Piet Mondriaan The Grey Tree 1912

No markets. No investors.

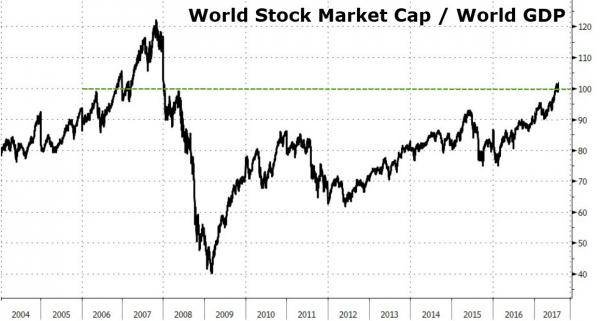

• Global Stocks Soared $1.5 Trillion This Week – Now 102% Of World GDP (ZH)

Thanks, it seems, to a few short words from Janet Yellen, the world’s stock markets added over $1.5 trillion to wealthy people’s net worth this week, sending global market cap to record highs. The value of global equity markets reached a record high $76.28 trillion yesterday, up a shocking 18.6% since President Trump was elected. This is the same surge in global stocks that was seen as the market front-ran QE2 and QE3. This was the biggest spike in global equity markets since 2016.

For the first time since Dec 2007, the market value of global equity markets is greater than the world’s GDP…

Of course – the big question is – how long can ‘they’ keep this dream alive?

“Actually, the longer it takes to hit, the better it is for us…”

• Central Bankers Are Always Wrong…Especially Before A Bust – Ron Paul (ZH)

The global dollar-based monetary system is in serious jeopardy, according to former Texas Congressman Ron Paul. And contrary to Fed Chairwoman Janet Yellen’s assurances that there won’t be another major crisis in our lifetime, the next economy-cratering fiat-currency crash could happen as soon as next month, Paul said during an interview with Josh Sigurdson of World Alternative media. Paul and Sigurdson also discussed false flag attacks, the dawn of a cashless society and the dangers of monetizing national debt. Paul started by saying Yellen’s attitude scares him because “central bankers are always wrong – especially before a bust.”

“There is a subjective element to when people lose confidence, and when is the day going to come when people realize we’re dealing with money that has no intrinsic value to it, we’re dealing with too much debt, too much bad investment and it will come to an end. Something that’s too good to believe usually is and it usually ends. One thing’s for sure, we’re getting closer every day and the crash might come this year, but it might come in a year or two.” “The real test is can it sustain unbelievable deficit financing and the accumulation of debt and it can’t. You can’t run a world like this, if that were the case Americans could just sit back and say “hey, everybody wants our money and will take our money.” Paul advised that, for those who are already girding for the crash by buying gold and silver and stocking their basements with provisions like canned food and bottled water, the rewards for their foresight will only grow with the passage of time.

“Actually, the longer it takes to hit, the better it is for us. The more we can get prepared personally, as well as warn other people, about what’s coming.” “It’s a sign that the authoritarians are clinging to power so they can collect the revenues collect the taxes and make sure you’re not getting around the system. That’s what the cashless society is all about. But it won’t work in fact it might be the precipitating factor that people will eventually lose confidence when the crisis hits. They say the crisis hasn’t come – welI in 2008 and 2009 we had a pretty major crisis and what we learned there is that the middle class got wiped out and the poor people got poorer and now there’s a lot of wealth going on but it’s still accumulating to the wealthy individual.” “People say it might not come for another ten years – well we don’t know whether that’s necessary but one thing that’s for sure when a government embarks on deficit financing and then monetizing the debt the value of commodities like gold and silver generally goes up.

