Economic and Monetary Affairs Commissioner Pierre Moscovici said Greece was quick to turn down proposals on reforms but slow to offer alternatives.

“They are more eager to say what they don’t want to keep in the program than to propose alternatives,” Moscovici told a news conference in Berlin, while noting that “some progress” had been made in recent days. In a speech at the annual general meeting of the Federation of Hellenic Enterprises (SEV) Alexis Tsipras was much more upbeat, claiming that Greece was “in final straight toward an agreement,” which, he said, “will come very soon.” “We are working, with absolute honesty and dedication, to reach a solution,” he said. He echoed the conditions he set out last Friday for a deal, saying it should include debt restructuring, no further cuts to wages and pensions, and an investment plan. He added that Greece is ready to compromise but that he wanted a deal that would allow Greece to return to markets soon.

One detail from this much-denied plan: it says the government must address ‘the enormous problem of unemployment’. Well, so must the creditors. Athens just rehired 4000 civil workers, that’s a start.

• Juncker Steps In With Greek Rescue As Talks Reach ‘Final Stages’ (Telegraph)

The president of the European Commission has reportedly intervened in Greece’s bail-out negotiations, proposing a reduction in Troika-imposed budget targets and a release of emergency cash to prevent Greece going bankrupt in the summer. According a blueprint leaked to Greek media, Jean-Claude Juncker’s “plan” to break Greece’s deadlock includes a relaxation of Athens’ primary budget surplus target to 0.75pc this year – half that previously sought by Greece’s paymasters. The proposals also include releasing €5bn to the government in June, and delaying a number of fiscal austerity measures until October. However, the blueprint maintained that Greece would have to retain a controversial property tax and push for flexible labour market reforms.

Despite refusing to confirm the plan, a spokesman for Mr Juncker said the EU chief was now “personally involved” in Greece’s talks. Speaking in Athens on Monday, Greek prime minister Alexis Tsipras said negotiations with creditors were reaching their “final stages”. He maintained the government would not agree to any plans to cut pensions and wages but said his government was willing to “accept compromises” to reach a deal should some form of bridging finance be agreed. The Leftist premier, who wrote to Mr Juncker earlier this month to say Greece would default to its creditors, added his country’s cash squeeze was being used as a “negotiating tactic”. Mr Tsipras also repeated calls for some form of debt restructuring as part of any agreement with Greece’s lenders.

Proposals from the Commission would represent an easing of the tough conditions demanded by Greece’s creditors over the last 110 days. Indicating a potential split among official creditors, the leaked memo highlighted objections to the plan from the IMF, and voiced concerns the Fund was willing to withdraw its support for Greece. The plan added that Athens’ Leftist government needed to “increase the competitiveness of the Greek economy and address the enormous problem of unemployment”. Greek markets rallied on the news of a potential compromise, jumping nearly 4pc in afternoon trading.

Shut down by previous government on questionable grounds.

• Tsipras: Relaunch Of State Broadcaster ERT ‘Victory Of Democracy’ (Kathimerini)

Public broadcaster ERT will reopen in a week, two years after it was shut down, leftist Prime Minister Alexis Tsipras said on Monday. Meeting with ERT chairman Dionysis Tsaknis and CEO Lambis Tagmatarchis, Tsipras urged the newly installed executives to work for a “pluralist and independent” network. “Your responsibility is to restore people’s bond with ERT, which was severed by the blackout,” he said. Tsipras added that June 11, the anniversary of ERT’s shutdown by the previous government and its replacement with NERIT, will be a day to celebrate “the victory of democracy.”

They should urge Europe to strike a deal, not only Athens.

• Every Day Without A Deal Costs Greece €22.3 Million, 600 Jobs (Kathimerini)

An average of 59 enterprises close every day of the working week and 613 jobs are lost, while every day, with the market facing a cash crunch, the economy loses 22.3 million euros from its gross domestic product, according to a report published by the Hellenic Confederation of Commerce and Enterprises (ESEE). A deal with the country’s creditors is more urgent than ever, ESEE stressed, but the economy would need as much as 25 billion euros in financing in order to restart, as losses from the first five months will be hard to cover over the rest of the year, argued ESEE. This uncertainty has hit the local economy after five years of crisis, during which retail commerce turnover shrank by 26.2%.

Things were worse for wholesale commerce, with turnover dropping 37.1%, while the car market crumbled by 61.9% in the same period, the confederation’s data show. Liquidity is becoming an unfamiliar term in the market as 95% of applications for loans are rejected every day by commercial banks, while only one in 10 enterprises dares to ask for funding from the country’s four systemic lenders, the ESEE report showed. The absorption of funding tools for business liquidity stands at 40%, while in the funding of commerce the rate does not exceed 12%. ESEE is urging the government in dramatic terms to reach a deal with Greece’s creditors even if it’s not a great deal.