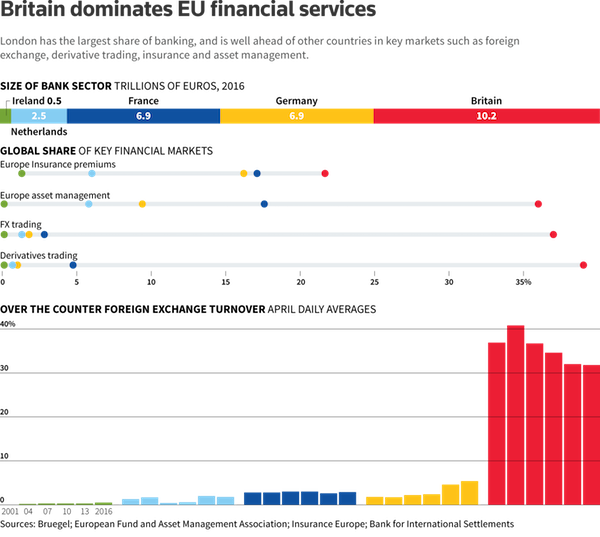

Anyone think the concentration of finance in the City is maybe not such a great idea? As, you know, for the people?

• How Brexit Is Set To Hurt Europe’s Financial Systems (R.)

Interviews with scores of senior executives from big British and international banks, lawyers, academics, rating agencies and lobbyists outline some of the dangers for companies and consumers from potentially losing access to London’s markets. The EU needs London’s money, says Mark Carney, governor of the Bank of England. He calls Britain “Europe’s investment banker” and says half of all the debt and equity issued by the EU involves financial institutions in Britain. Rewiring businesses will be expensive, though estimates vary widely. Investment banks that set up new European outposts to retain access to the EU’s single market may see their EU costs rise by between 8 and 22%, according to one study by Boston Consulting Group.

A separate study by JP Morgan estimates that eight big U.S. and European banks face a combined bill of $7.5 billion over the next five years if they have to move capital markets operations out of London as a result of Brexit. Such costs would equate to an average 2% of the banks’ global annual expenses, JP Morgan said. Banks say most of those extra costs will end up being paid by customers. “If the cost of production goes up, ultimately a lot of our costs will get passed on to the client base,” said Richard Gnodde, chief executive of the European arm of Goldman Sachs. “As soon as you start to fragment pools of liquidity or fragment capital bases, it becomes less efficient, the costs can go up.”

UK-based financial firms are trying to shift some of their operations to Europe to ensure they can still work for EU clients, but warn such a rearrangement of the region’s financial architecture could threaten economic stability not only in Britain but also in Europe because so much European money flows through London. European countries, particularly France and Germany, don’t share these concerns, viewing Brexit as an opportunity to steal large swathes of business away from Britain and build up their own financial centres. Britain alone accounts for 5.4% of global stock markets by value, according to Reuters data. Valdis Dombrovskis, the EU financial services chief, said the EU will still account for 15% of global stock markets by value without Britain, and that measures were being taken to strengthen its capital markets. But he added: “Fragmentation is preventing our financial services sector from realising its full potential.”

Industry figures have similar concerns. Jean-Louis Laurens, a former senior Rothschild banker and now ambassador for the French asset management lobby, told Reuters: “If London is broken into pieces then it is not going to be as efficient. Both Europe and Britain are going to lose from this.” London is currently home to the world’s largest number of banks and hosts the largest commercial insurance market. About six trillion euros ($6.8 trillion), or 37%, of Europe’s financial assets are managed in the UK capital, almost twice the amount of its nearest rival, Paris. And London dominates Europe’s 5.2 trillion euro investment banking industry.

Familiar patteren: first blow a bubble, then warn about it.

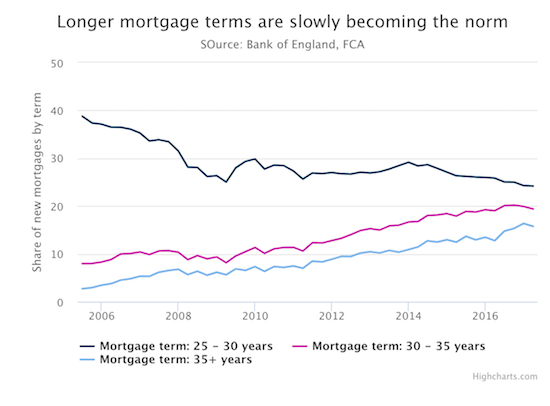

• Britons Face Lifetime Of Debt: BOE Warns Over 35 Year Mortgages (Tel.)

British families are signing up for a lifetime of debt with almost one in seven borrowers now taking out mortgages of 35 years or more, official figures show. Rapid house price growth has encouraged borrowers to sign longer mortgage deals as a way of reducing monthly payments and easing affordability pressures. Bank of England data shows 15.75pc of all new mortgages taken out in the first quarter of 2017 were for terms of 35 years or more. While this is slightly down from the record high of 16.36pc at the end of 2016, it has climbed from just 2.7pc when records began in 2005. The steady rise has triggered alarm bells at the Bank, prompting regulators to warn that the trend risks storing up problem[s] for the future if lenders ignore the growing share of households prepared to borrow into retirement. Several lenders including Halifax, the UK’s biggest mortgage provider, and Nationwide have raised their borrowing age limits to 80 and 85 over the past year.

Bank figures show one in five mortgages are taken out for terms of between 30 and 35 years, from below 8pc in 2005, as the traditional 25-year mortgage becomes less popular. David Hollingworth, a director at mortgage broker London & Country, said the trend showed that an increasing share of borrowers were struggling with affordability pressures, and deciding that lengthening the term will offer leeway as house price growth continues to outpace pay rises. However, he said most borrowers were unlikely to stick with the same deal, with most having a desire to review that later and potentially peg [the extra interest costs] back . Mr Hollingworth added that longer mortgage terms were also better than interest-only deals that were prevalent before the credit crunch. The Bank noted in its latest financial stability report that there was little evidence that borrowers were signing up for longer mortgage deals to circumvent tougher borrowing tests for homeowners introduced in 2014.

Fusion GPS.

• Is Russiagate Really Hillarygate? (Forbes)

The most under covered story of Russia Gate is the interconnection between the Clinton campaign, an unregistered foreign agent of Russia headquartered in DC (Fusion GPS), and the Christopher Steele Orbis dossier. This connection has raised the question of whether Kremlin prepared the dossier as part of a disinformation campaign to sow chaos in the US political system. If ordered and paid for by Hillary Clinton associates, Russia Gate is turned on its head as collusion between Clinton operatives (not Trump’s) and Russian intelligence. Russia Gate becomes Hillary Gate. Neither the New York Times, Washington Post, nor CNN has covered this explosive story. Two op-eds have appeared in the Wall Street Journal. The possible Russian-intelligence origins of the Steele dossier have been raised only in conservative publications, such as in The Federalist and National Review.

The Fusion story has been known since Senator Chuck Grassley (R-Iowa) sent a heavily-footnoted letter to the Justice Department on March 31, 2017 demanding for his Judiciary Committee all relevant documents on Fusion GPS, the company that managed the Steele dossier against then-candidate Donald Trump. Grassley writes to justify his demand for documents that: “The issue is of particular concern to the Committee given that when Fusion GPS reportedly was acting as an unregistered agent of Russian interests, it appears to have been simultaneously overseeing the creation of the unsubstantiated dossier of allegations of a conspiracy between the Trump campaign and the Russians.”

Former FBI director, James Comey, refused to answer questions about Fusion and the Steele dossier in his May 3 testimony before the Senate Intelligence Committee. Comey responded to Lindsey Graham’s questions about Fusion GPS’s involvement “in preparing a dossier against Donald Trump that would be interfering in our election by the Russians?” with “I don’t want to say.” Perhaps he will be called on to answer in a forum where he cannot refuse to answer.

And don’t think it’s over. The pension chips are yet to fall.

• The Way Chicago “Works”: Graft, Corruption, Connections, Bribes (Mish)

Those who wish to understand how things work in Chicago need read a single article that ties everything together:

“Teamsters Boss Indicted On Charges Of Extorting $100,000 From A Local Business. A politically connected Teamsters union boss was indicted Wednesday on federal charges alleging he extorted $100,000 in cash from a local business. John Coli Sr., considered one the union’s most powerful figures nationally, was charged with threatening work stoppages and other labor unrest unless he was given cash payoffs of $25,000 every three months by the undisclosed business. The alleged extortion occurred when Coli was president of Teamsters Joint Council 25, a labor organization that represents more than 100,000 workers in the Chicago area and northwest Indiana. Coli, 57, an early backer of Mayor Rahm Emanuel, was charged with one count of attempted extortion and five counts of demanding and accepting prohibited payment as a union official.”