“A final agreement, even if it is mediocre or below expectations, is certain to allow the Greek economy to feel free at last to operate for the remainder of 2015,” read Monday’s ESEE statement. “Financial and political time are running dangerously short, and reaching a sustainable agreement with our partners is vital as it is directly associated with the country’s capacity to draw liquidity from the European funding tools,” it added. “The official position of Greek commerce and small and medium-sized entrepreneurship is to end the market’s four months of stagnation caused by the ‘no deal, no Grexit’ situation, replacing the content of the original agreement offering ‘money for the debt and grace for the country’ with ‘money for the market and growth for the country’,” ESEE concluded.

Which they can only do by keeping the spigot open.

• China’s Lodestar Is Not Reform But Avoiding Chaos (Reuters)

China’s policymakers talk much of reform. What really drives them is something different: a fear of chaos. The treatment of the country’s local government debt pile is an example of risk aversion getting the upper hand. The strategy is imperfect, but also right. The ruling State Council on May 15 published an instruction to banks not to blindly “pull, pressure or stop” lending to borrowers linked to provincial governments, which have amassed an estimated 16 trillion ($2.6 trillion) of debt. Where creditors can’t pay, banks can extend lending. And where money has run out but construction continues, local governments can funnel in cash directly. That makes explicit what was already widely assumed.

The Chinese banking system’s suspiciously low reported bad loans, which rose to just 1.4% of total lending at the end of March, are due to the industry’s compulsive rolling over of doubtful debt. For a still-developing market, showing some mercy isn’t entirely foolish. Uncontrolled defaults would undermine confidence and real economic activity. Genuinely useful projects might be unable to find funding, to the dismay of the citizens who have to live among the ruins. The wider agenda may be to ring-fence those projects that deserve official support before identifying those that do not. Jiangsu and Xinjiang provinces will soon be the first to swap some safer government-backed credit into bonds. If failures can be kept at bay for a while, those trials are more likely to succeed.

Market-based debt restructurings are helpful in theory. But they are also messy, driven as much by bargaining and bullying as thoughtful analysis of assets and rights. Kaisa, a real estate developer in Shenzhen, is haggling with bondholders over a plan to delay repaying its existing loans by five years. Foreign creditors have almost no rights, but significant nuisance value. That situation replicated across a country with a fledgling legal system is a daunting prospect. Once a clear line has been drawn between what’s state-backed and what isn’t, other borrowers can be exposed to market forces. Hopefully the government’s latest largesse is part of that bigger plan. But if progress doesn’t come soon, a more dangerous kind of confidence crisis will emerge: the belief that the government hasn’t got a plan after all.

How much of this is just politics? And how much is favoritism? What is the wealth accumulated by the current president and PM? And their families?

• China Corruption Purge Snares 115 State Owned Enterprise ‘Tigers’ (FT)

More than 100 top executives from some of China’s largest state-owned enterprises have been detained on suspicion of corruption since the start of last year, according to official statistics. Since the beginning of 2014, China’s anti-corruption authorities have publicly named 115 C-suite officials from state groups including global giants such as PetroChina, China Southern Airlines, China Resources, FAW and Sinopec, who have been placed under investigation for graft. Because virtually all of them are also senior Communist party officials, they have mostly disappeared into the feared system of internal party discipline inspection , where they can be held indefinitely without trial and where torture is believed to be rife.

Since ascending to the top of the Chinese system in late 2012, Chinese President Xi Jinping has been engaged in a ferocious anti-corruption campaign that has already gone further and continued for longer than any other since the founding of the People’s Republic in 1949. Mr Xi has vowed to tackle high-ranking corrupt tigers as well as lowly flies in his quest to clean up the sprawling party bureaucracy. According to official announcements from China’s Central Commission for Discipline and Inspection, more than a fifth of the SOE tigers who have been toppled from their horses came from the energy sector. Executives at China’s enormous state energy monopolies command vast armies of employees and control budgets worth hundreds of billions of dollars.

They are often accused of acting like rulers over mini-states within the state. The enormous influence of companies such as Sinopec and PetroChina over government policy is sometimes blamed as one reason for weak enforcement of environmental standards and China’s shocking levels of pollution. But the energy sector is also the former power base of Zhou Yongkang, the most senior casualty of Mr Xi’s purge and the most senior party official to go on trial for corruption in the history of the People’s Republic. Until Mr Xi took power, Mr Zhou was a member of the all-powerful Politburo Standing Committee and controlled the Chinese courts, police, secret police, paramilitary and intelligence services. He is currently awaiting trial.