[..] Former governor Rod Blagojevich is now in prison for a 14-year sentence. He was found guilty of 18 counts of corruption, including attempting to sell or trade an appointment to a vacant seat in the U.S. Senate. He faces another eight years in prison after an appeals court upheld the sentence in April of this year. No other state can match this claim: 4 OUT OF PREVIOUS 7 ILLINOIS GOVERNORS WENT TO PRISON The way Chicago “works” is the same way Illinois “works”. Corrupt politicians get in bed with corrupt union leaders and screw the taxpayers and businesses as much as they can. Sometimes they get caught. Teamster boss Coli just got caught after all these years of extortion. His deals with Mayor Emanuel screwed Chicago taxpayers. Emanuel promised reforms and transparency but reforms and transparency stop once campaign donations are sufficient enough.

Macron plays Napoleon.

• France’s Macron Says Defense Chief Has No Choice But To Agree With Him (R.)

French President Emmanuel Macron said his defense chief has no choice but to agree with what he says, a weekly newspaper reported on Sunday, after his top general criticized spending cuts to this year’s budget. “If something opposes the military chief of staff and the president, the military chief of staff goes,” Macron, who as president is also the commander-in-chief of the armed forces, told Le Journal du Dimanche (JDD). Macron said on Thursday that he would not tolerate public dissent from the military after General Pierre de Villiers reportedly told a parliament committee he would not let the government “fuck with” him on spending cuts.

De Villiers still has Macron’s “full trust,” the president told JDD, provided the top general “knows the chain of command and how it works.” “No one deserves to be blindly followed,” De Villiers wrote in a message posted on his Facebook page on Friday. De Villiers’ last Facebook post is an open letter addressed to new military recruits that makes no mention of Macron. But it was perceived by French media as targeting the president’s earlier comments.

Macron wants to be a global force too. While he has nothing to say in Europe.

• France Calls For Swift Lifting Of Sanctions On Qatari Nationals (R.)

France called on Saturday for a swift lifting of sanctions that target Qatari nationals in an effort to ease a month-long rift between the Gulf country and several of its neighbors. Saudi Arabia, the United Arab Emirates, Bahrain and Egypt imposed sanctions on Qatar on June 5, accusing it of financing extremist groups and allying with the Gulf Arab states’ arch-foe Iran. Doha denies the accusations. “France calls for the lifting, as soon as possible, of the measures that affect the populations in particular, bi-national families that have been separated or students,” French Foreign Minister Jean-Yves Le Drian told reporters in Doha, after he met his counterpart Sheikh Mohammed bin Abdulrahman al-Thani. Le Drian was speaking alongside Sheikh Mohammed, hours after his arrival in Doha. He is the latest Western official to visit the area since the crisis began.

Later in the day he flew to Jeddah, where he repeated his concerns about the effects of the standoff in a televised press appearance with Saudi Foreign Minister Adel al-Jubeir. Jubeir said any resolution of the worst Gulf crisis in years should come from within the six-nation Gulf Cooperation Council. “We hope to resolve this crisis within the Gulf house, and we hope that wisdom prevails for our brothers in Qatar in order to respond to the demands of the international community – not just of the four countries,” he said. [..] Le Drian, who will visit the UAE and Gulf mediator Kuwait on Sunday, follows in the steps of other world powers in the region, including the United States, whose Secretary of State Rex Tillerson sought to find a solution to the impasse this week.

Officials from Britain and Germany also visited the region with the aim of easing the conflict, for which Kuwait has acted as mediator between the fending Gulf countries. In a joint statement issued after Tillerson and Sheikh Mohammed signed an agreement on Tuesday aimed at combating the financing of terrorism, the four Arab states leading the boycott on Qatar said the sanctions would remain in place.

The Tesla tulip.