“..Chinese stocks in general are looking “extremely” volatile and risky.”

• How China’s ‘Insane’ Rally Could Grind To A Halt (CNBC)

Foreign flows, investors using borrowed money to buy equities and a taste for new public offerings have aided a mega-rally in Chinese stocks this year. But analysts are fretting that the good times could end in the blink of an eye. The blue-chip Shanghai Composite has seen gains of 32% year-to-date but has been outpaced by smaller domestic stocks, or A-share indexes, which have seen gains of over 70% so far in 2015. “They just treat their stock market like a casino, they just poor all the money in,” Dickie Wong, the executive director at Kingston Securities, told CNBC Monday, warning of the irrational exuberance of Chinese investors.

“And after the recent gains, they just pour the money into the IPOs,” he added. He called the Shenzhen index a “bubble” but stressed that Chinese stocks in general are looking “extremely” volatile and risky. Analysts have warned that investors are borrowing money from brokerage firms to buy more shares – known as margin trading. Despite a crackdown by the Chinese authorities, Wong believes that more regulation is on the horizon which could lead to a pullback. “(The authorities) will do something, they will say something to cool down the market,” he said.

“The move would be a reaction to European governments having become less willing to prop up banks if they get into a crisis..”

• Ratings Agency Fitch To Downgrade Many European Banks (Reuters)

Ratings agency Fitch will soon downgrade European banks en masse, possibly even at the start of the week, German newspaper Handelsblatt said, citing unnamed financial sources. In most cases the banks will be downgraded by between one and a maximum of four levels, according to an advance copy of an article due to be published on Monday. The move would be a reaction to European governments having become less willing to prop up banks if they get into a crisis, the newspaper said. The newspaper said dozens of banks would be affected by the downgrade, including Deutsche Bank, which would see its rating fall slightly, and Commerzbank, which would be hit much harder.

It never feels good when the only people who share one’s views also have some really crazy ones. But sometimes it’s just like that.

• ‘We Must Resist Corporations’: Le Pen Targets TTIP Deal In New Campaign (RT)

Leader of France’s National Front party, Marine Le Pen, has launched a month-long blitz against the Transatlantic Trade and Investment Partnership (TTIP) – a proposed EU-US treaty, which has been criticized for secretiveness and lack of accountability. “It is vital that the French people know about TTIP’s content and its motivations in order to be able to fight it. Because our fellow countrymen must have the choice of their future, because they should impose a model for society that suits them, and not forced by multinational companies eager for profits, Brussels technocrats sold to the lobbies, politicians from the UMP [party of former president Nicolas Sarkozy], who are subservient to these technocrats,” Le Pen said during a press conference in Paris.

Since 2013, open-ended negotiations between Washington and Brussels have drawn up the framework for the agreement, intended to standardize legislation and bring down trade barriers between them. As per US practice, the contents of all economic treaties are classified. The EU has recently set up reading rooms throughout Europe for officials with clearance – but only a few thousand people have had access to the working documents. Le Pen hit out at the secrecy of the negotiations, which have featured mostly bureaucrats from the European Commission, the EU’s executive body, and nebulous “stakeholders” from businesses and public organizations. As a member of the European parliament, she forwarded a motion for greater transparency in negotiations last year. Le Pen’s motion was defeated.

She is now hoping for grassroots support. “I am convinced that we can push back the TTIP if the peoples are informed of its content, and if they decide themselves to join us in order to express their disagreement concerning this treaty,” Le Pen told journalists. Both of France’s leading parties have endorsed the treaty, but Le Pen is relying on strong the anti-European sentiment that propelled her party to first place in last year’s elections for the European parliament. While TTIP’s authors promise that the treaty will bring an extra 0.5% GDP to Europe and the US, figures across the political spectrum have expressed concern.

Jacksonville, Detroit, Chicago, Puerto Rico.

• Debt-Choked Puerto Rico at Fiscal Brink as Bond Buyers Pull Back (Bloomberg)

The sobering news arrived in San Juan via telephone from Washington. It was April 28, and U.S. Treasury Secretary Jacob J. Lew called to tell Puerto Rico officials they must confront one of the island’s gravest financial crises without a bailout. Saddled with $72 billion in debt, the commonwealth – a U.S. territory since the Spanish-American War – needs a “credible” plan, Lew said. The Caribbean island is hurtling toward the fiscal brink. After years of borrowing to paper over deficits, and with $630 million due to investors on July 1, Puerto Rico may confront the unthinkable: a default. The prospect has set Wall Street on edge as bond yields surpass those of Argentina and Greece; about half of municipal mutual funds hold commonwealth debt.

Puerto Ricans across the political spectrum are alarmed at the scale of the crisis, Rafael “Tatito” Hernandez, chair of the House Treasury Committee, said during a May 6 interview at the Capitol. Every mayor on the island will face angry constituents, he added, especially those whose work weeks may be cut to four days. “We used to have choices,” Hernandez said, a framed copy of his U.S. Navy honorable discharge on the wall behind him. Now “people have to realize where we’re really at. It may be late, but that’s the reality.”

October 30 1995 was the last referendum, which the PQ lost 50.58% against 49.42%. I was with a bunch of friends in Montréal watching the drama unfold on TV, everyone was very nervous.

• Flamboyant Tycoon Ready To Revitalize Quebec’s Separatists (Guardian)

Ice hockey is a religion in Quebec, but since the departure of the NHL’s Nordiques to Colorado in 1995, residents of the provincial capital, Quebec City, have had no icons to worship. So when Pierre Karl Péladeau – the CEO of Quebecor, Canada’s second biggest media group – announced in 2009 that he would invest C$33m to lease a new arena and bring a hockey club back to the city, he was hailed as a prophet. Now campaigners for Quebec independence hope that the media magnate can work miracles for their cause after Péladeau’s election as the new leader of the separatist Parti Québécois (PQ). Thousands of party delegates joined in chants of “PKP” even before victory was confirmed on Friday evening in Quebec City, home of the provincial parliament.

Visibly pleased with his 57.6% share of the vote, Péladeau hugged his wife, the television producer Julie Snyder with whom he forms the ultimate power couple in the province of 8 million people. “You have given me a clear and strong mandate: to make Quebec a country,” said the 53 year-old in a bilingual speech. Campaigners for independence have been starstruck ever since PKP joined the ranks of the Parti Québécois a mere 14 months ago, when he launched a successful bid for election to the provincial parliament (a vote which the Parti Libéral won by a landslide). Péladeau’s public embrace of independence had a galvanizing effect on the separatist cause. Separatists and federalists alike agree that PKP – dubbed “Citizen Péladeau” and often compared to the Italian media magnate-turned-politician Silvio Berlusconi – brought star quality to the PQ. “Is this the man who will break up Canada?” asked the national public affairs magazine Maclean’s.

Only 3% of our living environment is left. We paved paradise.

• 97% of Britain’s Wildflower Meadows Have Gone (Guardian)

With its flower-rich meadows, woodland and ponds, Ash Common in the village of Ash Priors near Taunton is a lovely corner of unspoilt countryside. It is a local nature reserve and home to an endangered butterfly, the marsh fritillary. A local wildlife lover recently tweeted a photograph that suggests the common has undergone a close encounter with a scalpel: a wildflower meadow has been shaved like a football pitch. It wasn’t a vandal or a developer who did this, but Taunton Deane borough council, which has managed the common for more than 20 years. The decline of the marsh fritillary vividly demonstrates the drastic loss of 97% of UK wildflower meadows since the second world war.

And the fate of Ash Common reflects a much bigger, hidden story about the damage being done to precious, unprotected local nature reserves. There are 42,865 of these local wildlife sites in England, ranging from large commons to tiny treasures such as the old tennis court at Gresham’s school in Norfolk, which boasts more than 200 orchid spikes. Many are privately owned and there is almost nothing to protect them: when the Wildlife Trusts surveyed 6,590 local wildlife sites, they found that 717 were lost or damaged over five years to 2013. Wildflower meadows need cutting, but conservationists usually advise to do so in the autumn, after flowers have seeded and invertebrates are hunkered down for the winter.

Taunton Deane borough council’s ecologist, Barbara Collier, explained that staff restructuring and illness meant they failed to trim Ash Common last October and so cut it this spring to prevent it “scrubbing up” with trees. “I admit that this year we didn’t get it quite right. I’m really sorry about that,” she said. According to the Wildlife Trusts, which freely advises owners how to better manage their special sites, such mistakes are all too frequent. The only real solution is for local communities to get involved (if permitted by the landowner) as I saw when I visited a more inspirational local nature reserve, Hoe Common, in Norfolk, which residents are restoring. A few marsh fritillaries may yet have survived the scalpel at Ash Common; hopefully local vigilance will stop them being cut to pieces again.