• Is California Bailing Out Tesla through the Backdoor? (WS)

The California state Assembly passed a $3-billion subsidy program for electric vehicles, dwarfing the existing program. The bill is now in the state Senate. If passed, it will head to Governor Jerry Brown, who has not yet indicated if he’d sign what is ostensibly an effort to put EV sales into high gear, but below the surface appears to be a Tesla bailout. Tesla will soon hit the limit of the federal tax rebates, which are good for the first 200,000 EVs sold in the US per manufacturer beginning in December 2009 (IRS explanation). In the second quarter after the manufacturer hits the limit, the subsidy gets cut in half, from $7,500 to $3,750; two quarters later, it gets cut to $1,875. Two quarters later, it goes to zero. Given Tesla’s ambitious US sales forecast for its Model 3, it will hit the 200,000 vehicle limit in 2018, after which the phase-out begins.

A year later, the subsidies are gone. Losing a $7,500 subsidy on a $35,000 car is a huge deal. No other EV manufacturer is anywhere near their 200,000 limit. Their customers are going to benefit from the subsidy; Tesla buyers won’t. This could crush Tesla sales. Many car buyers are sensitive to these subsidies. For example, after Hong Kong rescinded a tax break for EVs effective in April, Tesla sales in April dropped to zero. The good people of Hong Kong will likely start buying Teslas again, but it shows that subsidies have a devastating impact when they’re pulled. That’s what Tesla is facing next year in the US. In California, the largest EV market in the US, 2.7% of new vehicles sold in the first quarter were EVs, up from 0.4% in 2012, according to the California New Dealers Association. California is Tesla’s largest market.

Something big needs to be done to help the Bay Area company, which has lost money every single year of its ten years of existence. And taxpayers are going to be shanghaied into doing it. To make this more palatable, you have to dress this up as something where others benefit too, though the biggest beneficiary would be Tesla because these California subsidies would replace the federal subsidies when they’re phased out. It would be a rebate handled at the dealer, not a tax credit on the tax return. And it could reach “up to $30,000 to $40,000” per EV, state Senator Andy Vidak, a Republican from Hanford, explained in an emailed statement. This is how the taxpayer-funded rebates in the “California Electric Vehicle Initiative” (AB1184) would work, according to the Mercury News:

“The [California Air Resources Board] would determine the size of a rebate based on equalizing the cost of an EV and a comparable gas-powered car. For example, a new, $40,000 electric vehicle might have the same features as a $25,000 gas-powered car. The EV buyer would receive a $7,500 federal rebate, and the state would kick in an additional $7,500 to even out the bottom line.” And for instance, a $100,000 Tesla might be deemed to have the same features as a $65,000 gas-powered car. The rebate would cover the difference, minus the federal rebate (so $27,500). Because rebates for Teslas will soon be gone, the program would cover the entire difference – $35,000. This is where Senator Vidak got his “$30,000 to $40,000.”

Money changes everything.

• Brazil To Open Up 860,000 Acres Of Protected Amazon Rainforest (Ind.)

The Brazilian environment ministry is proposing the release of 860,000 acres in the National Forest of Jamanxim for agricultural use, mining and logging. The government’s order was a compromise measure after protests from local residents and ecologists who claim that the bill could lead to further deforestation in the Pará area. If approved, the legislation will create a new protection area (APA) close to Novo Progresso. Around 27% of the national forest would be converted into an APA, the ministry said. Carlos Xavier, president of a lobbying group in Pará to decrease the size of the Jamanxim forest, said the APA would bring economic progress to the region. According to the ministry, the bill includes stipulations to reduce conflicts over land, prevent deforestation and create jobs. The measures were criticised by environmental groups.

“The bill is seen as an amnesty for illegal occupation of the conservancy unit,” said Observatório do Clima on its website, claiming that the government “yielded to pressure” from the rural lobby. Carlos Xavier, president of a lobbying group in Para to decrease the size of the Jamanxim forest, said the APA would bring economic progress to the region. In 2016, deforestation of the Amazon rose by 29% over the previous year, according to the government’s satellite monitoring, the biggest jump since 2008. Mongabay, an environmental science and conservation website, reports that experts using satellite images have identified illegal logging activities to the east of the BR-163 highway, in Pará state. The BR-163 protests involved stopping trucks from unloading grains at the riverside location of Miritituba, where barges carrying crops are transported en route to the export markets. ATP, the Brazilian private ports association, calculated that the highway protests would result in losses of $47m.